Comerica (NYSE: CMA) Reports First Quarter 2025 Earnings ResultsComerica Incorporated (NYSE: NYSE:CMA ), together with its subsidiaries, a company that provides financial services in the United States, Canada, and Mexico reported her first quarter 2025 earnings results today before the bell.

The results are available on the Investor Relations section of Comerica's website: c212.net

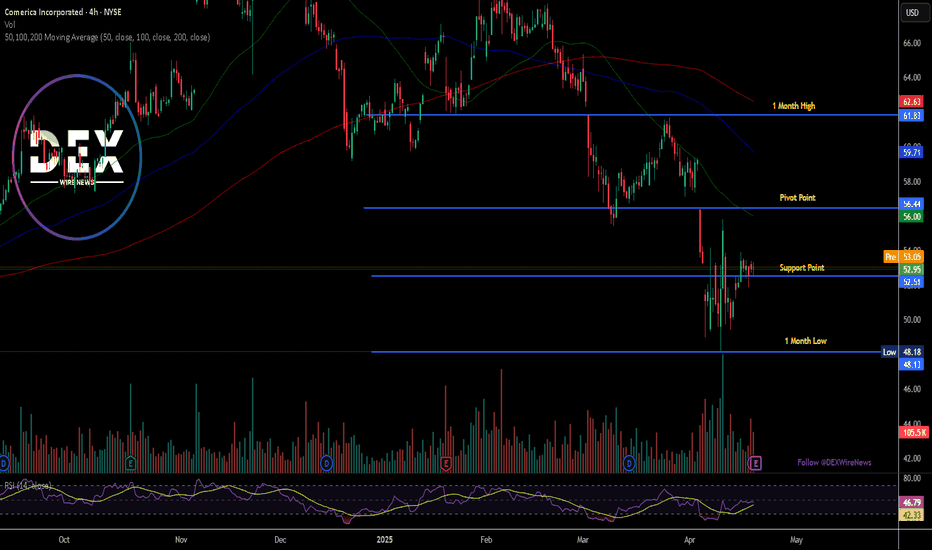

Technical Outlook

Prior the earnings, shares of Comerica Incorporated (NYSE: NYSE:CMA ) are up 1.28% in Monday's premarket session. The asset is trading in tandem with the support point of $52, a break above the 38.2% Fib level could set the pace for a bullish reversal albeit the stock was already consolidating as hinted by the RSI at 46.

Financial Performance

In 2024, Comerica's revenue was $3.20 billion, a decrease of -8.79% compared to the previous year's $3.50 billion. Earnings were $671.00 million, a decrease of -21.43%.

Analyst Forecast

According to 21 analysts, the average rating for CMA stock is "Hold." The 12-month stock price forecast is $67.43, which is an increase of 27.35% from the latest price.

Comerica

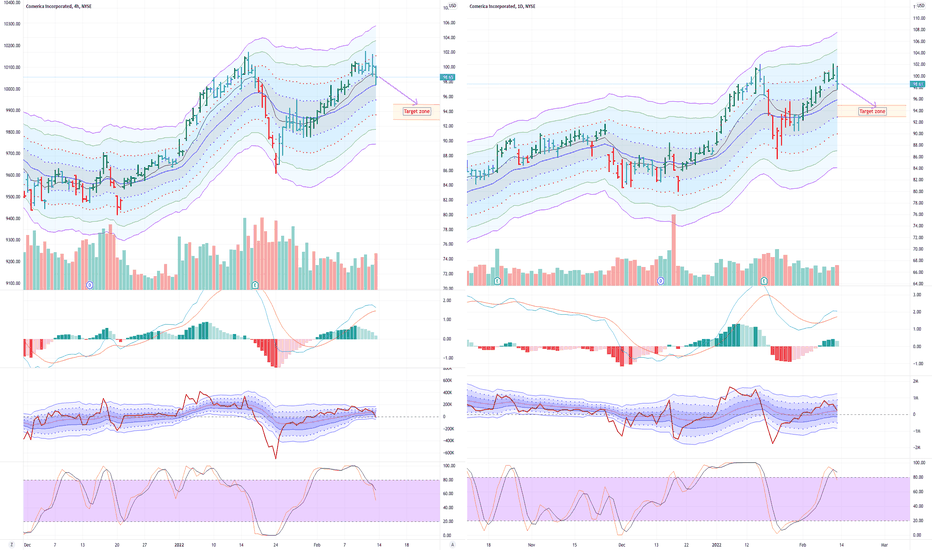

Bearish divergence on CMA Daily and 4HWeekly (not shown):

Possible bearish divergence coming up. Impulse still green, but is shows prices around 101 were rejected and price closed much lower.

MACD-Histogram still rising, as well as EFI. sRSI declining, although it could cross.

Daily

Bearish divergence on MACD-H, MACD lines, EFI and even Stochastic RSI. Stoch RSI crossed bearish and comes from an overbough condition. Even an ATR channel divergence. Current bar shows an upwick and rejected the to close around the 101$ resistance

4H

Bearish divergence again on ATR lines, MACD-H and MACD lines, and EFI. sRSI is bearish and is declining.

Entry:

At this level, but first we need to see how the weekly opens.

98-99,5

Stop:

102

Target 1: 94,46

Target 2: 92,88