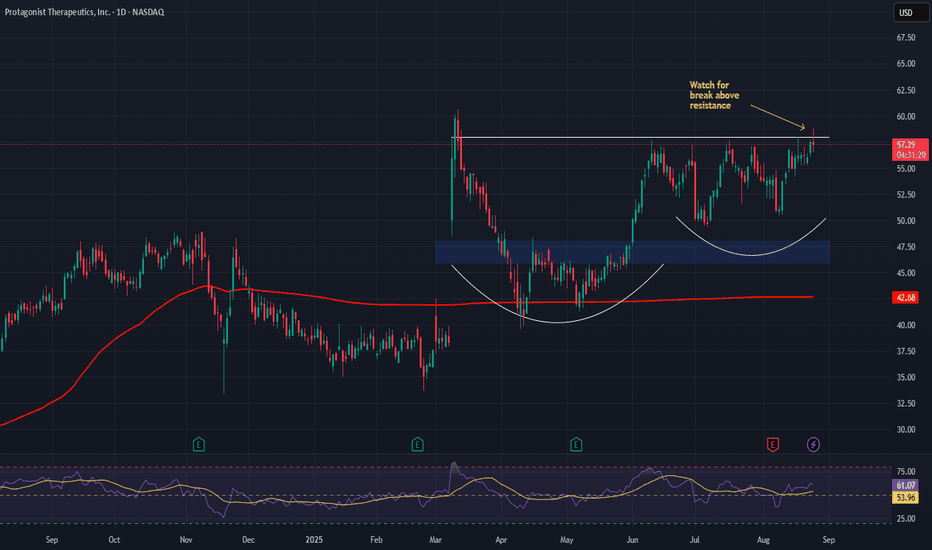

Protagonist Therapeutics (PTGX) AnalysisCompany Overview:

Protagonist Therapeutics NASDAQ:PTGX is a clinical-stage biotech developing peptide-based drugs in hematology, inflammatory, and metabolic diseases. Its pipeline spans polycythemia vera, psoriasis, and obesity — addressing multi-billion-dollar markets.

Pipeline & Catalysts:

Rusfertide (Polycythemia Vera) 🩸

Phase 3 VERIFY trial met all primary and secondary endpoints.

Showed reduced phlebotomy needs and improved hematocrit control.

Positions rusfertide as a first-in-class treatment and regulatory catalyst.

Icotrokinra (Psoriasis) 🌐

NDA filed for IL-23 receptor antagonist.

Approval could unlock a major dermatology revenue stream.

PN-477 (Obesity) ⚡

Expands PTGX’s reach into the fast-growing obesity market.

Strategic Advantage:

Global Takeda partnership enhances execution power.

Recent $25M milestone payment post-Phase 3 validates science & provides financial support.

Investment Outlook:

Bullish Case: Above $46–$48, driven by strong clinical data & regulatory progress.

Upside Potential: Target $78–$80, supported by trial success, NDA filings, and Takeda backing.

📢 PTGX—A high-upside biotech story with catalysts across hematology, dermatology, and obesity.

#PTGX #Biotech #ClinicalTrials #Obesity #Psoriasis #Takeda #GrowthStocks

Clinicaltrials

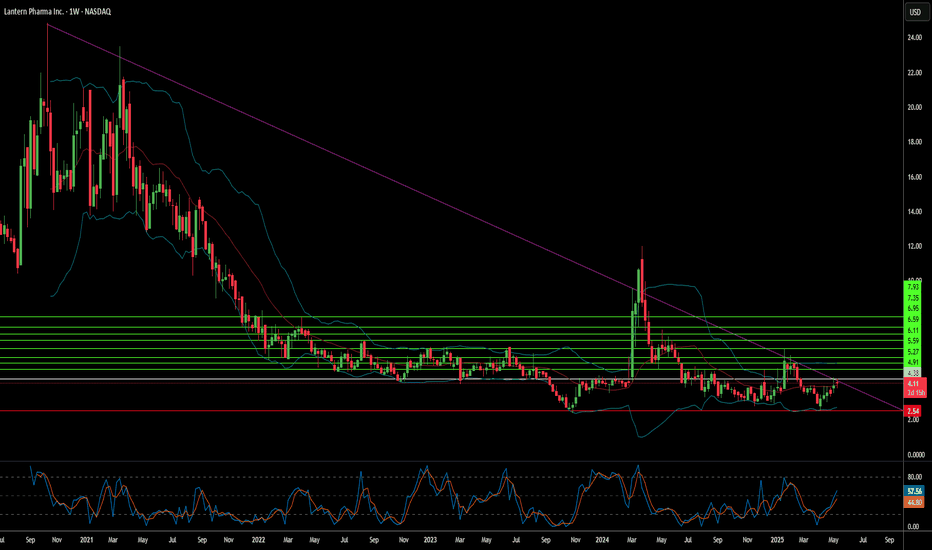

AI in Biotech: The Future of Cancer Therapy?Lantern Pharma Inc. is making waves in the biotech sector, leveraging its proprietary RADR® AI platform to accelerate the development of targeted cancer therapies. The company recently achieved significant milestones, including FDA clearance for a Phase 1b/2 trial of LP-184 in a difficult-to-treat non-small cell lung cancer (NSCLC) subset. This patient population, characterized by specific genetic mutations and poor response to existing treatments, represents a substantial unmet medical need and a multi-billion-dollar market opportunity. LP-184's mechanism, which selectively targets cancer cells overexpressing the PTGR1 enzyme, offers a precision approach aimed at improving efficacy while reducing toxicity.

LP-184's potential extends beyond NSCLC, having received multiple FDA Fast Track Designations for aggressive cancers like Triple-Negative Breast Cancer (TNBC) and Glioblastoma. Preclinical data support its activity in these areas, including synergy with other therapies and favorable properties like brain penetrance for CNS cancers. Furthermore, Lantern Pharma has demonstrated a commitment to rare pediatric cancers, securing Rare Pediatric Disease Designations for LP-184 in MRT, RMS, and hepatoblastoma, which could also yield valuable priority review vouchers.

The company's financial position, marked by strong liquidity according to InvestingPro data, supports its ongoing investment in R&D and its AI-driven pipeline. While reporting a net loss reflecting these investments, Lantern Pharma anticipates key data readouts in 2025 and actively seeks further funding. Analysts view the stock as potentially undervalued, with price targets suggesting future growth. Lantern Pharma's strategy of combining advanced AI with a deep understanding of cancer biology positions it to address high-need patient populations and potentially transform oncology drug development.