CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

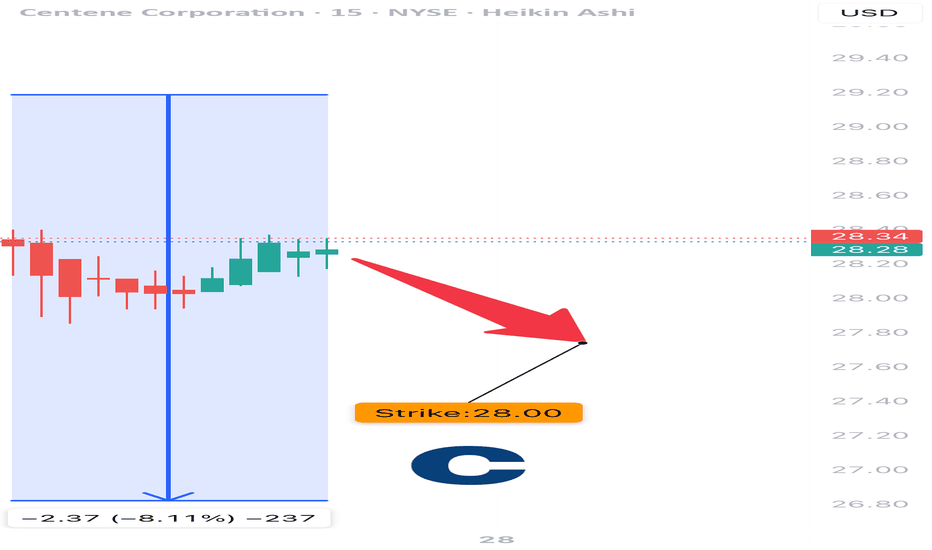

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk