CORN

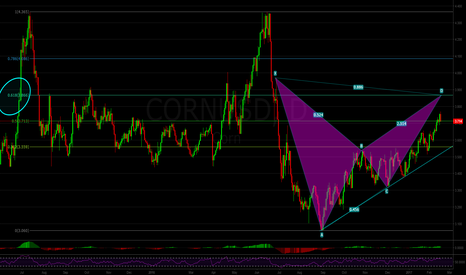

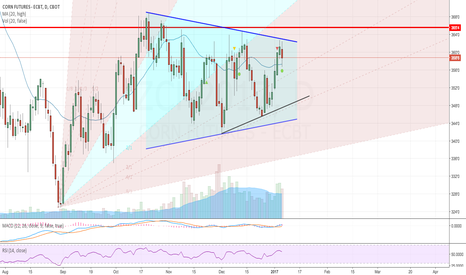

Buying Corn @ the Bat @ Trendline; Aiming for the Bearish BatI wanted to show the longer term view. Corn has been bullish but I have patiently been waiting to short at the large bearish bat/2618 trade set-up (linked below).

However if you zoom in you can see the potential buy set-up near the trendline based on 2 different bullish Bat patterns (yellow and pink). I will be watching price action near their completion points to choose which to take. I will move stops to B.E at TP1 of the pattern I choose and will likely choose to aim for the entry of the bearish Bat which would make a great long trade.

(Note: the bearish Cypher (blue) is only valid if the bat patterns do not complete!)

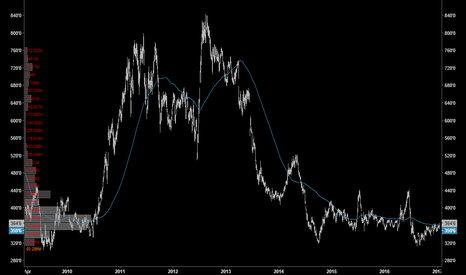

Update on Corn Futures: retrace, then next leg upThis is a follow up on this forecast:

Still bullish on Corn, after a surge up price retraced.

At this moment Corn is still in that retrace, but expect the next leg up soon.

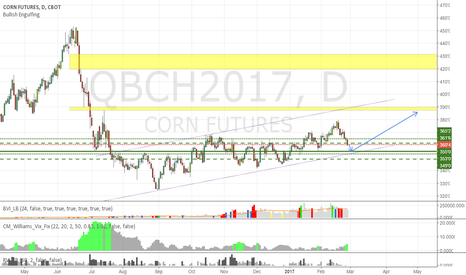

CBoT corn dailyThe daily MAY17 chart shows that price has been under influence of a solid horizontal resistance line at around the 375 level since October 2016. Price managed to break same resistance on February 7 from where price traded up to 385 until price made a reverse and started trading down towards same 375 level which now serves as support. During the last 2 sessions of last week price actually pierced through same supportive value. However, the green triangle that has been put into chart represents a strong supportive zone which comes from the horizontal trend line at around the 375 level and the ascending trend line which represents the lower boundary of the ascending price channel.

Friday’s candle in the shape of a so-called ‘Hammer’ suggests that the end of the decline of the past 6 sessions is now imminent and that price will find a bottom here. We will allow price one or two more down sessions towards the 363 level before we will consider an alternative short term outlook for this price.

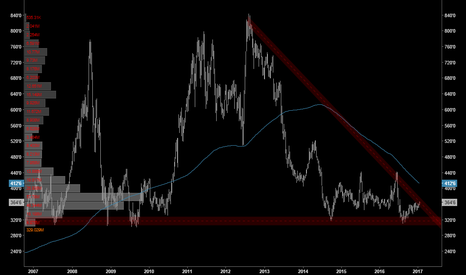

CBoT corn weeklyThe weekly continuation chart shows a very solid bottom at around 320 and an equally very solid top at around 440. Price has been trading sideways between these values since June 2014 and these values are relevant for us to keep in our minds.

From August 2016 on price gradually moved higher from its solid long term supportive level, gradually making higher highs and higher lows.

Within the 320/440 trading range there is a trending ascending channel that starts in August 2016 at 320 and gradually moves up. The ascending resistance of this trending price channel is at around 395 for the coming week and its ascending support is at 360 for the coming week. These supportive and resistance lines are to be kept in mind when looking at the price for the medium/long term. Until proven the contrary we have to assume that price will continue developing within this ascending price channel. Price could well make one more move down for the week to come but we keep our target at the upper boundaries of the ascending channel.

Forecast Corn Futures: Move up 385This is an update on a earlier forecast on corn futures.

The analysis remains the same: expect a move up to 385, then a retrace.

RICE IS A POTENTIAL HIGH REWARD BUY TRADETrendline broken, and market formed a textbook flag above the broken line.

For me a textbook buy signal is forming here.

If you like to take a little bit more risk like me, buy here at 975 and place your stop at 957.

Target would be the longterm trendline at 1060.

This would result in a nice 5:1 Risk:Reward trade.

If your looking for a more conservative approach wait for the flag to break and enter on the break.

Expect Corn to run up in the coming weeksExpect Corn (Futures) to run up between January and March 2017.

March CornMarch Corn is creating a bullish flag today suggesting higher prices. Would be careful on this one as more chop would be in the offing for grains before Thursday's report. Next potential high is 366, 88.6% of the XA leg. If bulls can push it higher then the top of this market at 369. If the report on Thursday is bullish then the completion of the Butterfly at 372'4 and possible extension around 380 level.

March CornMarch Corn still sees horizontal movement with creep upwards. Thursday is the USDA report for all grains, but the 2016 crop is still impacting this market. If USDA report shows a lowering of future crops, this may help corn. Also Funds may buy this week so support levels around 354'2 off the 3/1 Gann Fan may hold. If prices fall further look for 349 4/1 Gann Fan as next support.