Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

Cleantech

Can Small Reactors Solve Big Energy Problems?Oklo Inc. has recently captured significant attention in the nuclear energy sector, propelled by anticipated executive orders from President Trump to accelerate the development and construction of nuclear facilities. These policy shifts are designed to address the US energy deficit and reduce its reliance on foreign sources for enriched uranium, signaling a renewed national commitment to atomic power. This strategic pivot creates a favorable regulatory and investment environment, positioning companies like Oklo at the forefront of a potential nuclear renaissance.

At the core of Oklo's appeal is its innovative "energy-as-a-service" business model. Unlike traditional reactor manufacturers, Oklo sells power directly to customers through long-term agreements, a strategy lauded by analysts for its potential to generate sustained revenue and mitigate project development complexities. The company specializes in compact, fast, small modular reactors (SMRs) designed to produce 15-50 megawatts of power, ideally suited for powering data centers and small industrial areas. This technology, coupled with high-assay, low-enriched uranium (HALEU), promises enhanced efficiency, extended operational life, and reduced waste, aligning perfectly with the escalating energy demands of the AI revolution and the burgeoning data center industry.

While Oklo remains a pre-revenue company, its substantial market capitalization of approximately $6.8 billion provides a strong foundation for future capital raises with minimal dilution. The company targets the commercial deployment of its first SMR by late 2027 or early 2028, a timeline potentially accelerated by the new executive orders streamlining regulatory approvals. Analysts, including Wedbush, have expressed increasing confidence in Oklo's trajectory, raising price targets and highlighting its competitive edge in a market poised for significant growth.

Oklo represents a high-risk, high-reward investment, with its ultimate success contingent on the successful commercialization of its technology and continued governmental support. However, its unique business model, advanced SMR technology, and strategic alignment with critical national energy and technological demands present a compelling long-term opportunity for investors willing to embrace its speculative nature.

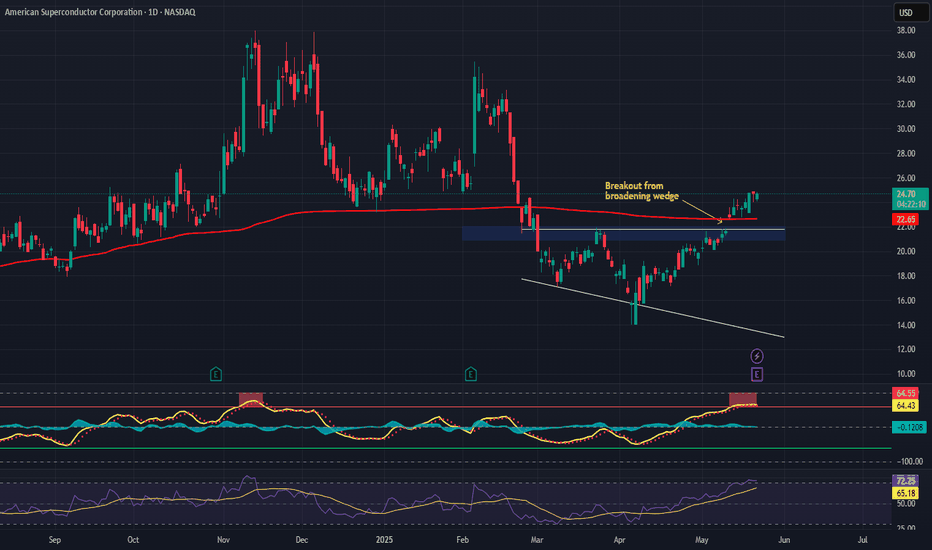

American Superconductor–Powering the Future of Energy & Defense Company Overview:

NASDAQ:AMSC is at the intersection of three megatrends: grid modernization, clean energy, and military innovation. With proprietary high-temperature superconducting (HTS) technology and a growing portfolio of energy and defense solutions, the company is moving from niche player to strategic infrastructure enabler.

🔑 Growth Catalysts:

📈 Grid Modernization & NWL Acquisition

Grid segment revenue +56% YoY in Q3 2024, accelerated by NWL integration

NWL expands footprint in grid-scale capacitors, transformers, and military-grade systems

Heightened U.S. focus on grid resiliency due to aging infrastructure and climate pressures

🌬️ Renewable Energy Tailwinds

Wind segment grew +58% YoY, bolstered by demand for advanced turbine control systems

Aligns with global decarbonization and offshore wind investment

🛡️ Defense Expansion

HTS tech used in shipboard systems, degaussing solutions, and high-power electronics

NWL opens doors to increased DoD contracts amid rising national security budgets

🔁 Recurring Revenue & Policy Support

Shift toward long-term service and tech licensing agreements

Backed by U.S. energy and defense spending, including DOE and DOD initiatives

📊 Fundamental Highlights:

Lean balance sheet and operating leverage

Strong YoY revenue acceleration across all segments

Diversified exposure to energy, defense, and renewables

📈 Investment Outlook:

✅ Bullish Above: $21.00–$22.00

🚀 Upside Target: $38.00–$40.00

🎯 Thesis: With breakthrough superconducting tech, strategic acquisitions, and bipartisan support for energy security, AMSC is emerging as a small-cap innovator in critical infrastructure.

#AMSC #GridModernization #DefenseTech #Renewables #Superconductors #EnergyResilience #CleanTech

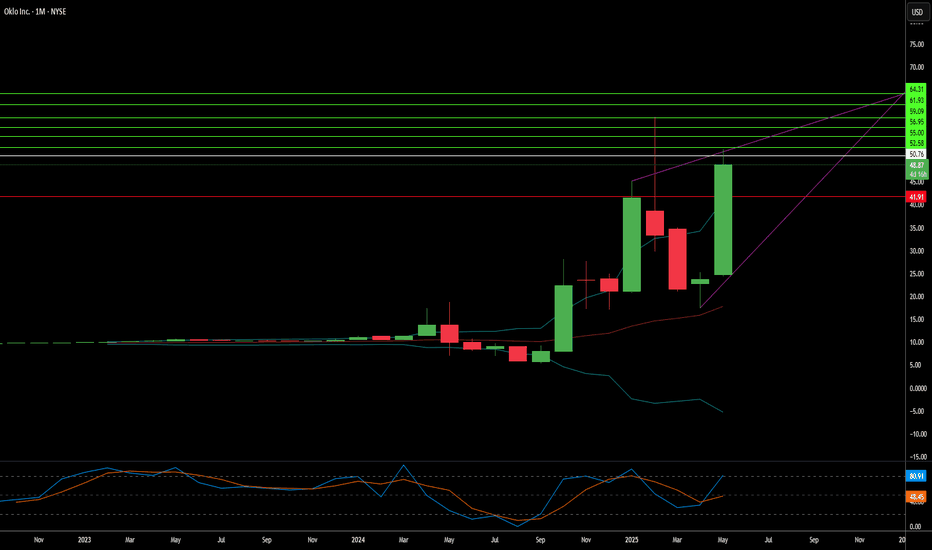

Oklo Inc. (OKLO) AnalysisCompany Overview:

Oklo Inc. NYSE:OKLO is at the forefront of the clean energy revolution, specializing in compact nuclear reactors designed for efficiency and scalability. Its innovative solutions position it as a transformative player in addressing the global demand for clean, reliable energy.

Key Catalysts:

Landmark Partnerships:

Switch Partnership: A deal to supply 12 gigawatts of nuclear power highlights Oklo’s leadership and demonstrates its capacity to scale operations, significantly boosting its revenue potential.

RPower Memorandum: Supporting data centers, a rapidly growing market, Oklo expands into industries with high energy demands, further solidifying its presence in strategic high-growth markets.

Robust Order Book:

With 14 gigawatts of secured orders, Oklo demonstrates strong market demand and a clear path toward sustained growth and market leadership in advanced nuclear energy solutions.

Market Potential & Expansion:

Oklo’s compact nuclear technology offers cost-effective, carbon-free energy, positioning it to capitalize on global trends toward decarbonization, increased data center energy needs, and clean energy mandates.

Investment Outlook:

Bullish Case: We are bullish on OKLO above the $31.00-$32.00 range, driven by strong partnerships, robust order growth, and expanding applications for its technology.

Upside Potential: Our target for OKLO is $60.00-$61.00, supported by its innovative solutions, increasing market adoption, and entry into high-demand sectors like data centers.

🚀 OKLO—Powering a Clean Energy Future with Innovation and Scalability. #NuclearEnergy #CleanTech #Innovation

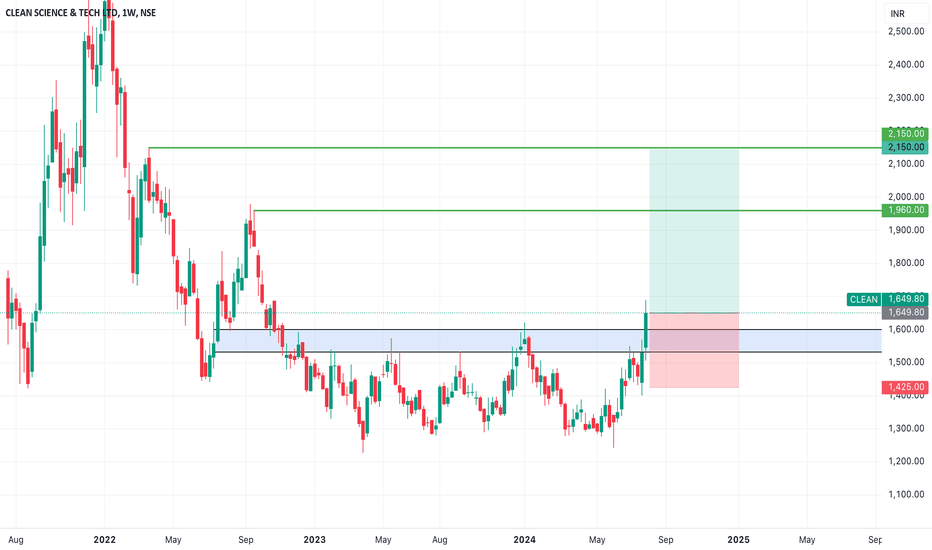

SWING IDEA - CLEAN SCIENCE AND TECHClean Science and Technology , a prominent player in the specialty chemicals sector, is exhibiting strong technical signals that suggest a potential swing trading opportunity.

Reasons are listed below :

1550-1600 Resistance Zone Broken : The price has successfully broken through the 1550-1600 resistance zone, indicating strong bullish momentum and potential for further upside.

Break of 1.5+ Year Consolidation : The stock has broken out of a prolonged consolidation phase of over 1.5 years, signaling a new bullish trend and increased investor interest.

50 EMA Support on Weekly Timeframe : The stock is finding solid support at the 50-week exponential moving average, reinforcing the overall bullish sentiment and providing a reliable support level.

Volume Spike : A noticeable increase in trading volumes confirms the strength of the price move, indicating strong investor interest and participation in the current trend.

Target - 1960 // 2150

Stoploss - weekly close below 1425

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

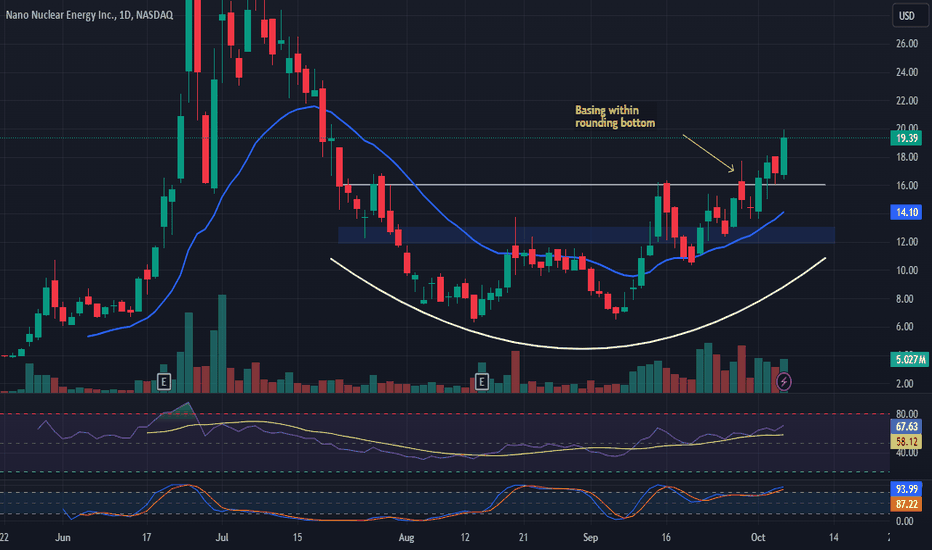

NANO Nuclear Energy (NNE) AnalysisCompany Overview: NANO Nuclear Energy NASDAQ:NNE is at the forefront of the clean energy revolution, focusing on small modular reactors (SMRs) and microreactors. These innovations are vital for delivering reliable, clean energy to remote areas and are also being considered for space exploration, potentially opening up vast new revenue streams.

Key Catalysts:

Small Modular Reactors (SMRs): SMRs offer a scalable, reliable solution for generating clean energy, especially in areas where traditional infrastructure is difficult or costly to develop.

Space Exploration Potential: Microreactors are being considered for space exploration, which could lead to significant revenue opportunities in the burgeoning space economy.

Partnership with Idaho National Laboratory: This collaboration adds credibility to NNE’s technology and accelerates the path to commercialization.

Vertical Integration: NNE is vertically integrating its operations with plans for a HALEU fuel fabrication facility, ensuring control over critical components and improving efficiency.

Expansion Commitment: The recent acquisition of a 14,000-square-foot facility in Oak Ridge, TN, demonstrates the company's commitment to growth and infrastructure development.

Investment Outlook: Bullish Outlook: We are bullish on NNE above $12.00-$13.00, based on its leadership in SMRs and promising new markets like space exploration. Upside Potential: Our upside target is $25.00-$26.00, driven by strong partnerships, technological advancements, and commercialization progress.

🚀 NNE—Leading the Future of Clean Energy with Innovation. #NuclearEnergy #SMRs #CleanTech

Investing Green: Global X CleanTech ETFIn this post, I'll be introducing a way you can gain expose yourself to green investments through Global X CleanTech ETF ($CTEC).

Disclaimer: This is not financial advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

The Potential of Green Investing

- President Joe Biden is expected to unveil a new $1.75 trillion spending framework on Thursday, which will include $555 billion for clean energy investments.

- The spending targets emissions-reducing technologies across buildings, transportation, industry, electricity and agriculture.

- The dollars earmarked for climate spending focus on incentives rather than punishments.

- The initiatives will start cutting pollution now, with more than one gigaton of greenhouse gas emissions reduced in 2030.

- This will set the U.S. on a path to reduce emissions by 50% to 52% below 2005′s levels by 2030.

- The plan includes a 10-year expansion of tax credits for utility-scale and residential clean energy, transmission, storage, electric vehicles and clean energy manufacturing.

- More than $100 billion is set aside for resilience investments as extreme weather events, including wildfires fueled by climate change, batter the U.S.

Framework Breakdown

- $320 billion: Clean energy tax credits

- $105 billion: Resilience investments

- $110 billion: Investments and incentives for clean energy technology, manufacturing and supply chains

- $20 billion: Clean energy procurement

Information about the ETF

- The Global X CleanTech ETF (CTEC) seeks to invest in companies that stand to benefit from the increased adoption of technologies that inhibit or reduce negative environmental impacts.

- This includes companies involved in renewable energy production, energy storage, smart grid implementation, residential/commercial energy efficiency, and/or the production and provision of pollution-reducing products and solutions.

- Inception Date: Oct 27, 2020

- Total Expense Ratio: 0.5%

- Net Assets: $187.38B

- Net Asset Value (NAV): $22.23

Top 10 Holdings

1. PLUG POWER INC (PLUG) - 8.02%

2. ENPHASE ENERGY INC (ENPH) - 7.60%

3. VESTAS WIND SYSTEMS A/S (VWS DC) - 5.71%

4. SIEMENS GAMESA R (SGRE SM) - 5.24%

5. SAMSUNG SDI CO LTD (006400 KS) - 5.19%

6. SOLAREDGE TECHNO (SEDG) - 5.10%

7. XINYI SOLAR HOLDINGS LTD (968 HK) - 4.89%

8. FIRST SOLAR INC (FLSR) - 4.80%

9. QUANTUMSCAPE CORP (QS) - 4.33%

10. JOHNSON MATTHEY PLC (JMAT LN) - 3.66%

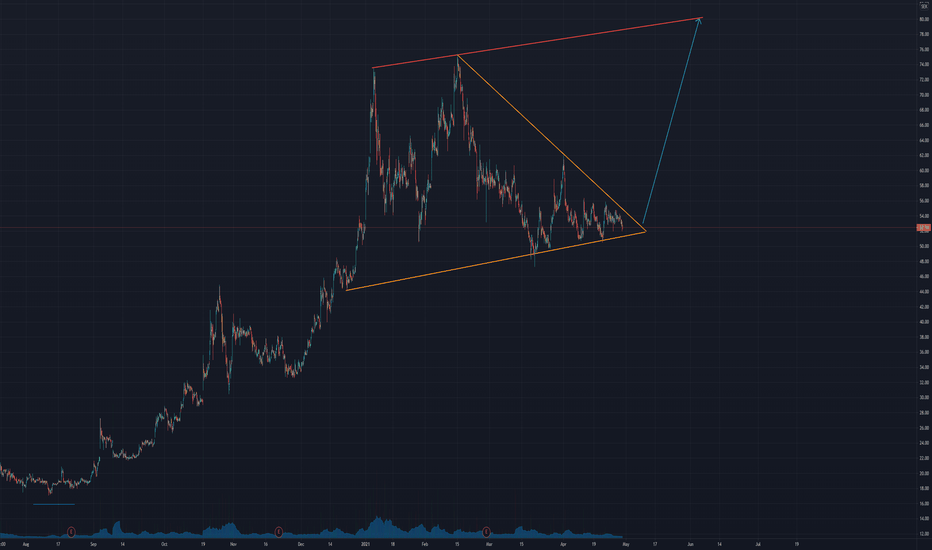

Technical Analysis

- This ETF has undergone a long phase of accumulation between $16-21

- While it has broken out of the accumulation range, there are two main levels of resistance it needs to break; $23.3 and $29.6

- We could expect the ETF to test the now resistance-turned-support in the form of a pullback before moving up to create higher lows and higher highs

- Based on the fibonacci retracement level, we could consider the 1.618 a plausible long term target.

Conclusion

The US government is investing heavily in cleantech, and paving way for green companies to grow, and it's highly likely that other governments will begin to do the same across the world. Finding a specific winner for their cause might be difficult, but this ETF allows you to gain exposure to a variety of cleantech companies. While this ETF doesn't have a long track record, it's managed by a reputable company. Technically, we have broken out of the accumulation range, and yet the price is still close to the ETF's net asset value, providing high upside potential for the mid to long term.

If you like this educational post, please make sure to like, and follow for more quality content!

If you have any questions or comments, feel free to comment below! :)

Azelio towards first target around 80 SEK My take on Azelio. If they follow through with orders in Q2 which is their plan and they've delivered accordingly to their plans with precision so far. Both the technical and fundamental pieces are in place here for a breakout. Biggest owner bought more shares at 52.90 and the company had a new issue of shares (596 million SEK) at around 56 SEK in march 2021. There's always a risk to break down on the downside as well of course. Such a thing could be due to maybe a latency due to restrictions and more lockdowns etc. There's always a risk. On the long term though I see a bright outlook for this company. This is no financial advice, only my 2 cents.

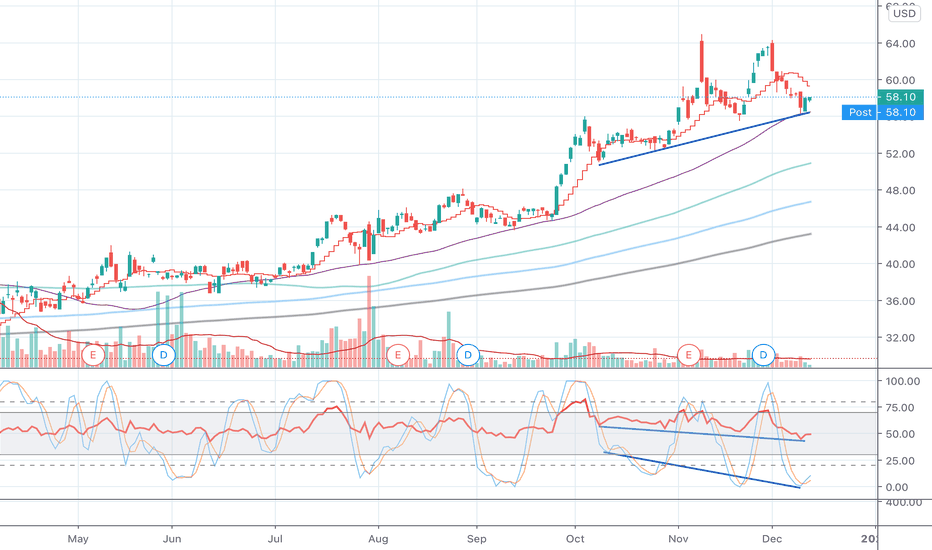

How is the planet doing BEP?Not very well, I am afraid. Nevertheless, as an idealist and an optimist I would like to save the world one share at a time. The renewable energy and EV stocks are mostly very expensive at the moment. However, this $BEP (or $BEPC if you wish) is almost reasonably priced.

In addition, there seems to be clearly distinguishable hidden bullish divergence on both RSI and Stoch suggesting that the bullish momentum could continue. I certainly hope so as I bought some shares today.

Trade well and take care!

Cheers, Whoop

Aurora Clean Tech RisingAurora Solar Technologies a low float big potential company. Fully diluted share count of just over $96 mil along with Sales presence in Asia, 50% gross Margin, and a current addressable market of $435 mil + in the growing clean energy sector.

They provide a suite of In- line Solar cell visualization and diagnostic equipment to aid in the manufacturing of solar Cells, Allowing companies to cut cost due to Labor and poor cell quality. They have been obtaining repeat orders / larger orders of this suite of Equipment as well as just received a order from the world's largest Solar Cell Manufacture which speaks volumes to where this company is heading.

Currently in a bullish up trend trading just above its .115 support and with both dema 11/22 cross and moving higher along with A/D above its ema I see lots of short term influence to keep this stock rising. Financials at End of Feb and news of any more new volume orders should break through .15 and reaching .19 in Feb. I currently hold a mid term goal of .26 but with growing orders new improvements to the system along with order from World Largest manufacture and the Savings to the Manufactures they provide I see Aurora heading towards $1 going into 2021

Gumbie and Bottoms UpUranium futures

TSX:U

AMEX:UEC

OTC:FCUUF

TSXV:GXU

OTC:URPTF

UUUU

NYSE:CCJ

DNN

TSX:MGA

TSXV:BSK

OTC:AZZUF

NYSE:AZZ

NASDAQ:FOSL

PALAF

OTC:CAULF

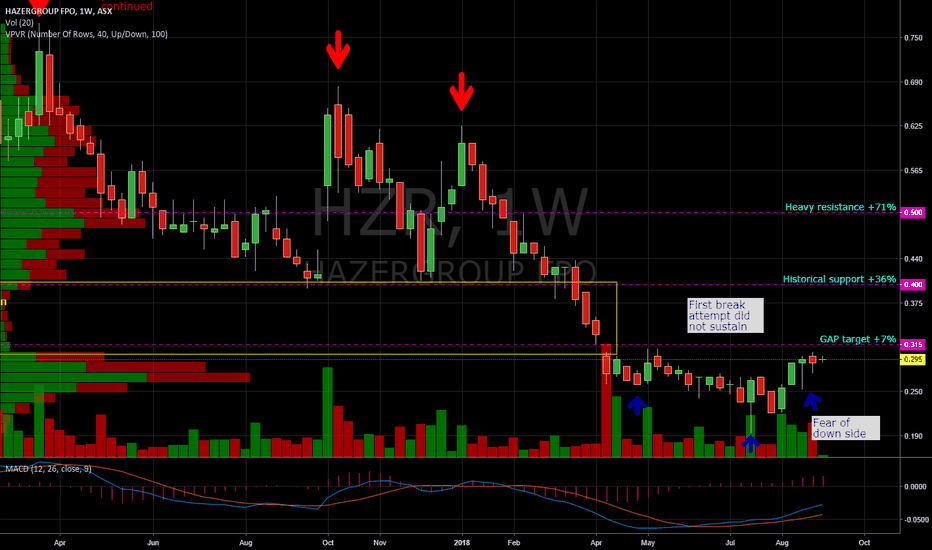

Hazer Group Reversal Trade $HZR$HZR and by association HZRO looks set to break to the upside in coming days and will likely present some opportunities. There has been growing pressure on the supply range at 30c for several weeks now and as the range trims the likelihood of a break increases. The gap at 31.5c is first target which is around 7% from current SP and this will set the scene for a push through the easy lifting 30-40c range offering a 36% move if it plays out. The stretch target being major resistance at 50c represents an upside move of 71%

With management currently conducting roadshows and high net worth meetings it's likely that over the coming weeks interest grows. The other catalyst is that MIN.ASX who have partnered with Hazer Group will soon be beginning to commission a facility to produce high purity battery grade graphite. With the HZRO expiring at the end of 2018 and having a strike price of 30c management are highly likely to deliver a very strong news flow.

Lepedico Bullish Continuation LPD chart has recently broken a solid consolidation pattern, surging 20% above the 6.3 support level to test remaining resistance at the 7.5c mark. After trading up to 7.9c the move has encountered resistance and fallen back to 7.0c on relatively low volume which has continued to drop into the retrace until flattening out at around the 50% retrace level. This has formed a minor flag with a target at 8.4c. This is a typical breakout consolidation, sellers appear to be dropping off signalling that the stock is ready to move north again.

Should this continuation play out then the next anticipated resistance will be encountered at 8.4c or up 19% with the larger Flag break target giving a 11.9c target representing an 89% move from the breakout point at 6.3c

All in all the bullish trend remains in control

Hazer Group Potential Move From 50% FibHZR put in a solid inside bar today after bouncing off both the 50% fib retracement level and the previous resistance line which should now act as support. Expecting to see this trade in range for a few days before moving to the next resistance hurdle at 58c

FA behind this one is well worth looking into also as they aim to be the lowest cost hydrogen and high quality graphite producer globally

"Hazer Group Limited is a pioneering ASX-listed technology development company undertaking the commercialisation of the Hazer Process, a low-emission hydrogen and graphite production process. The Hazer Process enables the effective conversion of natural gas and similar feedstocks, into hydrogen and high quality graphite, using iron ore as a process catalyst."

www.hazergroup.com.au