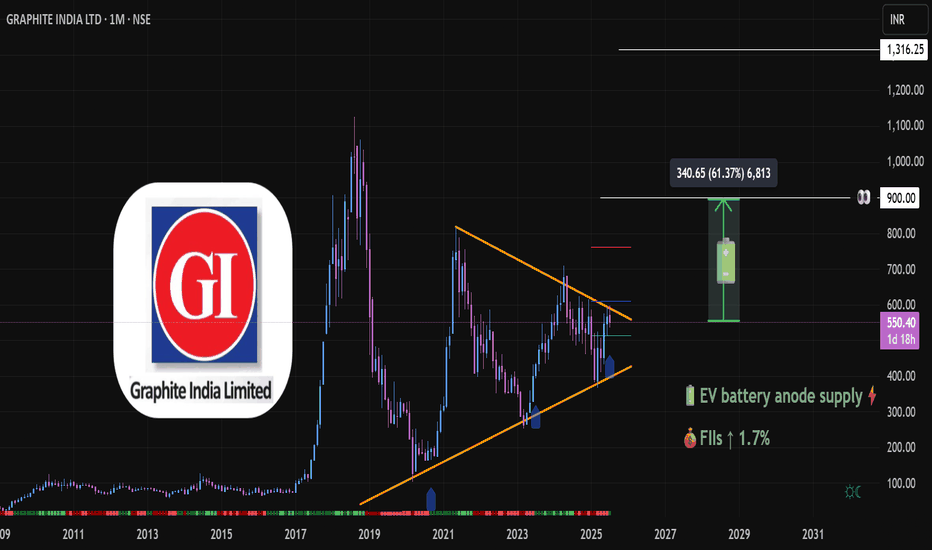

Graphite India (1M TF) - Big Technical Base ►NSE:GRAPHITE

⚙️ Materials: Commodity Cycle Turnaround

(Green energy metals, China recovery)

Sector context: India’s rising graphite demand (e.g. electrode expansion for steel, battery material on horizon) aligns well with Graphite India’s positioning.

►Graphite India is the largest producer of graphite electrodes in the country and one of the largest in the world.

At the time of charting NSE:GRAPHITE PA was at 550

PA in 1D TF has bounced from Support

Trend 1M TF: Long-term Symmetrical 📐triangle formation since 2018 highs — price now testing upper trendline

Monthly shows range‑bound to mild consolidation since topping near ₹623 and bouncing around ₹540‑560.

Multi-year consolidation forming a textbook volatility squeeze, often a precursor to explosive directional moves. Volume compression inside the triangle suggests strong hands accumulating.

Candlestick structure: Bullish engulfing-type recovery candle forming off the trendline support. Breakout Energy above 586 = potential energy. A monthly close👀 above the downtrend line may unlock significant upside ⇗ momentum.

Daily MACD turning positive, weekly and monthly crossovers 🟢suggest building momentum.

Monthly Resistance line 762🔴 Pivot line 🔵611 Support🟢512

₹575–586 is the breakout threshold. Above the pivot and away ⇗

Post-break, next projection target : ₹900 (≈+60%), followed by ₹1,300. (Text Book)

📊 Fundamental Alignment

🔋 EV Battery Anode Narrative: Global lithium/graphite demand surging → Graphite India well-positioned as key electrode supplier.

🌍 China Supply Risks = India graphite players gain global relevance.

💼 FIIs Inflow: Recent uptick (+1.7%) hints at sectoral re-rating in anticipation of capex cycles and commodity upturn.

📉 Valuation Context: After steep de-rating post-2018, current price offers favorable risk-reward compared to earnings expectations and sector re-alignment.

► Graphite electrodes are the main heating element used in an electric arc furnace

extremely high levels of heat generated in EAF.

Graphite electrodes are divided into 4 Types: RP Graphite electrodes, HP Graphite electrodes, SHP Graphite electrodes, UHP Graphite electrodes.

► Needle coke👀 is a key ingredient in the production of graphite electrodes for electric arc furnaces (EAFs) in the steel industry.

🧰 Strategic Outlook

►we'll follow this trade closely and within incoming week we'll up a close up view of 4h TF

Bias: Strongly Bullish on breakout; Neutral if it stalls below ₹550.

Targets: ₹900 (swing), ₹1,300 (positional)

ideal for swing/long-term portfolio adds

Alternate Case: Breakdown below🔻₹480 negates pattern; re-evaluate around ₹400 for demand re-entry.

Always DYOR

See you on the other side

💡 Reflective Close:

“What if true breakouts don’t come from hype — but from time, patience, and the quiet work of smart money preparing long before headlines catch up? Are you watching the price, or are you watching the behavior behind the price?”

Commoditycycle

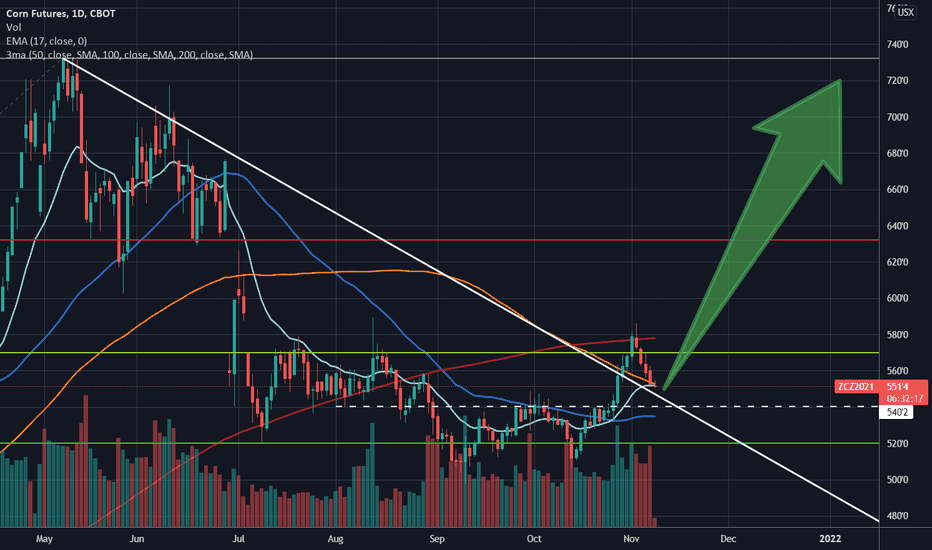

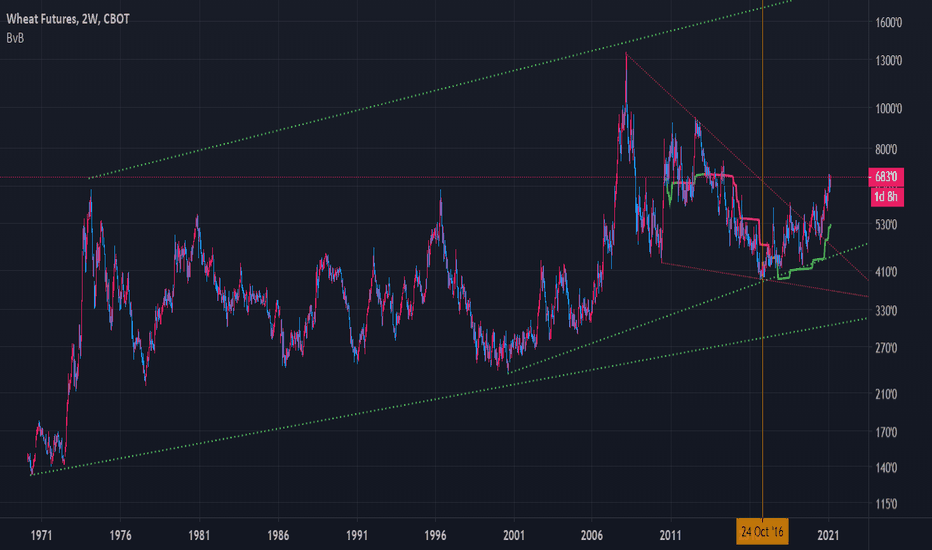

Are You Positioned for Quad 2? I hope you're readyWe're already in the midst of record runs in the equity and commodity markets but as bubbly as it seems, its not over.

We are in an environment that not many people are familiar with. The last time Growth and Inflation on a global scale were accelerating as fast as they are now was immediately after World War 2. Previous commodity cycles were sparked by 1 or 2 catalysts. The current macro setup has nearly the most accommodative and bullish catalysts for global growth and inflation that we could imagine. Fed on autopilot, Fiscal out the wazoo, supply chain disruptions and shortages everywhere, all major political interests want a weaker dollar.

Given that is the case and YoY GDP will probably show about +10% and CPI +3% in the 2nd Quarter, there's a good chance this current run, especially for commodities, could continue for a couple more months before a major correction.

Things I have been and remain bullish on: Potash, Sugar, Wheat, Soybeans, Corn, Cocoa, Coffee, Orange Juice, Copper, Uranium, Crude Oil, Natural Gas.

I've added to my exposure recently Aluminum, Nickel, and Coal.