Can One Idaho Mine Break China's Grip on America's Defense?Perpetua Resources Corp. (NASDAQ: PPTA) has emerged as a critical player in America's quest for mineral independence through its Stibnite Gold Project in Idaho. The company has secured substantial backing with $474 million in recent financing, including investments from Paulson & Co. and BlackRock, plus over $80 million in Department of Defense funding. This support reflects the strategic importance of the project, which aims to produce both gold and antimony while restoring legacy mine sites and creating over 550 jobs in rural Idaho.

The geopolitical landscape has dramatically shifted in Perpetua's favor following China's export restrictions on antimony imposed in September 2024. With China controlling 48% of global antimony production and 63% of U.S. imports, Beijing's ban on sales to America has exposed critical supply chain vulnerabilities. The Stibnite Project represents America's only domestic antimony source, positioning Perpetua to potentially supply 35% of U.S. antimony needs and reduce dependence on China, Russia, and Tajikistan, which collectively control 90% of global supply.

Antimony's strategic significance extends far beyond its typical use as a mining commodity, serving as an essential component in defense technologies, including missiles, night vision equipment, and ammunition. The U.S. currently maintains stockpiles of just 1,100 tons against annual consumption of 23,000 tons, highlighting the critical supply shortage. Global antimony prices surged 228% in 2024 due to these shortages, while conflicts in Ukraine and the Middle East have amplified demand for defense-related materials.

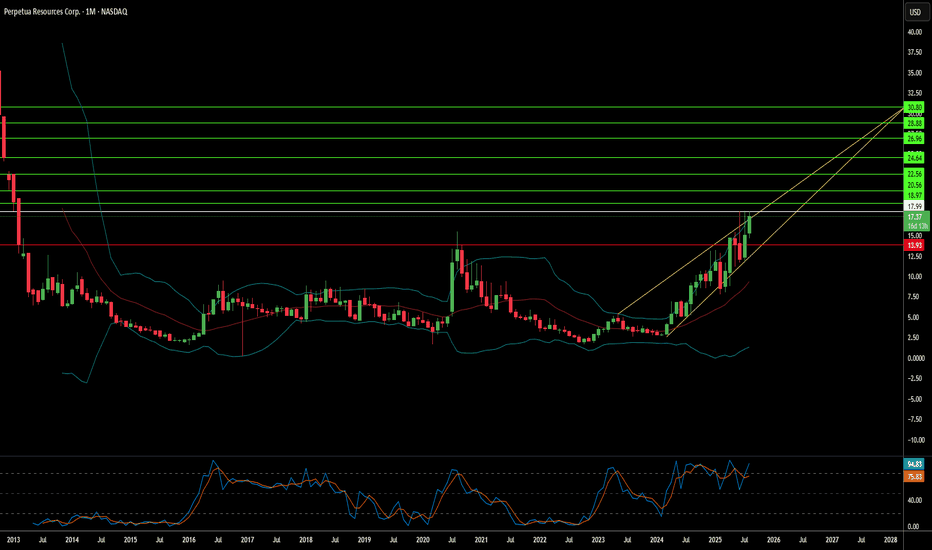

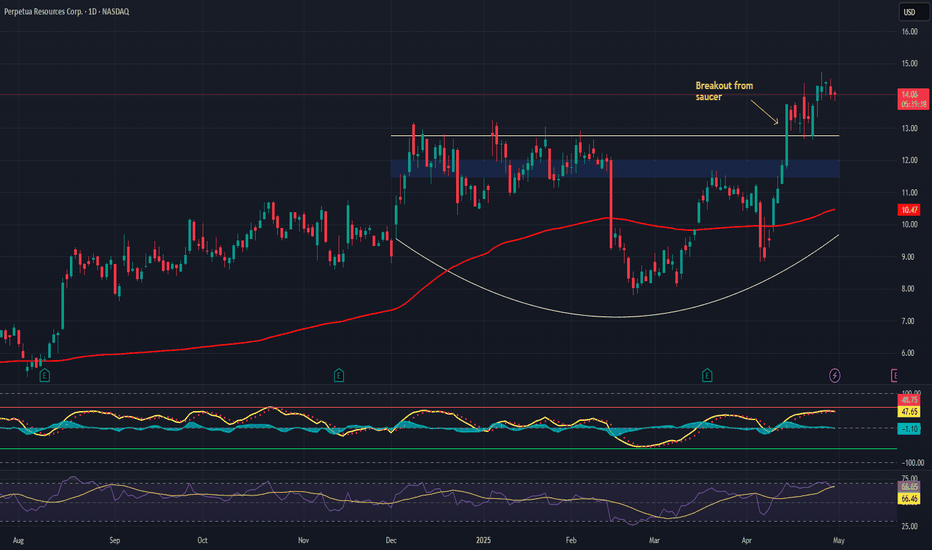

The project combines economic development with environmental restoration, employing advanced technologies for low-carbon operations and partnering with companies like Ambri to develop liquid metal battery storage systems. Analysts have set an average price target of $21.51 for PPTA stock, with recent performance showing a 219% surge reflecting market confidence in the company's strategic positioning. As clean energy transitions drive demand for critical minerals and U.S. policies prioritize domestic production, Perpetua Resources stands at the intersection of national security, economic development, and technological innovation.

Criticalminerals

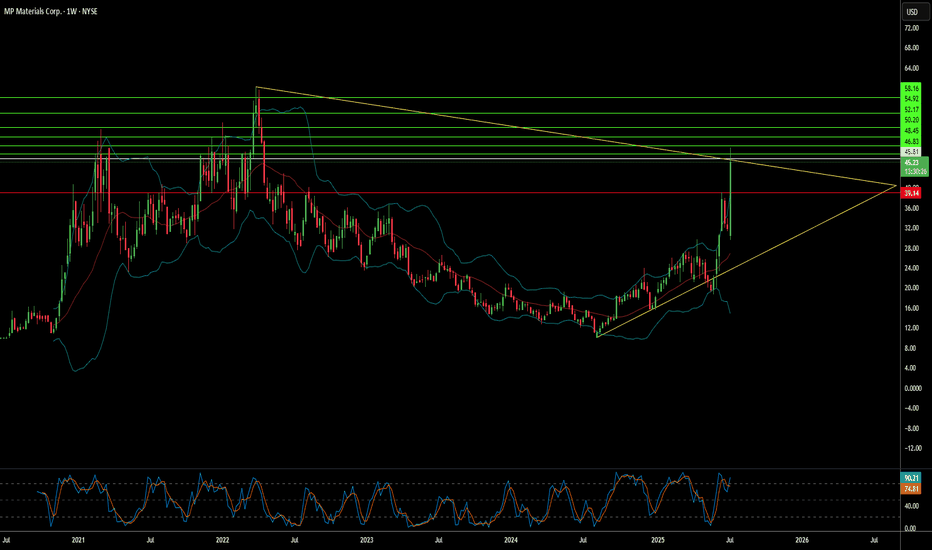

Can Strategic Minerals Transform National Security?MP Materials has experienced a significant market revaluation, with its stock surging over 50% following a pivotal public-private partnership with the U.S. Department of Defense (DoD). This multi-billion-dollar agreement, which includes a $400 million equity investment, substantial additional funding, and a $150 million loan, aims to rapidly establish a robust, end-to-end U.S. rare earth magnet supply chain. This strategic collaboration is designed to curtail the nation's reliance on foreign sources for these critical materials, which are indispensable for advanced technology systems across both defense and commercial applications, from F-35 fighter jets to electric vehicles.

The partnership underscores a profound geopolitical imperative: countering China's near-monopoly over the global rare earth supply chain. China dominates rare earth mining, refining, and magnet production, a leverage it has demonstrably used through export restrictions amidst escalating trade tensions with the U.S. These actions highlighted acute U.S. vulnerabilities and the imperative for domestic independence, propelling the DoD's "mine to magnet" strategy aimed at achieving self-sufficiency by 2027. The DoD's substantial investment and its new position as MP Materials' largest shareholder signal a decisive shift in U.S. industrial policy, directly challenging China's influence and asserting economic sovereignty in a vital sector.

Central to the deal's financial attractiveness and long-term stability is a 10-year price floor of $110 per kilogram for key rare earths, significantly higher than historical averages. This guarantee not only ensures MP Materials' profitability, even against potential market manipulation, but also de-risks its ambitious expansion plans, including new magnet manufacturing facilities expected to produce 10,000 metric tons annually. This comprehensive financial and demand certainty transforms MP Materials from a commodity producer vulnerable to market whims into a strategic national asset, attracting further private investment and setting a powerful precedent for securing other critical mineral supply chains in the Western Hemisphere.

Perpetua – Unlocking Strategic Gold & Critical Mineral Value Project Focus:

Perpetua NASDAQ:PPTA is advancing the Stibnite Gold Project—a rare dual-value asset with both economic and national security significance.

Key Catalysts:

Federal Backing Accelerates Permitting 🏛️

Labeled a “Transparency Project” by the White House

Streamlined permitting process → lowers execution risk, expedites timeline

Outstanding Economics 💰

$3.7B after-tax NPV, 27%+ IRR at spot prices

AISC: $435/oz in early years → Tier-one margins + downside protection

Antimony Exposure: Critical Strategic Edge 🇺🇸

One of the few domestic sources of antimony, vital for:

Defense applications

Battery storage technologies

Geopolitical importance enhances long-term value proposition

Environmental Remediation Built-In 🌱

Project includes restoration of a legacy mining site → aligns with ESG frameworks and broadens support base

Investment Outlook:

✅ Bullish Above: $11.50–$12.00

🚀 Target Range: $18.00–$19.00

🔑 Thesis: Tier-1 economics + critical mineral relevance + federal backing = asymmetric upside for long-term investors

📢 PPTA: A gold play with strategic minerals and federal momentum behind it.

#Gold #CriticalMinerals #Antimony #MiningInnovation #EnergySecurity #PPTA