Confluence

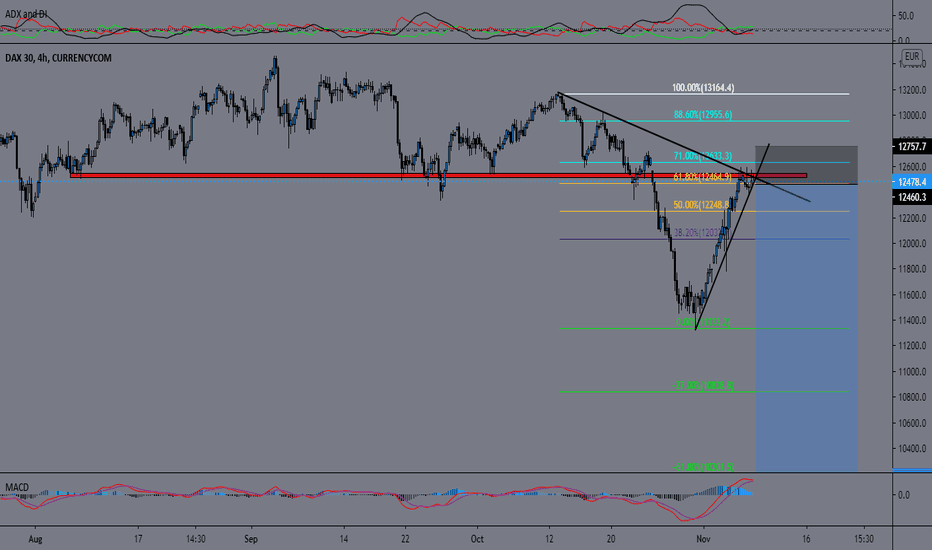

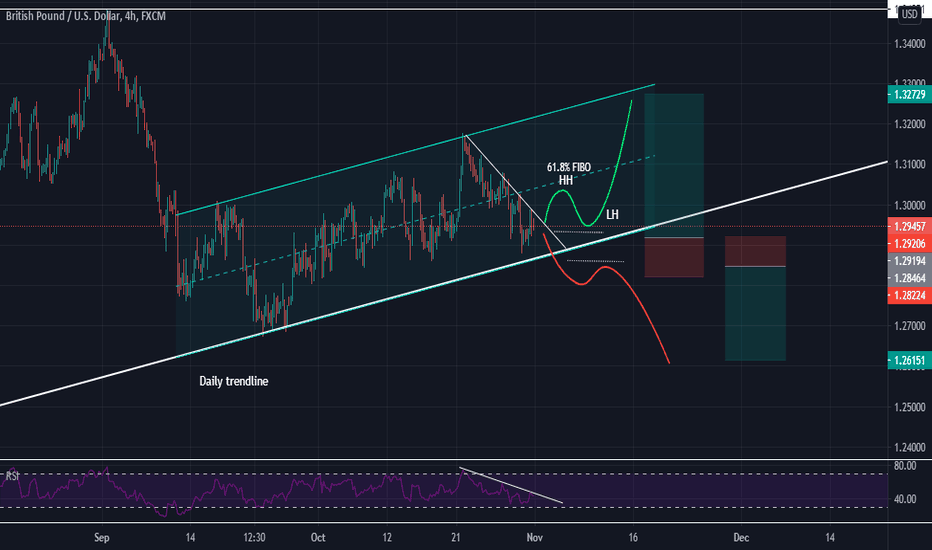

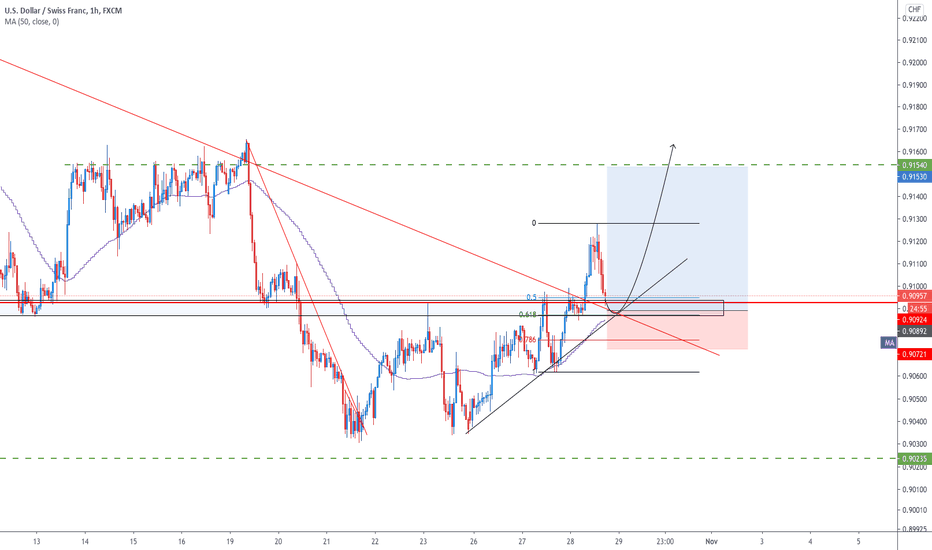

DAX with major confluenceThe market is currently at a strong area of resistance which closed with a shooting start candlestick formation and has tested the area multiple times in the past 24 hours which is a good indication that the market could possibly turn around. The MACD shows along with the ADX and DI show that the bullish trend has weakened coupled with it being on a 61.8% Fibonacci retracement level. These three tools create confluence, a good entry would be a break of the trend line and a retest of the 61,8 fib.

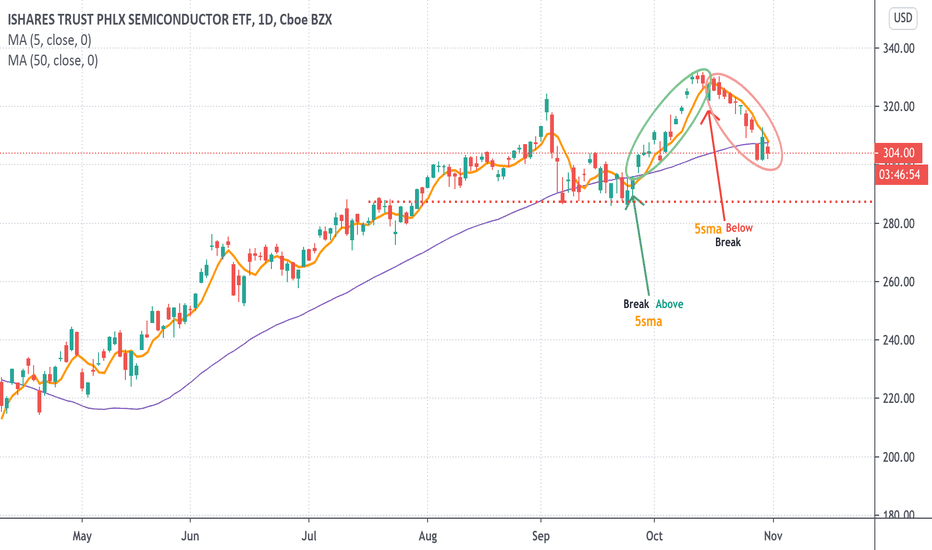

SOXX 5smaNotice how the 5sma has been resistance for the SOXX for the past 12 trading days (red oval).

This tells us that short-term, SOXX has to break the 5sma to get out of its current down-trend.

The purple line is the 50sma, which is now also resistance, as we crossed below it, and is now touching the 5sma.

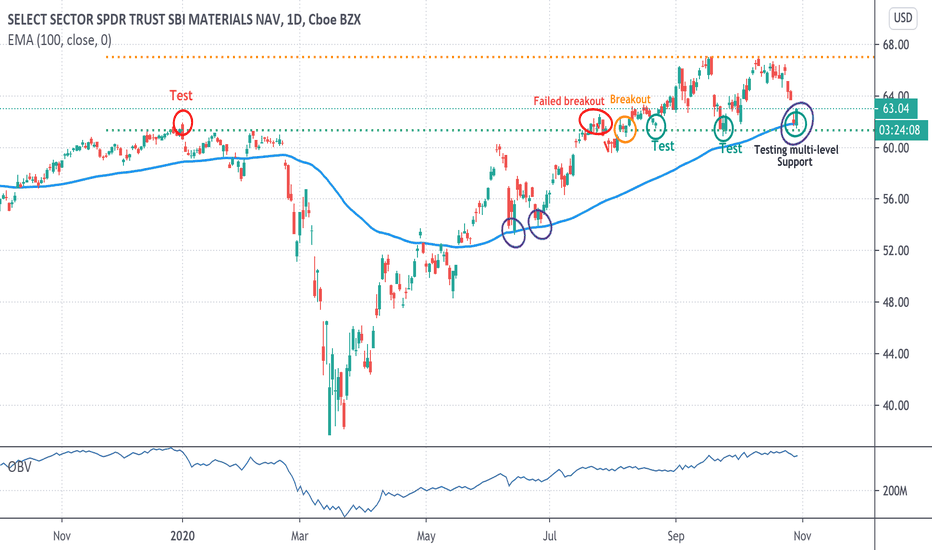

Materials at multi-level supportMaterials sector has been showing relative strength. It is actually 3th in YTD performance, after 1. Technology, 2. Discretionary (Mega-cap lead sectors)

Today it is resting on the 100ema, which has been supportive since march 23rd crash.

This level is also coinciding with early 2020's high, as well as 4 other tests of the support; including a failed breakout, which worked the next time it tried.

OBV has been supportive of the uptrend. (BULL)

RSI showing slight divergence as the last bottom late September has a slightly higher RSI(10) than the current one. (BEAR)

A strong close below $60 would deny the support, and make the chart a short-term bearish one.

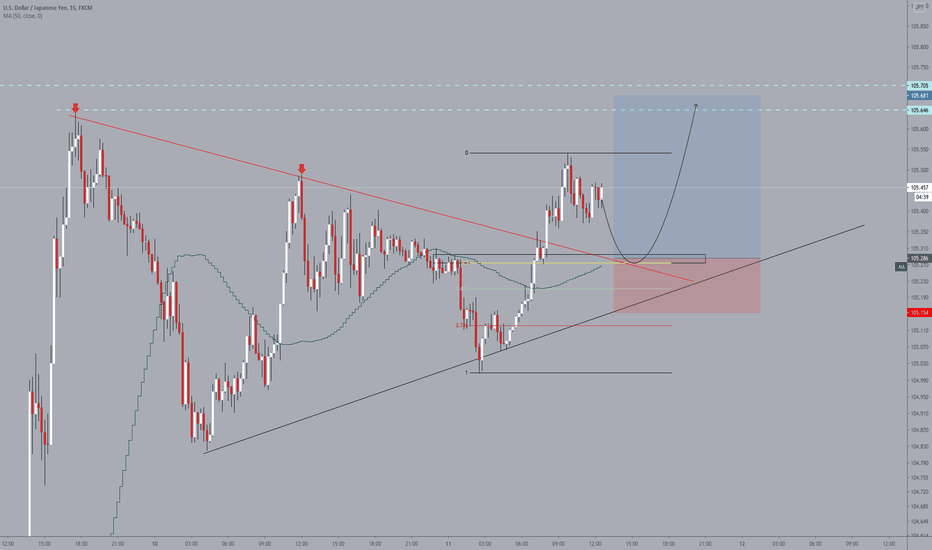

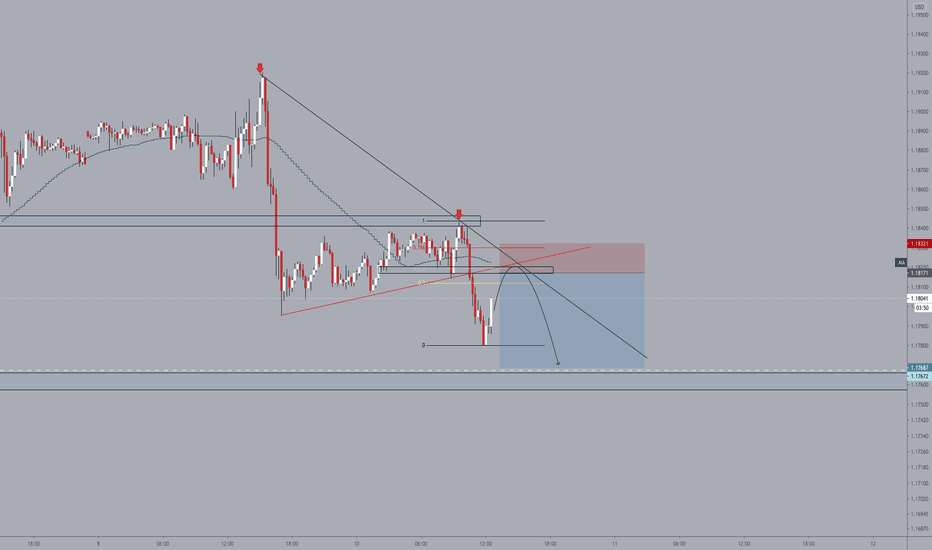

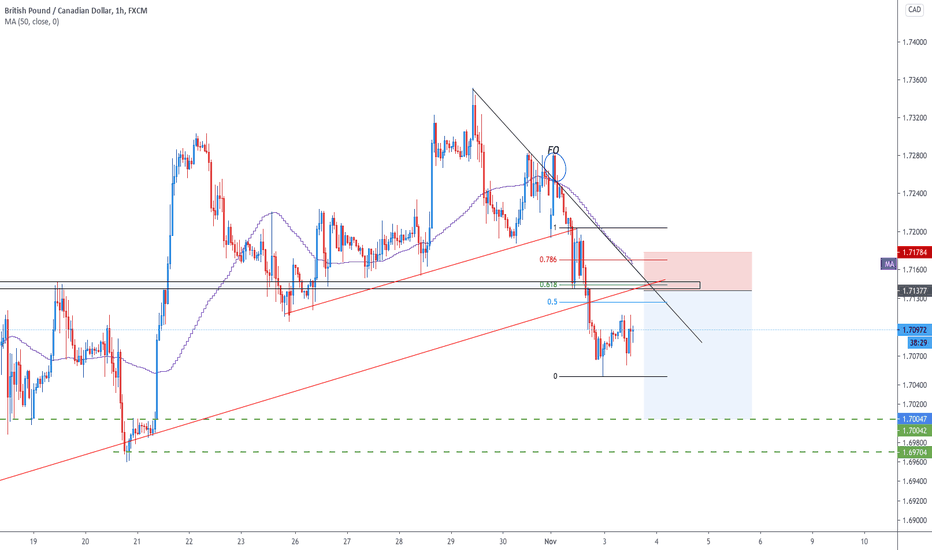

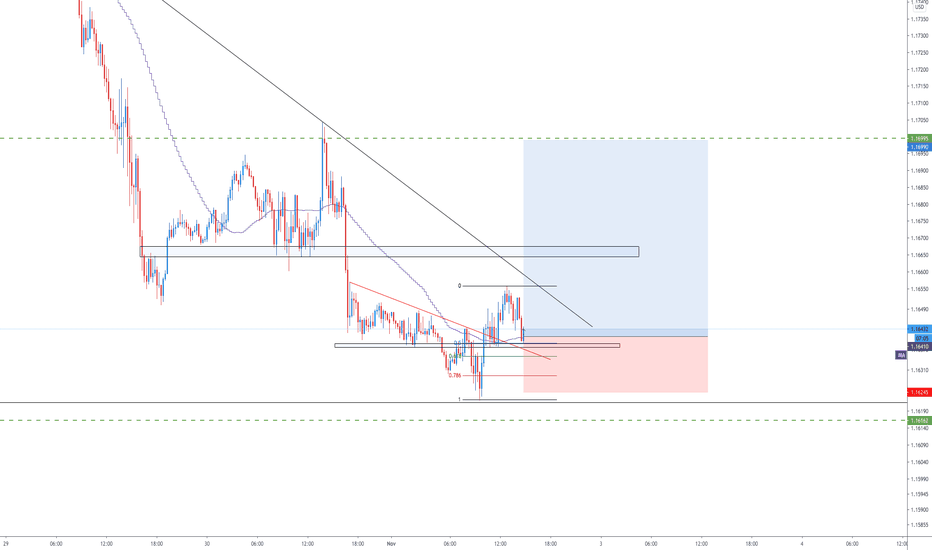

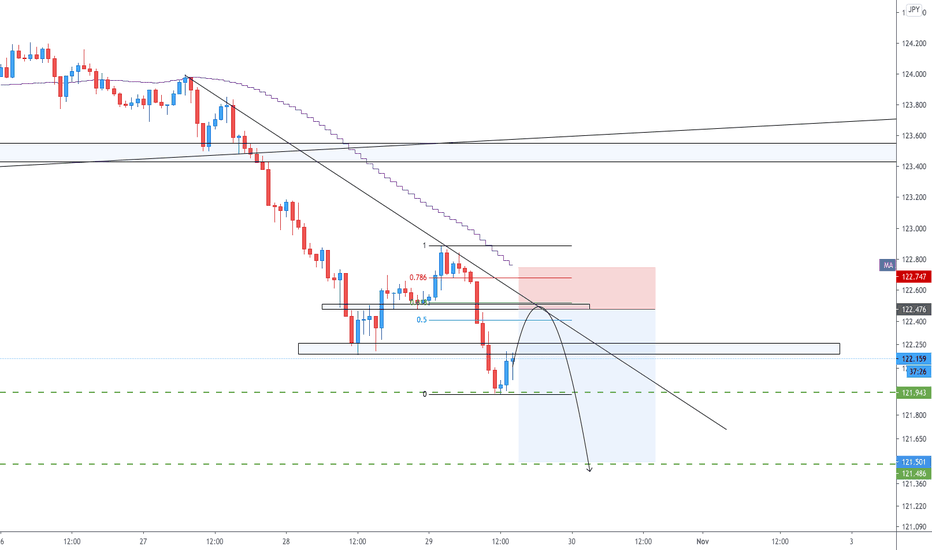

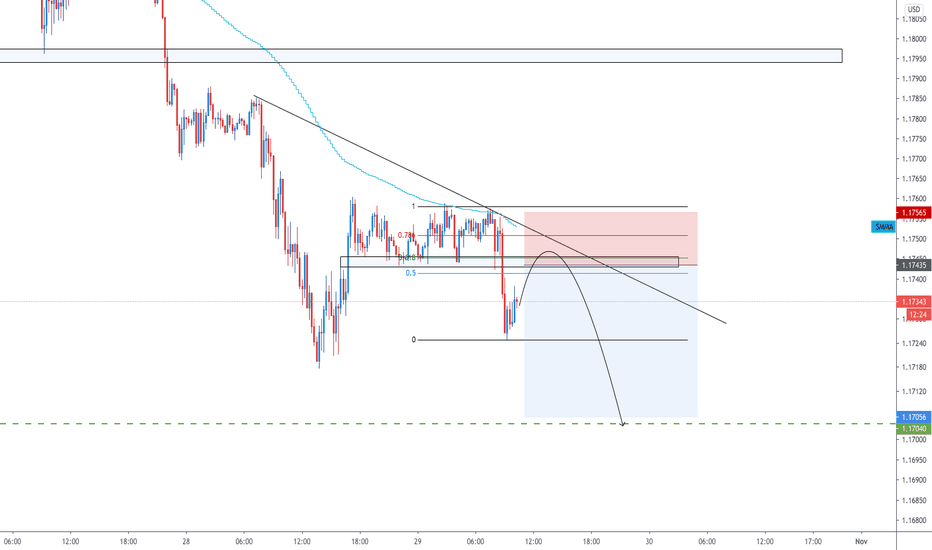

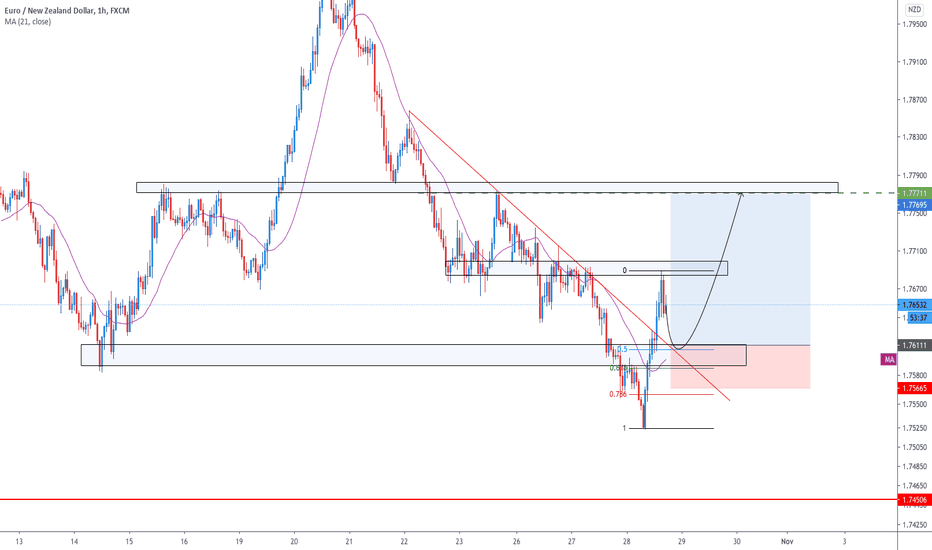

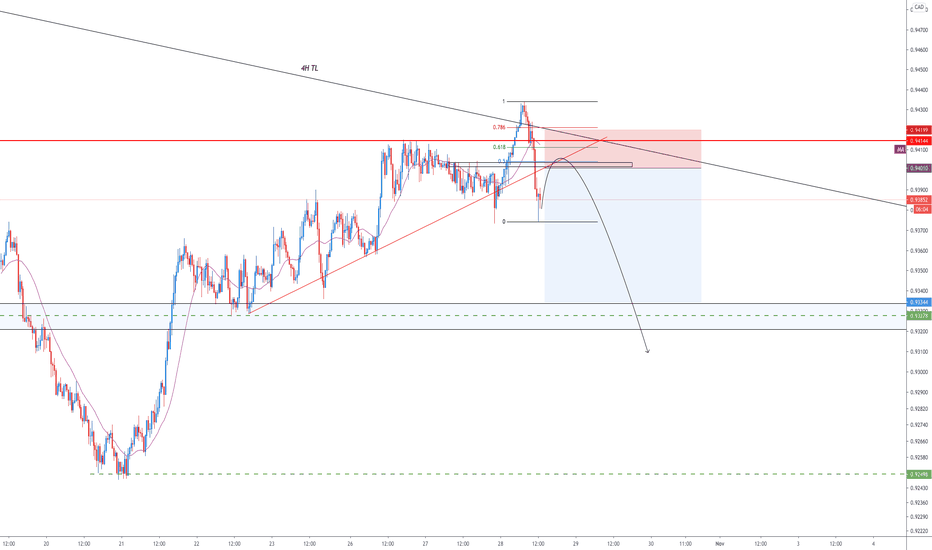

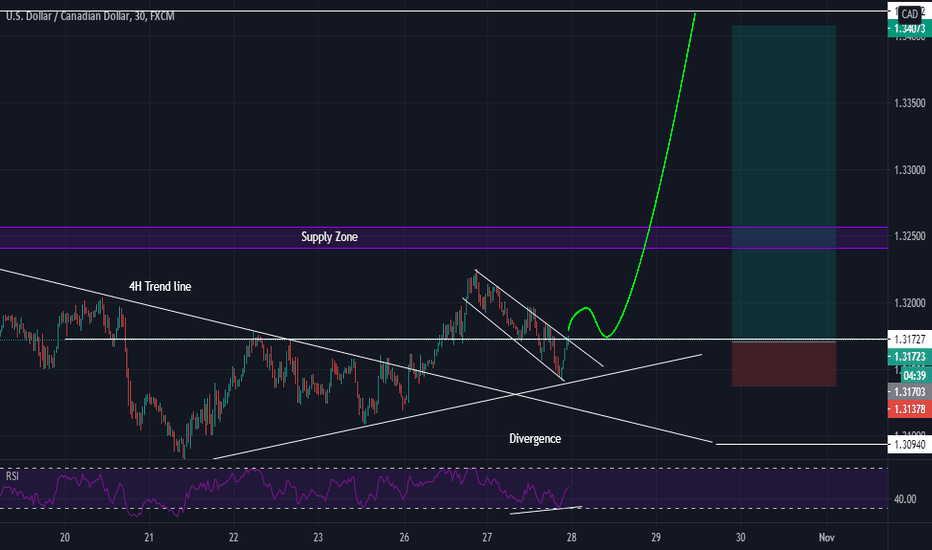

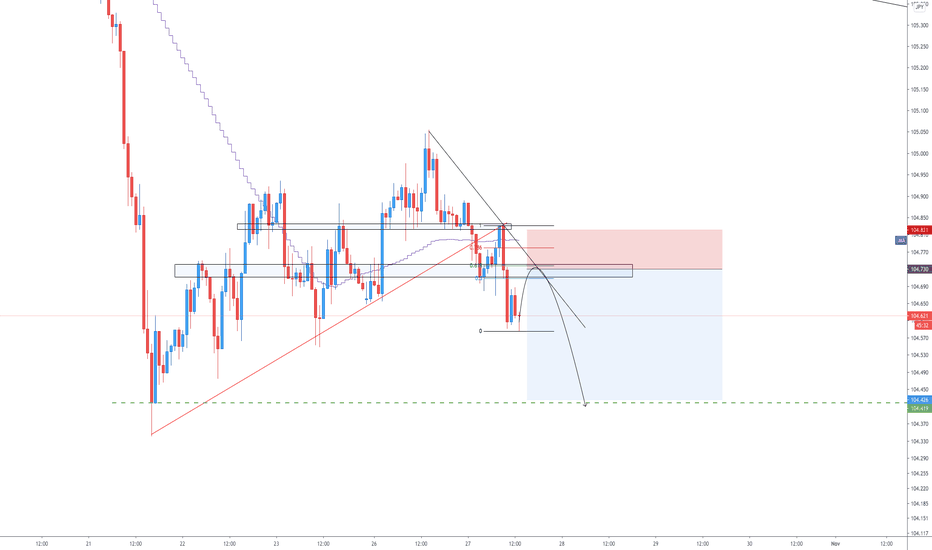

Short on Pullback & Fundamental Update on JPYTechnicals:

-Respectable descending TL, pullback for a retest expected

-0.618 fib retracement

-Previous support now acting as resistance

-MA50 supporting the bearish trend very well with further downside expectancy

Fundamentals:

Investors started moving their money into "safe haven" currencies (such as the USD & JPY) due to the upcoming election, the fiscal stimulus talks, and the recent European lockdowns. With so much uncertainty across the board, the safest option we have is to continue shorting currency pairs trading against USD & JPY, hence one of the reasons for shorting EURJPY.