CRCL WEEKLY TRADE SIGNAL (JULY 31)

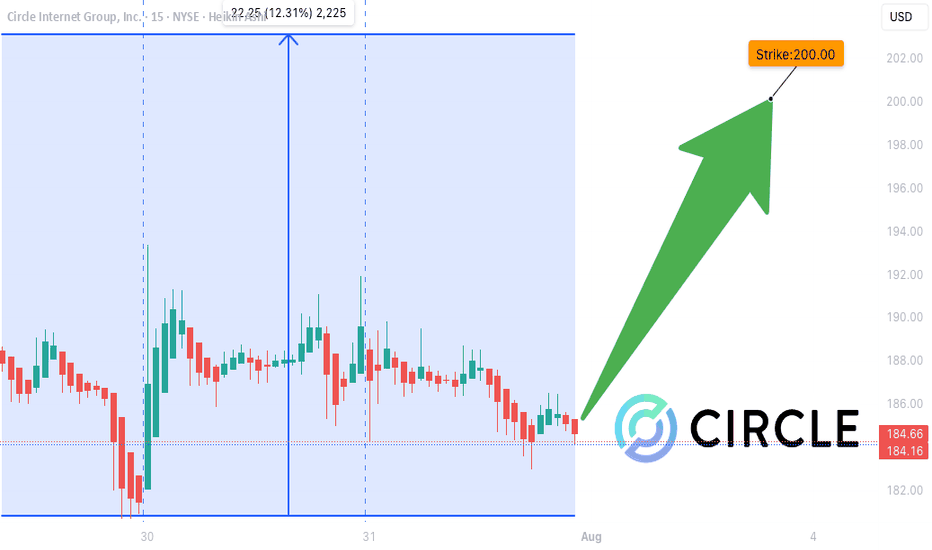

### 🚨 CRCL WEEKLY TRADE SIGNAL (JULY 31) 🚨

**Call Option Setup – Based on Multi-Model Consensus**

📈 **Momentum**:

🟡 RSI Daily: 46.7 (Neutral)

🟥 Volume: 0.4x last week = 🚨 Weak participation

🟢 Options Flow: Bullish (C/P Ratio = 1.42)

🌤️ VIX: Low (15.4) → Low volatility = 💰 opportunity

🔍 **Model Summary**:

✅ **Grok**: Bullish setup → RECOMMENDED TRADE

❌ Claude, DeepSeek, Gemini, Llama: No trade (weak volume + gamma risk)

🤝 ALL agree: Weak volume & mixed trend = caution

---

### 💥 Trade Setup 💥

🎯 **Direction**: CALL (Bullish bias)

💸 **Strike**: \$200

💰 **Entry**: \$0.85

📆 **Expiry**: Aug 1 (1DTE – high gamma 🔥)

🎯 **Profit Target**: \$1.11

🛑 **Stop Loss**: \$0.51

📊 **Confidence Level**: 65%

📍 **Entry Timing**: Market Open

---

### 🧠 Key Insight

📉 Weak volume = 🚫 no institutional conviction

📈 Bullish options flow = 🔥 potential short squeeze

🕓 Time-sensitive 1DTE = Fast hands needed!

---

👉 If you trade momentum, watch CRCL at open.

🧠 **Strategy**: scalp the move or exit near \$1.11

💥 High risk, high gamma, tight leash.

\#OptionsFlow #CRCL #CallOption #TradingSignal #UnusualOptionsActivity #0DTE #GammaScalp #TradingView #SwingTrade #TFlow