COOKIE/USDT on the Verge of a Breakout? Descending Triangle

📊 Complete Technical Analysis

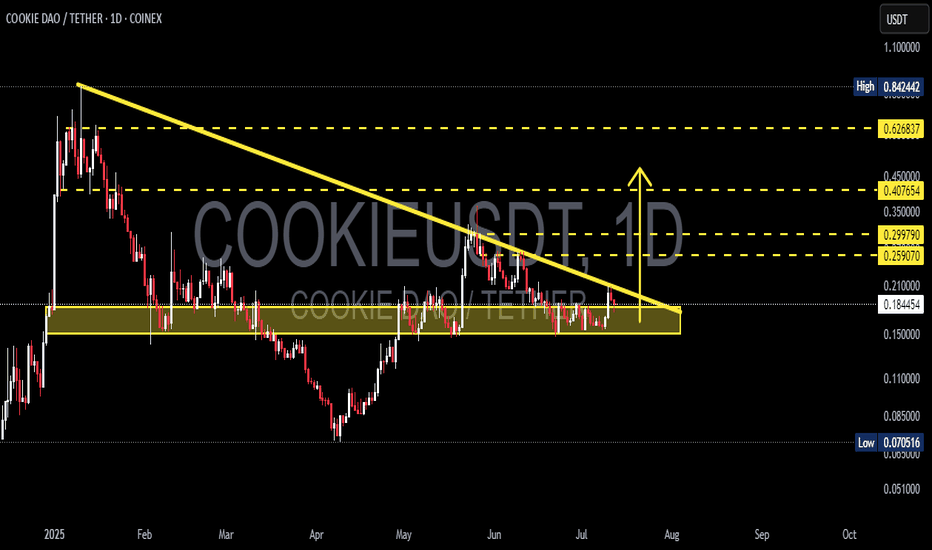

COOKIE/USDT has been forming a classic Descending Triangle since February 2025, indicating prolonged market consolidation. Sellers have been pushing the price down gradually (lower highs), but buyers have strongly defended the horizontal support around $0.16–$0.18.

Now, the price is testing the upper boundary of this structure, signaling a potential explosive breakout.

🔍 Pattern Breakdown

Pattern Name: Descending Triangle

Key Traits:

Lower highs compressing price action

Strong horizontal support zone holding steady

Typically a continuation pattern, but in this case, it can act as a reversal signal if breakout occurs to the upside

Formation Duration: ±6 months

Breakout Confirmation: A daily candle close above ~$0.22 with strong bullish volume

🚀 Bullish Scenario (Upside Breakout)

If COOKIE/USDT successfully breaks above the triangle resistance, here are the potential bullish targets:

Target Price Reason

🎯 Target 1 $0.259 Local resistance zone

🎯 Target 2 $0.299 Key breakout confirmation

🎯 Target 3 $0.407 Measured move from triangle height

🎯 Target 4 $0.626 – $0.700 Historical resistance range

🏁 Final Target $0.842 (ATH Zone) If bullish sentiment fuels momentum

✅ Volume confirmation is crucial. A breakout without strong volume might signal a fakeout.

🛑 Bearish Scenario (Rejection or Breakdown)

On the flip side:

❌ If the price fails to break the triangle resistance (~$0.22) and gets rejected again, we could see a retest of:

Support zone around $0.18

A breakdown below this level could drive the price toward:

$0.140

$0.120

Possibly as low as $0.095 – $0.075 if sentiment worsens

❗ Be cautious of fake breakouts or bear traps near key levels.

📚 Summary & Insights

> The current descending triangle is a textbook setup of “compression under pressure.” If the structure breaks upward with conviction, COOKIE/USDT may enter a powerful bullish trend after months of consolidation.

This setup is ideal for swing traders, breakout traders, or early trend investors seeking solid entries before momentum accelerates.

#COOKIEUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #BullishReversal #TechnicalAnalysis #TradingView #CryptoTA #AltcoinSetup #ChartPattern

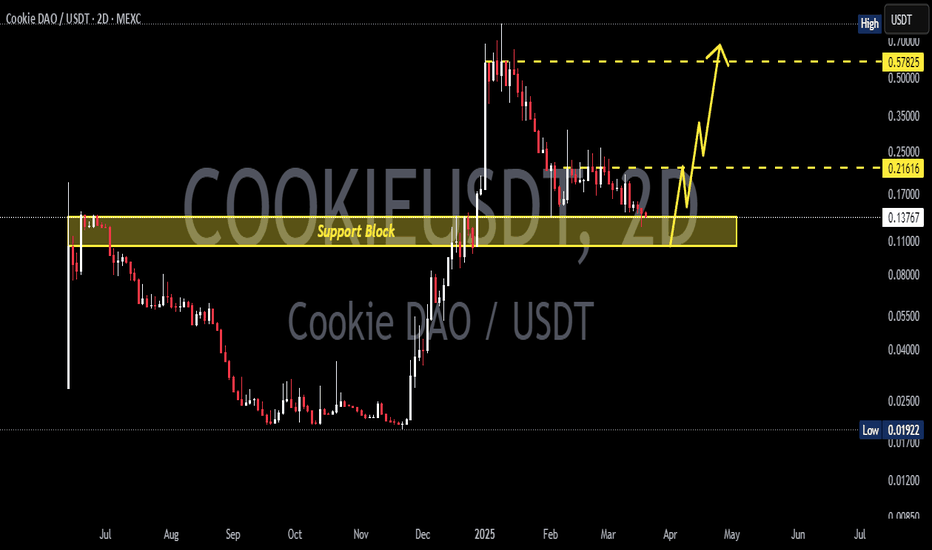

Cookieusd

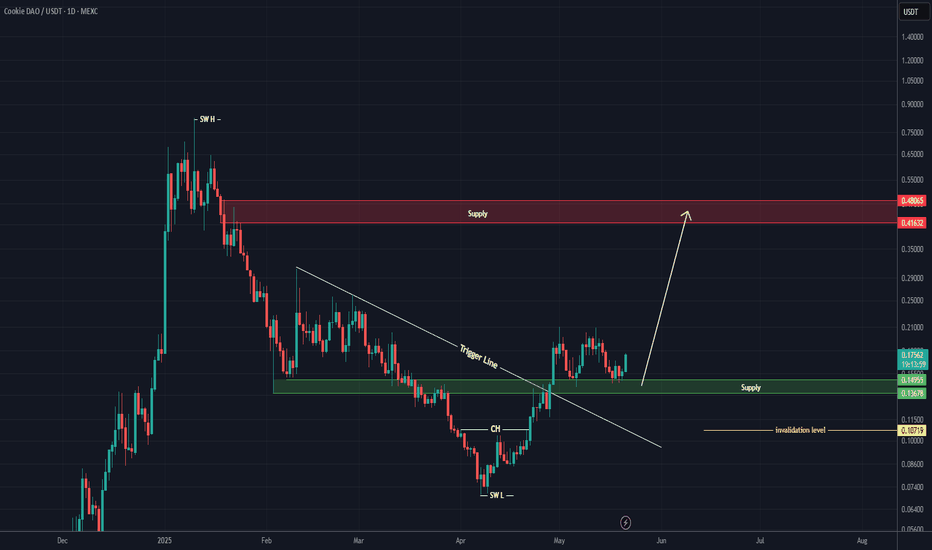

COOKIE Looks Bullish (1D)We have a good setup on the chart. A bullish CH has formed, the trigger line has been broken, and the price is currently sitting on a support level.

The green zone has been tested twice and rejected, which has strengthened the bullish outlook for this asset.

The main supply zone is marked in red. It is expected that, with price fluctuations, the asset will reach the red zone in the coming days or weeks.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

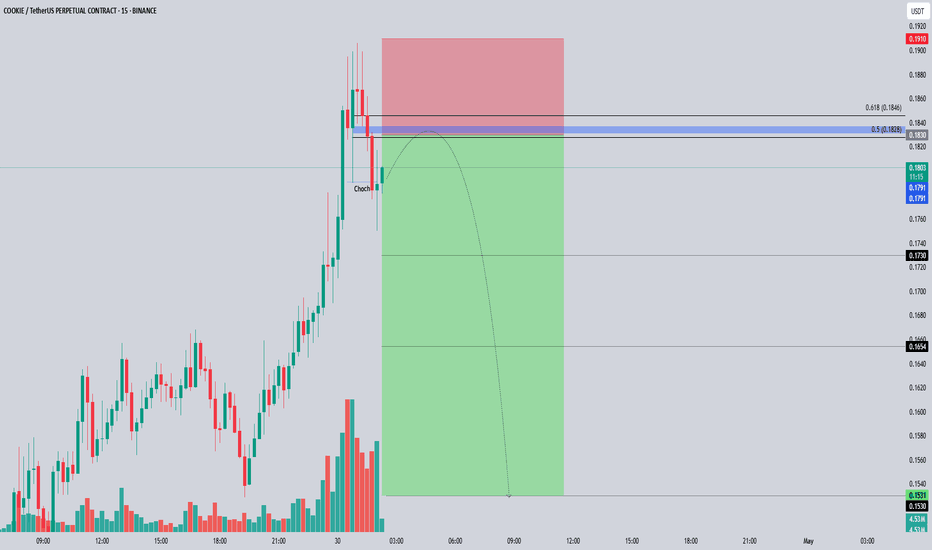

COOKIE/USDT Short Setup Loading - High-Probability DropPrice recently pumped into a premium zone and gave us a clear Change of Character (ChoCh) — a classic signal that momentum is shifting from bullish to bearish. Now, we’re seeing a pullback into the 0.5–0.618 Fibonacci retracement zone, which often acts as a key area for entries.

📍 Trade Plan

Entry: 0.182 USDT

Stop-Loss: 0.191 USDT (above recent high / invalidation point)

Target: 0.173 - 0.1657 - 0.153

🔎 Why This Setup Stands Out:

✅ ChoCh Confirmed – Momentum has shifted, suggesting the bulls are losing control.

✅ Fibonacci Confluence – Price is pulling back right into the golden zone (0.5–0.618), offering a textbook short entry.

✅ Clean Risk/Reward – With a tight stop and a defined target, the setup offers solid R:R potential.

💭 Final Thought:

Now it’s all about confirmation. If we see a solid rejection in the zone, this setup could play out with strength. Patience is key — let the market come to you.

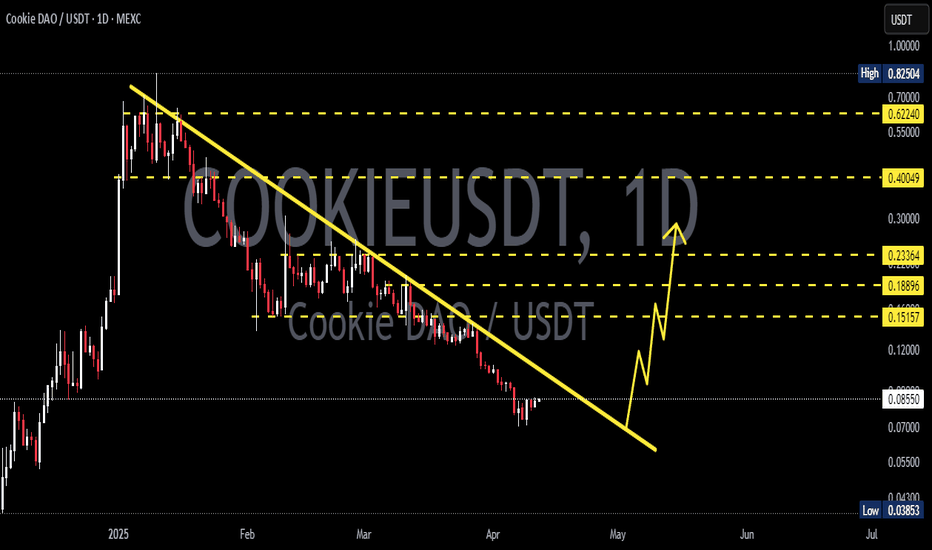

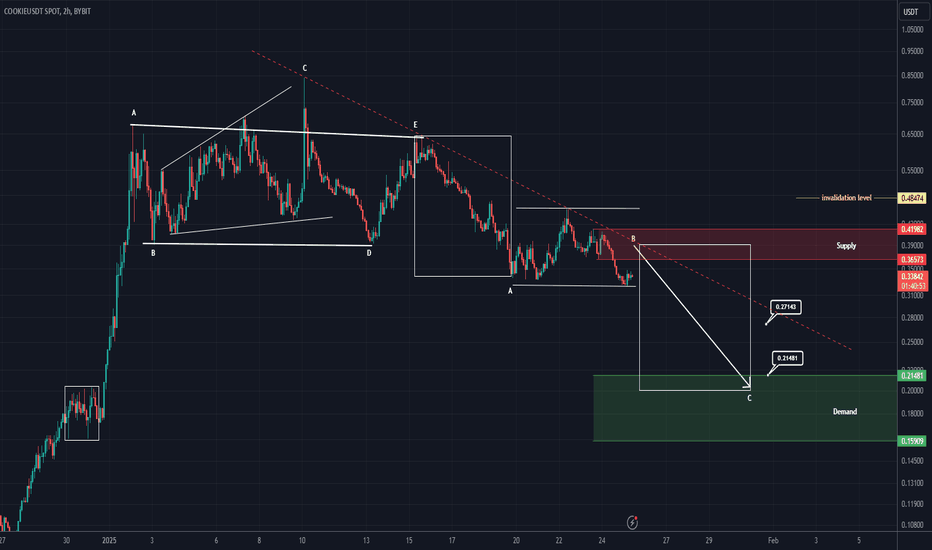

COOKIE is Bearish (2H)First of all, note that this symbol is highly volatile and risky.

From the point where I placed the red arrow on the chart, it seems that the COOKIE correction has begun.

Currently, it appears that COOKIE is in wave B of an ABC pattern or possibly a more complex structure.

As long as the red zone is maintained, it is expected to move toward the specified targets.

Closing a 4-hour candle above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You