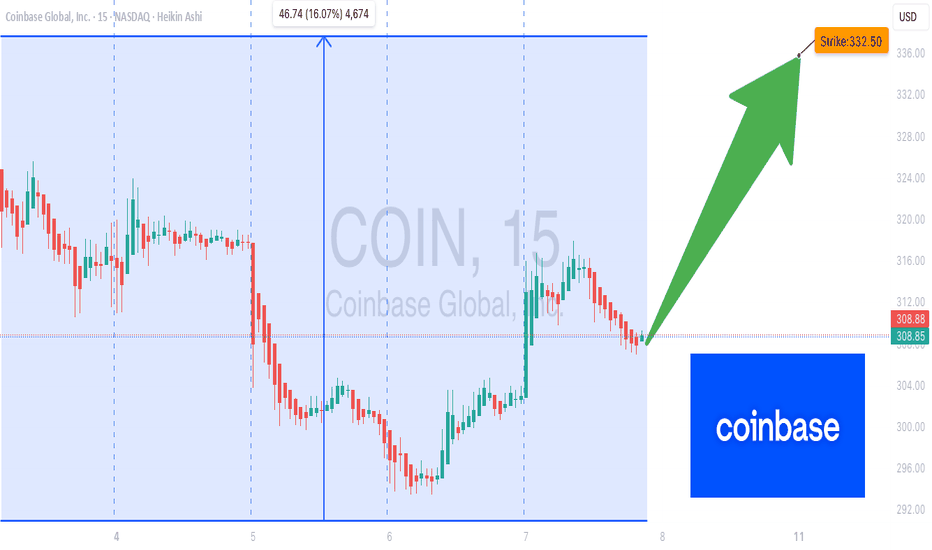

COIN Gamma Storm Incoming!!!## 🚨 COIN Weekly Options Setup (Aug 7, 2025) 🚨

**Massive Call Flow vs. Bearish Momentum — Who Wins?**

> 🔍 Multiple AI models conflicted. Gamma risk rising. One day to expiry. Here's the trade...

---

### 🧠 Key Model Consensus (Across Grok, Claude, Llama, DeepSeek, Gemini):

✅ **Bullish Options Flow** from institutional players

📉 **Bearish Price Momentum** and RSI

⚠️ **High Gamma Risk** into expiration

🤔 **Signal Divergence** = Uncertainty + Volatility

---

### 🟩 **Bulls’ Case (Grok, Claude, Llama):**

* Oversold conditions + call buying = Rebound Setup

* Volume spike confirms institutional interest

* Moderate bullish lean with upside potential

### 🟥 **Bears’ Case (DeepSeek, Gemini):**

* Price action still weak

* Distribution pressure detected

* Recommending no trade or puts

---

### 📊 Trade Setup Summary

| Parameter | Value |

| -------------------- | ----------------- |

| 🎯 **Strike** | \$322.50 |

| 📅 **Expiry** | 2025-08-08 (1DTE) |

| 📈 **Direction** | CALL (LONG) |

| 💵 **Entry Price** | \$0.96 |

| 🎯 **Profit Target** | \$1.44 |

| 🛑 **Stop Loss** | \$0.57 |

| 📏 **Size** | 2 Contracts |

| 🔁 **Entry Timing** | Market Open |

| 🧪 **Confidence** | 65% (Moderate) |

---

### ⚠️ Risks to Watch:

* 1DTE = High volatility swings ⚡

* Momentum still leaning bearish 📉

* Gamma moves could trigger sharp reversals

---

📌 **Final Take**:

**Trade if you’re aggressive. Sit out if you’re cautious.**

This is a classic high-risk/high-reward setup driven by **options flow vs. price action divergence**.