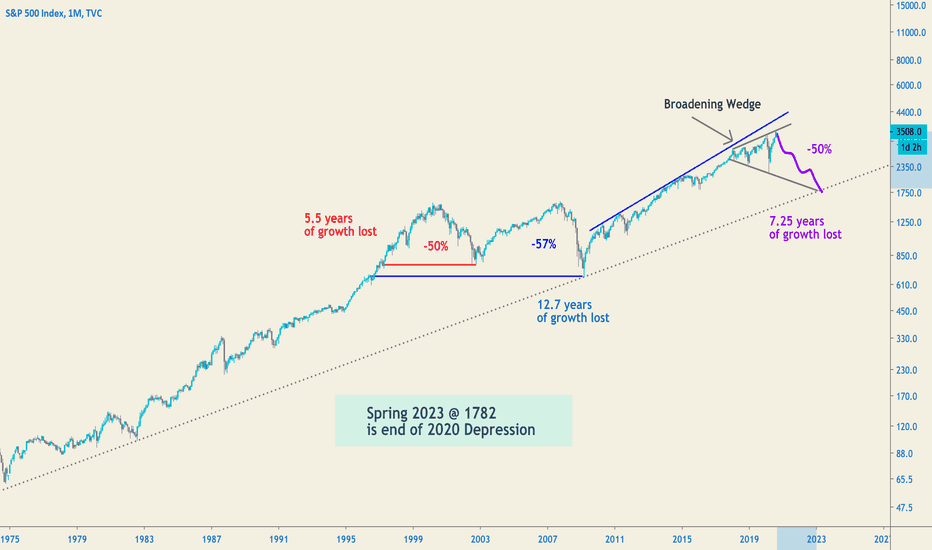

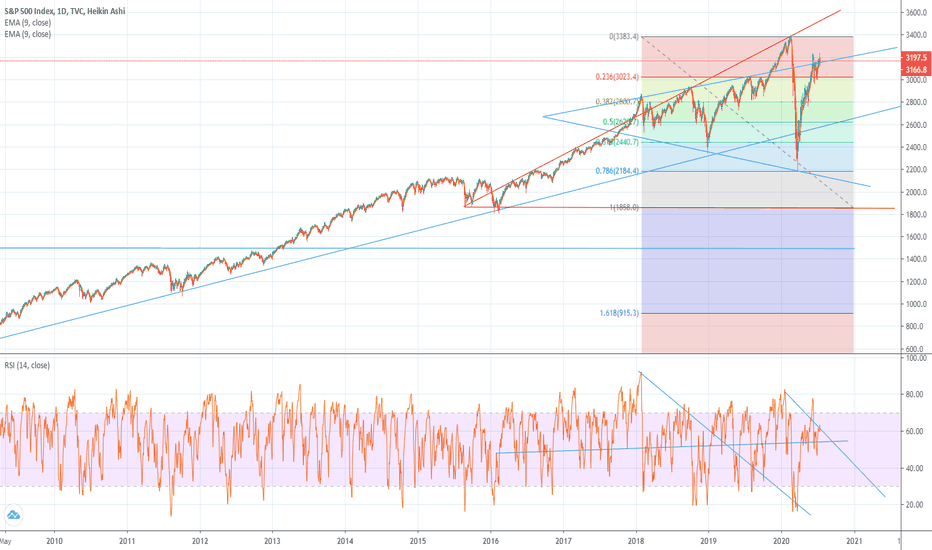

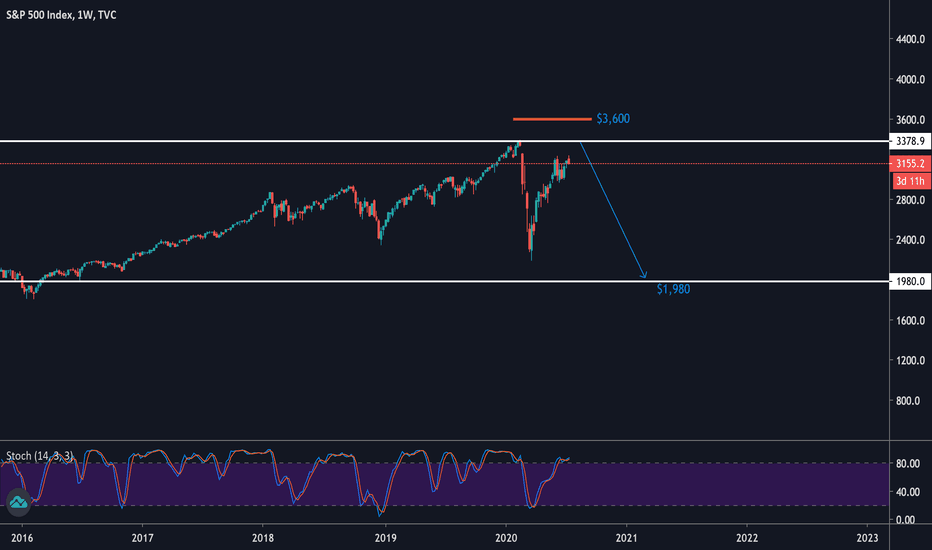

SPX Macro Outlook: Spring 2023 @ 1782 On the low time-frame the SPX has a blatantly obvious broadening wedge. This tends to be a bearish pattern, as volatility is increasing to the downside

more so than the upside. From a fundamental analysis perspective, the economy is valued at the highest it has ever been, but the economy is the worst it has been in almost a century. Something has to give...

On the high time-frame notice the trend line support extending more than 50 years to 1975! Assuming out broadening wedge plays out, and we retrace to a major support level, the pertinent question is where and when? I find it likely that the trend line support of our broadening wedge and the trend line support of the last 50 years converge at a critical point: Spring 2023 @ 1782

Analyzing the past two recessions yields interesting information. The 2000 Dot Com Bubble retraced 5.5 years of growth. The 2008 Housing Bubble retraced over 12 years of growth. Assuming the 2020 Everything Bubble retraces to that key support of 1780 and converges with two trend line supports, we will have wiped out over 7 years of growth.

Attached below is a chart made in 1875 identifying the length and magnitude of market cycles. As with any model, there is a degree of error. Nonetheless, it came pretty damn close to predicting the 1913 crash, Roaring 20's, Great Depression, WWII, 1970s stagnation, 1897 crash, housing crash, booming 2010s, and now 2020.

Chart: drive.google.com

Now, this model predicts this depression level correction to end in, you guessed it, 2023... Wow, that lines up with this analysis of Spring 2023 being the bottom @ 1782. How odd...

Covid-2019

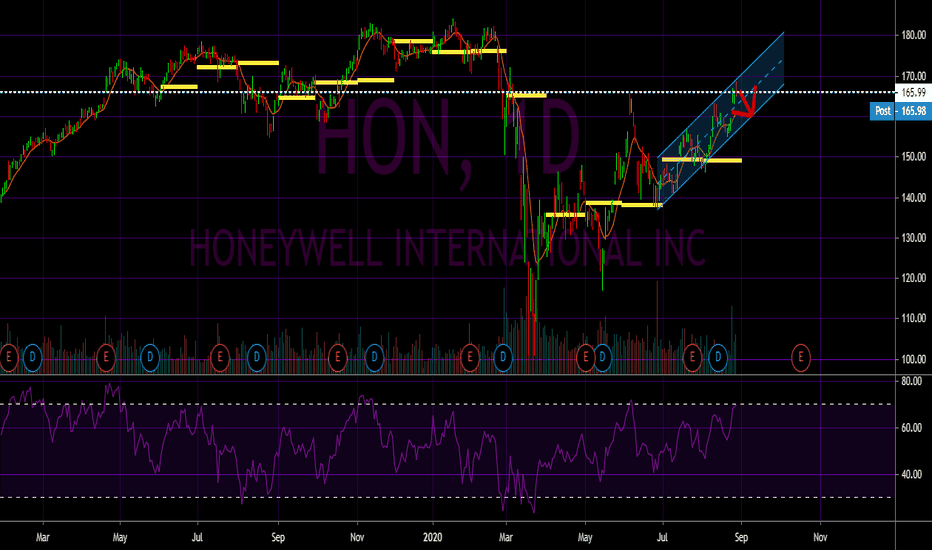

Gap fill for HoneywellPossible quick profits on a short position, but the trend is generally upwards. The gap could get filled quickly followed by a return to the upside due to increased sales of surgical masks in the COVID-19 pandemic.

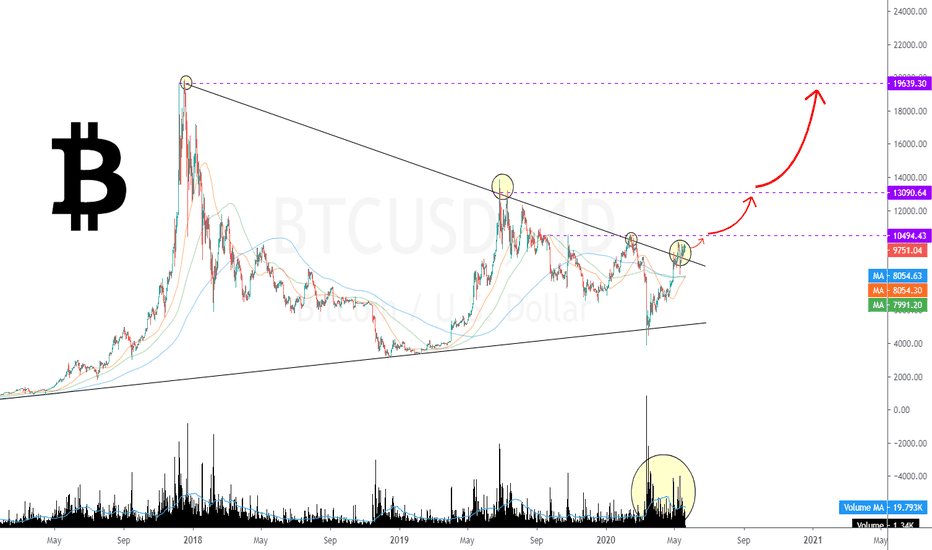

Bitcoin vs COVID-19 - The pathway back to all time highs in $BTCAs the world entered its first pandemic in 100 years all financial markets cratered in early 2020. Even popular safe haven assets like $GOLD were not immune to the rush to liquidity amidst the panic and uncertainty. $BTC not widely known for its "safe haven" status also suffered the effects of this global liquidity squeeze. After 30 days of pain the fed ultimately injected trillions of dollars of liquidity into the financial markets while dropping rates to 0%. As the money printers go brrrrrr and the horrific economic data confirms the damage, investors and now seeking alternative safe havens for their cash as the purchasing power of all currencies is eroded by central bank money printing.

The fundamental case for Bitcoin has always been there. Bitcoin, like Gold is hard money. By design Bitcoin is a scarce asset. You cannot print more bitcoin, there is a finite supply. Bitcoin is a weapon to battle deflation and inflation.

Regardless of your opinion on Bitcoin my argument is this:

Bitcoin will capture a growing asset allocation from investors as a hedge over the coming years. Not just from internet kids and contrarian investors but major institutions. A small shift in this allocation will send Bitcoin to a 6 figure price.

The Chart:

Bitcoin has broken up from a major falling wedge pattern. The volume spike is a massive tell. You can easily see the final capitulation followed by a very strong move upwards. 10500 is a key level and trading above here would provide strong conviction.

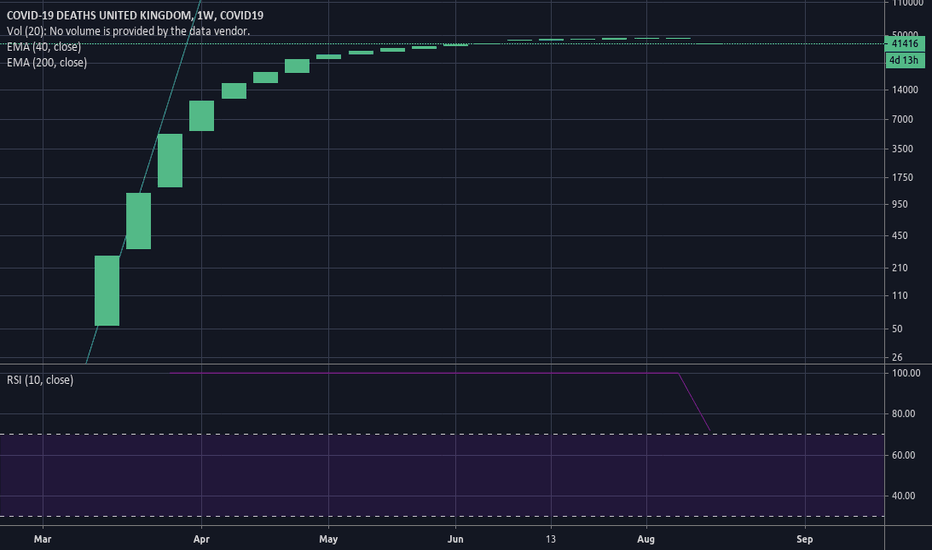

It's a miracle, forget vaccines for COVID, death itself is cured10th Aug 2020 -48 deaths, okay: British people are resurrecting from the dead.

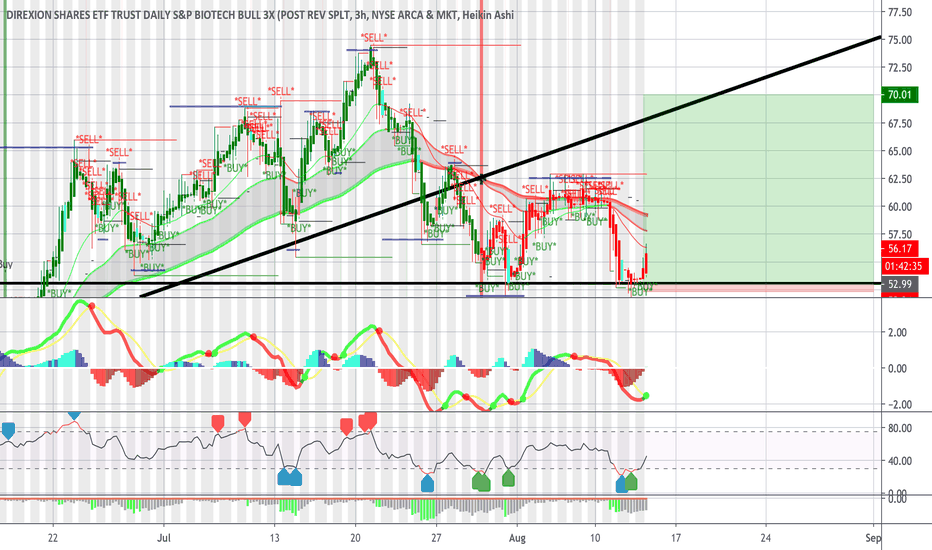

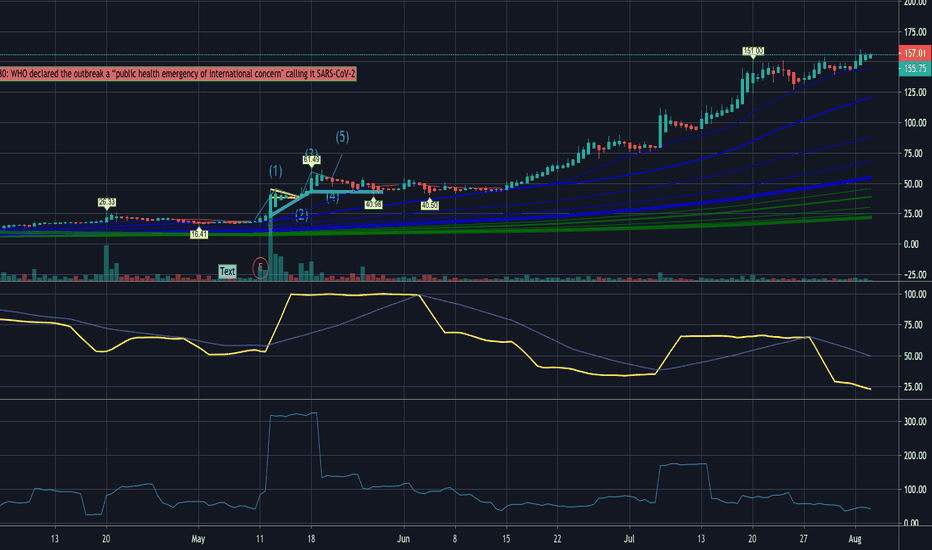

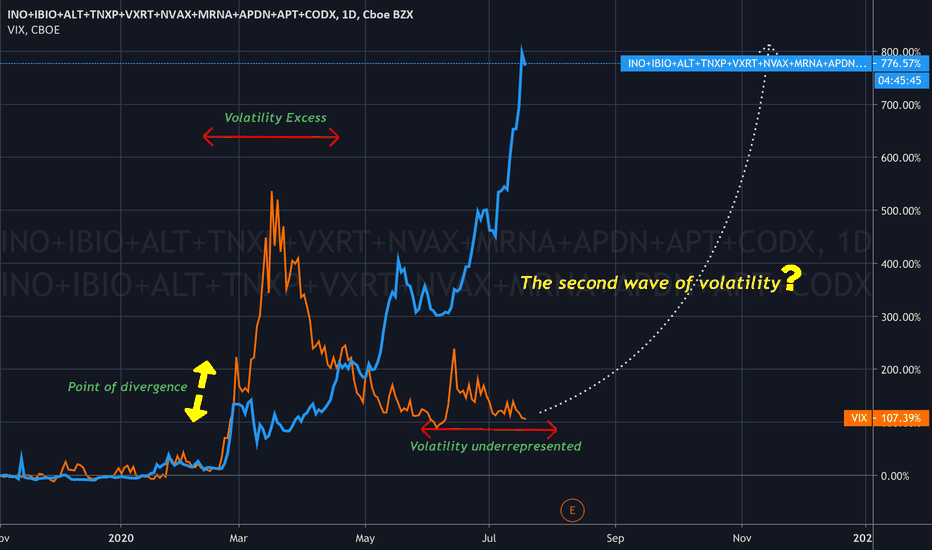

[NVAX] Novavax: Preliminary studies produce promising resultsPreliminary studies on coronavirus vaccines have produced promising results.

I'm still a believer in their technology. Check out my previous NVAX posts and/or the first one. They have a promising technology that could revolutionize the vaccine industry. We (humanity) are already very behind in how we produce vaccines AKA using chicken eggs. So Novavax will hopefully pave the way for vaccines going forward.

Things to watch even after COVID-19:

- NanoFlu™

- ResVax™

- Recombinant Nanoparticle Vaccine Technology

- Matrix-M™ Adjuvant Technolog

TL;DR - To the moon and (probably) back lol

*Note: This is pure speculation and my own opinion*

NY Times: www.nytimes.com

CNBC: www.cnbc.com

GBP/USD Forecast | April 21, 2020Hello Traders! Considering the current status of COVID-19 and the upcoming UK Claimant Count Change (Unemployment Claims) that will be released in a few hours (Around 1 a.m. Central Time), we could expect to see a downward movement of the GBP. If unemployment rates are worse than expected, we can take this opportunity to make a profit by selling the British Pound. Again, due to the extremely high volatility of the markets in these past weeks, there still is a possibility that the markets could bounce up instead. For that reason, I would suggest using "Sell Stops" at a lower price point instead of current market execution so that you can add a layer of risk management in case the markets don't move downward.

Thank you for considering my opinion on GBP/USD!

- ALPHALICIOUS

Disclaimer: This is my personal opinion on the upcoming markets. I am not responsible for any trades that you place. Please trade using proper risk management and your own analysis. Thank you.

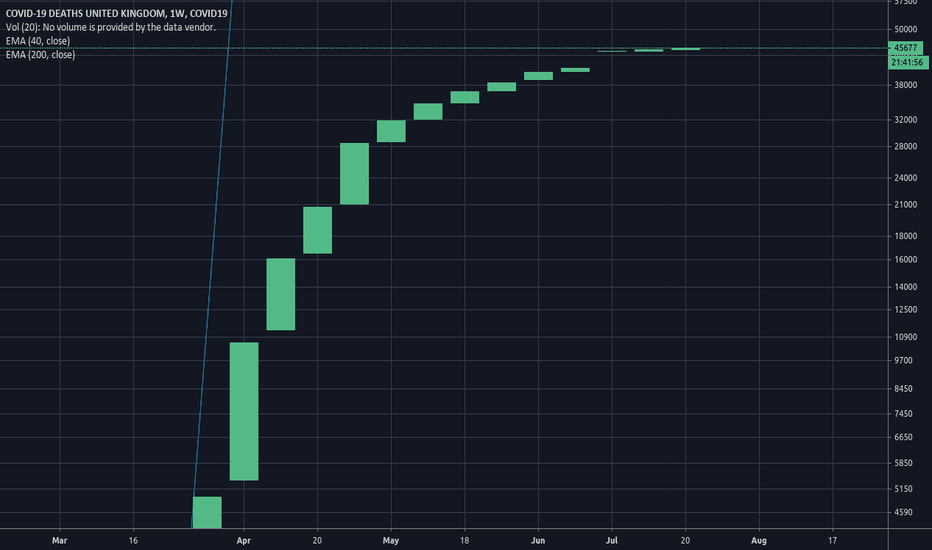

Yay, the chart is back!Yes, after disappearing for weeks the COVID-19 DEATHS_GB is back. And now we can see, probably not for long, that there were 3587 deaths in the week beginning 6th July 2020, a supposedly 8.69% increase. As I've watched COVID-19 charts change before my eyes I wouldn't be surprised if this disappears without warning or record too.

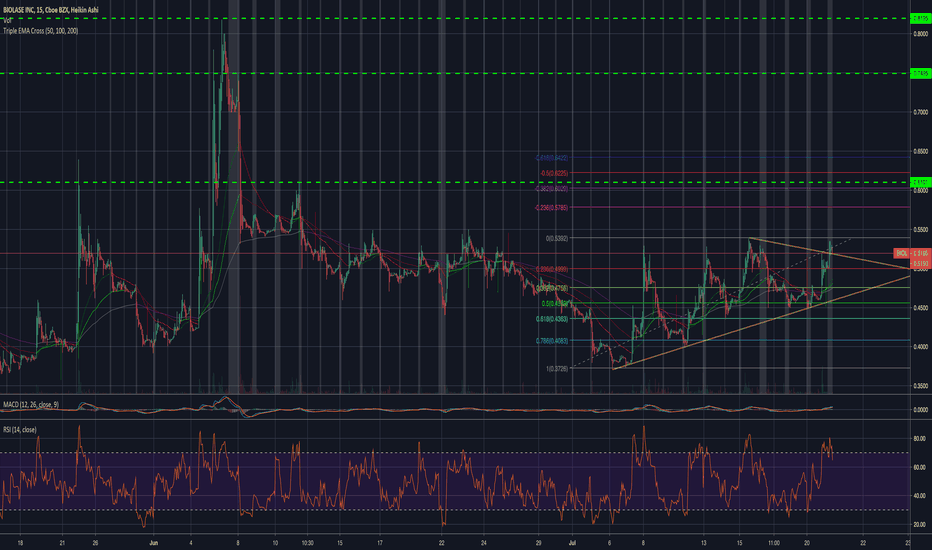

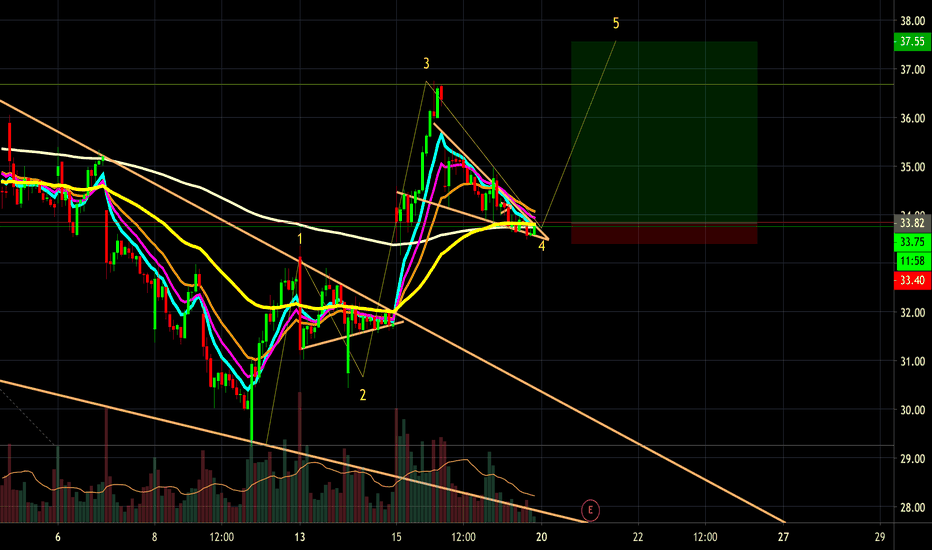

BIOL WWLooking for .48c entry

Tight stop below .45c support @ .44c

looking for PT1 .61c

RR 3.25

Risking 8.33%

for

Gains of 27.08%

PT2 .75c

Risking 8.33%

RR 6.75

Gains of 56.25%

PT3

Risking 8.33%

RR 8.5

Gains of 70.83%