Agricultural Commodities Ripping! Food Prices to Rise in 2021!Ending my posts of major themes to look for in 2021, I want to end with the agricultural commodities. Particularly Corn, Wheat and Soybeans. The agricultural commodities are some of my favorite assets to trade, and I do not think many people pay too much attention to them. I focus on the three mentioned above, but you can also trade sugar, coffee, cocoa, orange juice (yes seriously), cattle, hogs, and pork bellies to name a few more.

Let me give you a quick run down on the ag commodities.

Corn is the most traded agricultural commodity, and is an important food source for both humans and animals. What makes Corn important is that it can be grown in a variety of climates and conditions, unlike the other agricultural commodities. Other uses include starches, corn oil and fuel ethanol. According to my handy dandy commodity handbook, approximately 35 million hectares are used exclusively for corn production world wide.

Just as Oil has different qualities (Brent, West Texas, Canadian West etc), Corn does as well. There are different grades but the most important are high grade number 2 corn and number 3 yellow corn.

The futures ticker for corn contracts is ZC. The top 5 producers of Corn in the world are: The United States, China, Brazil, Mexico and India (Canada makes it in 9th place).

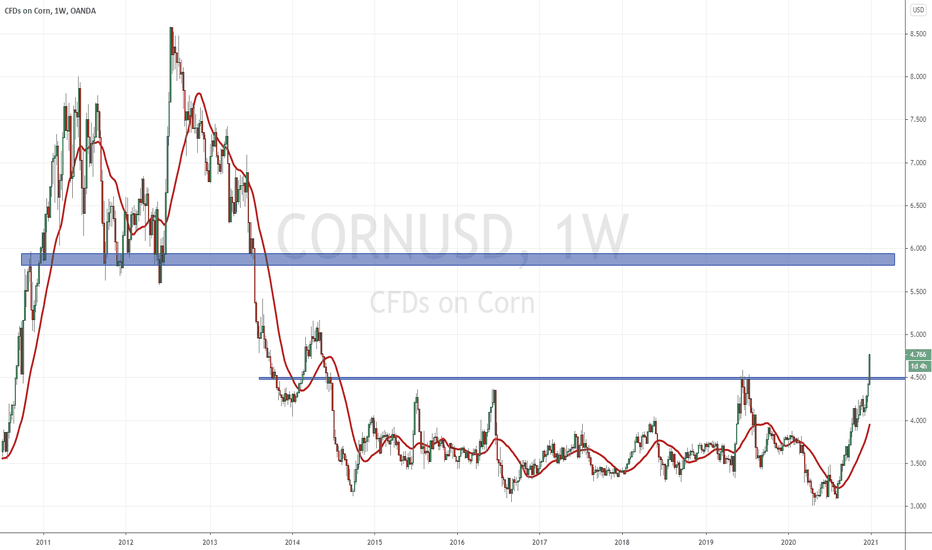

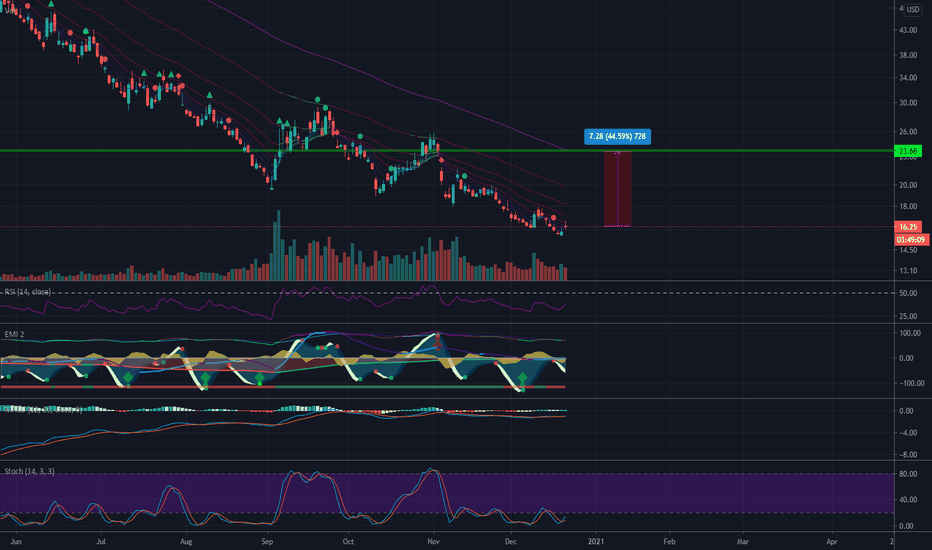

Corn has had an amazing run since June. We will get to the why when at the end of this post, but pay attention to the commodity charts. These are all going to be LONG term weekly charts. You can see that Corn is breaking out, and in fact, will confirm a breakout with this weeks close, which occurs today. Lot of room higher to go in 2021. The breakout zone will be our support, and as long as we remain above, Corn moves higher.

Wheat is the second most produced agricultural commodity. Rice comes in at third for those that are interested. No country necessarily dominates wheat production a la Saudi Arabia with Oil and Kazakhstan with Uranium.

China, India, Russia, the United States, and France produce the most wheat in the millions of tons. Canada, Australia, Germany, Pakistan, and Ukraine also boast significant production.

The future contract ticker for Wheat is ZW.

Wheat on the weekly is setting up to breakout. Just like Corn, we would confirm a breakout on the weekly chart by the end of today.

Finally, Soybeans. Perhaps the more ‘mainstream’ financial media agricultural commodity that has seen plenty of coverage due to the US-China trade deal. Part of the phase 1 deal was for China to increase their purchases of US Soybeans.

I am focusing on the the whole soybean, but most soybeans are used for soybean oil and soybean meal.

The United States dominates the Soybean market, composing 50% of the total global production. Brazil comes in second at around 20%. Many analysts predicted Brazil to be the big winner in a US-China trade war spat, as China could look to Brazil for more Soybean exports.

The futures contract for Soybeans is ZS. Let’s take a look at the other traded forms of soybeans which have their own futures ticker.

Soybean Oil is a vegetable oil and is one of the most used culinary oil in the world. Soybean Oil is also popular as a biodiesel. Believe it or not, but there are cars that have engines which can convert from regular diesel to Soybean Oil during production. They are known as ‘frybrids’. The futures ticker for Soybean Oil is ZL.

Soybean Meal is a quick one. Whatever is left from the extraction of Soybeans into Soybean Oil can be converted into Soybean Meal. This is used for high-protein, high-energy food for feedstock for cattle, hogs, and poultry. The futures contract for Soybean Meal is ZM.

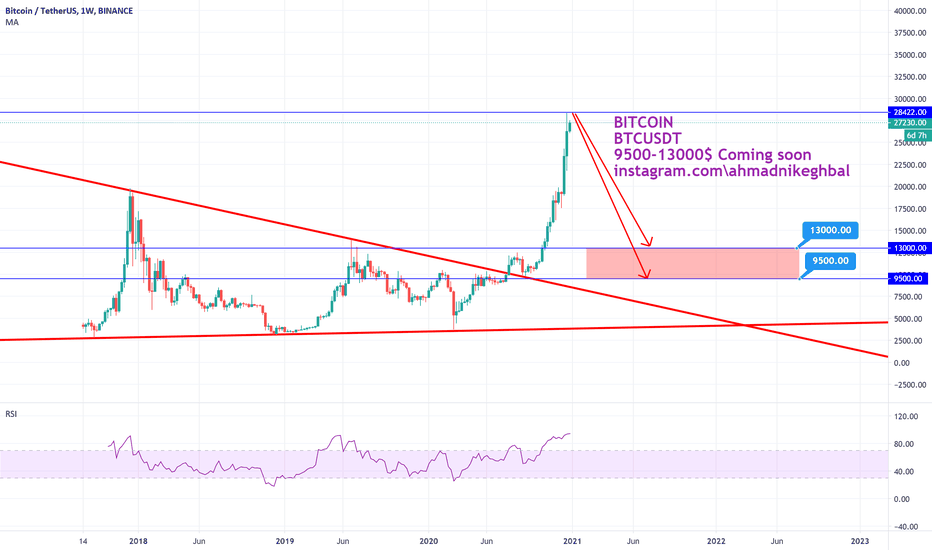

Soybeans have been ripping in 2020. Again, China demand and the US-China Trade war headlines play a large part, but there was some other factors which we will discuss soon. Just like Corn and Wheat, Soybeans is set to confirm yet another breakout with a weekly candle close today.

The agricultural commodities do not get the attention they deserve, and as you can see, they have made huge moves. For traders, they present a great trade opportunity due to the volatility, but also add on some more risk. Consider at least watching them if you do not want to trade them.

M readers know I am extremely bullish on the agricultural commodities and agriculture in general. Jim Rogers is the one who got me excited about this sector. His argument is that most young people do not want to become farmers anymore, and that the average age of farmers is well above 60. Governments may need to create larger incentives to get young people to take up farming.

I see some issues and challenges for agriculture, but will be rectified by human ingenuity. The first issue is soil. A lot of soil sucks due to the pesticides and other chemicals we use. If the soil is not great, the crop will not have the full dose of nutrients and could lead to health issues down the road. As many of you are aware, the organic food movement is a huge trend, and will grow year by year. Soil replenishment will be big. I have head some things in the past about zinc being used to replenish soil, particularly in California. Phosphorus and Potash also come in mind. In fact, some foresee a phosphorus faming crisis.

A big issue for farming has been climate change. Obviously farming is cyclical. Winter has been lingering longer, especially on the East Coast. Farmers tend to await for certain birds to return to let them know Spring is here and it is time to plant crops. But Spring has been coming later while Winter lingers longer. Climate change will continue to disrupt agriculture and this could lead to a shortage of crops.

In fact, this is the primary reason for the spike in Corn and Soybeans this year. Iowa is where the majority of these crops are grown in the US. Millions of acres were destroyed due to the storm in Iowa in August. This has led to spikes in agricultural commodities, and some say, points to a food crisis in 2021.

Finally, something not many people consider are the ramifications of green energy. This info I learned from Peter Zeihan’s book, “Disunited Nations“. Highly recommended for anyone with an interest in geopolitics and where the world is going in the future.

Green energy is coming. We all know it. Governments will be spending a lot for green infrastructure. Due to the fiscal policy required to combat covid, taxes need to go up. The best way is through green taxes because they know the people will not complain. Government will say these taxes are going to be used for green infrastructure which will aid in an economic recovery and creating jobs.

The issue, as Mr. Zeihan states, is that solar panels and wind turbines need to be put in areas that are very sunny and/or windy. These areas tend to be where the best agricultural land is situated. So nations would have to sacrifice agriculture for energy. In his book, Zeihan states that there only a few nations which can come out as winners in this predicament. China is not one of them.

Do not panic, a lot of these issues can be remedied. In house and Greenhouse farming can be a way to cope with the effects of climate change and unpredictable weather patterns. Vertical integrated farming can be a solution to allow for green energy infrastructure to be built in the best agriculture lands, and can also be a solution for nations that do not have much agricultural lands. So yes there will be issues, but human ingenuity will get us through it. The question is how long will it take?

I want to end of with Covid. It seems we are setting up for a food crisis next year. Tons of articles about supply chain disruptions due to covid and worsening food insecurity for many nations. If this winter turns out to be a dark winter due to covid cases, the likelihood of empty shelves increases.

A lot of this could also have an impact on the prices of agricultural commodities. Canada is already preparing for this. In Canada’s Food Price Report 2021, bread, meat and vegetable prices are set to rise between 3-5% in 2021. The average Canadian family will pay up to $700 more for food in 2021.

The agricultural charts are pointing to higher food prices. Covid and Climate will have impacts, and hence why I am bullish on this sector going forward.

Coronavirus (COVID-19)

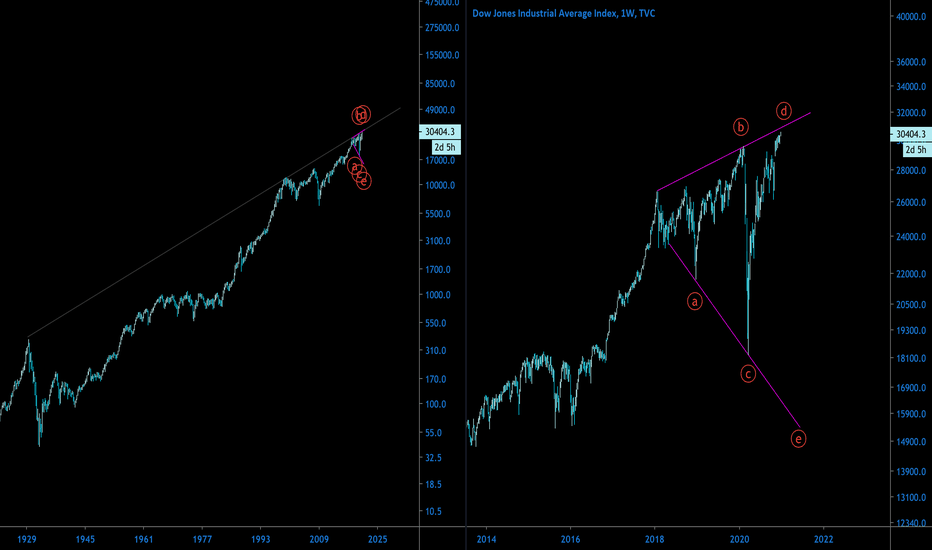

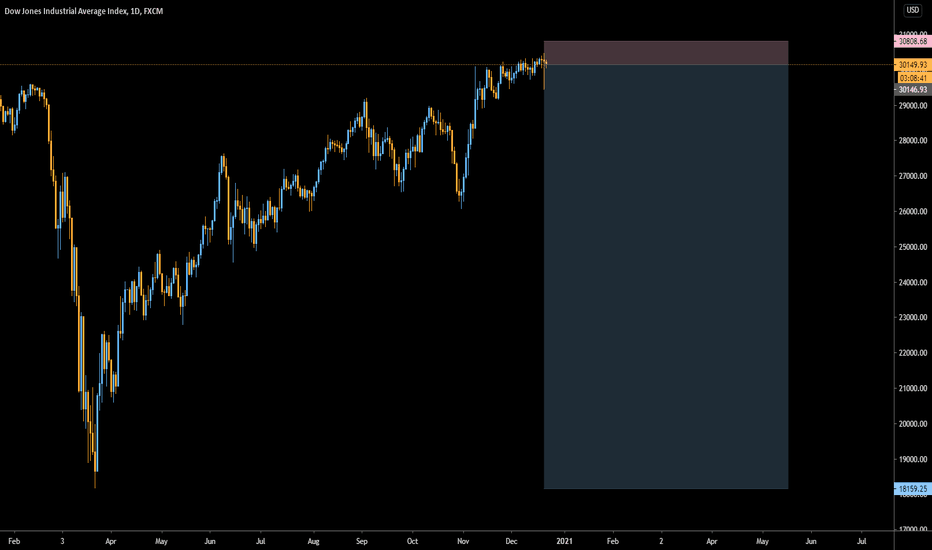

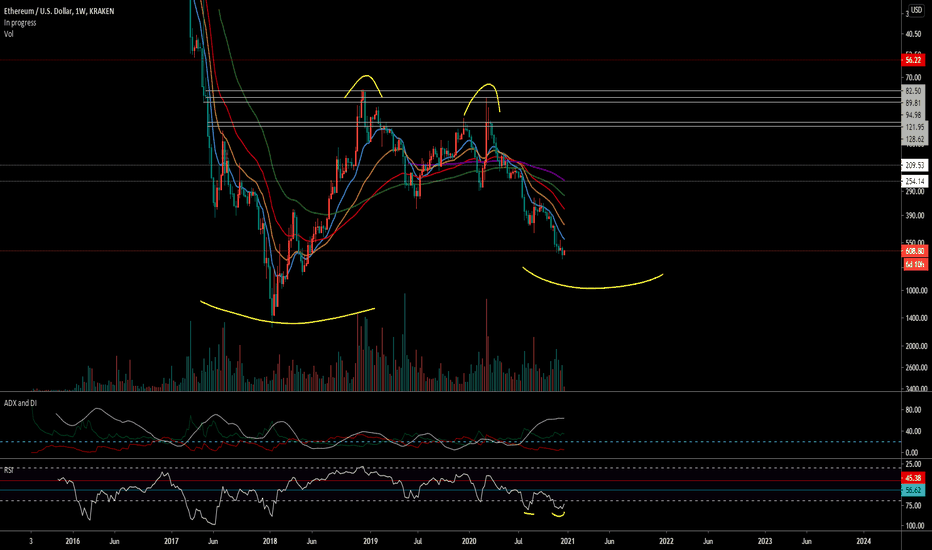

Goodbye DJI: Broadening WedgeOn the left is the 3M timeframe which shows a trend line resistance extending all the way back to the Great Depression.

Touch 1 = Roaring 20's 1929

Touch 2 = Dotcom 1999

Touch 3 = 2010's Bull Run

Touch 4 = 2020 Covid Stimulus

On the right we have the 1W timeframe showing a broadening wedge nearing completion. Looks like we are finishing Wave D and about to dump into Wave E. However, this count could be off and we actually completed our Wave E in the March crash. From a fundamental perspective, I am leaning towards the former as the economy is not healthy at the moment. Disregard ATHs, stimulus, and vaccines. People are in debt, unemployed, and the dollar is inflating away.

Over the first half of 2021 I am expecting Wave E to play out. Reflecting upon the Great Depression, we had an initial wave of selling and a sharp buyback. This created the "V" correction that we have right now. However, the Great Depression then accurately reflected the state of the economy as it slowly grinded down for the next 3-4 years. That is what I suspect is coming.

I am ready, are you?

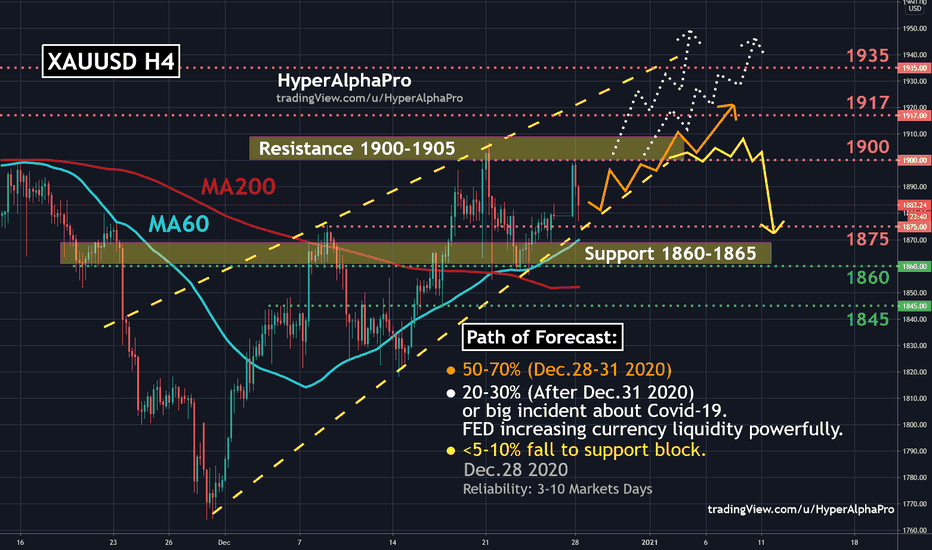

Gold (XAUUSD) Analysis and Happy New Year.Gold (XAUUSD) Analysis and Happy New Year.

Path of Forecast:

● (Orange) 50-70% (Dec.28-31 2020)

● (White) 20-30% (After Dec.31 2020)

or big incident about Covid-19.

FED increasing currency liquidity powerfully.

● (Yellow) <5-10% fall to support block.

Dec.28 2020

Reliability: 3-10 Markets Days

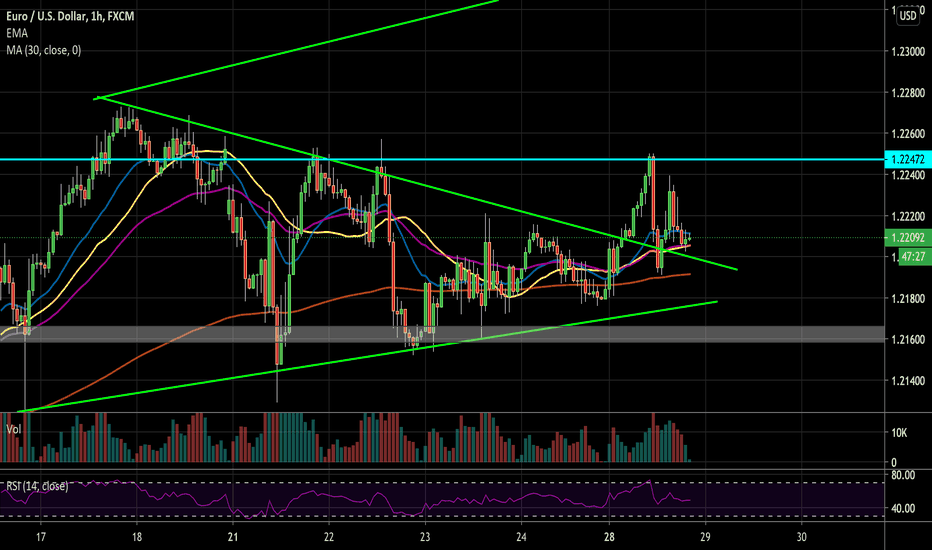

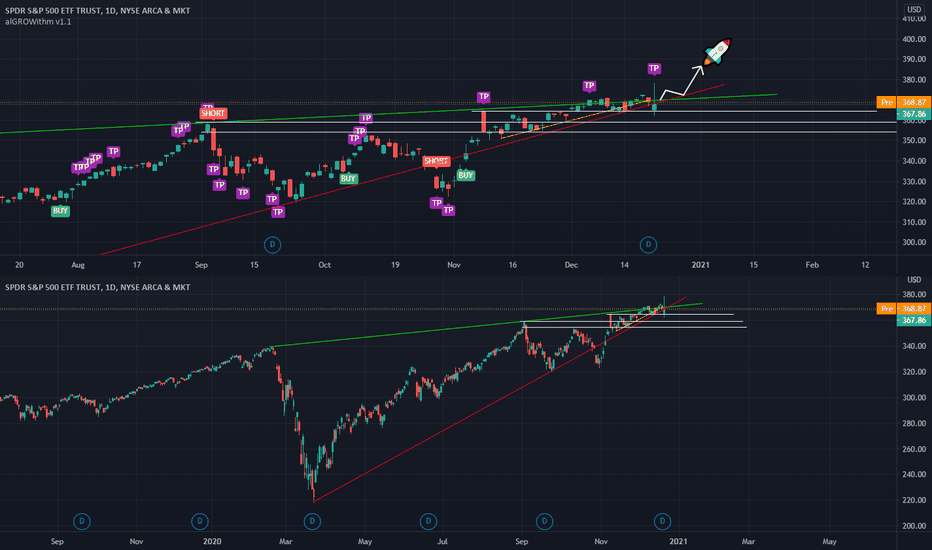

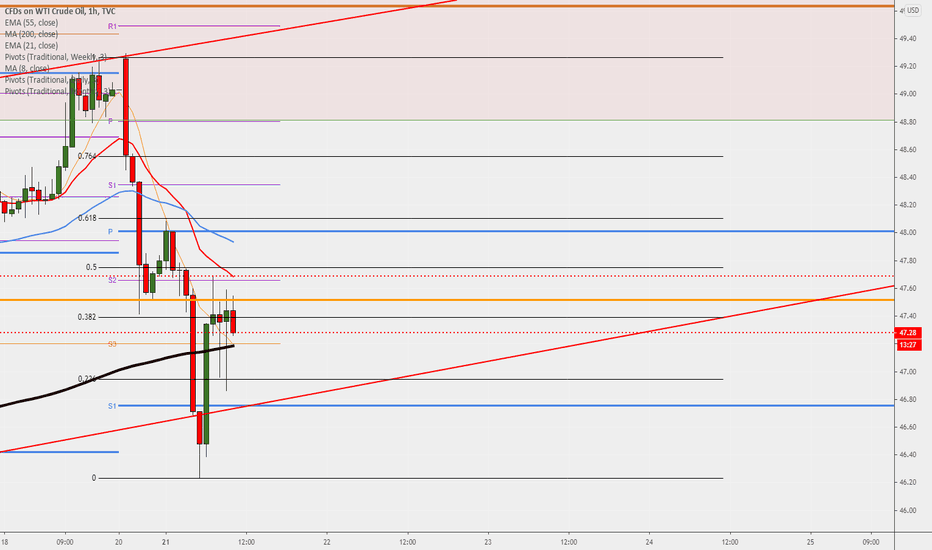

12/23 WATCHLIST + MARKET OUTLOOK (Warning!)** THIS IS PURELY MY OPINION AND I AM NOT LIABLE FOR YOUR TRADING DECISIONS **

Very interesting day today where even though we GOT the stimulus bill, the market did not seem satisfied. We remained under the major support (now resistance) trendline in red, which has served as support since the coronavirus low. There are 2 reasons this may have happened: (1)There is a big possibility that the market had fully priced in a large stimulus package, and is now asking "ok, what else can you feed me?" OR (2) Investors are scared of the covid mutation making its way through Europe.

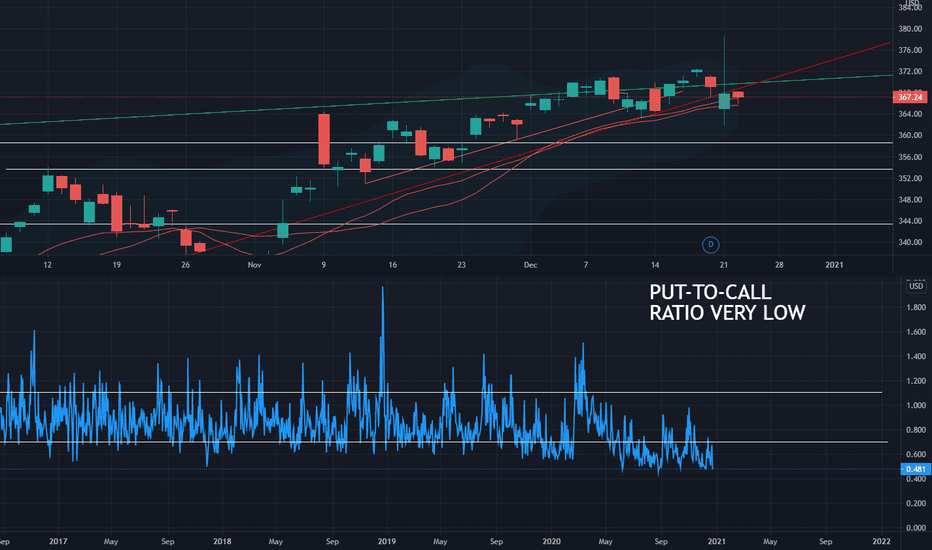

Regardless of the reason, it is a particularly dangerous time for this to be happening because if you look at the put-to-call-equity ratio, it dropped to pretty much all time lows as soon as the stimulus bill was announced. This means that market participants are overleveraged on calls and expecting the market to continue going up (being greedy). While this is not a sell signal by itself, if the market starts to correct, we could see a big long squeeze as investors panic and offload their long positions. I would save the PCCE graph to your watchlist and check it frequently. It is essentially the chart that tells you when to be greedy vs. fearful according to the old adage: "When others are fearful, be greedy. When others are greedy, be fearful." A normal PCCE level is roughly indicated by the 2 white lines I've drawn on the graph.

My bias going into tomorrow is neutral. However, the market doesn't care about my opinion and will do what it wants, and I will trade what it gives me!

The watchlist from yesterday went absolutely nuts. Highly suggest finding your favorite setups and focusing on those. Don't worry about missing a play! There are opportunities every single day.

WATCHLIST 12/23

Recall that my trading style is short scalps and intraday options. These are not swing levels.

ZM calls over 409.1

BABA puts under 255.4

BLNK calls over 49

PENN calls over 96.65

PYPL calls over 244

SQ calls over 243.4

MRNA puts under 123

NVDA calls over 531.8

WKHS calls over 23.45

TWLO calls over 374.7

NFLX calls over 527.6

CHFJPY SHORTAyo Fuck the US and what they think.

Swiss Banks do what the fuck they wanna do.

You think the FED are the only fucks who wanna devalue their own currency?

Difference between FED and Swiss Banks is that the Swiss Purchased APPLE with their bank money

While the FED bought FAILING US CORPORATIONS

Thats why Swiss Banks are gangster nigga

12/22 WATCHLIST + MARKET OUTLOOK** THIS IS PURELY MY OPINION AND I AM NOT LIABLE FOR YOUR TRADING DECISIONS

With the stimulus bill all but passed, and fairly positive sentiment around existing vaccines being effective against the new coronavirus strain, I remain bullish and continue to believe we will see a blow-off top in equities in the short term. This morning during pre-market, we're seeing SPY back above the major support line (red) that has been support since the coronavirus low. Let's see whether we can break the major resistance line (green) today. If so, a good trade would be to wait for a retest of this line, and enter long on the bounce confirmation.

Yesterday's watchlist went absolutely bonkers. I post watchlists daily - be sure to follow me so you get the notification!

WATCHLIST 12/22

Recall that my trading style is short scalps and intraday trading. These are not swing levels.

LONG LIST TODAY! Highly suggest you pick a few of your favorite setups out of these and just focus on them

BA calls over 221.2, puts under 215.6

PLTR calls over 29.75

MSFT calls over 224

CHWY calls over 109.1

GRWG calls over 41.2

JMIA calls over 43, second entry 44.5

NFLX calls over 531.9

NVDA calls over 534.9

BABA puts under 257.8

DIS puts under 170

PYPL calls over 240.45

SOLO calls/equity over 7.65

TWLO calls over 370.5

HD calls over 272

Hope but also fear & despairHOPE

I have to start with a little lesson or reminder:

- Parasites: Organisms that live temporarily or permanently in a host, feeding off its host rent free, in its best interest to keep the host healthy or at least alive.

- Bacteria: Entire domain (Bacteria, Archaea, Eukarya - Animals & Plants are Eukarya) that just doesn't care, some of them eat their "host" alive or dead.

- Virus: Undead creatures (technically...) that inject dna in their host to make more of them. They cannot spread on their own. Need living host.

- Prion: Misfolded protein which transmits its shape to other ones in a chain reaction and causes terrifying psychiatric symptoms, death. No diagnosis, no cure.

Let's focus on viruses. Their objective is to multiply. They're quite basic.

Take 2 viruses, which one do you think will spread the most?

A- Host instantly collapses to the ground, bleeds through his eyes, and dies in 3 days.

B- Host is full of energy, never gets any symptoms, speaks to people, laughs, goes into nightclubs weekly.

The second epidemic of SARS-cov-2 which was also called covid-19 had more cases but less deaths.

The UK has a third mutation (third is incorrect as there have been at least thousands of mutations) and this one is far more contagious than the last ones...

If it is more contagious it would not be crazy to expect it to be less severe... FFS it's a virus that's not even alive, not an alien invasion trying to wipe us out.

Most viruses have very low mortality rates. All the very lethal ones come from? From other species! In particular flying critters, and in more particular bats.

HIV is said to come from some monkey, could be flying primates who knows?

These viruses have adapted to their hosts, and when they transmit to humans they come in another form.

Common sense says "don't eat anything that looks like you". Eating humans enough times will result in a guaranteed light speed devastating exponential spread of 100% death rate prion disease. Eating monkeys often ends up badly. I would also avoid bats.

Why do bats develop so many "super viruses"?

This is the answer: Bats fly, and when they do their body heats up (I think it goes up to 40°C which is what a human gets when they have hardcore fever - fever is a body method to get rid of disease by killing it with heat). Since their body heats up it damages their dna so they have a super saiyan immune system.

A virus is fragile. Only the "strongest" ones, in this case severe, will survive, and they'll be just severe enough to live in bats without killing them.

The "weak ones" just go away.

So when this bat virus jumps to humans it's super deadly compared to where it should be at, because humans don't heat up all day long like bats and humans do not have a radioactive immune system. The virus is overtuned for humans.

Then what happens is now the "strong" virus individuals - the most severe ones - are now the "weak" ones, host dies, host does not spread, and the virus dies with it.

The "weak" ones are now the "strong" ones that will spread their genes. The virus evolves until it finds the perfect balance, which is never ending as the environment in general always changes but not as fast as changing species.

Oh by the way, this blows out the "survival of the fittest" theory. The organism that survives is the one most adapted to its environment, and the result can be as we see here a total 180°.

We can expect things to calm down, and no need to get all paranoid and have panic attacks. Anything can happen, but things settling down is very likely.

FEAR & DESPAIR

Haha just kidding we're all going to die. In the past years the world has become completely open. Globalism always existed but not as much as today.

SARS happened about 20 years ago, who knows how bad it would have been if there were no borders like today?

Look at Europe and the rest of the world, they blocked all travel from the UK.

Even Bill Gates was able to predict something like covid-19 (I think we got very lucky here, could have been really terrible), it was obvious it would happen, only a matter of time.

There are extreme diseases all the time, but most of the time they remain local and die off (not during the black death era).

If half the planet is constantly jumping around countries you can be certain some local deadly diseases will jump with them.

Having noble virtuous openness philosophical ideals is cute and all but keep in mind opening up comes with everything: ideas, people, problems, disease.

It's like always putting all your eggs in the same basket, you are very optimistic.

The science cult believes science will save us all. All I've seen until is mass panic and a rushed untested vaccine with coinflip long term effects against a virus that mutated dramatically, no idea if it will work against this new virus.

The vaccine also came long after the epidemic was over and it killed more than 1 million people.

Now imagine a kind hearted virtuous noble open world with a continent wide schengen area in every continent, and ease of movement, migrants can go anywhere they want, illegals are welcome with open arms and actually are not illegals because it's legal to do whatever you want.

Now. Tell me.

WHAT WILL HAPPEN DURING THE NEXT EBOLA/MARBURG VIRUS OUTBREAK?

It's only a matter of time. Maybe the next one won't spread. But EVENTUALLY I can guarantee with absolute certainty there is one that will spread.

And it will be lots of fun. Towns will fall first. Armed civilians and/or tanks will obliterate anyone trying to leave the cities. But this won't stop the spread.

Half the planet will die. Every one will become ultra-racist and murder anyone that looks different. Governments will collapse.

There will be no more order. People will isolate, kill each other for food. Wow such inclusiveness.

Or the next plague could be hantavirus (rats), or something else (with climate change there has been an explosion of wildlife - boars, foxes, deers, goats...)

Or maybe it will be much much worse than even Ebola. We'll all get our food from the same place, and our food will develop some prion disease.

People that eat this food will catch a disease we can not diagnose. The proteins will end up spreading exponentially to fields hence all types of food, they will end up in the water, they will end up everywhere with no sign of illness. And then people will start dying by the millions. Those alive will know deep down they have it. And remember prion causes horrifying psychiatric symptoms yay!

Governments will straight up nuke all large cities in a desperate attempt to save humankind. It sounds crazy but it's very real.

People will get paranoid and shoot anything that moves in a 25 meter circle around them.

But it will be too late anyway. No one will survive. Everyone will die a horrible slow excruciatingly painful death. The end.

If you risk 100% of your money on each trade, no matter how high your winrate YOU WILL BLOW UP this is a promise I make to you.

Same concept with getting all food from the same source, or 1 single worldwide globalist borderless nation.

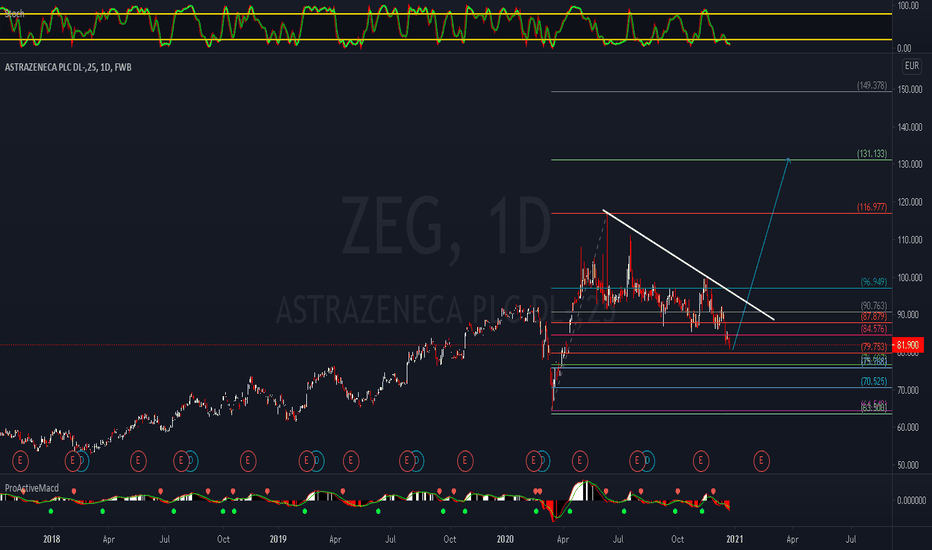

Potential Impulse is setting upChart of Astra-Zeneca, they are #developing the #COVID #Vaccine with #Oxford. Although they have had some issues with the vaccine, the chart tells something is coming...

I am Projecting high quality example, by covering the most likely Predictiv and Effective way of #ChartReading Egde behind any upcoming movements. Is this sounds something #realistic ? Although Life is much more #nonlinear than our brain thinks it is I personally focused on a more proven #bias to get very high returns by Identifying behavioral model of development structure recognizing which is validating that potential change in major direction within the process of its momentum phase as a guide to avoid some vital mistakes to have a complete set of clean filtered compound flowing approach method based on the fact that within a aspect oriented Data-class elements, setting up simplified valid technique and executing more high probability confidence in confirmation that will increase the accuracy of taking an educated guess solution.

Pro-Tipp: Buildup your #corrective account.

US Markets are "gonna' get it"?Hello Traders!

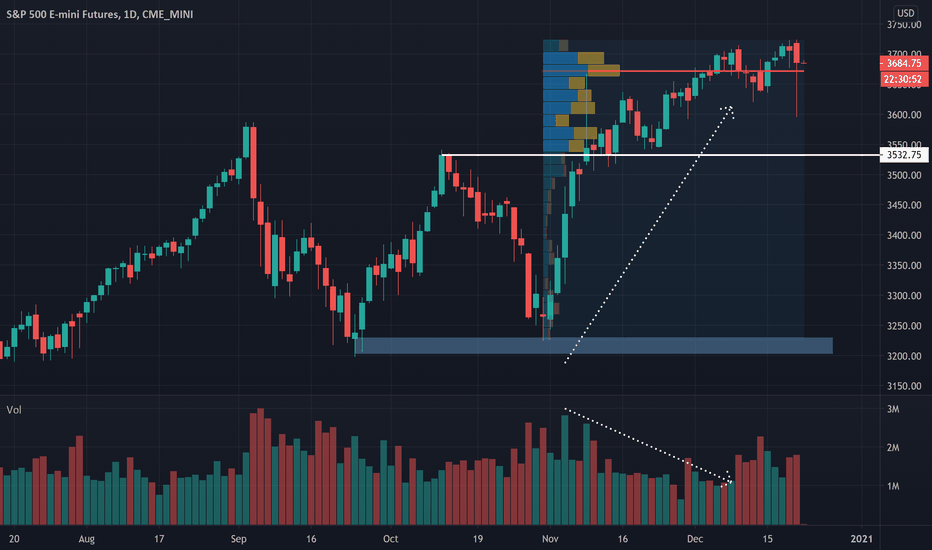

Happy start of the week. I hope you are having a good end of the year holiday. :D In this idea we will talk a little more about the outlook of the US markets, mainly due to the characteristics of the recent rally, which has brought several indexes to all-time highs, once again.

The recent news of the stimulus packages approval in the US has resulted in optimism as the markets had a lot of uncertainty (and fear) that government aid would stop. However, these good news doesn’t seem to have had a very significant impact on the price, as there is growing fear about a new wave of lockdowns.

These concerns arise from the lockdowns we’ve seen in various European countries, which has caused a risk-off sentiment in the markets again. This combined with doubts about the vaccine's distribution due to the required storage temperatures, raises even more concerns.

If we analyze the message on the volume that the market leaves us, we can see how, repeatedly, when the market rallies, the volume decreases, which ends up causing the rally to be weak, and to run out of further progress. On the other hand, we can see that as the volume increases, the market begins to show dumps in the price, which reflects a high bearish interest.

In the same way that we commented in the past analysis on the US markets, this is nothing more than a factor to consider within our trading plans, since in summary, the market tells us "Hmm, I’ll go up a bit but dumping like a rock seems more appealing to me", and while this is not a direct message to take trades, it is something that we must consider when conducting our analysis.

I hope this post helps you! Remember to leave your opinion in the comments.

As always, no matter what your perspective is about the market, you gotta’ plan your trades and trade your plan!

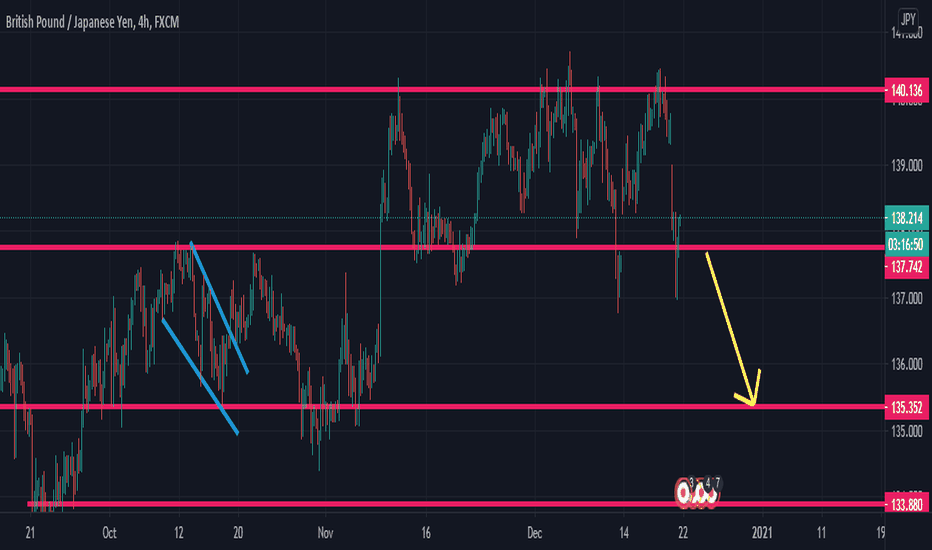

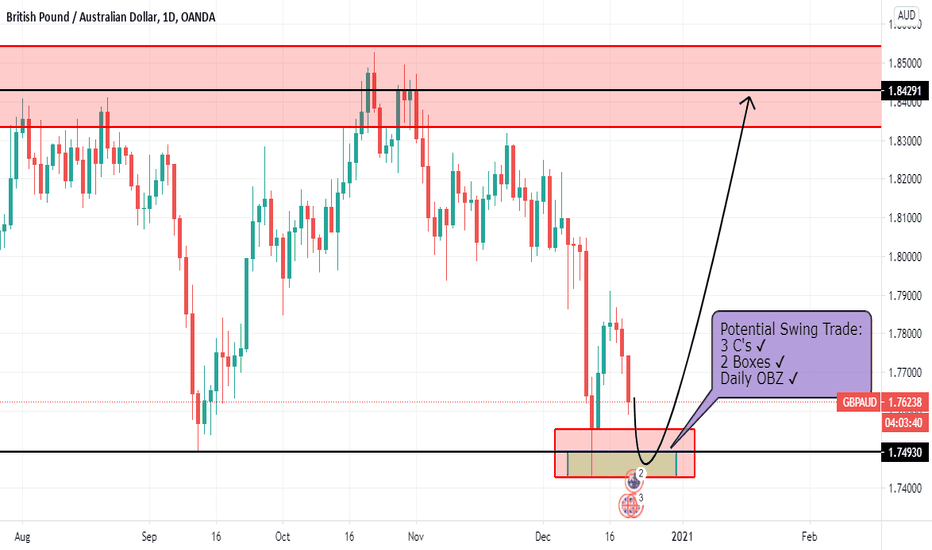

GBPAUD: Where From Here?Expecting GA to drop before making a U-turn to the upside and potentially rally up to 1.8400 in the process. If I do get my entry at 1.7500 I'll be looking at collecting 900 pips if everything goes according to plan. There's a lot of fundamentals surrounding the Pound at the moment as there were news that surfaced on the weekend about Mutant Coronavirus Strain, Brexit No-Deal and London going back to full lockdown, I think it's fair to say not everything will g smoothly in terms of my analysis after all this is Trading there are never guarantees.

Fortunately should things go south there is a way out as I make sure risk management comes first before anything else. My advice to anyone who's looking to make it here in this business is for them to make sure they do apply risk management in their trades at all times. Btw an idea I posted Friday on GBPUSD is currently going according to plan Check it out.

If you've got any questions comment below.

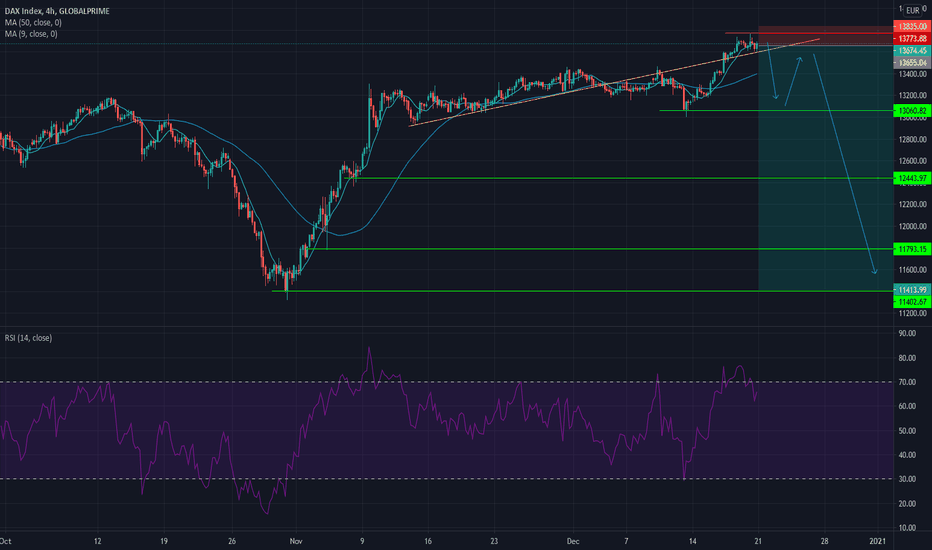

Second Wave of Covid-19If there is an second Virus, which is an diffrent variant of Covid-19, then we will see an drop down to 11000 points for sure.

All the Vaccine hype will be over.

Stay safe!

If not, we will have an stop near to us, but if the yellow line will broke it will go down to the next green line, if this can´t hold drop to the next and so on.

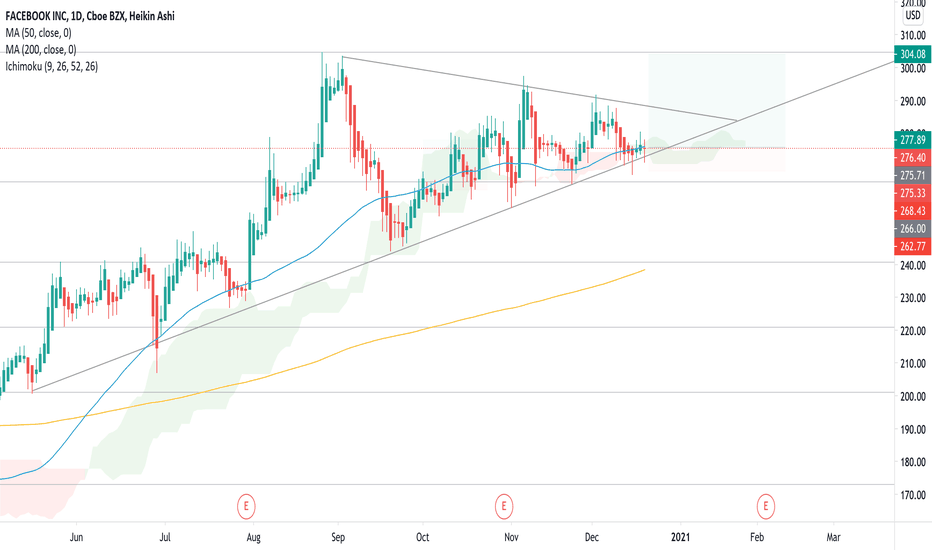

#FB - 1D - DEFINITION ZONE.Perfect uptrend since May. Multiple tests over the past few months. 7 to be exact.

Here we are now again. The last session left us with a Doji candlestick pattern just under MA50.

This Sunday, Republican and Democratic party leaders announced that a deal had been reached for a new stimulus check. There are enough votes for a majority approval this Monday on congress. We might spect a bullish day tomorrow for all mayor companies of SP500.

With this tailwind in favor, the price could break MA50 and cross Ichimoku's cloud at the same time. This will could create the propper impulse to break that pennant triangle and reach ATH as the first target.

In this case, we don't have a main support under trendline to act as a safety net. So, I would like to take two approaches:

Conservative Strategy:

- Open position: USD 276. 40

- Stop Loss: USD 269.54

- Price target: USD 304.

- Risk/Reward ratio: +4.6

Risky Strategy:

- Open position: USD 276. 40

- Stop Loss: USD 264.46

- Price target: USD 304.

- Risk/Reward ratio: +2.53

Risk management is always as important as all research and technical analysis we can make. Long-term profitable trading is about been wrong small and right big.