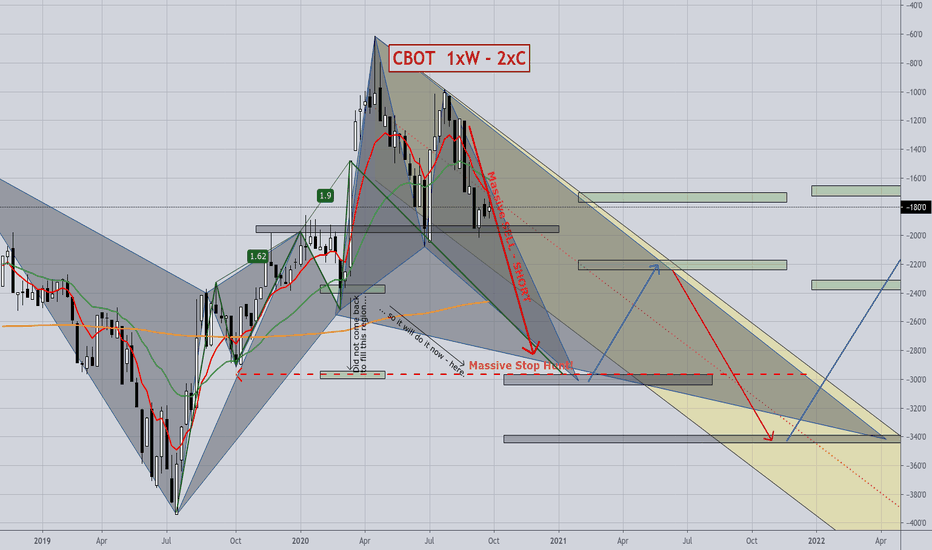

GRAIN SPREADS; Kansas Wheat - CBOT W - 2x Corn; Weekly long termCBOT:KE1! CBOT:ZW1! CBOT:ZC1! CBOT:ZS1!

KE (Kansas City) Wheat - CBOT (World) Wheat

These tend to be extremely reliable signals, indicating long term trends / changes, as Wheat itself has a relatively long (~7 year) cycle. (Wheat growing regions spreading from (north) pole to (south) pole.)

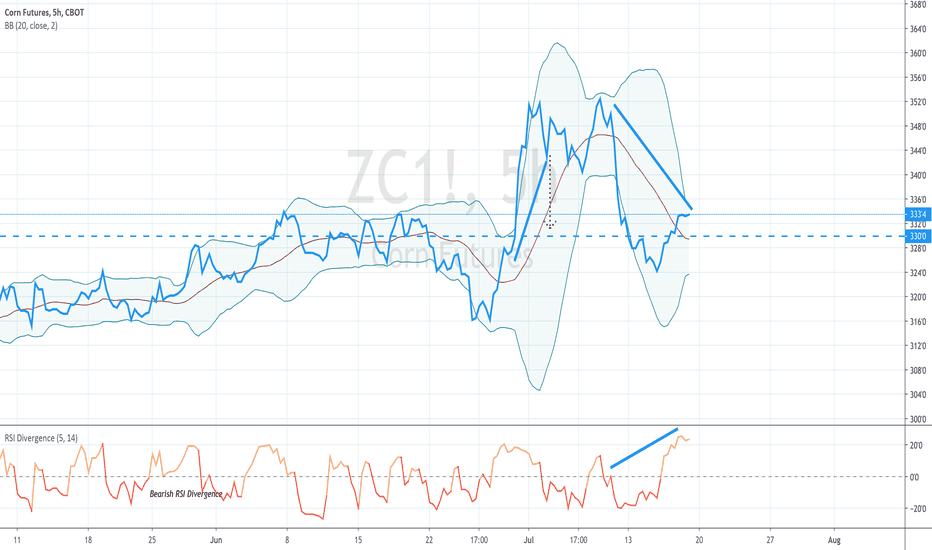

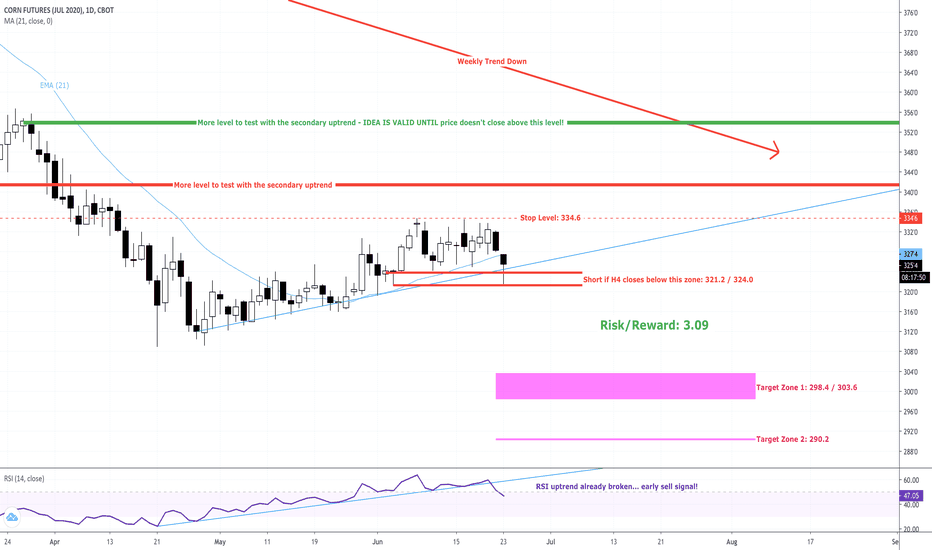

CORN

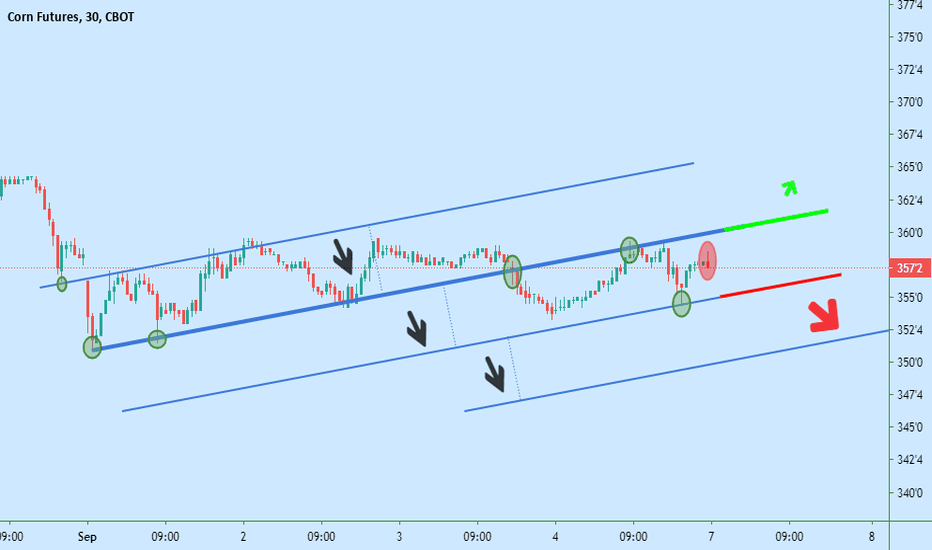

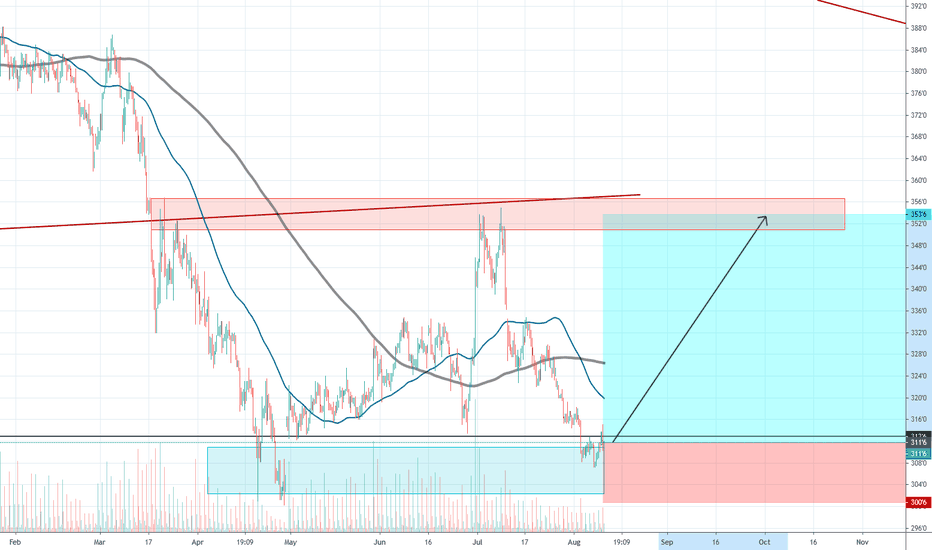

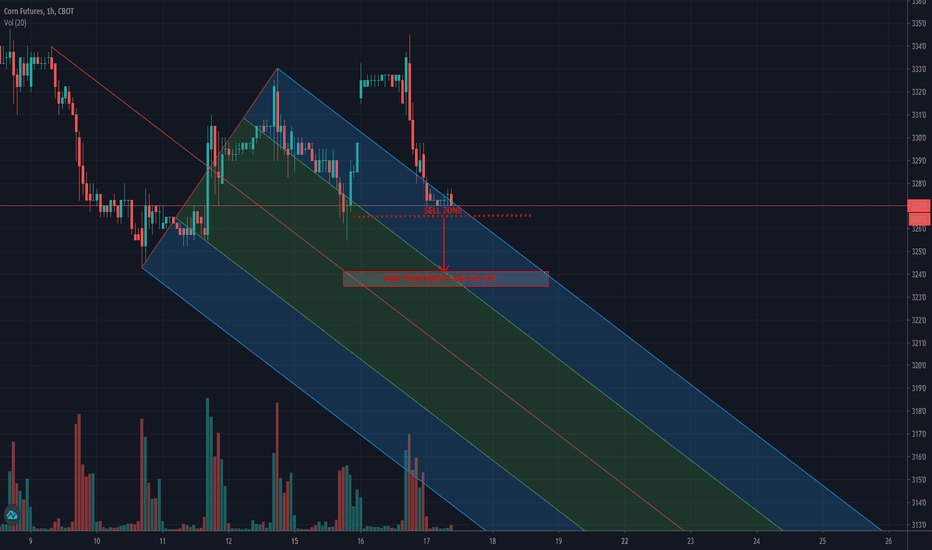

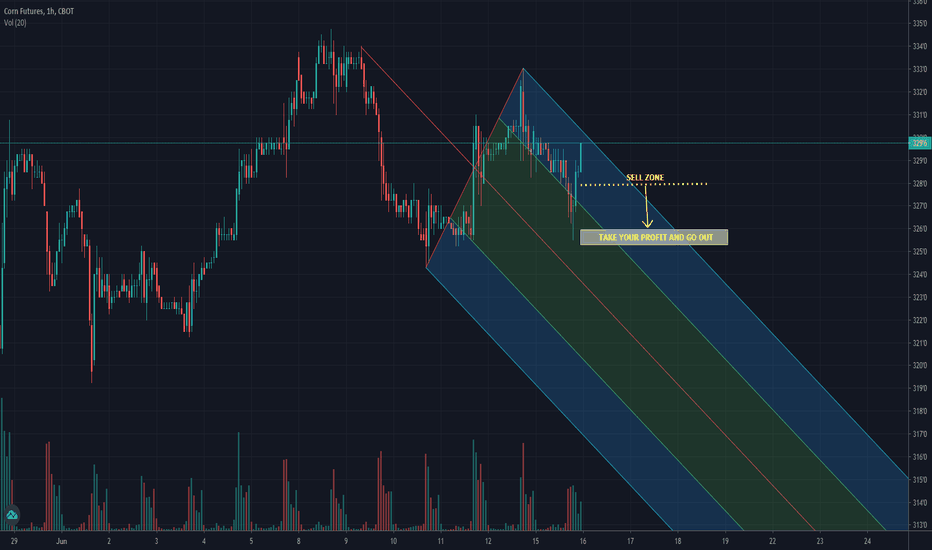

UPTREND SUPPORT SLIDING DOWN - CORN - ZC1! - 30MNWe have seen an up trending line hidden but being actually acting like a super strong resistance line stopping the market to go further up. Shall we see it like a regulated price for the Corn ? Not sure. But this line is clearly sliding and in a very regular way giving us a probability to see it sliding further.

The black arrow are showing the sliding effect.

We have marked with a red line the potential next break. if it breaks, there is a strong probability to see the market going down further to the next blue line down, following the logic of a next level of support from past history data.

We have also market in green a potential break up, as the market decides at the end. But, that point can be seen as a probable good entry for a short position direction. A potential pullback down might occur as the candlestick in the red circle shows a brake in the uptrend. it is a signal. Huge volumes have been stopping the market from going up further.

For the moment we stick to the possible short direction scenario.

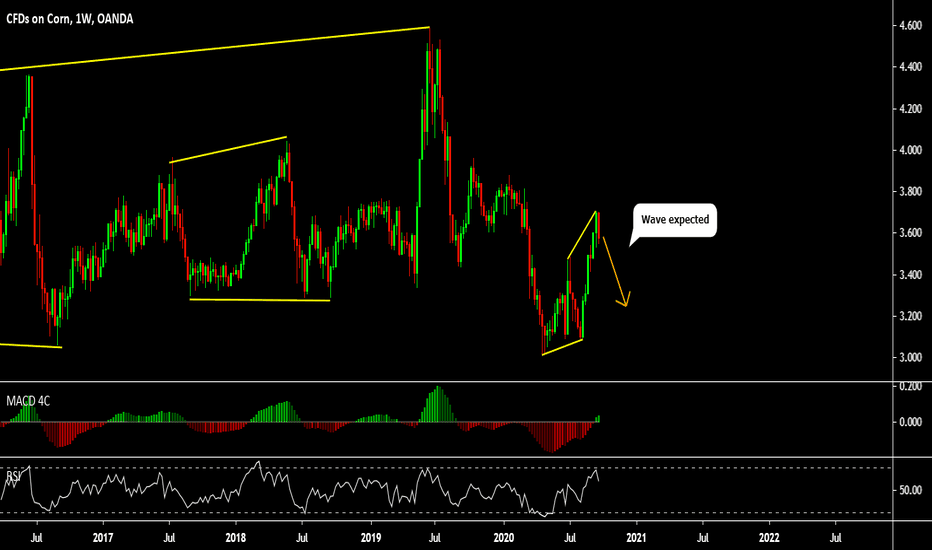

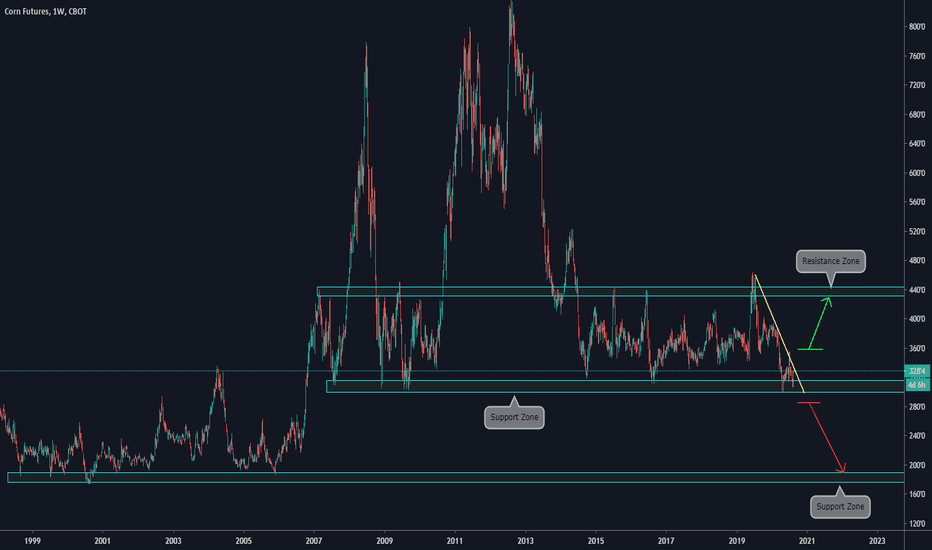

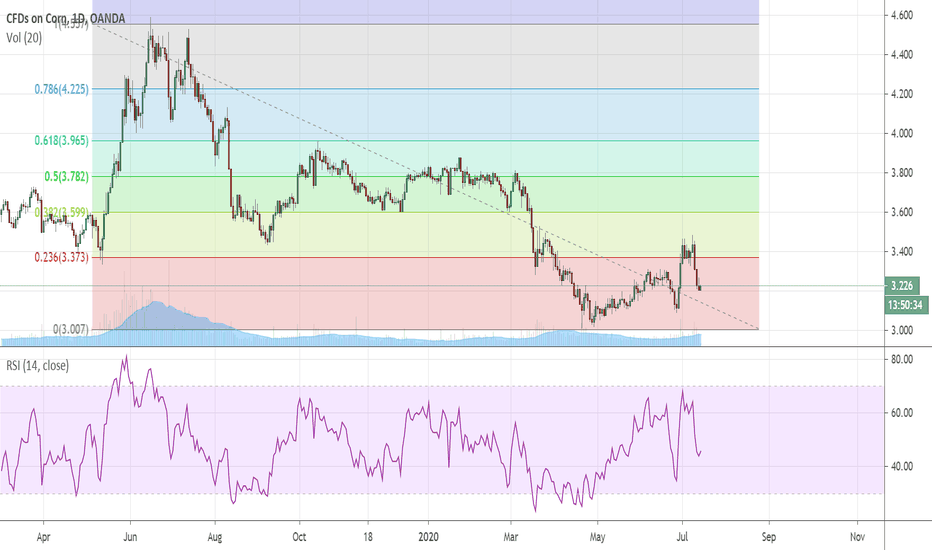

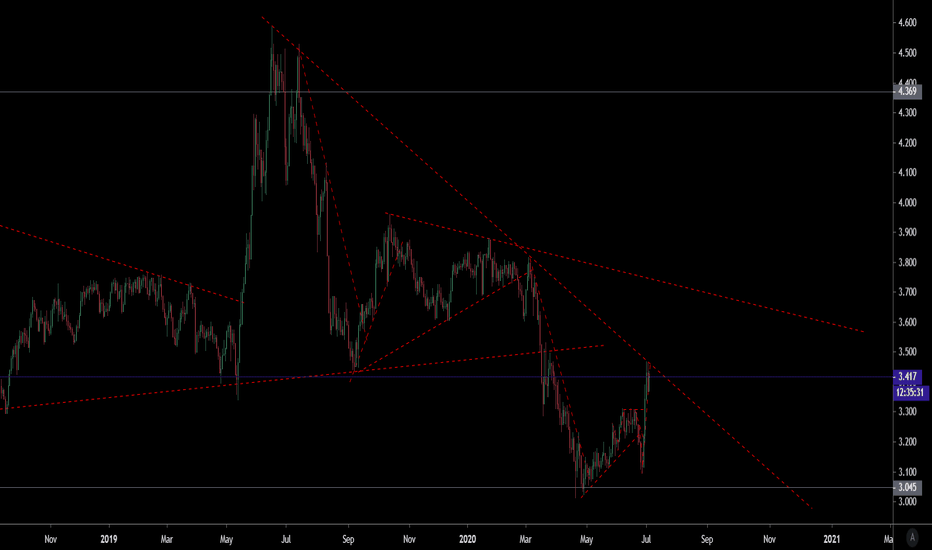

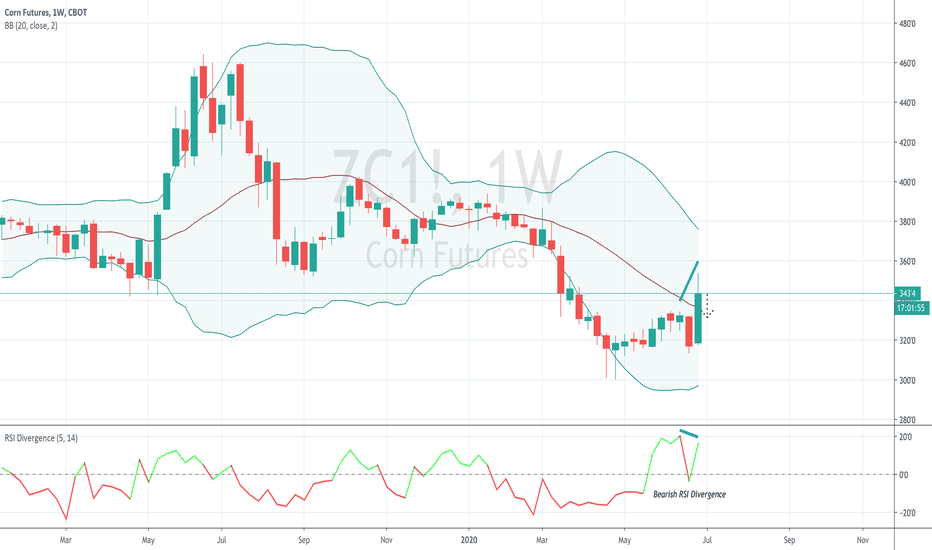

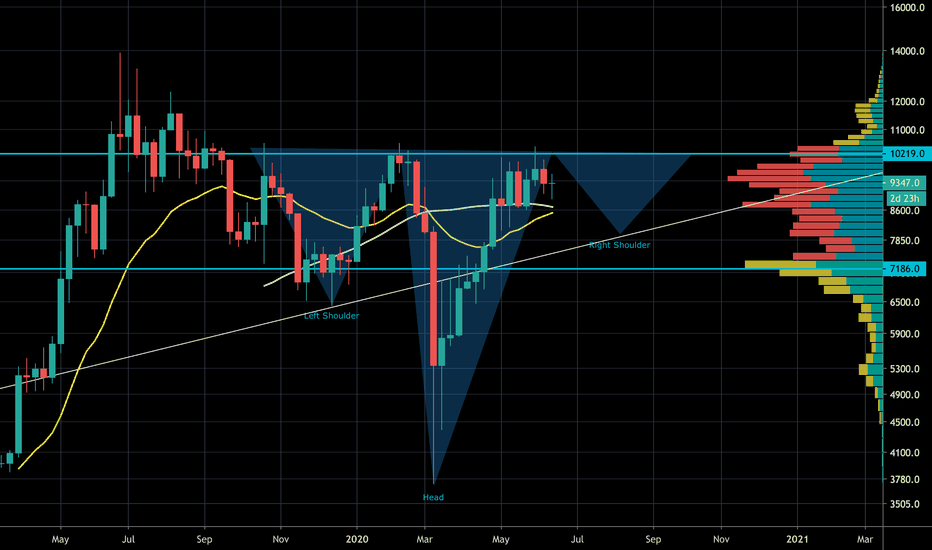

A short and Long view on the Weekly chart - CORN FuturesMain items we can see on the chart:

a) On the weekly chart, we can define 3 clear structures

b) The first structure is the support the price is currently in

c) The other 2 zones are the Targets we have either for the bullish or bearish movement

d) Our Long view will wait for the breakout of the descending trendline (yellow line) and we will expect for a corrective structure on a lower timeframe after that

e) The bearish scenario needs the support zone to be broken and then a corrective structure after that. The main target is the next support zone

f) Both scenarios have good potential in terms of movement

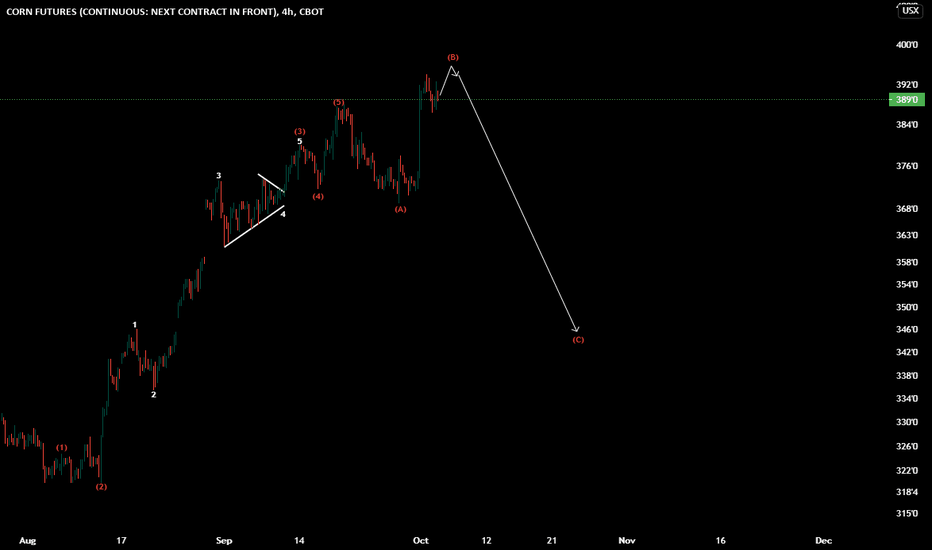

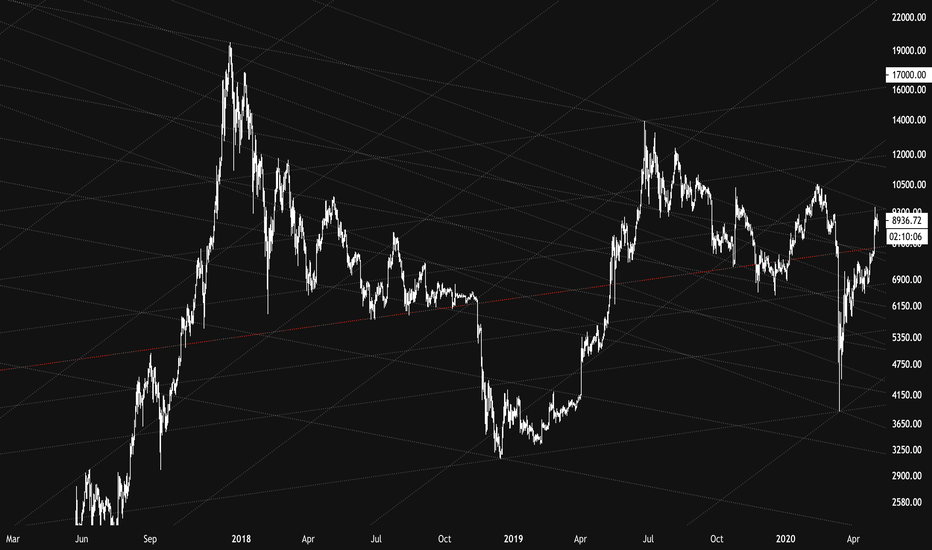

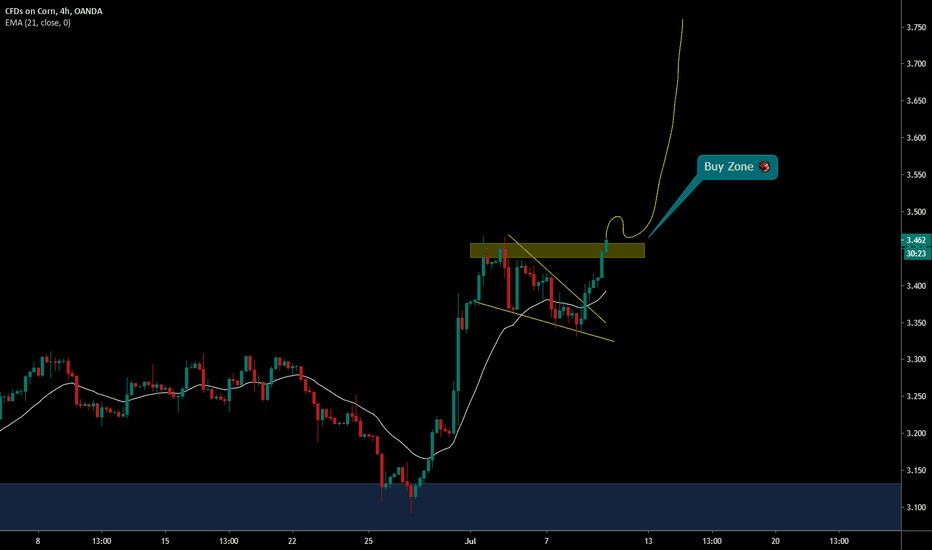

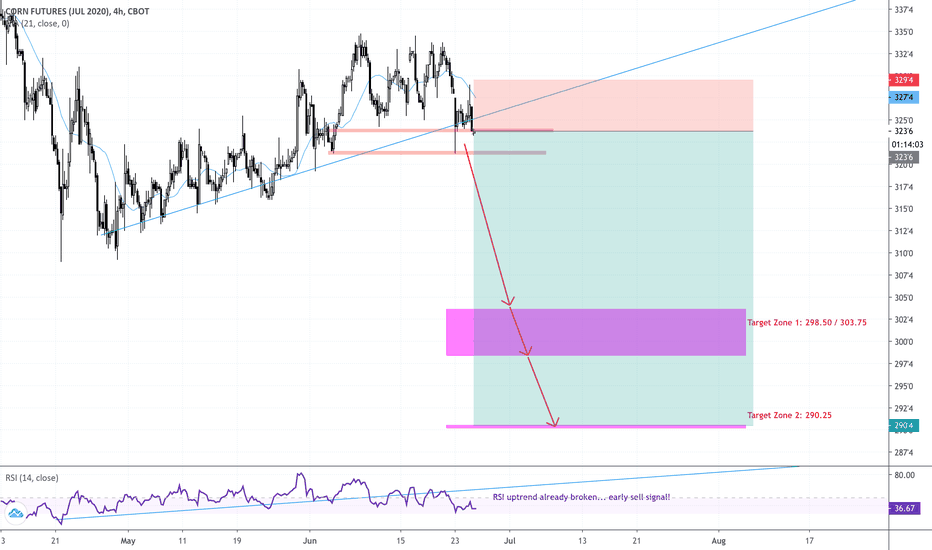

Corn Looking Aneamic - But How Low Is LowWith the breakdown in ethanol needs, general and feed lot demand, corn has suffered immensely. Recent favorable weather has also pushed the shine off the this juicy grain. From a fundamental point of view demand and exports looking to offer more support into later part of year, TA was looking good until recent sell off. The rally on 29th June shows how quickly the buyers can come back to market though. The drop 11th July however, shows how quickly contracts can fall. Overall, looking at 4 hour, long is my preference, given the higher lows, and higher highs since around the 29th April (from each large move not just the candles). That said I am careful of my entry point. For a riskier trade I would buy at today's price around $3.20, but I am also considering a wait and watch approach for a re-visit of $3 based on upcoming news. Fundamentals may produce more favourable yield results, but demand is set to return, and this may bring the buyers back for a snap rally - which is why I will avoid short positions at this multi year lower price point at this time.

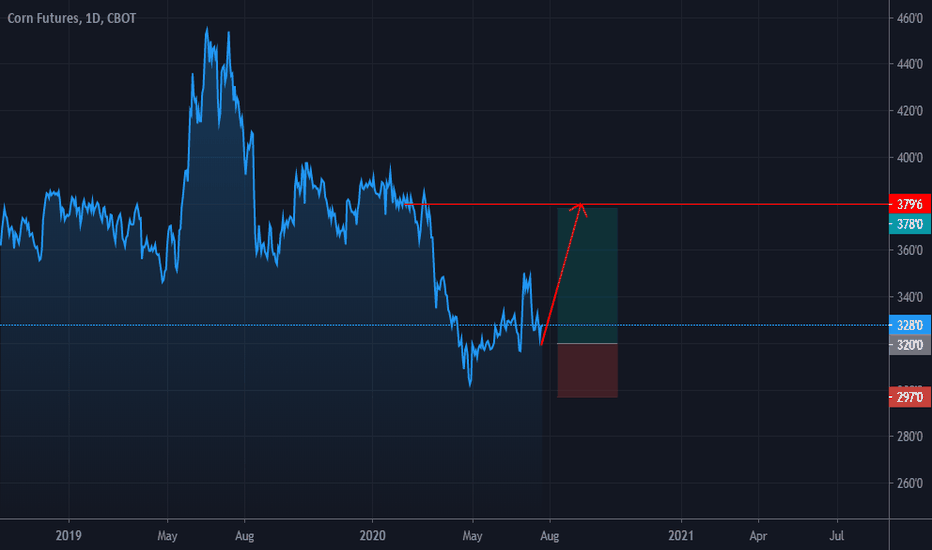

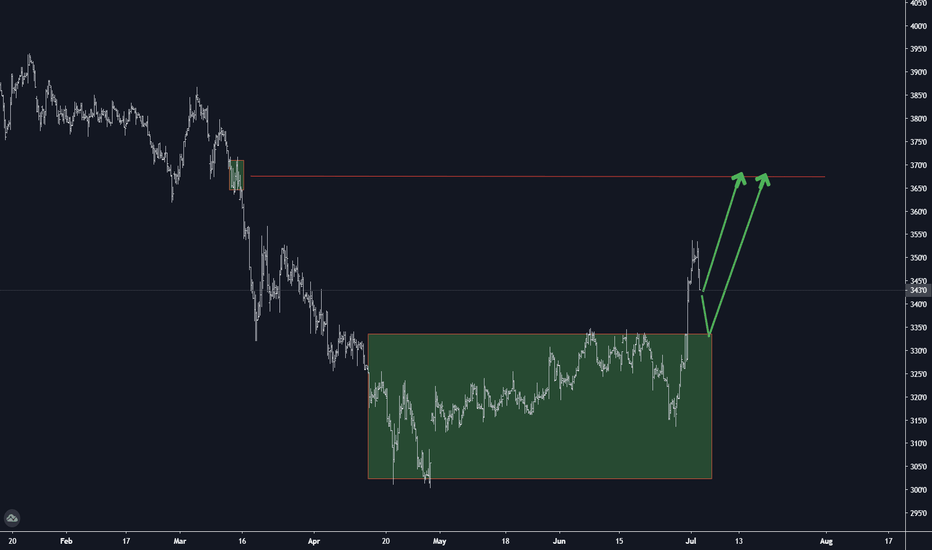

Pop Corn rise 🦐After hitting an extreme support on the weekly chart the price has been moving up in a strong impulse.

Now after creating a falling wedge the market is trying to break above the resistance area for the next impulse up.

If the price will break and close above it we can look at the retest of the structure for a nice long order according with our rules.

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger

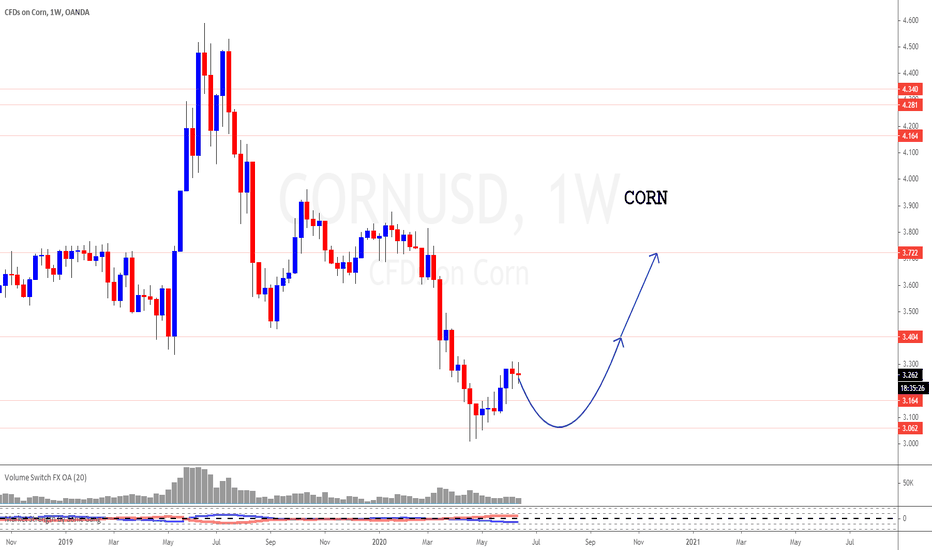

Corn (Central Banks can print money but they can't print food!)View On Corn (19 JUNE 2020)

As the investors focus only on the FANGs, the movement on CORN is pretty dull lately.

We believe it is a blessing in disguise. it is time to get in slow and steady.

Central Banks can print money but they can't print food.

It should go to $3.4 region soon and ultimately $3.72.

Let's see

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

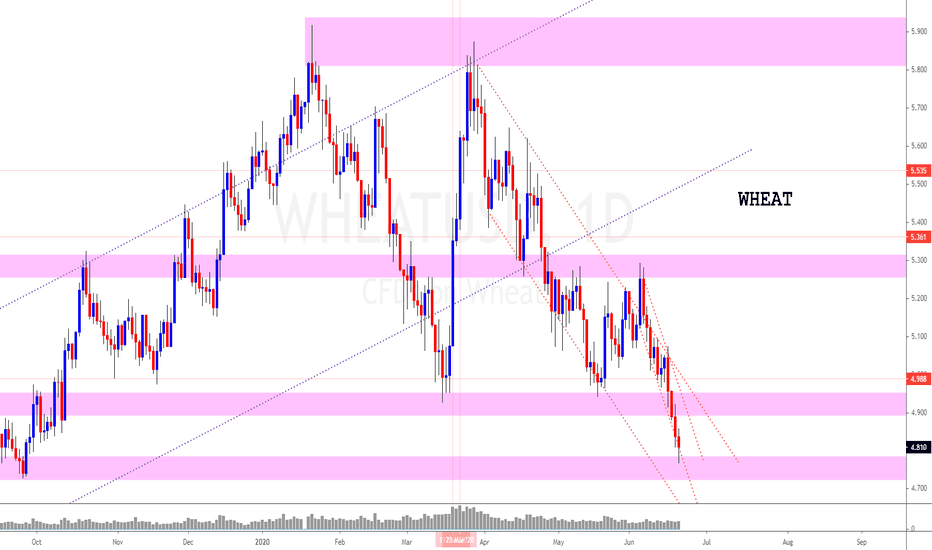

Wheat (“Everyone's a knucklehead at one point or another.”)View On WHEAT (20 JUNE 2020)

Expecting every call/trade analysis to be correct? If you do, you might very well belong to the group that believes unicorns are real.

The previous bullish call didn't work out and it is diving lower for now. It may find some footing near $4.7 region with some decent bullish candle.

Alternatively, you can take a look at CORN too.

Let's see

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

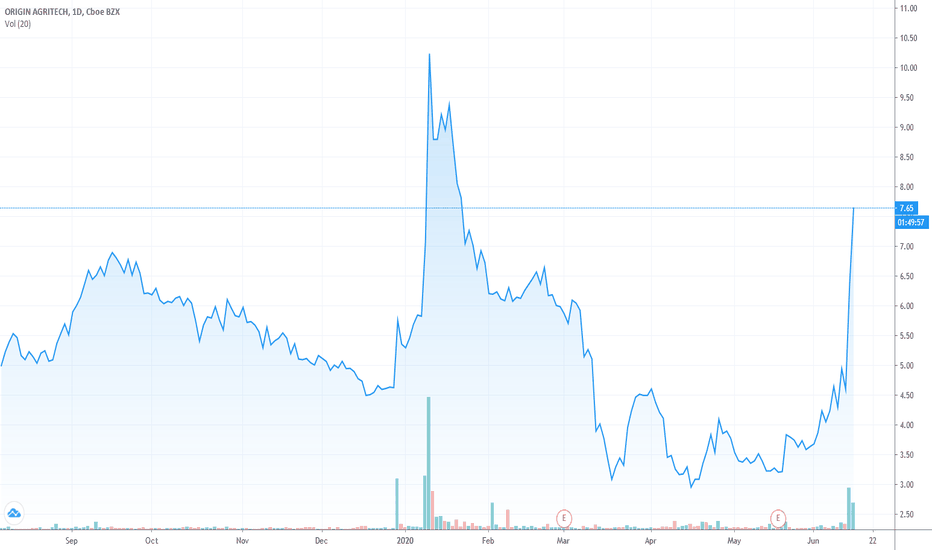

Bullish Charts - Ready to Explode HigherOrigin Agritech Limited, through its subsidiaries, operates an agricultural biotechnology and an e-commerce platform primarily in the People's Republic of China. The company engages in crop seed breeding and genetic improvement activities. It develops, produces, and distributes hybrid crop seeds, as well as hybrid seed technology. The company also operates an e-commerce platform, which delivers agricultural products comprising agricultural seed products, other agricultural inputs, foods, household products, and other consumer products to farmers through online and mobile ordering. Origin Agritech Limited was founded in 1997 and is headquartered in Beijing, China.

From the looks of what I read, SEED is could have approval any day to start growing its biotech corn in China.

Looking for a pop soon.

Target - $9.00 to $10

Long

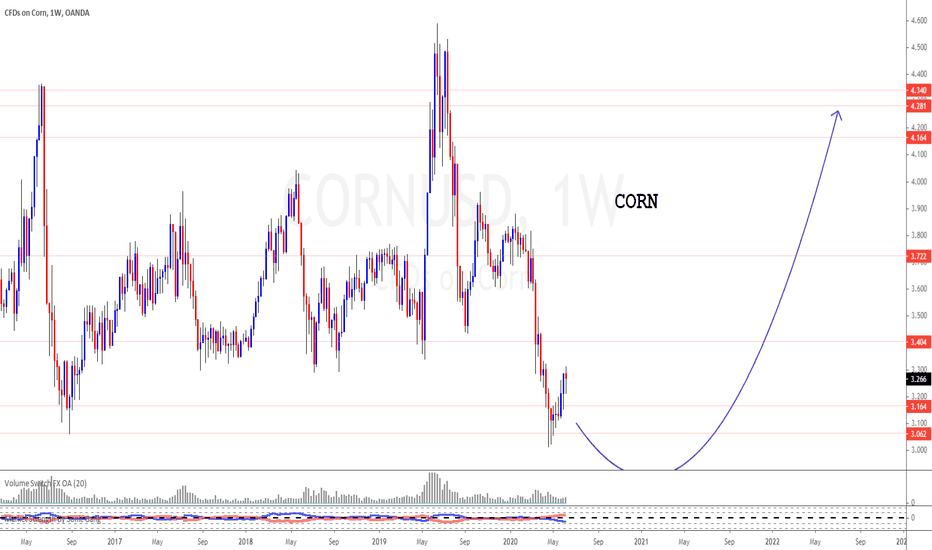

CORN (Every big thing has a small beginning!)View On Corn (10 JUNE 2020)

After all these years of trading/investing, we realize that good traders/investors possess a good grasp of these two things.

They are, Knowing what is going on in the market right now and knowing what is coming up next.

The price of corn has been bouncing around the range since 2008 and now it is at the lower band of that range.

In Addition, due to the global geopolitical situation around the world, we are witnessing the major disruption of worldwide economic mechanisms, and expecting the basic soft commodities price shall skyrocket in the near future.

That's why we are going to position ourselves on the very potential upside of CORN. This set up may or may not work out.

The move up may take some time but it should unfold soon. Every big thing has a small beginning

Let's see

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.