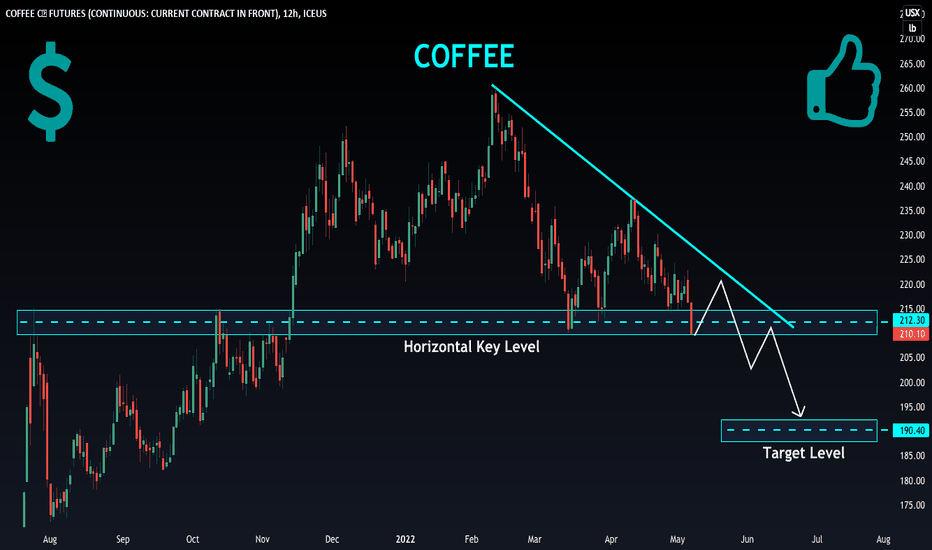

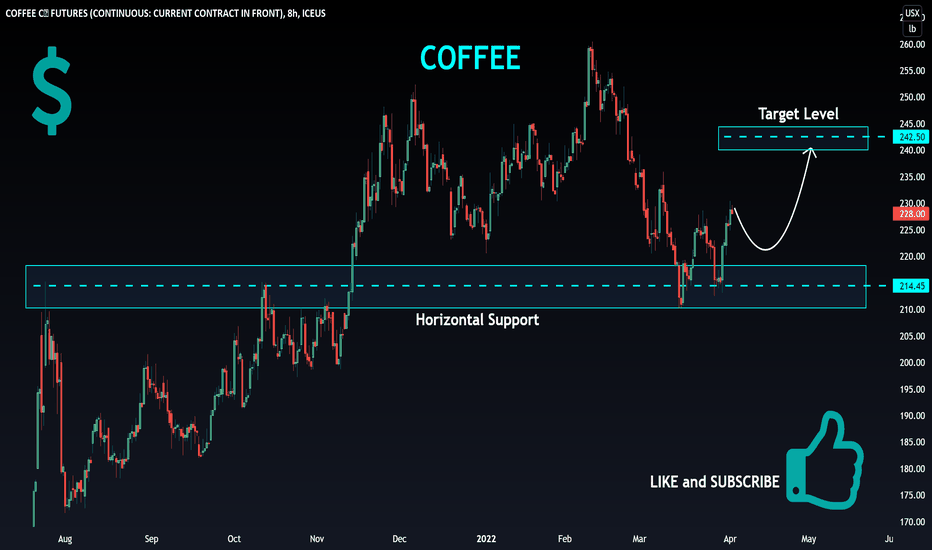

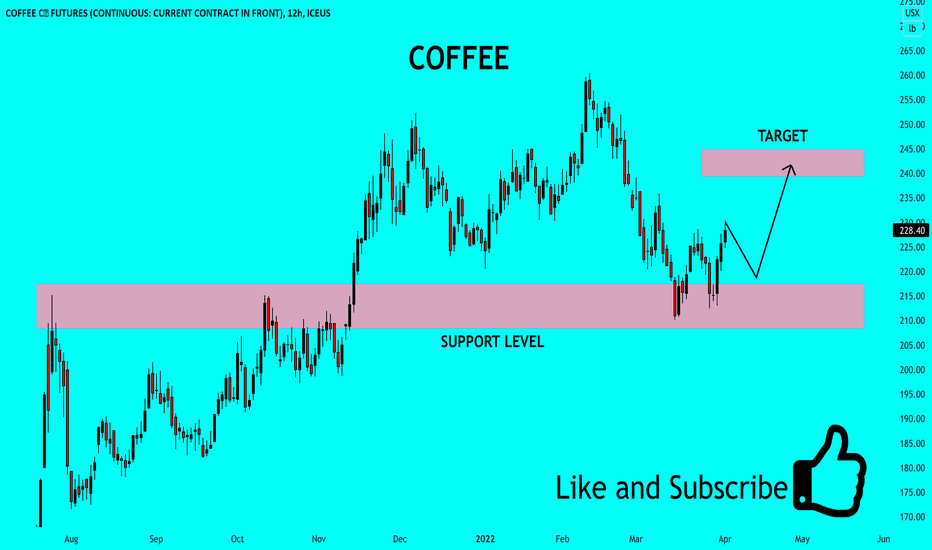

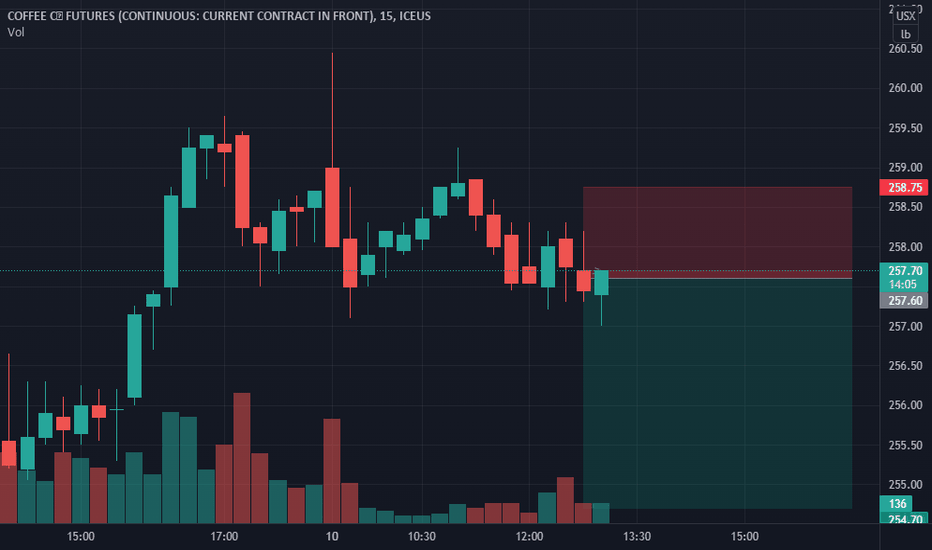

COFFEE Wait For Breakout! Sell!

Hello,Traders!

COFFEE is again retesting a key level

And the price action looks somewhat bearish

So IF we see a breakout then I think that

The price will go further down

Towards the target below

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

Coffee

Sugar and FCOJ Take the Bullish BatonThe soft commodities sector of the commodity market can be highly volatile. Historically, sugar, coffee, cotton, cocoa, and frozen concentrated orange juice futures that trade on the Intercontinental Exchange have doubled, tripled, and halved in value over short periods. While clothing and other consumer goods depend on the cotton market, the other sector members are foods.

The soft commodity sector rose in 2021, and Q1 2022

Coffee and cotton rose to multi-year highs in 2022

FCOJ takes off on the upside in April and makes a new multi-year high

Sugar could be next for three reasons

Trading softs from the long side- Buy those dips

Brazil is the world’s leading producer and exporter of three of the soft commodities; sugar, coffee, and oranges. Sugar comes from two sources, sugar beets and sugarcane. Brazil’s tropical climate makes it the leading sugarcane producer. Arabica coffee beans are popular in the US and other areas, while Robusta beans produce espresso coffees. Brazil leads the world in Arabica production. While many people associate orange production with Florida and California, Brazil is the world’s top orange producer. Cocoa, the primary ingredient in chocolate confectionery products, comes mainly from West Africa, as the Ivory Coast and Ghana produce over 60% of the world’s annual supplies.

Soft commodities are agricultural products, so the weather in growing areas typically determines the prices each year. Since the 2020 pandemic, the price action has been anything but ordinary.

The two latest soft commodities to lead the sector on the upside have been sugar and FCOJ futures.

The soft commodity sector rose in 2021, and Q1 2022

In 2021, the composite of the five soft commodities that trade in the futures markets on the Intercontinental Exchange rose 31.57%. In Q1 2022, the softs added to gains, rising 6.58%, with all five members posting gains.

Cotton futures led the softs higher with a 20.51% gain. Cocoa futures moved 5.16% to the upside, with FCOJ posting a 3.86% gain. Sugar rallied 3.23%, and Arabica coffee futures eked out a 0.13% gain.

Meanwhile, coffee and cotton rose to new multi-year highs during the first three months of 2022.

Coffee and cotton rose to multi-year highs in 2022

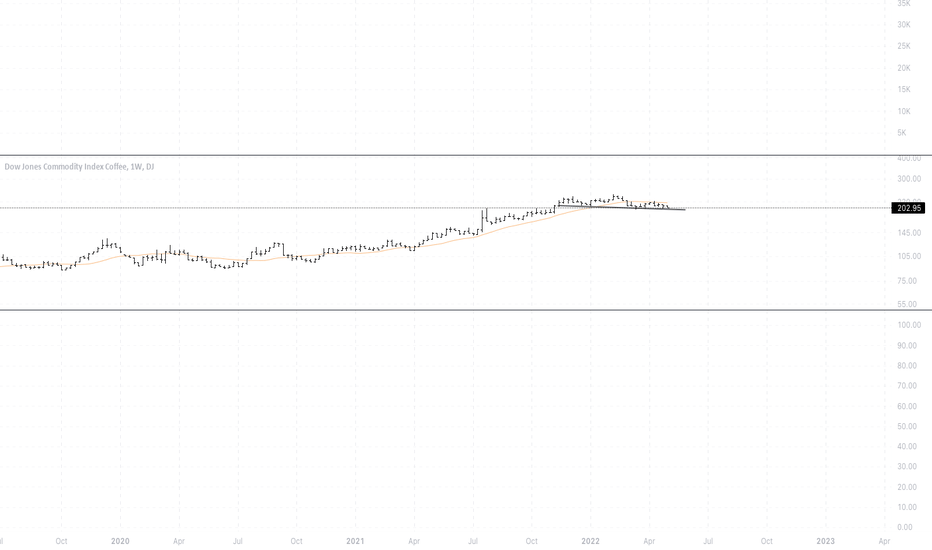

In June 2020, coffee futures made a higher low under the $1 per pound level before taking off on the upside.

The weekly chart shows the bullish trend of higher lows and higher highs that took coffee futures to $2.6045 per pound in early February 2022. Coffee futures rose to the highest price since 2011.

Cotton futures also rose to the highest level since 2011, peaking at the $1.4614 per pound level in April 2022.

Coffee futures were over the $2.20 level, with cotton above $1.40 on April 14.

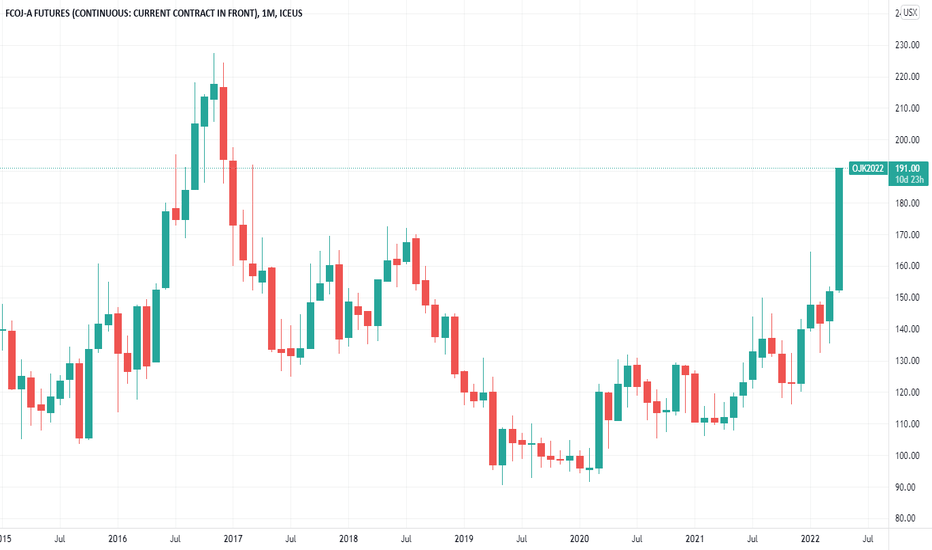

FCOJ takes off on the upside in April and makes a new multi-year high

Frozen concentrated orange juice futures are the least liquid of the five soft commodities, based on daily volume and open interest metrics. While the FCOJ futures arena rose to a new multi-year high in Q1 2022, the bullish price action continued in April with higher highs.

The chart shows that nearby FCOJ futures rose to $1.8660 per pound last week, the highest level since March 2017. The all-time high in the orange juice market came in 2016 at $2.35 per pound.

Brazil is the leading producer and exporter of oranges and Arabica coffee beans. The South American country also is the leader in free-market sugarcane production and exports.

Sugar could be next for three reasons

Sugar futures rose to 20.69 cents per pound in November 2021, the highest price since February 2017.

The weekly chart shows that sugar futures were above the 20 cents per pound level last week. Sugar is approaching the first technical resistance level at the November 2021 20.69 cents high. Above there, the next target is at the October 2016 23.90 high, which is a technical gateway to the 2011 36.08 cents per pound peak.

Three factors support sugar prices in April 2022:

Rising inflation is lifting all commodity prices, and the trend is always your best friend in markets across all asset classes.

Rising crude oil and natural gas prices support sugar. Crude oil is over the $100 per barrel level, and natural gas stopped just short of $7 per MMBtu last week. Multi-year highs in the energy market support sugar as it is the primary input in Brazilian ethanol production. As more sugarcane goes into ethanol production, less is available for exports.

Sugarcane production costs are increasing as they are labor-intensive. The rising Brazilian real makes sugar more expensive to produce.

The chart illustrates the technical breakout to the upside in the Brazilian currency against the US dollar. A higher real increases the cost of production, putting upside pressure on sugar’s price.

Trading softs from the long side- Buy those dips

Stocks and bonds have been shaky in 2022, and cryptocurrencies have not yet of the slump that took prices lower since the November 2021 highs. Commodities have been the place to be for investors and traders over the first four months of 2022. The latest inflation report will likely keep the bullish party in raw material markets going.

I remain bullish on soft commodities as they are highly volatile and can offer explosive returns. Sugar is my top choice as of April 15, as the sweet commodity loosed poised to eclipse the 2021 high on its way to higher ground. Meanwhile, I favor all soft commodities in the current environment. The optimal approach to the sector has been buying on price weakness, and I expect that to continue. Bull markets rarely move in straight lines, and corrections can be the best route to optimizing returns over the coming weeks and months.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

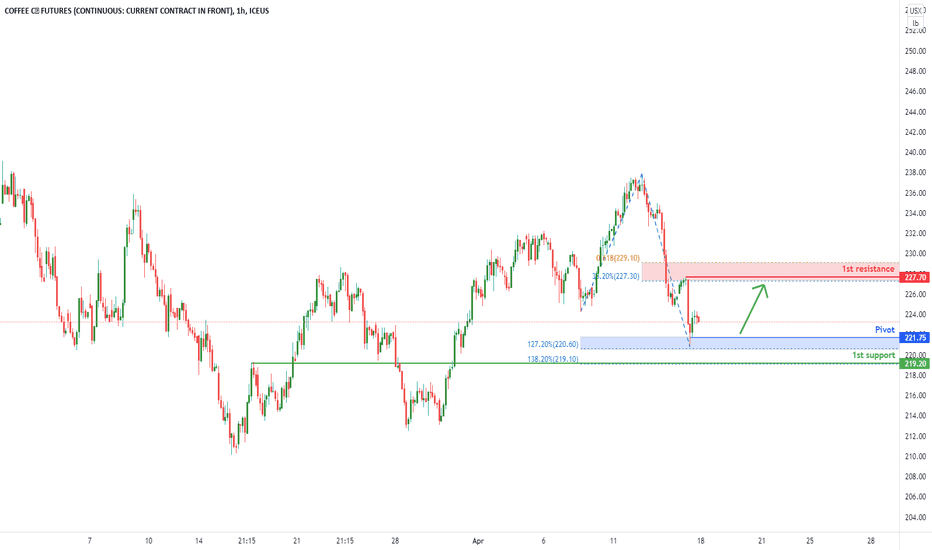

Coffee Futures ( KC1!), H1 Potential for Bullish BounceType : Bullish Bounce

Resistance : 227.70

Pivot: 221.75

Support : 219.20

Preferred case: We see the potential for a bounce from our pivot at 221.75 in line with 127.2% Fibonacci extension towards our 1st resistance at 227.70 in line with 38.2% Fibonacci retracement and 61.8% Fibonacci extension.

Alternative scenario: Alternatively, price may break our pivot structure and head for 1st support at 219.20 in line with 138.2% Fibonacci extension.

Fundamentals: No major news.

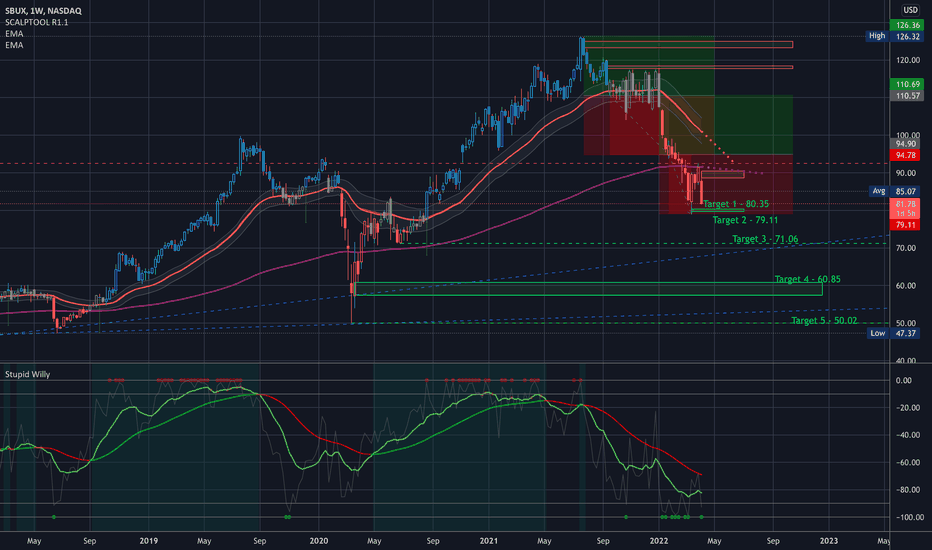

$SBUX Key Levels, Analysis, & Targets$SBUX Key Levels, Analysis, & Targets

So I do think that here I’m going to start with target 2 - but target 1 might catch it. I’m still aiming for 2.

Swing setup

1 at 79.11

1 at 71.06

2 at 60.85

4 at 50.02

(Then multiply by your multiplier (x5, x10, x100, x1000, etc to find your position size)

---

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

IF you need anything analyzed Technically just comment with the Ticker and I’ll do it as soon as possible…

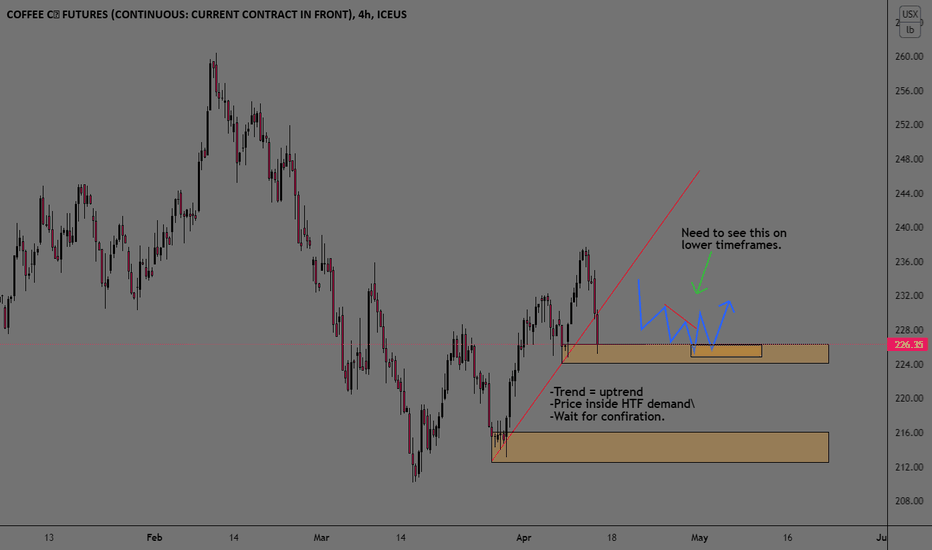

COFFEE Will Keep Growing! Buy!

Hello,Traders!

COFFEE is trading in a local uptrend

And we saw the pair retest the horizontal key level

From where we are already seeing a bullish reaction

Which will continue I think, with the target

Of retesting the target above

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!

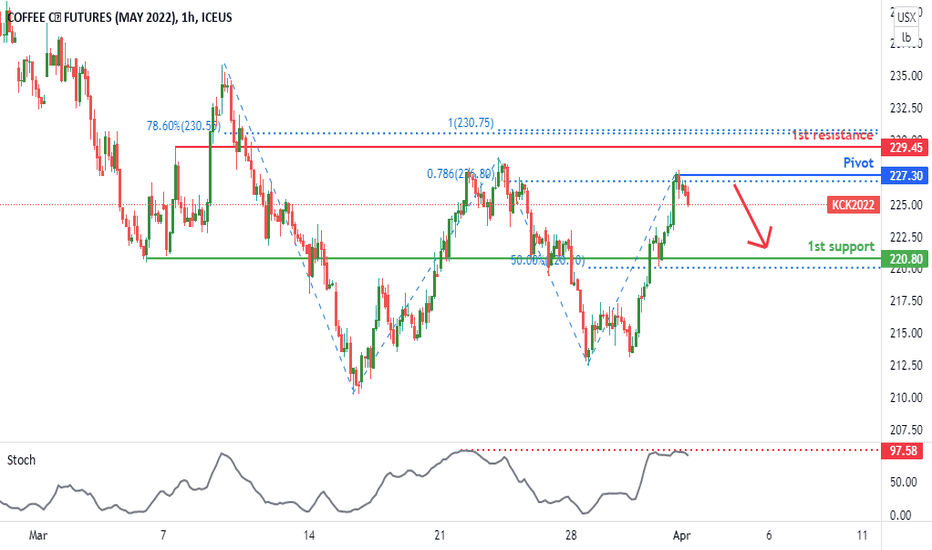

Coffee Futures (KCK2022), H1 Potential for Bearish Dip!Type: Bearish Dip

Resistance : 229.45

Pivot: 227.30

Support : 220.80

Preferred case: We see the potential for further bearish continuation from our Pivot at 227.30 in line 78.6% Fibonacci projection towards our 1st support at 220.80 in line with 50% Fibonacci retracement. Our bearish bias is further supported by stochastic indicator where it is at resistance level.

Alternative scenario: Price might move towards the 1st resistance level of 229.45 in line with 100% Fibonacci projection and 78.6% Fibonacci retracement.

Fundamentals: No major news

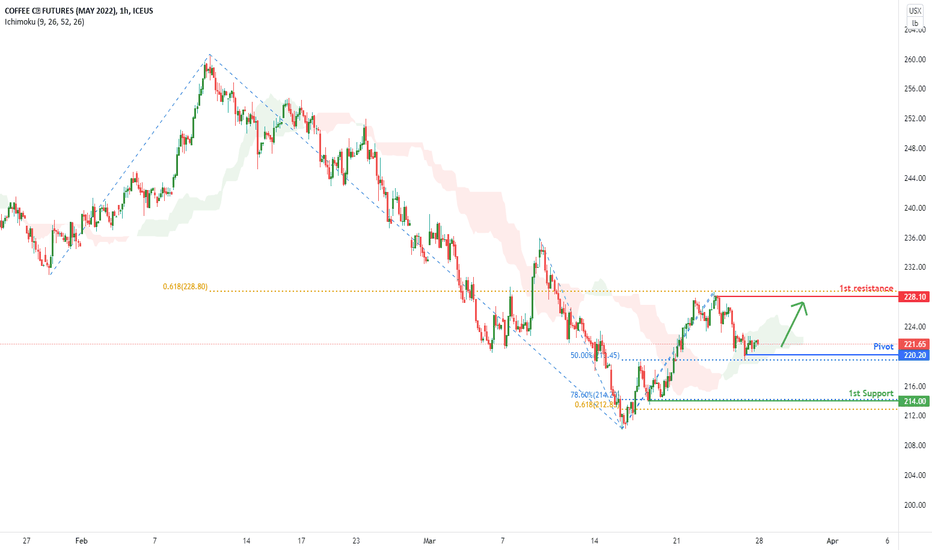

KCK2022 (Coffee Futures) | H1 Bullish PressureType : Bullish Pressure

Resistance : 228.10

Pivot: 220.20

Support : 214.00

Preferred Case: Price is near pivot level of 220.20 in line with 50% Fibonacci retracement. Price can potentially rise up to the 1st resistance level at 228.10, in line with 61.8% Fibonacci projection, with a graphical swing high resistance. Our bullish bias is further supported by price trading above the Ichimoku cloud indicator.

Alternative scenario: Price might also dip towards the 1st support level of 214.00 in line with 61.8% Fibonacci projection and 78.6%% Fibonacci retracement.

Fundamentals: No Major News

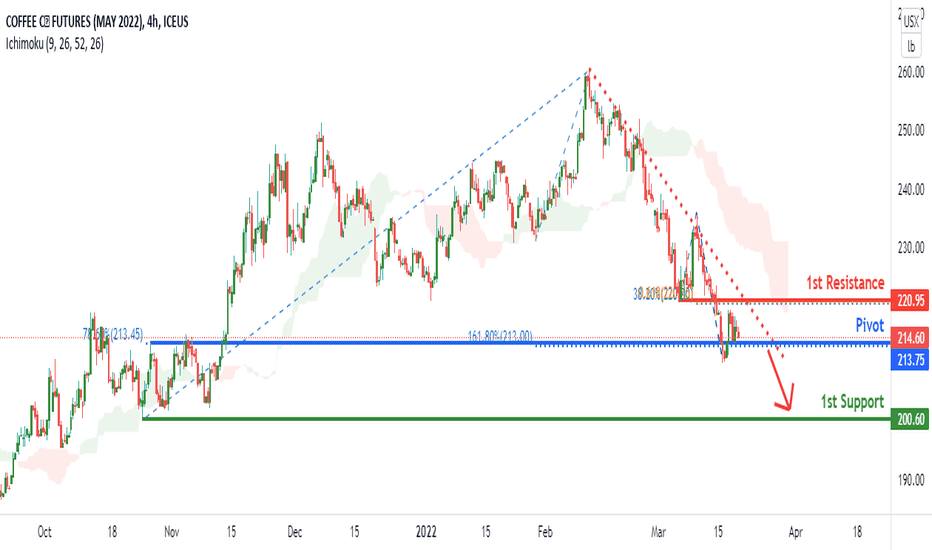

KCK2022 (Coffee Futures) | H4 Bearish MomentumType : Bearish Momentum

Resistance : 220.95

Pivot: 213.75

Support : 200.60

Preferred Case: Price is near pivot level of 213.75 in line with 161.8% Fibonacci extension and 78.6% Fibonacci retracement. Price can potentially move towards the 1st support level which is graphical swing low support. Our bearish bias is further supported by price trading below the Ichimoku cloud indicator.

Alternative scenario: Price could also head towards the 1st resistance level of 220.95 in line with 61.8% Fibonacci projection and 38.2%% Fibonacci retracement.

Fundamentals: No Major News

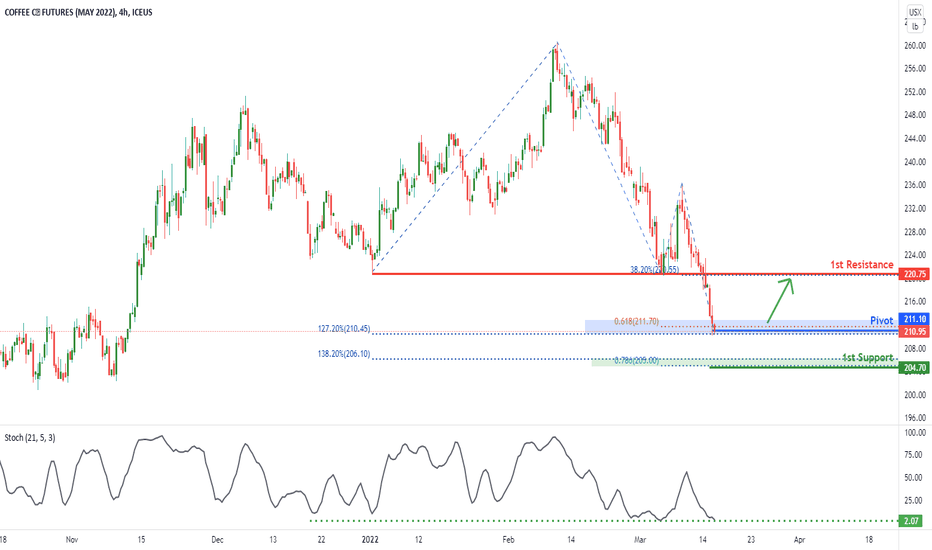

KCK2022 (Coffee Futures) | H4 Bullish BounceType : Bullish Bounce

Resistance : 220.75

Pivot: 211.10

Support : 204.70

Preferred Case: Price is near pivot level of 211.10 in line with 127.20% Fibonacci extension and 61.8% Fibonacci projection. Price can potentially move towards the 1st resistance level of 220.75. Our bullish bias is further supported by stochastic indicator as it is at support level.

Alternative scenario: Price could also head towards the 1st support level of 204.70 in line with 78.6% Fibonacci projection and 138.2%% Fibonacci extension .

Fundamentals: No Major News

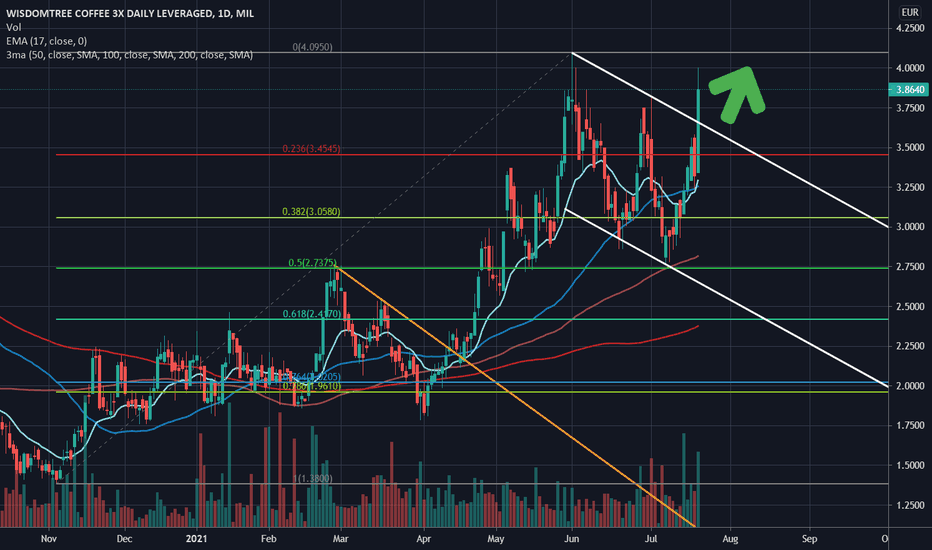

Up, up and away!The coffee futures have broken today the bullish flag, and this derivate on coffee follows the coffee price accordingly. Maybe in the following days, a pullback is possible, reaching 3,71 or the vicinity of the broken trendline below.

According to the seasonality and inflation, I expect a general bullish trend in coffee until the end of the year. But buying this instrument and holding it until the end of the year could be difficult because of the volatility decay. Take care!

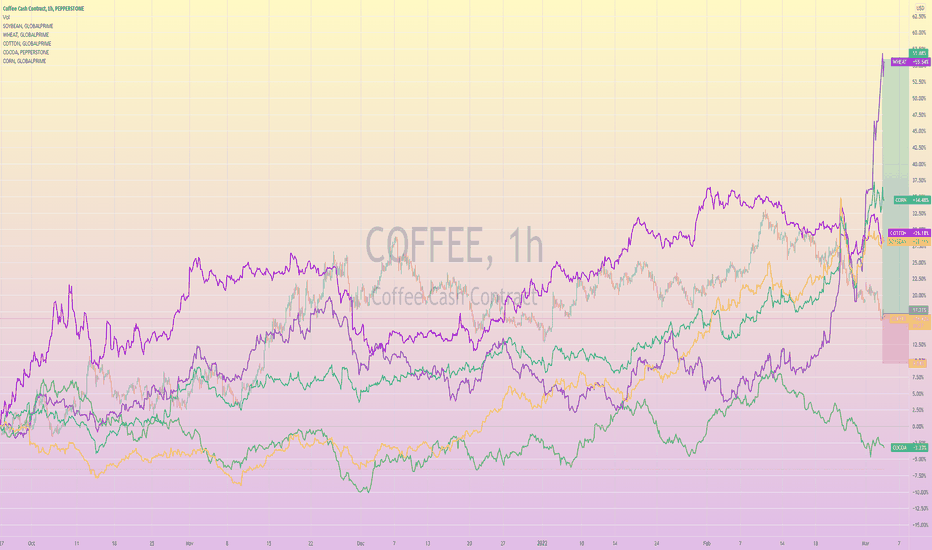

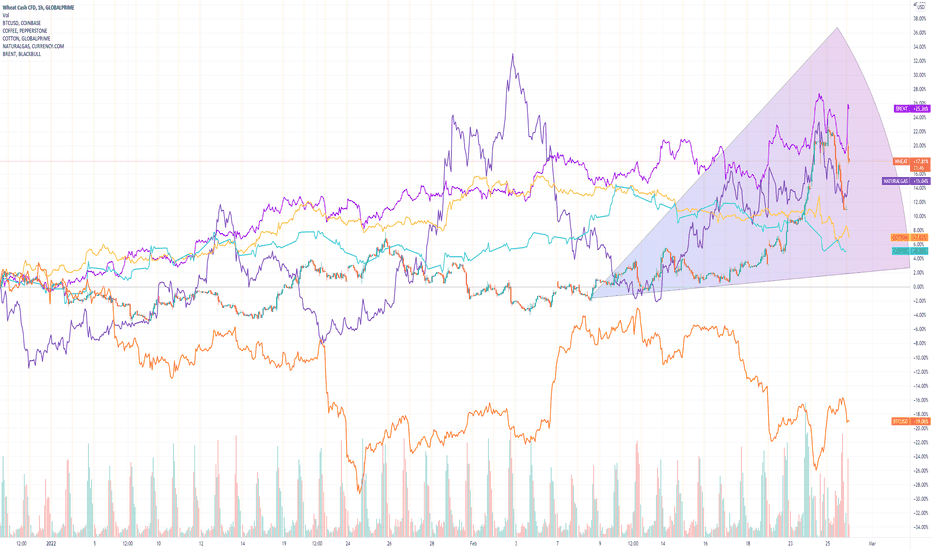

Wheat, Naturalgas, Brent, Coffee and Cotton vs BTCWheat, Naturalgas, Brent, Coffee and Cotton vs BTC in one chart, all long!

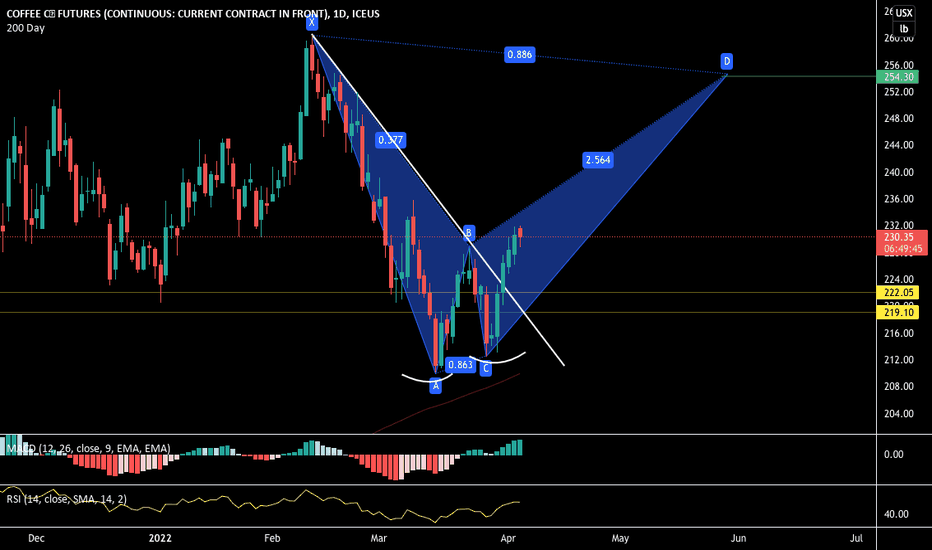

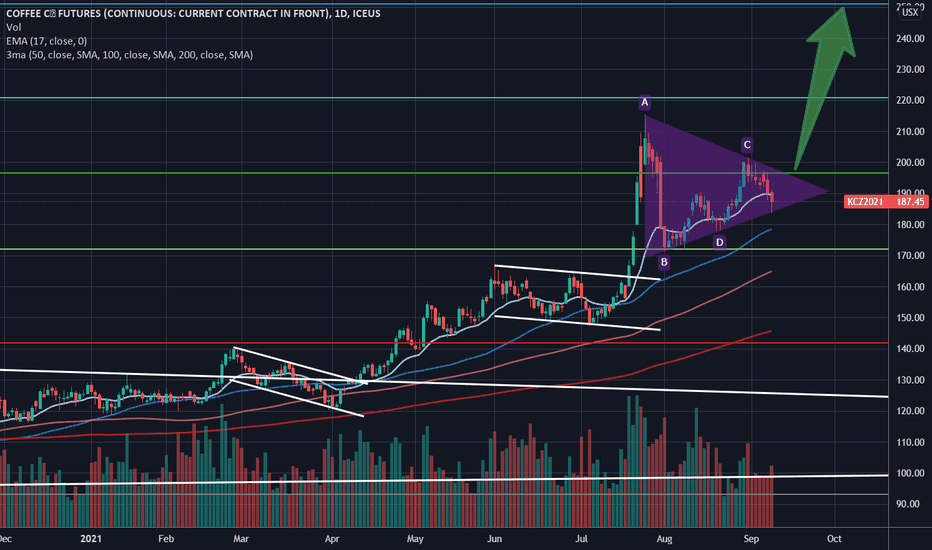

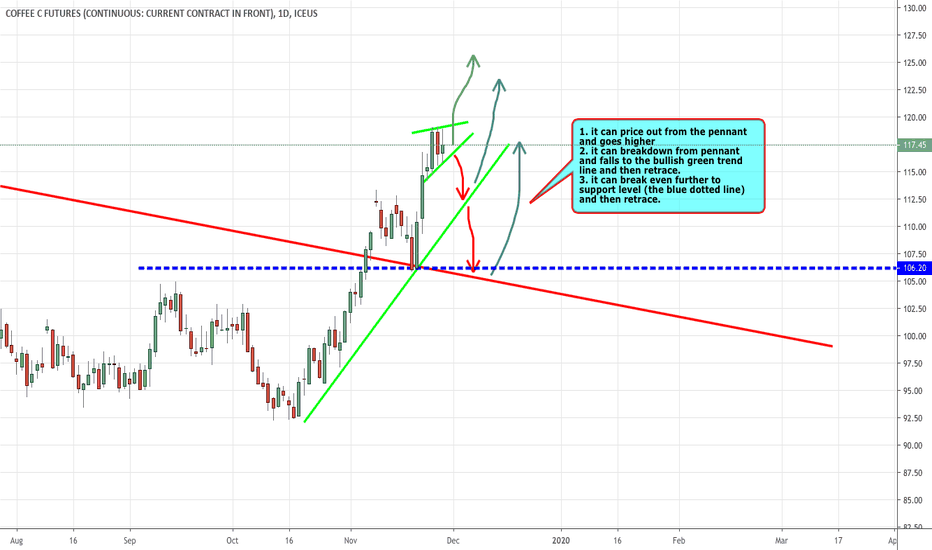

It's coffee time!See chart.

NOTE : The thing about charting is IT IS BASED on probability based on historical price actions and patterns. But the market is forward looking and to restrict oneself to say that if the price moves to A, then it would goes to B, then C is not only myopic but also underestimate the Market which is ever changing.

Price action could very well not touched the support line before retrace higher. Or price may not necessarily hit the 50% or 61.8% FIB level as precisely as we would like it to be. IT IS A GUIDE only.

When one trades on a larger time frame, then the short term price movements would matters less as you are concerned with the overall direction of the product you are trading.

I have find my heart beating way too fast and my emotions go haywire the time when I tried trading 15 minutes time frame or less. Sometimes, after keying in the order, I am already stopped out!! OUCH!!!

Leave this fast trading game to the experts who can make millions trading thousands of trades a day. They earn their marks through years of practice , I am sure.

Technical Outlook for the Coffee Market, backed by fundamentals.Fundamentals: The coffee Market has been in a strong bullish trend ever since a frost hit the brazil coffee belt in July / August 2021, followed by a period of drought. This left the world´s biggest producer of Arabica coffee with huge productivity losses for the 2021/2022 crop. That results in a really tight Arabica balance sheet for 2022, which could get worse through re-openings of coffee-to-go shops after Covid-19 lockdowns. The tense global logistic situation with low vessel space, exploding freight rates and shortage of containers and truckers is fuel to the already burning fire of less coffee supply than demand.

What can be examined from this is, that roasters tap into certified coffee inventories drowning them to 10-year lows, an extremely bullish factor ever since.

Technicals: Prices stay in an uptrend channel, that can be divided into a major channel and two minor ones. The structure stayed between those two lines while completing several Elliott-Waves. After a new ABC correction from the 160,00 cts high, prices could start a new 5-Wave up to test the upper line of the major channel at ~175,50 cts. The certified inventories sliding below the magical number of 1 million bags would support this move.

Certified Coffee Inventory

bilderupload.org

Chart