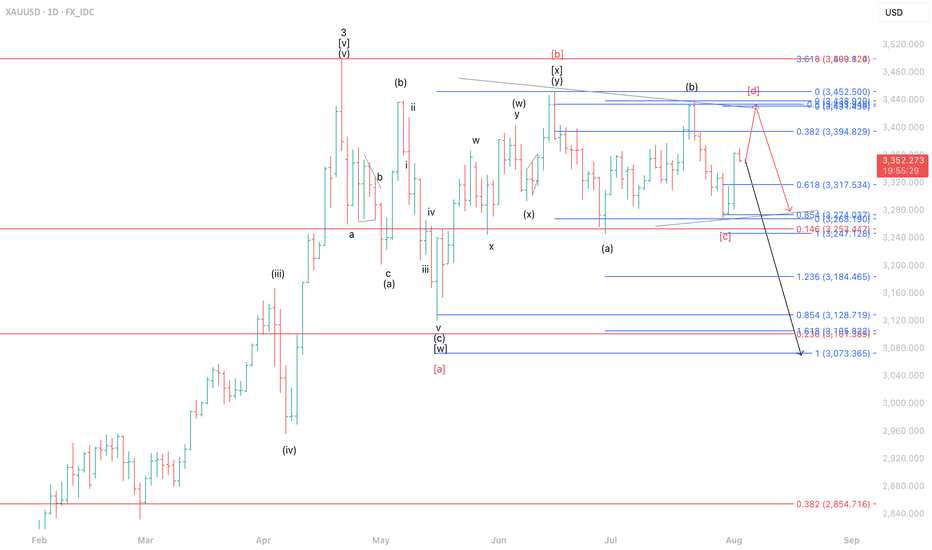

Potential Reversal After Complex CorrectionThe current movement of gold (XAUUSD) is estimated to be forming part of wave ii of wave (c) of wave under the black label scenario. This implies that XAUUSD has the potential to undergo a deeper correction, targeting the 3,073–3,184 range.

However, under the alternative red label, the price action appears to be developing a triangle pattern as part of wave of wave 4. In this scenario, XAUUSD still holds the potential for further upside toward the 3,394–3,438 area, which also coincides with a Fibonacci cluster zone, serving as a critical resistance region.

Consolidationzone

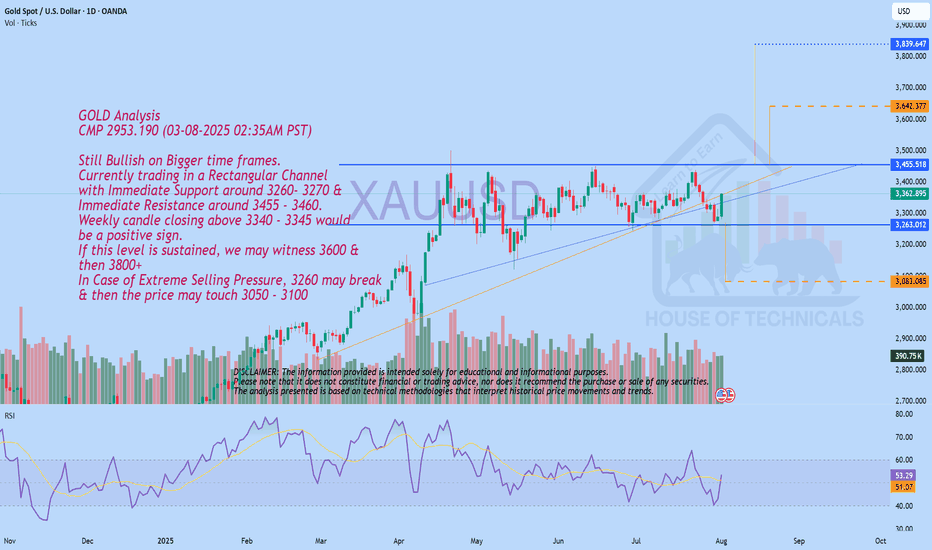

Currently trading in a Rectangular ChannelGOLD Analysis

CMP 2953.190 (03-08-2025 02:35AM PST)

Still Bullish on Bigger time frames.

Currently trading in a Rectangular Channel

with Immediate Support around 3260- 3270 &

Immediate Resistance around 3455 - 3460.

Weekly candle closing above 3340 - 3345 would

be a positive sign.

If this level is sustained, we may witness 3600 &

then 3800+

In Case of Extreme Selling Pressure, 3260 may break

& then the price may touch 3050 - 3100

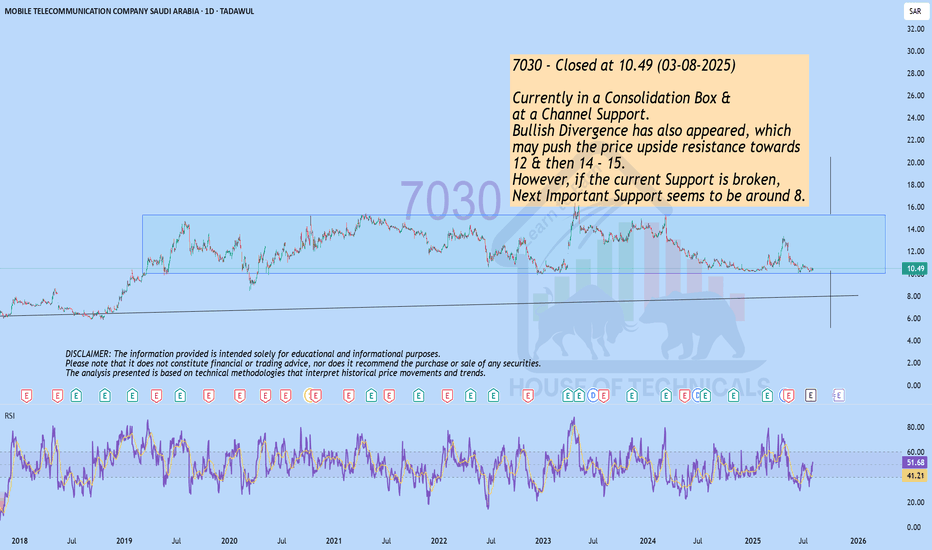

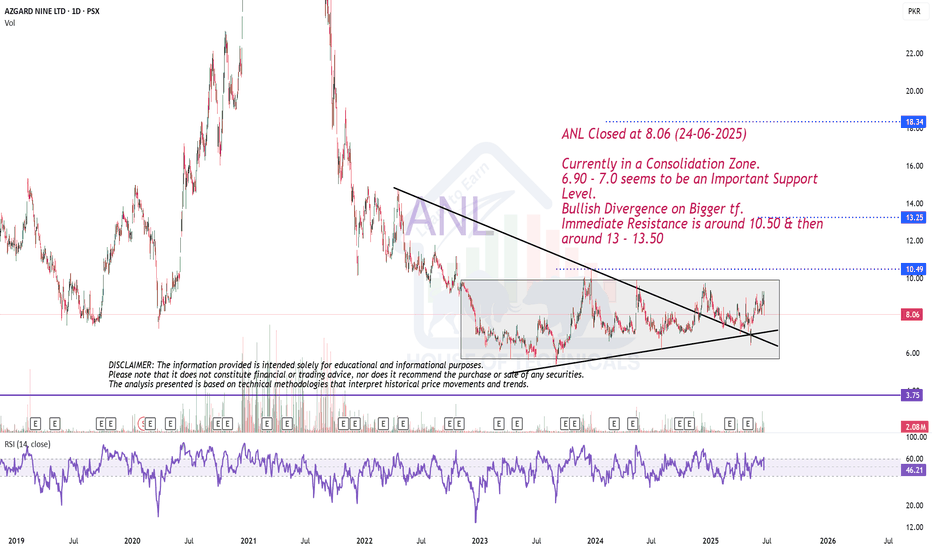

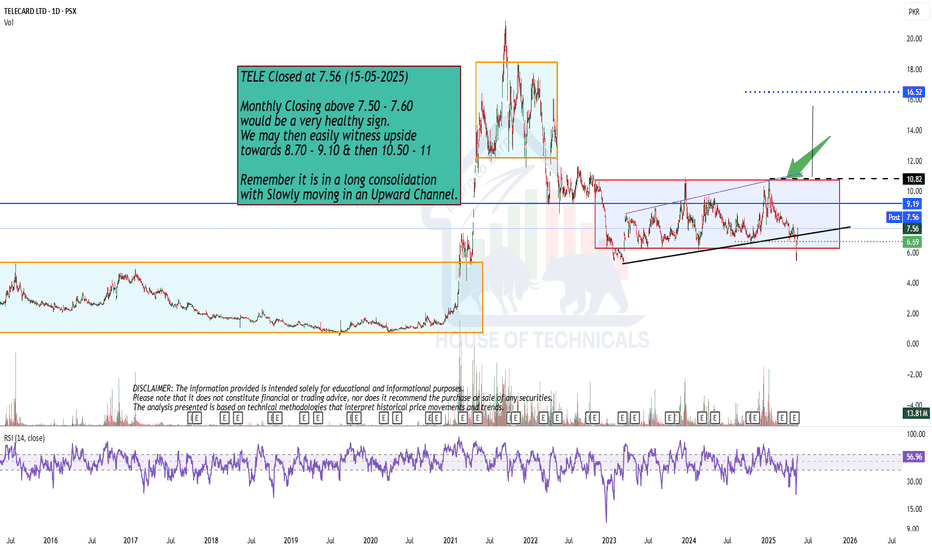

Currently in a Consolidation Box &..7030 - Closed at 10.49 (03-08-2025)

Currently in a Consolidation Box &

at a Channel Support.

Bullish Divergence has also appeared, which

may push the price upside resistance towards

12 & then 14 - 15.

However, if the current Support is broken,

Next Important Support seems to be around 8.

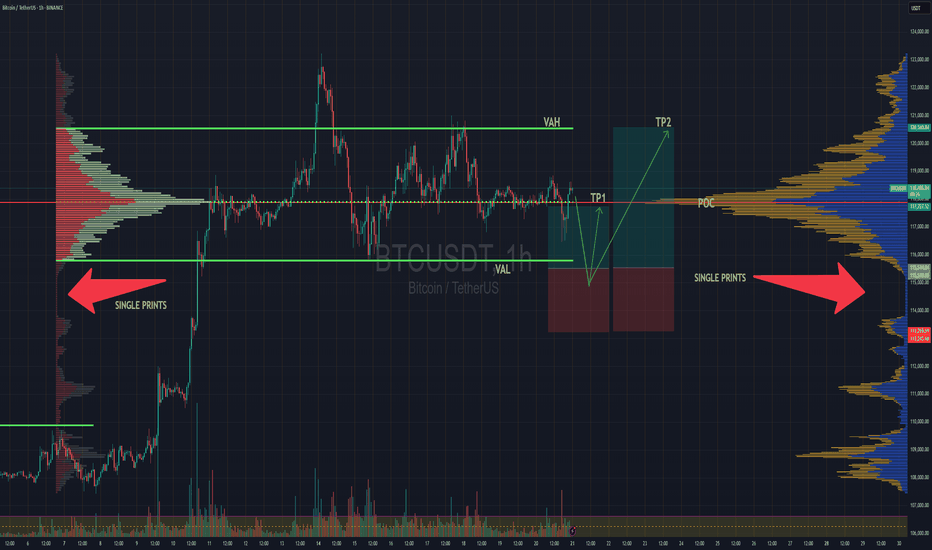

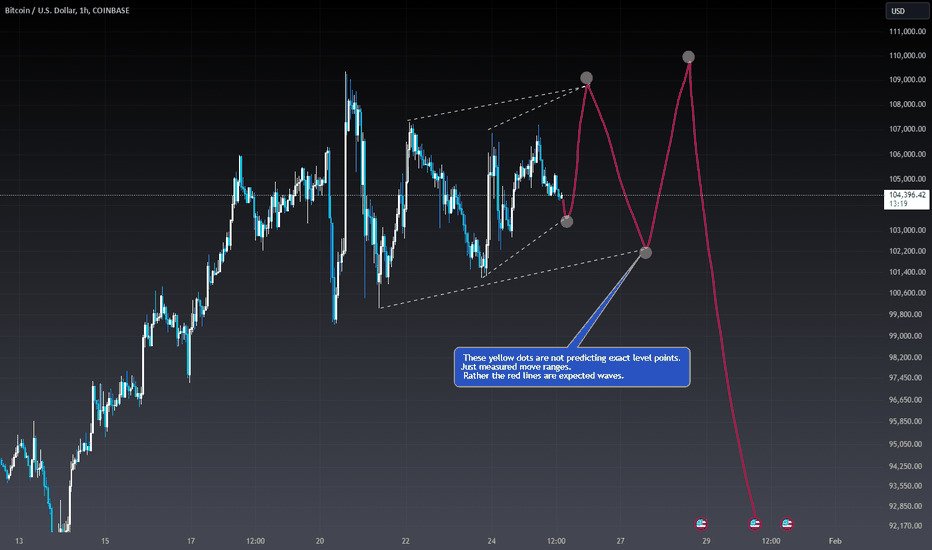

BTC Balanced Volume Profile BTC is now trading in a textbook D-Shape Volume Profile. In english - Buyers & Sellers are happy to transact here and will stay inside the value area & consolidating sideways until further notice.

Consolidation at POC is a signature of this profile, and one of the easiest and least stressful trade setups because now, your mission, should you chose to accept. Is to fade the Highs (VAH) and Lows (VAL) and avoid the middle unless you love donating money to the market.

I'll have buy limit orders waiting right below the VAL where we have the single prints. It doesn't get any easier than this.

Doesn't mean price cant rip through, but this is always the best entry with less risk, especially when the single prints have not been tested yet..

BINANCE:BTCUSD CME:MBT1!

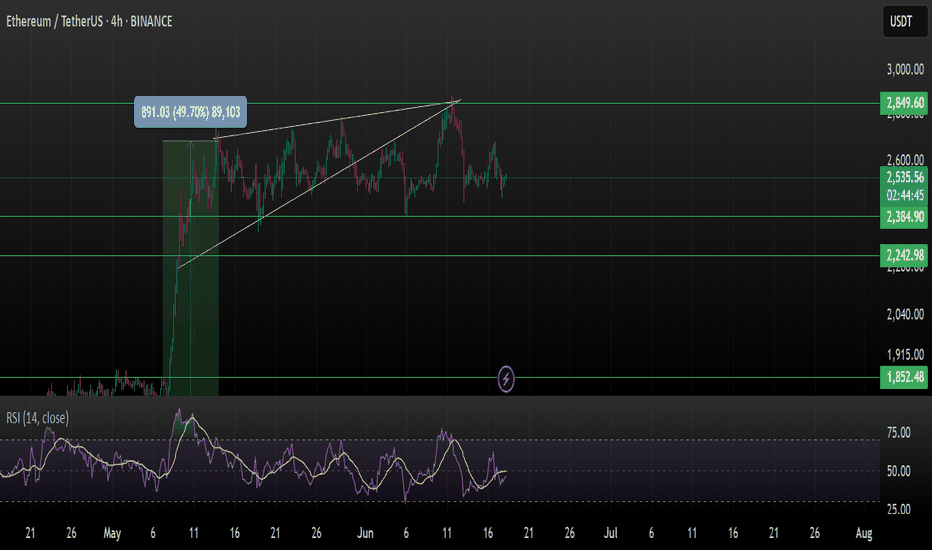

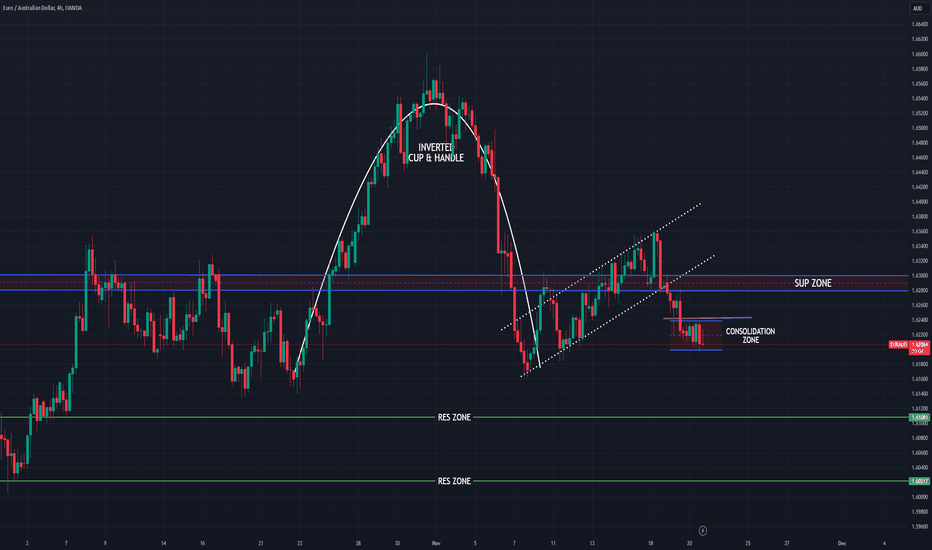

Ethereum (ETH/USDT) – Breakdown From Ascending TriangleEthereum failed to hold above the crucial resistance of $2,849 and has broken down from the ascending triangle on the 4H timeframe — invalidating the bullish breakout structure.

It seems to be consolidating and moving sideways in the range. The move is possible only if we break the channel either upside or downside.

Key Observations:

Ascending triangle fakeout followed by sharp rejection

RSI dropped from overbought (~70) to neutral zone (~46), showing weakening momentum

Current price: $2,537, testing local support at $2,384.90

Next major support zones: $2,242.98 and $1,852.48

Watch for further weakness below $2,384 — could accelerate downside toward $2,242 or lower.

Caution advised: Wait for the structure to rebuild before positioning it long.

This is not financial advice, please do your research before investing, as we are not responsible for any of your losses or profits.

Please like, share, and comment on this idea if you liked it.

#ETH #Ethereum #ETHUSDT

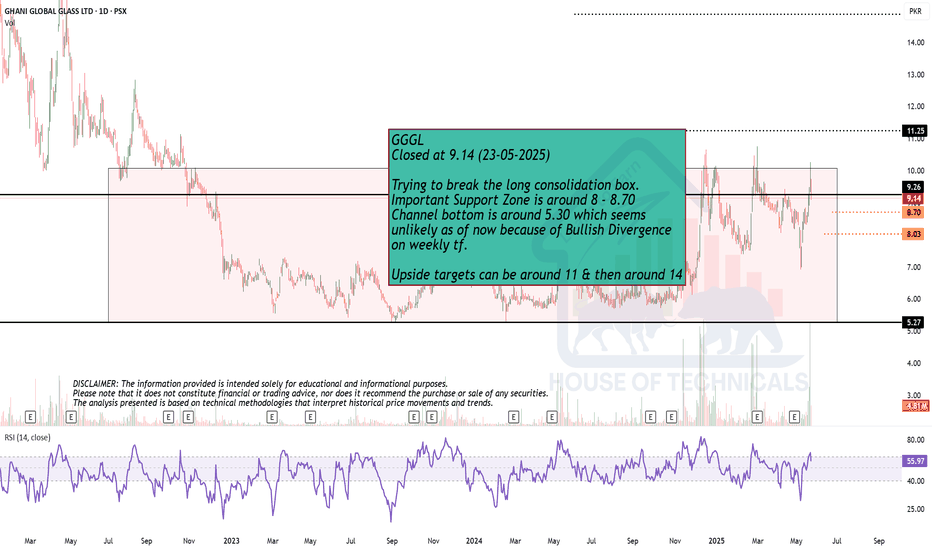

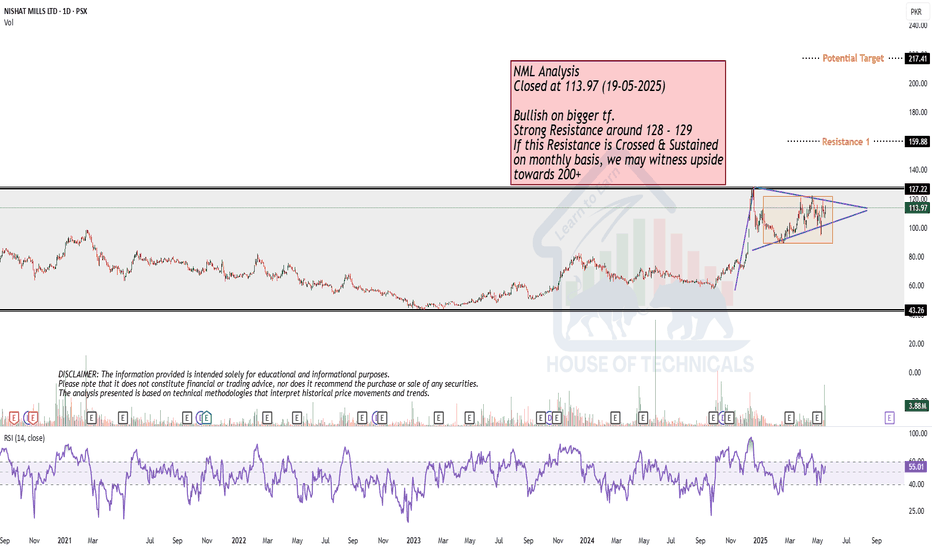

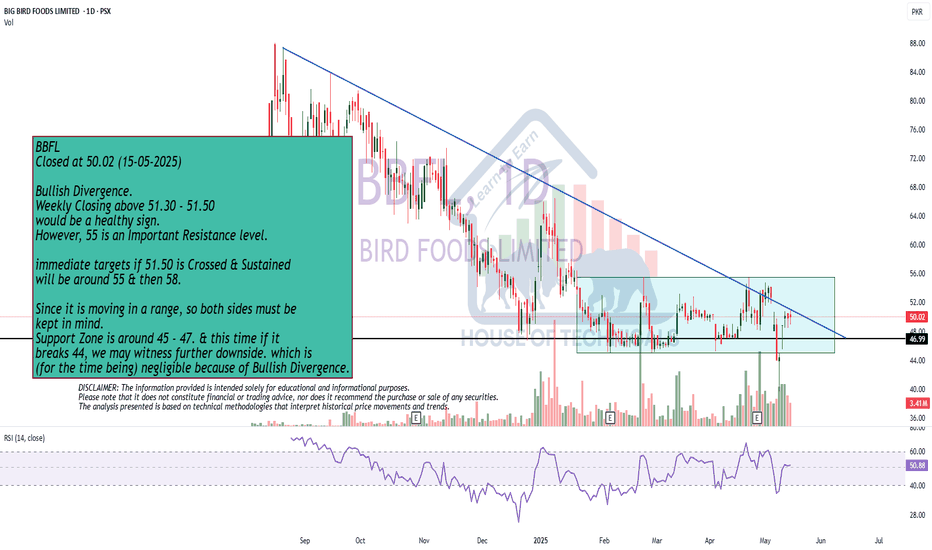

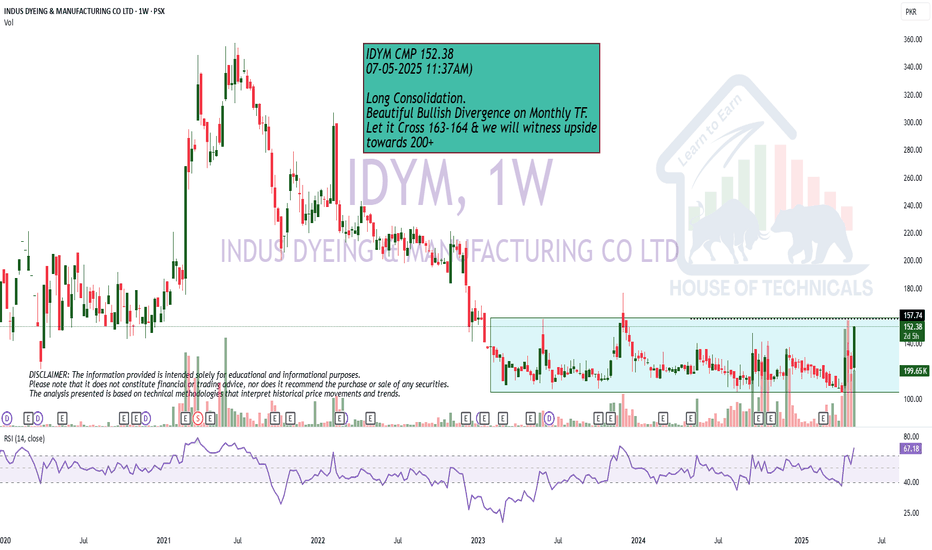

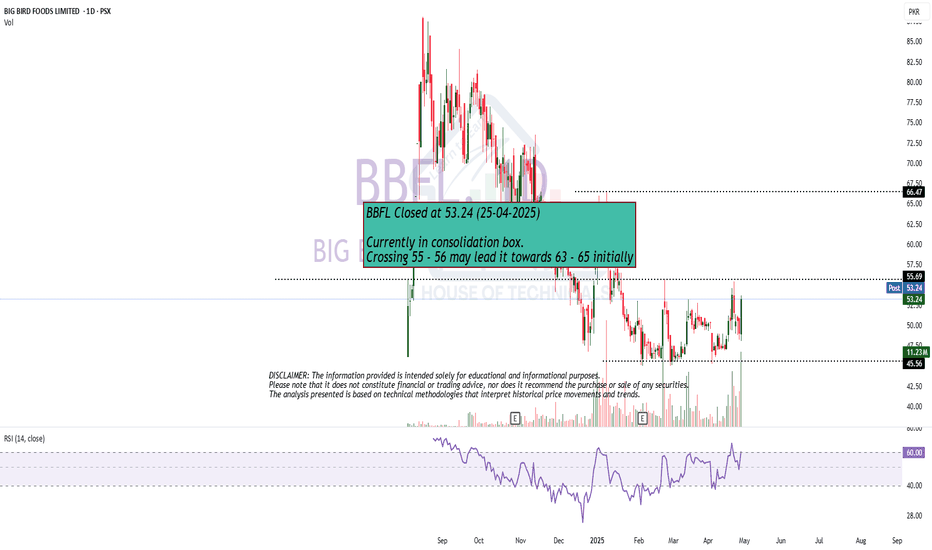

Bullish Divergence.

Bullish Divergence.

Weekly Closing above 51.30 - 51.50

would be a healthy sign.

However, 55 is an Important Resistance level.

immediate targets if 51.50 is Crossed & Sustained

will be around 55 & then 58.

Since it is moving in a range, so both sides must be

kept in mind.

Support Zone is around 45 - 47. & this time if it

breaks 44, we may witness further downside. which is

(for the time being) negligible because of Bullish Divergence.

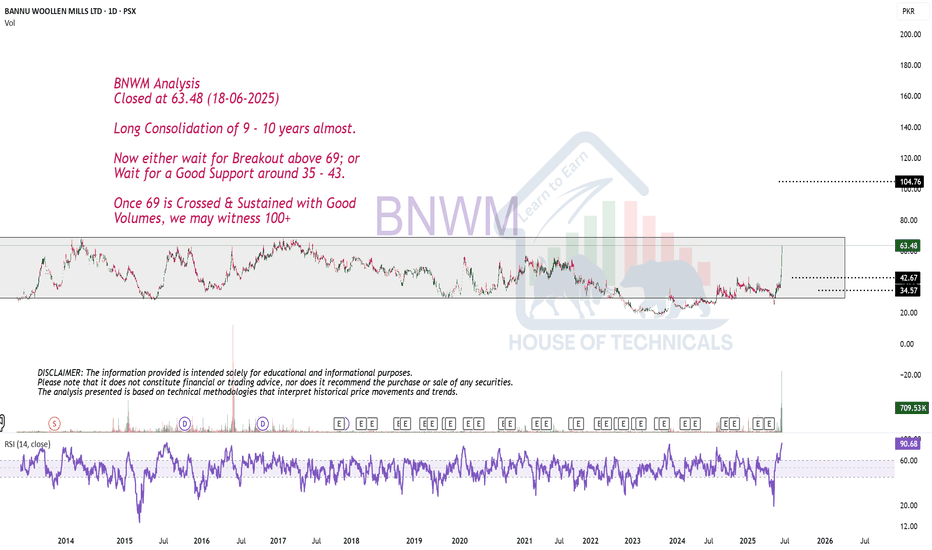

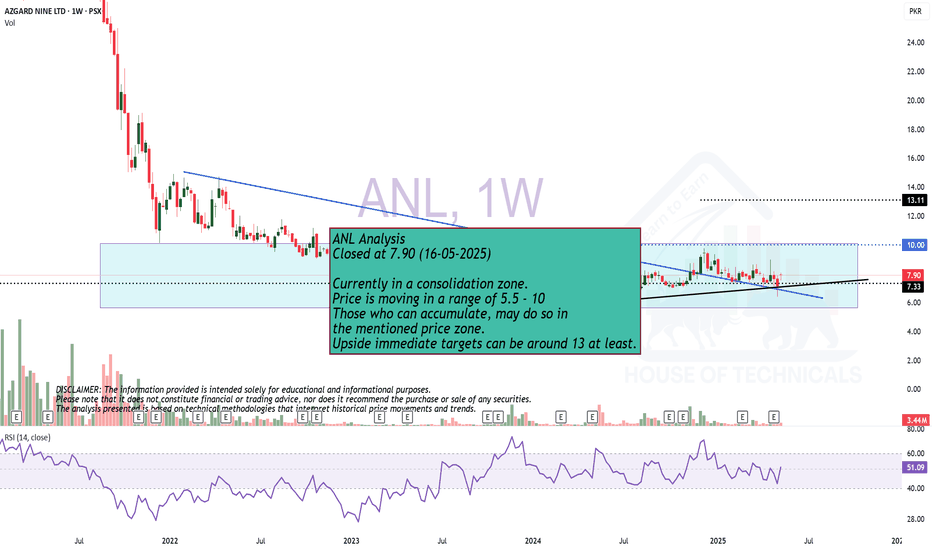

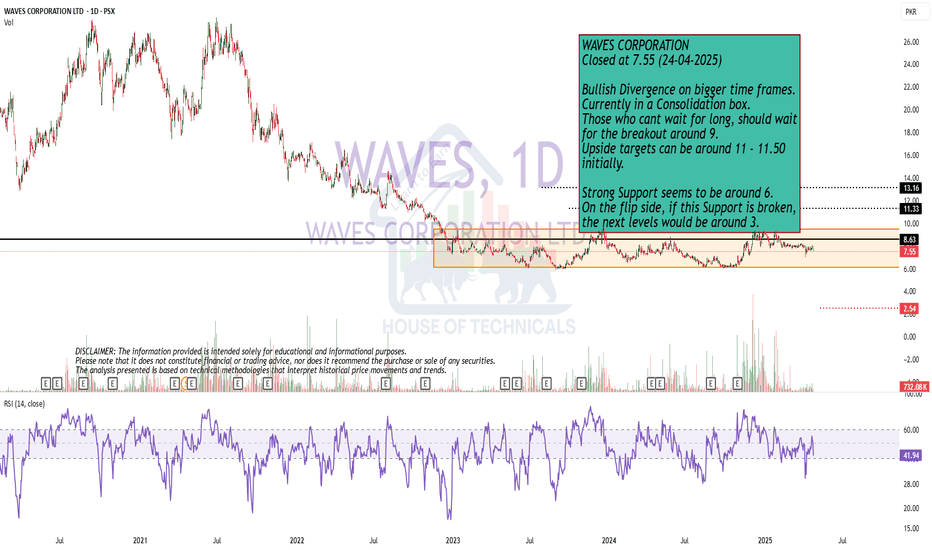

Bullish Divergence on bigger time frames.

Bullish Divergence on bigger time frames.

Currently in a Consolidation box.

Those who cant wait for long, should wait

for the breakout around 9.

Upside targets can be around 11 - 11.50

initially.

Strong Support seems to be around 6.

On the flip side, if this Support is broken,

the next levels would be around 3.

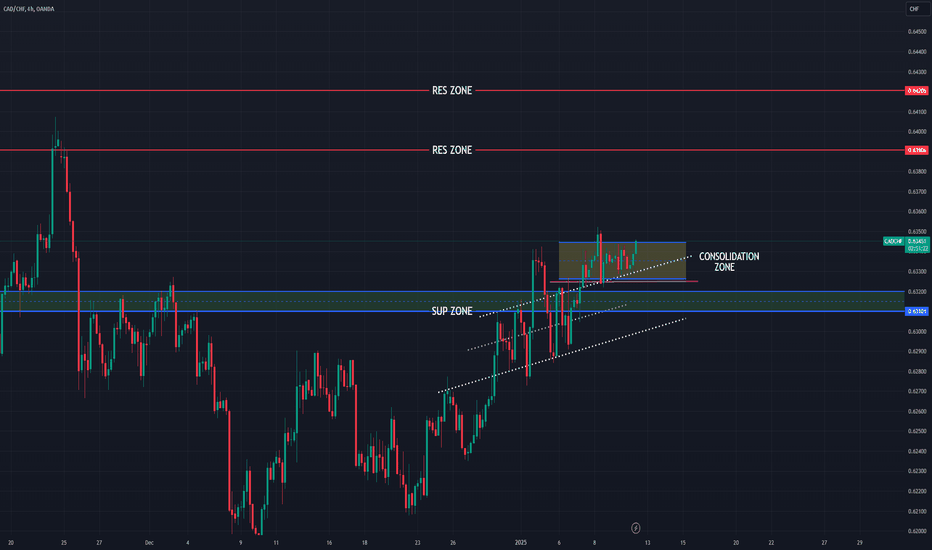

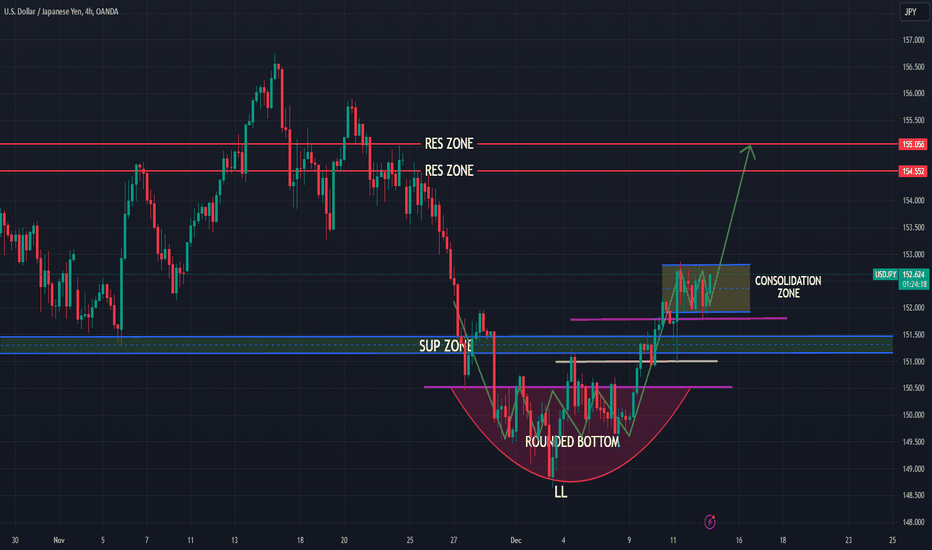

USDJPY new bullish for expect

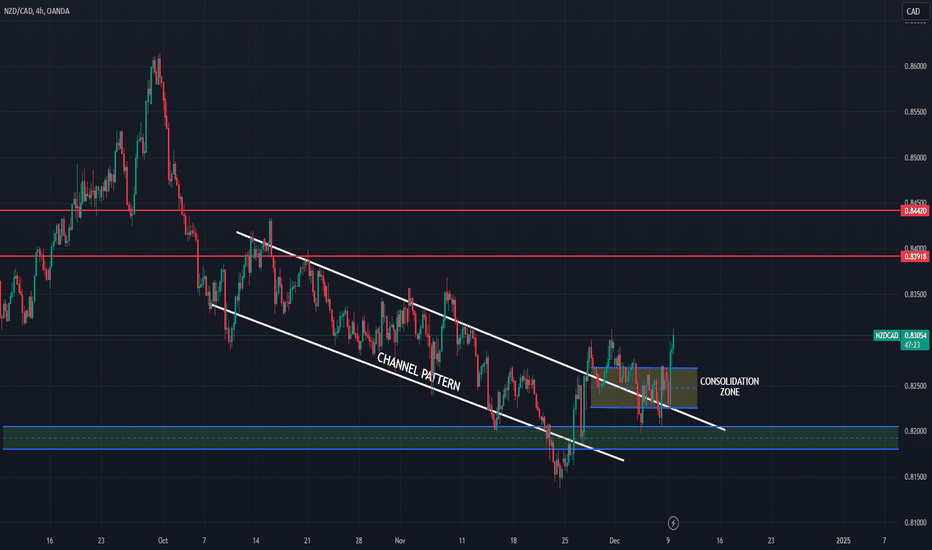

FX:USDJPY trend based analysis, we having in period from 1.12 - 9.12 ROUNDED BOTTOM pattern visible, price is make break of same and confirmation of same (yellow line) and its make short bullish push, currently price in consolidation, its on strong ex. zone 151.800 (violet line).

What here expecting after todays and past events in this week, still looks like we will have strong USD and here exepcting to see new bullish push.

SUP zone:151.450

RES zone:154.550, 155.050