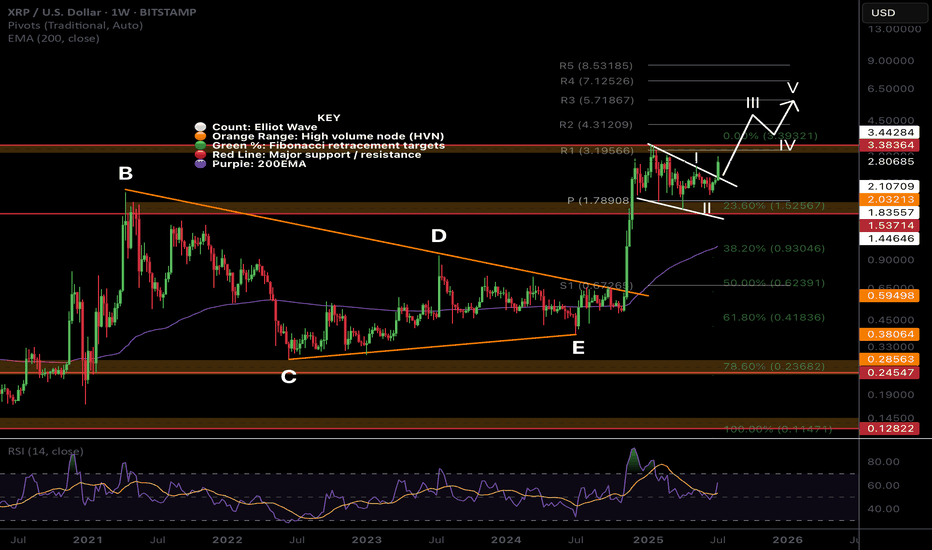

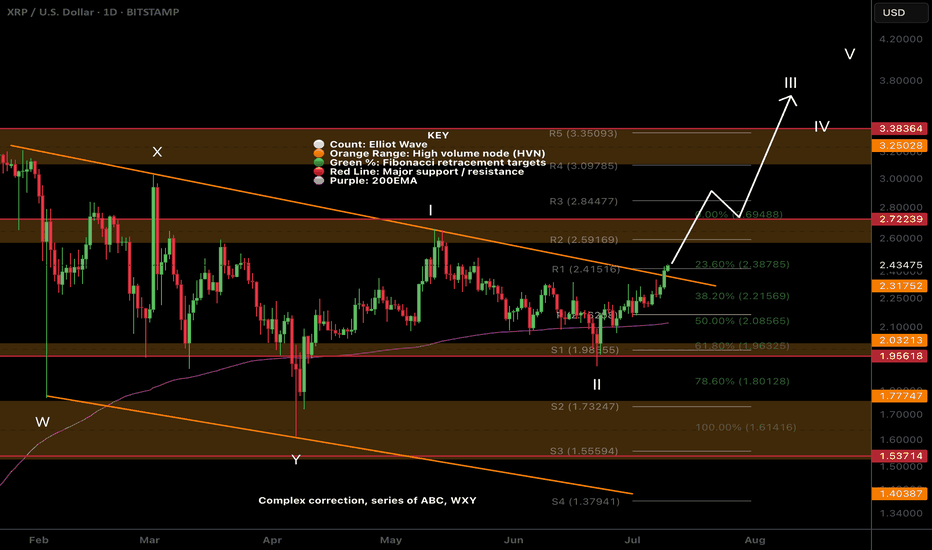

$XRP Macro Tiangle Final Thrust ContinuationCRYPTOCAP:XRP completed a macro triangle pattern last year. Triangles proceed a terminal motif wave which already completed a wave 3.

Wave (3) of (5) is underway with a terminal target around $5.7 after price broke out of the pennant / wedge pattern.

Weekly RSI confirmed bullish divergence.

Safe trading

COIN-M

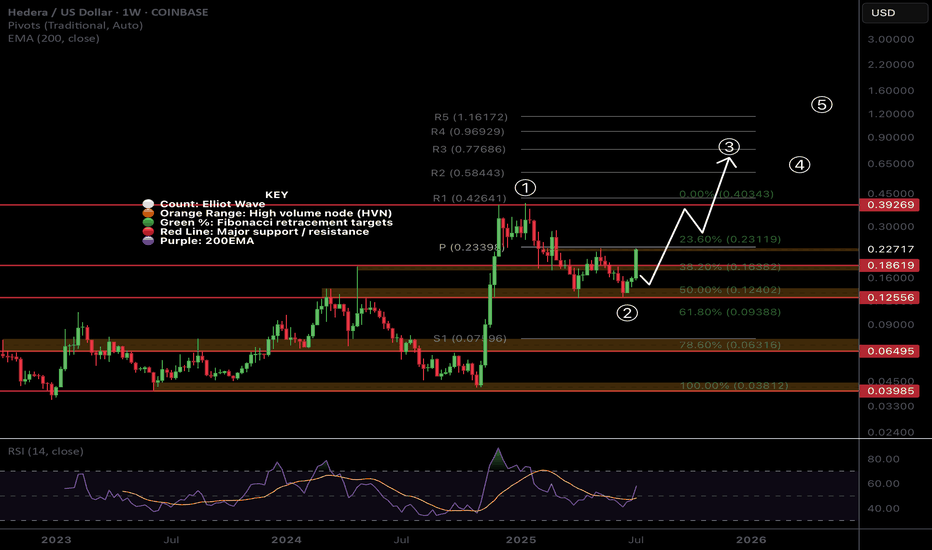

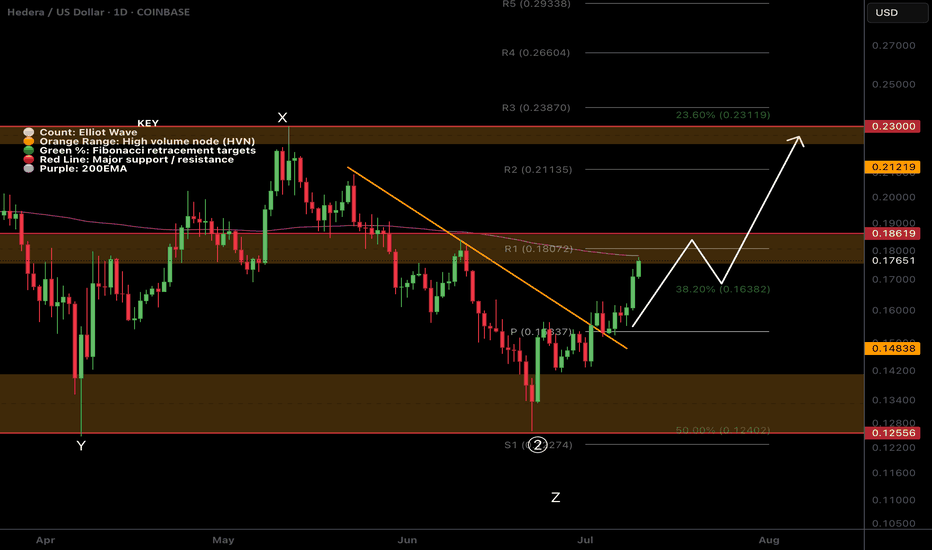

$HBAR Shooting Up in Wave 3CRYPTOCAP:HBAR is flying off the High Volume Node and 0.5 Fibonacci retracement with Elliot wave 3 characteristics keeping the count alive.

Price is testing the weekly pivot point which should act as resistance for the time being but a break straight through will demonstrate a very bullish trend. Traders should be cautious about entering here.

RSI confirmed a weekly bullish divergence

Safe Trading

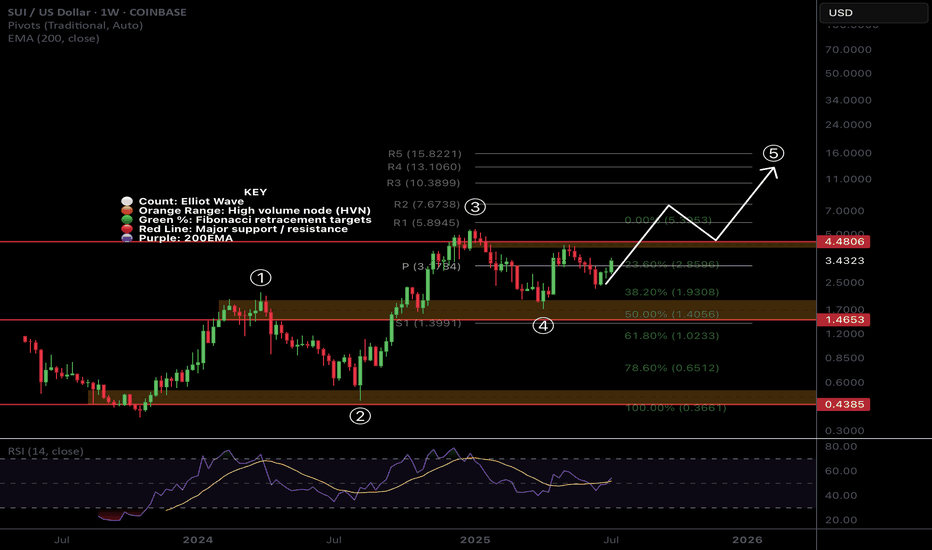

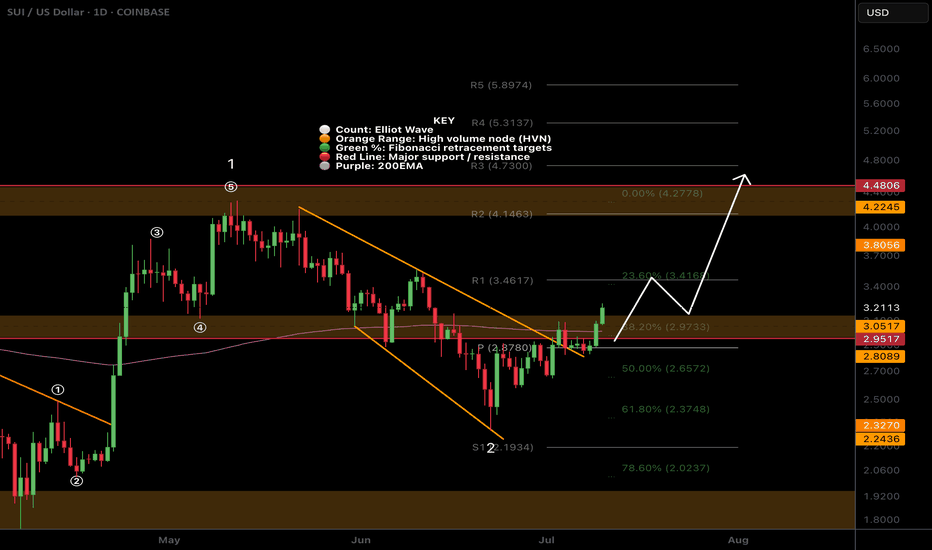

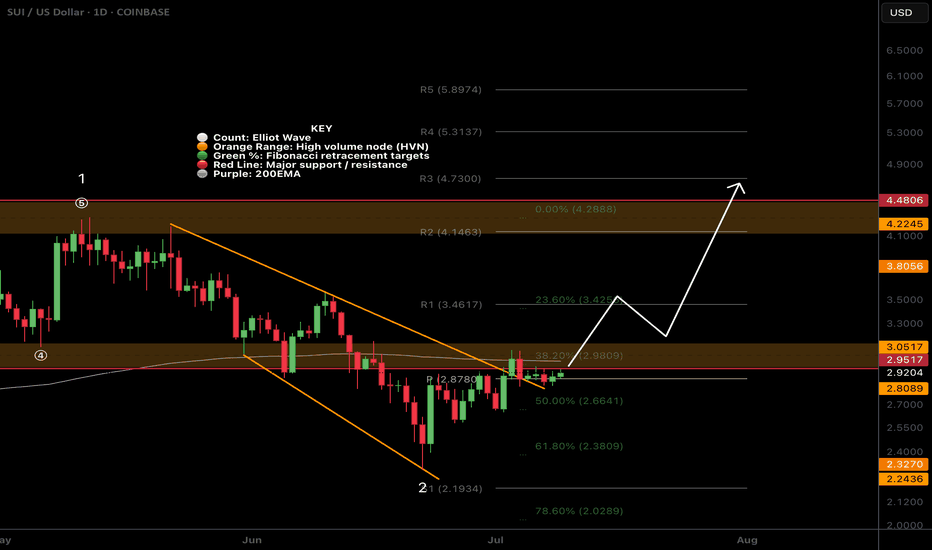

$SUI Wave 3 to Continue with a Strong Weekly CloseCRYPTOCAP:SUI printed a great weekly candle that will be closing today above the weekly pivot point with RSI trying to flip bullishly.

Price found support at 0.5 Fibonacci retracement and High Volume Node.

Wave 4 penetrated wave 1 which we potentially have a ending or leading diagonal Elliot Wave count limiting the potential upside with my current terminal target being around $10-13. Wave 4 could also actually be another wave 2 which would give us ridiculous targets but this is my preferred count for now.

Safe trading

Coinbase (COIN) Shares Reach All-Time HighCoinbase (COIN) Shares Reach All-Time High

According to the chart of Coinbase Global (COIN), the share price of the cryptocurrency exchange has reached a historical all-time high (closing price).

The bullish sentiment has been supported by the following factors:

→ Bitcoin price rally. Yesterday, we analysed the BTC/USD chart and anticipated that bulls might attempt to set a new record. Following the publication, Bitcoin made a strong upward move, breaking above the $118,000 level.

→ Passage of the GENIUS bill in the US , which establishes a regulatory framework for the use of stablecoins.

Can COIN stock continue to climb?

Technical Analysis of Coinbase (COIN) Share Price

At the end of June, our analysis of the COIN chart highlighted the following:

→ From a broader perspective, COIN’s price fluctuations over the past year had formed an ascending channel (marked in grey).

→ The ongoing intermediate rally (marked in blue) had the potential to drive the price towards the upper boundary of this grey channel.

This scenario has materialised: today, COIN shares are trading near the upper edge of the grey channel. However, several factors now warrant a bearish outlook:

→ The upper boundary of the channel may act as resistance;

→ The psychological level of $400 could also serve as resistance;

→ Shareholders may be tempted to lock in profits;

→ A potential bearish divergence on the RSI indicator.

It is possible that in the near term, COIN bulls will attempt to break through the $400 level. However, if buying momentum weakens, the conditions may favour a price correction — which would appear justified after a nearly 60% rally since early June.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

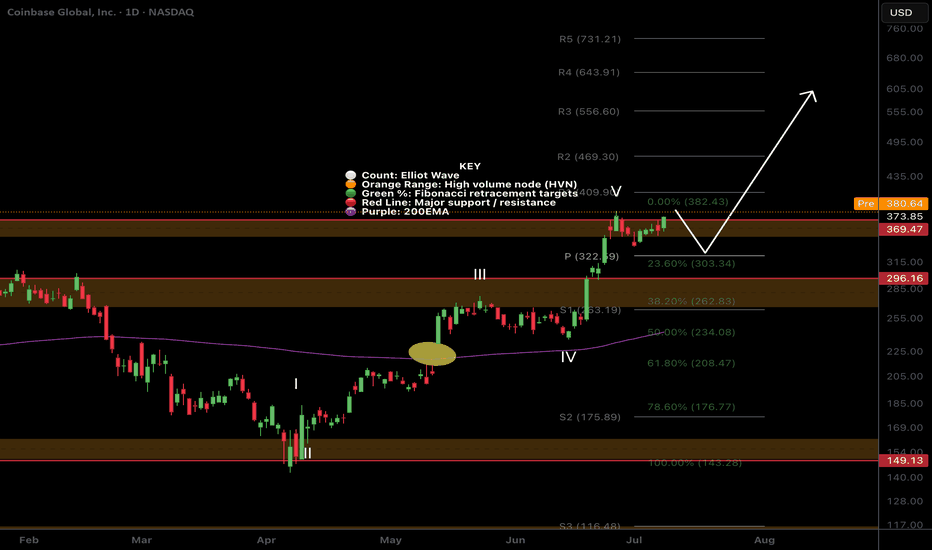

$COIN Price discovery?I was looking for a deeper pullback on NASDAQ:COIN but it appears to be heading into price discovery!

The pivot at $322 was my target but sentiment must be bullish if investors are impatient! Still... i wouldn't count out another sell off as a bear trap on a poke above the swing high.

Safe trading

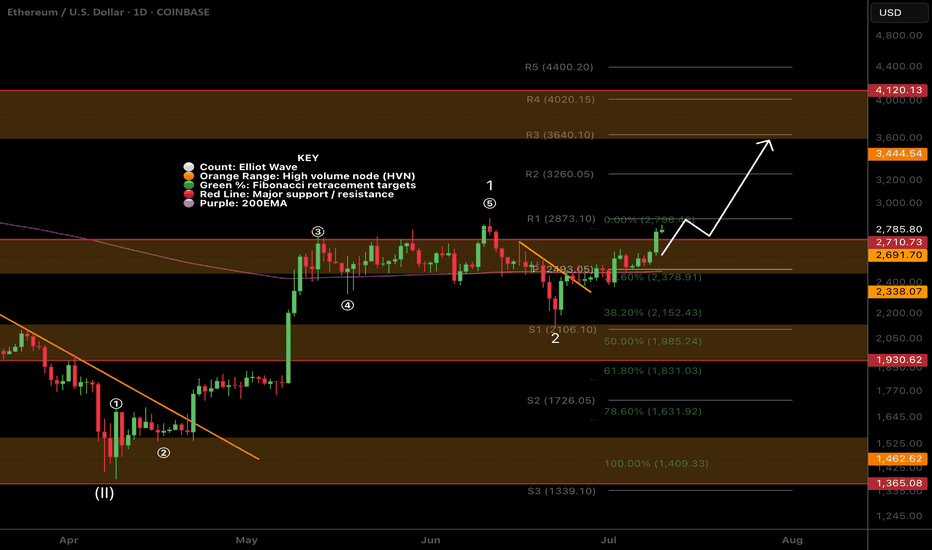

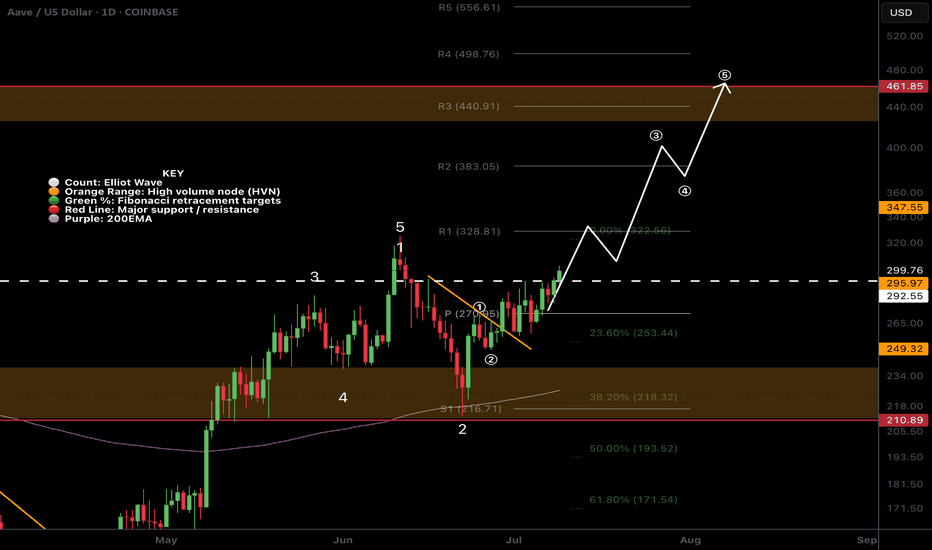

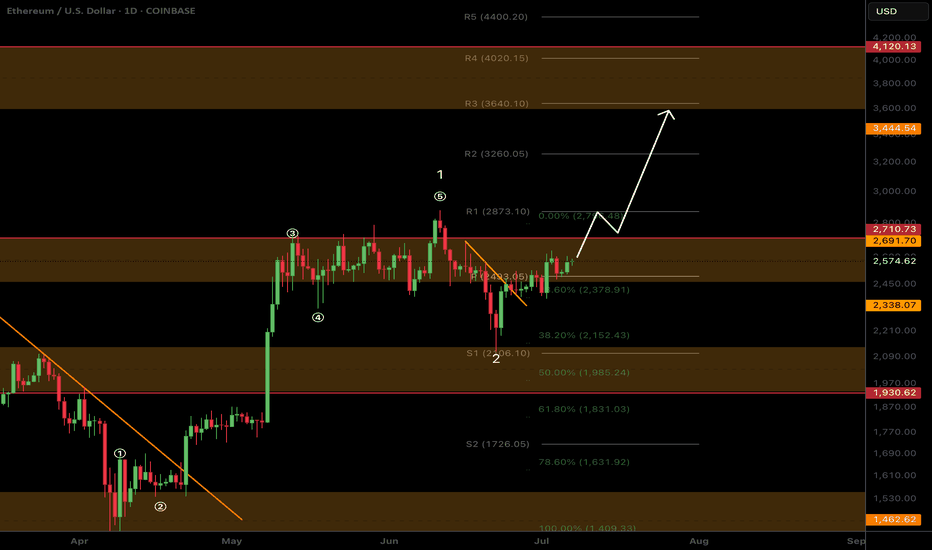

$ETH clear for an impulsive move to $3600?CRYPTOCAP:ETH has slowly but surely cleared resistance, with just the swing high to tackle which will activate another trade signal in my Trade Signals Substack.

Major support High Volume Node, daily pivot and daily 200 EMA proved tough support and demand continues to come in.

ETFs had an astonishing amount of inflows yesterday at $200M+

Analysis is invalidated below $2100

Safe trading

$HBAR Resistance at daily 200EMA!CRYPTOCAP:HBAR analysis continues to play out but should consolidate for a while before moving to the next target at $0.22.

This area should be tough resistance as its the daily 200EMA and major High Volume Node resistance and R1 daily pivot.

The CRYPTOCAP:HBAR signal has now hit take profit #1 from my Trade Signals Substack posted last week.

Safe trading

$SUI Big Breakout Happening?CRYPTOCAP:SUI is smashing above triple resistance: a major High Volume Node , daily 200EMA and the daily pivot. The signal I posted in my trading signals Substack is now live, and the HBAR one is about to hit take profit 1.

Target for this rally remains $4.2 High Volume Node near the swing high.

Analysis is invalidated below the daily pivot at $2.8

Safe trading

$XRP Bias Change: Bullish Elliot Wave CountCRYPTOCAP:XRP is breaking out the descending resistance causing me to take another look at my WXYXZ corrective Eliot Wave count expecting lower. I have adjusted the count to WXY and a 1-2 new motif wave with a target of $3.8

Price is well above the daily 200EMA and daily pivot after testing both as support including the High Volume Node. Closing above the descending resistance today will be a bullish signal but a retest of that resistance as support before continuing onwards its what to look out for.

Analysis is invalidated below $1.8

Safe Trading

$SUI Gearing Up to Break Triple Resistance?CRYPTOCAP:SUI is consolidating under resistance which often leads to a breakthrough but can take some time.

Price is sat above the daily pivot after breaking the downward trend resistance, but still under the daily 200 EMA and High Volume Node resistance. A pop above $3.09 swing high would be a bullish signal to long towards a first target of $4.2 High Volume Node.

Analysis is invalidated with a move below $2.7, leaving heavy resistance still ahead.

Safe trading

$ETH Breakout this week?CRYPTOCAP:ETH local chart looks ready

I think were looking at a decent ETH breakout this week to the next resistance High Volume Node at $3600 minimum target.

👉 BTC is consolidating under all time high resistance after multiple tests which is usual a sign of bullish continuation. Usualy giving alts room to room.

👉 Ethereum is above the daily 200EMA, daily pivot and also consolidating under resistance once more after testing the 0.382 Fibonacci retracement and S1 daily pivot adding confluence to that being the local bottom. This appears to be Elliot wave 2, a shallow wave 2 retracement (less than 0.5) is a show of strength and investor impatience.

Analysis invalidated below the daily pivot and daily 200EMA as this will lock in 3 waves up and look corrective.

Safe trading

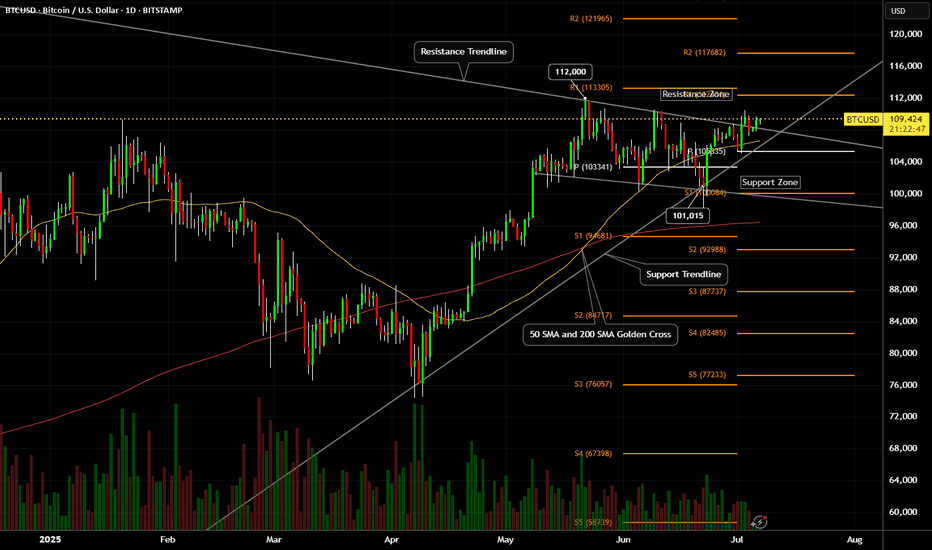

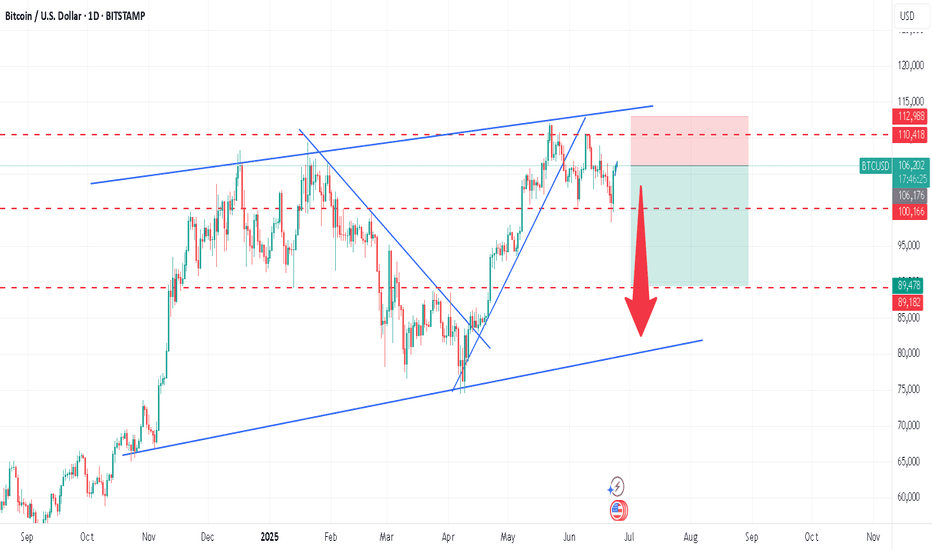

Bitcoin (BTCUSD) - Daily Price Uptrend, Resistance Breakout TestBitcoin (BTCUSD) has been in a recent Daily price Uptrend, rallying up from the $100,000 price support level.

A SMA Golden Cross printed on May 21st, 2025.

Bitcoin price is attempting a resistance zone test and has yet to breakout and hold above the $111,000 to $112,000 price zone.

Resistance levels: $110,000 , $112,000 , $117,000 , $121,000.

Support levels: $108,000 , $107,000 , $105,000 , $104,000 , $100,000.

Recent crypto industry, government legislation news, and institutional crypto purchases have helped to keep Bitcoin price above $100,000 support.

Stock market correlation volatility could also affect the crypto market and prices for the next 30 to 45 days.

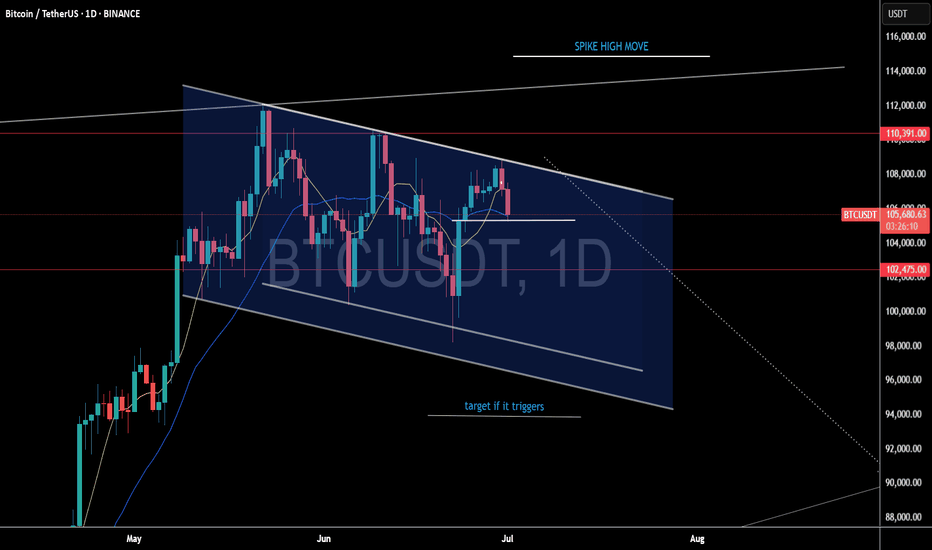

Bitcoin - An Epic Move Awaits!Bitcoin gained 13% in H1 2025, outperforming Ethereum and Solana, which dropped ~25% and ~17% respectively—highlighting BTC's strength in turbulent market conditions.

Institutional wedge: spot-BTC ETFs saw huge inflows—BlackRock’s took in $336M, and total crypto product inflows approached $45B+ this year.

AI models foresee BTC holding $105K+ by end-June, with ChatGPT pointing to $118K and Grok forecasting $108K, based on momentum and ETF flows.

We see BTC holding the 20 MA and spiking to new all time highs.

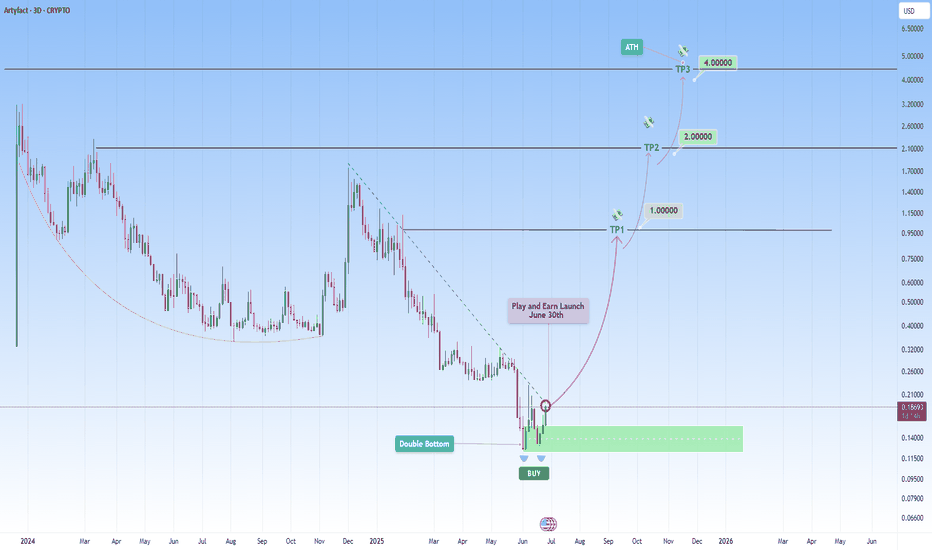

ARTY Launch: Play-and-Earn goes live June 30KUCOIN:ARTYUSDT Artyfact (ARTY) is approaching a major milestone, with its Play-and-Earn platform scheduled to launch on June 30. In anticipation, the token is already showing signs of strength, trading around $0.188 and gaining upward momentum. This move comes off a clear technical structure: a double-bottom reversal followed by a breakout above the descending trendline.

Price action is beginning to confirm the shift in sentiment as the official Play-and-Earn tournament kickoff draws near. With just days left until June 30, anticipation is building as the launch will mark a real turning point. Until then, the current pre-launch sentiment continues to lean optimistic, driven by growing community engagement, strong social media traction, and increasing excitement around what Artyfact is building.

The anticipation surrounding the June 30 launch could be creating strong momentum, as traders and early supporters position themselves ahead of what could be a key moment for the project.

From a broader market perspective, Bitcoin continues to lead the risk-on rotation. BTCUSD recently had an aggressive bullish rally and is poised to maintain upward momentum if macro conditions remain favorable.

Historically, Bitcoin strength has preceded major capital inflows into small-cap altcoins. As BTC resumes its bullish trajectory toward the $110,000 zone, it provides ideal conditions for undervalued projects to reprice aggressively. The rotation effect tends to flow from BTC → ETH → high-utility altcoins and ARTY is positioned to benefit from this dynamic.

Fundamentally, ARTY is deeply undervalued relative to its potential.

Low market cap: A micro-cap with asymmetric upside.

80%+ of total supply is in circulation, reducing inflation risk and encouraging organic demand.

Holder base is expanding, reflecting early-stage adoption and network growth.

Major catalysts ahead:

🎮 Launches on PlayStation, Xbox

📱 Releases on AppStore and Google Play

🧩 NFT integration and metaverse gameplay expansion

These milestones could drive exponential user growth, attracting both gamers and crypto enthusiasts to the ecosystem. When combined with the convergence of technical bottoming, bullish macro conditions, and strong fundamental catalysts, the setup supports the potential for a sustained move toward the $1.00 zone as momentum builds post-launch.

Traders should monitor for confirmation:

-Higher low formations

-Expansion in bullish volume

-Strong closes above interim resistances

With BTC strengthening and capital rotating down the risk curve, early entries in fundamentally sound projects like ARTY offer high risk-reward profiles.

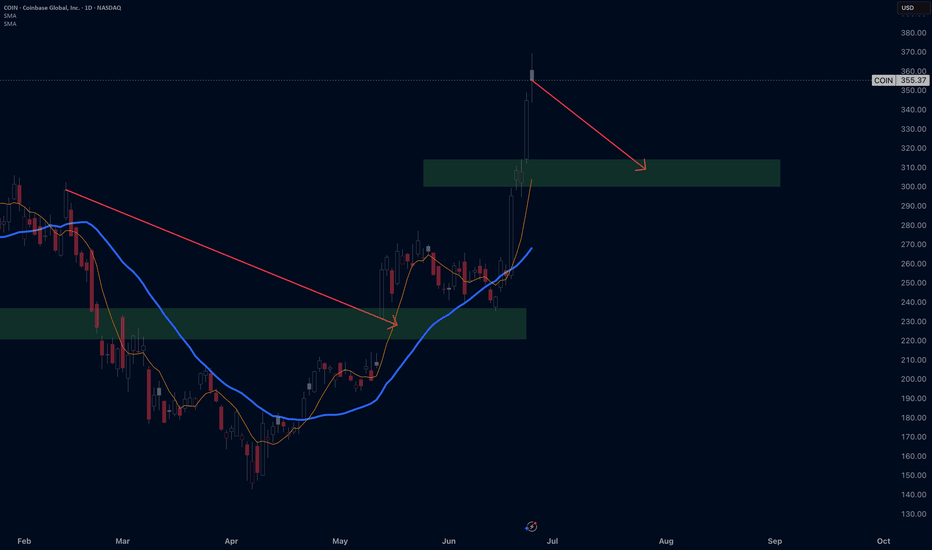

Short COINBASE $COINPlease do your own analysis, i am not responsible for your losses. Trading is risky.

This is daily candle, so when will it happen will take time, 1month or 1.5 month...can't know that.

Please don't tell me you traded and lost, you have to be careful.

The price will drop to the target green area..

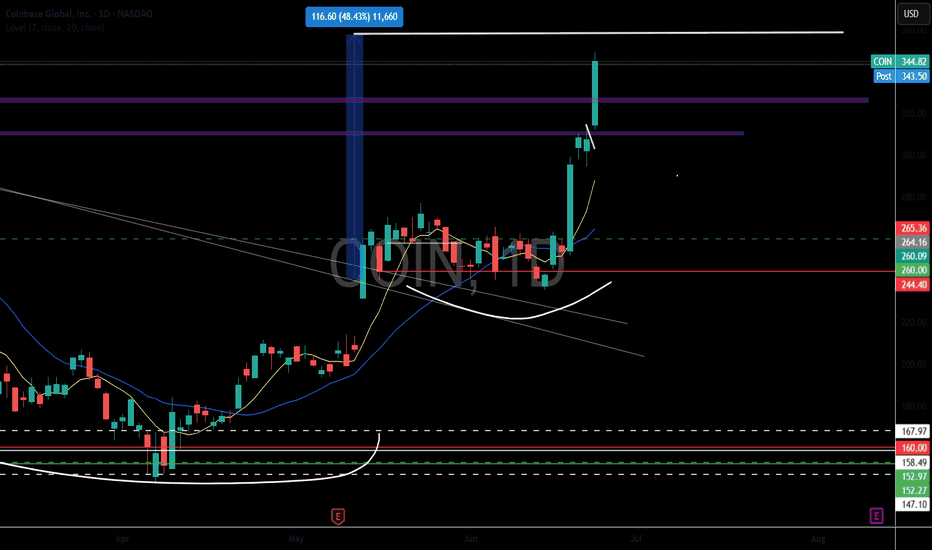

Coinbase (COIN) Shares Hit Year-to-Date HighCoinbase (COIN) Shares Hit Year-to-Date High

As we reported six days ago, shares of Coinbase Global (COIN) received a strong bullish boost after the US Senate approved the GENIUS bill, which sets out regulations for the use of stablecoins.

As the Coinbase Global (COIN) stock chart shows, the rally is ongoing. Yesterday, the price surged by over 12%, once again becoming the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

Bullish sentiment is being fuelled by news that:

→ Two funds managed by Cathie Wood’s Ark Invest acquired around 4,200 Coinbase shares;

→ Analysts at Benchmark raised their target price for Coinbase Global (COIN) from $301 to $421.

Could the COIN share price continue to rise?

Technical Analysis of the Coinbase (COIN) Stock Chart

From a broader perspective, the COIN share price has formed an ascending channel over the past year (marked in grey), and only once — in reaction to news about Trump tariffs — did the price briefly fall outside of this channel.

Based on this, it is reasonable to assume that the developing intermediate rally (highlighted in blue) could reach the upper boundary of the grey channel. However, the psychological level of $350 — near the 2024 peak — appears to be a significant resistance point on this path.

It is possible that we will soon see this level act as resistance on the COIN stock chart, leading to the formation of a correction — which would seem appropriate after a nearly 40% price increase since the start of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Circle Collapse - Will COIN follow? Circle stock has been on a wild ride lately

After a meteoric rise of over 700% since its IPO on June 5, it's now facing some turbulence:

- Today, the stock dropped nearly 16%, partly due to Cathie Wood’s ARK Invest selling $110 million worth of shares.

- Analysts are also sounding caution. Compass Point initiated coverage with a $205 price target—below its current trading price—citing rising competition in the stable coin space.

- Despite the dip, some still see long-term potential. A recent Forbes analysis explored whether Circle could hit $500 per share, driven by growth in USDC reserves and infrastructure revenue.

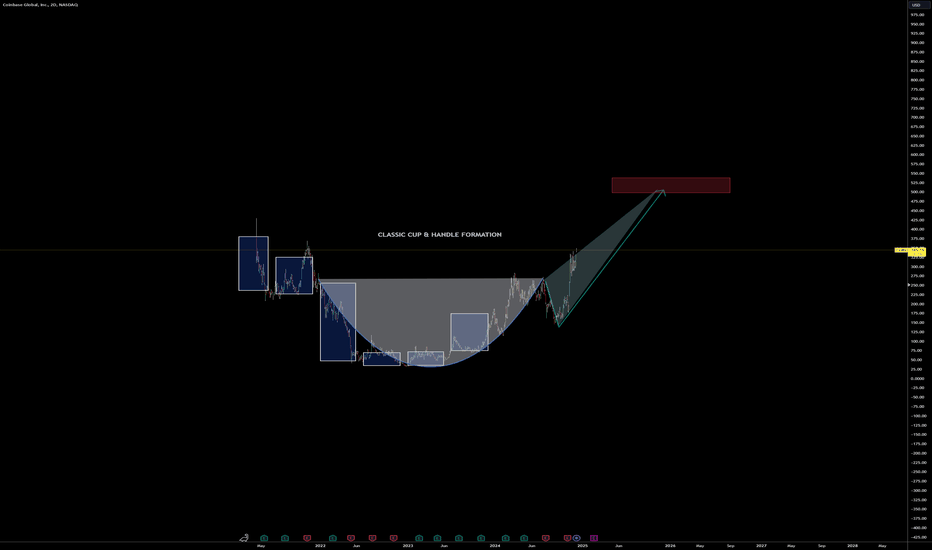

COIN- Cup and Handle FormationThere is more to this, but the basic formation is here. Other systems seem to also support the formation (such as Gann, and Harmonics).

There are a few 6 month candles overlaid in the entry to this that I was creating- illustrating the 6 month gains to form the cup. The handle portion did catch me off guard as we are typically use to seeing a cup form at the initial correction, but this one seems to have formed inside of the down move (very interesting).

Lets see how it works out. If true- its 50% gain on the bone here.

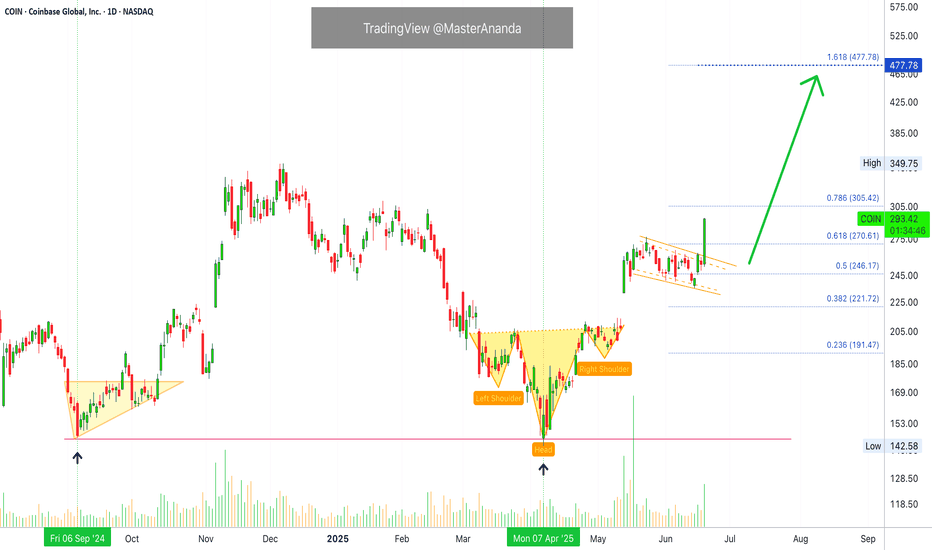

Coinbase Global Inc. Bullish Confirmed Confirms Bullish BitcoinCOIN's chart looks very similar to Ethereum. Today's action reveals something great; bullish confirmed.

Always, since this stock started trading, it has been moving as a unit together with Bitcoin and the entire Cryptocurrency market.

When Bitcoin is bullish, Coinbase is bullish.

When Bitcoin is bearish, Coinbase is bearish and vice versa.

Here we have a very strong, high volume bullish breakout on COIN. This means that Bitcoin, Cardano, Ethereum, XRP, Dogecoin, Avalanche and the rest of the Cryptocurrency market is about to break bullish really strong.

There was a low point 7-April 2025. The same with the projects I just mentioned above.

Here this 7-April low marks a double-bottom compared to September 2024. After this low, the recovery starts and we have a strong rise.

In late May, there is a price peak and we enter a consolidation phase, in this case a small retrace. The chart is identical to ETHUSDT.

After a strong higher low, some minor bearish action with no bearish pressure, Coinbase is going up. You can expect the exact same dynamic happening to Bitcoin and all the Altcoins. Bullish confirmed. The market will resolve green.

Today Coinbase hits the highest price since February 2025.

Namaste.

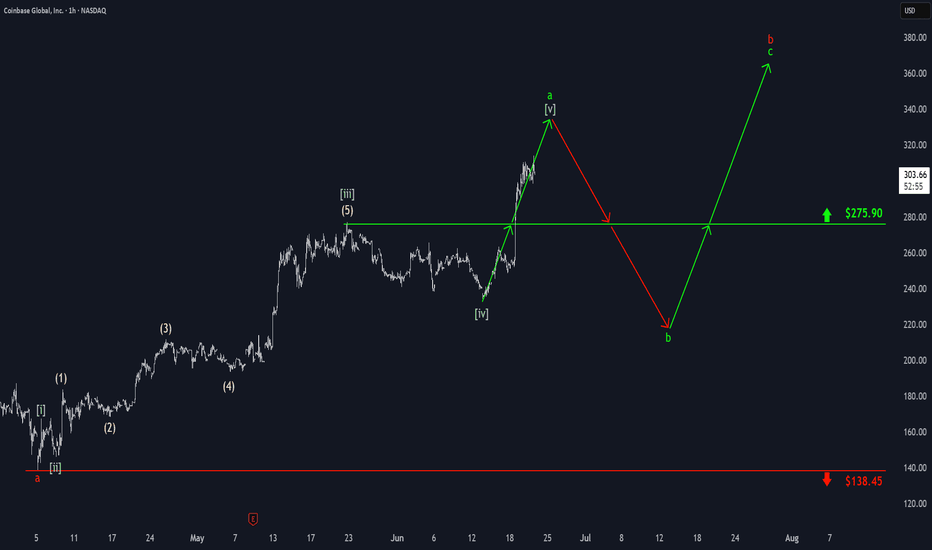

Coinbase: Surging HigherCoinbase has surged sharply above the $275.90 level, prompting us to consider green wave finished. Now, we see the stock advancing in wave , which still has more upside potential to finalize light green wave a. Afterward, we expect a corrective pullback in wave b, which may dip below $275.90, before green wave c resumes the advance, thus completing orange wave b distinctly above $275.90.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.