EZCORP (EZPW) AnalysisEZCORP, Inc. NASDAQ:EZPW , a leading pawn services and consumer lending provider, is scaling operations across the U.S. and Latin America—expanding its footprint, diversifying revenue streams, and enhancing resilience.

Key Catalysts:

Operational discipline: Focus on cost controls, inventory management, and service upgrades supports steady performance.

Growth expansion: Geographic diversification reduces reliance on any single market.

Valuation edge: Trading at a forward P/E of ~8.8, EZPW remains significantly undervalued vs. S&P 500 averages despite solid growth drivers.

Investment Outlook:

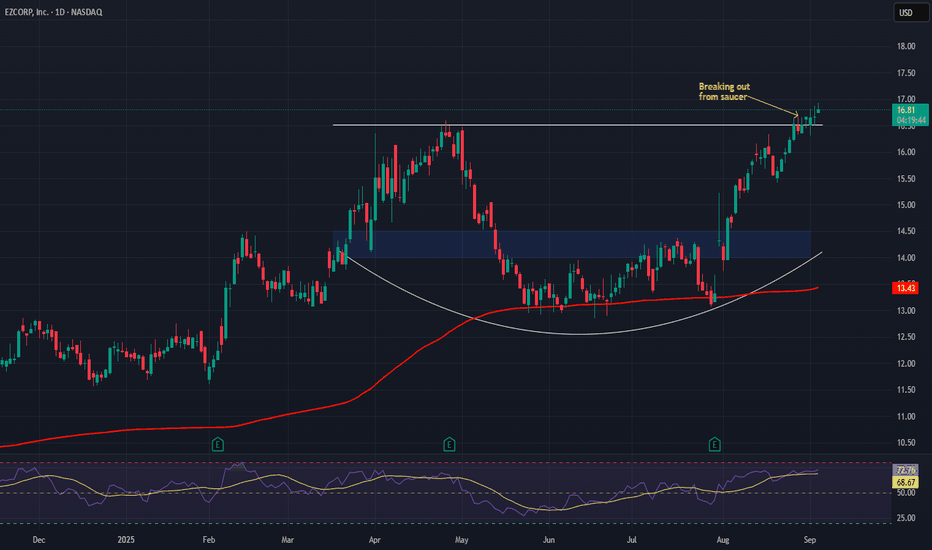

Bullish above: $14.00–$14.50

Upside target: $21.00–$22.00, backed by expansion momentum, cost efficiency, and attractive valuation.

📢 EZPW — a growth story trading at value multiples.

#EZPW #PawnServices #ConsumerLending #LatinAmerica #ValueStocks #Investing