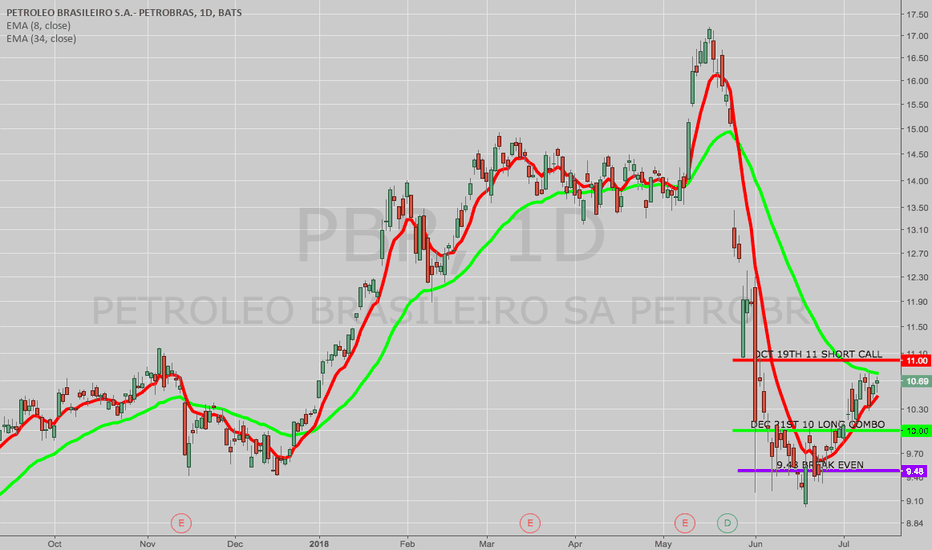

OPENING: PBR OCT/DEC 11/10 COVERED LONG COMBO... for a .58/contract credit.

Max Profit on Setup: $158/contract (the width of the spread plus the credit received)

Max Loss on Setup: $958 (assuming you do nothing and the underlying goes to zero)

Break Even: 9.42

Delta: 47.77

Theta: .62

Notes: A small buying power effect, cost basis reduction setup in a high implied volatility petro underlying battered by negative emerging market sentiment, and, well, everything else that's recently been wrong with Brazil. I have a good-'til-cancelled order in to take profit at 50% the width of the spread, but we'll see how it goes ... . Went out a little farther out in time that I usually like to go to get a break even I'm comfortable with.

Coveredcombo

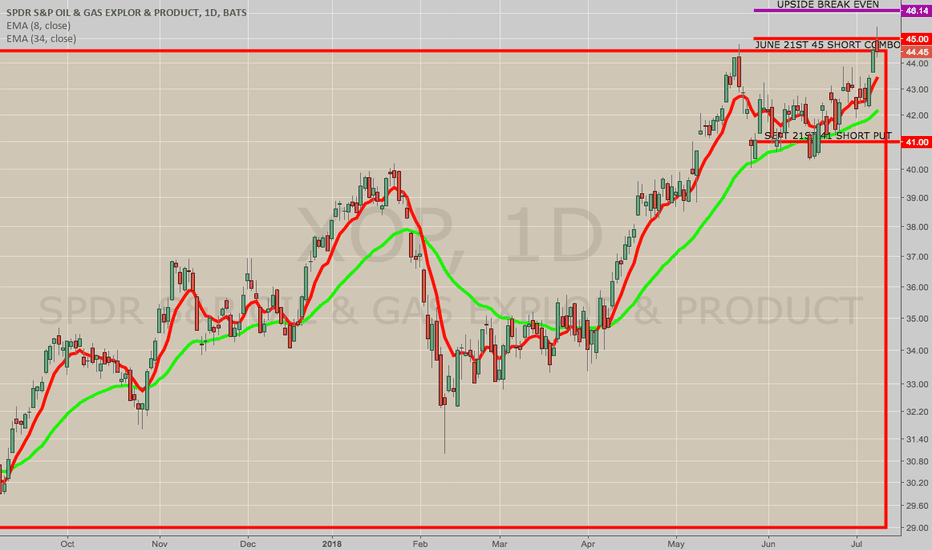

TRADE IDEA: XOP SEPT 21ST/JUNE 21ST 41/45 COVERED SHORT COMBOAnother covered short "combo" setup (see Post Below) with the delta metrics of a covered put sans the buying power effect of short stock and plenty of time to work out and/or reduce cost basis ... .

Metrics:

Max Loss/Buying Power Effect: Undefined/~$1234

Max Profit: $514/contract (realized on finish below the short put)

Break Evens: 46.14/no downside risk

Delta: -75.86

Theta: 1.4

Notes: XOP at long-term horizontal resistance with oil at 74.21/bbl./long-term highs. Work as you would a covered put, rolling out the short put on significant decrease in value, to maintain delta, and/or to defend the combo. Would look to take profit and/or manage at 20% of the buying power effect ($247 profit), although taking profit at 10% of the debit paid wouldn't be bad either ... .

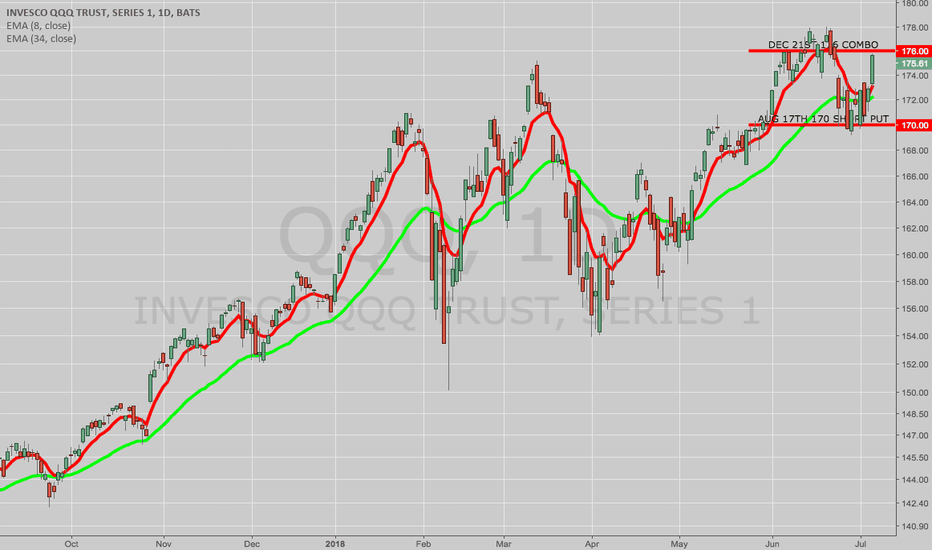

TRADE IDEA: QQQ AUG/DEC 171/176 COVERED SHORT "COMBO"A "combo" is a two-legged option setup with a "long combo" consisting of a short put and long call sold at the same strike and in the same expiry, and a "short combo" consisting of the inverse -- a short call and a long put sold at the same strike. The short combo emulates a short stock position with static* -100 delta; a long, a long stock position with +100 delta. Consequently, they're thought of as synthetic stock positions.

The primary benefit of these over taking on a long or short stock position (at least in a margin environment), is buying power effect: the combo aspect of the pictured setup has a buying power effect of something around 20% of the buying power it would take to short the stock at 176/share. Naturally, I could go with my standard Poor Man's, but going deep in the money and far out in time with the long leg of those setups can be costly from a buying power standpoint,** but also "pesky" -- long-dated, deep in the money long options frequently aren't the most liquid things in the world, and low liquidity generally isn't a trader's friend. In comparison, at-the-money combos tend to be relatively more liquid compared to their long-dated, deep in the money buddies.

In the pictured example, you're basically doing a covered put with the combo at the 176 strike standing in as your static -100 delta short stock and the August 17th, 30 delta, 170 short put "covering" that position, and you work it as you would any other "covered" setup -- rolling the short aspect on significant decrease in value to reduce your cost basis, improve your break even, and/or to defend.

Max Profit: The width of the spread (6) plus the credit received (here, 2.92) for a total of 8.92 and is realized on a finish below the "covering" short put at 170.

Break Even: The combo strike plus the credit received (2.92) or 178.92.

Delta: -70.62***

Theta: 5.04

Take Profit: Take profit is somewhat subjective with these, but I'd begin looking to take the trade off at 20% max, although I can also see leaving it on longer than normal to keep and maintain the static short delta the setup offers.

* -- The delta of a combo is "static," as it is with stock. It never changes, regardless of how price moves in relation to it.

** -- The longer-dated you go with a Poor Man's, the deeper in the money you generally have to go to find longs that have extrinsic value that is less than that of the front month short option you're selling. The deeper you go, the wider the spread, the more expensive it is to put those on. In comparison, the buying power effect of a combo generally doesn't increase significantly over time. In the above example, you actually get paid more in credit for the 176 short combo the farther you go out in time due to put side skew: October: .20 credit; December: .68; January: .67; March: 1.14 which also has the welcome effect of improving the break even of the combo aspect (October: 176.20; December: 176.68; January 176.67; March 177.14).

*** -- You can naturally be more aggressive with these on the covered short put end of these, going with the 40 delta shortie instead of the 30, for example, which would yield a 60 short delta setup.