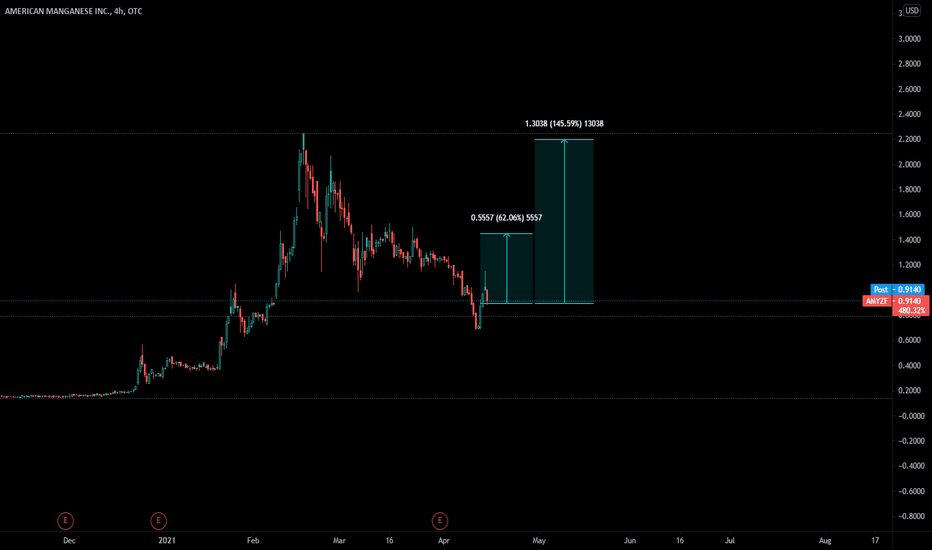

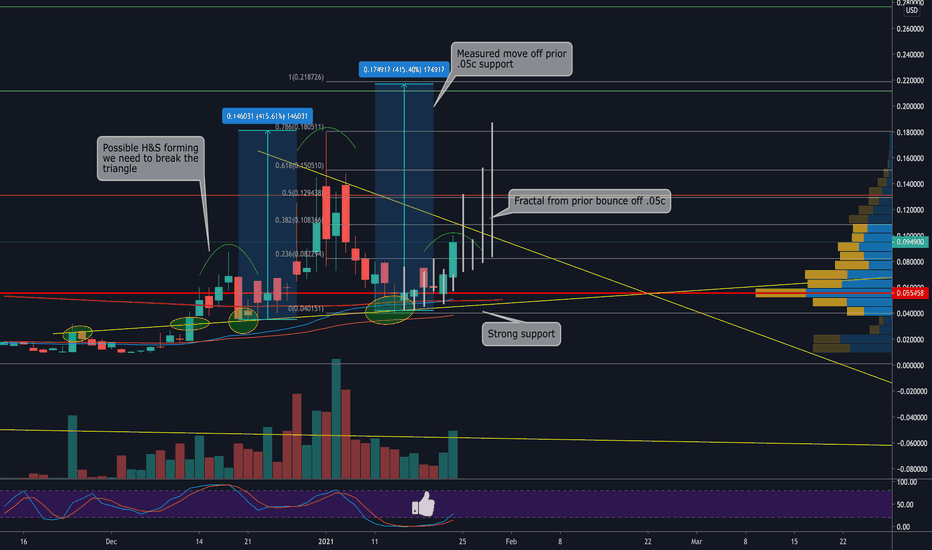

Metals - AMYZFModel has given entry signals for American Manganese:

- American Manganese Inc., a metals company, focuses on the recycling of lithium-ion batteries with the RecycLiCo Patented Process.

- Lithium ion batteries are critical in the renewable energy industry.

- We are very excited about opportunities in the commodities sector, as we believe a macro turn is approaching in the nearest future.

- Technically in a Wyckoff accumulation structure with a spring, possibly testing the channel top.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

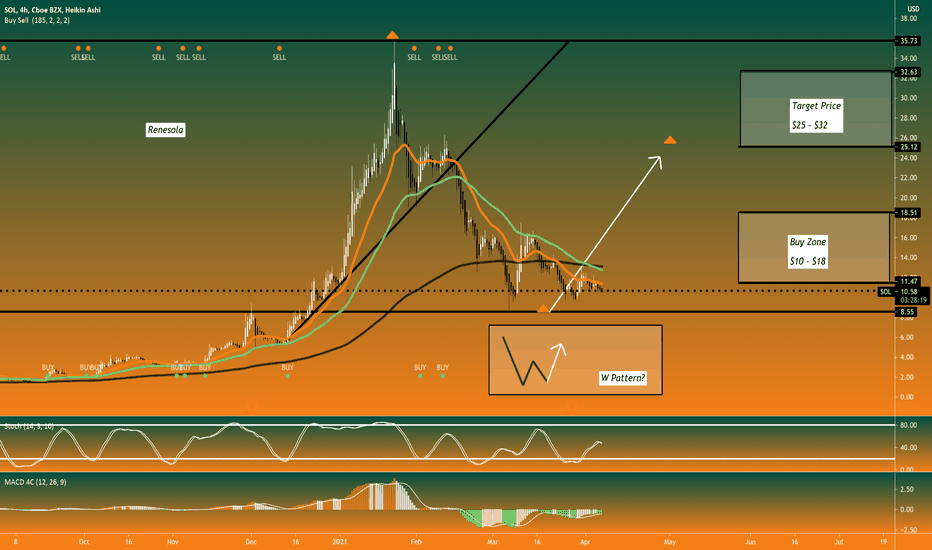

Cleanenergy

RenesolaMission:

We are focused on improving production efficiency. We are also continually developing new product lines to provide additional value to our portfolio of green energy offerings

Recent News:

1. STAMFORD, Conn., April 8, 2021 /PRNewswire/ -- ReneSola Ltd. ("ReneSola Power" or the "Company") (www.renesolapower.com) (NYSE: SOL), a leading fully integrated solar project developer, today announced that it closed the sale of an approximately 10 MW portfolio of solar development projects to Greenbacker Renewable Energy Company ("Greenbacker"). The sale continues a successful track record in North America. This sale will positively contribute to 1Q 2021 results and was not in the original first quarter guidance.

2. STAMFORD, Conn., April 1, 2021 /PRNewswire/ -- ReneSola Ltd ("ReneSola Power" or the "Company") (www.renesolapower.com) (NYSE: SOL), a leading fully integrated solar project developer, today announced that it closed the sale of a portfolio of projects originally disclosed on January 8, 2021. The projects are in Hungary and were sold to Obton, a leading international solar investment company headquartered in Aarhus, Denmark. The sale closed on March 19, 2021.

3. STAMFORD, Conn., March 25, 2021 /PRNewswire/ -- ReneSola Ltd ("ReneSola Power" or the "Company") (www.renesolapower.com) (NYSE: SOL), a leading fully integrated solar project developer, today disclosed the sale of two ground-mounted solar parks in Romania totaling 15.4 MW to Alternus Energy Group plc, a pan-European Independent Power Producer (IPP). The sale closed in December 2020 and will be reflected in fourth quarter 2020 results. Payment of €24 million was received this week.

What do you think?

Like, Follow, Agree, Disagree!

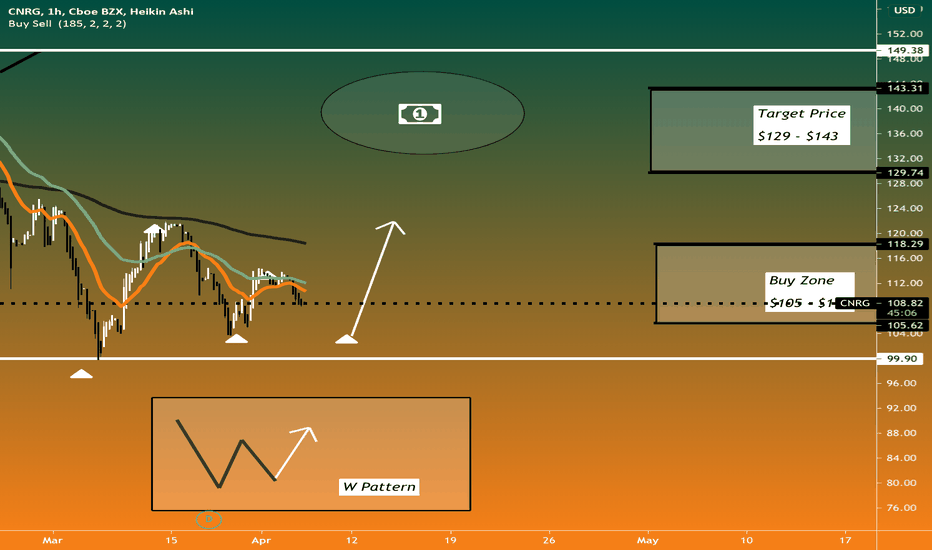

CNRG ETF Clean PowerKey Features:

- The SPDR S&P Kensho Clean Power ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Kensho Clean Power Index (the “Index”)

- Seeks to track an index utilizing artificial intelligence and a quantitative weighting methodology to capture companies whose products and services are driving innovation behind the clean energy sector, which includes the areas of solar, wind, geothermal, and hydroelectric power

- May provide an effective way to pursue long-term growth potential by investing in a portfolio of companies involved in the transition to lower emission generating power supply

Inception Date: October 2018

Performance:

YTD: 4.19%

1 Year: 207.07%

3 Year: n/a (Inception Year 2018)

5 Year: n/a (Inception Year 2018)

Annual Dividend Rate:

- 0.63%

Expense Ratio:

- 0.45%

Top Holdings:

Renesola Ltd, Daqo New Energy Corp, Fuel Cell Energy, Sun Power Corp, TPI Composites, AES Corporation, Ballard Power Systems, Plug Power, Canadian Solar, New Jersey Resources Corp, Maxeon Solar Technologies, ALLETE Inc, General Electric Company, Arcosa Inc, Enphase Energy.

*Not Financial Advice

What do you think?

Like Follow Agree Disagree!

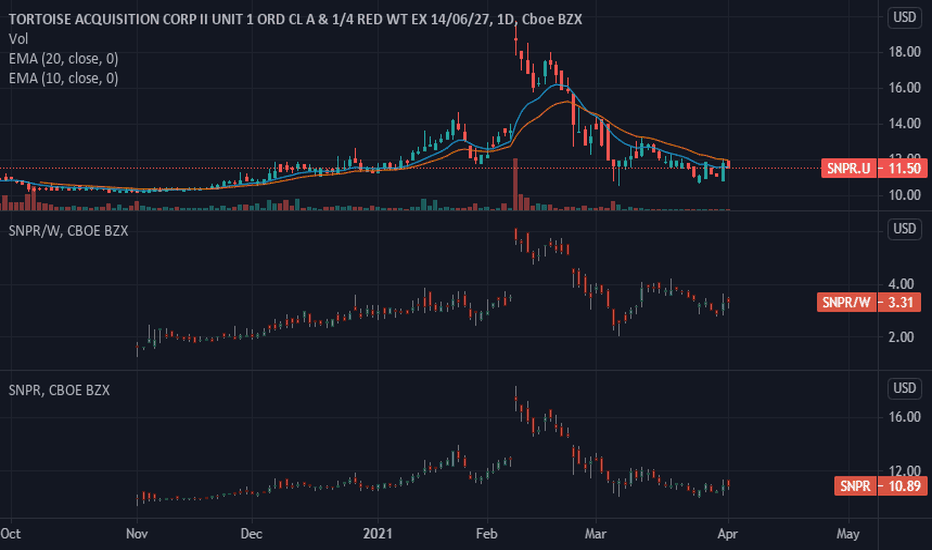

SNPR - LONG near NAV and here is howNOT FINANCIAL ADVICE

I may wait to purchase depending on market open and the ES premarket performance. If it opens up considerably I may pass all together on the opportunity.

SNPRU

BUY 500 units for 11.50 and apply

for split with transfer agent.

($5,750/500=$11.50 per unit)

SNPRW

500 units came with 0.25 of one warrant each,

which amounts to 125 warrants to sell instantly

to remove some risk and take the entry from

$11.50 per unit to $10.75 per share if all 125

warrants are sold at $3.00(conservative calculation)

SNPR

Hold 500 shares and sell call options at the

shortest expiration possible to continue

reducing entry price, eventually under the

trust value and then simply for the

purpose of generating income.

The chart is laid out from top to bottom, top=step 1/enter units for a discount on share price, middle=step 2/sell warrants for rebate & reduce entry, and bottom =step 3/further reduce entry & gen small income from covered calls.

I'll come back to this and post total P&L from the run when I move on to the next trade. Aiming to run this until merger takes place unless price is over entry, then I will continue to sell calls until i eventually get forced into profit. According to the recent filings, the merger will be voted on by shareholders sometime in the second quarter of 2021.

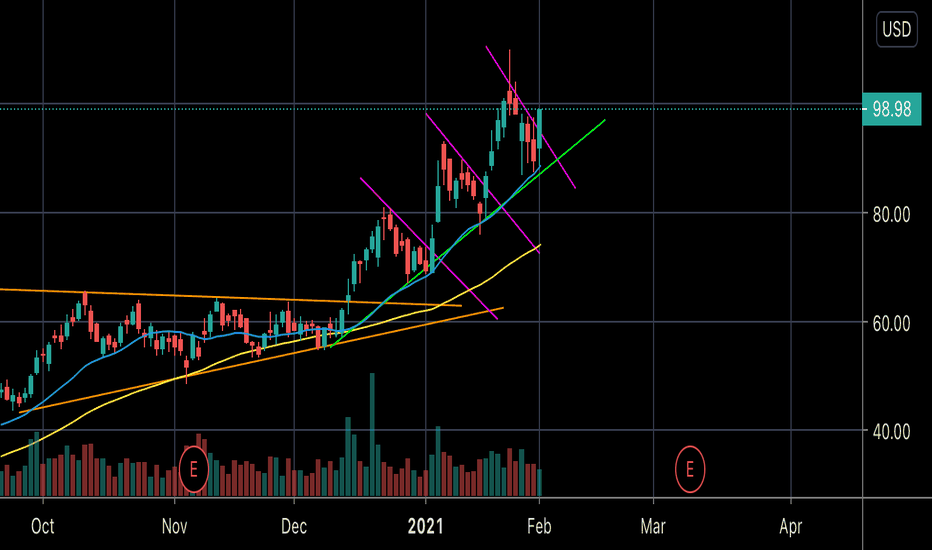

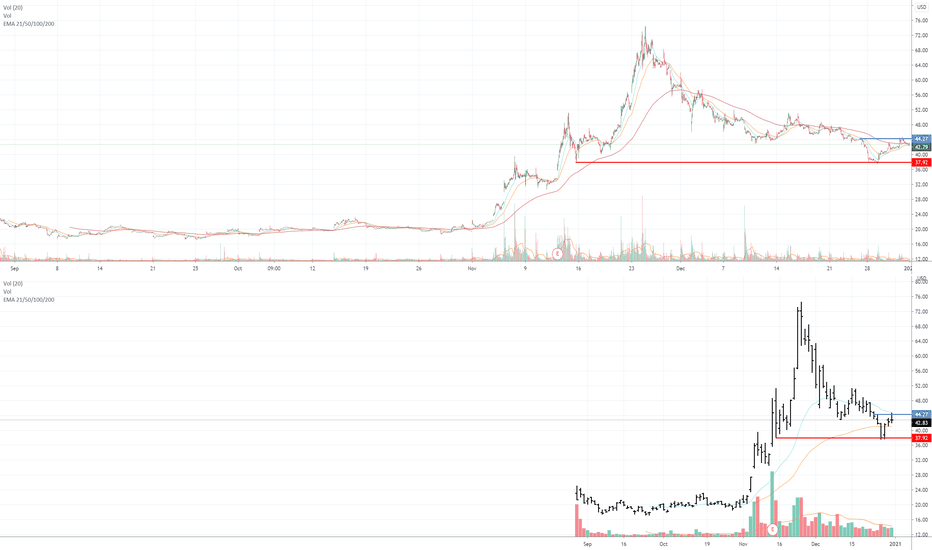

REGI BACK AT MAJOR SUPPORT LEVELSREGI as looked to find support again at last year's levels before it almost doubled post december. This may take time but if this support levels hold, we could see the price move back up. I will likely add more around these levels.

The 1 hr chart shows a double bottom with the little explosion of today. Im hoping these levels will hold and in a few months time we can test the ATH again.

I will add more in regi at these levels, just waiting for an entry after today's rise. Im hoping to add under more under 63.

This levels acted as a major support for the previous bull run so i am expecting them to act as support levels again this time around. My first PT would be 75.

Potential parabolic growth beyond the line of least resistance.Pleas see complete sector analysis below.

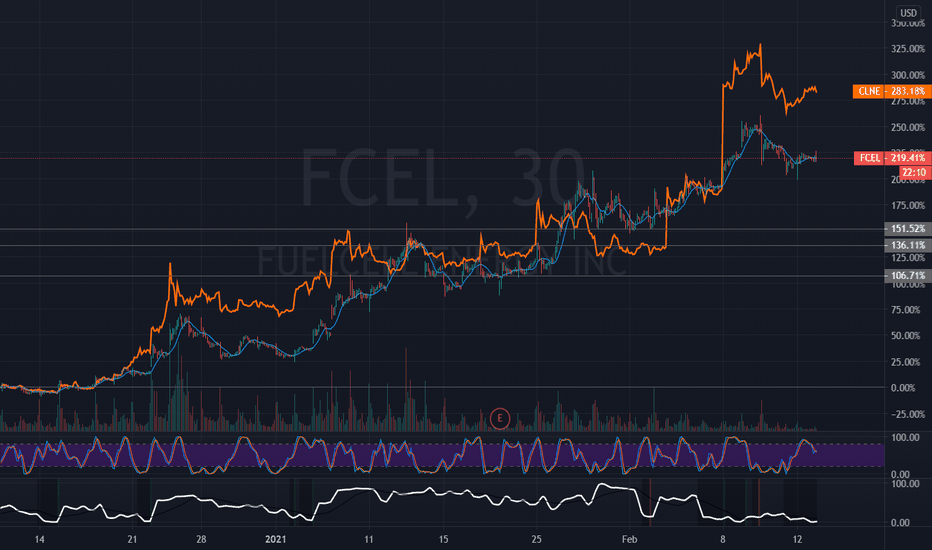

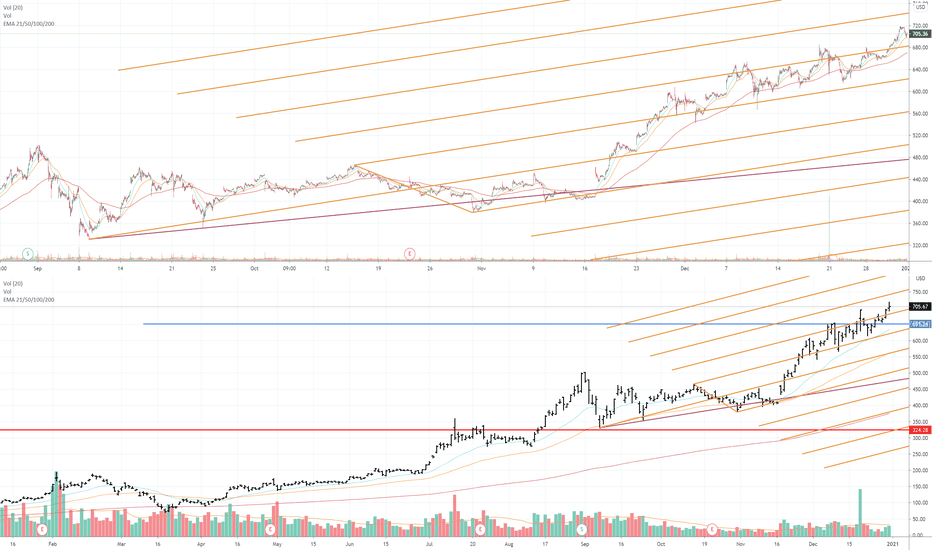

Here is an analysis on the hydrogen fuel cells, which is a part of Clean Energy campaign (solar, electric vehicles, hydrogen- this sector is encapsulated in etf- CNRG)... within this, solar and fuel cells are truly clean energy. Electric vehicles still run on electricity produced by coal. so the definition of clean energy is either carbon-neutral or negative. Nuclear should clearly qualify as is carbon neutral, but is not deemed clean. (sorry for this jargon... now to the point)... Fuel cells are considered a major future source of energy, with thousands of patents claimed every year. (search "Fuel-cell patent applications per year")

A new etf was launched in march 2021, to reflect the HYDROGEN energy sector, which essentially is largely fuel cells. See the HYDRO line in the chart.

In this chart you can see PLUG is a major player. the second largest players is FCELL.

PLUG uses very expensive catalysts to generate energy.. so their technology is not really commercialized.. major car companies have spend lots of time with them.

The chart compares FCELL vs SPY, the new HYDRO ETF, clean energy etf CNRG, and its peers in the sector PLUG and BLDP (not competition as they do not serve same markets). FCELL has outperformed all these benchmarks.

Issues with PLUG are not only linked with the technology, they had issues with accounting and reporting. got warnings. Ballard's tech is lagging.

FCEL did not have a favourable earnings quarter, but is positioned the best in this sector to deliver fastest growth. I believe the line of least resistance is $18.69, beyond which the volume profile is very thin. Stop loss at that point could very well be the current price of 15.47, with an expected return of 56%. See the long position plan.

___ not a financial advice____

REGI UpdateTook a hit on this.

Still holding.

Falling wedge. Hoping for target over 80.

Looks oversold.

67$ looks to be the bottom.

Update on $ACTC, I Remain EXTRA BullishI've corrected my last idea ( ) on the formation of the Bullish pennant and the date of my PT.

MACD and RSI on the 3-month are still looking very tasty. As I described in my last $ACTC post, Proterra has a strong presence in the EV space- owning 50% of the North American market share within EV bus sales.

Short interest has also DOUBLED in a two-week timeframe. nasdaqtrader.com

This is a 10yr+ hold for me. Crazy how little conversation is going around about this hidden gem!

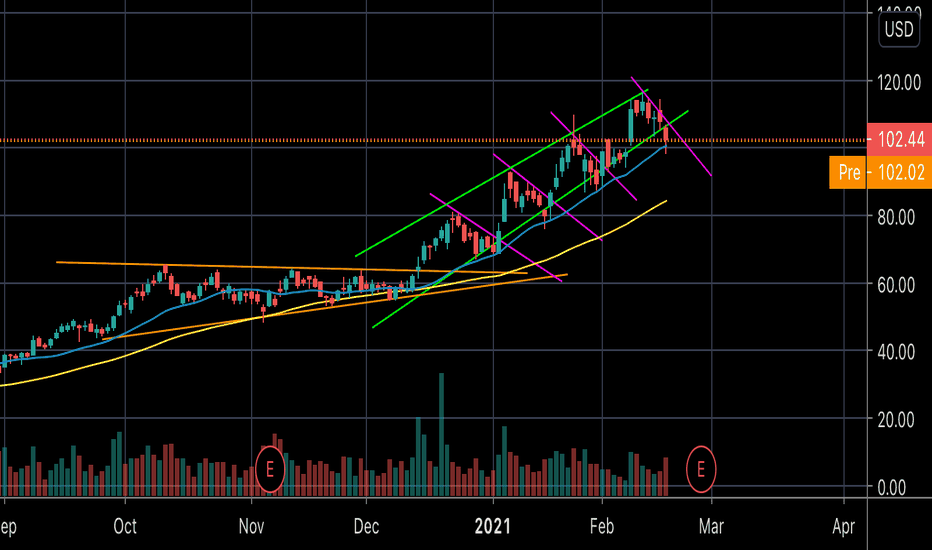

Up from here? $REGIRegi looks ready for another move up if we can close green today.

Pattern of pennants forming.

I think we will see 120 soon.

Update from a previous chart a few weeks back.

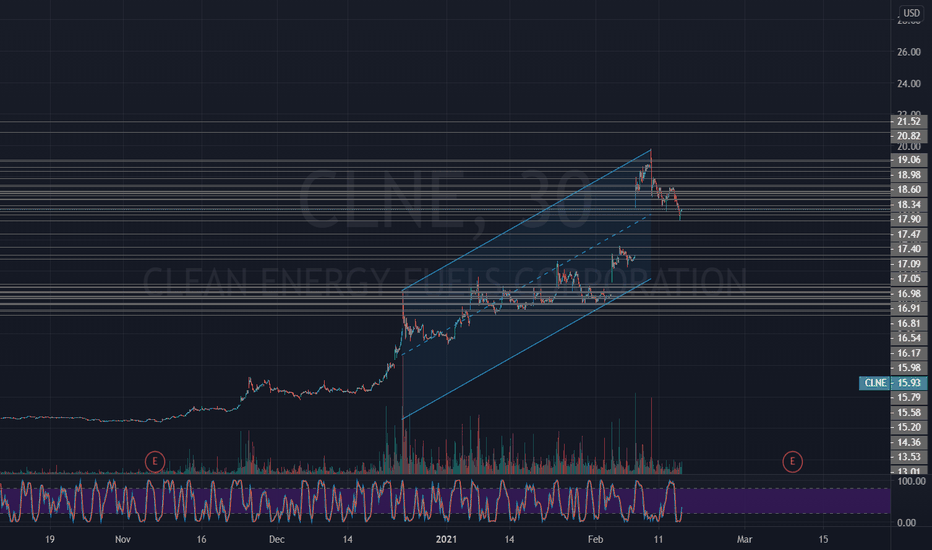

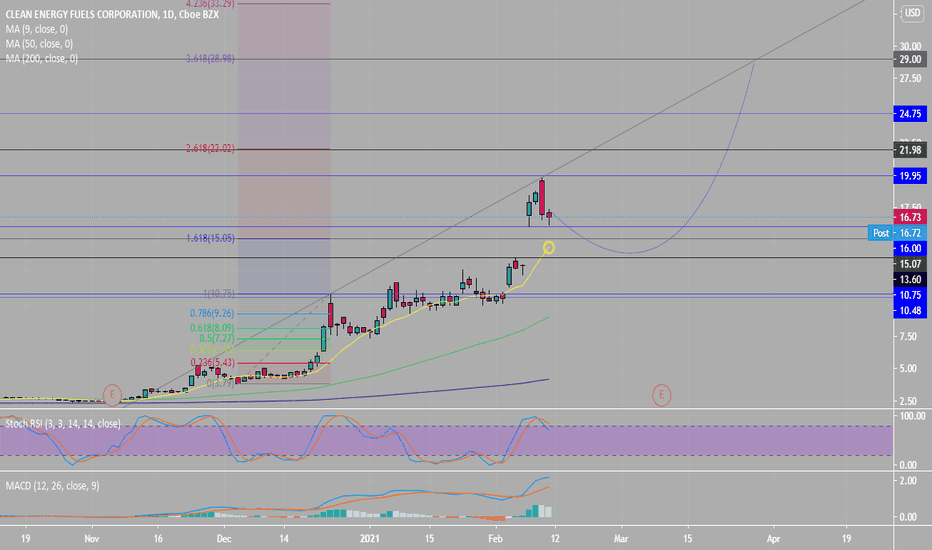

CLNE . Ride the Pelican to $29What's not to like fundamentally. They got deals with New York City and Los Angeles County Metropolitan Public Transportation. Nat Gas assists the bridge to cleaner energies.

Technically, I just wanted to draw a pelican. They glide across the skies like kites and only wanna go up.

This analysis is dedicated to Doctor Yield Curve, twitter tasty furu usa.

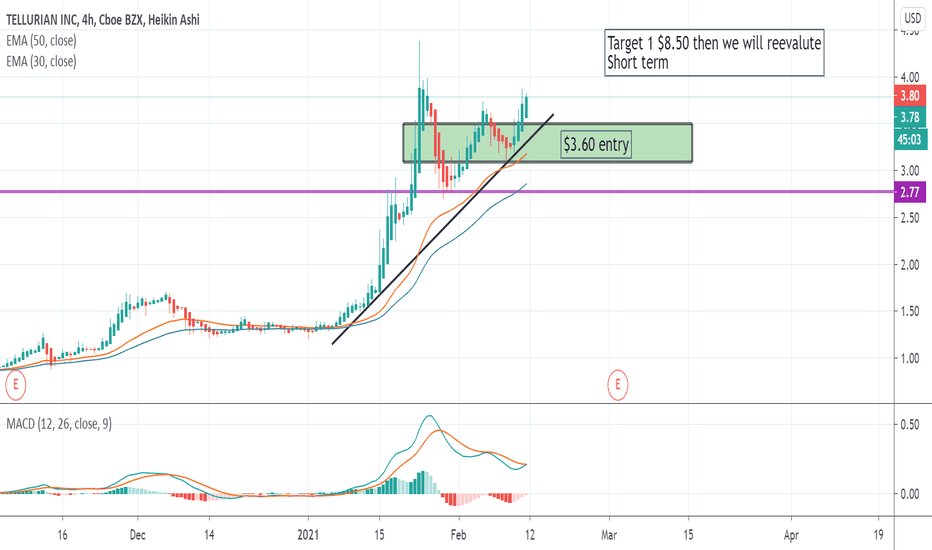

Short Term Money MakerThis play has great potential. I LOVE it below $3.50 but I still like it below $4.00... Their last quarter earnings they performed great and on track. Income Statements are good, Balance sheet good, Cash Flow shows they are profitable, and debt to asset below 100 ... This is GOLDEN!!!!

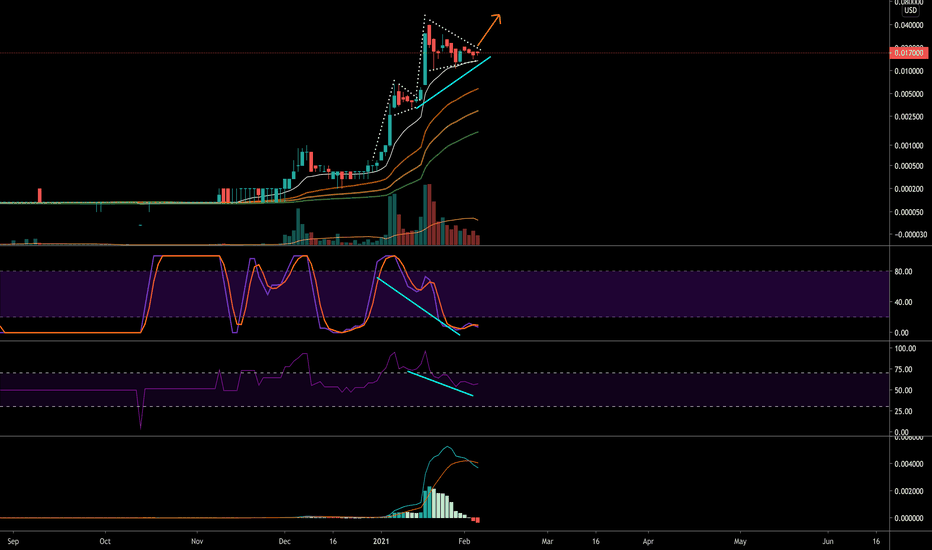

This penny stock looks ripe for takeoff! 🚀$BLSPLet's just talk technicals first. We can see that this stock is on an upward trajectory, retracing to the 21 EMA like a plethora of momentum stocks out there. It has created two perfect bullish pennants (or bull flags depending on who you talk to), perfect for the continuation play. You also have hidden bullish divergence between the price, the RSI and Stoch RSI.

From a fundamental standpoint Blue Sphere Corp. has seen impressive sales growth going from $588K in 2016 to almost $11 million. They specialize in transforming millions of tons of agricultural, municipal and industrial waste into sustainable clean energy, which is perfect for the environment created by the new administration in the US.

It's always important to remember position sizing, regardless of how bullish we may be on a stock; this is especially more poignant when talking about penny stocks where small ticks can represent large percentage swings.

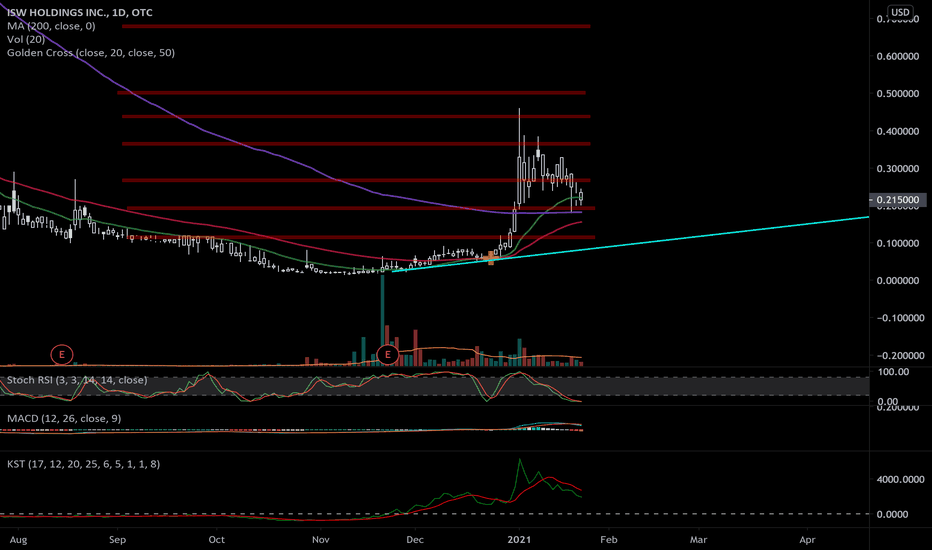

BREAKOUT ALERT!This chart is ready for breakout!

the stock is ISWH.

they are in to bitcoin mining, telehealth and renewable energy.

has a decent share structure.

On technicals, this is clearly oversold as evidenced by the stoch rsi and macd; it also held the support really well (red line). This area is where i would scale in, and a break of that 0.26 is my bullish confirmation. As far as Eliot Waves, I strongly think it's setting up for the wave 3.

a good catalyst could break that 0.45 resistance and with the tiny share structure, I have no doubt this would reach its 52 week high $1.40

This is a SWING to dollar land!

RISK WHAT YOU CAN AFFORD TO LOSE!

DISCLAIMER:

Futures, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks and options may fluctuate, and, as a result, clients may lose more than their original investment.

In any trading or Investing, a due diligence is a must.

xpev will pick direction next week1. lockup expiraction date 23-Feb-21

2. xpev compared to li and nio has advantage of automatic driving, and high investment into AI.

3. Current support around 38, and bounce back to 44, 44 is previous resistence, and it was not able to

zoom much above it. I think it will have another push down and break 38 level.

4. Will keep close eyes next week.

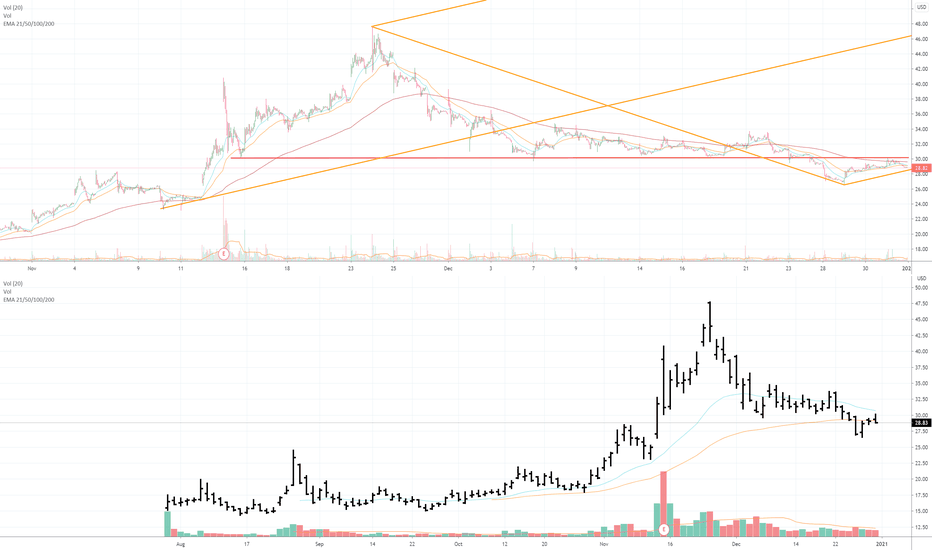

li waits for picking up directionsLI gets rejected on $30 level.

Lockup expiration date is 26-Jan-21.

Latest news for LI deliveries have a good result.

Tesla drops price for Y model in china, and need to see how much impact on LI.

From 1 day chart, it nears 50 ema and potentially breaks it. Will it get a further pullback into $15? That will be a crazy deal.