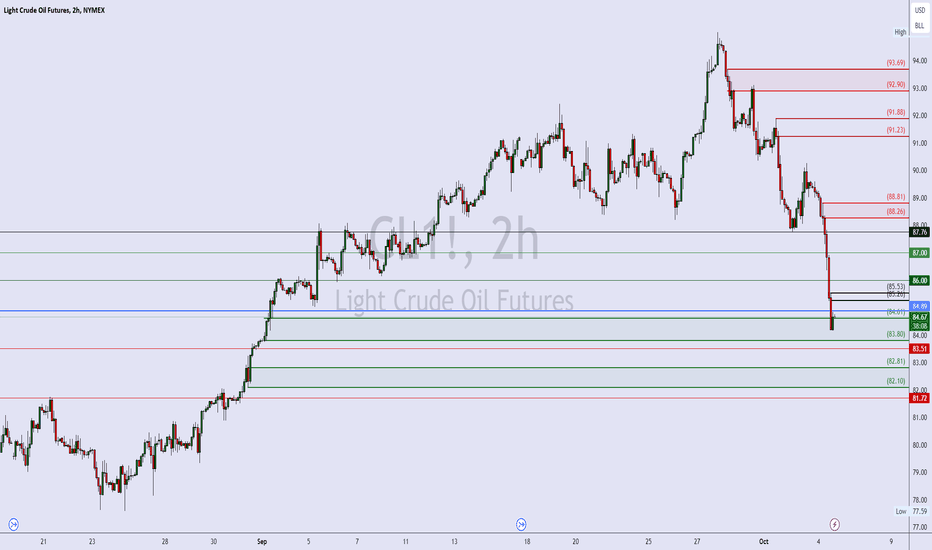

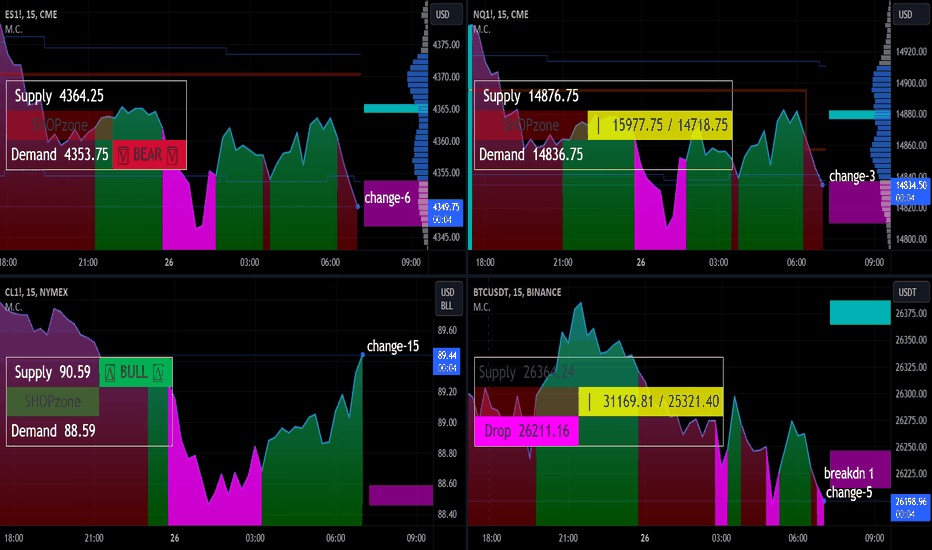

CRUDE OIL (WTI): Will The Gap Be Filled?!🛢️

WTI Oil opened with a huge gap up due to the Israeli - Palestinian conflict.

As you know, the is always up to 80% chance that the gap will be filled.

For us, it can be a nice shorting opportunity.

To trade that with a confirmation, focus on 84.5 - 85.0 area.

That is a minor intraday support that is based on gap close level

and recent historical price action.

My bearish confirmation will be a 4H candle close below that - its breakout.

I will anticipate a bearish movement to 83.1 - gap opening level.

As always, pay close attention to events.

A new higher higher higher close will indicate the escalation of the conflict.

❤️Please, support my work with like, thank you!❤️

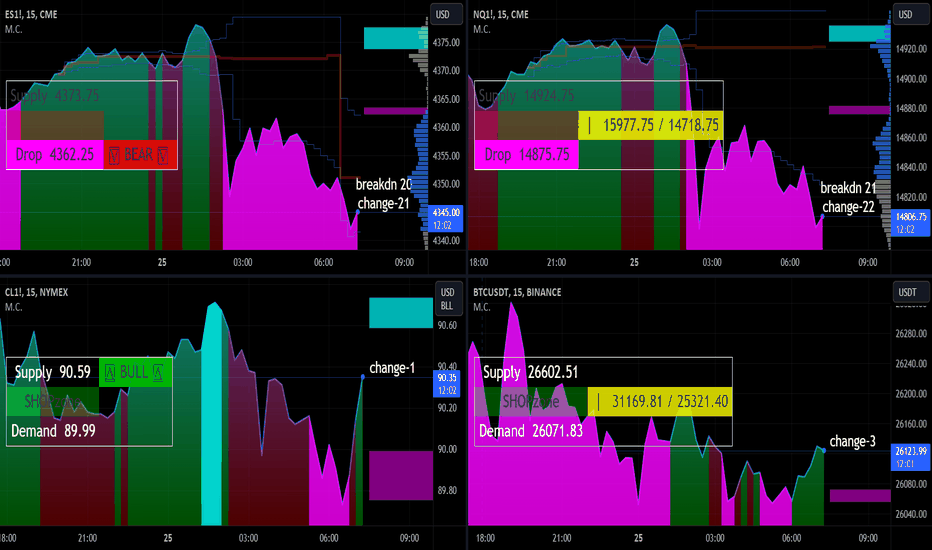

Crude Oil Futures WTI (CL1!)

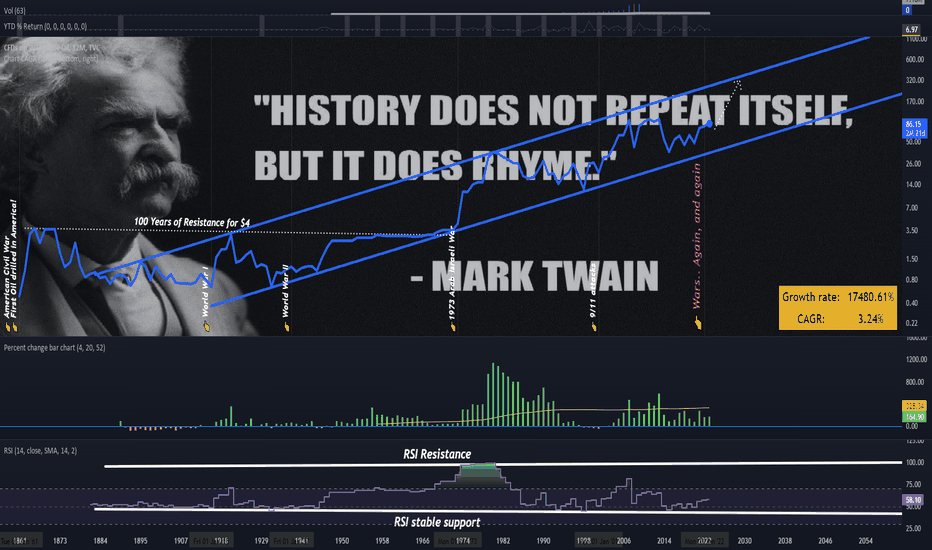

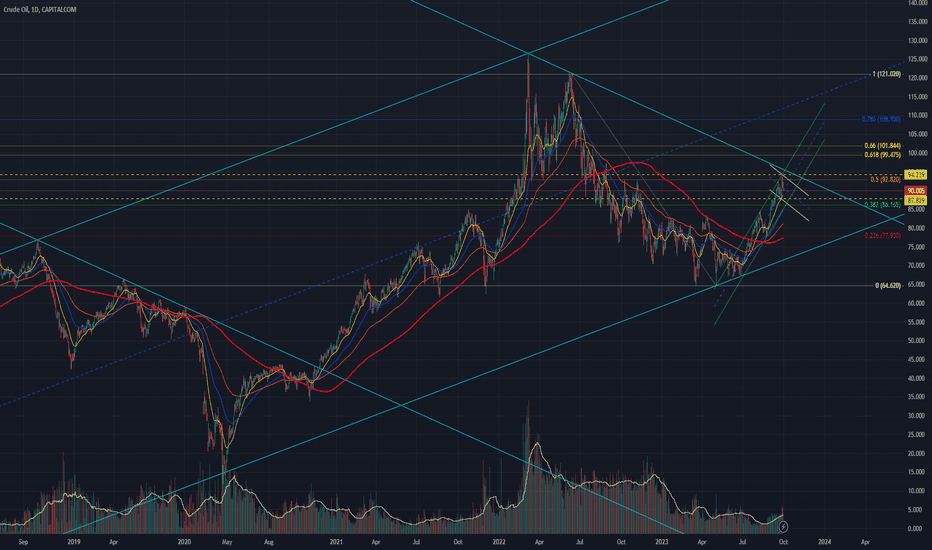

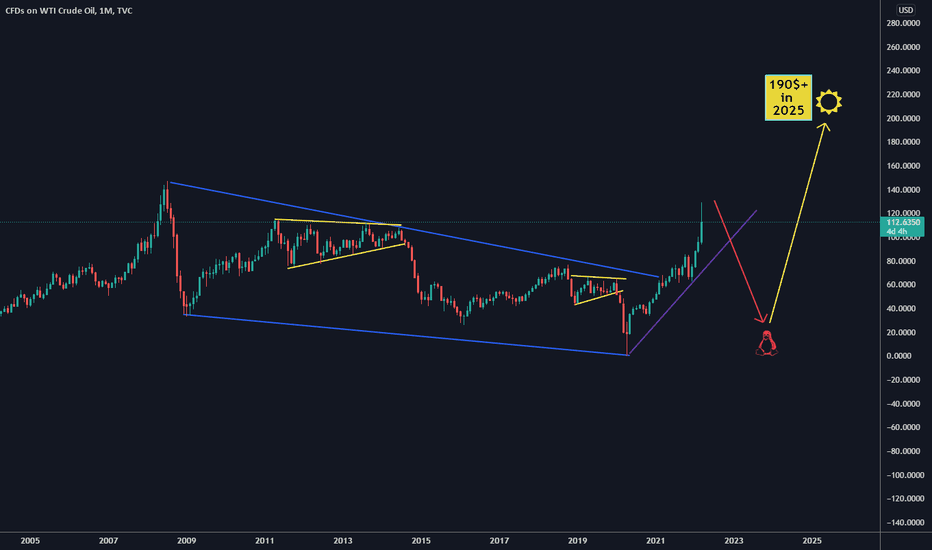

WTI Crude Oil All Time Chart. Does History Repeat Itself..?!I'm writing this article, because of the striking resemblance with Today's oil and the one that has been a lot of times before..

I believe that history repeats itself, and there are lessons to be learned. And since this boom and bust cycle are not new, it might also provide some understanding on where we are heading.

I hope you enjoy.

The time of dinosaurs

In the 1850s the whale fisheries had failed to keep pace with the mounting need for illuminating oil, forcing the price of whale oil higher and making illumination costly for ordinary Americans. Only the affluent could afford to light their parlors every evening.

There were many other lighting options such as lard oil among others but no cheap illuminant that burned in a bright, clean, safe manner.

George Bissell, considered as the father of the American oil industry, had the intuition that oil that was plentiful in western Pennsylvania could be a first rate illuminant. The slimy liquid was so ubiquitous that it tainted well water and plagued local contractors drilling for salt.

In 1855, Professor Benjamin Silliman from Yale produced a report that vindicated Bissell's hunch that oil could be distilled to produce a fine illuminant (like kerosene), plus a host of other useful products. As a result, Bissel and his company, Seneca Oil Company (formerly the Pennsylvania Rock Oil Company) needed to dispatch someone to Pennsylvania to look for large pools of oil.

First oil drilled in America

That man was Colonel Edwin Drake, known as the first to successfully drill for oil. Drake arrived in Titusville, Oil Creek Valley. Oil was known to exist here, but there was no practical way to extract it. Its main use at that time had been as a medicine for both animals and humans. Natives used it for war paint and for soothing skin liniment. It took a couple years but Drake struck oil in 1859.

This was the beginning of a pandemonium. Bands of fortune seekers and speculators streamed into Titusville and other oil-related businesses quickly exploded on the scene.

I guess we can call this the Klondike of oil, as a beginning of Global Industrialization Era.

Mr. Rockefeller was known as the co-founder of the Standard Oil Company and was the world's richest person. Crude oil jumped multi X times in 1860s from approximately 50cents per barrel in early 1860s to over 3 dollars in late 1860s.

Additionally, I would like to note that crude oil fluctuated between $10 and 10¢ a barrel in 1860! Adjusted for inflation, Mr. Rockefeller fortune upon his death in 1937 stood at $336 billion according to Fortune (in 2008 U.S. dollars).

Similar how crypto enthusiasts built their wealth in 2010s, right? 😉

Pump and Dump

By the late 1860s, there was a slump in the oil industry, keeping it depressed for the next five years. Low kerosene prices, a boon to consumers, were catastrophic for refiners, who saw the profit margin between crude and refined oil prices shrink to a vanishing point.

Worse, the oil market wasn't correcting itself according to the self-regulating mechanism described by neoclassical economists. Producers and refiners didn't shut down operations in the expected numbers.

John D. Rockefeller said "So many wells were flowing that the price of oil kept falling, yet they went right on drilling." Rockefeller tirelessly mocked those "academic enthusiasts" and "sentimentalists" who expected business to conform to their tidy competitive models.

One Hundred Years of Resistance for $4

According to the standard model of competition, as oil prices fell below production costs, refiners and producers should have shutdown.

But the oil market didn't correct itself in this manner because refiners and producers carried heavy bank debt and other fixed costs and by operating at a loss they could still service some debt. Each refiner, pursuing his own self-interest, generated collective misery.

Does it sound like today's crypto news, right? 😉

The U.S. drilling activity didn't slow down after hot 1860s as much as expected and a lot of producers are still pumping oil to avoid defaulting on their loans..

There was World War I in 1914-18, and total number of military and civilian casualties was around 40 million - around 20 million deaths and 21 million wounded. 😓

There was World War II in 1939-45, and total number of military and civilian casualties estimated around 50 - 56 million.. 😓

Crude oil prices jumped again, and again. But still remained below $4 until 1970s, as there were no all time peaks in crude oil after super hot 1860s.

Money-printing Era Breaks the Rules

The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system, that has been resulted with huge inflation all over the world within further decades..

Technical pictures at the main WTI crude oil chart illustrates, oil price are on the sustainable path since then, with huge bullish accelerations within local and global conflicts, like Arab-Israeli War in 1973, 9/11 attacks in 2001 and Russia-Ukraine conflict in 2022.

Nowadays

Knee-jerk surge’ happens again, and again, so oil experts repeatedly predict market impact of new 2023 Israel-Hamas conflict.

Crude oil price sees a spike on early Monday trading Oct 9, 2023 so the overall impact of the attack on Israel by Palestinian militants Hamas has yet to consider...

In a conclusion.. Does history repeat itself..

Certainly "Yes". As lessons of history still remain unlearned.

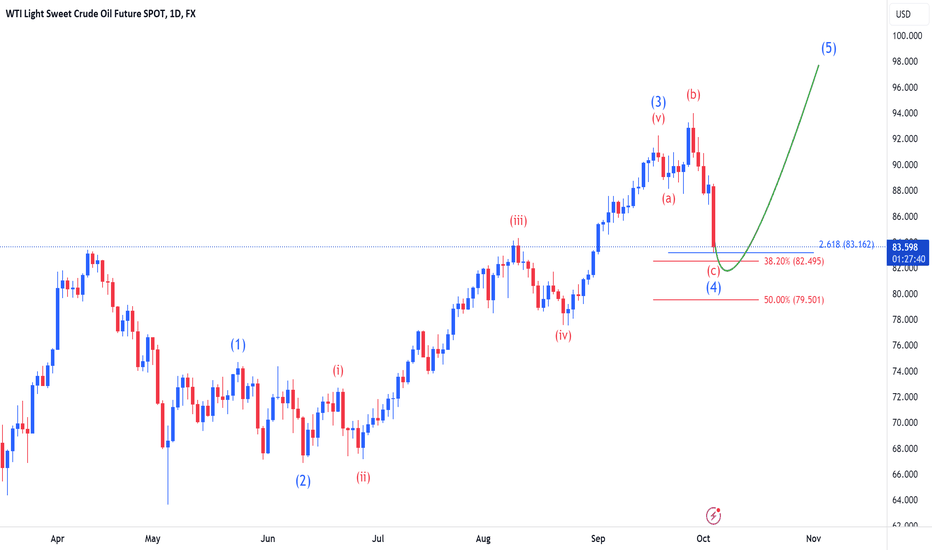

Crude Oil - Elliott Wave CountCrude Oil - Elliott Wave Count

Crude appears to be completing wave 4 near 78.5$, with an impulse wave 5 up move expected.

Remember that if the price drops below 78, it is considered invalid.

This information is for educational purposes only, so trade with caution.

MCX:CRUDEOIL1! NYMEX:CL1! TVC:USOIL MCX:CRUDEOILM1! CAPITALCOM:OIL_CRUDE FX:USOILSPOT TVC:USOIL BLACKBULL:USOIL.F

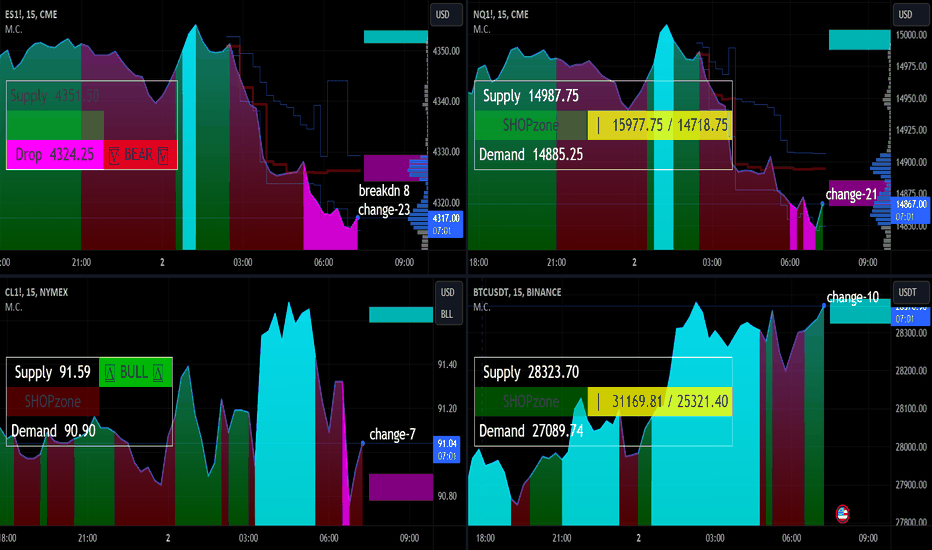

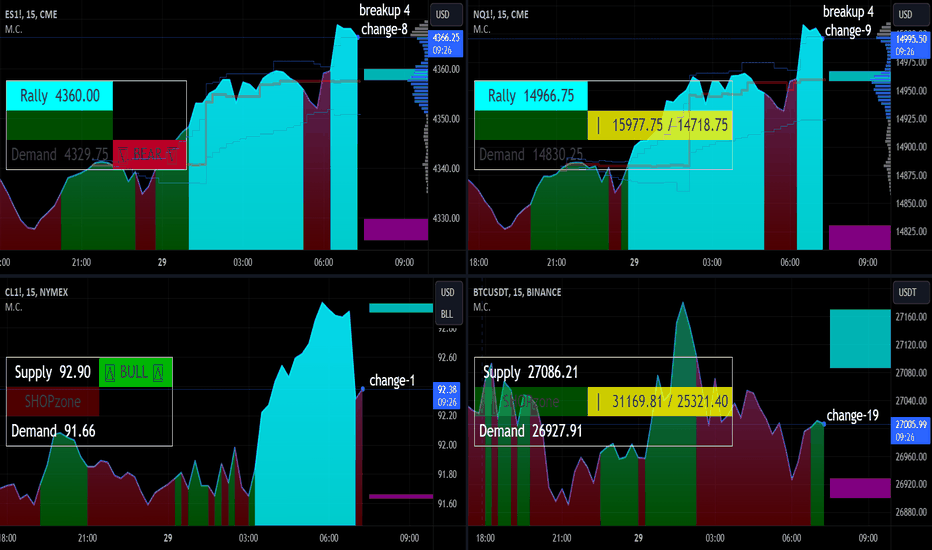

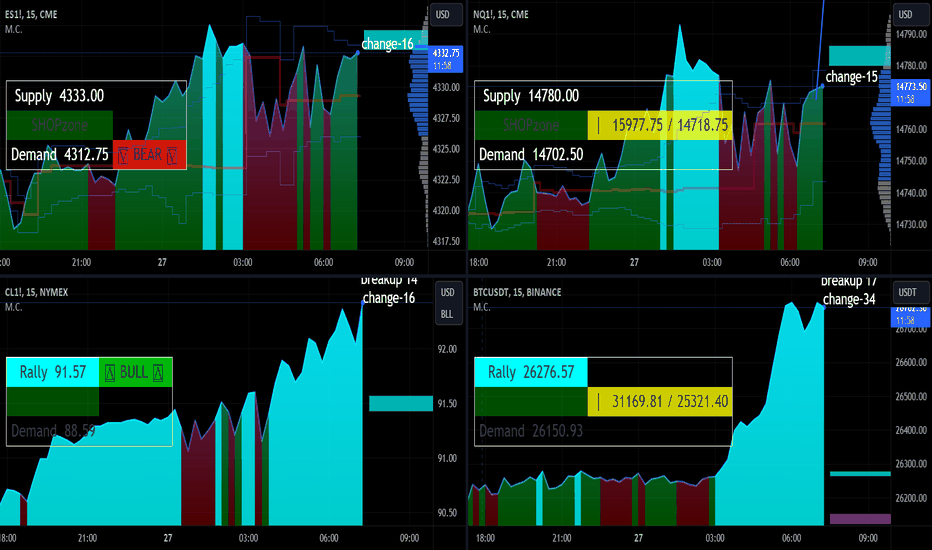

CL1! Crude Oil Day Trade 5-Oct-2023TRADE DIRECTION: SHORT; as indicated by the downward trendline (red line) and the market structure.

KEY LEVEL: Round numbers S&R with 50 ticks range between each level.

TRIGGER SIGNAL: Broke bearish pennant with the confluence from 2 trend continuation candles (red arrows).

RR: 1:1.7

SL: 88 Ticks

TP: 150 Ticks

Oil (CL) Aggro/Oversold Fade BUYQuick take/analysis, but consider scooping some low-risk crude contracts here (break above 84.84). Better demand zones are lower, but we've had a sizable downdraft into buy areas + are testing a key support/resistance area (~84-85), so those traders may be at our backs. The US dollar has finally taken a pause at the supply zone we ID’d in posts from earlier this week/last week, so that may help commodity, including CL, longs. Keep this one a tight leash; the bounce we’ve had thus far has been tepid, a micro timeframe higher high/higher low hasn’t yet been put in , and daily/weekly “demand” is lower still (low-80s/upper-70s). That said, CL is certainly a trade to put on your radar. Given the technical structure of the recent selloff, consider taking any profits at 1:1, then 86, 87, and 88+. Again, better buys are lower, but start paying attention/stalking longs as remaining profit margin for short sellers is a lot smaller than it was at the beginning of the week (though there is still some downside risk)!

Happy trading!

Jon @ LionHart Trading

Crude Oil - Elliott Wave CountCrude Oil - Elliott Wave Count

Crude appears to be completing wave 4, with an impulse wave 5 up move expected.

Remember that if the price drops below 82.5, it is considered invalid.

This information is for educational purposes only, so trade with caution.

MCX:CRUDEOIL1! NYMEX:CL1! CAPITALCOM:OIL_CRUDE FX:USOILSPOT TVC:USOIL

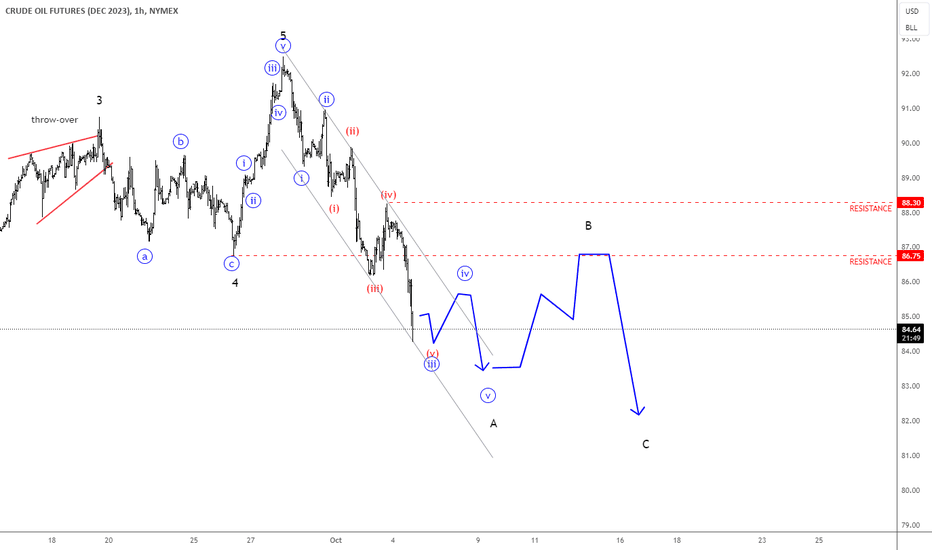

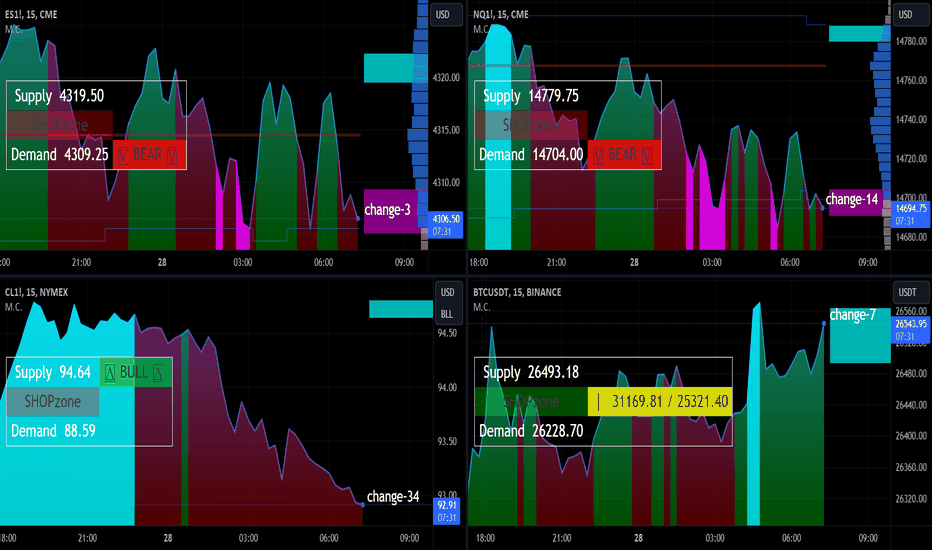

Crude Oil: Ongoing Elliott Wave Corrective Drop Can Be DeeperCrude oil has been on the rise over the last view weeks, which is the main reason why inflation is still the main global problem, so we have seen some positive correlation between dollar and crude as speculators believe that rates will stay here higher for longer. Well, what’s interesting now is that after that after a lot of crude oil bull calls for 100 dollar and higher, the energy is turning south. Looking at the current intraday drop, we can see some sharp move down now, it looks like an ongoing intraday impulse with room for more weakness after Crude inventory data shows decline of 2.2 million barrels last week. From an Elliott wave perspective that’s going impulse for wave A, so more weakness can be seen after subwave iv rally, or even after wave B bounce. Resistance is at 86.75 and 88.30.

In fact, lower energy can also mean that inflation can slow down, and this can then at some point puts limited upside for the USD and yields.

Grega

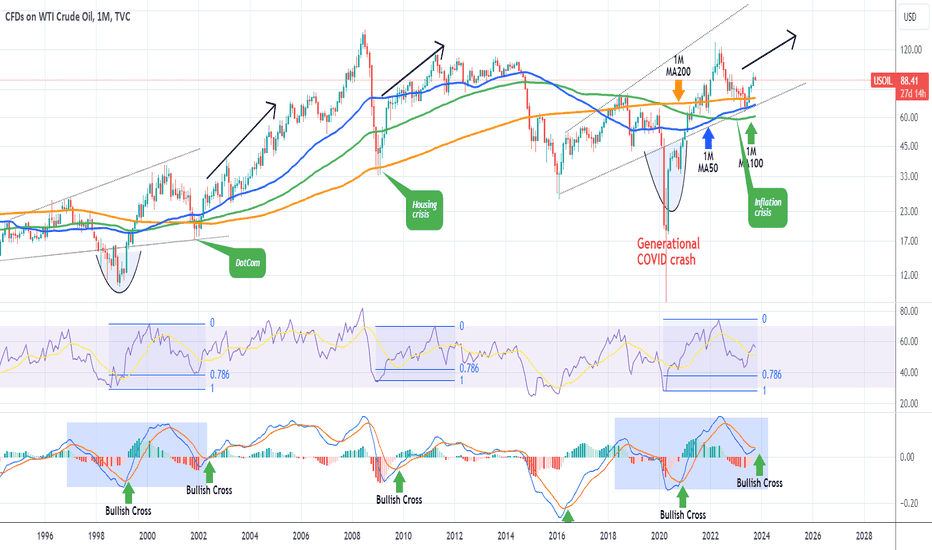

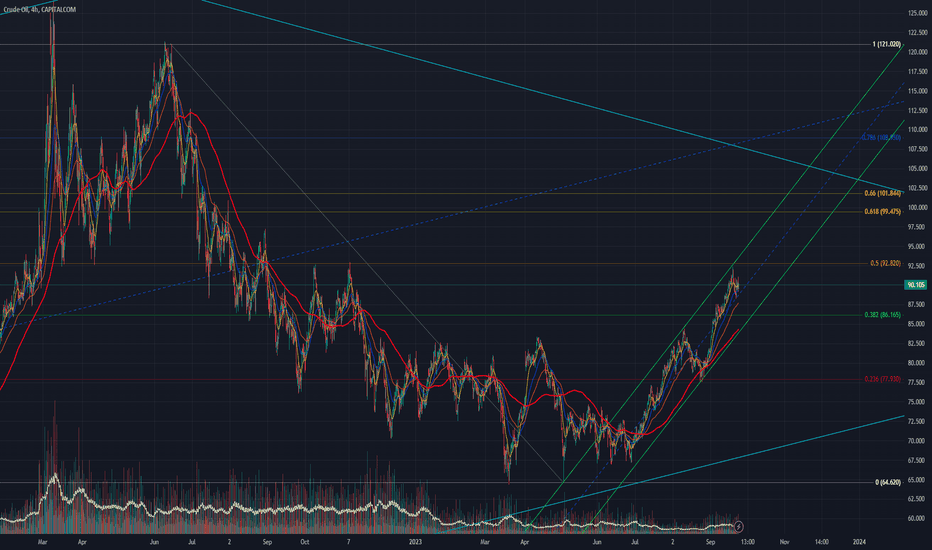

WTI OIL Rising prices are here to stay for years to comeUnderstanding WTI Oil (USOIL) on the larger, long-term time-frames such as the 1W or 1M charts can broader your perspective and allow you to consider market dynamics that you never thought they were possible to affect the trend. From time to time we tend to make such studies in order to give you an idea of how the long-term trend may be shaped. Example of such pieces of publications include the following, where a slow down on the Oil rise allowed us to realize that inflation peaked and get a timely sell:

Or the following that got as a timely buy while the price was still at $69.20 to target $100 after a break above the 13 year Lower Highs Resistance:

** Why is Oil rising now? **

On today's study we look into the 1M time-frame and attempt to explain the current non-stop rise (completed 4 straight green 1M candles) that has taken most of the market by surprise. Let's start by acknowledging that it started on strong foundation as the 1M MA50 (blue trend-line) held on 3 separate tests. The 1M MA100 (green trend-line) that was formerly the Resistance (had 2 emphatic rejections on June and October 2018) since October 2014, has been holding as Support since the April 2021 bullish break-out.

** The MA levels, Inflation and comparison with DotCom **

At the same time it is the first time we have all three 1M MA50, 1M MA100 and 1M MA200 (orange trend-line) squeezed so close to each other since late 2001. That was during the DotCom Bubble burst. As you can see, the patterns of now and then aren't all that different. In our time the market is attempting a recovery from the Inflation Crisis, coming off a war and the generational COVID crash (that led to the inflation crisis of course). The 1M RSI fractals have started and peaked on similar oversold and overbought levels respectively, while holding on their strong corrections the 0.786 Fibonacci level. Similar situation with the 1M MACD, Oil is about to form the 2nd Bullish Cross of the fractal, placing us in relative time terms to the 2002 rise.

** Importance of MACD and conclusion **

Similar oversold 1M MACD Bullish Crosses were during the 2016 Oil crisis (May) and in the aftermath of the 2008/09 Housing Crisis (October 2009). As a result, in our humble view, if Oil completes that Bullish Cross, it will give the market a signal that the price will continue to rise for many years to come (unless of course a higher fundamental intervention takes place). In conclusion, this shouldn't surprise us, as Oil has risen along with stocks following such Bear markets.

Do you also expect rising Oil prices in the near future?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

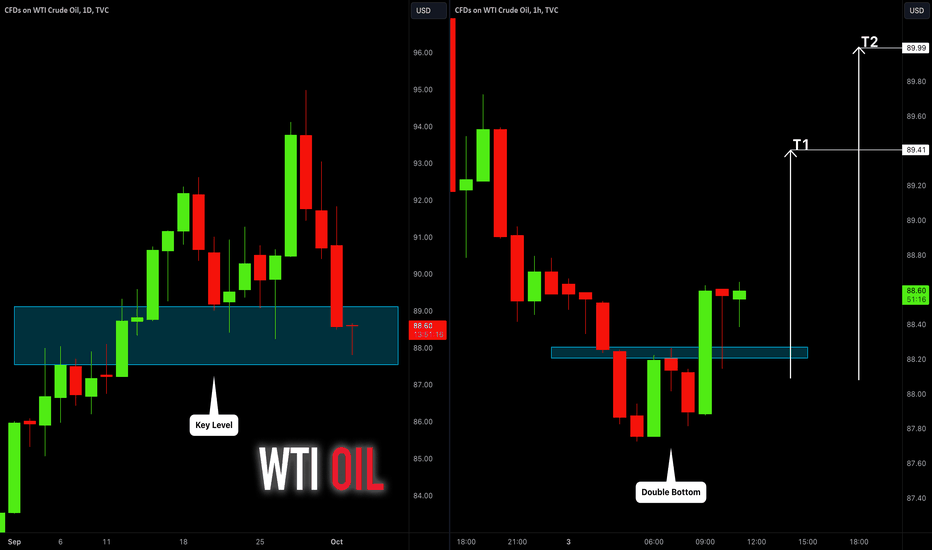

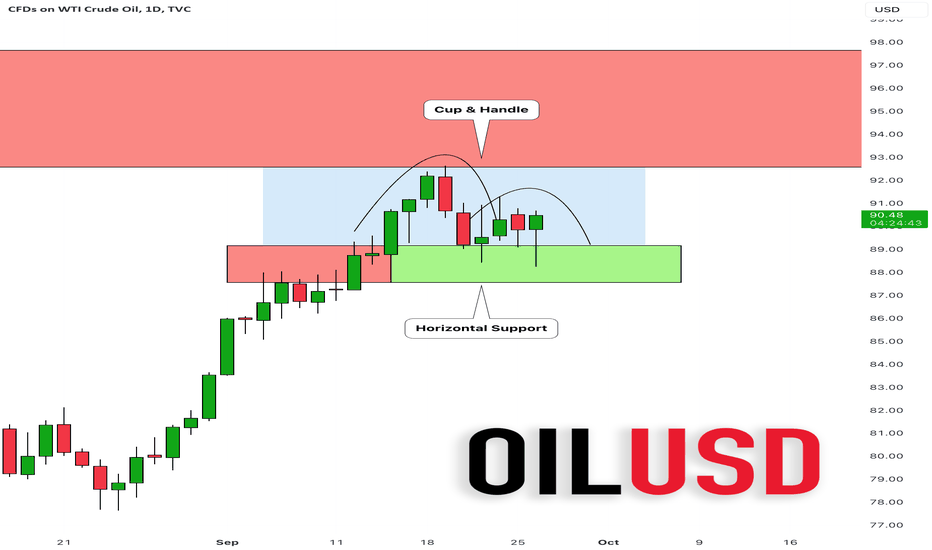

CRUDE OIL (WTI): Good Moment to Buy 🛢️

WTI is testing a key horizontal support.

The price formed a tiny double bottom on that on an hourly time frame

and violated its neckline, giving us a nice bullish confirmation.

I expect a pullback from the underlined blue area to 0.894 / 0.900

❤️Please, support my work with like, thank you!❤️

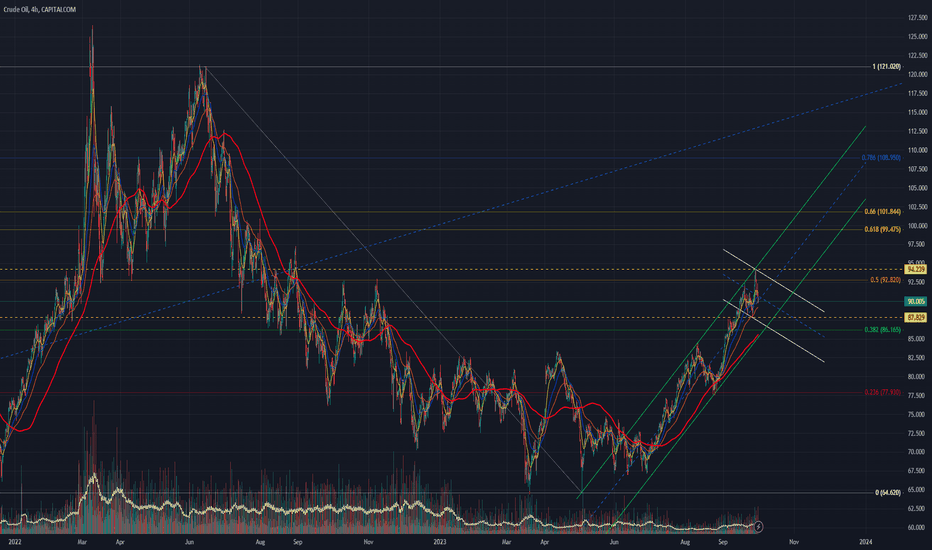

Crude Oil ~ 4H Swing V2 (Sept-Oct)Updated 30/09/23:

- Revised up-trending parallel (green)

- Added down-trending/consolidation parallel (white)

- Added horizontal lines (yellow/dashed) to mark upper/lower range (94.239-87.829)

Everything else stays the same (chartist holy grail lol).

Notes:

- Further write-up on Daily Swing V2 Chart

- Faded out longer TF parallel lines (light blue)

TradingView has a sh*tty chart bug where any trend-lines drawn on longer TF become misaligned when you switch to shorter TFs.

Temporary workaround = set "Opacity" on affected lines to "0%" before publishing & restore afterwards so you don't have to manually erase/re-draw...just remember where you drew them to begin with lol.

Crude Oil ~ Daily Swing V2 (Sept-Oct)Updated 30/09/23:

- Revised up-trending parallel (green)

- Added down-trending/consolidation parallel (white)

- Added horizontal lines (yellow/dashed) to mark upper/lower range (94.239-87.829)

Everything else stays the same (chartist holy grail lol).

CAPITALCOM:OIL_CRUDE has done an amazing job respecting its upward parallel channel since June.

Could see period of consolidation (foreshadowed by prev price action) into lower trend-line before deciding whether to push higher towards Golden Fib (break upper trend-line), or capitulate to global recession fears & collapse towards 200DMA/23.6% Fib, TBC.

Price action would be biased towards upside given OPEC+ bullish manipulation, however OPEC+ would also be hyper-vigilante on excessive Crude Oil prices which could threaten demand destruction - hence why they opted to review production cuts on a monthly basis to maintain price/economic stability.

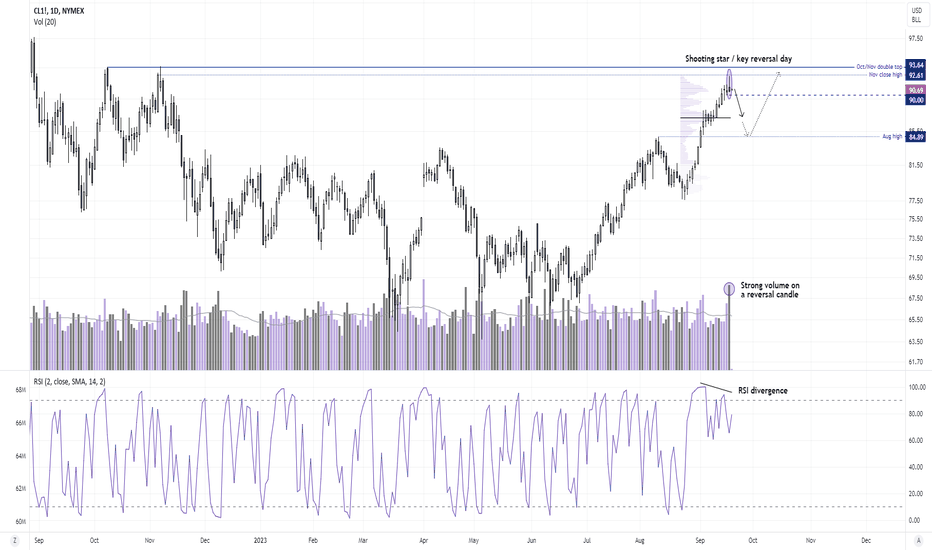

WTI prints key reversal day ahead of FOMCWhilst we retain our view that oil prices could be headed for $100 further out, the trend seems to have hit a speed bump over the near-term.

WTI broke above $90 with ease yet faltered around $95 with a shooting car candle with high volume (which makes it a potential key reversal day). A bearish divergence has also formed with the RSI (2) after it reached overbought.

With the potential for the Fed to be more hawkish than expected, it could provide the catalyst for a pullback on WTI. A break below $90 confirms the near-term reversal is underway, with $87 making an initial target around the volume node from its preceding leg higher. $85 could also provide support around the August highs, which might tempt dip buyers more focussed on the fundamentals currently supporting higher oil prices.

CRUDE OIL (WTI) Detailed Technical Outlook 🛢

I received a lot of questions about WTI Crude Oil.

Analyzing a weekly time frame, we can spot that the market is currently

approaching a significant supply zone.

Even though we see a strong bullish rally since the beginning of summer,

I will anticipate a further growth only after a bullish violation of that entire area: 92.5 - 97.8.

Alternatively, analyzing a daily time frame, we can identify a recent retracement from the underlined red area and a strong daily support that was nicely respected.

At the moment, I also see a completed cup & handle pattern there.

A bearish breakout of its neckline - daily candle close below 87.5 will be your bearish confirmation.

I am monitoring oil closely and if I see a good trading setup, I will definitely share that with you.

❤️Please, support my work with like, thank you!❤️

Crude Oil - Wave CountCrude oil - wave count

Crude appears bullish and may have begun its third wave.

Remember that if the price drops below the red line, it is considered invalid.

This information is for educational purposes only, so trade with caution.

MCX:CRUDEOIL1! NYMEX:CL1! TVC:USOIL CAPITALCOM:OIL_CRUDE FX:USOILSPOT