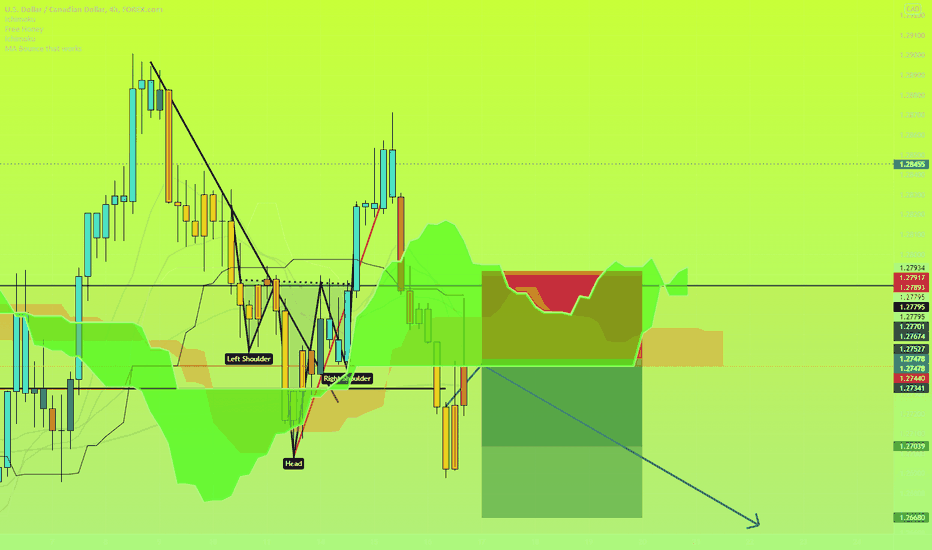

USDCAD - Demand ZoneBesides waiting for the Bullish Deep Gartley setup, there's another way to engage the USDCAD chart. If you are into this consolidation or sideways movement, you could wait for a trading setup on the lower timeframe, preferably the 1-hourly chart for this setup.

You can wait for a minimum setup of Double Top setup with RSI Divergence, in that case, you can have a tight stop, even if it fails you won't be losing a lot.

Always remember, there isn't any hurry in hopping into a trade.

It's always better to miss a trade than to jump in to one you regret.

Consolidationzone

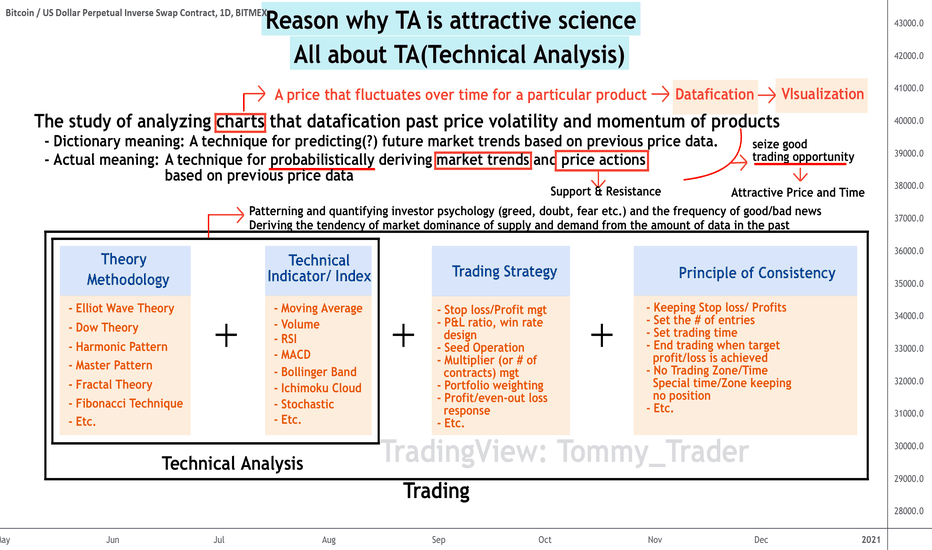

Chart Analysis is not a gambling! Reason why TA is greatHello traders. This is Tommy.

Today, I prepared the most basic and at the same time essential materials that every trader should know. Trading is literally the act of exchanging or trading something with a certain value. If we look at the history, we humans have always traded something within the social community from the Neolithic Age to develop into a better civilization or for individual survival when we have enough food or assets. When the surplus accumulation and self-sufficiency economy due to food production was formed, even before the concept of currency or money, buying and selling (trading) was always with us.

But when we trade, it is not a reasonable thing to do if we lose money when you buy or sell something, right? We humans have always traded at a value or price that is commensurate with supply and demand, within this immutable fence. And we, who are full of greed, have been trading in such a way as to somehow benefit ourselves a little bit more. In a way, I think this is the basic idea of capitalism.

Anyway, our ancestors naturally oriented trades for profit, sometimes seeing losses and sometimes profits through these transactions. And suddenly realized. “Ah, the quantity demanded, and the quantity supplied change over time. Because of this, all objects in this world, even abstract ones, change in value over time. Oh, I can make money if I use this well?”

A culture of profit taking has naturally been formed thanks to those who possess the temperament of smart entrepreneurs. In this way, the economy and financial markets were eventually born, and several market participants came in for the sole purpose of generating profits, that is, for investment purposes. People who have properly understood the market principle of supply and demand have been trading with certain standards to make money with it. Some people can trade by the weather (buy when it's sunny, sell when it's raining), some by rolling the dice (buy when it's high, sell when it's low), and someone just by feeling. Of course, economists studied after realizing that trading on unreliable and absurd standards would eventually destroy them. And realized it. “Ah, let’s find the right standard to set the standard. From what I've seen so far, does it make money by trading based on the information about the product and the value of the product that changes every moment? Let’s dig into it properly!”

And they created a great science. Analysis through information, Fundamental Analysis (FA), analysis through charts, that is, past transaction data, and Technical Analysis (TA: Technical Analysis).

FA is an analysis method that determines whether a product's current intrinsic value is overvalued or undervalued. For example, when we want to invest in a company, that is, if we want to buy shares or stocks in that company, we must first estimate the company's growth potential and potential, right? To do this, you must make a final investment decision by referring to the company's financial indicators, good news/bad news, past asset/revenue growth rates, etc.

On the other hand, TA is a method of making investment decisions by referring to various theories and indicators with meaning in charts that intuitively show past price movements and momentum.

Of course, it would be the best to do both FA and TA, but in these days, retail traders and individual investors, like us, have time/technical limitations to receive information, analyze it, and immediately reflect it in investment. It is not enough that there are various kinds of false information to deceive the traders, and even if it is reliable information, it is highly likely to start at a loss even if it is received a little later than others. It is useful to spot large market trends in the long run, but when this information reaches the public, it is likely that it has already been priced in by institutions (Big Parties). Without huge information power or a computer that can perform FA quickly and accurately, it is difficult to survive in this market with only FA. There is a risk that is too great to carry out an investment with only one FA standard.

Therefore, to make a successful investment decision, you need to find a more precise trading position through TA, and in the end, if you are a skilled investor, you must learn TA.

The dictionary meaning of TA is known as a technique for predicting future market trends by examining a tool called a chart that digitizes the overall price volatility and momentum of a product. I'm someone who doesn't fully agree with this meaning. The term “prediction” itself is a very dangerous word. Even the most talented investors in the world cannot predict future prices unless they are gods. Technical analysis is closer to the realm of response than prediction. For this reason, our traders look at the charts and always have various possible scenarios in mind and come up with appropriate countermeasures accordingly.

With less than 10 years of trading experience, if I dared to define the meaning of the term technical analysis, I would like to say: Personally, all TAs are based on historical data, and through various theories (or methodologies) and technical indicators, first, probabilistically identify the market trend, that is, whether the price is an upward trend or a downward trend, and then determine the price action, that is, support resistance. I think it is an analysis technique that derives the sections with high probability.

Some of you may have questions like this. “No, how do you find a trend and price action interval by looking at only historical data?”

This is the reason I fell in love with market analysis. This study called technical analysis is a technique that statistically patterned and quantified the psychology of investors (greed, doubt, fear, etc.) with a lot of data from the past. Surprisingly, external variables that can affect the market, such as good news/bad news, are also reflected in this probabilistically. There have been many times when I have felt the greatness of technical analysis, and there were many times when good news/bad news came out amazingly at just the right timing in situations where there was no choice but to rise or fall referring to the chart. Of course, there are situations where Big Parties leak news to the media to take advantage of popular psychology, but even the pattern, timing, or frequency of such good news and bad news is reflected in the study of technical analysis.

Anyway, once you have probabilistically derived the market trend and price action section through TA, you need to design a trading strategy according to the situation. There are words that I keep emphasizing like nagging. Just looking at the charts doesn't mean you're good at trading. This trading strategy includes how to structure the portfolio, how to design the profit/loss ratio/range, how much seed to enter, high/low multiplier, and how to set up profit/loss response strategies.

In addition, a well-designed principled strategy is essential to prevent non-thinking trading. This principled strategy is easy to design, but incredibly difficult to follow and implement. No matter how well technical analysis and trading strategies are formulated, these principles are of no use if they are not well designed or adhered to. There are individual differences, but honestly, I don't think there is an answer to the principle strategy other than learning or mastering it through long-term practice or entrusting your own technical analysis/trading strategy to a machine/computer/algorithm. The fewer human emotions are involved, the higher the success rate, but how can you trade without emotions when your money is at stake? It's hard. One tip is to start trading with a small amount that you don't mind losing if you want to learn principle trading well. It doesn't matter if you lose it, so you'll be less empathetic that much, and you'll be able to increase a seed little by little.

We must become traders who always think of risks (losses) before rewards (returns). Please keep this word in mind. For example, in a trading setup that costs 10 million dollars if you make a profit and 10 million dollars if you lose, rather than a mindset like “Oh, I want to win 10 million dollars quickly~”, “I may lose 10 million dollars. You must trade with the mindset of “Let’s be prepared.” This will naturally match the seed to your bowl.

Then I'll wrap up for today.

Until now, this was Tommy of the Tommy Trading Team.

Your subscriptions, likes, and comments are a big help to me.

Thank you.

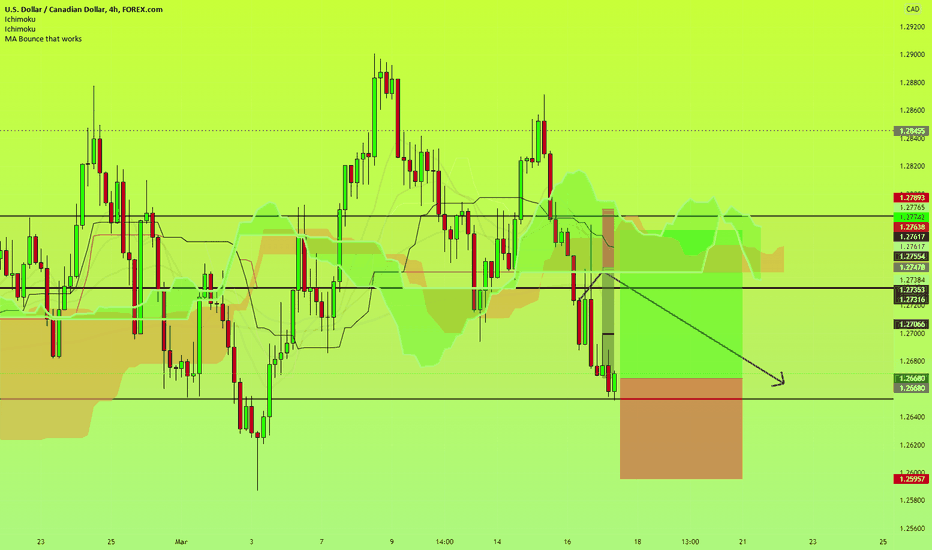

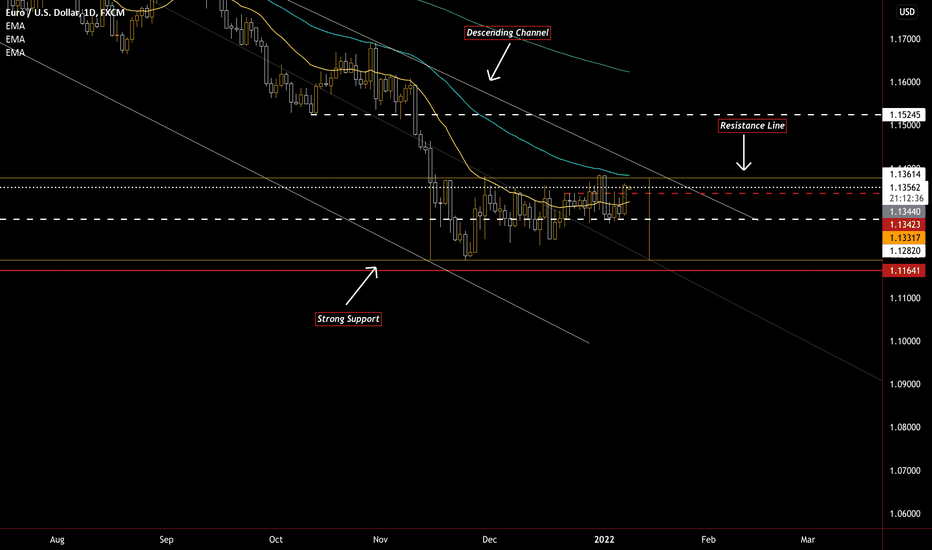

Short the Moving average + ichimoku.When I just opened the chart I saw a rapid decline from the Kijun-Sen and moving averages towards the bottom of the cloud. I expect price to move all the way to previous range low and put stop right above that range where the Kijun-Sen confluences with that line. Once I master this form of charting Ill start educating, my goal right now is to become a profitable trader first and not be a clown guru who does not even make money himself.

USDCAD Long for 600+ pipsUsdCad has been in a bullish considation zone since June 2017... For the past 4 months its been gradually falling but i see opportunity to hop back into a perfect buy for the next few weeks off a double bottom on the Daily which is touching a monthly resistance, so possible swing trade for 600+ pips

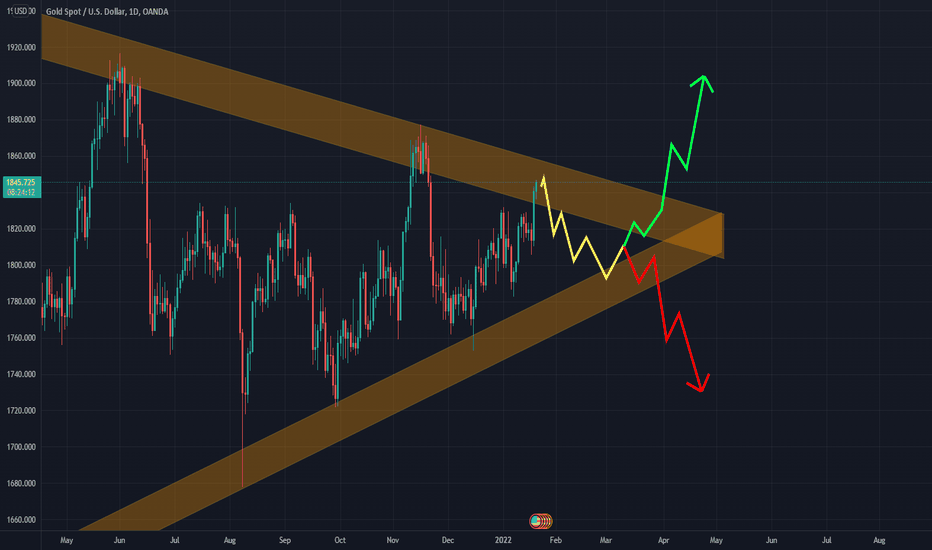

XAUUSD Awaiting breakout, but not yetGold has is trading within a huge triangle, with a lower trendline support spanning back to 2018 and an upper trendline resistance spanning back to mid 2020, with a good number of clear rejections of these levels from each.

Gold has just entered the upper boundary again, coming in with a little momentum this time, with RSI just breaking above 70 on the 4H.

I expect to see another rejection in the area of this upper trendline back into the triangle to continue this huge consolidation, but price is getting wound tighter and tighter and may be due for an explosion in the near future.

Expect to see a rejection from this level - which could be taken as a good risk/reward short with stop loss above the trendline - and price to squeeze further into the peak of the triangle, at which point we will be primed for a big breakout.

Whenever it happens, the breakout of this triangle will be one to watch, and I'll be taking a position intending to following the trend in whichever direction it breaks out with the intention of a medium-term hold, which for me would be approx. 7 - 30 days.

LITE breaking out of a tight range with higher than average volu* Excellent earnings

* Strong up trend in the long term

* High 3-month relative strength of 2.61 in the Tech sector

* High 50 day U/D ratio of 2.11

* Breaking out of a 3.31% range

* During the consolidation the volume did dry up and as it started breaking out the volume picked up.

Trade Idea:

* You can enter now as the price is just breaking out of the tight range

* If you're looking for a better entry you may wait for an entry opportunity near the $105.61 area

WM is one to keep an eye on!* Great earnings

* Very strong up trend

* High 3-month relative strength of 2.55 in the Industrial sector

* Pays out dividends

* Has been in a tight range of ~3.94% for the past 5 to 6 weeks

* Held up incredibly well during this time of market uncertainty

Trade Idea:

* There are a few plays you can do here since the 4% stop is quite a distance away:

1) Enter now if you can stomach a little volatility

2) You can look for a buying opportunity once it has broken and closed above $166.23

3) You can wait for a discounted entry near the $164.22 area

4) You can wait for a bounce from the $161.24 area.

Any thing below $161.24 would negate this idea.

Bitcoin & The Debt Ceiling Effect Welcome ! Feel Free to comment below Like and Follow me for future ideas !

Todays overall BTC is a little bit lower than this morning and roughly same point as last night you can see that btc is going sideways once again but there is always bullish things to talk about when it comes to btc and here is one that is indirectly related which is the Debt Ceiling and you know every time the Debt Ceiling goes up that means a couple of trillions more are going to be printed in the near future but you know and i know this isn't affect BTC indirectly because that as inflation gets worse and worse and worse and trust me it will get worse in 2022 we already seen effects of in 2021 So people are preparing they're putting their money into hard assets lie bitcoin.

Mabye this doesnt have a medium pump effect but long term it will definitly help hard assets like bitcoin so this is being voted on and im almos certain its going to pass so be prepared !

-Mike

Where is PLD headed next?* Exceptional earnings

* Very strong up trend

* High 3-month relative strength in the Real Estate sector

* Built a 3 month base between $125.45 and $138.67

* After breaking out started to consolidate in a tight range

* Slowly kept moving higher even as the general Real Estate sector was ranging during the same period

* Broke out of the tight consolidation with higher than average volume

Trade Idea:

* Now's a great time to enter as the price just broke out of the tight range

* If you're looking for a slight discount you can look to buy near the $150.90 area as that should serve as support

* Even if the general Real Estate sector continues to range it seems like PLD will continue to move higher; given how it performed over the past three weeks.

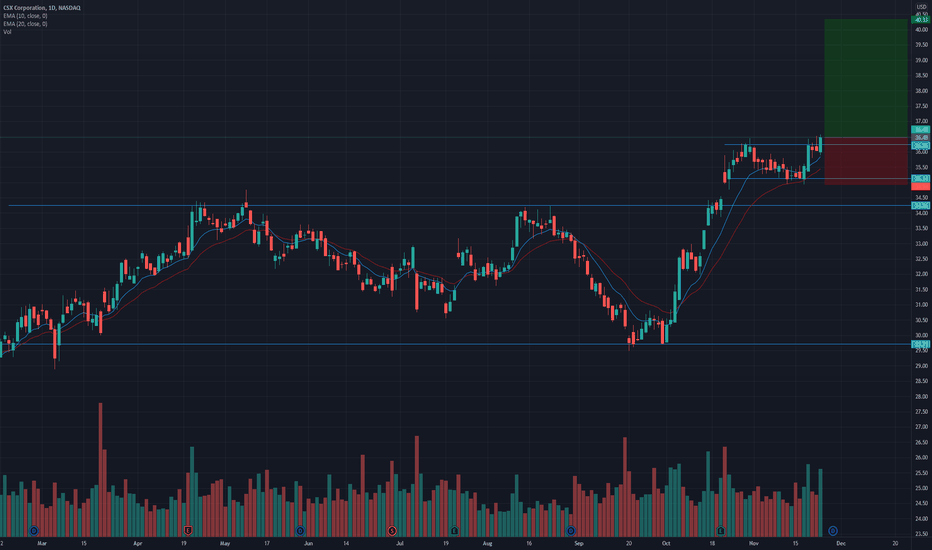

CSX broke out of a tight range. Where is it headed next?* Great earnings

* Very strong up trend

* High 3-month relative strength in the Industrial sector

* Built an 8 month base between $29.71 and $34.26

* After breaking out it started to consolidate in a tight range creating a base on base pattern

* Breaking out of the range with higher than average volume

Trade Idea:

* Now's a great time to enter as the price is very close to the broken level

Caution:

* A daily close below $36.25 would put the price back inside the range and expose $35.14 as support

* Consider exiting the trade early if the price make 4 consecutive lower lows on a daily basis.

* Alternatively, a daily close below $35.14 would negate the idea

Consolidation breakoutArtroniq has been in consolidation stage for a very long time. Although price and volume looks quite promising today, 0.435 is the price to beat with increase in volume. Otherwise, it should keep moving within the range again. Let's see if this will be a successful breakout play or back to consolidation again.

AJG looking to continue its moveI last spoke about this back in late September as it was forming its cup with handle pattern. The stock since then broke out and rallied higher from there.

Due to the current market correction the stock did slow down but now is looking to continue its move.

The tight consolidation it was in during this short correction indicates that institutions were accumulating during this time.

The stock broke out with higher than average volume and is showing signs of continuing its move.

Trade Idea:

* Now's the right time to enter as it's not too far from its broken level.

* If you're looking for a slight discount you can look for an entry near the $164.08 area as this should now serve as support.

Caution:

* A daily close below 164.08 would put it back inside the consolidation range.

* A daily close below $160.21 would negate this idea.

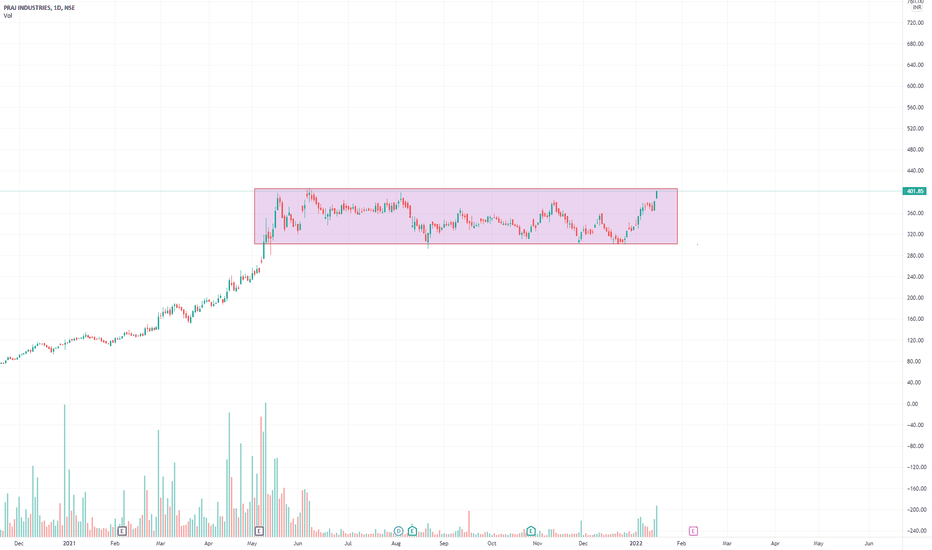

MoneySwap (MSWAP) is in more than 100 days consolidationMoneySwap (MSWAP) is in more than 100 days consolidation and anytime it may give big breakout. I am expecting 300% return after KUCOIN:MSWAPUSDT gives breakout from this long accumulation phase.

Be patient, as it may move side ways for couple of weeks before breakout. Longer is the consolidation/accumulation higher is the breakout.

Do leave your feedback in comment section.

Thank you.

CRL offering an early entry with a pocket pivot?* Exceptional earnings

* Very strong up trend

* High RS in the Healthcare industry

* Pocket pivot occurring on the right side of a rounded constructive basing pattern

Trade Idea:

* You can get in now as indicated

* Or if you're looking for a slight discount you can look for an entry near the $423.63 area

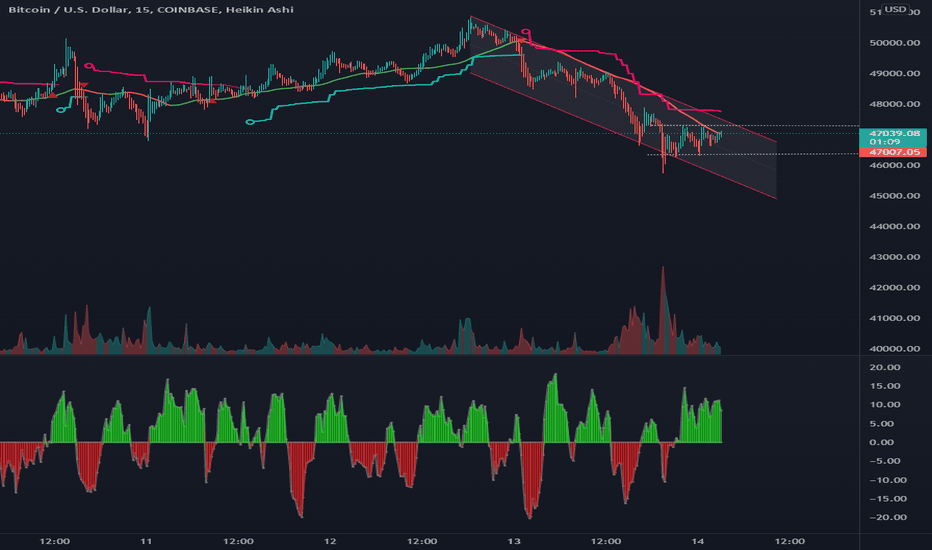

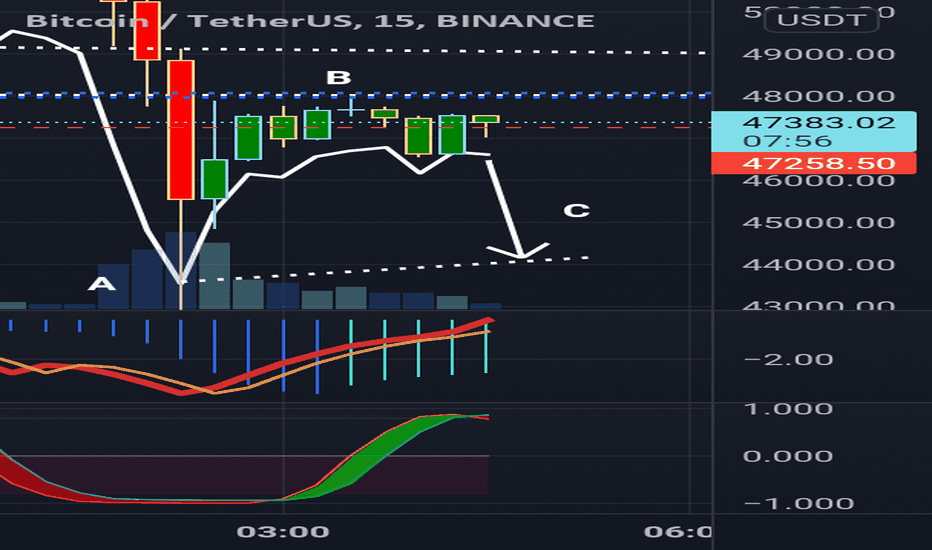

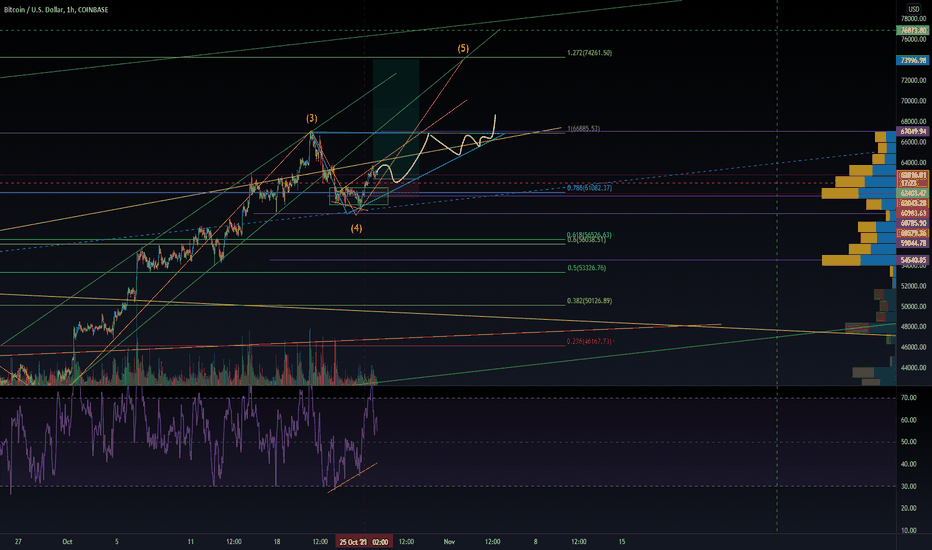

Btc scalping in playBtc is forming a nice cup and handle pattern and that is a good indicator for predicting the next move in the formation of the handle consolidation until breakout with small correction all the way is a good sign for this scenario to happen

measuring the target with Fibonacci it leads us to the 74000

The trend is going upwards with small corrections all the way and it proof the strength of the movement

Cryptoindex.com (CIX100) is in more than 100 days consolidationLooks like Cryptoindex.com 100 (CIX100) is ready for trend reversal. I am expecting 300% return after CIX100 gives breakout from more than 100 days long consolidation. It may move side ways for couple of weeks before breakout, be patient.

BNL broke out of consolidationBNL had a pull back mid June and has since recovered to make new all time highs.

Since breaking out it has been consolidating right above resistance hence making it a new support level.

* New company

* Steady up trend

* Pays generous dividends

* Broke above pull back with relatively higher volume (7.28%)

* Creating new support level from the broken resistance

* Price is at a great point!

Trade Idea:

* Entry at previous close $27.63

* Stop at $26.20 (~5%)

* Target at $33.17 (~20% ROI)