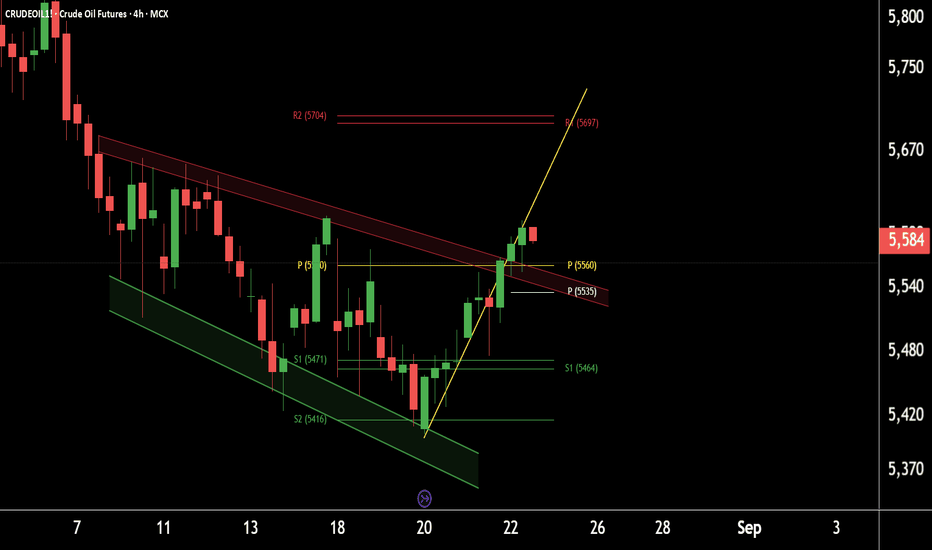

Crude Oil breaks out of falling channel –Watch for higher level.This is the 4-hour timeframe chart of CrudeOil1!.

The price has been moving within a well-defined falling channel and has now given a breakout. A possible retest of the breakout level around 5560 may occur, after which CrudeOil could move towards the falling channel completion target near 5700.

Weekly pivot support is also placed around the 5400–5450 zone and resistance around 5700.

If this level is sustained, we may see higher prices in CrudeOil1!

Thank You !!

Commdodities

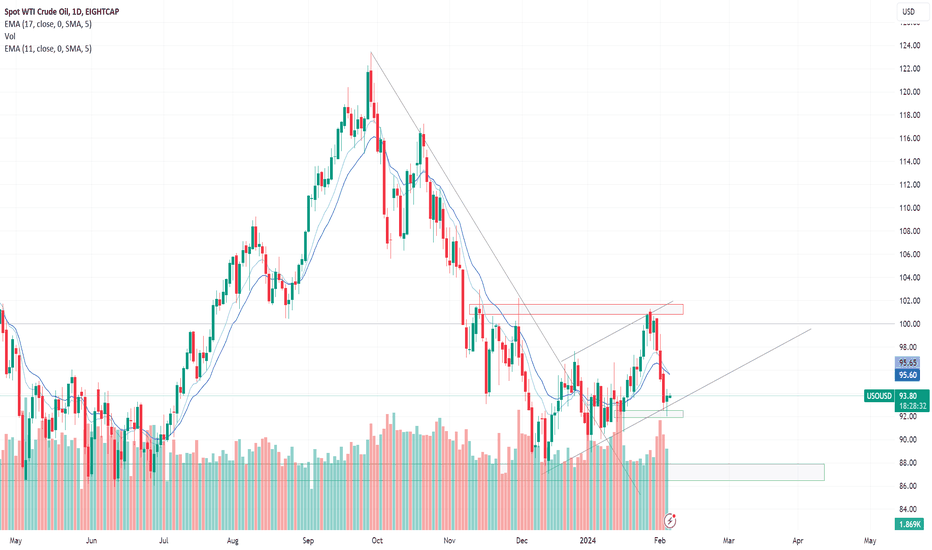

Oil: Thoughts and AnalysisToday's focus: Oil

Pattern – Support Hold

Support – 71.80

Resistance – 78.80

Hi, traders; thanks for tuning in for today's update. Today, we are looking at Oil.

After a solid three-day decline, buyers have put up a fight from 71.80, but is this enough to hold the current uptrend? A break below yesterday's bar with a trend break could suggest that the current move lower has further to go.

We have reviewed a few scenarios we are looking for, depending on what we see today.

Good trading.

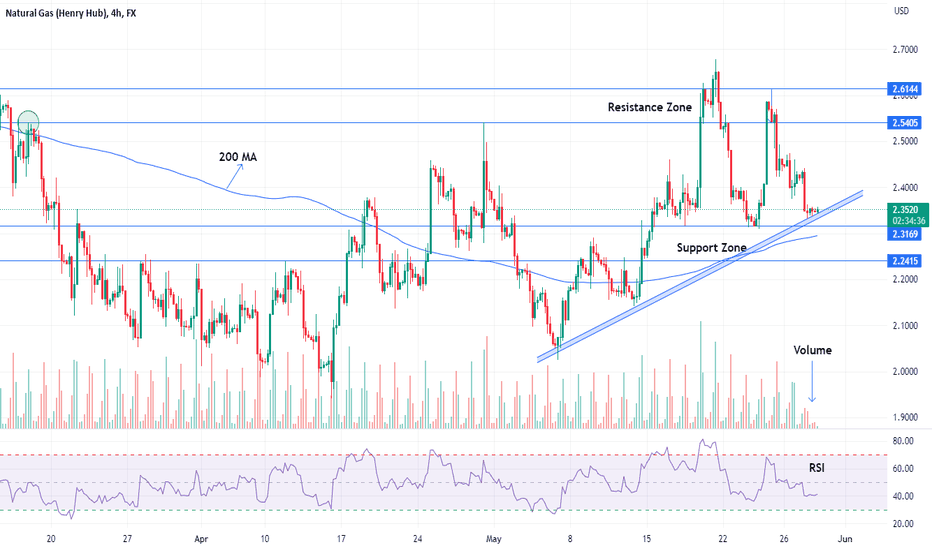

NATURAL GAS Possible Long analysisThe NATURAL GAS trend is bearish for the last couple of months. The market placed a 1.9625 low on 22-Feb-2023. In a 4Hour time frame market reject the resistance area ( $2.54-2.61 ) as mentioned in the price chart and continued the bearish move. Now price is traded near the Support area ( $2.31-2.24 ). Volume indicates bears lose momentum. Price respect the Trendline in the past two times and now again near to test. Price also traded above the 200 MA ( moving average ) which indicates a bullish trend. So initiate long positions after closing above the Support area and also the trendline. On the other side, Short selling is favorable near the resistance area as mentioned above in the price chart after confirmation by a bearish price action structure.

Support and Resistance levels for day trading ;

Pivot Point Level: PP 2.3776

Support Levels: S1 2.3137, S2 2.2684, S3 2.2045

Resistance Levels: R1 2.4229, R2 2.4868, R3 2.5321

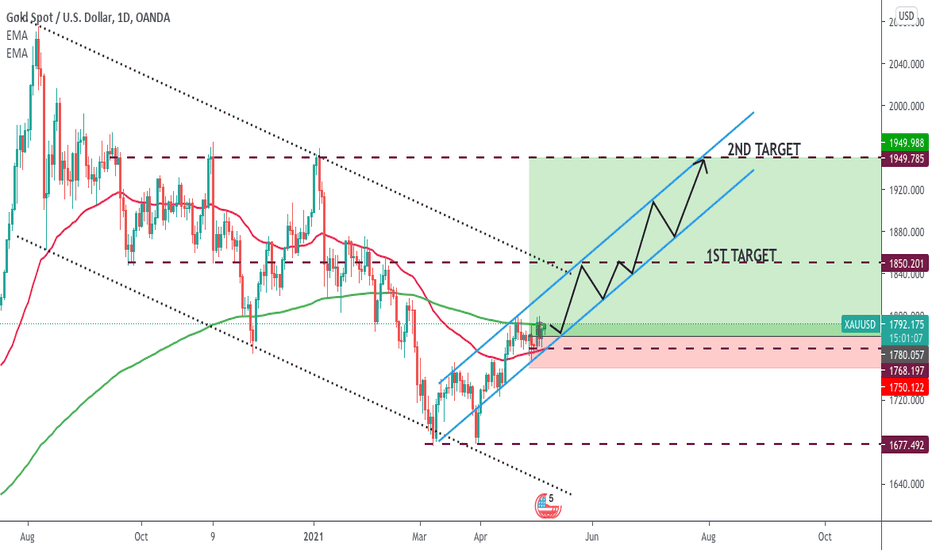

GOLD - trade idea - from 27.04.2021 - active Analysis: Gold was advancing to the upside since our last trade (27.04) and I am waiting for a price action for the price to hit my first target in the upcoming weeks. Once we can manage to clear the zone near the 1850$ level it will open the road to test the second target around the 1960$ level.Bad fundamental news from the worlds large economies or geopolitical/healthcare news can boost up the price momentum.

Trade from 27.04.2021 - ACTIVE

Trade: BUY

Entry: 1780$

1st target: 1850$

2nd target: 1950$

S/L: 1750