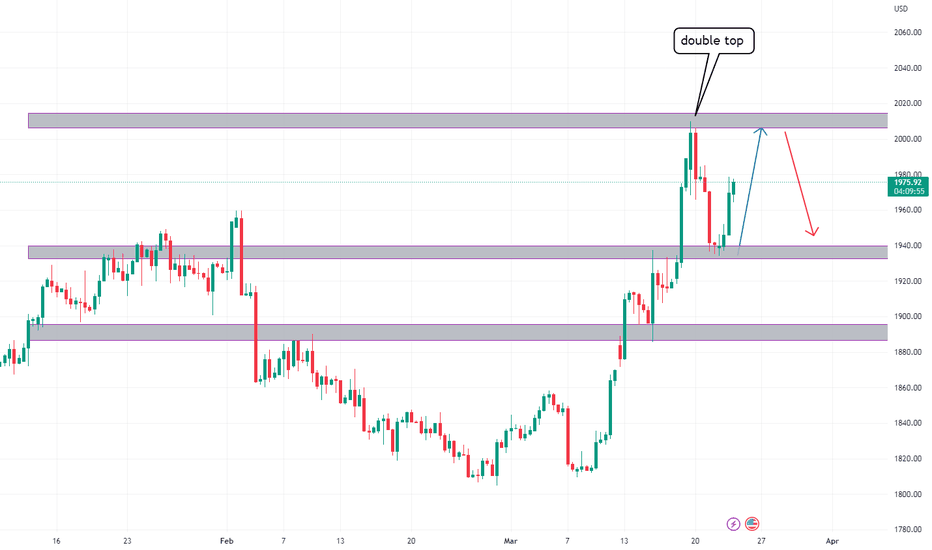

Gold Outlook 24 March 2023Gold approaches 2000 again. But it looks like Gold could reject 2000 again.

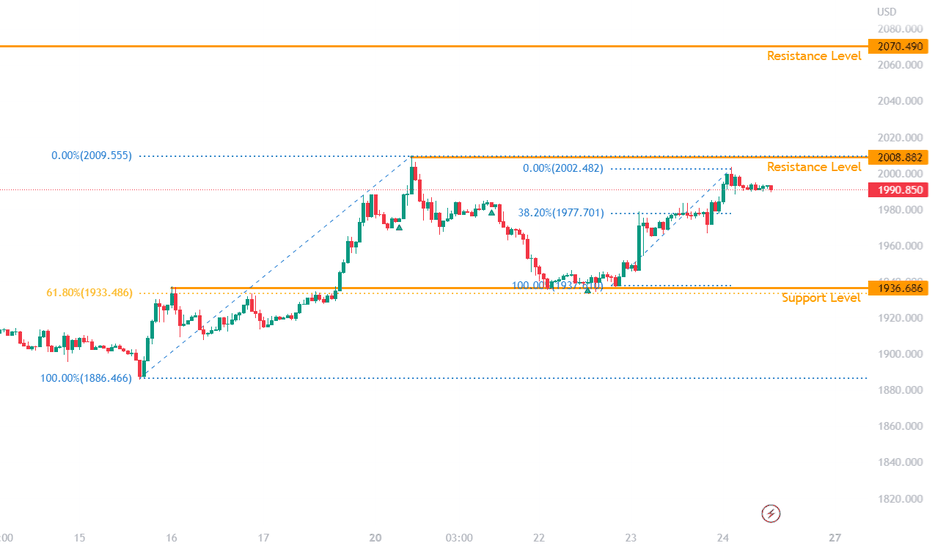

The last time when Gold reach the 2000 level (and breached it slightly by forming a new high of 2008) the price retraced down to the 61.8% fib level, which was 1940 price area.

A confirmation of a stronger retracement to the downside would be signaled if the price trades below the 1977 price level which coincides with the 38.2% Fibonacci retracement level.

However, anticipating further downside for the DXY, it is likely that Gold could continue with the uptrend.

Therefore, look for buying opportunities on retracements of Gold, with the key resistance levels at 2000 and 2070

Commodity

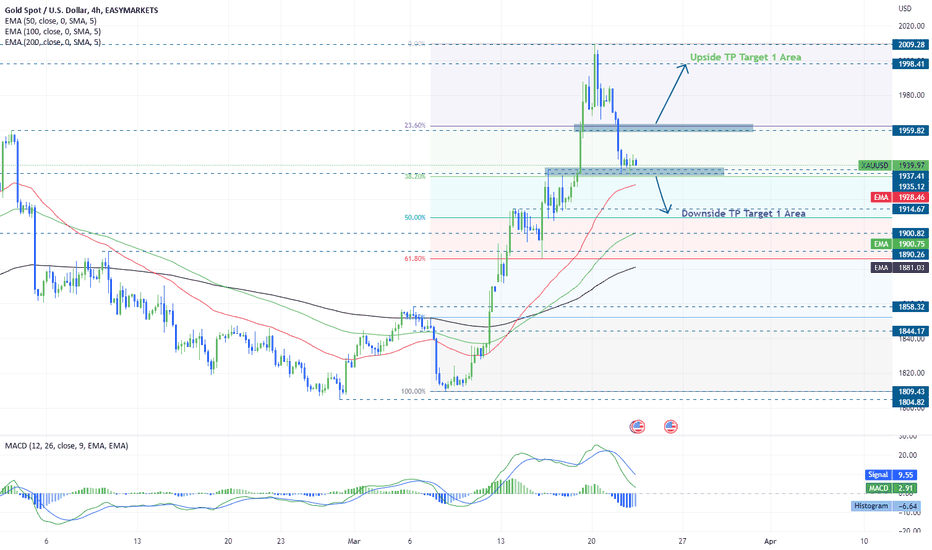

easyMarkets Gold 4-hour - Quick Technical OverviewAfter a sharp decline on Tuesday, Gold is now balancing slightly above our 38,2% retracement on the Fibonacci. Given that we have the Fed rate announcement on Wednesday evening, we will take a cautious approach and wait for the decision first, before getting comfortable with either of the short-term directional moves.

From the technical perspective, a break below the 1935 zone may invite a few more sellers into the game, possibly clearing the way towards the 1915 area, or even the 50,0% retracement.

However, to get comfortable with the upside scenario, we prefer to take a conservative approach and wait for a move back above the 1960 hurdle first. This way, the path towards the psychological 2000 area could opened once again.

Disclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold Outlook 22 March 2023Gold retraced strongly following the move to the 2000 price level. Forming a head and shoulder pattern, Gold traded down to the 1938 price level which coincides with the 61.8% Fibonacci retracement price level

The next directional move on Gold is going to be highly dependent on the volatility of the DXY, especially with the FOMC interest rate decision due.

In the short term, if the price breaks below 1933 (the 61.8% fib level), gold could continue trading lower, down to the key support level of 1914.

However, in the medium term, anticipating further DXY weakness, look for Gold to bounce either at the fib level or the 1914 support level to continue with the uptrend to retest the 2000 price level again.

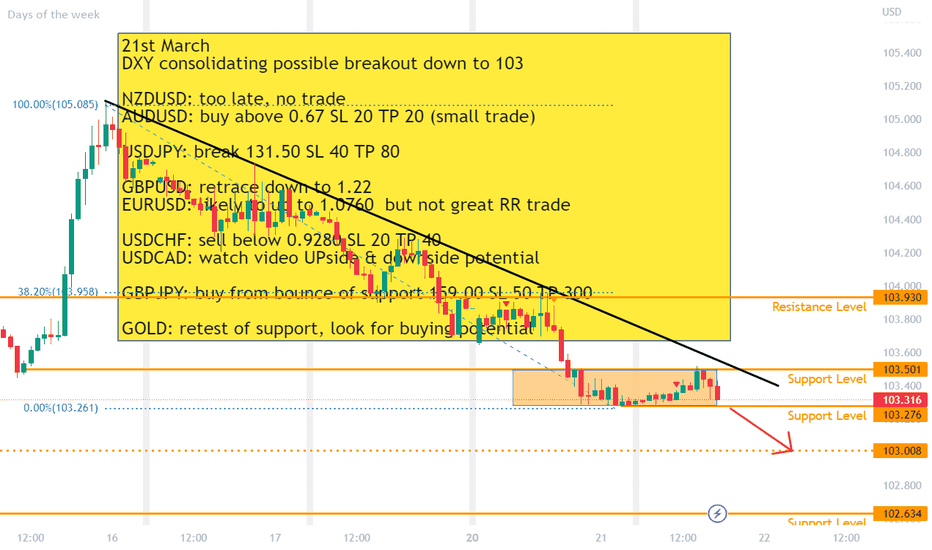

Levels discussed during the webinar 21st March21st March (might not be alot of trading opportunities)

DXY consolidating possible breakout down to 103

NZDUSD: too late, no trade

AUDUSD: buy above 0.67 SL 20 TP 20 (small trade)

USDJPY: break 131.50 SL 40 TP 80

GBPUSD: retrace down to 1.22

EURUSD: likely to up to 1.0760 but not great RR trade

USDCHF: sell below 0.9280 SL 20 TP 40

USDCAD: watch video for the setup with upside & downside potential

GBPJPY: buy from bounce of support 159.00 SL 50 TP 300

GOLD: retest of support, look for buying potential

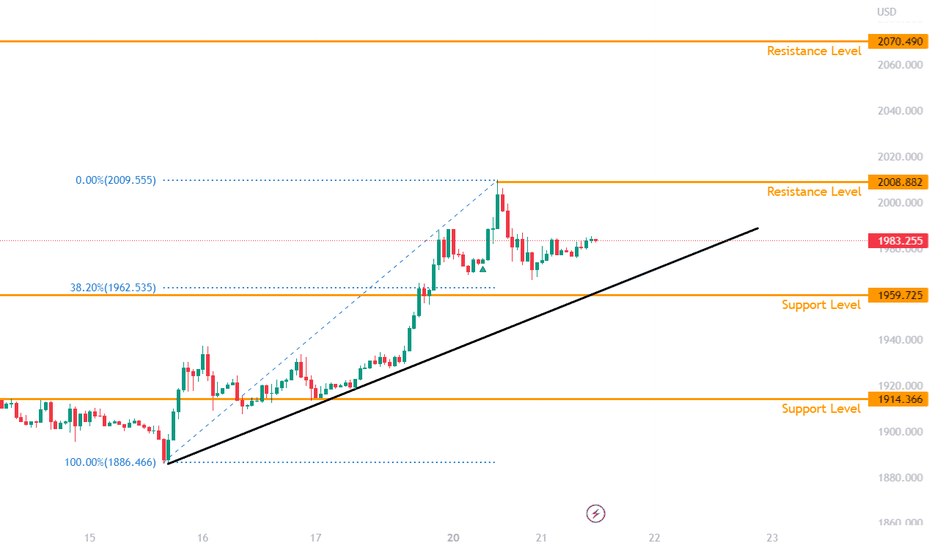

Gold Outlook 21 March 2023During the trading session yesterday, Gold broke above the round number level of 2000 to reach a high of 2009.55.

However, the move higher was brief as Gold quickly retraced to consolidate along the 1982 price level.

Further upside is anticipated for Gold if the price stays above the support level of 1960 which coincides with the 38.20% Fibonacci retracement level and the bullish trendline.

However, before the price trades higher, Gold price could consolidate/retrace first. In addition, an upward move in Gold could require either further downside on the DXY or increasing market uncertainty, driving investors toward the safe haven commodity.

If the price breaks above the recent high, the next key resistance level is at 2070.

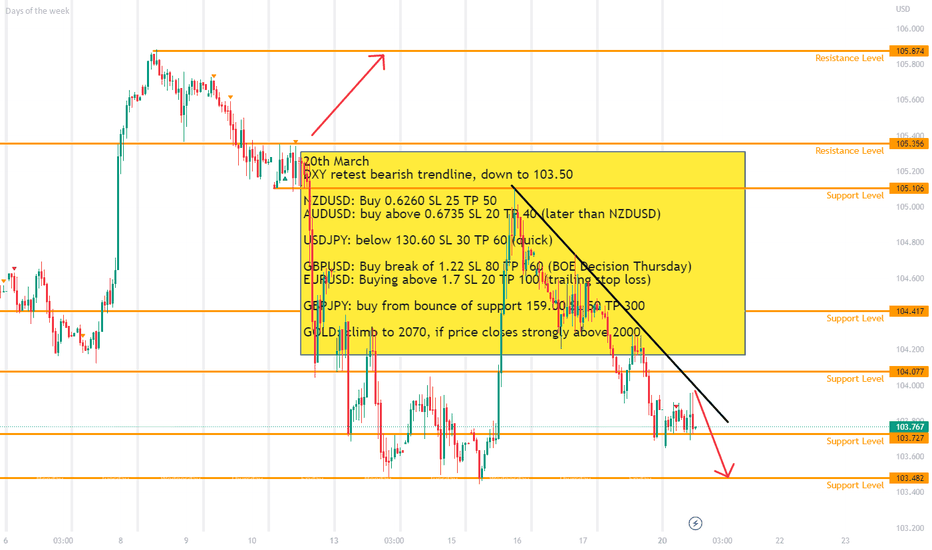

Levels discussed during the webinar 20th March20th March

DXY retest bearish trendline, down to 103.50

NZDUSD: Buy 0.6260 SL 25 TP 50

AUDUSD: buy above 0.6735 SL 20 TP 40 (later than NZDUSD)

USDJPY: below 130.60 SL 30 TP 60 (quick)

GBPUSD: Buy break of 1.22 SL 80 TP 160 (BOE Decision Thursday)

EURUSD: Buying above 1.7 SL 20 TP 100 (trailing stop loss)

GBPJPY: buy from bounce of support 159.00 SL 50 TP 300

GOLD: climb to 2070, if price closes strongly above 2000

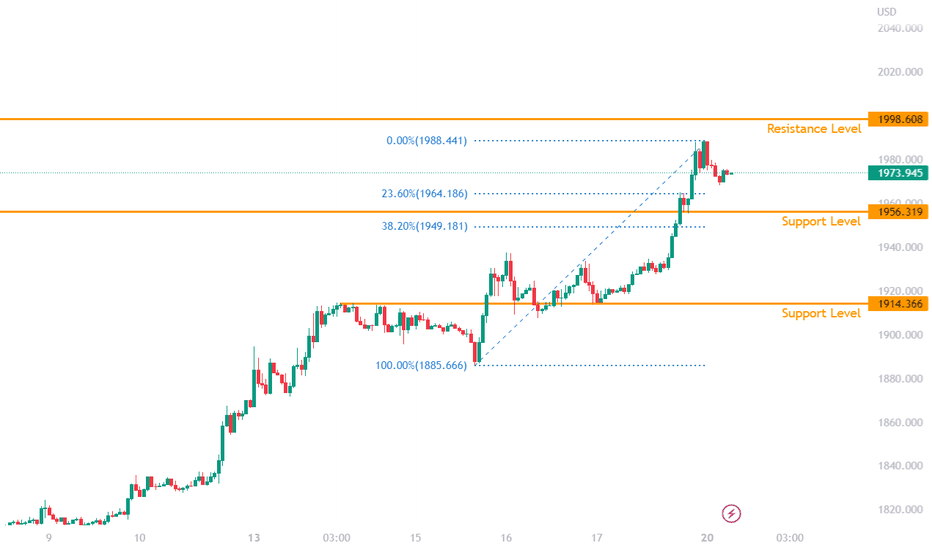

Gold Outlook 20th March 2023Gold traded significantly higher last week, due to several key events;

1) gross market uncertainty increased as banks collapse (SVB and Credit Suisse).

2) flight toward the reserve commodity

3) weakness in the DXY

Currently, the price is retracing and is trading along the 1973 price level, with further downside expected. The price is likely to test the support level of 1956 which sits between the 23.60% and 38.20% Fibonacci retracement levels.

However, as the uptrend of Gold remains strong, anticipate the retracement to be brief with the price likely to rebound from the support to trade higher again.

The next key resistance level is at the round number level of 2,000 which was last visited in April 2022

GS Commodity Index ChartLooking at the Goldman Sachs Commodity Index and how the prices went up dramatically from the Covid lockdown, i would say that there is still room for a final rally, before a major correction in 2024.

The chart is self-explanatory.

Looking forward to read your opinion about this.

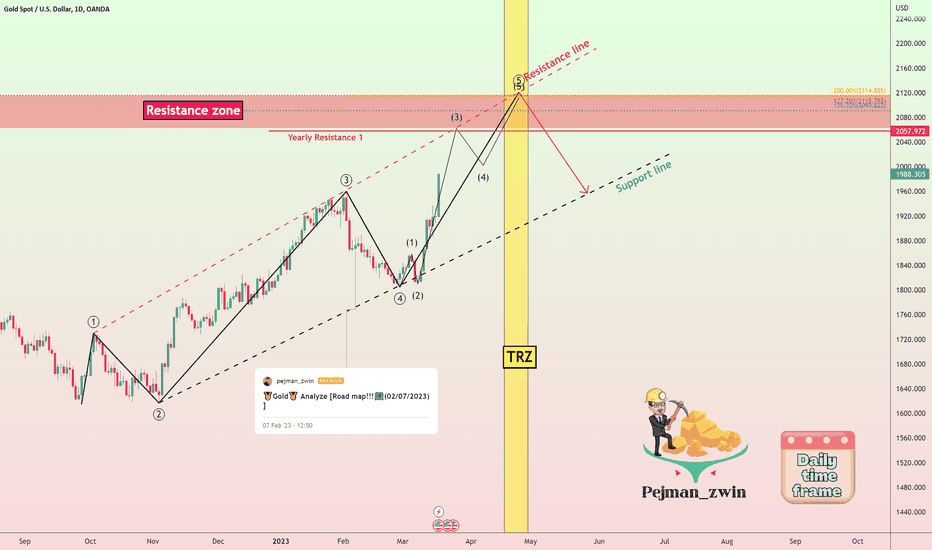

🥇Gold🥇 Analyze [Road Map!!!🗺️(03/19/2023)]Hi everyone, today I want to update the 🗺️Gold road map🗺️.

It is better to look at the previous roadmap that I published on Feb 7 in the 8-hour time frame. (Gold is moving ✅well,✅ according to the analysis).👇

Now we have to look for the end of the main wave 5.🧐

The end of wave 5 will most likely be in the 🔴resistance zone($2,114.9-$2,062.7)🔴 and 🟡Time Reversal Zone(TRZ)🟡.

Of course, according to the fundamental news, Gold seems to touch the resistance zone and resistance line easily.

Gold Analyze ( XAUUSD ), Daily Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe

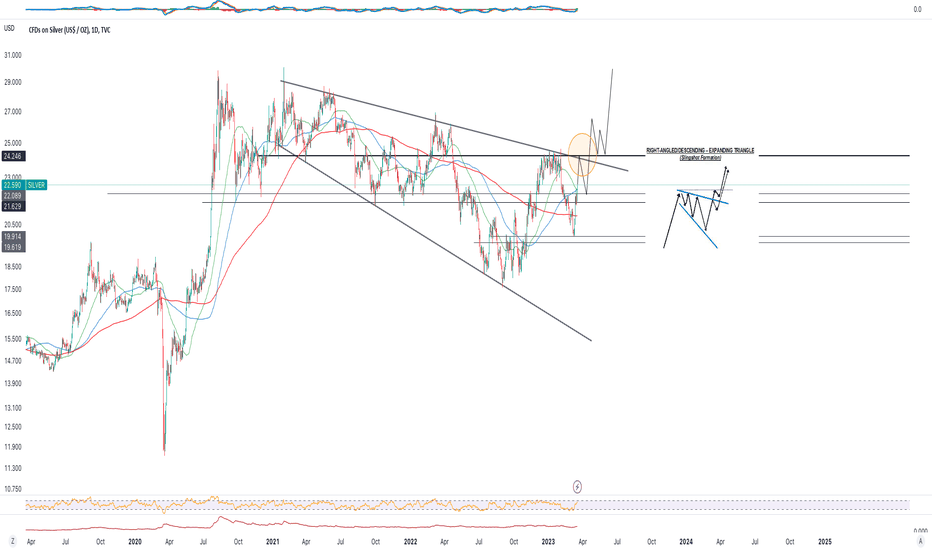

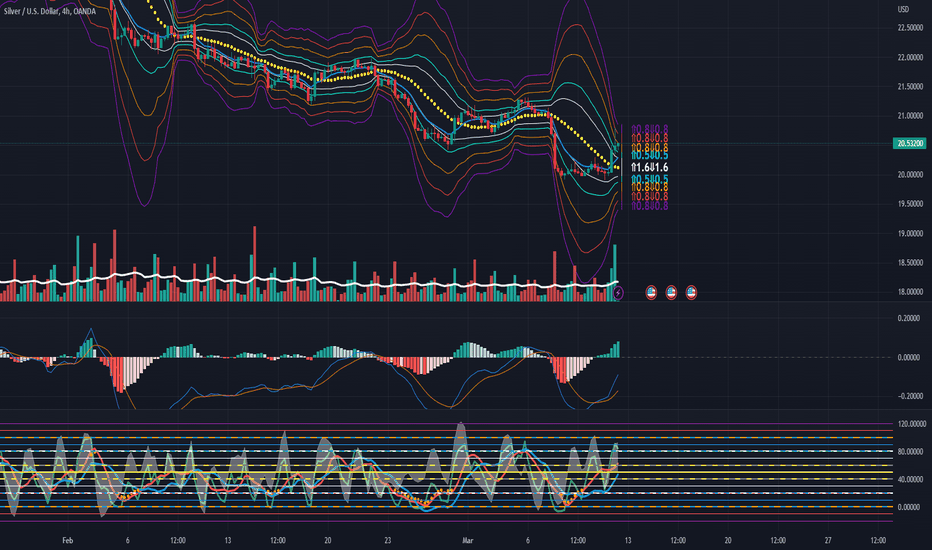

Silver - Are you ready? Hi, this is my new update for Silver. This week we got a big green weekly candle (+10%). We lost a big support level 2 weeks ago around 21.50$ and now we are above it again, I think that was beautiful bear trap. Right now we have smashed all daily and weekly moving averages and we are getting back the bullish momentum on daily chart. Another thing that is bullish in silver chart is that we are in a bullish expanding triangle and I expect we are going to break both the trendline and the the resistance around 24.40$ on this wave.

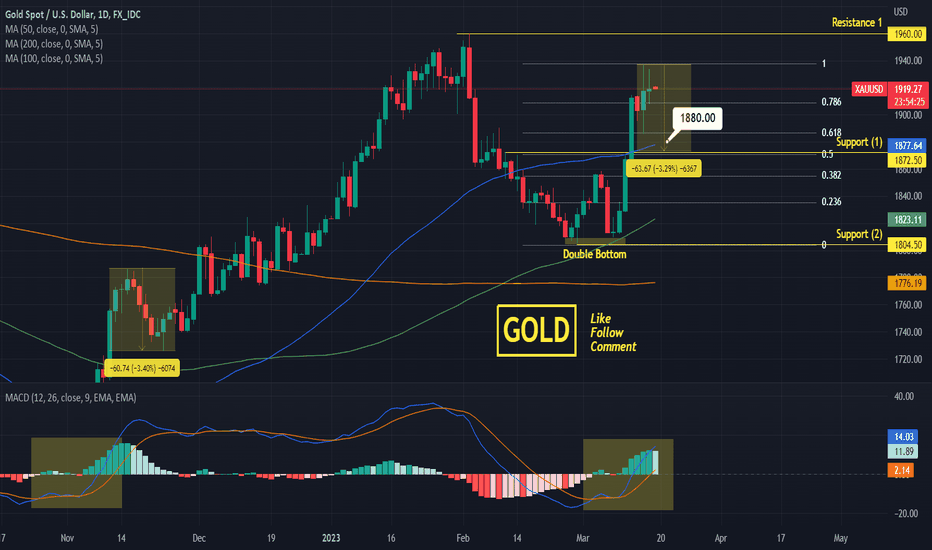

XAUUSD Small pull-back but bullish long term.XAUUSD is at the start of a new long term bullish wave as per the MACD (1d).

At the same time this suggests that a short term pull back is possible with the MA50 (1d) a standard Support level during uptrends.

Trading Plan:

1. Sell on the current market price.

Targets:

1. 1880 (over the MA5 1d and rough -3.40% as per November.

Tips:

1. The MA100 (1d) provided the necessary long term Support twice. As long as this holds, the long temr trend will be bullish.

Please like, follow and comment!!

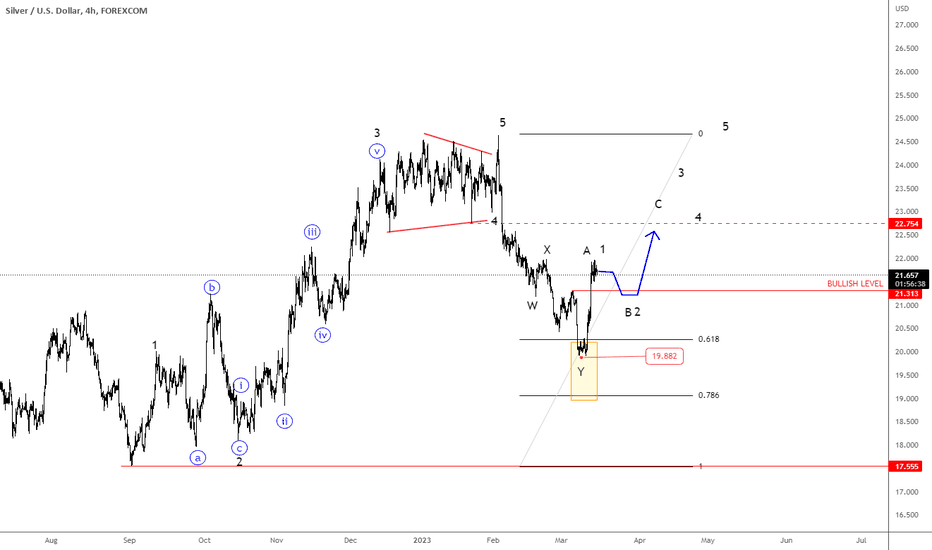

Silver Turning Up For Minimum Three Waves

Silver made strong and impulsive rally since September 2022 till February 2023. A sharp drop in February from 24.50 and break below 22.50 supports suggests that metal is in a higher degree correction. That’s quite strong decline, but due to a five-wave rally earlier, we still see it as part of a complex sharp W-X-Y correction with the support here in the 61,8% - 78,6% Fibonacci retracement and 20-19 area.

We can currently see a nice bounce from the support, but due to sharp leg down previously, we are tracking a minimum three-wave A/1-B/2-C/3 recovery at least up to 22.75 area for wave C or maybe even higher and back to highs for wave 3 of a new five-wave bullish impulse.

Support on intraday dips is at 21.30 followed by 20.60

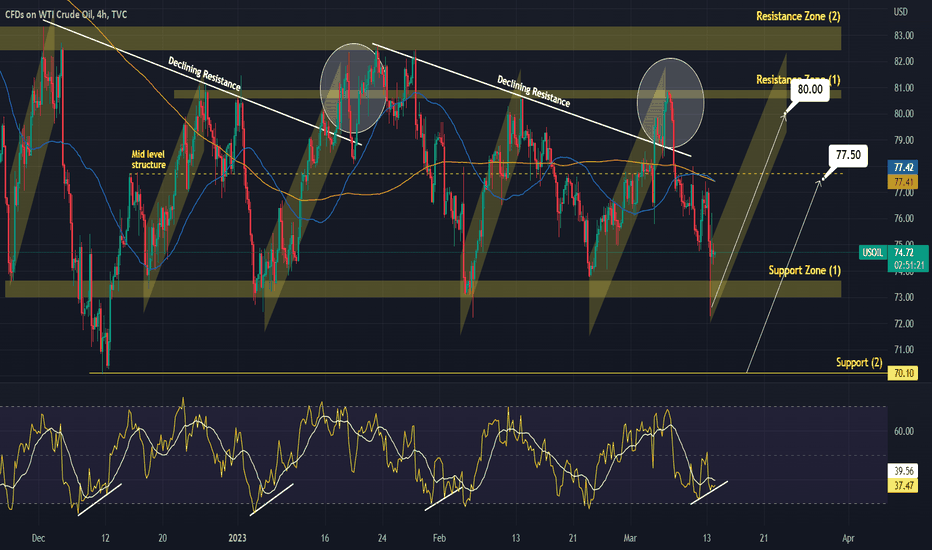

WTI CRUDE OIL Two buy entriesWTI Crude Oil hit Support Zone (1) and is rebounding.

The pattern has been extremely steady since November and Support Zone (1) has delivered 5 rallies of at least +9.50% each.

Trading Plan:

1. Buy on the current market price.

2. Buy near Support (2).

Targets:

1. 80.00 (near Resistance Zone 1).

2. 77.50 (mid level structure).

Tips:

1. The RSI (4h) is on a Rising Support. A common characteristic of all prior rallies since November.

Please like, follow and comment!!

Notes:

This is a continuation of this trading plan:

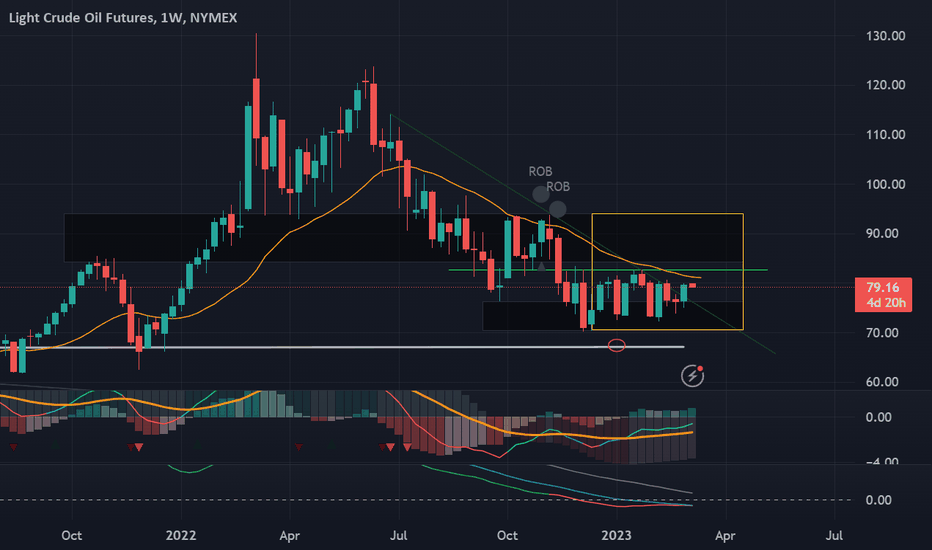

CRUDE to bounce too!Been a while since crude futures were reviewed, and since the last post, crude categorically dropped... but it maintained a decent range between 70-80/82. The thing about crude now is that it appears to be coiling and is starting to show signs of a break out.

Here is how I see it... the candlestick pattern (especially in the Daily chart, not shown here) is bullish, at least leaning towards bullishness. The MACD is aligning up, and the VolDiv is tapering but not crossed over yet. The MACD is forming that not so subtle anymore bullish divergence. Also noted that the TD Sequential is still in bullish primary trend mode (not shown here).

Now, to qualify a good break out, we need to set some parameters. 82 is the break out resistance level (green line) and this is about half of the range since August 2022. Coincidentally (or not), the 23EMA is at 81, and the weekly price needs to close above 81. And a really good break out (out of the yello box range) above 94 would be seriously bullish, although that might mean the Ukr-Russ conflict might have escalated.

Sidenote that the USD in a choke-hold and depreciating would help Crude rally up more.

Alternatively, a 23EMA failure, MACD cross under can happen as the VolDiv accelerates further into bearish territory. a close below 72 would favour the bear case.

Given the longer term view, it appears Crude is ready for a (surprise) bounce, and is likely to revisit the last low in December 2022, probably May-July 2023. While this is not obvious in the weekly chart, the Monthly chart TD Sequential indicates, so heads up.

Silver, You should dump your paper and buy some physicalOANDA:XAGUSD

Paper trading things like silver and gold are a total joke. You who trade paper shares are trading in mostly fake, extremely diluted, worthless shares. Your paper certificate is diluted somewhere on a ratio of 900 paper shares to every actual physical once of silver.

Soon enough, actual silver will decouple itself from these made up paper shares. When it decouples, physical silver will go through the roof, and the silver paper market will crash, because it will be no longer tied to silvers actual spot.

It is a massive risk to be involved in paper shares of anything that is diluted so much, its insane. Hard times are very close, the crash is right around the corner. Best invest in physical, or if not, be aware of the risks that come with the paper market. Also. To those using technical analysis on Silver or Gold.. It does not work so well, especially right now, because precious metals have too much reaction to financial instability and economic crisis.

I wish all a great day and to stay strong in the hard time that will come upon us all. Prayers. Strength and Unity.

Inverse head & shoulders for PalladiumIf we break the neckline, price may test the weekly pivot point 1440.

Disclaimer – WhaleGambit. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

XAUUSD is accumulating for a 1925 target.Strong 1D candle for Gold today, still some way off the 1day MA50. The rebound was achieved on the 1day MA100.

There are strong similarities between February-March and August-October as you see. The rising RSI validates that the pattern is on the Double Bottom pricing. One last drop for a Triple Bottom is possible.

Perfect time to buy and Target Fibonacci 0.786 at 1925.

Follow us, like the idea and leave a comment below!!

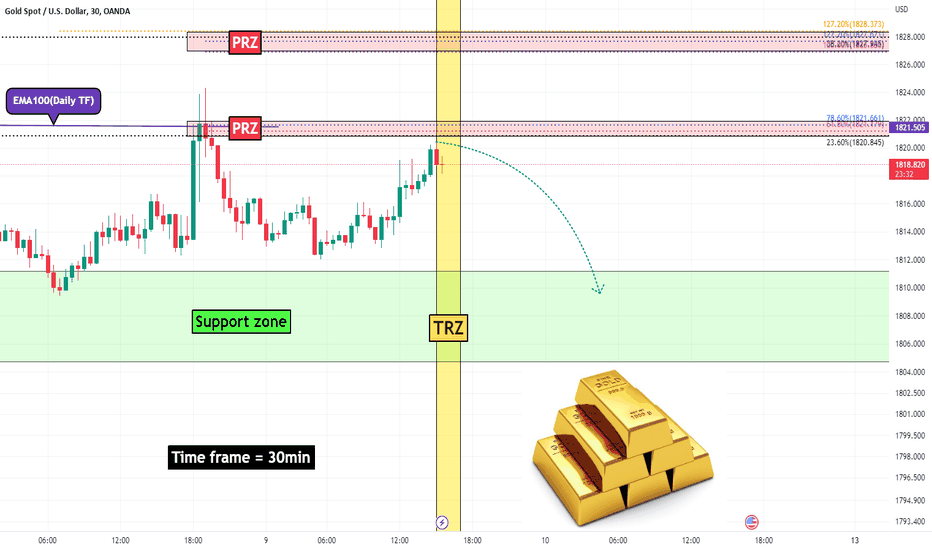

🥇Gold🥇 Analyze (Short term, 03/09/2023)!!!Gold is approaching the PRZ(Price Reversal Zone) and TRZ(Time Reversal Zone).

I expect the rise in Gold prices to be temporary and Gold will again drop to the 🟢support zone($1811.2-.$1804.6)🟢.

Gold Analyze ( XAUUSD ), 30-min Time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my Idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

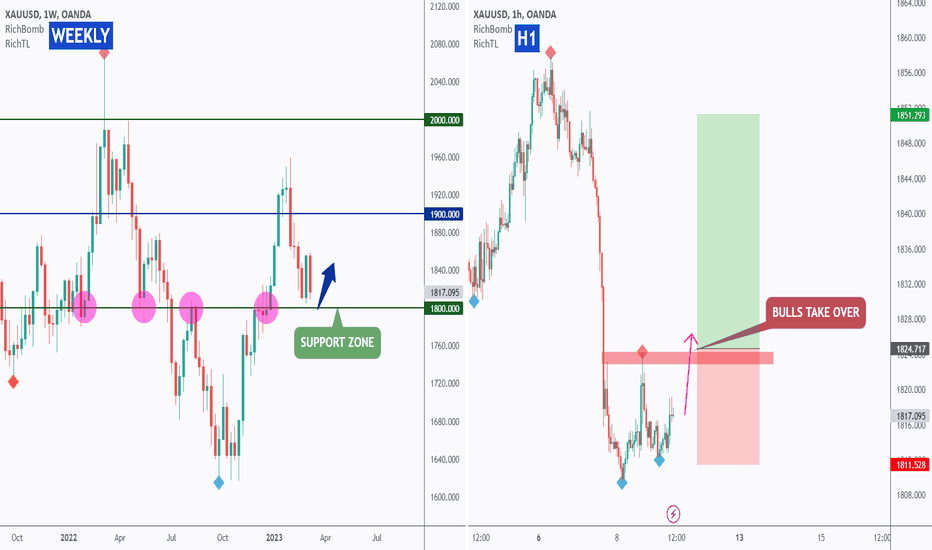

GOLD - Potential Buy Setup - Analysis #2/50Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

on WEEKLY: Left Chart

GOLD is retesting a support zone and round number 1800. So we will be looking for buy setups on lower timeframes.

on H1: Right Chart

For the bulls to take over, we need a momentum candle close above the last major high in red.

Meanwhile, until the buy is activated, GOLD can still trade lower till the 1800 support or even break it downward.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

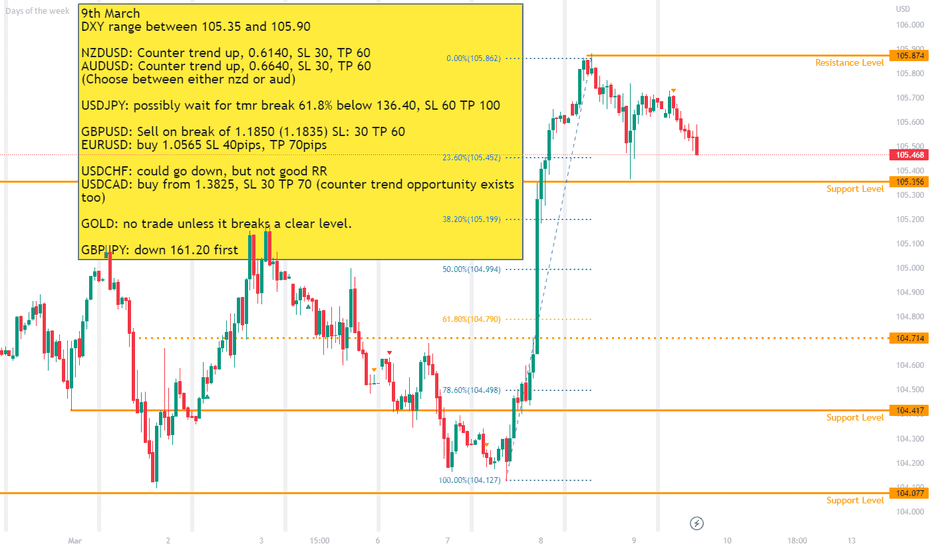

Levels discussed during the webinar 9th March9th March

DXY range between 105.35 and 105.90

NZDUSD: Counter trend up, 0.6140, SL 30, TP 60

AUDUSD: Counter trend up, 0.6640, SL 30, TP 60

(Choose between either nzd or aud)

USDJPY: possibly wait for tmr break 61.8% below 136.40, SL 60 TP 100

GBPUSD: Sell on break of 1.1850 (1.1835) SL: 30 TP 60

EURUSD: buy 1.0565 SL 40pips, TP 70pips

USDCHF: could go down, but not good RR

USDCAD: buy from 1.3825, SL 30 TP 70 (counter trend opportunity exists too)

GOLD: no trade unless it breaks a clear level.

GBPJPY: down 161.20 first

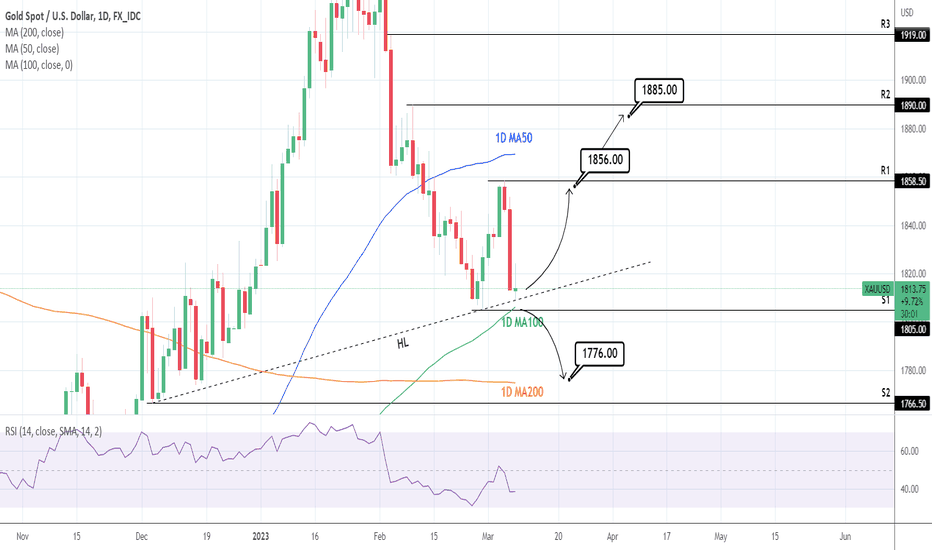

XAUUSD: The closest to the 1D MA100 since November.Gold hit the 3 month HL trend line today, turning the 1D time frame red technically (RSI = 38.134, MACD = -12.150, ADX = 37.931) and coming the closest to the 1D MA100 since November 10th 2022.

Holding those two is a major buy entry (TP = 1,856) all the way to R1 but breaking below them and S1, will make us close and open shorts aiming at the 1D MA200 (TP = 1,776).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

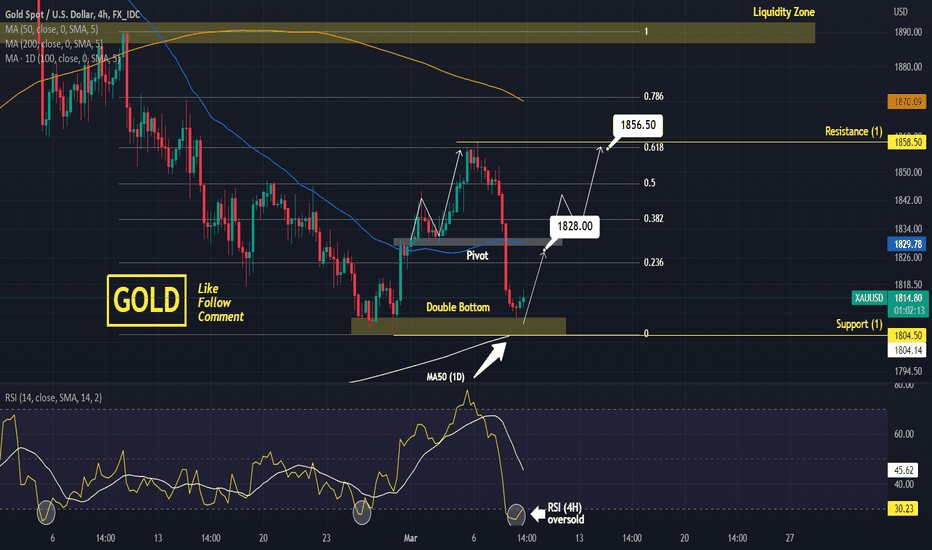

XAUUSD on February's Support ZoneXAUUSD after its biggest daily drop in recent months, it reached the Support Zone of February.

The MA50 (1D) has entered this Support Zone and can support as it is intact since November 10th 2022.

Legitimate short term buy opportunity.

Trading Plan:

1. Buy on the current market price.

2. Buy if the price breaks over Fibonacci 0.382 and retests the Pivot.

Targets:

1. 1280 (MA50 (4H) and Pivot).

2. 1856 (Fibonacci 0.618 and Resistance 1).

Tips:

1. The RSI (4H) is rebounding after breaking deep into the oversold level. It has been a strong buy signal before.

Please like, follow and comment!!