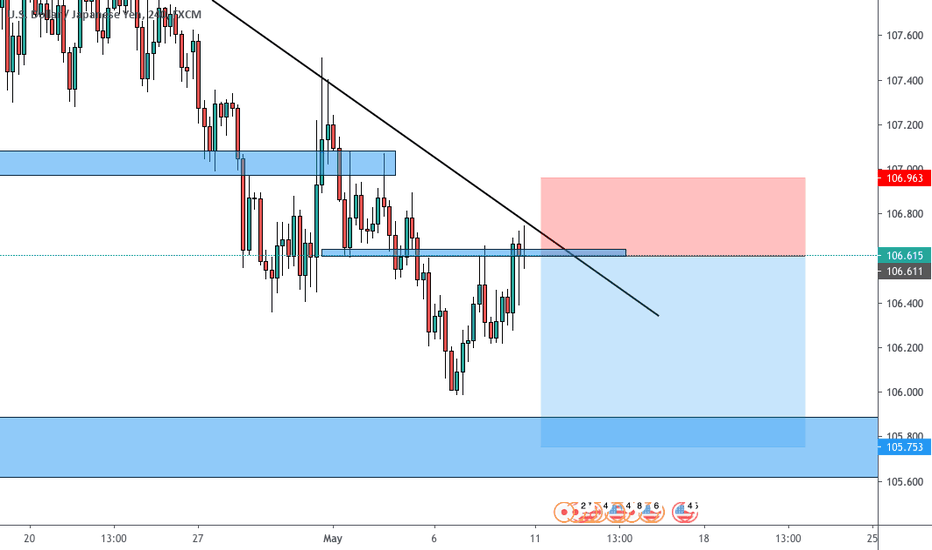

Continuation

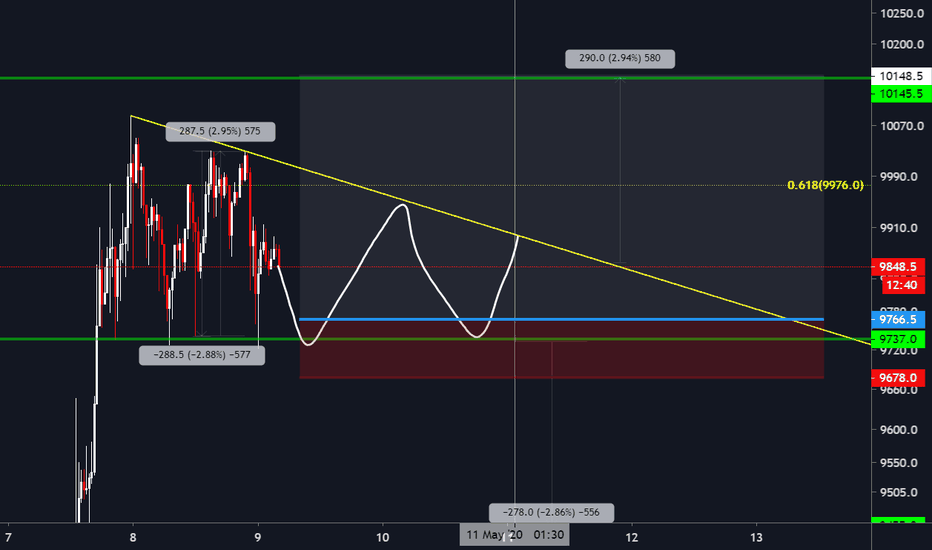

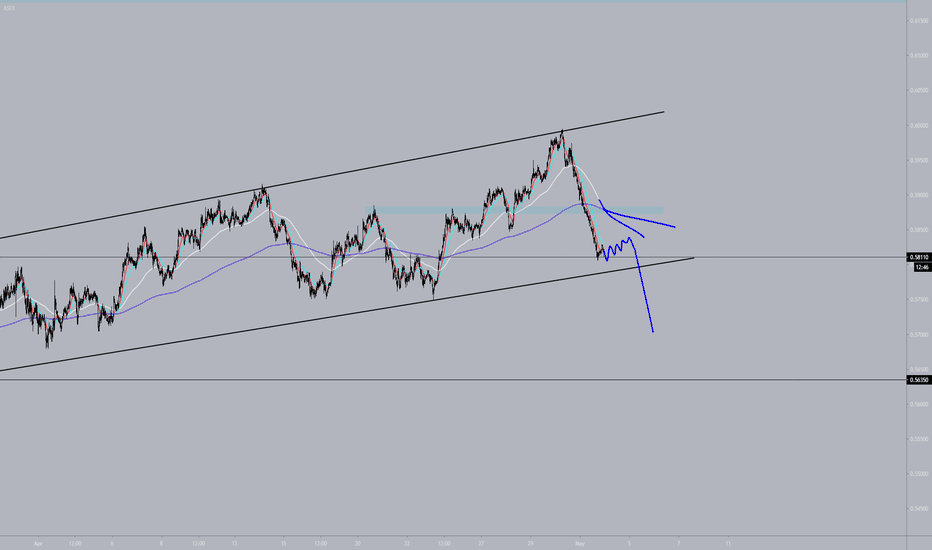

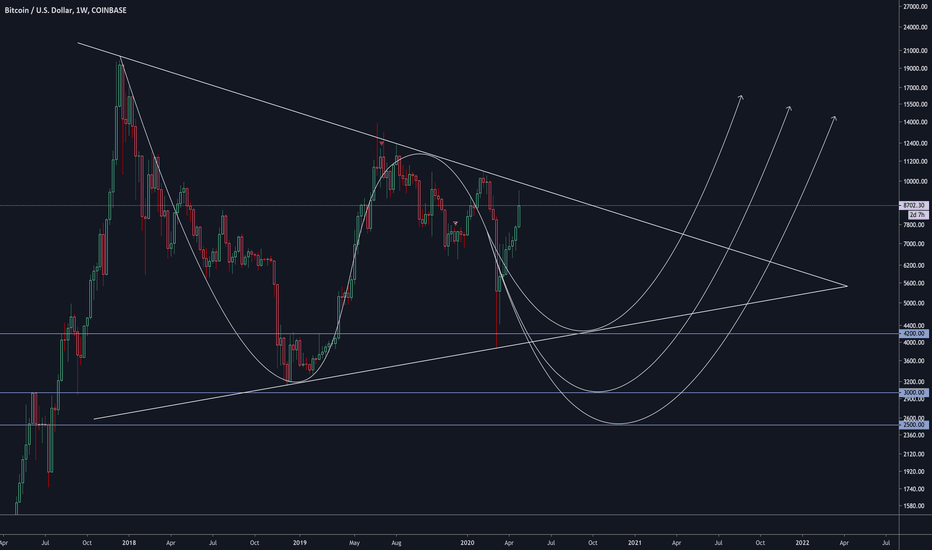

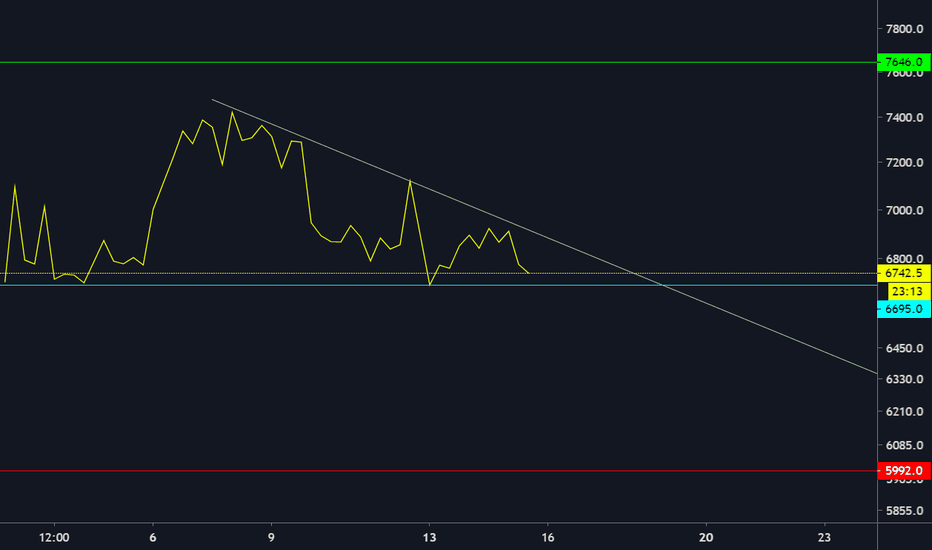

#BTC - Triangle - Hedge long for ongoing short expecting sideways market for the next 2 days, maybe on last day before halving we might see some fireworks

i was expecting a deeper retrace to 94xx to long but we are forming a descending triangle after the big move up, so simple rule long at support short at resistance once we break on either side just HODLLLLL!!!!

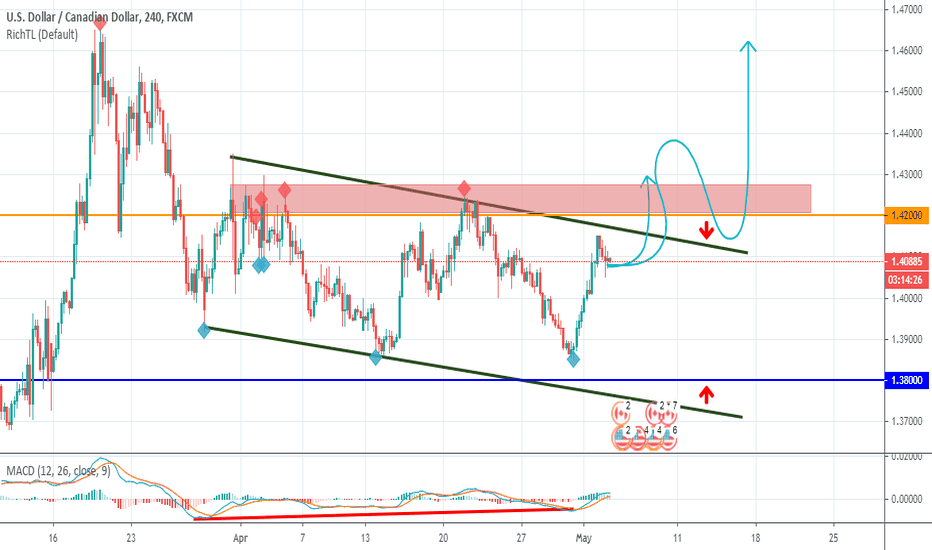

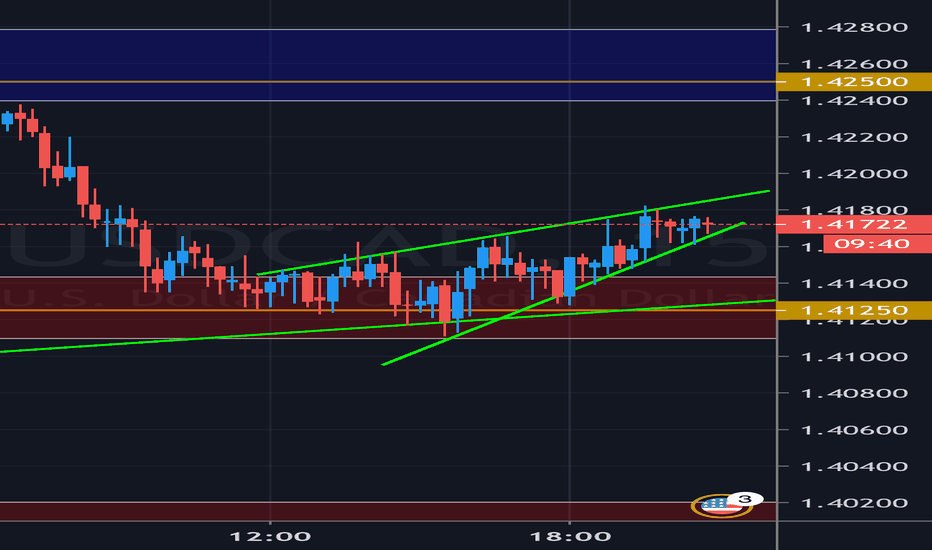

USDCAD two possible ScenariosUSDCAD H4 - TWO POSSIBLE SCENARIOS

this pair is trading inside this green channel, so we are overall bearish here.

price is now sitting around the upper green trendline and orange resistance, so we may expect a downward movement from here

unless price breaks above the orange level 1.4200 upward aggressively, then an upward movement till around 1.4650 would be expected

as mentioned, for now, this pair is overall bearish (going downward), in this case, the first main rejection area is the lower green trendline and blue level 1.380

if price breaks below the blue level 1.3800, then a downward movement till around 1.3500 would be expected

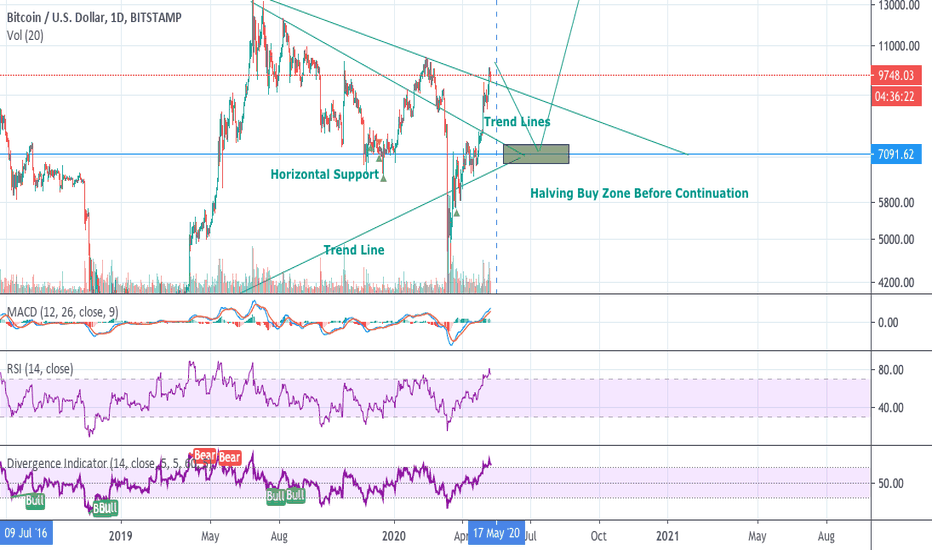

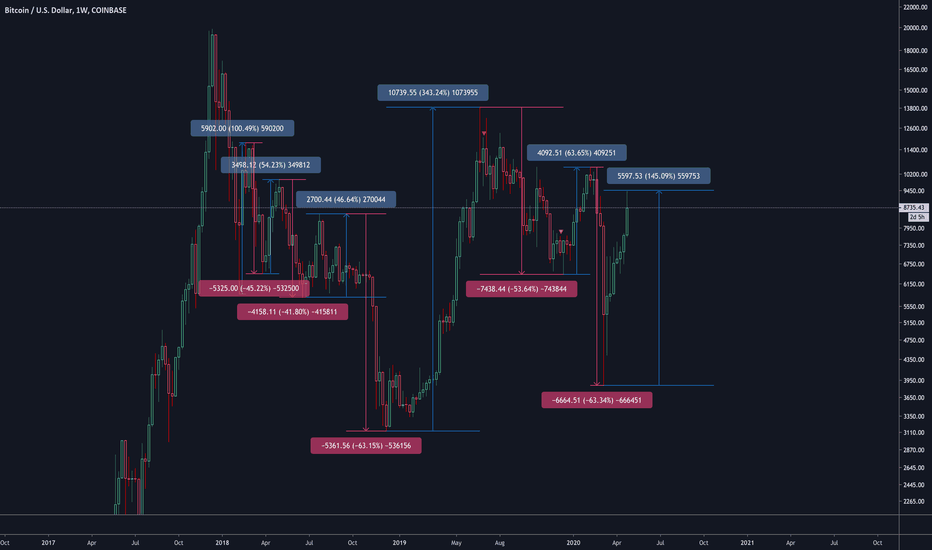

IT'S NOT OVER YET | THE FASTER WE RISE, THE HARDER WE FALLI am not confident this is the end.

In the history of Bitcoin's existence, the faster we rose, the harder we fell. Vast acceleration always resulted in a large correction. We rose up too fast... yet again. Thus, I believe a large correction is due... yet again. Now I understand this pattern breaks eventually and we progress into a bull market, a long, multi-month, sideways bottoming pattern forms. I have yet to see anything of the likes. So why is this scenario any different?

Historical Rapid Acceleration

It seems like nothing has changed... yet again.

VERDICT: Until we actually form a bottoming pattern that is sustainable and reasonable, I can't be confident that price is ready to start the next journey to new highs.

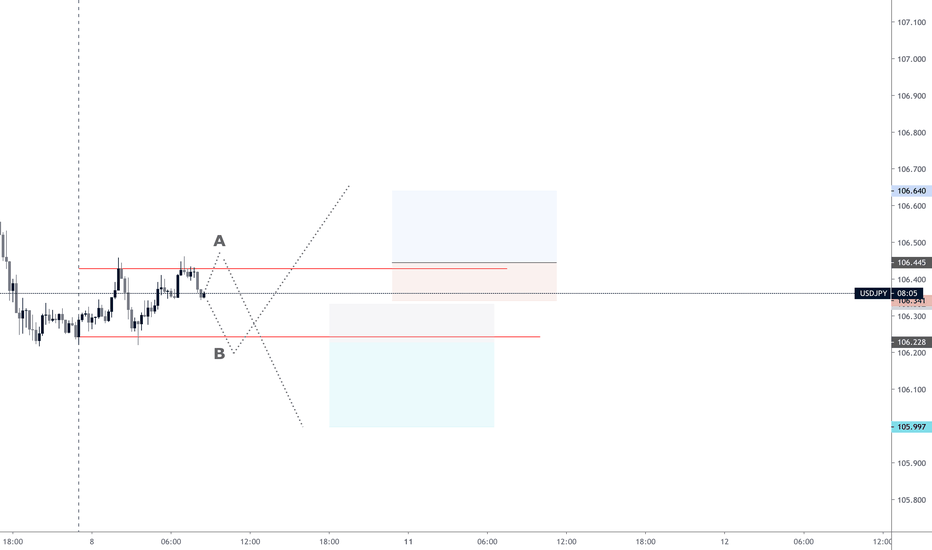

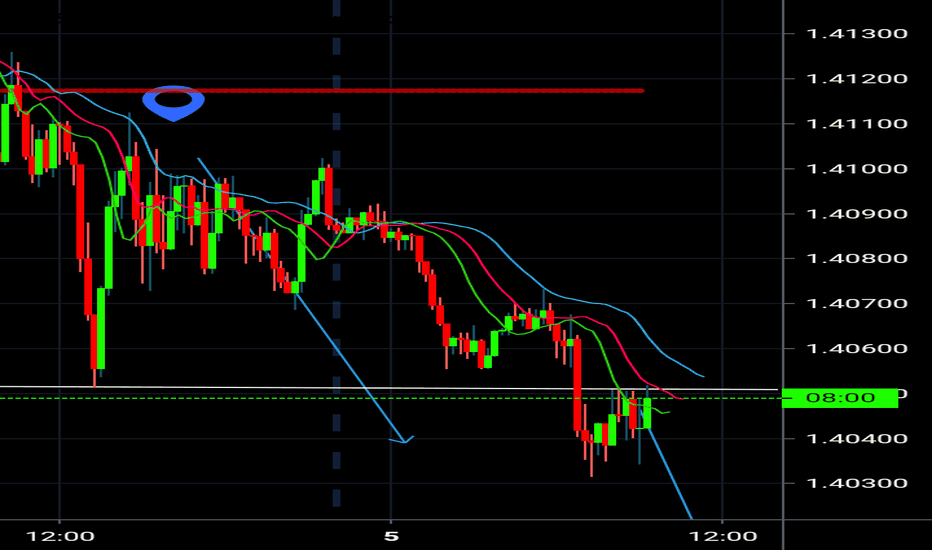

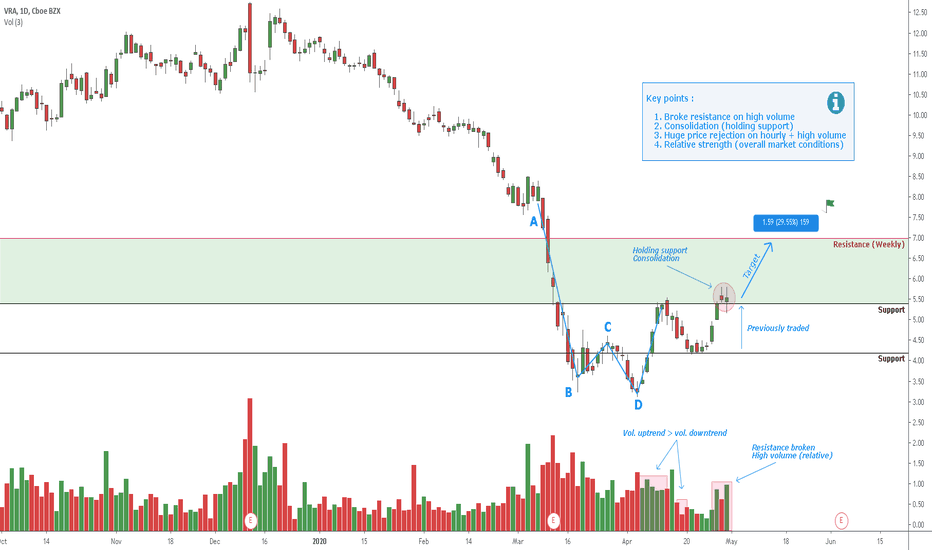

Price action & Psychology - Resistance, consolid., continuationHello !

Key points :

Resistance broken on high volume and wide range candles

Consolidation phase and support hold

Huge price rejection on the hourly + high volume

Relative strength (compared to today's market conditions)

I've left some charting from the previous trade on this analysis, to get a context. On the previous analysis, we said that basically, what happens after an "ABCD" pattern, is that the "D" makes a new low (depending on what chart you're looking at it must not be an all-time low). So we're entering a new trend. As we know, stocks nearly always move in waves (higher highs, higher lows when uptrending, reverse for downtrending).

What happens here, is that the stock needs some room to "breathe" before resuming the trend. Some people are taking profits (like I did yesterday), others are joining the party, while others wait on the sidelines.

BUT , there's still a "healthy" balance between the different actors, otherwise, if the conviction was gone or there would have been enough sellers to absorb the buy orders, the stock would have reversed right away.

The 2 reasons for a stock price (or any other security) to go up (reverse for down)

Fundamentally, there are 2 reasons :

There are not enough sellers to absorb buy orders (buyers > sellers)

Traders/investors think that the stock is cheap (they have the belief that the stock will go up in the future, i.e. the conviction)

***Disclaimer : This is not an advice to buy the stock. Please, be aware that trading is a matter of probabilities, it takes only ONE trader to deny your trade.***

Thanks for reading and if you have suggestions or wanna discuss the idea, just leave a comment, I'll be happy to answer.

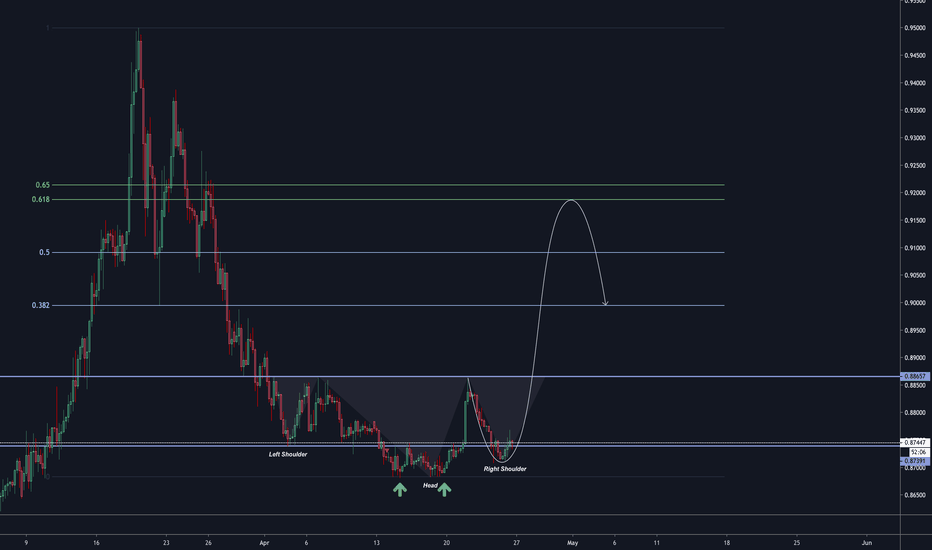

EUR/GBP REVERSAL | INVERTED H&S / DOUBLE BOTTOMNOTE: The following extends my earlier post on EUR/GBP. Please refer to it in addition to this post; attached below as a related idea.

Inverted H&S - Right Shoulder Forming

Double Bottom Still Holding As The Local Low

Targeting The 61.8% Fibonacci Retracement Level

Macro-Economic Analysis - Further Downside Expected, Thus A Rise In EUR/GBP

VERDICT: Cycle low is in and forecasting movement to the upside. Targeting the 61.8% retracement level.

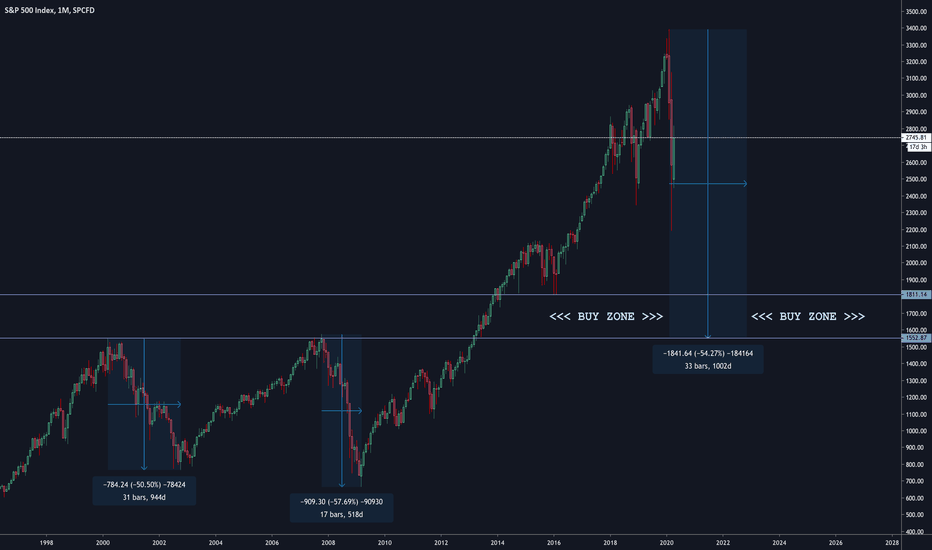

BITCOIN & SP500 | THE SIMILARITY IS PRECEDENTED | NOT A HEDGE.No unnecessary words needed. The chart speaks volumes.

Bitcoin has never experienced a recession let alone a pandemic.

Bitcoin will follow and mimic the global economy so long as economic implications exist.

Main indicator for investing in Bitcoin should be the SP500, or any other equity index.

This isn't a bull market. This is a bull trap correction.

VERDICT: Bitcoin is not a hedge and will follow the broader markets until this recession/pandemic is over. Just ask yourself... why would bitcoin act differently?

USDCAD continuation bullishyes, we have huge wick on the monthly TF, but it couldn't penetrate the Daily demand zone. based on that we could say the bull still in charge. on 1H there is a huge movement and nice demand zone. but we decide to cover the pivot to minimize the risk getting stopped out. because it is possible the price could break the previous support. you could set the second target with trailing stop loss

drop a comment below what your thought about this

Rising wedge trend continuation USDCAD Do your own analysis ...

Dont Forget Moving StopLoss At Breakeven

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. You must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

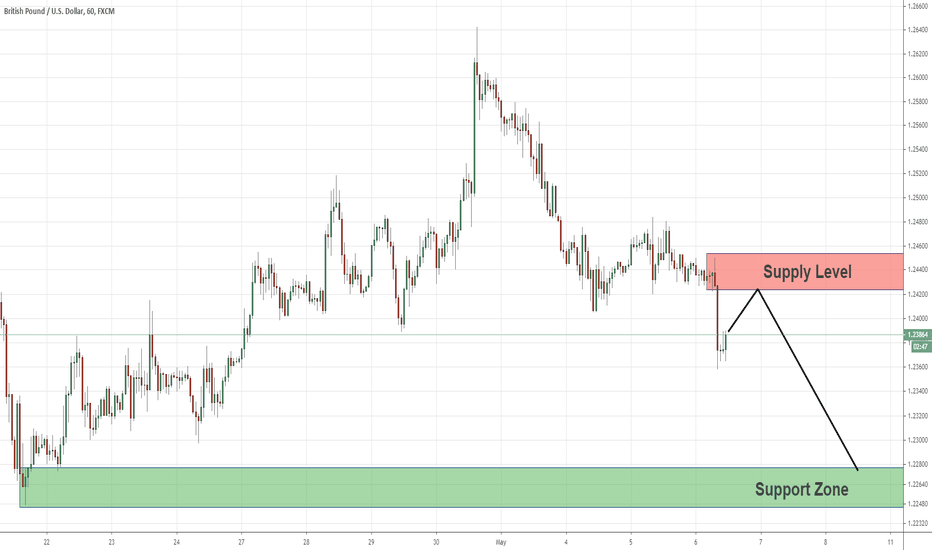

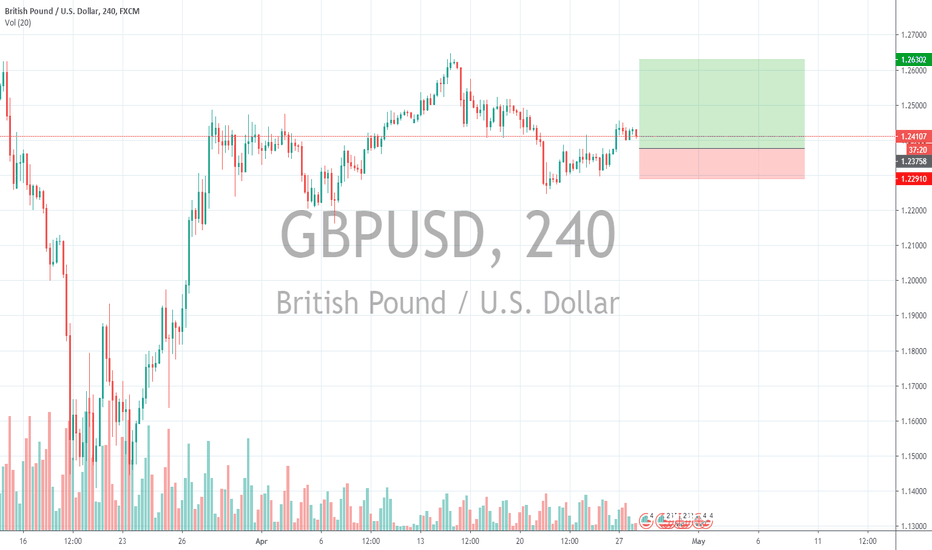

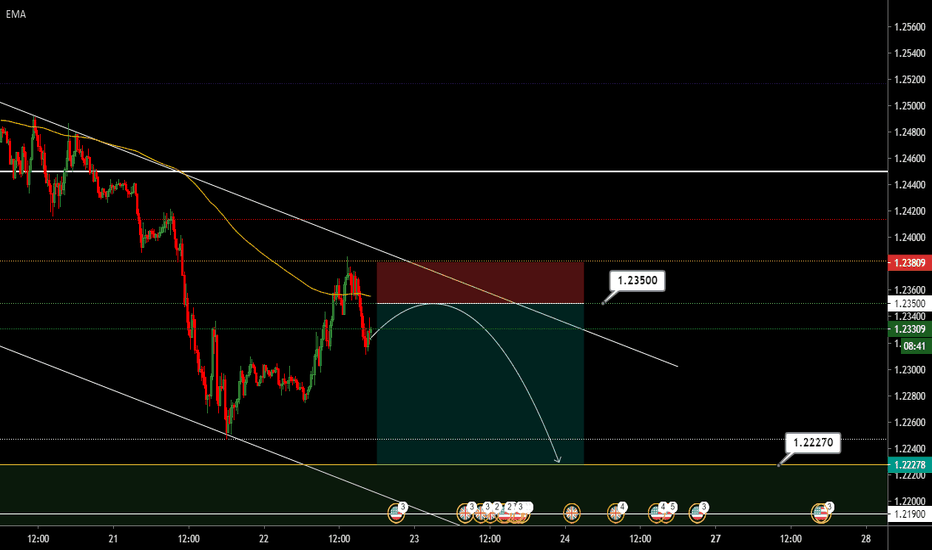

GBPUSD sell idea ***GOOD RISK TO REWARD RATIO***We find GBPUSD in a 4 hourly bearish channel.

Following an exhaustion to the up side, we will be looking to jump onto sells as we see upward momentum being lost on the 1h timeframe.

Sells will be entered upon retest and denial of the 38.2% fib level as shown, where we could see a big push downwards to the 1.22270 price level.

We find this to be a high probability trade, with a RR of 3.95 and is very well worth entering.

Remember to trade responsibly and with appropriate risk management.

Happy trading!

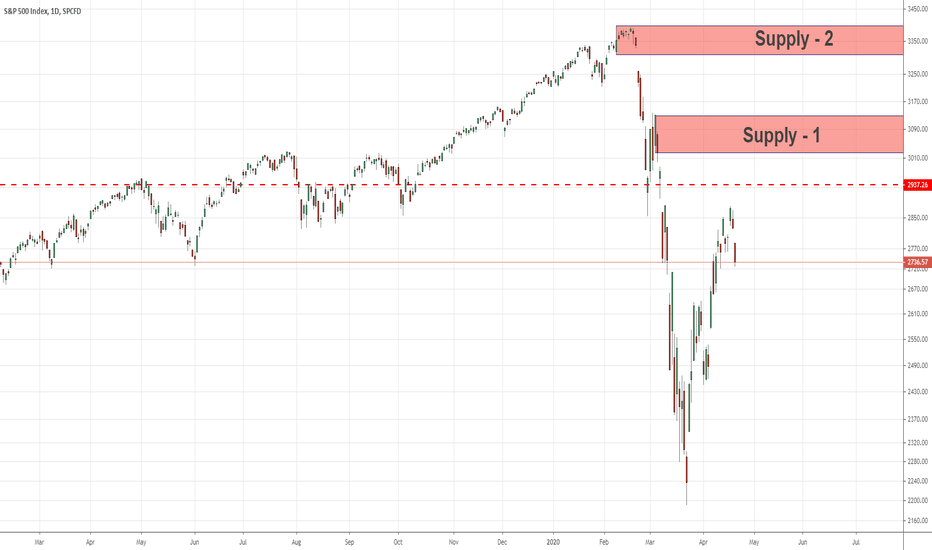

Great Supply Levels to sell the SPX IndexAs we can see on the daily chart, the SPX500 has a great recovery after the massive drop a few weeks ago.

The price now getting close to supply - 1 that is a great level to sell SPX500.

If the price will breakout this supply toward up I'll close this position and I'll open a new sell position if the price reach to supply -2.

Both options are relevant for swing or long term traders.

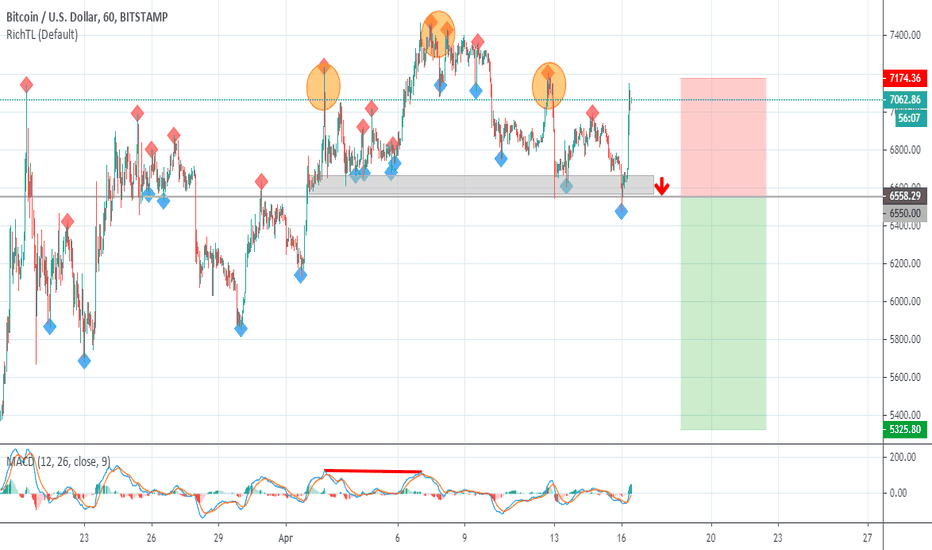

BTCUSD Potential Bearish MovementBTCUSD Potential Bearish Movement

we are waiting for a momentum candle close below 6550.0 to sell this one

Reason:

1- Regular Bearish Divergence on MACD (in red)

2- Objective Head and Shoulders (in orange)

3- Supply zone from Daily

Three confluences are enough to consider Selling BTCUSD, after a break below 6550.0 (in gray)

GLOBAL EQUITIES BULL TRAP | FURTHER DOWNSIDE EXPECTED

Often in downside and upside moves of large magnitude, a phase is present where a large correction occurs.

This is known as a Bear or Bull trap, respectively.

It is reasonable to say that we could be in a bull trap right now with stocks up by almost 30%

An average market cycle high to low has been in the region of 50-60%. This would bring price to strong support and a reasonable area for a rebound (Buy Zone)

This assumes that this downside cycle will be of the same level or worse than the previous downside cycles.

The reason for such an expectation is due to the extremity of Covid-19 in terms of unemployment, trade, demand shock and other macro-economic metrics/indicators.

Also the fact that the pandemic indicates a more longer/severe cycle due to the nature of the event being so complex and impactful.

VERDICT: Signs of a bull trap are becoming increasingly more noticeable and this, along with the extremity of Covid-19, indicates that the crash is expected to continue further.