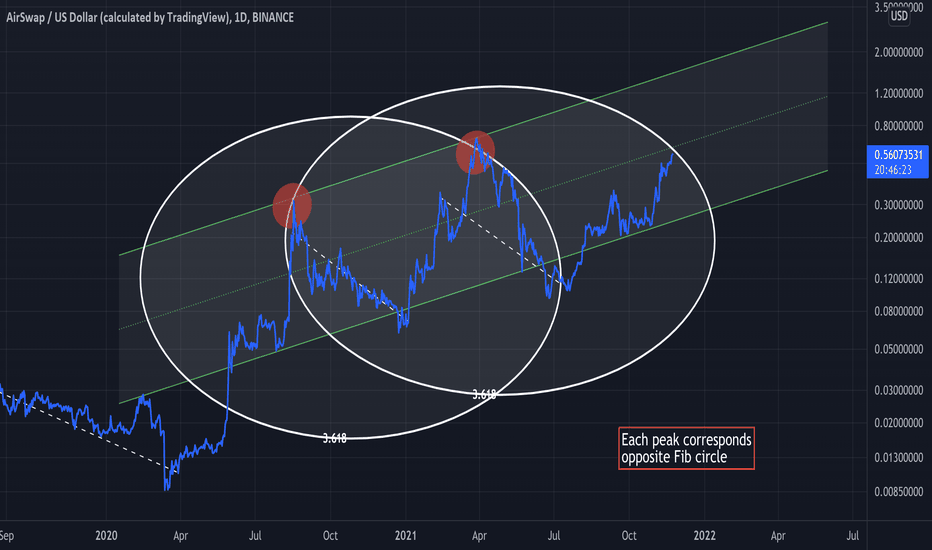

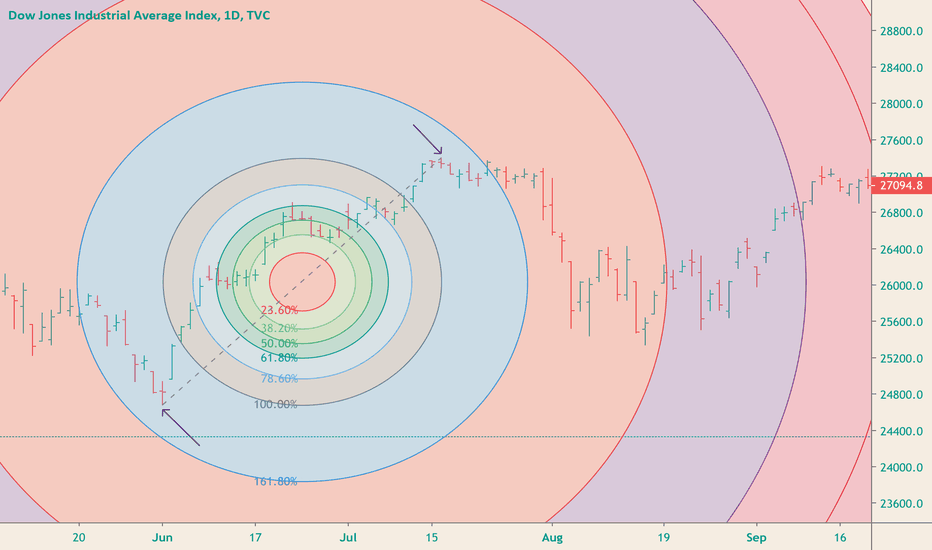

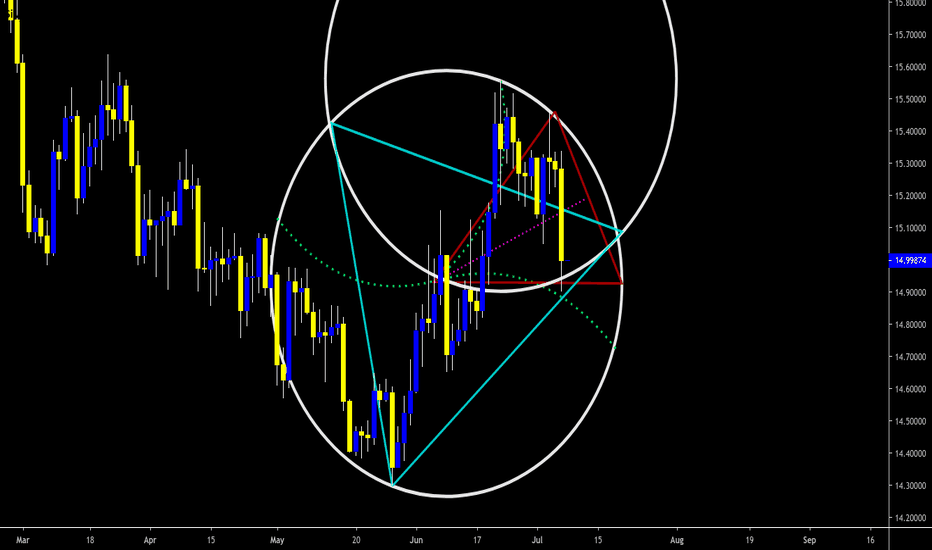

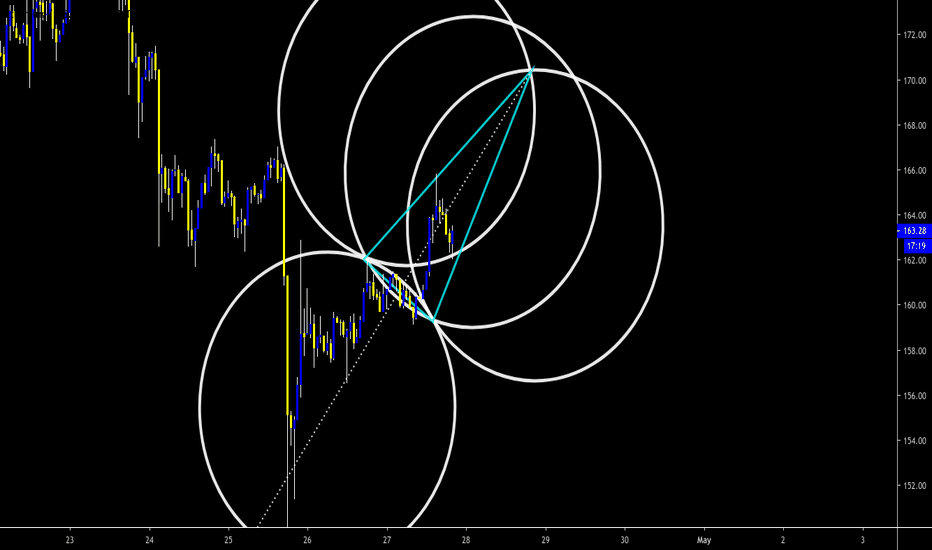

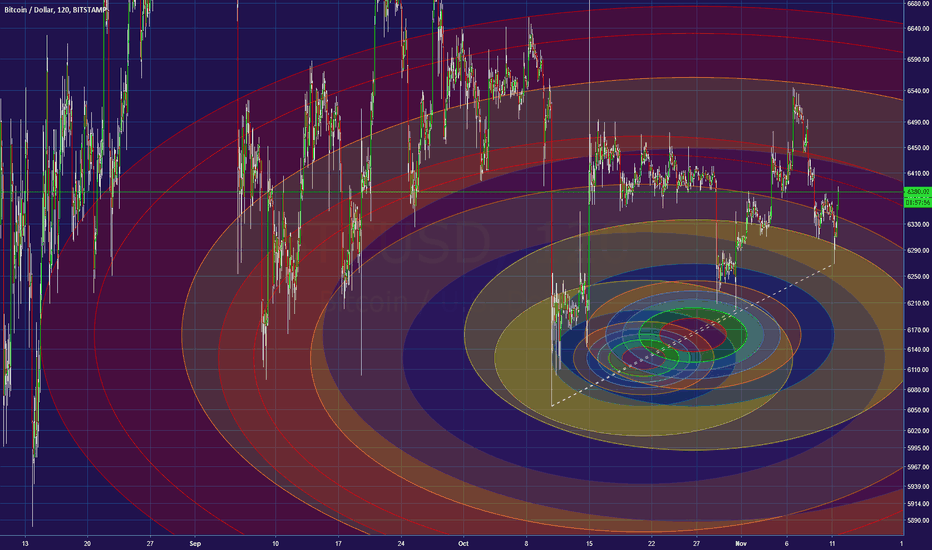

Interesting Fib Circle PeaksOn this chart it can be seen that Fib circles correspond to opposite peaks within the current uptrend (red ovals)

I'm not sure of the correlation and causation of this, but it is pretty cool to see

Price will likely continue up through the channel placed

Circle

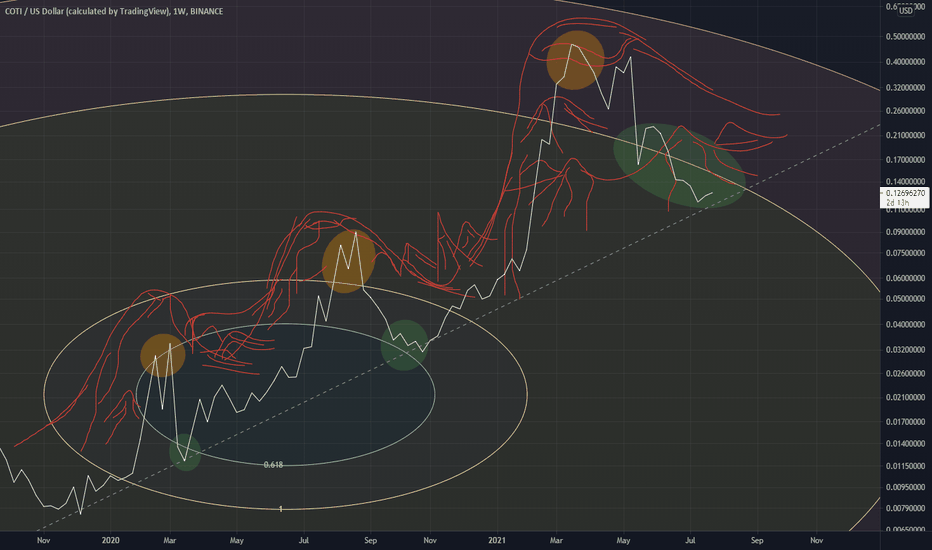

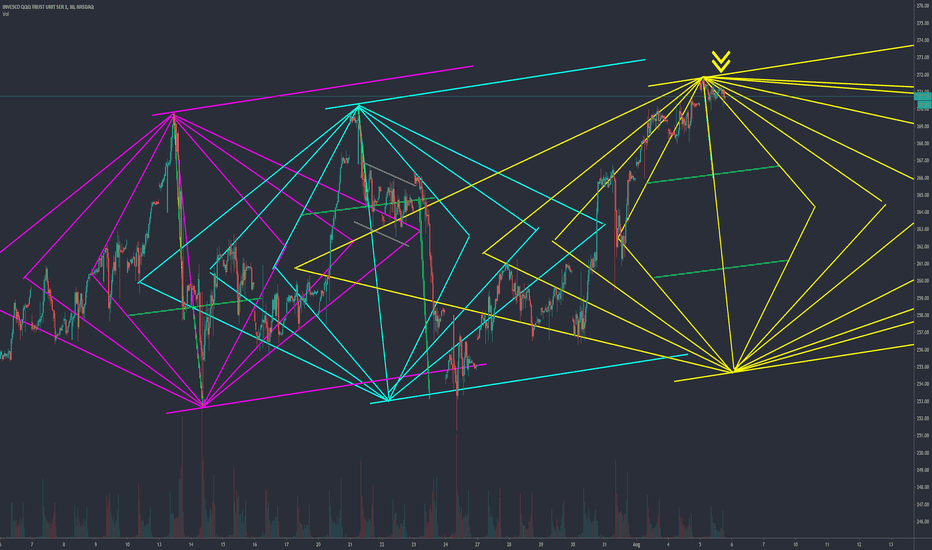

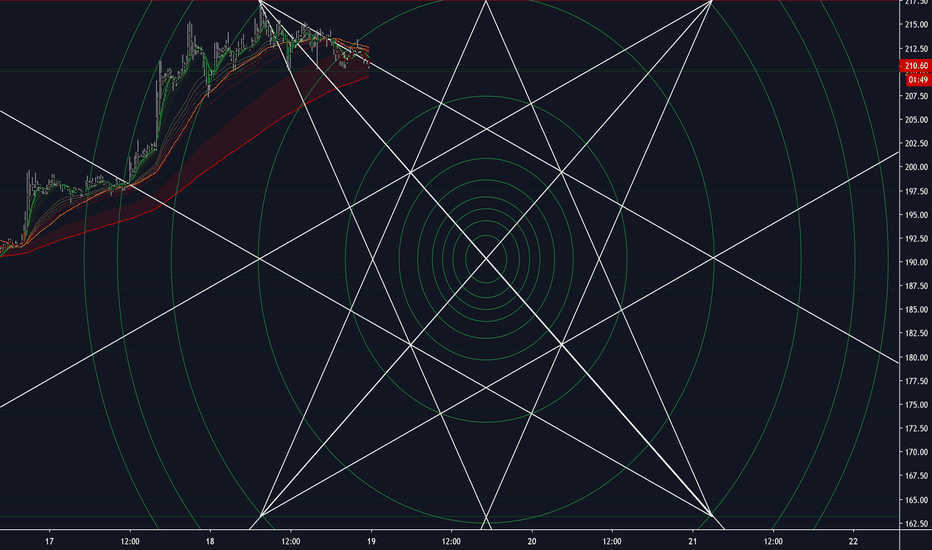

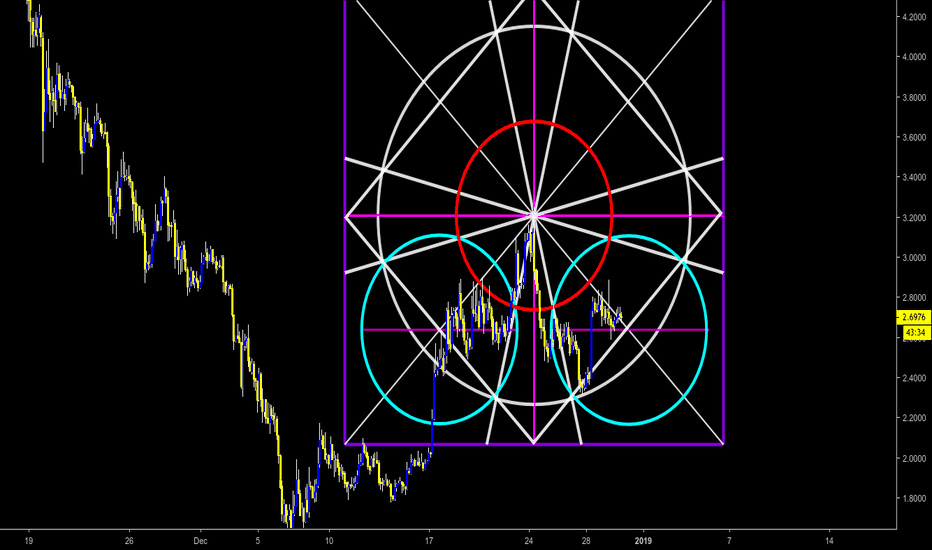

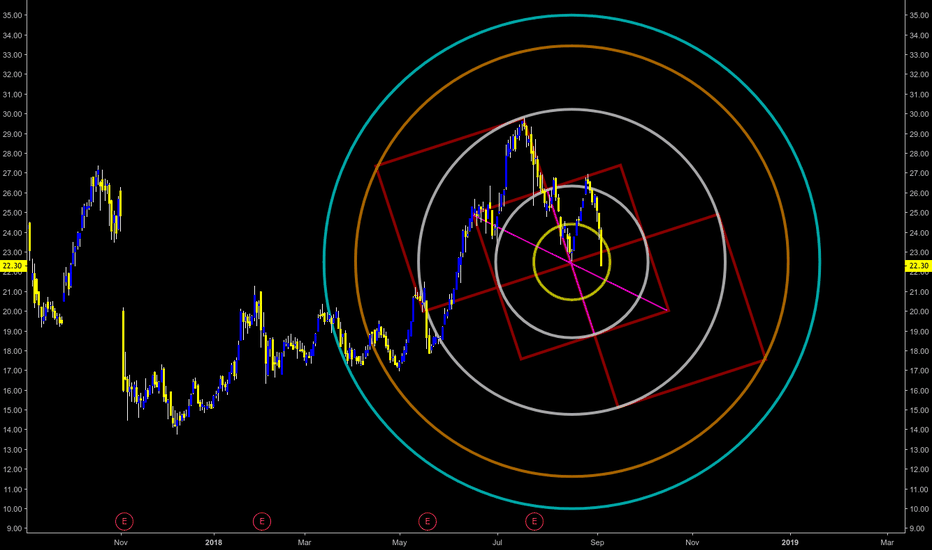

Geometry: Chart ExhibitFirst and forever reminder: expand into your own, continually evolve and grow.

Press share "Make it Mine" to view the full interactive chart

Note: Relationship of numbers to each other

Note: The sequence of the various shapes

Note: Geometric Angles

Note: "45" angles up and down various intersection points

In-exhaustive book list

Law of Vibration - Tony Plummer

Michael Jenkins - Geometry of Stock Market Profits, Chart Reading for Professional Traders, Complete Stock Market Forecasting Course

Scott M. Carney - The Harmonic Trader, Harmonic Trading Volume I, Harmonic Trading Volume II, Harmonic Trading Volume III

H.M. Gartley - Profits in the Stock Market

Bill Wiliams - Trading Chaos, New Trading Dimensions, Trading Chaos 2nd Edition

J.M. Hurst - The Profit Magic of Stock Transaction Timing, Cyclic Analysis: A Dynamic Approach

Disclaimer: Not financial advice, no recommendations to buy or sell, no warranties of merchantability, profitability, or probabilities.

Forum:

blackcryptolink.com

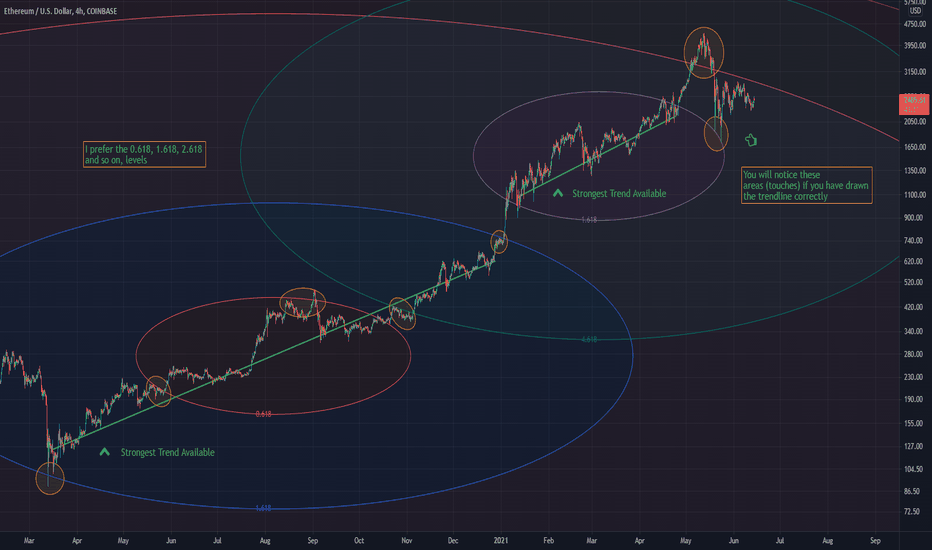

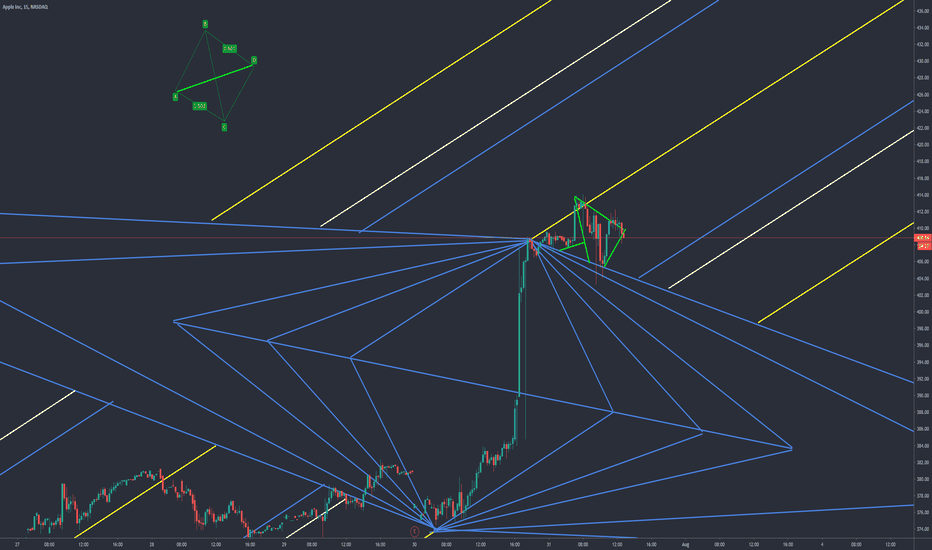

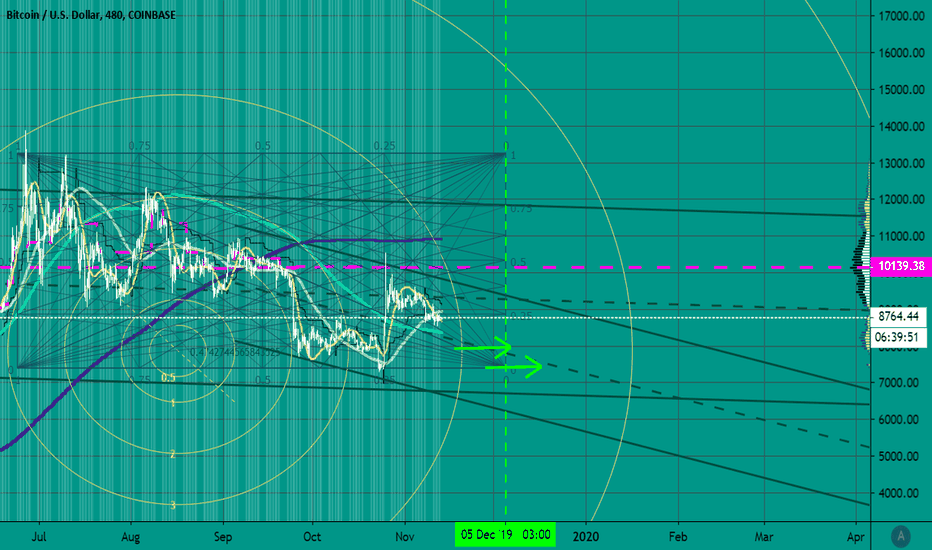

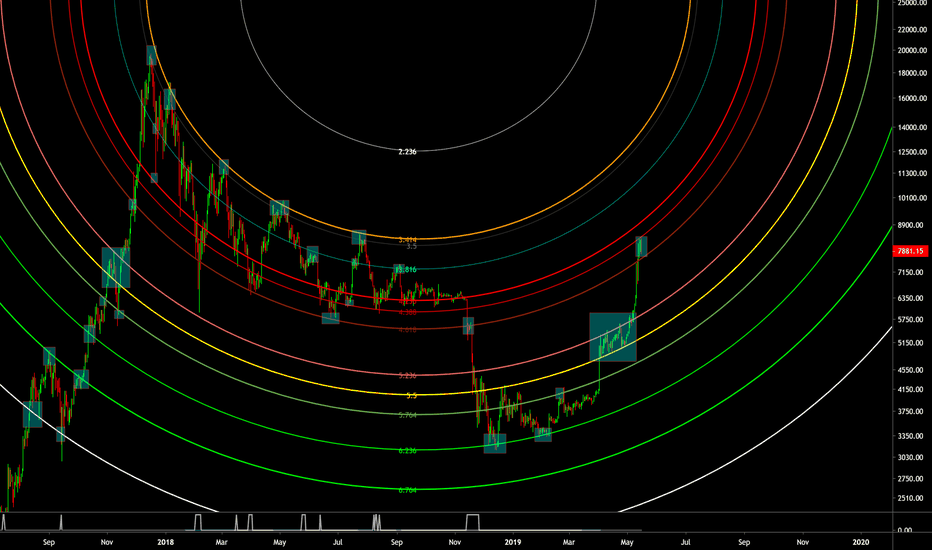

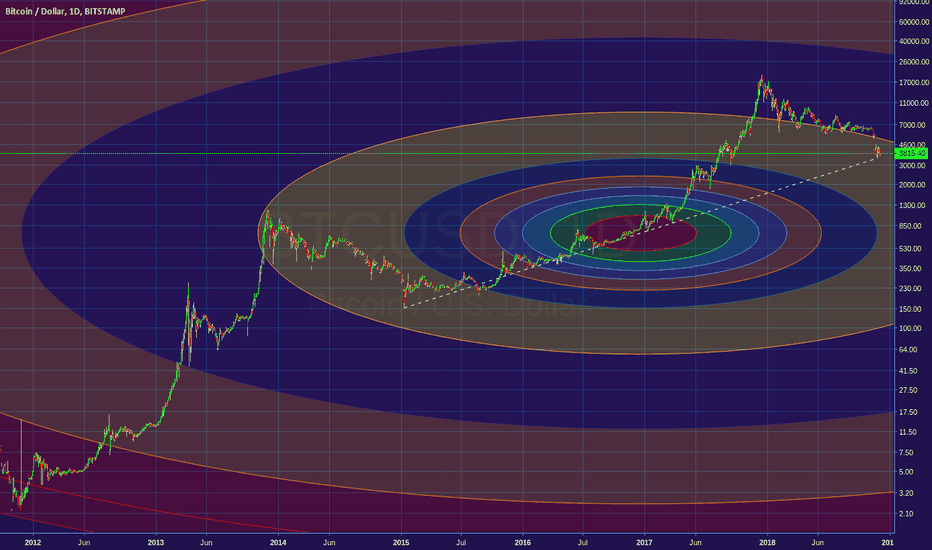

Fibonacci Circles GuideA guide for Fib circles

1 - Draw the trendline

2 - look for areas of confluence around the circle at levels for example 0.618, 1.618, 2.618, 3.618 ...

3 - Make an assessment

This is the 4Hour chart for Ethereum and isn't as reliable as using a higher timeframe, say drawing the trendlines through the entire bear market on the weekly for Ethereum would be more effective. Regardless it still serves its purpose.

This is little data for the current bull run.

This trendline drawing can be applied to any (weekly preferable) chart and assessments can be made based on the position of the price, above or below a key Fib level E.g (0.618)

Hope this helps aspiring chartists

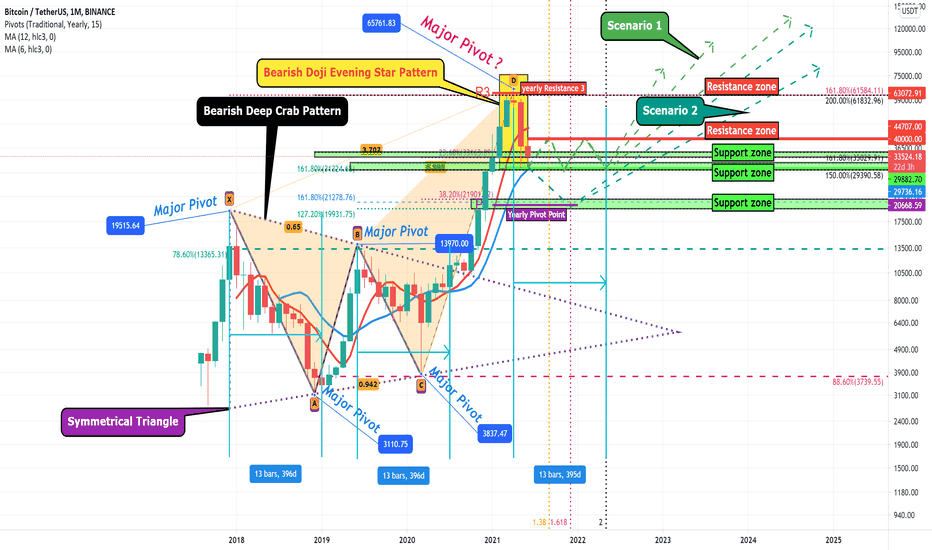

Bitcoin Long-term Analyze (Monthly Time frame)📆Today, I want to speak about Bitcoin's Long-term Analyze ( Monthly Time frame).

First, For long-term analysis , it is better to use logarithmic charts (Do not forget, if you want to use fibs , you have to turn on Fib Levels based on log scale ). I was able to find 4 Major pivots on the BTCUSDT chart, these pivots were able to make a Symmetrical Triangle .

Also, around 65761$ I found == Bearish Deep Crab Harmonic Pattern + Bearish Doji Evening Star Pattern ( it can verify our harmonic pattern / This pattern can make reverse or range on charts) + yearly Resistance 3

For finding the Next Major Pivot, first, we have to know the rules of Major pivots . If point D of our harmonic pattern wants to be a major pivot, the price must return at least 38.2% of point C to D (This rule makes Scenario 2 ) OR price has to rest ( at the time ) at least 38.2% of point C to D (This rule makes Scenario 1 ).

In addition, I found one circle on the Monthly Time frame . BTC wants about 13 months or one year to start the next bullish movement . This circle will happen again? 🧐

As I said, I have two Scenarios :

Scenario 1 : BTC will run between 30000$ until 40000$ ( Range channel ) for at least about 2 months and 22day (If Point D wants to be a Major pivot/ Time Retracement ) OR Maximum until May 2022 😱. I think that after this correction price can go UP 80$k-91$k // 104$k-107$k // even 130$k-140$k .

Scenario 2 : BTC will go down until 22000$ - 19900$ (If Point D wants to be a Major pivot/ Price Retracement ). I think that after this correction price can go UP 81$k-871$k // 119$k-128$k .

My Suggestion : please DO NOT buy Coins for Midterm and Long-term investment until the market finds a way.

Do not forget to put Stop loss for your positions (For every position you want to open)

Please follow your strategy , this is just my idea, and I will be glad to see your ideas on this post.

Please do not forget the 'like' button :) & Share it with your friends, Thanks, and Trade safe.

Good luck

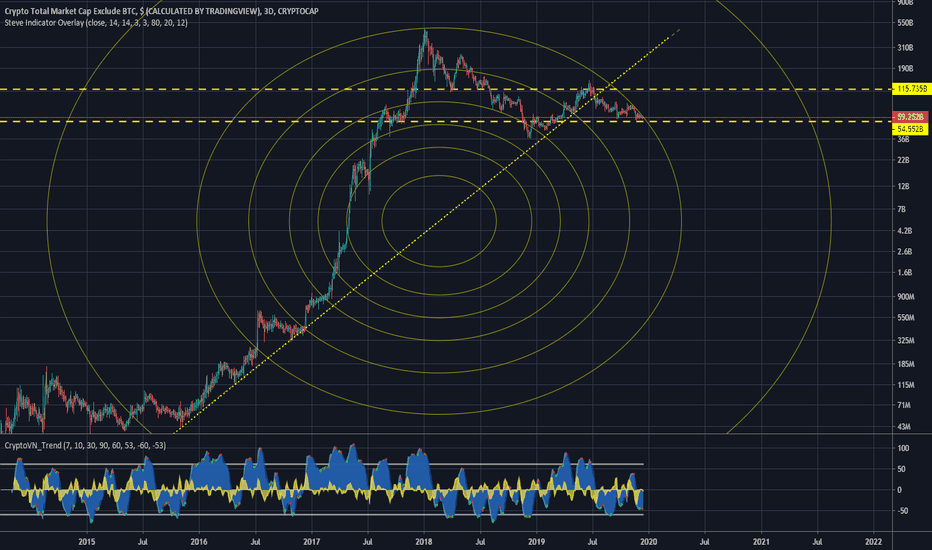

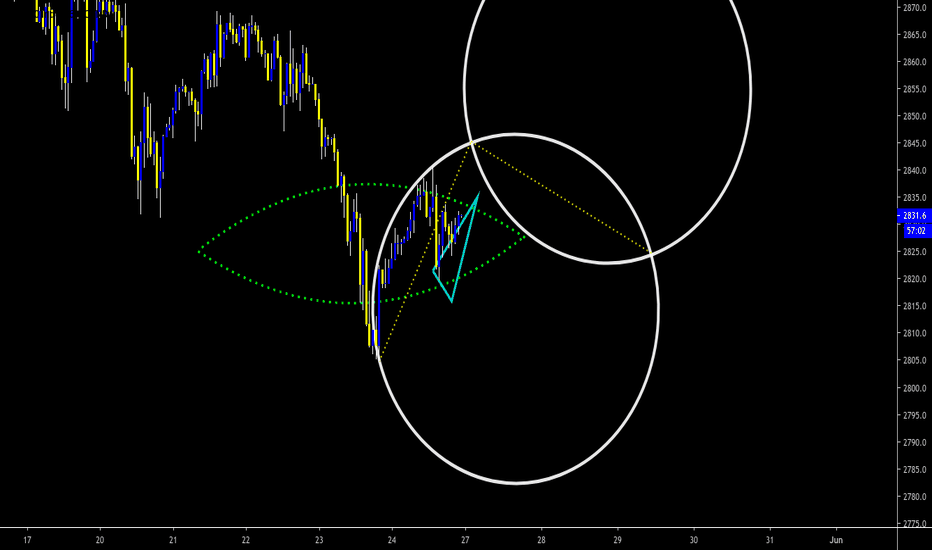

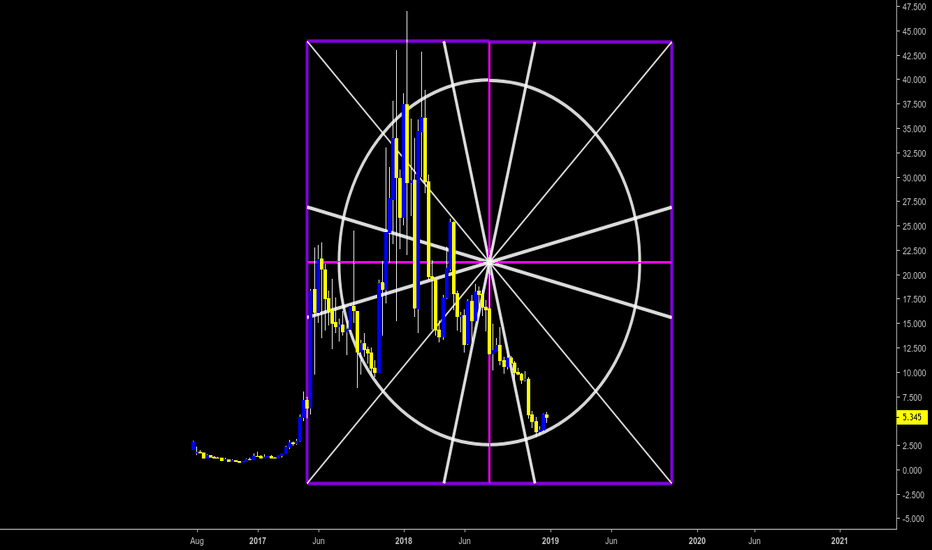

Altcoins - Trend Line or Fib Circle - something's gotta give!Here is a long term analysis of the altcoins market cap. We are sitting on a pretty strong horizontal resistance, but we are being pushed by this fib circle which was never broken before.

As its a 3D chart this will be resolved rather quickly, but as you see many fakeouts in history where we break a line, just to have a massive move on the opposite side in the next candle.

If we do break the fib line and confirm it as support it could be the beginning of a nice mini bull run for alts!