CRN

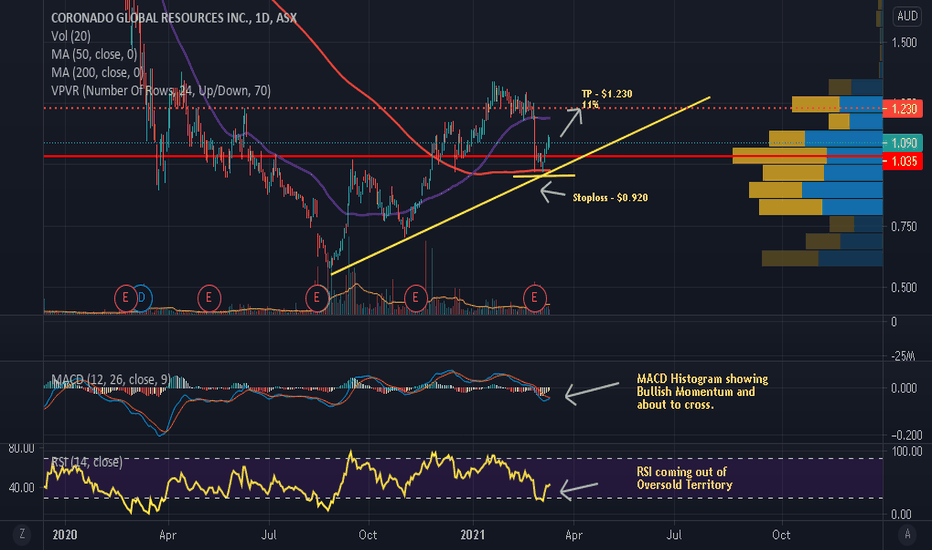

CRN - Pullback Over?CRN seems to be in a very stable uptrend as we have witnessed Higher Highs and Higher Lows. The recent pullback has provided an excellent buying opportunity as price has bounced of the Bullish Trendline for the third time, as well as the 200 SMA and the POC of Volume Profile. RSI has also popped out of the Oversold region and MACD Histogram is showing Bullish Momentum and is about to cross. I am bullish and my trade plan is to target the highs.

TP - $1.230 (Potential 11%)

Stoploss - $0.920

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.