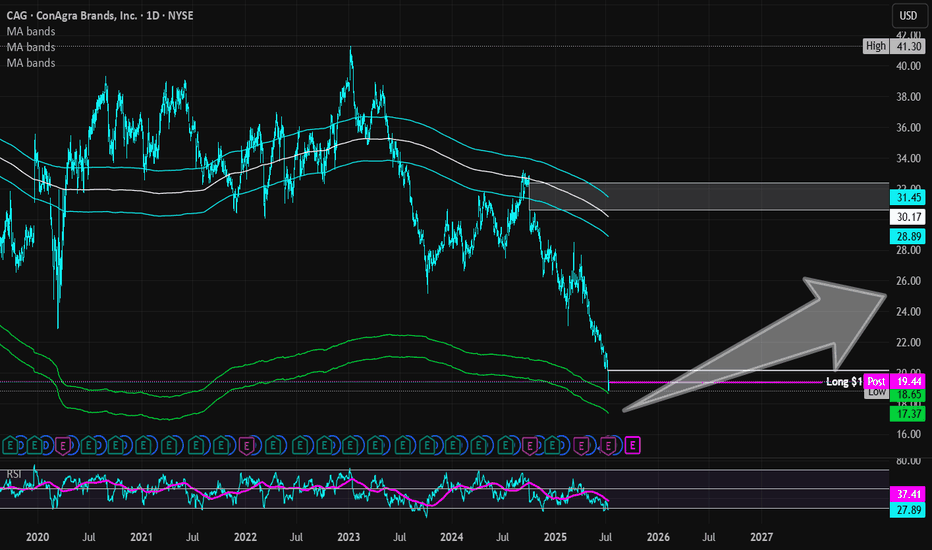

ConAgra Brands | CAG | Long at $19.38ConAgra Brands NYSE:CAG , maker of Marie Callender's, Healthy Choice, Birds Eye, Orville Redenbacher's, Slim Jim, and many more, has seen a continuous drop in share price since the rise of interest rates, inflation, and tariffs. The stock is currently trading near its book value of $18.71 and has a dividend yield of 6.9%. Debt-to-equity is reasonable (0.9x), but the company does have a Quick Ratio of 0.2x (short-term liquidity issues) and a Altman's Z Score (bankruptcy risk) of 1.7, which should ideally be 3+. Like almost every large-scale food company, earnings growth is relatively low, but 2025 is anticipated to be its worst performing year - which explains the price.

While the stock is not likely to generate triple-digit returns in the near-term, NYSE:CAG is a strong company with a nice dividend and some growth ahead. I foresee such stocks getting new life with drops interest rates. However, a dip near $17 (into my "crash" simple moving average area) or even slightly lower is possible - which may likely result in another stock entry.

Thus, at $19.38, NYSE:CAG is in a personal buy-zone with future entries planed near $17 or below.

Targets into 2028

$22.00 (+$13.5%)

$25.00 (+29.0%)

Conagrabrands

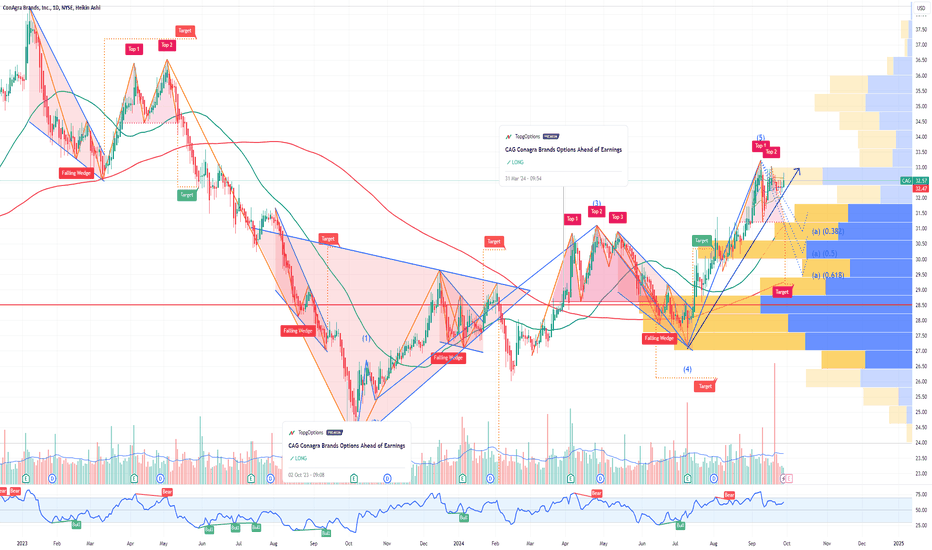

CAG Conagra Brands Options Ahead of EarningsIf you haven`t bought the dip on CAG:

Now analyzing the options chain and the chart patterns of CAG Conagra Brands prior to the earnings report this week,

I would consider purchasing the 32usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

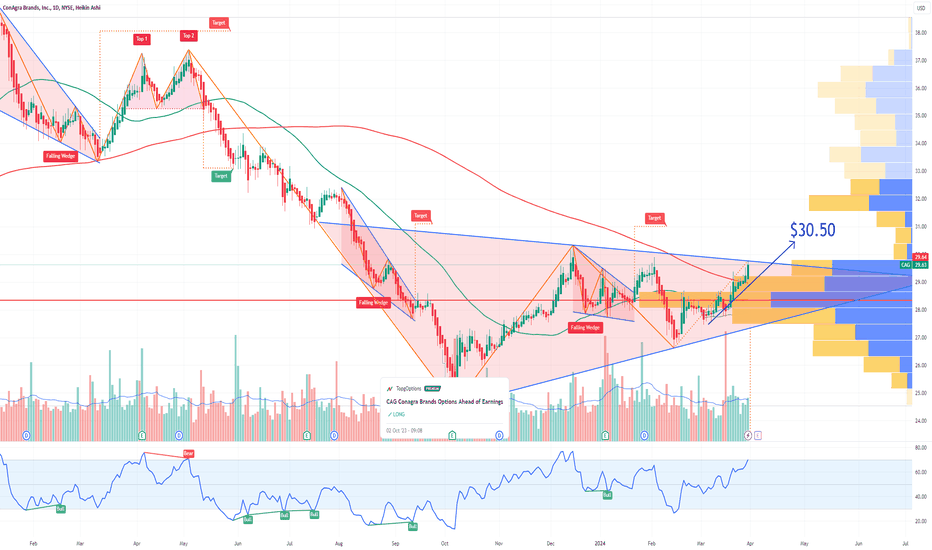

CAG Conagra Brands Options Ahead of EarningsIf you haven`t bought CAG before the previous earnings:

Then analyzing the options chain and the chart patterns of CAG Conagra Brands prior to the earnings report this week,

I would consider purchasing the 30.50usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

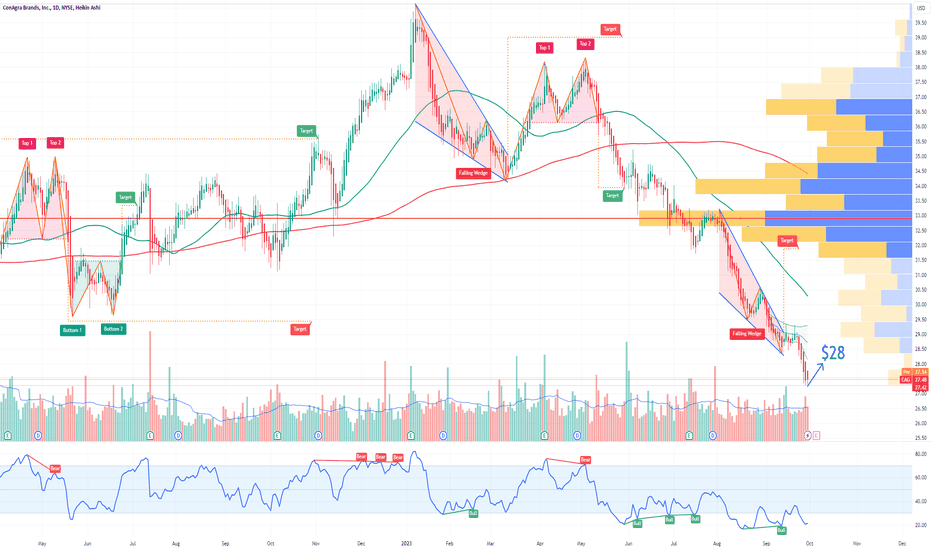

CAG Conagra Brands Options Ahead of EarningsIf you haven`t bought CAG here:

tradingview.sweetlogin.com

Then analyzing the options chain and the chart patterns of CAG Conagra Brands prior to the earnings report this week,

I would consider purchasing the 28usd strike price Calls with

an expiration date of 2024-3-15,

for a premium of approximately $1.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

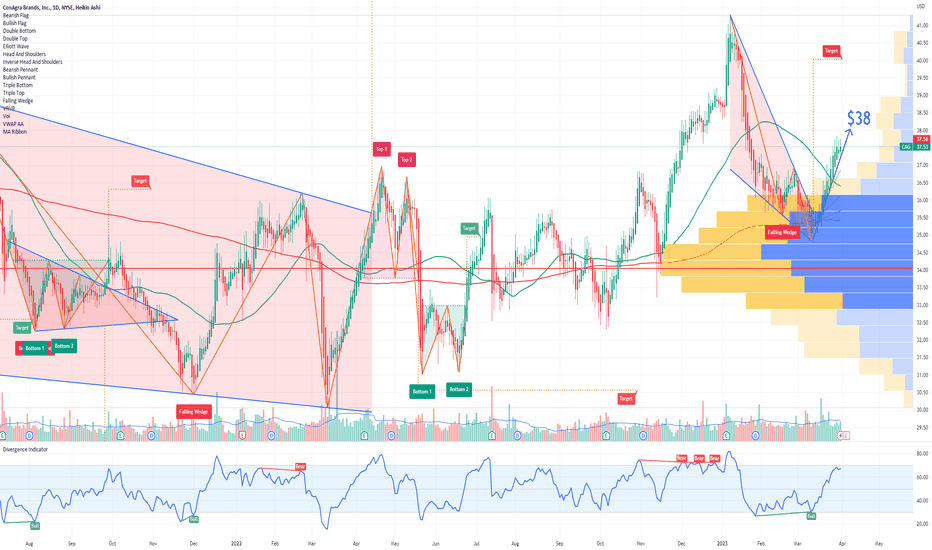

CAG Conagra Brands Options Ahead Of EarningsLooking at the CAG Conagra Brands options chain ahead of earnings , i would buy the $38 strike price Calls with

2023-4-14 expiration date for about

$0.57 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.