Coffee

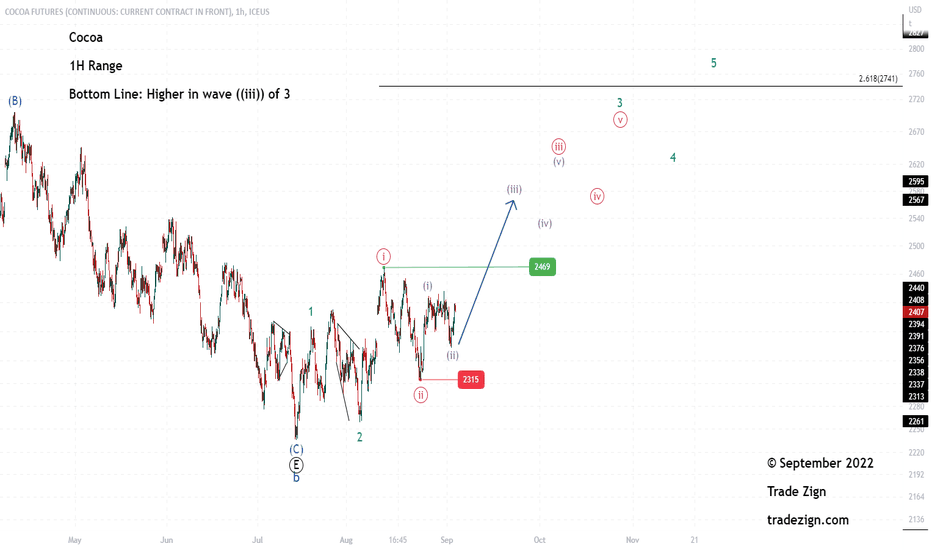

Commodity Cocoa idea (05/09/2022)cocoa

Expecting cocoa to continue rising in the coming period, and this rise depends on the continuation of trading above the support point 2315 and the end of wave ((ii)), and the beginning of the rise in wave ((iii)) targeting prices of 2741 and now we expect cocoa to rise and the end of the decline in wave (ii) at Prices 2356

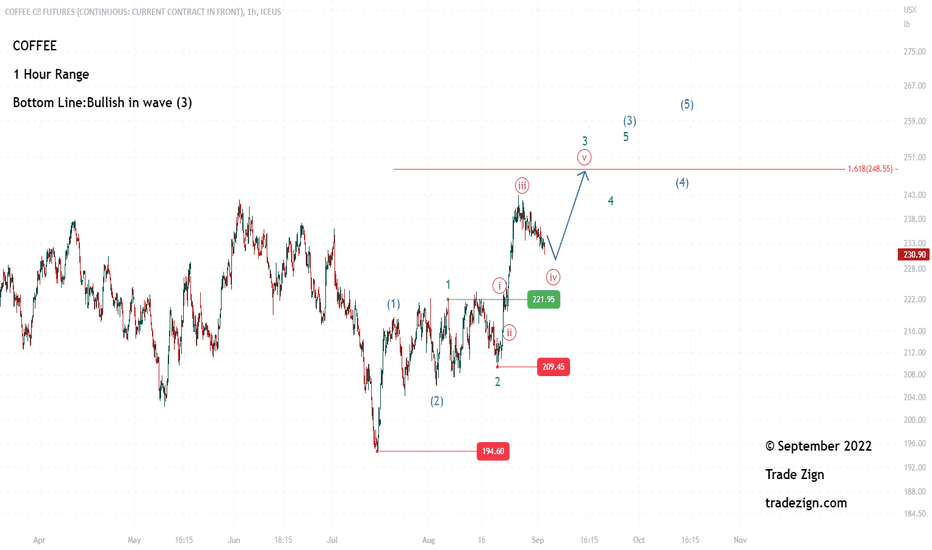

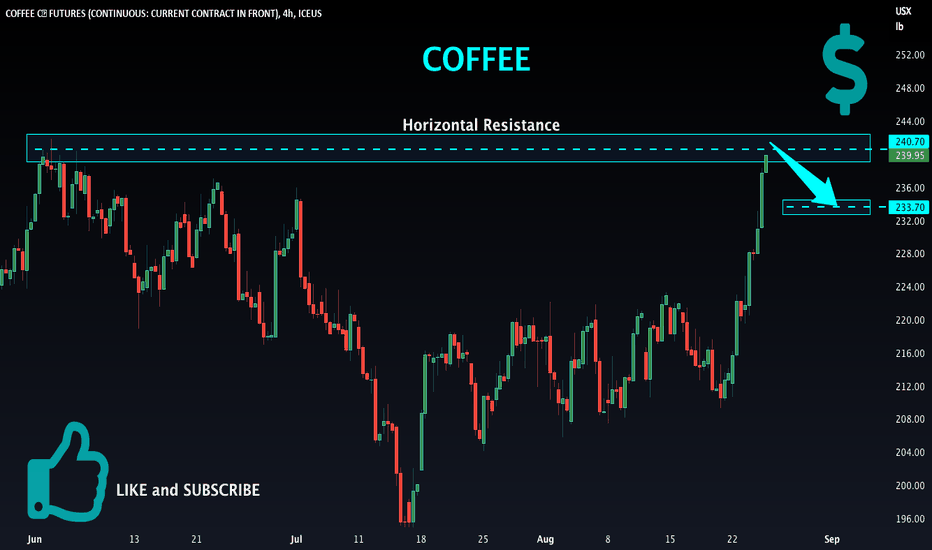

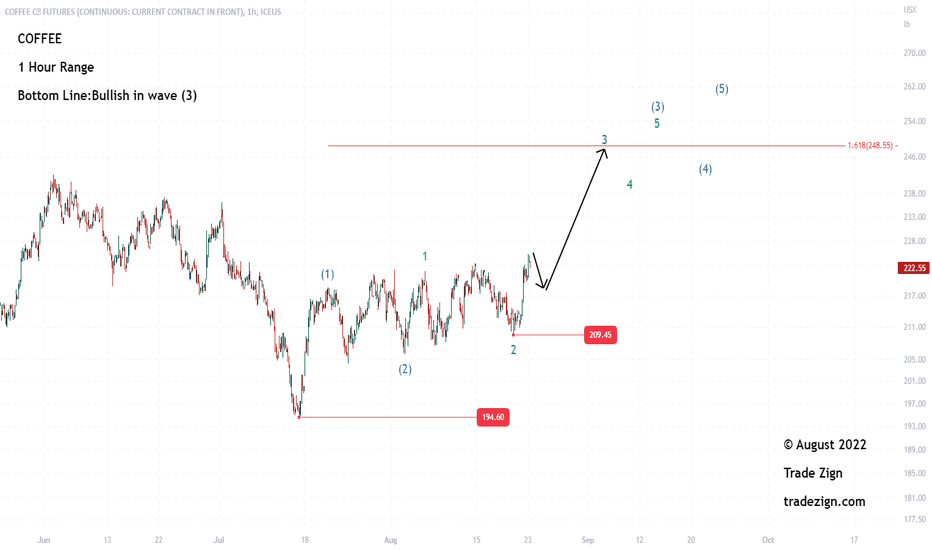

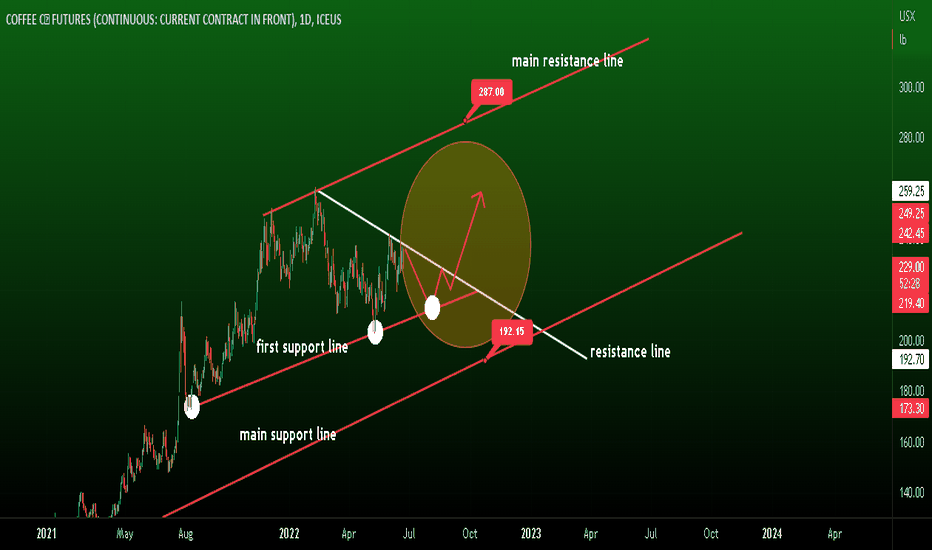

Commodity Coffee idea (02/09/2022)coffee

We expect the rise to continue to complete wave 3 of wave (5). We expect it to continue to 1.618, targeting 248.55. we expect not to break the support point at 209.45, which is the bottom of wave 2. Currently, we expect a correction in wave ((iv)) before completing the rise.

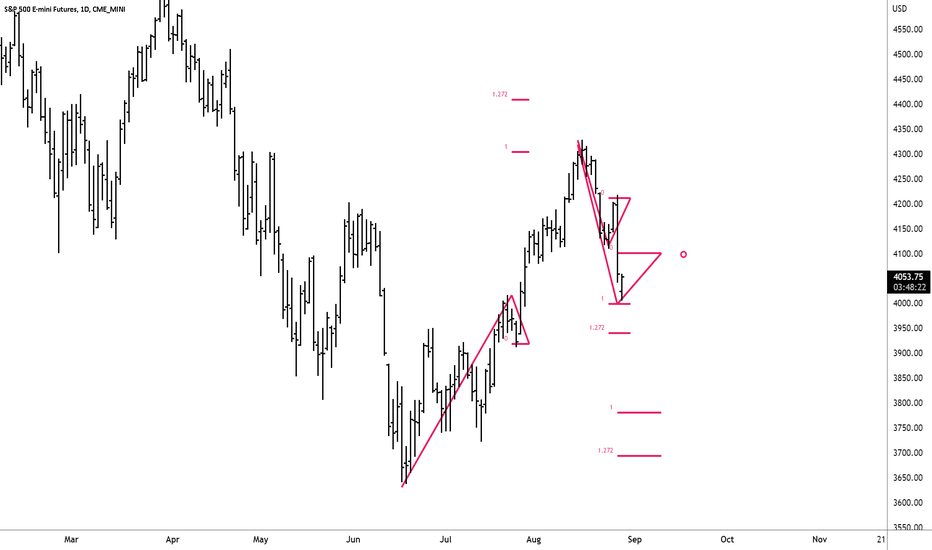

KCZ2022 ES1!8.29.22 Today's review a coffee and the ES. I think you need to be very careful with coffee which can definitely have great move and is volatile enough to be a market you want to follow. The ES had a great reversal lower, and seems to be developing a trending swing lower. however, it came to support and may trade higher for a period of time. I think it will eventually find sellers and I want to show you how I might use my tools, and how I think the market might trade.... and even be profitable for buyers and sellers the scalp.

coffee idea (29/08/2022)coffee

We expect the rise to continue to complete wave 3 of wave (5). We expect it to continue to 1.618, targeting 248.55. we expect not to break the support point at 209.45, which is the bottom of wave 2. Currently, we expect a correction in wave ((iv)) before completing the rise.

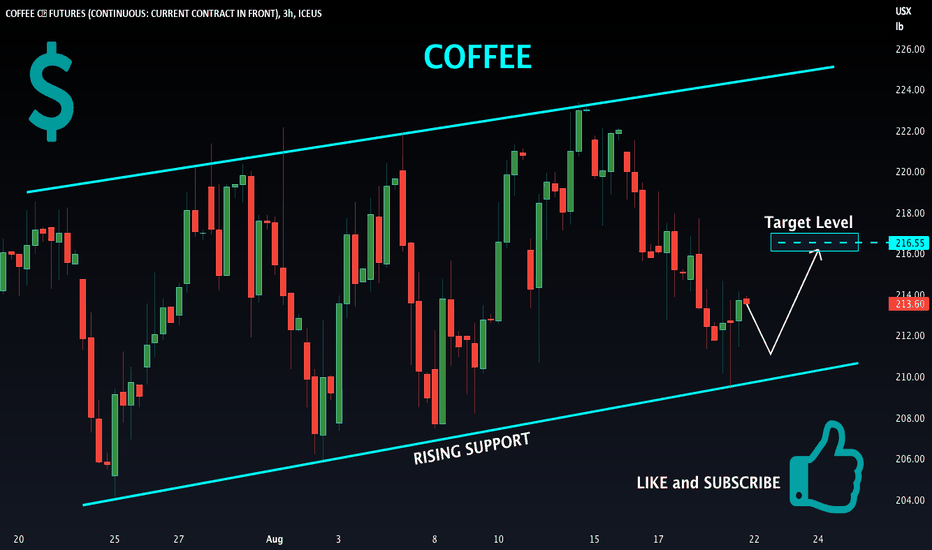

COFFEE Local Long! Buy!

Hello,Traders!

COFFEE went down from the resistance cluster

Just as I predicted in my previous analysis

Then retested a rising support line

And is making a rebound already

So I think the price will go further up a bit

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!

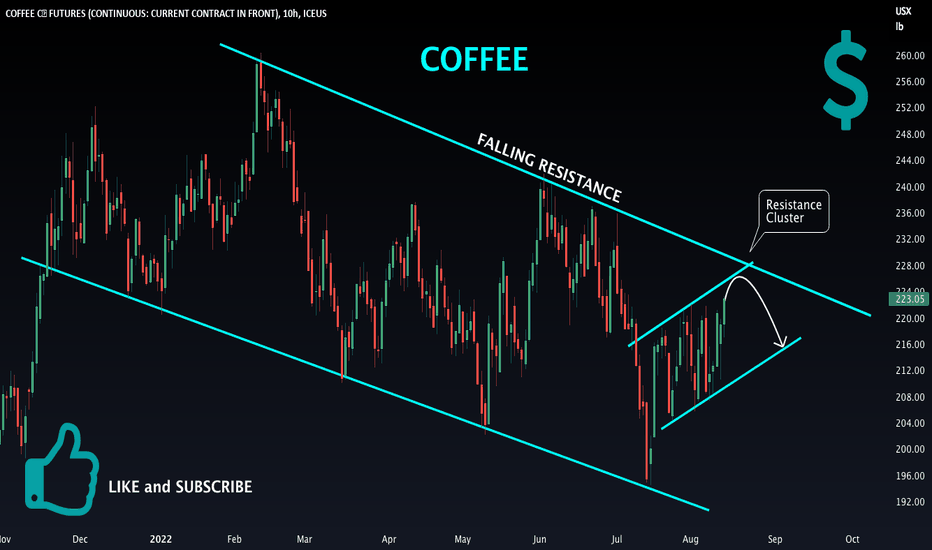

COFFEE Resistance Cluster! Sell!

Hello,Traders!

COFFEE is trading in a downtrend

And the price is about to retest a resistance cluster

Of the falling resistance and the rising one

That of a bearish flag pattern

So after the retest we will see a move down

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

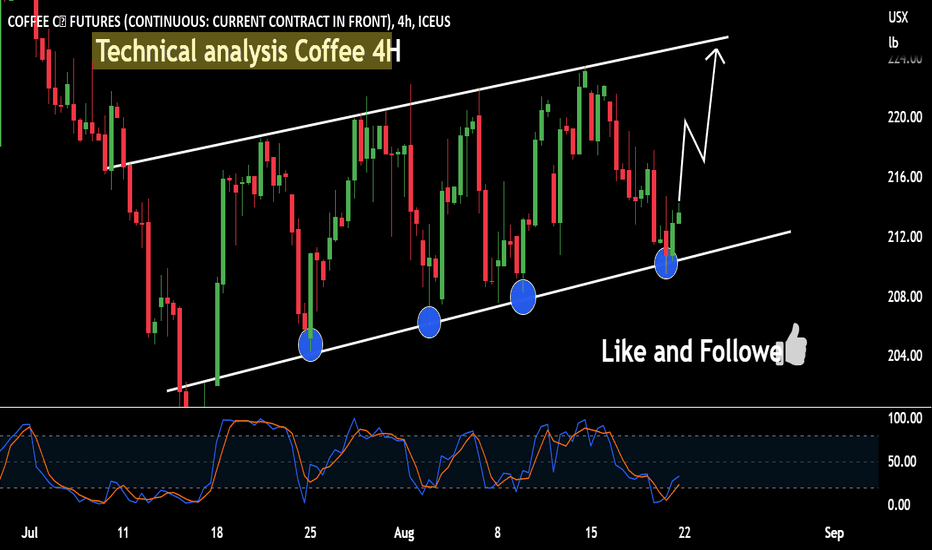

✅COFFEE LONG FROM SUPPORT🚀

✅COFFEE is about to retest a key structure level

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

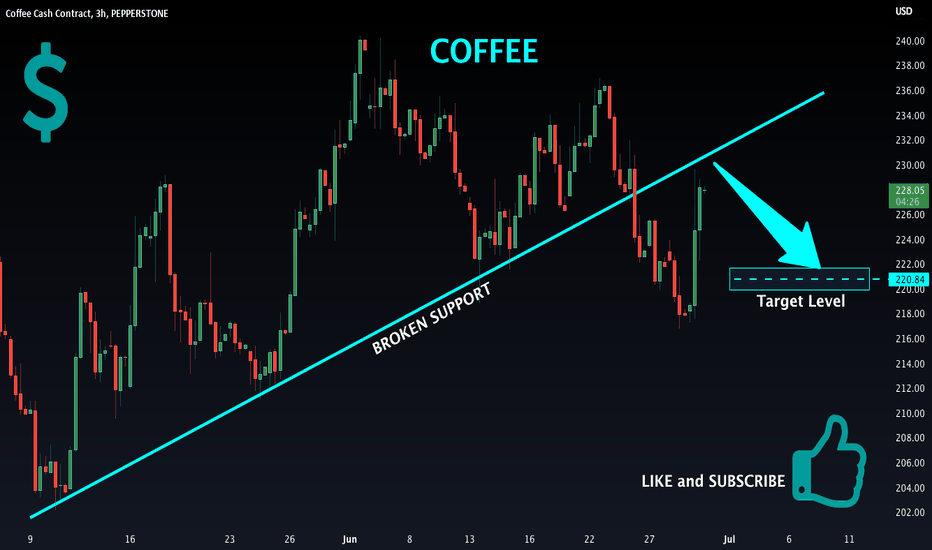

COFFEE Potential Short! Sell!

Hello,Traders!

COFFEE broke a local rising support

Then went down and is now back up

To retest the broken line which became a resistance

And I am expecting a local pullback

Towards the target below

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

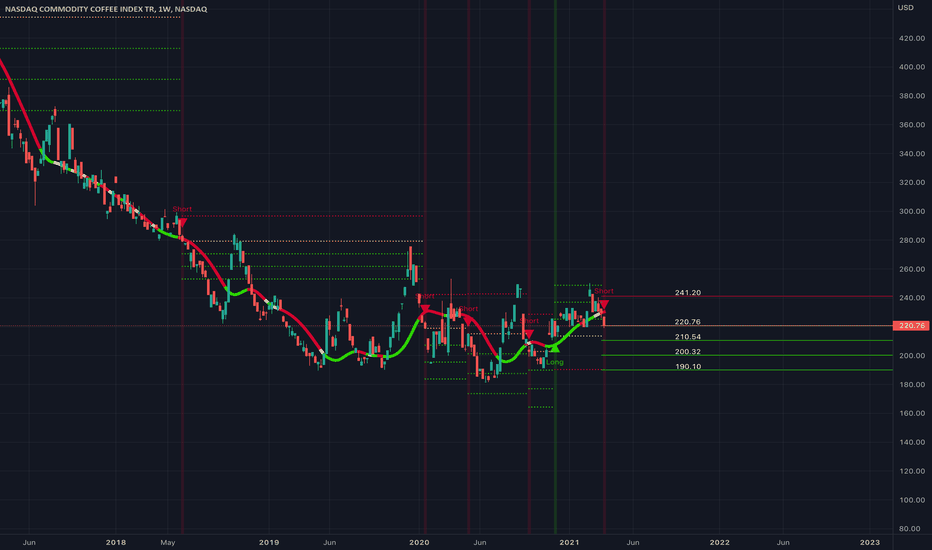

NQCIKCTR $NQCIKCTR Initial Short NQCIKCTR $NQCIKCTR Initial Short. SL and TP on chart. Move SL on TP.

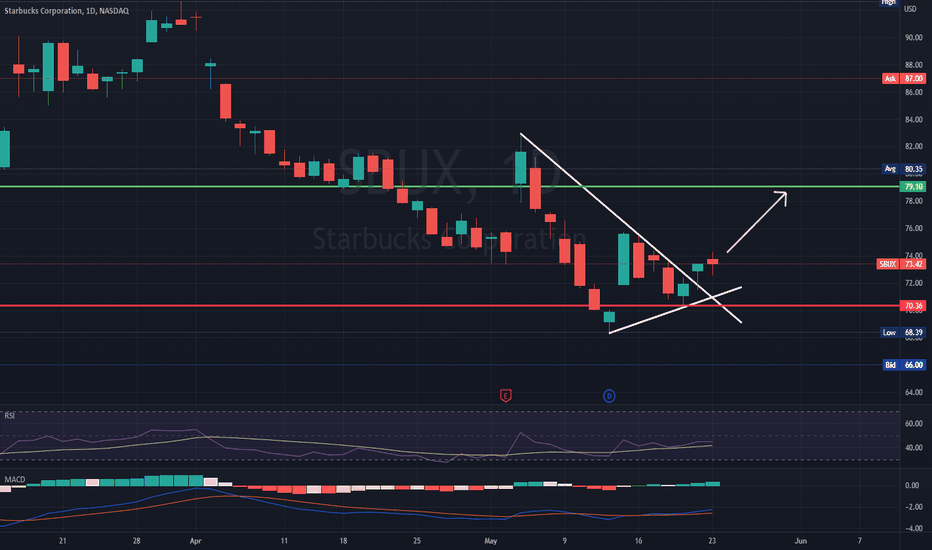

Starbucks (SBUX) bullish scenario:The technical figure Triangle can be found in the US company Starbucks Corporation (SBUX) at daily chart. Starbucks Corporation is an American multinational chain of coffeehouses and roastery reserves headquartered in Seattle, Washington. It is the world's largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks' U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. The Triangle has broken through the resistance line on 21/05/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 4 days towards 79.10 USD. Your stop loss order according to experts should be placed at 70.36 USD if you decide to enter this position.

After 15 years in the country, Starbucks announced it was exiting Russia. Starbucks to close 130 stores in Russia, unionization push expands to over 260 U.S. stores. n addition, as a result of its exit from Russia, the fast food giant said it expected to record a charge of approximately $1.2 to 1.4 billion to write off its net investment in the market and recognize significant foreign currency translation losses.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Volatility 19 May 22 Grains Commodities Futures CORN ZC Futures 19 May 2022

Based on the HV measures from the last 5612 candles our expected volatility for today is around 1.59%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 1.99%

This is translated into a movement from the current opening point of 15.48

With this information our top and bottom , with close to 85% probability for today are going to be

TOP 797.5

BOT 766.5

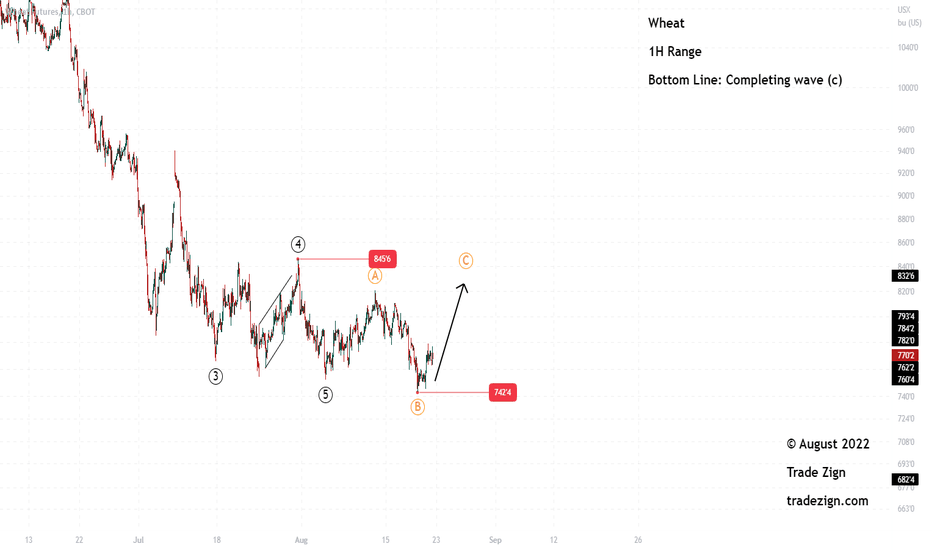

WHEAT ZW Futures 19 May 2022

Based on the HV measures from the last 5600 candles our expected volatility for today is around 2.84%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 3.55%

This is translated into a movement from the current opening point of 43.13

With this information our top and bottom , with close to 84% probability for today are going to be

TOP 1265.34

BOT 1178.65

SOYBEAN ZS Futures 19 May 2022

Based on the HV measures from the last 5600 candles our expected volatility for today is around 1.19%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 1.49%

This is translated into a movement from the current opening point of 24.82

With this information our top and bottom , with close to 84% probability for today are going to be

TOP 1688.5

BOT 1639

OAT ZO Futures 19 May 2022

Based on the HV measures from the last 5600 candles our expected volatility for today is around 2.43%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 3.04%

This is translated into a movement from the current opening point of 19.56

With this information our top and bottom , with close to 84% probability for today are going to be

TOP 664.35

BOT 625.15

COCOA CC Futures 19 May 2022

Based on the HV measures from the last 5615 candles our expected volatility for today is around 1.46%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 1.82%

This is translated into a movement from the current opening point of 44.98

With this information our top and bottom , with close to 85% probability for today are going to be

TOP 2550.62

BOT 2459.4

COTTON CT Futures 19 May 2022

Based on the HV measures from the last 5615 candles our expected volatility for today is around 2.24%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 2.8%

This is translated into a movement from the current opening point of 4

With this information our top and bottom , with close to 85% probability for today are going to be

TOP 148.5

BOT 140.5

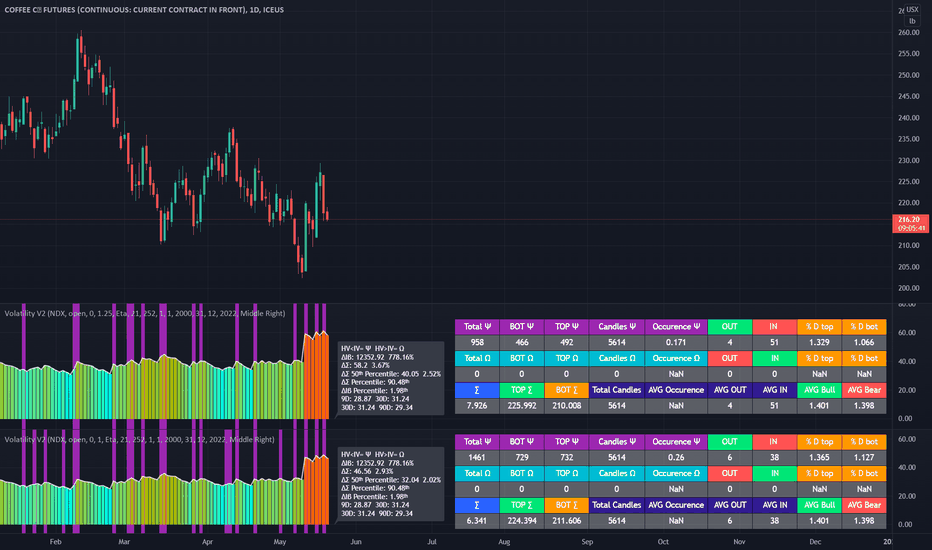

COFFEE KC Futures 19 May 2022

Based on the HV measures from the last 5615 candles our expected volatility for today is around 2.94%

However, in order to increase our accuracy I am going to use a 1.25x multiplier => 3.67%

This is translated into a movement from the current opening point of 7.92

With this information our top and bottom , with close to 83% probability for today are going to be

TOP 226

BOT 210

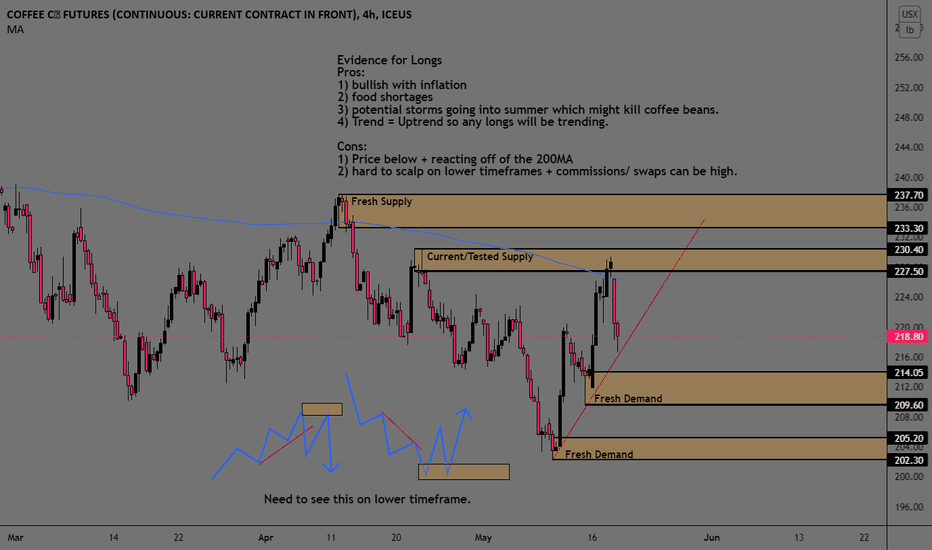

COFFEE KC Supply And Demand AnalysisSee picture for analysis

Evidence for Longs

Pros:

1) bullish with inflation

2) food shortages

3) potential storms going into summer which might kill coffee beans.

4) Trend = Uptrend so any longs will be trending.

Cons:

1) Price below + reacting off of the 200MA

2) hard to scalp on lower timeframes + commissions/ swaps can be high.

What’s brewing with coffee futures?Like most commodities, London coffee futures saw a massive price uptrend in 2021. However, since the beginning of 2022, it's finally cooled off to an eight and half month low. As a silver lining, perhaps more interesting price action is currently heading our way.

With a very sharp fall during the last two weeks of February it's since consolidated, trading between $2,000 and $2,200 per metric tonne. As of writing, London robusta coffee futures (LRC) are trading at $2,099 per metric tonne.

For London coffee futures, May is typically a ranging month with price starting to pick up towards the second half of June. More often than not, highs of the year are made during the June and July months. However, seasonal trends will be butting up against the possibility that coffee prices are still overextended from 2021’s price hike.

Where could coffee prices reasonably head?

Looking at the daily chart with the Awesome Oscillator indicator, we can see some slight divergence. In spite of its undescriptive name, the Awesome Oscillator details trends and shifts in momentum. On the chart above, can see that the indicator is showing signs of a shifting momentum since the first week of March. With price consolidating, the indicator has slowly crept back up to its zero line, failing to keep correlation to the actual price and trend of the price chart. This could be a suggestion that price may make its way towards June and July highs. If so, the bigger question is if it will actually create the yearly high as well before making its way back down.

In respect to fundamentals, it has been noted that Brazil is currently harvesting a record setting yield of robusta coffee beans. However, the risk of frost hitting Brazil’s crop might not have been priced into its current trading price.

Start trading coffee futures with live and demo accounts today