Macroeconomics for Crypto.Why bitcoin does not go with the S&P?This is research is to figure out where and when to look for the bottom of bitcoin. More importantly when to get out of it if we have a bull run. This may be something new to you, but macroeconomics is crucial here. And this I will try to explain it.

The main hypothesis is that the cryptocurrency market has become highly institutionalized, the guys from Wall Street came here. They don't know how to trade from the level, unfortunately, but they know how to do macro sentiment - and Bitcoin became part of their portfolios and now trades the same way as the stock market. Bitcoin has all but lost its independence when Wall Street the weekend trading volumes and volatility is very low almost nothing happens.

In 2018 guys like Fidelity came into cryptocurrencies. In 2020 they invited their rich clients and it was a turning point, since then all major banks and funds have been sending their clients compilations with analytics on cryptocurrencies

This is an example from UBS bank

It's not what we're used to seeing in Tradinvgview or on Twitter, but it's nothing complicated

My opinion is that, the connection between cryptocurrency and stock market will only increase, so I urge all traders and investors to pay attention to the way Wall Street analyses work. Their job is to constantly monitor the analysis of the two economic cycles: business cycle and stock market cycles

This is a schematic representation, the cycles are unsynchronized. The stock market is a reflection and result of the expectations of traders as to what is happening or will happen in the business cycle

Business cycle scheme

Everything starts with a reduction in interest rates by the central banks or with an increase in government spending, loans and mortgages become cheaper, the housing sector grows first - houses are built, more resources and materials are spent, the economy comes to life. People buy homes, make repairs, buy appliances, furniture, buy cars, have children, pets. They multiply their consumption, buy a second TV in the living room, subscribe to netflix, go to barbershops and beauty salons - the manufacturing and service sectors grow, unemployment falls, household incomes and corporations grow, and prices rise with them. Consumption peaks - inflation becomes dangerous - the Central Bank raises interest rates - credit and mortgages become more expensive - the housing sector collapses followed by the manufacturing and service sectors, unemployment rises, household and corporate incomes fall, consumption slows, inflation slows down.

Sometimes there is a recession, the central bank lowers interest rates - the cycle is closed 😀

This year, almost all central banks in developed emerging markets are raising interest rates.

Fact - 50% of all macro analysis will come down to assessing the likelihood of interest rate increases or decreases.

Obviously there is money, there is growth and vice versa there is no money, no growth.

We're about here in the middle of the cycle, a global recession is likely ahead

All this is necessary and important to understand in order to assess the prospects and dynamics of stock prices on the stock market. We are used to the fact that there are many companies whose shares are traded on the stock exchange, and the companies themselves are divided into sectors and industries for classification. The first to react to the expectation of economic recovery are the sectors of financial housing and transport and so on. The logic was described above - mortgage, Home, Car, Kids, TV, netflix subscription and barbershop, etc.

Wall Street looks at the stock market a little differently, through factors, that is, properties of certain groups of stocks, for example: industry sectors are commonly divided into cyclical - these are goods services secondary necessities that are highly dependent on the business cycle and non-cyclical - that is, these are goods services primary necessities that are not so highly dependent on it.

The first - will respond cyclical, the factors are hundreds, but I will tell you with the most important and understandable. Imagine we take all the stocks and sort them by properties, by volatility, by beta, by dividend yield, by business margins, by multiples and so on so by these factors the stocks are sorted into a whole group.

The first factor I consider is the volatility factor aka beta imagine an index of unprofitable junk companies like Virgin Galactic and other meme stocks this will be the extreme manifestation of the beta factor and the riskiness of the idea in Ark innovation by Cathie Wood - it consists of just that.

The Quality factor is dividends, blue chips, s&p 500 index, Dow Jones is about them.

The Value factor is the value of perpetually undervalued companies with low multipliers, the core of the real economy, they also have their own index, Russell 2000

Growth factor - Growth stocks are companies with prospects of perpetual revenue growth Apple Tesla uber is them And the nasdaq 100 is their index

The Size factor is about capitalization small, medium, large, huge

The institutional manager's view on the composition of the portfolio is approximately as follows: there are two modes of money and no money.

When all is well, money is worthless, cash is trash. The manager buys into his portfolio everything that has high risk and high profitability, high-risk assets: IPO, SMall Cap, venture capital, cryptocurrencies, etc.

When the regime is like now, when money is expensive and everybody needs it, the riskiest part is sold first, and further down the chain the portfolio increases the share of cash and bonds from the shares.

Here's how these factors look within the stock market cycle. High-risk cyclical small-cap stocks are the first to respond to rate cuts and economic recovery. Next come value stocks, then quality stocks, then growth stocks. Eventually the party ends for everyone and everything goes down, risk OFF mode kicks in.

Finally, Bitcoin's connection to the stock market

Next you will see the result of a manual correlation search with thousands of stocks of different factors and other asset classes.

I will show just a few : the orange line is what we are comparing to, the blue line is the bitcoin scale logarithmic.

correlation coefficient on the right - peak correlation and current correlation

look only at the visual picture

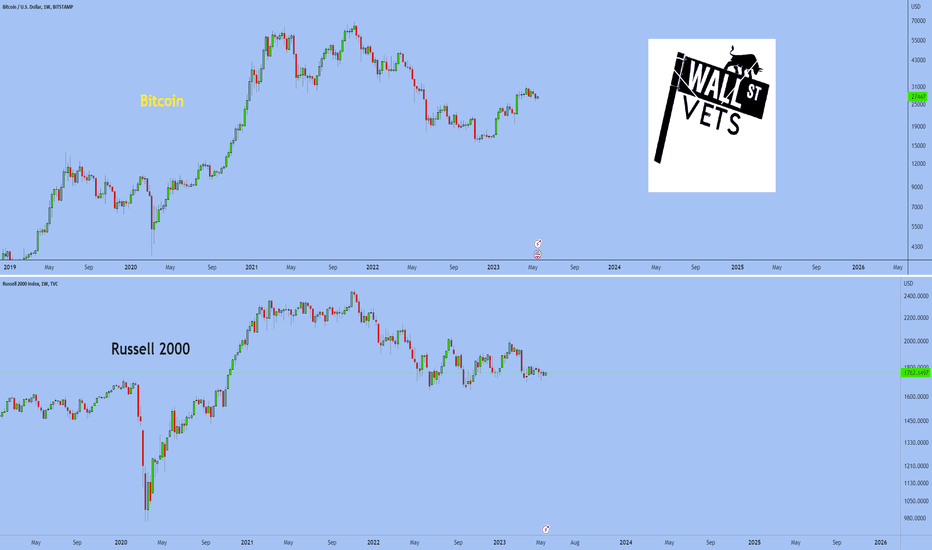

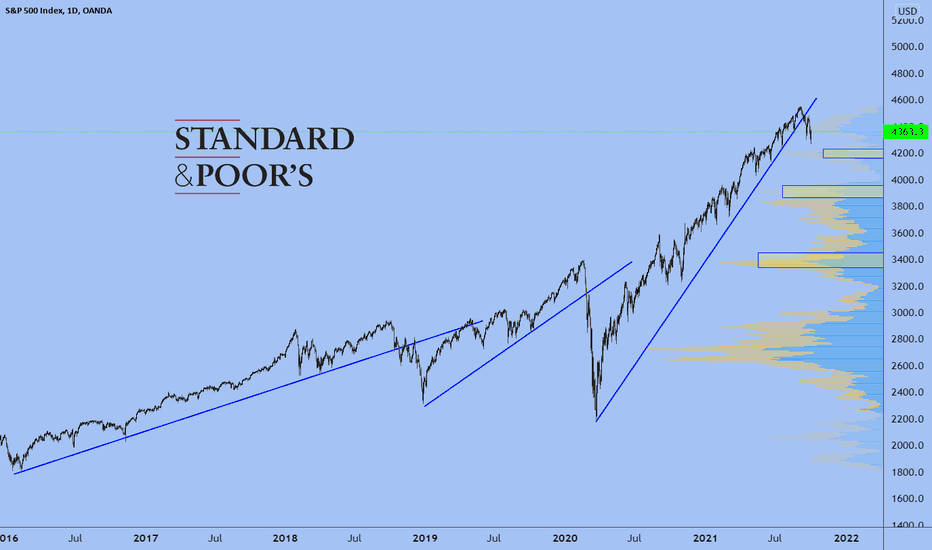

First s&p 500 index is a quality factor peak correlation 88 current 68. Large Cap, Quality, Low Beta

For example Coca Cola - Correlation is negative.

Nasdaq 100 factor Grow stock growth peaks correlation 86 current 72 is little

is the Russell 2000 Value Factor Index And in it most of the small and mid-cap companies from the real economy cyclical sectors in the Peak correlation 93 now 79

The transport industry index in Peak is 95 current 82

Bank index 94 peaks 30 now

If Bitcoin were a stock

it would be an asset: Value, Cyclical, Small Cap, High Beta, High Risk asset.

Stock - value, cyclical sector, small capitalization, high beta and high risk

Its place in the cycle starts from where all cyclical industries like transportation, small capitalization companies with the value factor before the recession

Here's what the dynamics of the various stocks look like depending on the macro regime actually this is the main chart look at top Bitcoin next comes the SP500 below the Russell 2000 index and the nasdaq 100

From the covid bottom After the rate cuts, everything went up - it's understandable high risk and loss assets rose the most. But of the indices, it was the Russell 2000 that showed the most growth

February 2021 marked the vertical lines , inflation expectations hinted that things would be very bad and the entire high-risk segment of the portfolios began to close. the highbets and High Risk were the first to go under the knife.

The Russell 2000 stayed basically the same as Bitcoin for a whole year, but it moved stronger.

And the Nasdaq 100 and s&p 500 continued their movement.

This January's response is the second vertical line turned risk OFF for all assets and the party is over. Bottom line Bitcoin doesn't go for the nasdaq it doesn't go for the s&p 500 goes with the Rassell 2000 index and high-risk assets as part of someone else's portfolios.

So we have already seen a new bull run early and it will quickly start and quickly end we should try to be ready for it and not wait for miracles.

I really want to remind you that bitcoin's bottom and peak is not a price or a date - it doesn't work that way. It is a period of macro regime change from risk on to risk off and back

I have a plan for How to watch and how to act. Thank you very much for your attention. I wish you success in trading and learning the macro, I am sure you will find it very useful .

I would also like to thank Anton Klevtsov for the information

Best regards EXCAVO

Crisys

USA. Taxes. China. Crisis. Electricity. Europe. BitcoinThe world leaders have begun to create a synthetic crisis. This crisis is far scarier - the energy crisis.

It is not an accident that coal-fired power plants in Great Britain were not just shut down or canned. They exploded it without any chance to rebuild. It gave the island 44% of its generation in 2012.

Britain is developing a plan to build a 3,800 km long transmission line off the coast of Morocco. There will build wind farms. They will be able to meet as much as 5% of Britain's electricity needs. By the way, they will lose up to 30% of the generated electricity in the submarine cables. All countries in whose territorial waters the cable runs will have to pay a constant fee. There has never been a more costly energy project on the planet.

Last year, in 2020, China permanently abandoned imports of coal from Australia, which covered 25% of the Celestial Empire's electricity generation. Most interestingly, China has not sent proposals to, for example, the Russian Ministry of Energy to organize coal exports. It simply increased its consumption of liquefied gas. The result was not long in coming.

The largest factories all over China receive a schedule of power outages. The schemes include 2 in 2 or 1 in 3 days. The most extensive electricity consumers are the industrial companies. They will work only 3 or 4 days a week.

Orders from major technology companies are in jeopardy. It is the most trivial issue we have. The fact is that almost all manufacturers in the world in mechanical engineering, electronics, pharmaceuticals, light industry, and the food industry are dependent on component supplies from China.

They couldn't invent anything better than an energy crisis in China to disrupt global supply chains, production processes and provoke mass unemployment and hunger.

There are two global dangers in the world right now. The first is the bankruptcy of the Chinese mega-developer Evergrande, which threatens to bankrupt dozens of businesses in China and even more investment funds in the United States. The second is a default by the U.S. federal government, which could occur soon.

So far, there is not a hint of consensus among congressmen (Democrats and Republicans) about the issue of raising the limit of the federal budget borrowing by $3.5 trillion. Such a decision would automatically be associated with a bill to change the taxation rules in the United States. Biden signs a government funding bill to prevent a shutdown.

So-called unrealized gains will now be taxed. For example, you own a house for $400,000, and last year it went up in value to $600,000. In that case, you immediately owe $60,000 to $100,000 in taxes. So if you don't currently have that money, you will need to sell your house to pay your taxes.

The same goes for cryptocurrency owners. Let's suppose that you have Bitcoin in your portfolio, and it has grown in value by 300% during a year. You don't want to sell it. You are waiting for the price of $300k per BTC. In case of this law is passed, you have to pay taxes and have to sell half of your bitcoins to pay taxes.