CORN

Corn Futures Expected to Move Lower Towards 563'4Disclaimer

The views expressed are mine and do not represent the views of my employers and business partners. Persons acting on these recommendations are doing so at their own risk. These recommendations are not a solicitation to buy or to sell but are for purely discussion purposes. At the time publishing, I have a position in Corn Futures ( ZC1!).

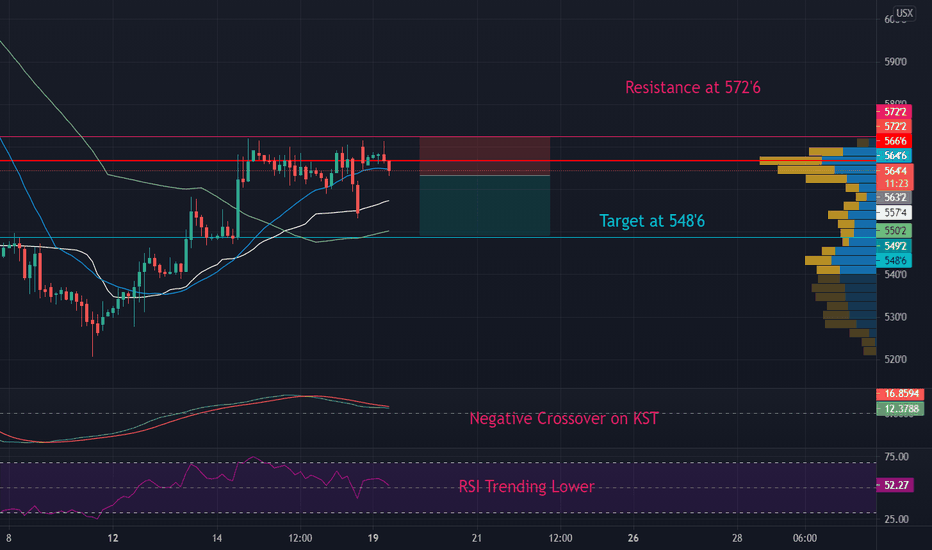

Trend Analysis

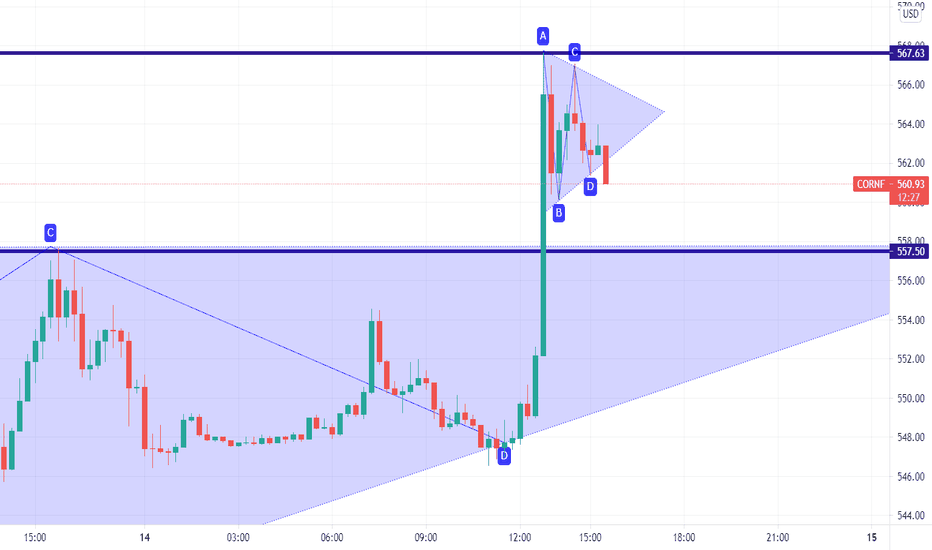

The main view of this trade idea is on the 2-Hour chart. ZC1! Hit some resistance around the 572’2 price level and is expected to move lower in the short term. This resistance is a lower high on the commodity and is expected to make another leg lower.

Technical Indicators

ZC1! is currently above its short (25-SMA), medium (75-SMA) and fractal moving averages. This price increase appears to be a counter trend move of an overall decline in the commodity. The RSI was overbought and is now trending lower towards the 50 level. Moreover, the KST is also displaying negative divergence as the indicator had a negative crossover.

Recommendation

The recommendation will be to go short at market. At the time of publishing ZC1! is trading around 563’4. The short- term target price is observed around the 548’6 price level, towards the medium term SMA. A stop loss is set at 572’2. This produces a risk reward ratio of 1.56.

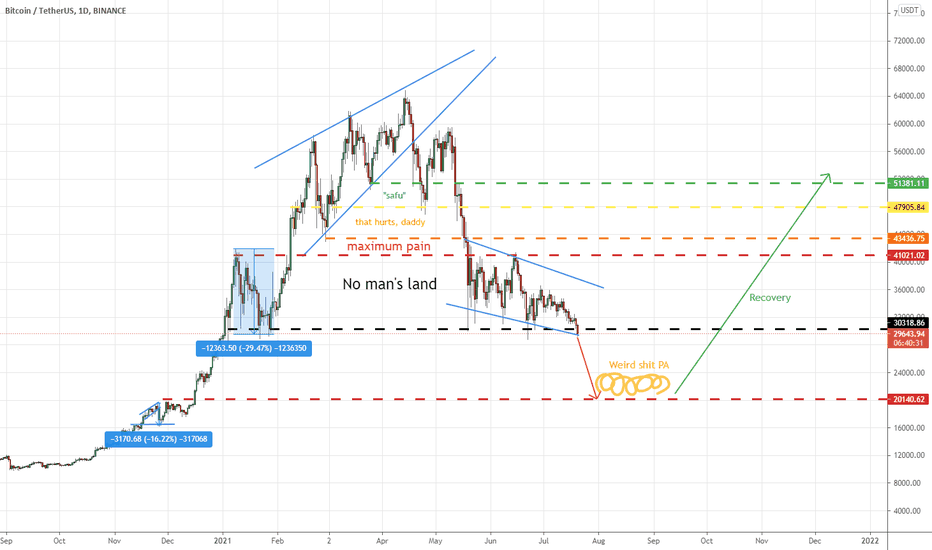

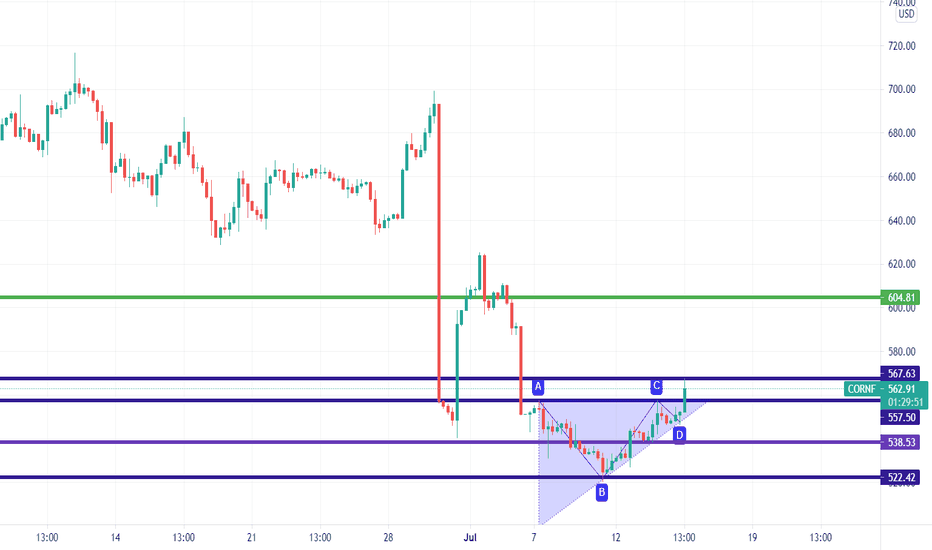

December CornPossibly put the highs in for Dec Corn here...as shown in chart, we faded the gains from the bullish July USDA crop report (which showed lower acreage) on better weather forecasts after wknd of the 4th...weather maps less threatening in corn belt as of late and is bearish feature for the next few weeks should forecasts confirm. Condition ratings expected to increase. Spreads are firm though and there is some support from Bean oil as the Canola mkt is experiencing production issues due to ongoing drought. This feature could have potential to pull CZ higher but I believe the upside here is limited. I expect CZ to trade down to ~520 range and b/c range bound from there.

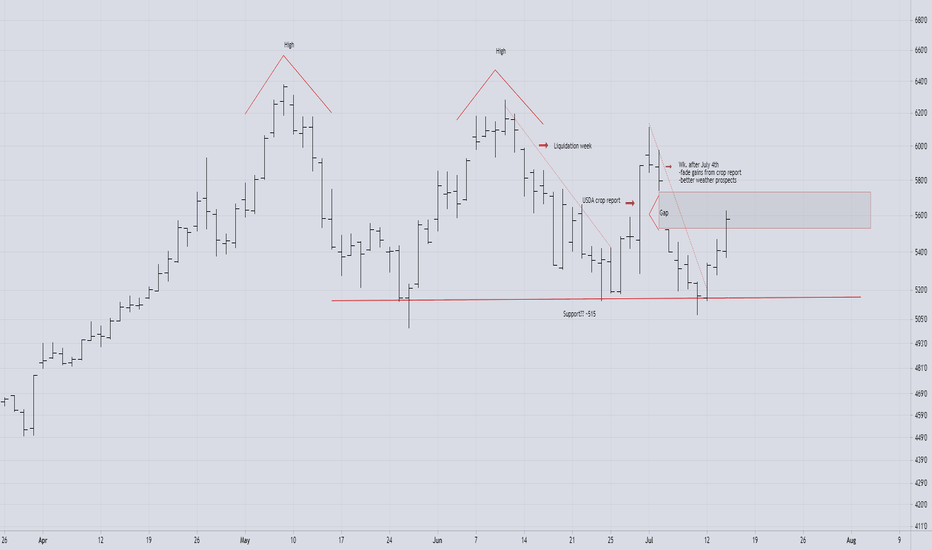

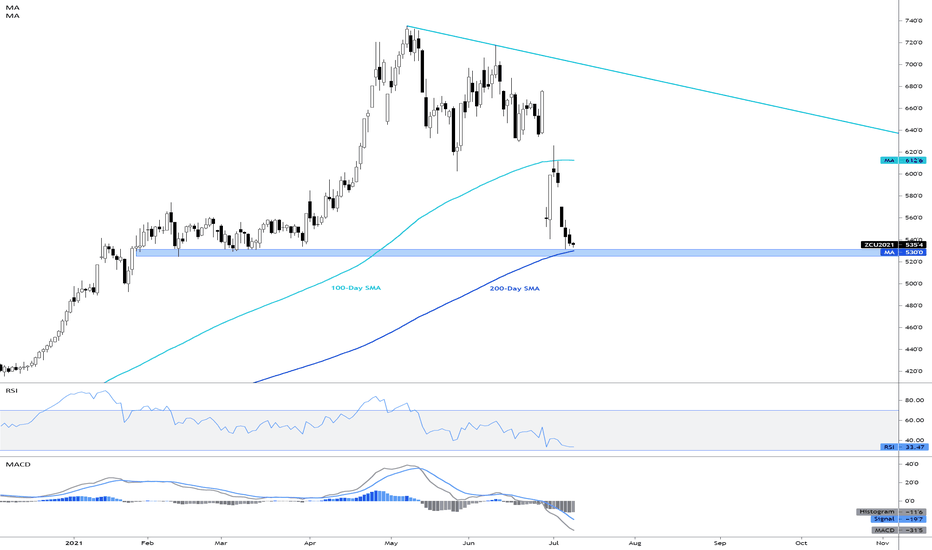

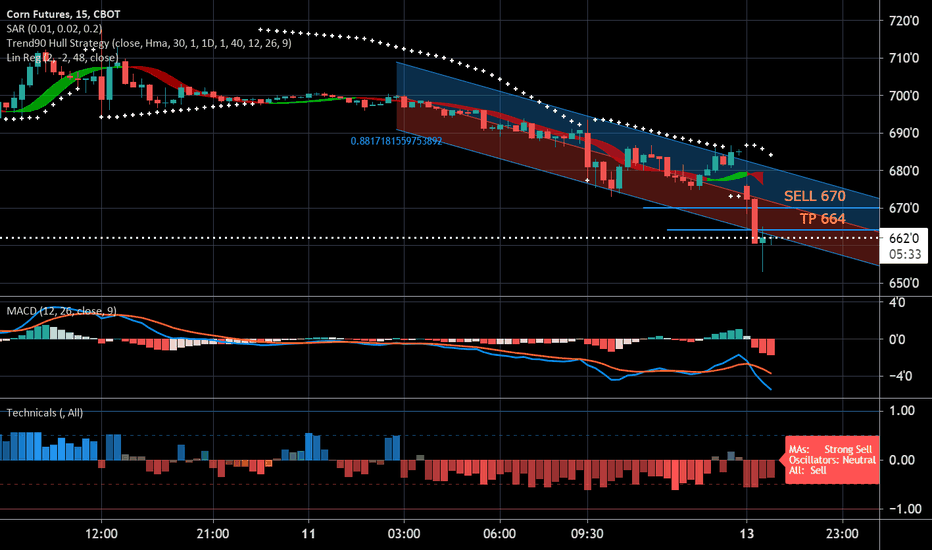

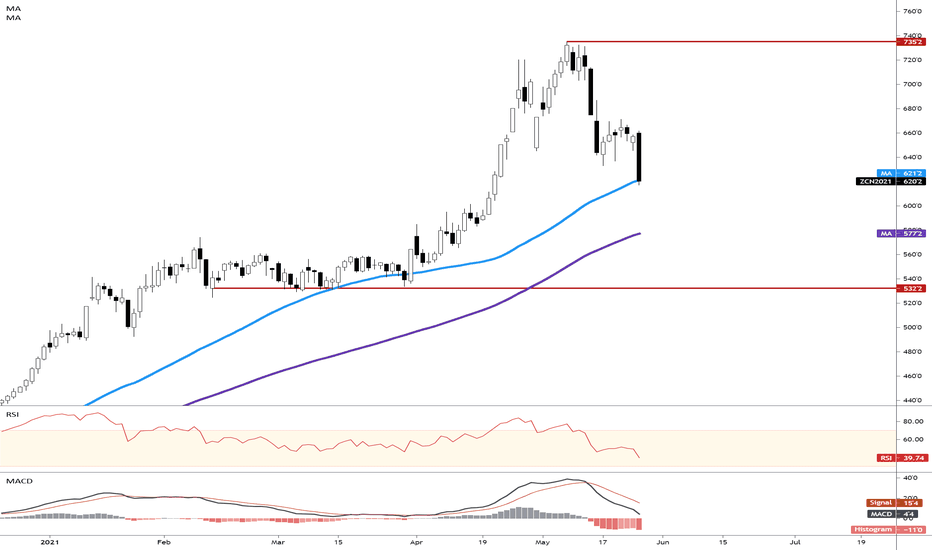

Corn Nears Critical Test - Will Bears Gain More GroundCorn prices are up against the wall after a sharp multi-month drop. The rising 200-day Simple Moving Average (SMA), along with an area of support from January to March trading, may offer bulls a chance to regroup. The MACD and RSI oscillators indicate downward momentum may win out, however. A break lower likely opens the door for further losses.

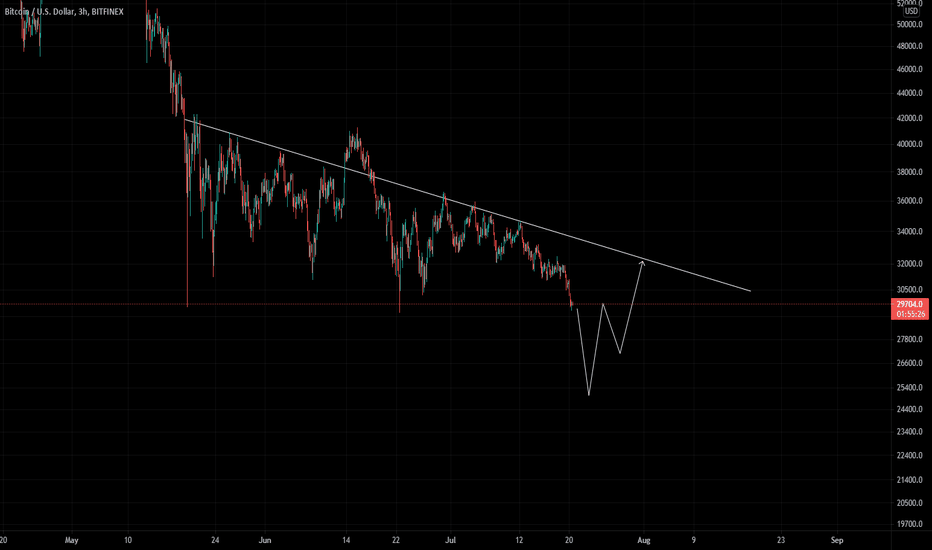

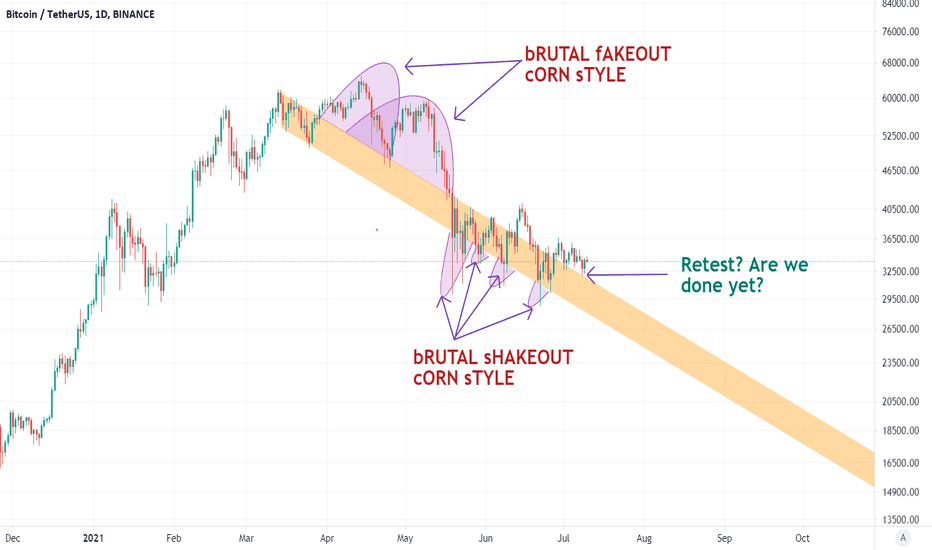

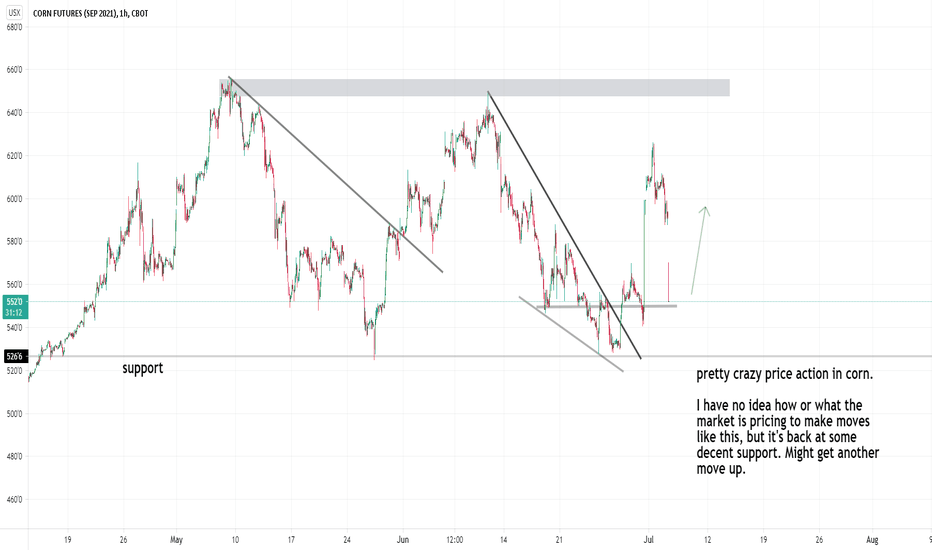

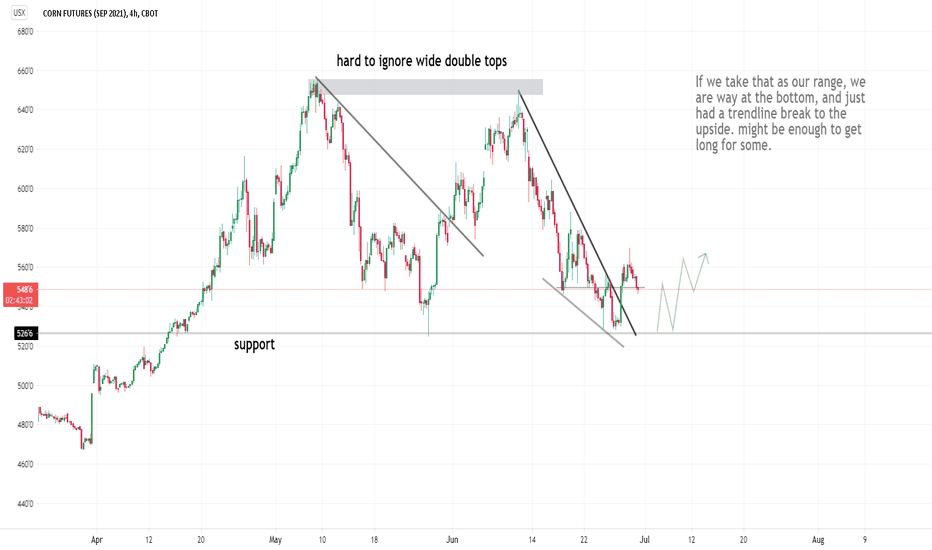

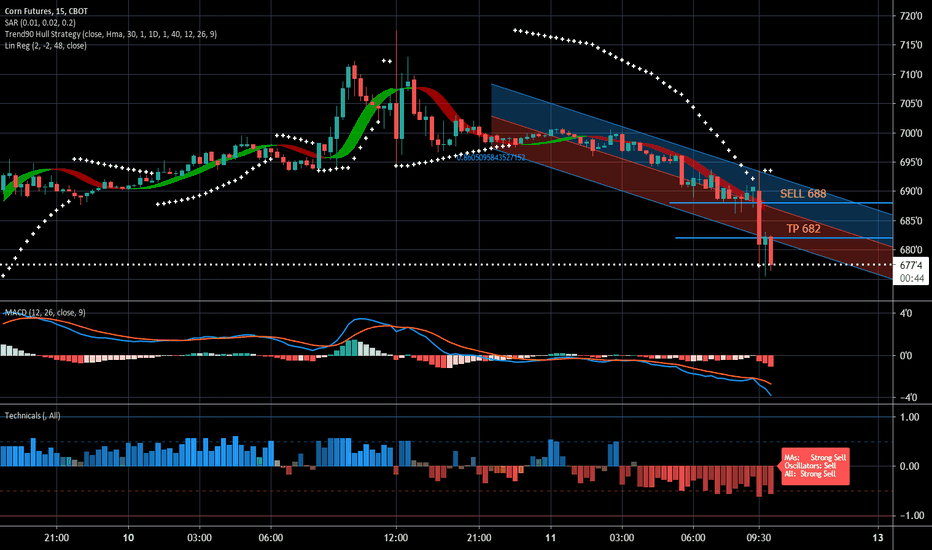

corn experiencing wild movement. back at support.Corn made a scary move upward, and had an equal downward reaction.

Those moves were so volatile I don't know if it means they cancel each other out, or what the deal is, but corn is basically back where it started, which is above a trendline break and low in the range, which is an area for long considerations.

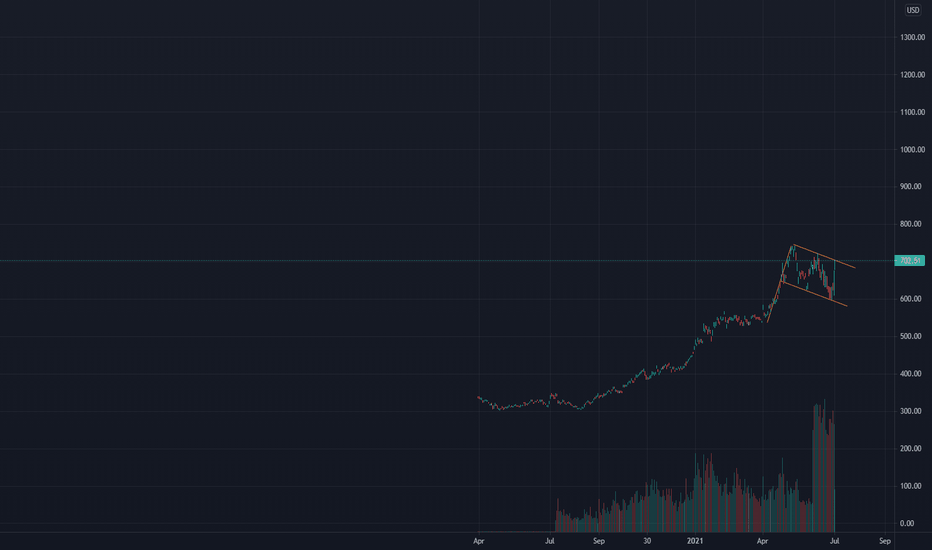

Possible bullflag on Corn cash. Se my related idea. We are in for a lot of volatility in the grain market.

🌽𝘾𝙤𝙧𝙣 𝙛𝙪𝙩𝙪𝙧𝙚 - we buy canned food for the New Year🚜ZC1! : 🕐 2W

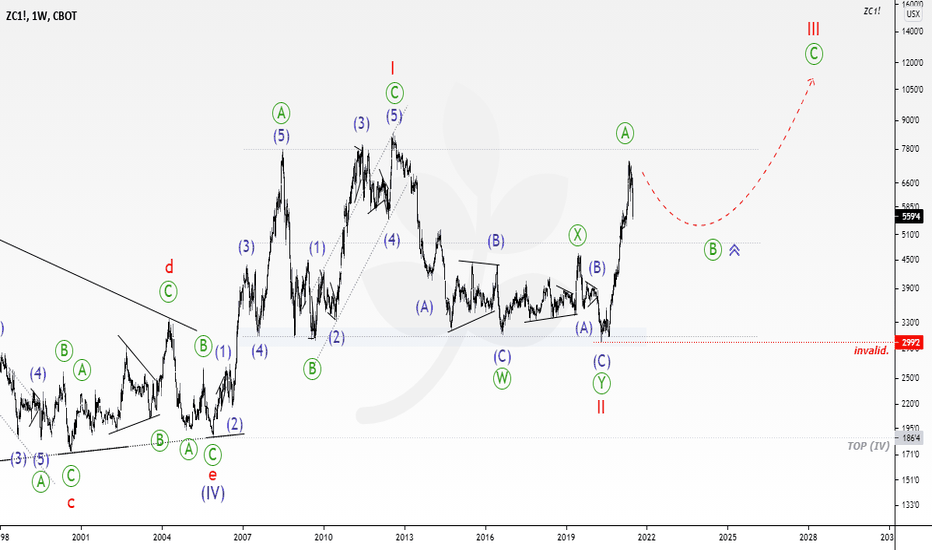

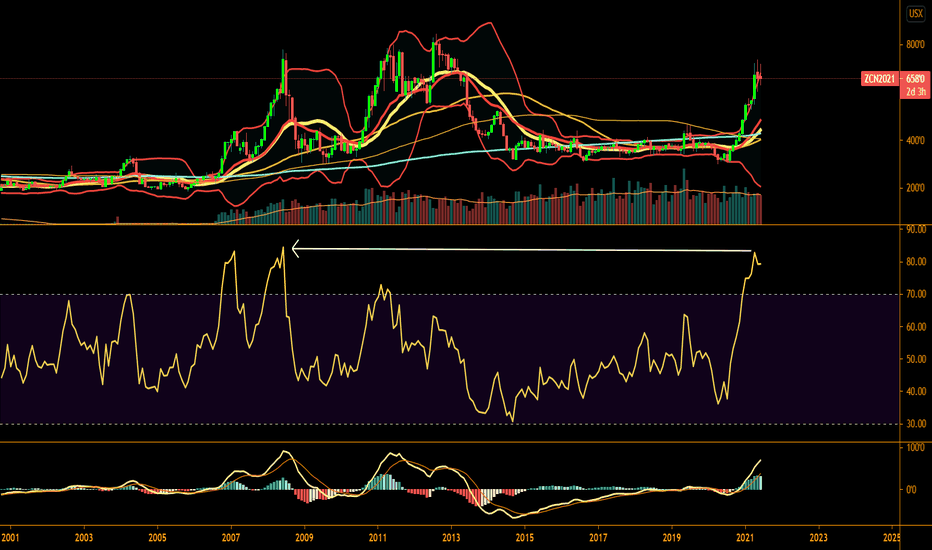

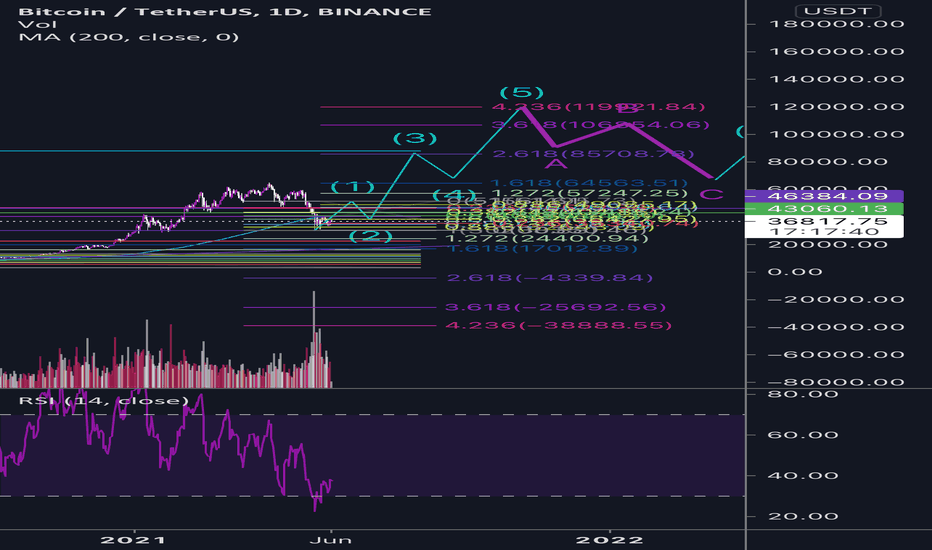

Most likely, wave (V) of the "Supercycle" degree unfolding the ending diagonal I-II-III-IV-V , in which the growth is in wave III .

ZC1! : 🕐 1W

The growth marked with ((A)) is most likely over, although one more local maximum is not excluded. Further, a rollback is expected within the wave ((B)) of III , which has the right to take the form of any corrective pattern.

CORNUSD :🕐 1D

When the correction forms appear, at the completion of the corrective wave ((B)) of III , I plan to take a closer look at a long position on one of the available trading instruments, as well as at companies in the agricultural sector.

The wave marking in the double circle parenthesis corresponds to the green marking in the circle on the chart.

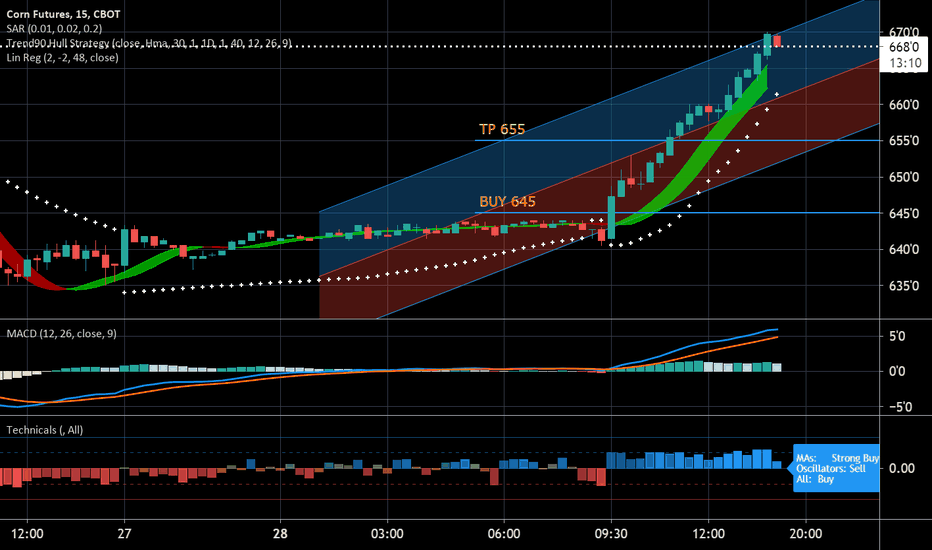

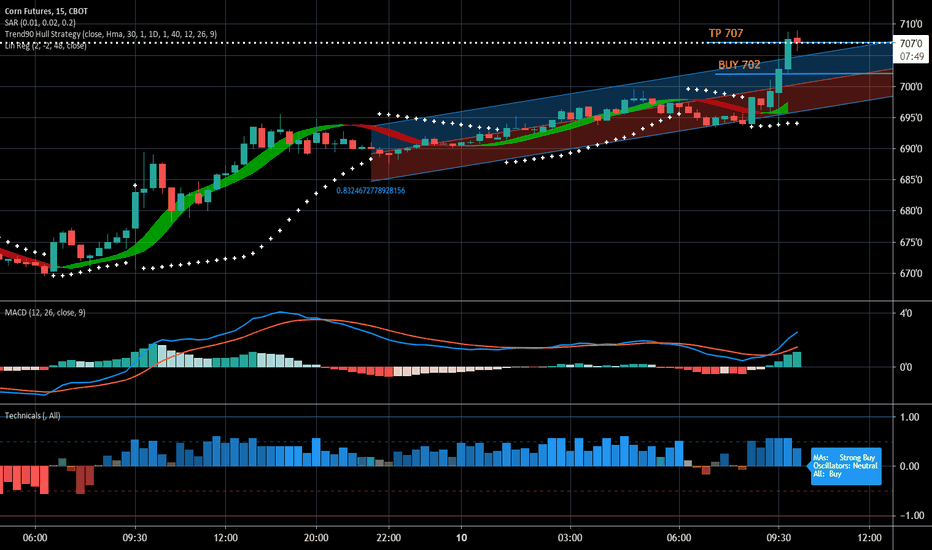

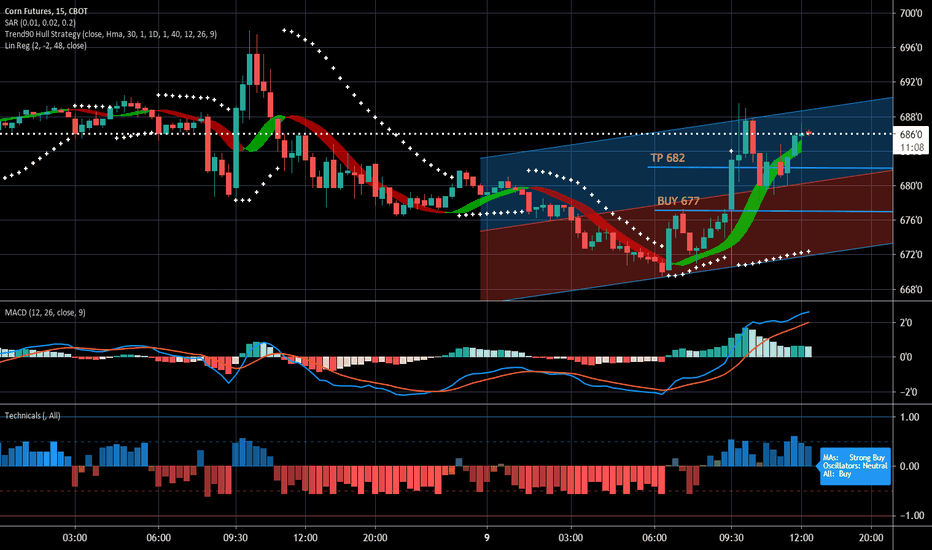

Corn Opening Bell Winner once againOnce again, I love volatility. The 9:30 opening bell is so many times an incredible thing. Look at the huge sideways action all night long and into this morning. I put a buy order in at 645 in case price action goes crazy at the opening bell and it did - straight up through my 30 HMA to my Take Profit of 40 points. Beautiful Monday!!