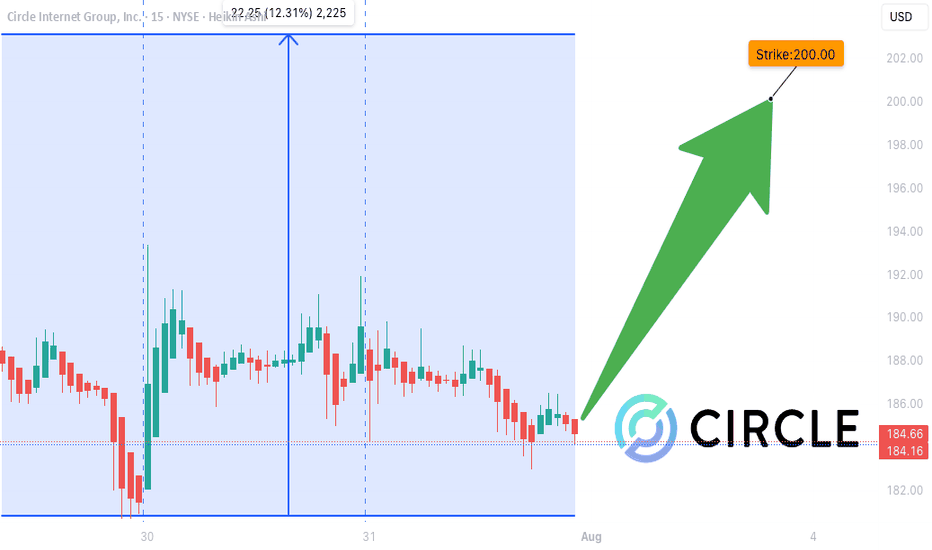

CRCL WEEKLY TRADE SIGNAL (JULY 31)

### 🚨 CRCL WEEKLY TRADE SIGNAL (JULY 31) 🚨

**Call Option Setup – Based on Multi-Model Consensus**

📈 **Momentum**:

🟡 RSI Daily: 46.7 (Neutral)

🟥 Volume: 0.4x last week = 🚨 Weak participation

🟢 Options Flow: Bullish (C/P Ratio = 1.42)

🌤️ VIX: Low (15.4) → Low volatility = 💰 opportunity

🔍 **Model Summary**:

✅ **Grok**: Bullish setup → RECOMMENDED TRADE

❌ Claude, DeepSeek, Gemini, Llama: No trade (weak volume + gamma risk)

🤝 ALL agree: Weak volume & mixed trend = caution

---

### 💥 Trade Setup 💥

🎯 **Direction**: CALL (Bullish bias)

💸 **Strike**: \$200

💰 **Entry**: \$0.85

📆 **Expiry**: Aug 1 (1DTE – high gamma 🔥)

🎯 **Profit Target**: \$1.11

🛑 **Stop Loss**: \$0.51

📊 **Confidence Level**: 65%

📍 **Entry Timing**: Market Open

---

### 🧠 Key Insight

📉 Weak volume = 🚫 no institutional conviction

📈 Bullish options flow = 🔥 potential short squeeze

🕓 Time-sensitive 1DTE = Fast hands needed!

---

👉 If you trade momentum, watch CRCL at open.

🧠 **Strategy**: scalp the move or exit near \$1.11

💥 High risk, high gamma, tight leash.

\#OptionsFlow #CRCL #CallOption #TradingSignal #UnusualOptionsActivity #0DTE #GammaScalp #TradingView #SwingTrade #TFlow

CRCL

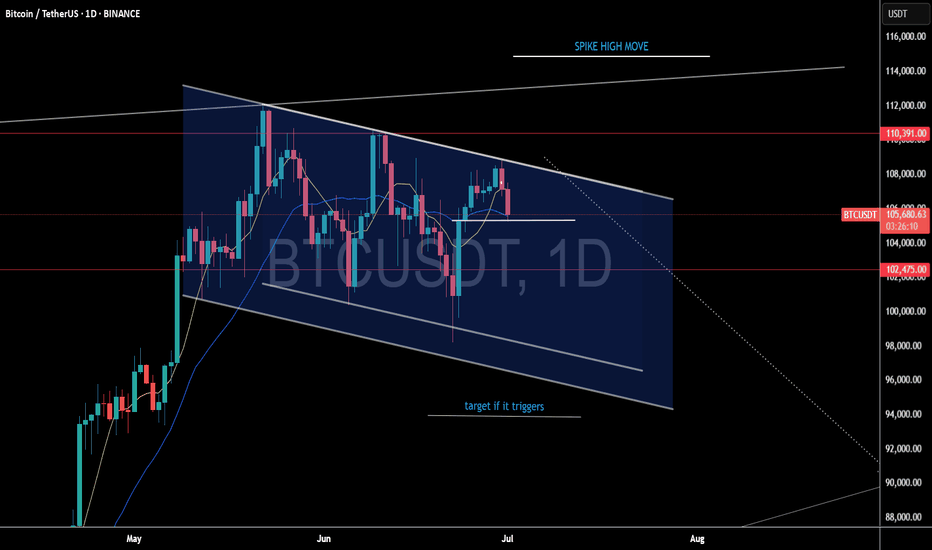

Bitcoin - An Epic Move Awaits!Bitcoin gained 13% in H1 2025, outperforming Ethereum and Solana, which dropped ~25% and ~17% respectively—highlighting BTC's strength in turbulent market conditions.

Institutional wedge: spot-BTC ETFs saw huge inflows—BlackRock’s took in $336M, and total crypto product inflows approached $45B+ this year.

AI models foresee BTC holding $105K+ by end-June, with ChatGPT pointing to $118K and Grok forecasting $108K, based on momentum and ETF flows.

We see BTC holding the 20 MA and spiking to new all time highs.

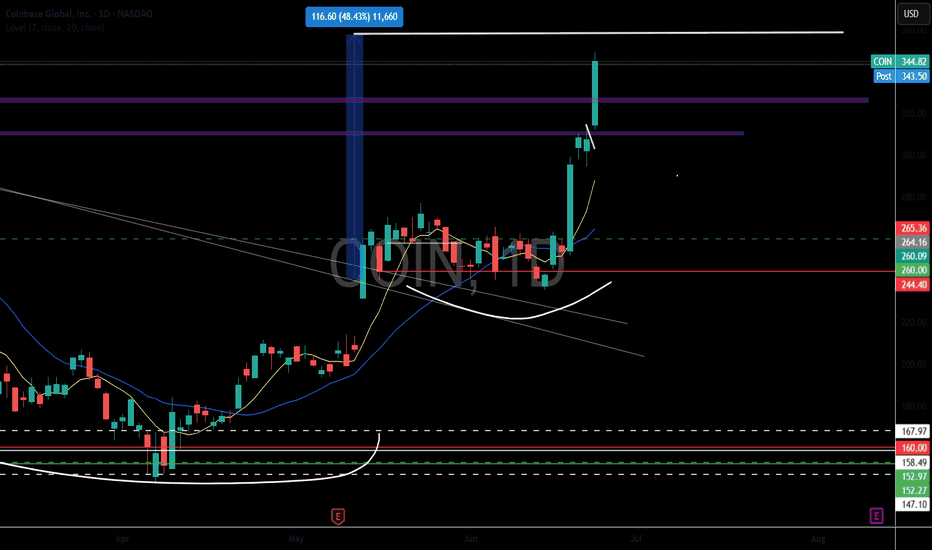

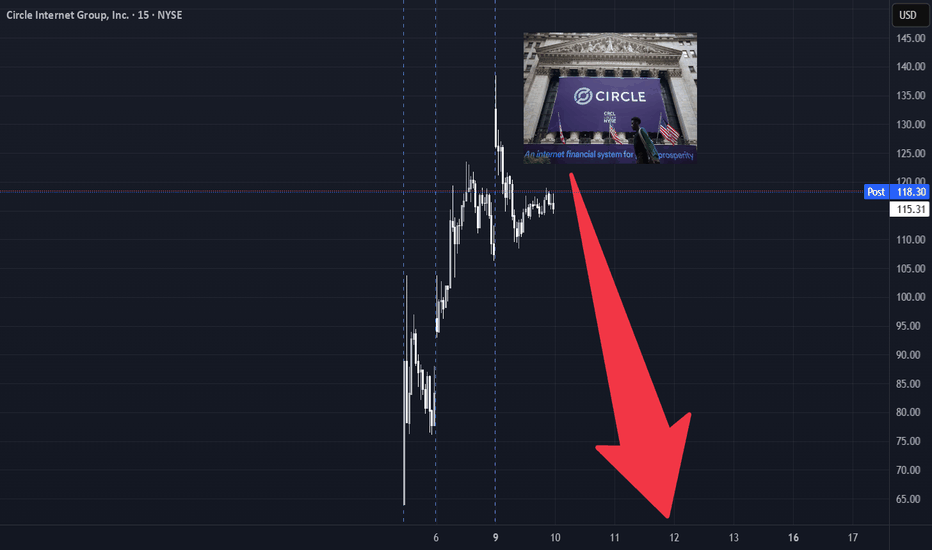

Circle Collapse - Will COIN follow? Circle stock has been on a wild ride lately

After a meteoric rise of over 700% since its IPO on June 5, it's now facing some turbulence:

- Today, the stock dropped nearly 16%, partly due to Cathie Wood’s ARK Invest selling $110 million worth of shares.

- Analysts are also sounding caution. Compass Point initiated coverage with a $205 price target—below its current trading price—citing rising competition in the stable coin space.

- Despite the dip, some still see long-term potential. A recent Forbes analysis explored whether Circle could hit $500 per share, driven by growth in USDC reserves and infrastructure revenue.

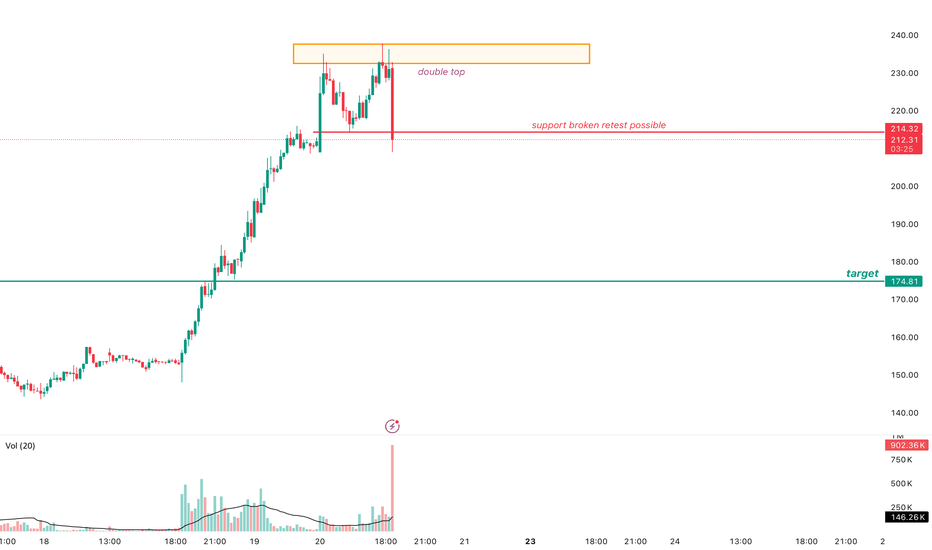

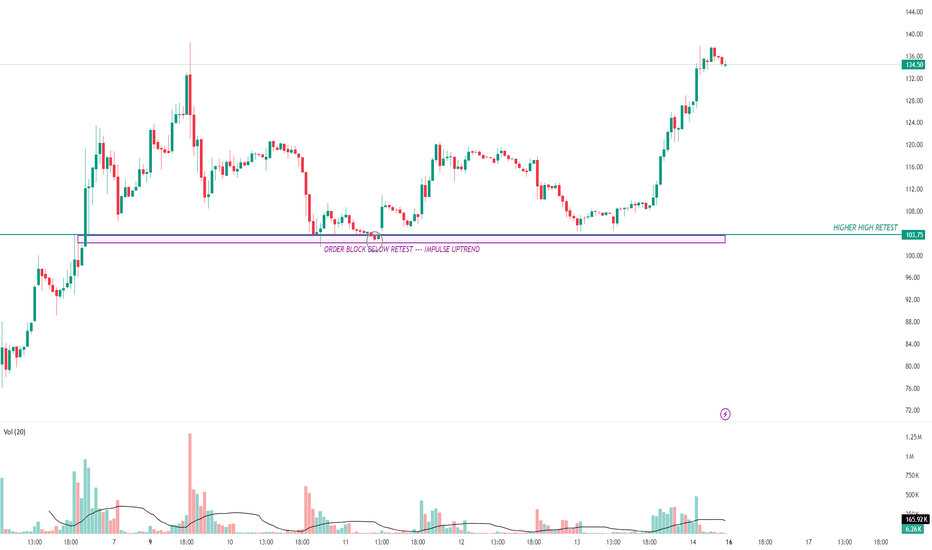

CRCL LOOKS OVERBOUGHTAs you can see after a good ride from 102 to 234 now the stock looks overbought. and on shorter time frames the price action shows a classic pattern of double top and breaking the previous support. simply if the stock closes 15 m candle below the support you might see a short retest to the support from downside that is a good point to short.

CRCL Weekly Bearish Setup (Week of 2025-06-09)📉 CRCL Weekly Bearish Setup (Week of 2025-06-09)

🔍 Ticker: NYSE:CRCL

Multi-model AI consensus indicates a bearish short-term outlook for CRCL this week, driven by weak technicals, downside pressure from max pain, and poor option liquidity.

🧠 Model Summaries:

🔹 Grok/xAI

• 📉 Bearish: Price below 10EMA, negative MACD, RSI near 41

• 🧊 Support: $115.20 | Resistance: $116.34

• ⚠️ Max Pain: $100 → downside bias

• 💡 Trade: Buy $115 Put (Jun 20) → PT: +50%, SL: –50%

🔹 Claude/Anthropic

• 📉 Bearish intraday: below EMAs, negative MACD, RSI ~41

• ⚠️ Max pain at $100, light OI → downside risk

• 💡 Trade: Buy $115 Put @ ~$12.95 → Target 30–50%, SL: 25%

🔹 Llama/Meta

• ⚖️ Mixed: Slight short-term bearish tilt, but warns against poor liquidity

• 💸 Trade: No Trade due to spread/premium inefficiency

🔹 Gemini/Google

• 📊 Daily trend bullish, but intraday showing exhaustion

• ⚠️ Extreme spreads, no open interest

• 💸 Trade: No Trade recommended

🔹 DeepSeek

• 🚨 Strong Bearish: Breakdown of $115.20 w/ volume, negative MACD, RSI ~41

• ⚠️ Sentiment: Max pain at $100 + bid-side put action

• 💡 Trade: Buy $115 Put @ $12.70 → PT: $18.90 (+50%), SL: $8.82 (–30%)

• 🔥 Confidence: 80%

✅ Market Consensus:

📉 Outlook: Bearish Bias

– Short-term momentum is weak (price < EMAs, MACD negative)

– RSI ~41 suggests downside room

– Max pain at $100 = gravity effect

– VIX falling = no panic relief for bulls

– Key Level to Watch: Breakdown below $115 = confirmation

📌 Suggested Trade Setup

🎯 Symbol: NYSE:CRCL

🟢 Strike: 115 PUT

📅 Expiry: 2025-06-20

💵 Entry: $13.30 (ask)

🎯 Profit Target: $19.95 (+50%)

🛑 Stop Loss: $9.31 (–30%)

📈 Confidence: 75%

⏰ Entry Timing: At open

⚠️ Risk Watch:

• ☠️ High premium & wide bid-ask spreads = slippage risk

• ⛔ Low open interest = exit uncertainty

• 🕒 Theta decay accelerates late in the week

• 📈 Invalidated if price breaks above $116.34

• 📰 Unexpected crypto/news rallies = trend reversal risk

📊 TRADE JSON

💬 Are you trading this NYSE:CRCL bearish setup? Share your thoughts below.

📉📈 Follow for daily AI-powered trade breakdowns.