Cl1

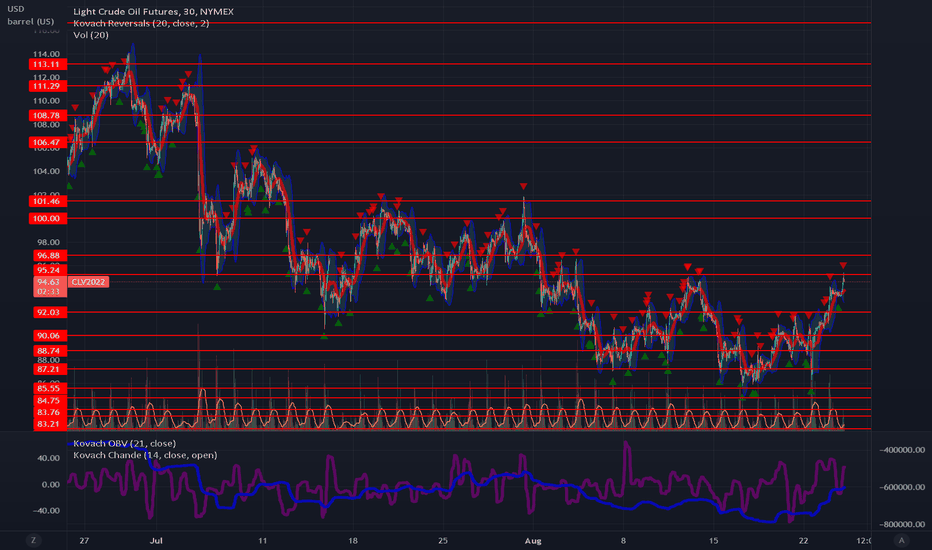

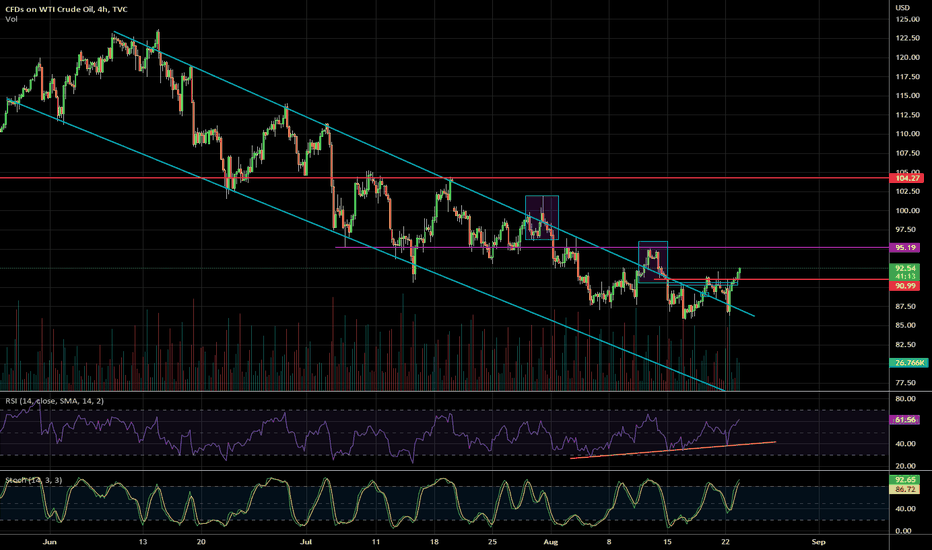

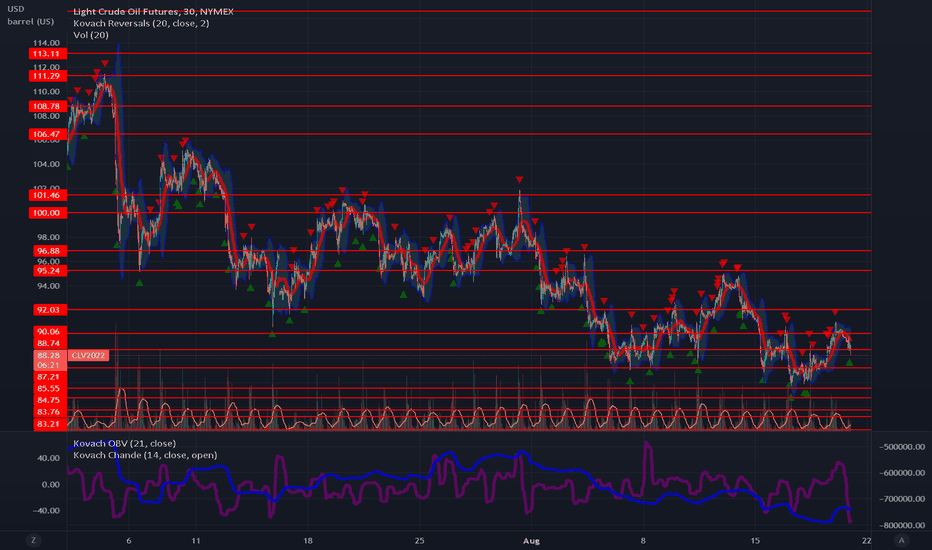

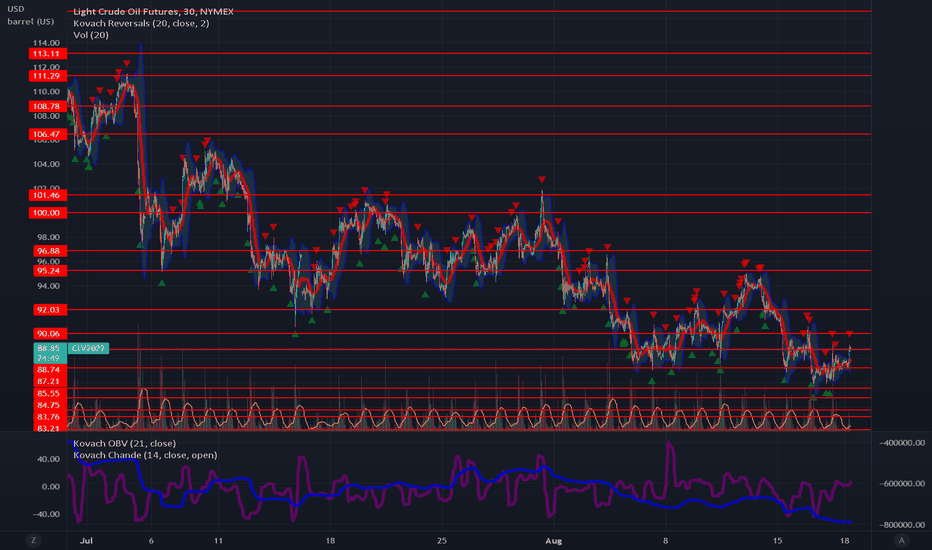

Can Oil Test $100 Again?Oil has rebounded into the $90's after establishing a solid value area in the high $80's. It seemed like prices were finally coming down, when we saw a nice spike back to the $90's, reestablishing value above $92.03. We are currently testing $95.24, but a red triangle on the KRI may indicate that we are running into resistance. If we can break through then the next target is $96.88. After that, we are clear to attempt the $100's again. If we reject current levels, we should see support at the base of the $90 handle.

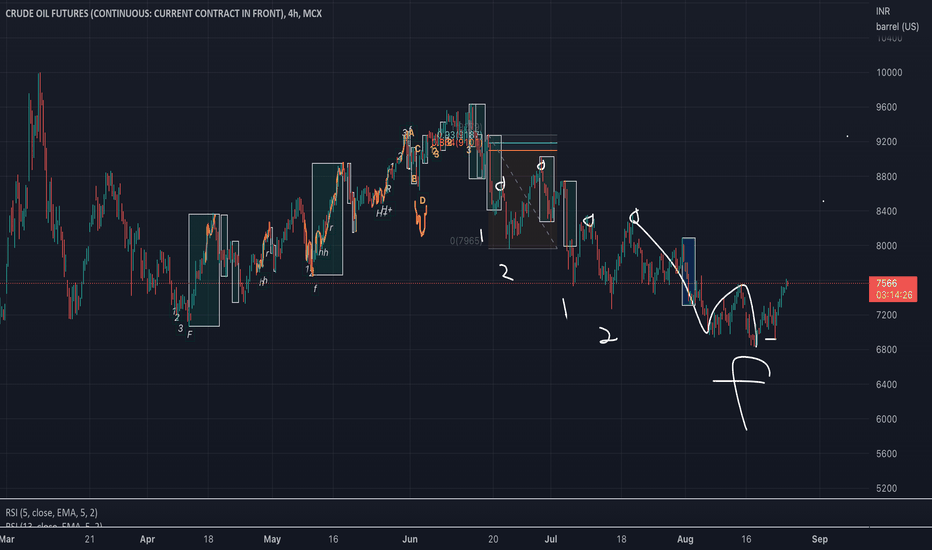

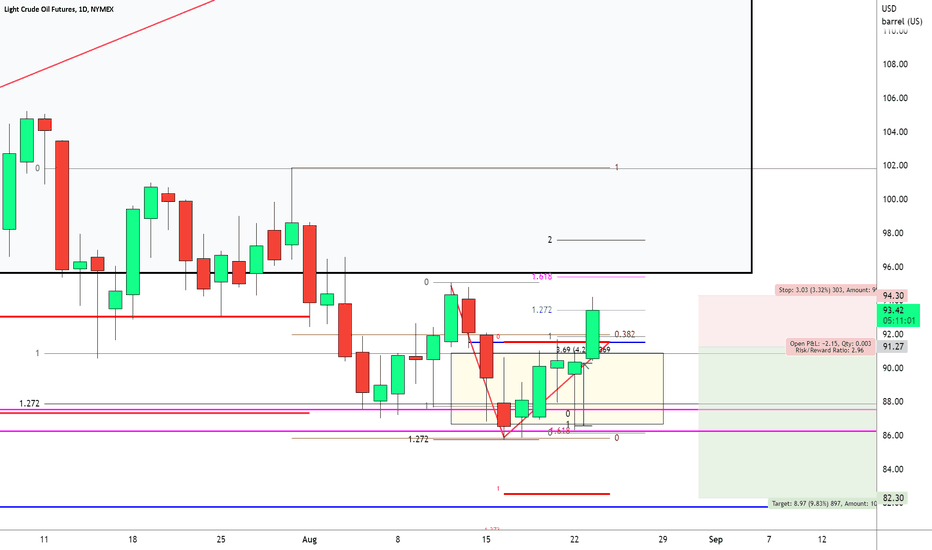

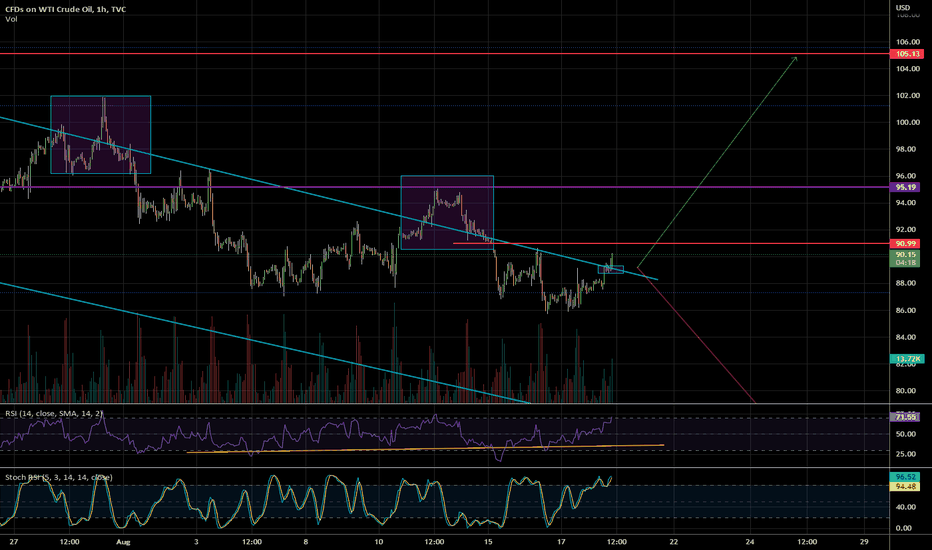

OIL8.23.22 This is a review of oil, specifically how you could have made significant trades in both directions with $3,000 ranges for more. The support and resistance were easy to identify, but there were nuances that you could see if you knew how to look at the chart that could have helped you make fewer mistakes and better trade decisions. Honestly, I don't know how you can make a lot of money in markets with relatively risk unless you focus when support and resistance areas. On the other hand, it is not quite as easy to trade the support or resistance because of the battles between buyers and sellers at those lines. I believe if you don't really think in terms at support or resistance, your risk will actually be that you will trade wrong direction. You can't live without focusing on those lines.... And once you do that, you have to learn how to manage your trade decisions. I go to those scenarios has the buyer and the seller looking at support and resistance in a two-day., with long and short trades. If you can learn this in one market, even the market you may not trade, you can use the analysis one markets that you will trade.

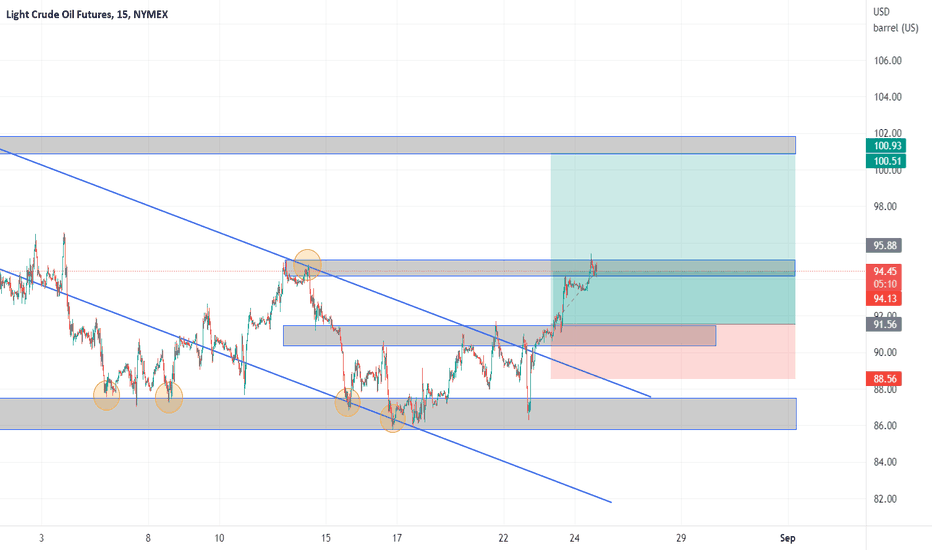

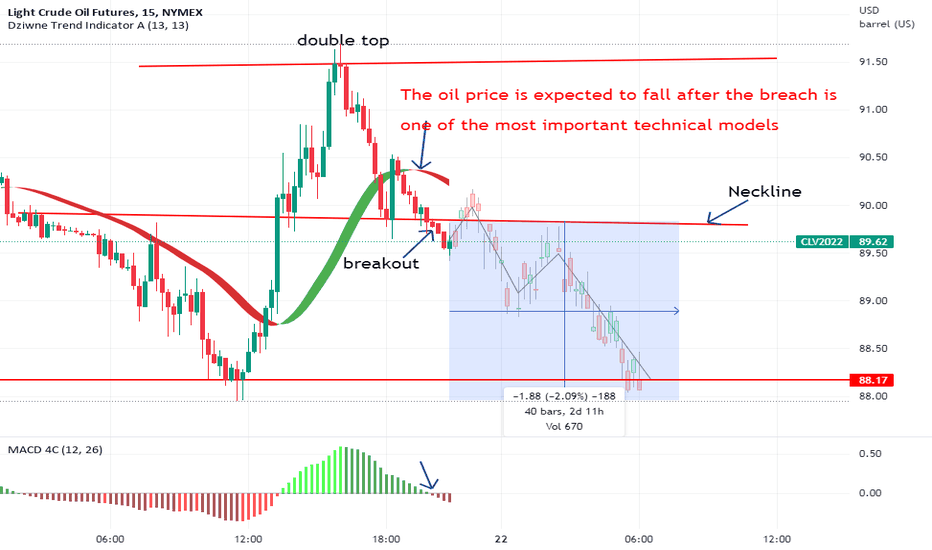

USOIL 23rd AUGUST 2022Oil prices briefly surged in mid-trade due to a push to raise the Fed's benchmark interest rate. However, prices eased back after investors believed that the US central bank's policy this month was to maintain interest rates.

Another factor, the US dollar strengthened again to its highest level in five weeks, which limited the increase in crude oil prices. This is because oil becomes more expensive for buyers with non-US dollar currencies.

US Dollar Index

Oil prices will not be too bearish, this is due to the prospect of higher demand entering the winter season.

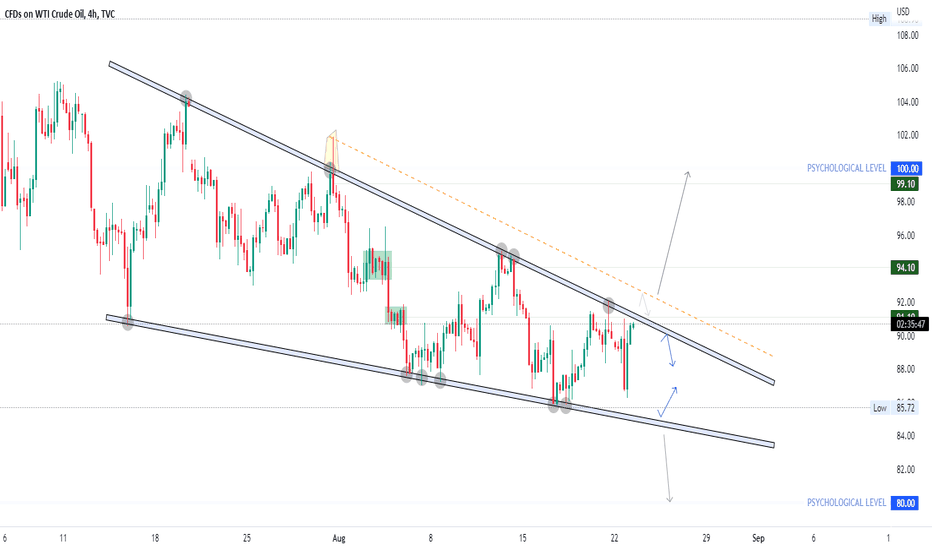

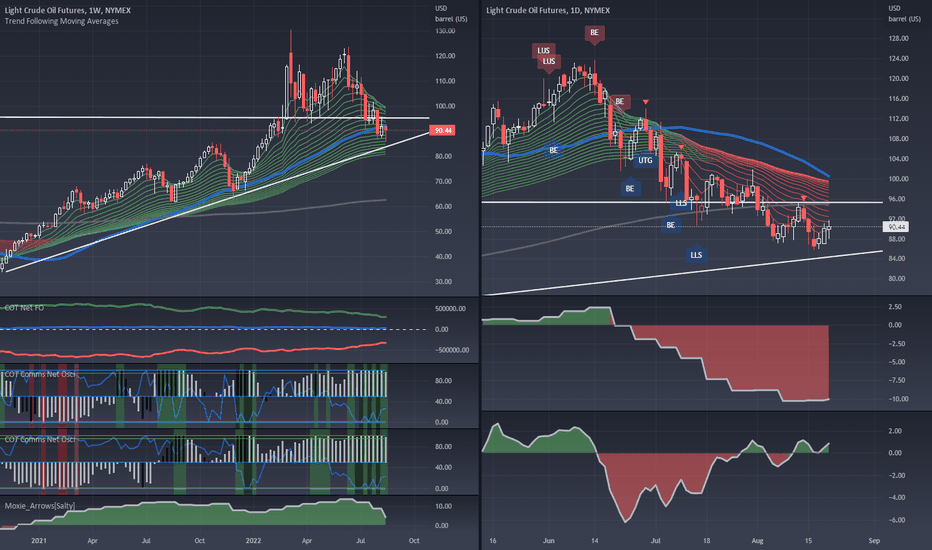

LONG CRUDE - Trading with COT dataCOT Data is pointing to Crude Oil ( NYMEX:CL1! or AMEX:USO ) being primed to pop after it's seasonal downturn

This is a great example where money management is key as well as not blindly using the COT data as the sole reason for entry. Personally, I have a proprietary daily chart indicator I use to enter trades where COT data is giving signals. Crude Oil has been declining all the way down since June despite COT data that is telling us it is ready to go up (My proprietary indicator did not once provide a buy signal throughout that time period). I'm looking closely for a short-term signal to enter off of this week

Notes on My Trading Methodology and What I'm Even Talking About

COT Definitions:

- COT: Commitments of Traders Reports - A weekly report published by the government (CFTC) that shows long and short positions of the below 3 groups (As well as much more data I don't look at). We look at the NET positions of these 3 groups and compare them to historical levels to signal trade opportunities

1- Commercials: Hedgers - We want to trade with them when they're at extreme levels (Think Tyson, Cargill, General Mills, etc)

2- Large Speculators: Hedge funds and large institutions - We want to fade them when they are at max positions (Think suits in NYC and commodity funds)

3- Small Speculators: People/institutions trading small lot sizes not big enough to report to CFTC - We want to fade their max positions as well since they represent the public (Think dude in his PJs trading and small trading firms)

Indicators on Chart:

- The first indicator shows the net positions of the 3 groups above plotted over time

- The second indicator is an index of the relative buying/selling of commercials over a certain lookback period. Anything above 95 is looking for buy, look to sell when it hits 0

- Note: Just because the Commercial's net position is negative doesn't mean it can't be relatively net long and signal a buy (same in the opposite scenario)

Trade Setup - Both Must Happen:

- When commercials are at max levels we are alerted to buy or sell (Depending on the criteria above)

- On a daily chart , use technical indicators, candlestick patterns, news, etc to enter the trade (not shown here)

- Added bonus when the trend is your friend (I use a Multiple Moving Averages indicator to visualize)

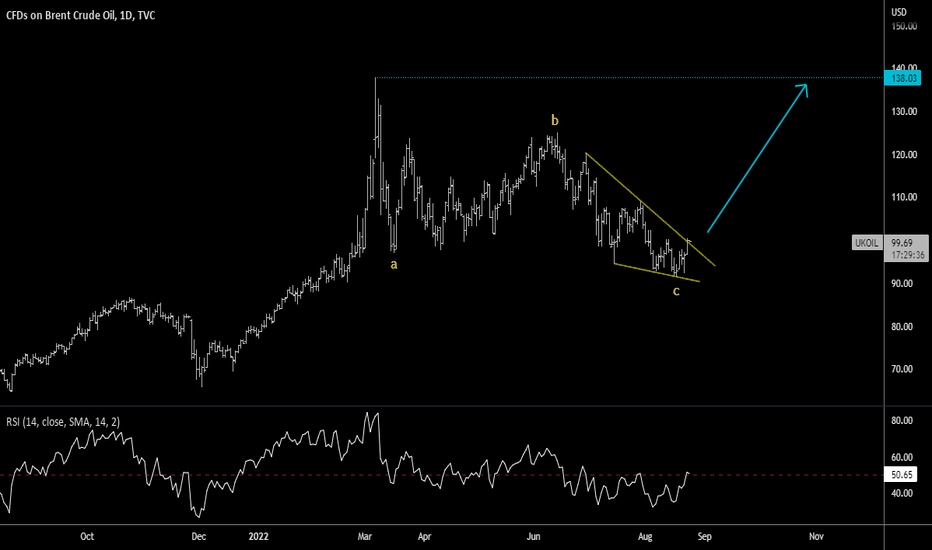

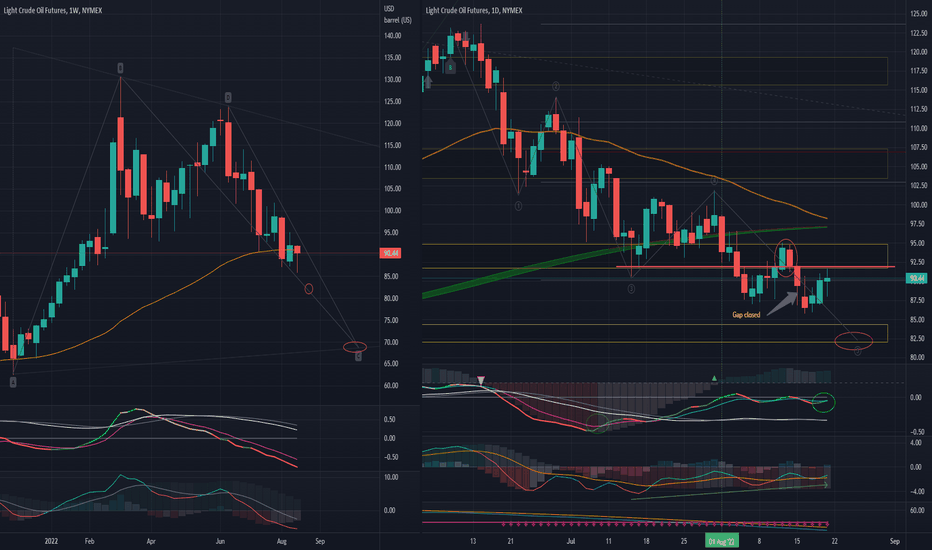

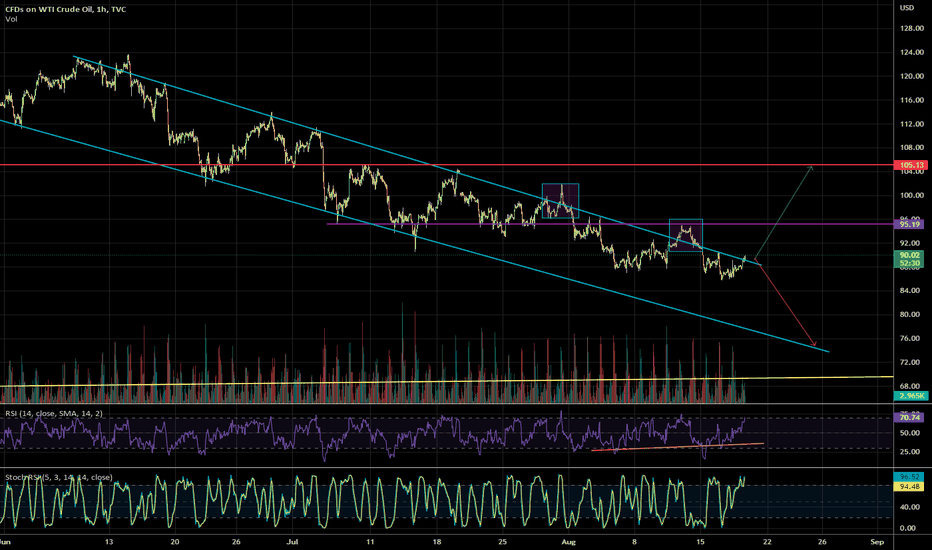

CRUDE - now what?Initially, it appeared that Crude prices were very robust and strong. Then came a retracement after a lower high and formed a lower low, and it appeared weak (in the face of a looming recession. Missing the downside target, Crude actually appears that it found a base, just bellow the weekly 55EMA.

Hint is mostly in the daily chart, where there is an obvious closed gap down, and as RPM accelerates upwards, the MACD is showing a bullish divergence. The coming week, breaking above 92, and then 95 is important to establish a good effort to reach the daily 55EMA, estimated about 95 then.

So Crude is expected to have some upside in the short term...

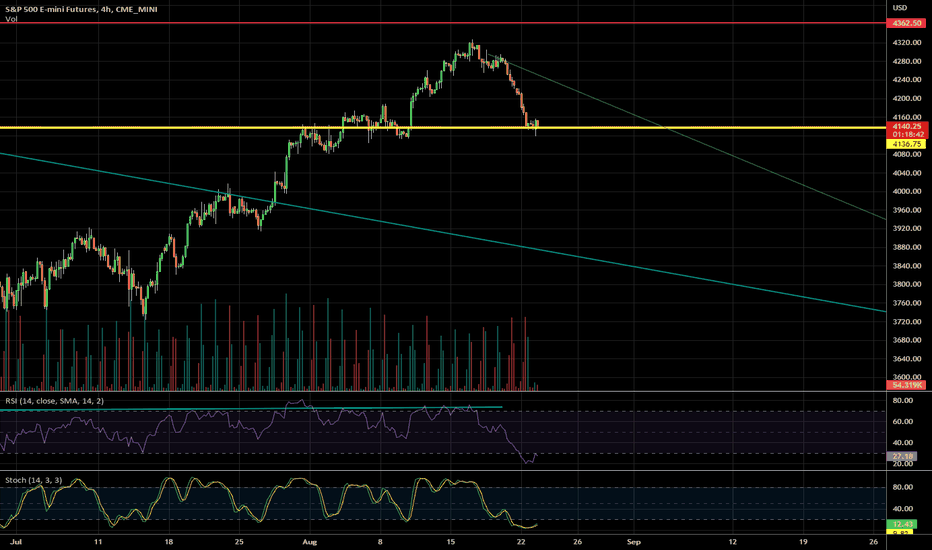

Oil Tests the $90's AgainOil has found support at $85.55, but is having difficulty ascending to higher levels. We did test $90.06, as we anticipated yesterday, however it seems that we are rejecting this level. We are meeting strong resistance here confirmed by a red triangle on the KRI. If we reject the $90's, we could head straight back to support at $85.55. If that does not hold, then $84.75 and $83.76 are the next support levels below.

potential breakout on USOILI mentioned yesterday there was daily bull divergence and now we are starting to get over the channel trendline. We've gotten over it before only to be sold off rather quickly, so I'm just putting a caution out there. Bulls want to see 88.50 hold if there is any sell off. Over 93 and holding would be very bullish and probably would rally to about 104 minimum quickly. Nothing is clear yet.

Oil Struggles to Recover $90Oil seems to have bottomed out at $85.55. We saw good support from green triangles on the KRI, and a subsequent pivot back to the high $80's. We are now just below $90, with $90.06 in particular being the level to break before attaining higher levels. We should see significant resistance there. The Kovach OBV is bearish and keeps pressing lower. If we fail to test the $90's, then $85.55 should provide support, with the next support levels below including $84.75 and $83.76.