CROUSDT

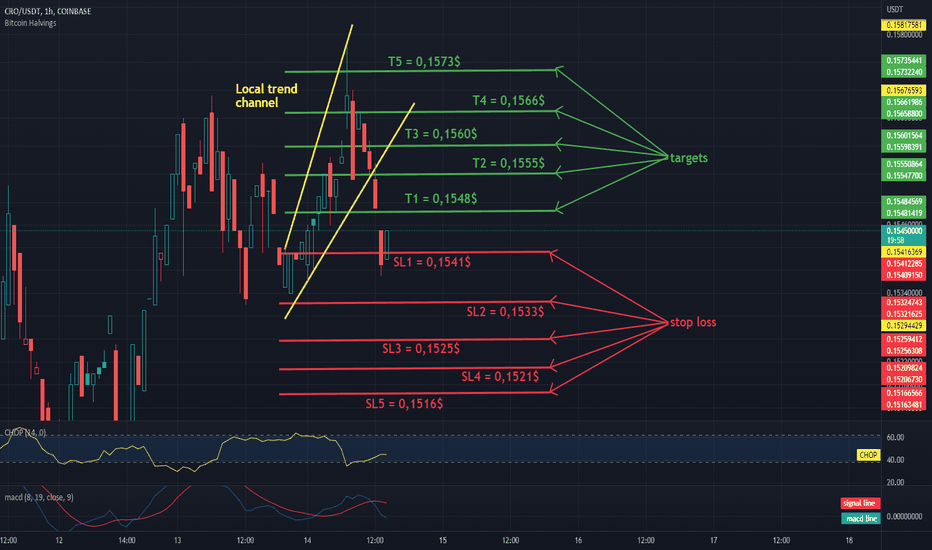

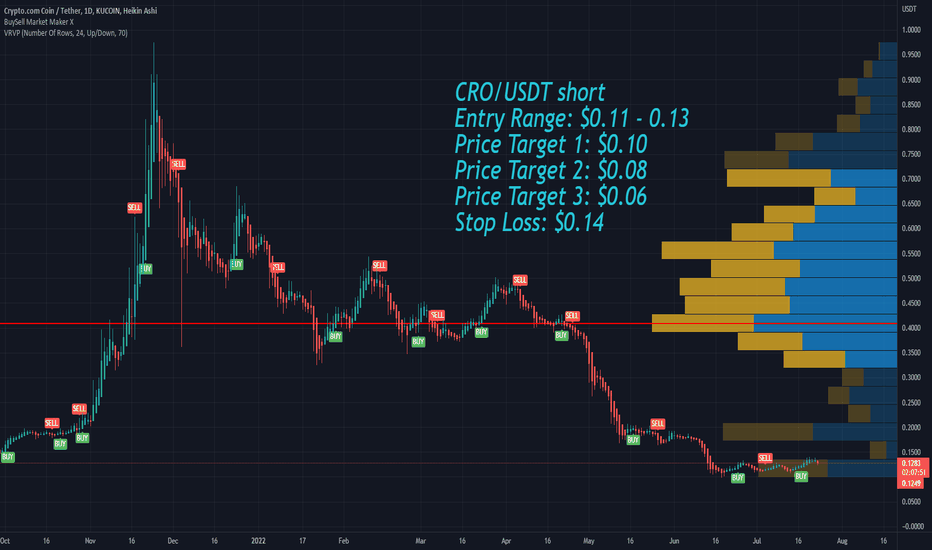

CRO / USDT Short on 1H IntervalHello everyone, let's take a look at the 1H CRO to USDT chart as you can see the price is moving below the local uptrend channel.

Let's start by setting goals for the near future that we can consider:

T1 = $ 0.1548

T2 = $ 0.1555

T3 = $ 0.1560

T4 = $ 0.1566

and

T5 = $ 0.1573

Now let's move on to the stop loss in case of further market declines:

SL1 = $ 0.1541

SL2 = $ 0.1533

SL3 = $ 0.1525

SL4 = $ 0.1521

and

SL5 = $ 0.1516

Looking at the CHOP indicator, we can see that in the 1H range we have very little energy and the MACD indicator shows a local downward trend.

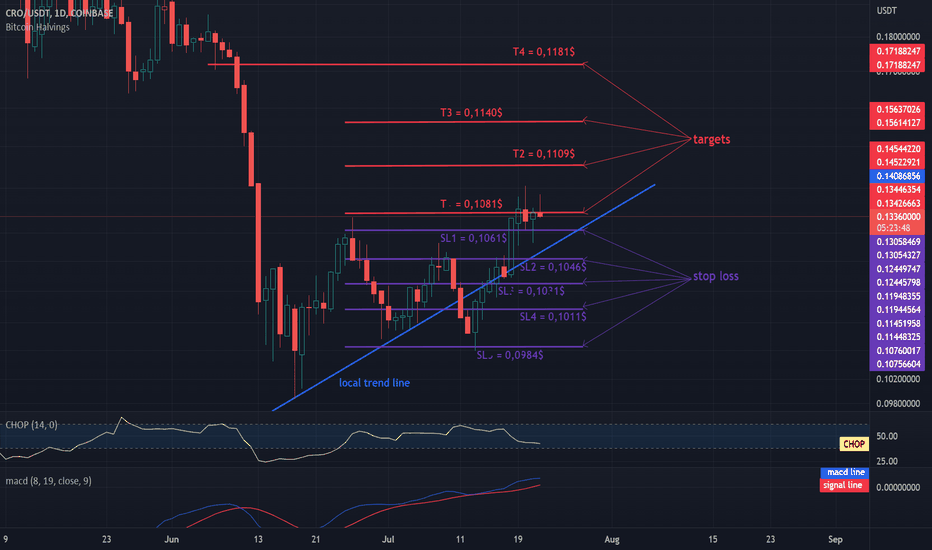

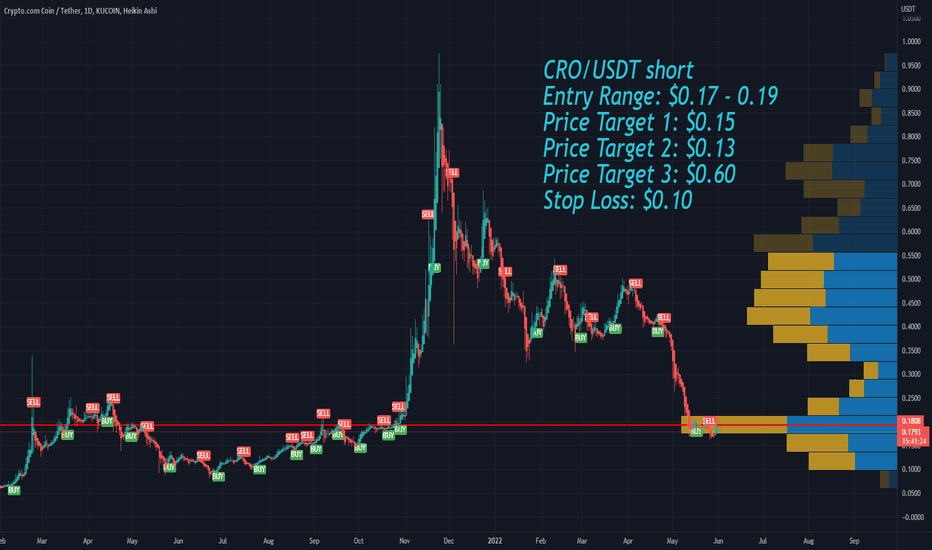

FTM continues the local uptrend.Hello everyone, let's take a look at the 1D CRO to USDT chart as you can see that the price has returned above the local uptrend despite its decline.

Let's start by setting goals for the near future that we can consider:

T1 = $ 0.1081

T2 = $ 0.1109

T3 = $ 0.1140

and

TT4 = $ 0.1181

Now let's move on to the stop loss in case of further market declines:

SL1 = $ 0.1061

SL2 = $ 0.1046

SL3 = $ 0.1031

SL4 = $ 0.1011

and

SL5 = $ 0.0984

Looking at the CHOP indicator, we can see that in the 1D range most of the energy has been used, while the MACD indicator shows a local upward trend.

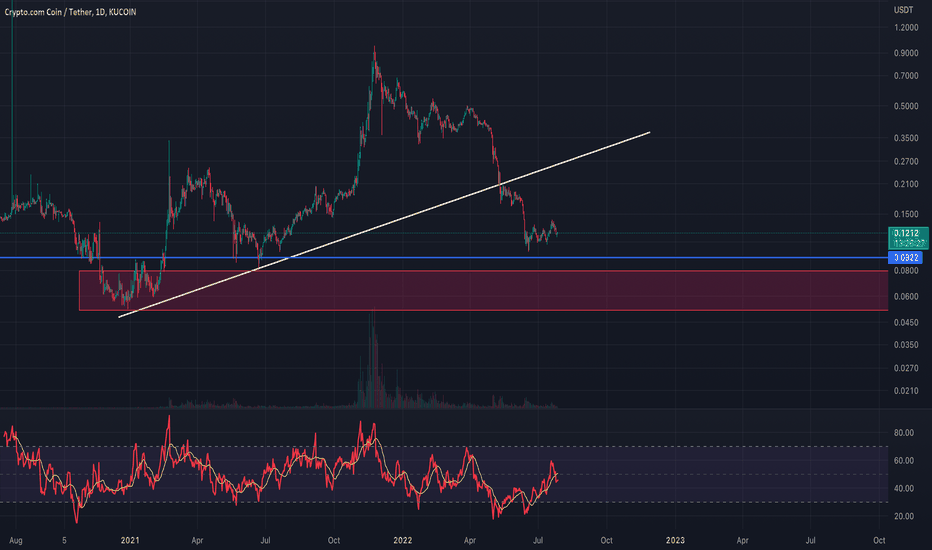

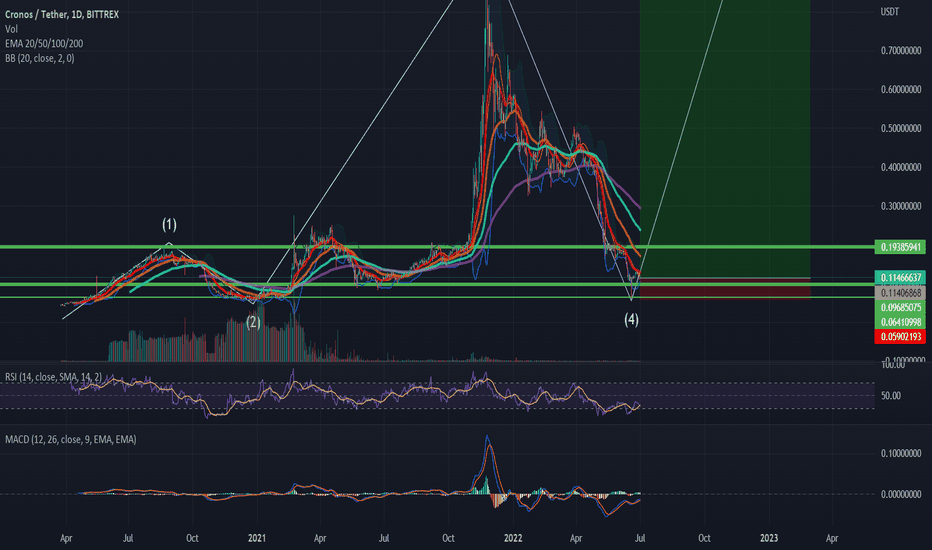

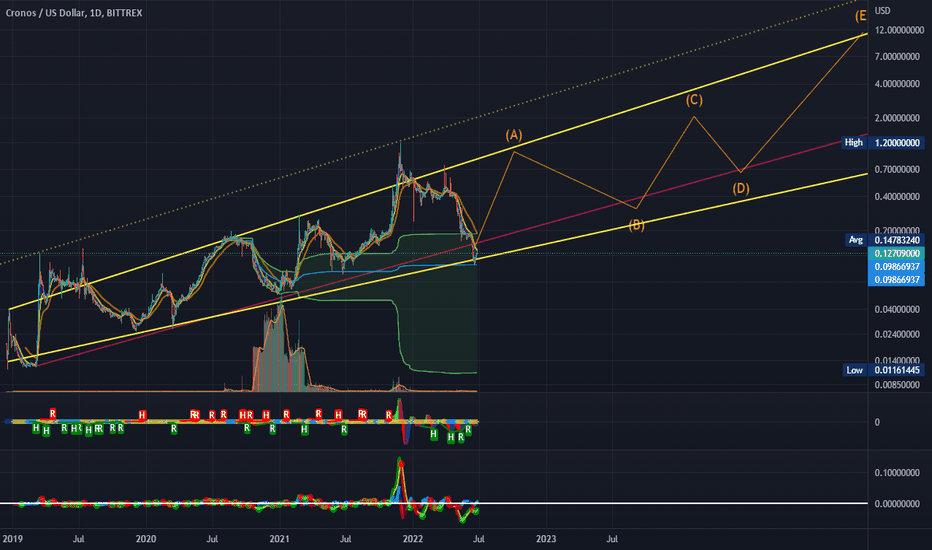

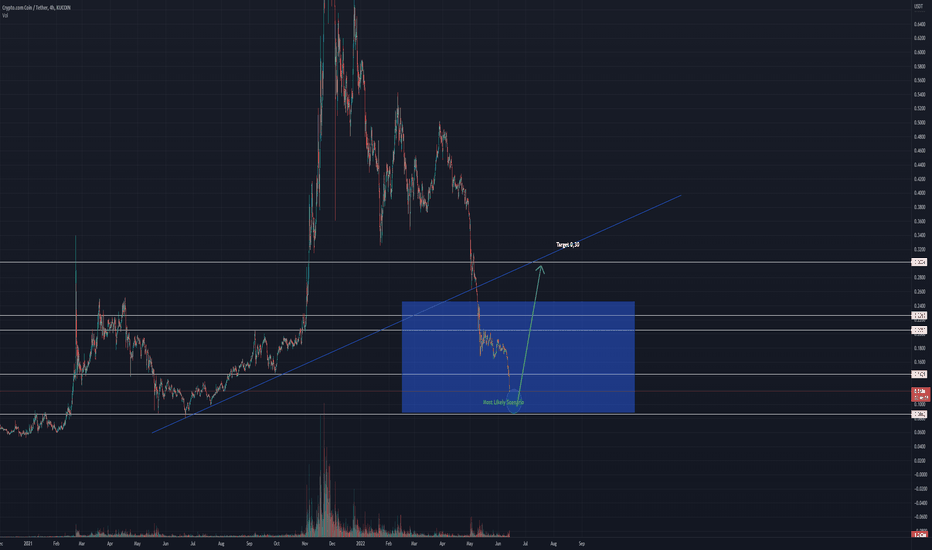

CRO/USDTesting/tracking elliot wave theory. Please do not trade off idea without S/L. Not financial advice.

RR: 25

Possible upside: 1200%

Possible downside: 48%

The bottom for CRO is in. 99.99% sure.

If you take a look at the wave (4) bottom it touched the price around 0.06. It went a bit under the support line. This is a prime example of what I meant by getting stop hunted. When they are looking to take out players who places stop losses on support lines they will go a bit right under to trigger your stop loss.

The stop loss I have placed on this chart goes a bit further than that. 0.055

Wave 2 bottomed around 0.048

0.06 is really close to 0.048 so I'm 99.99% sure the bottom for CRO is in. If we go anywhere near 0.048 this chart is invalid.

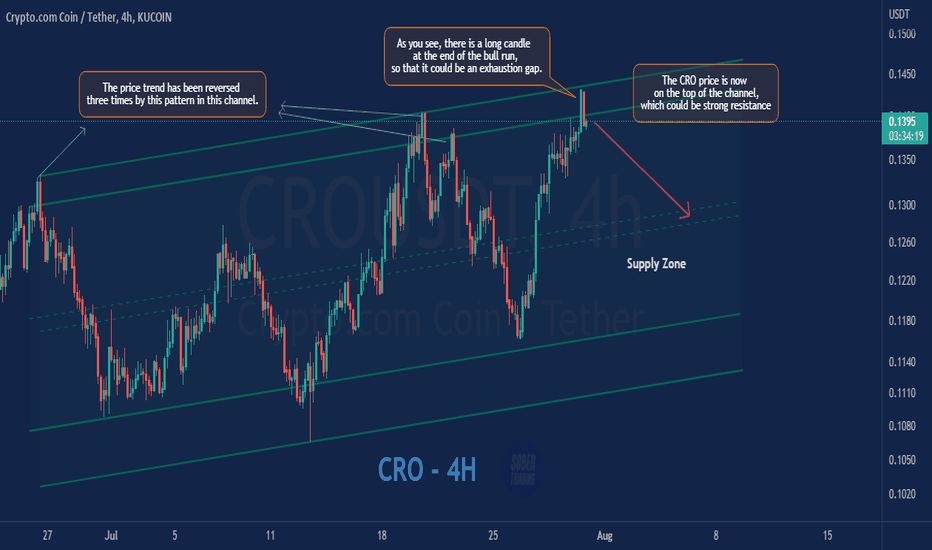

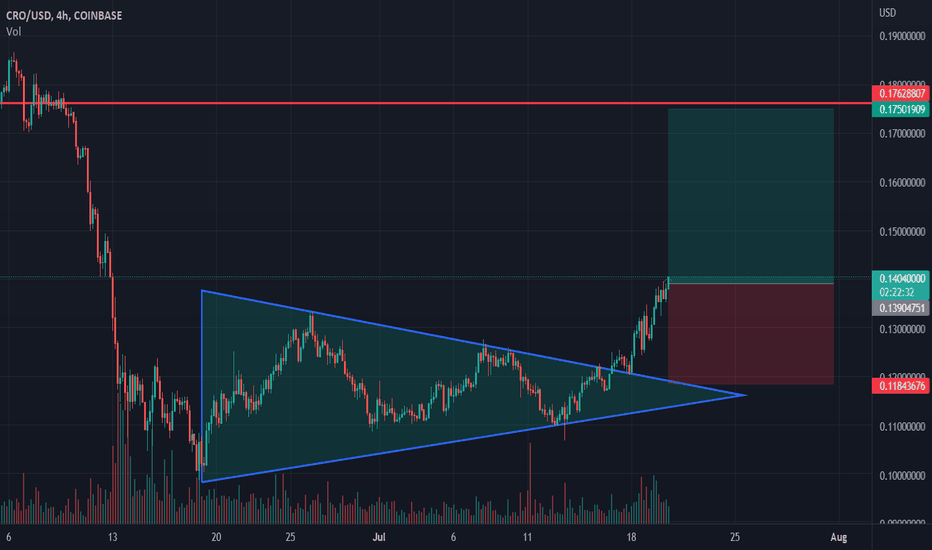

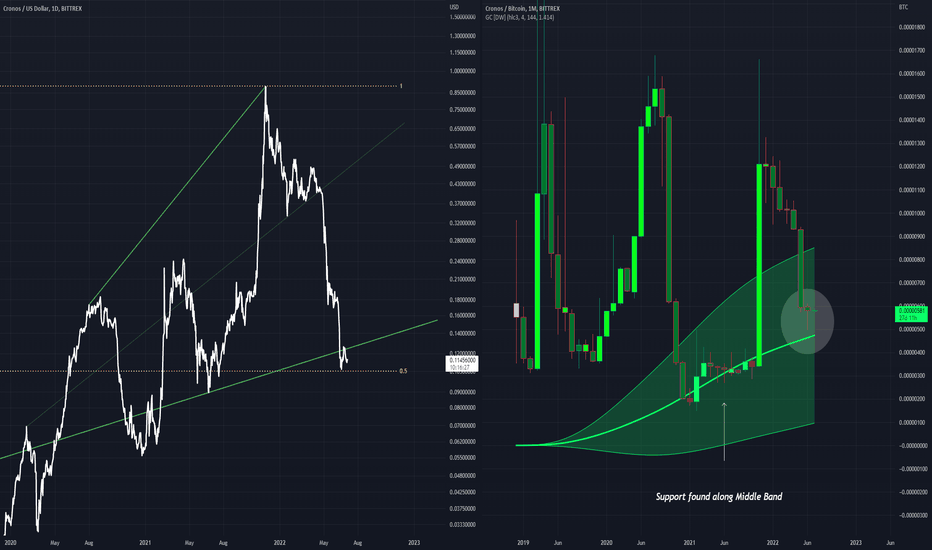

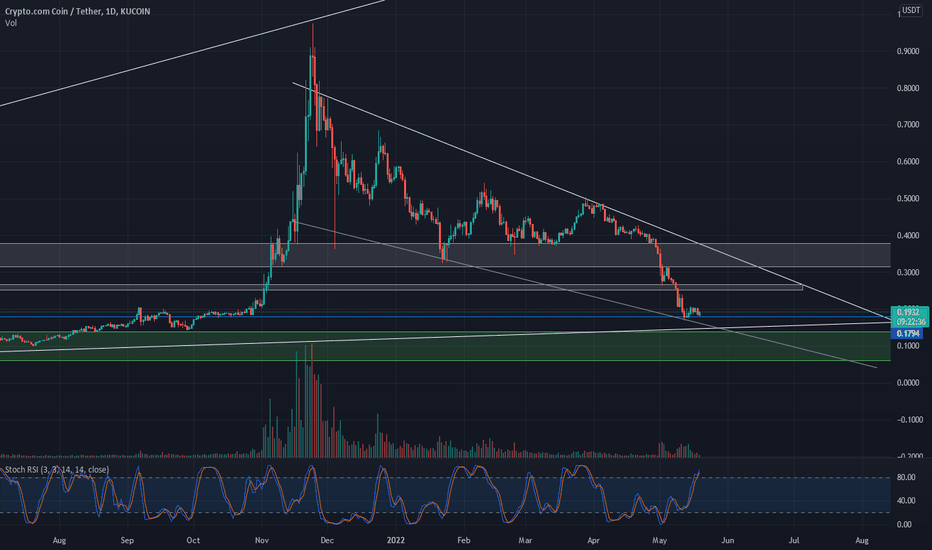

CRO AnalysisOn the left we an see price hitting 0.5 fib which has been previously seen as a support area, also aligning well with the green uptrend line

On the right the Gaussian Channel indicator shows the middle band as a point of support, price on this BTC pair is just above this Middle Band right now

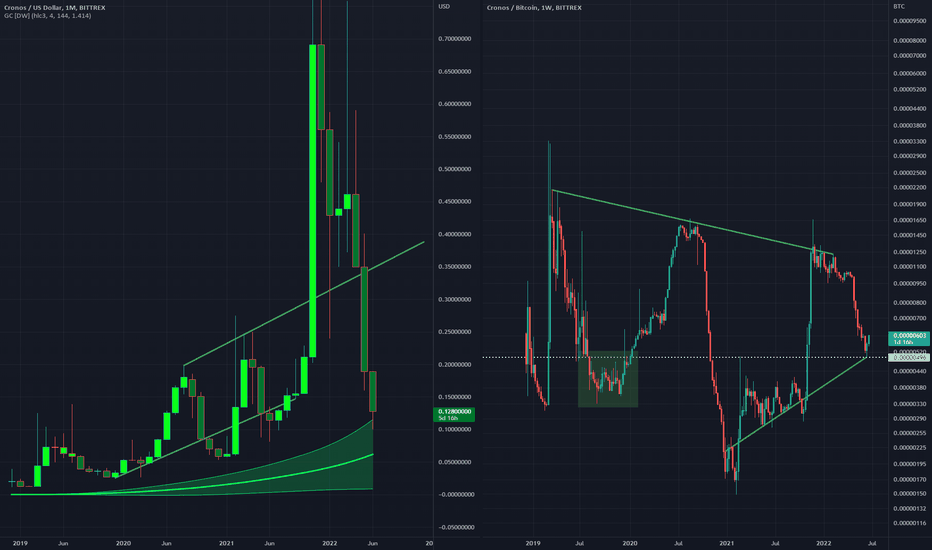

CRO following prior path along long term support lines. Hello you beautiful trader you!

Copied the Elliot wave forward and outlined some long term channels. Excess bleeds to either side, but here's to hopium eh?!

This is until crypto either depegs from the US Stock Market or BTC finds a functional bottom.

CRO - Gaussian Upper BandCROUSD chart on left, CROBTC chart on right

The USD pair can be seen to be touching the top of the channel, this provides a possible bounce and recovery point

While the BTC pair has poised itself right in the middle of a seemingly triangle structure, which has some fair supports (shown in the green box and along the white line)

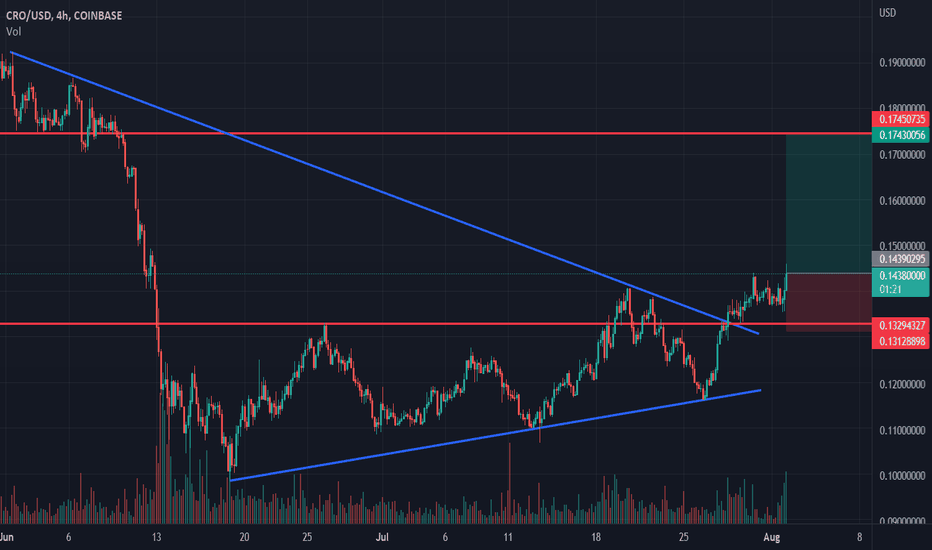

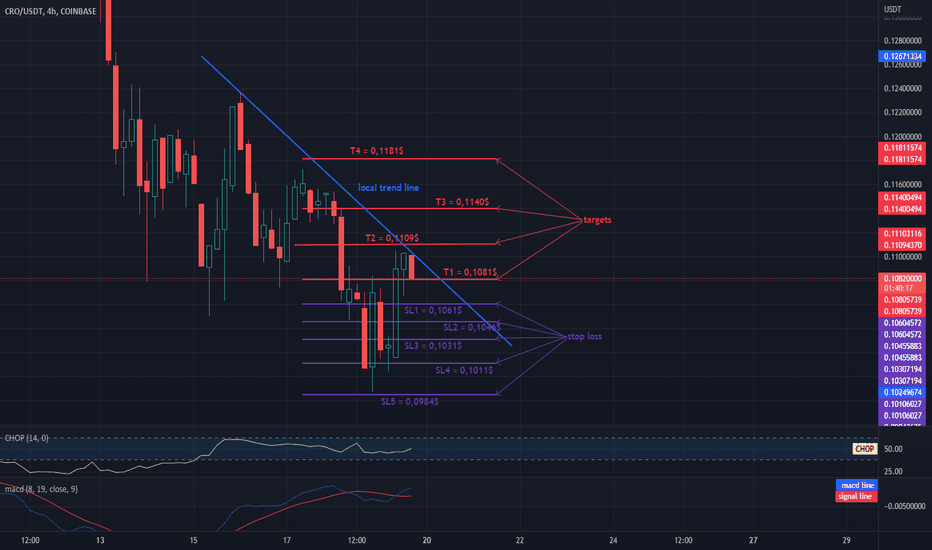

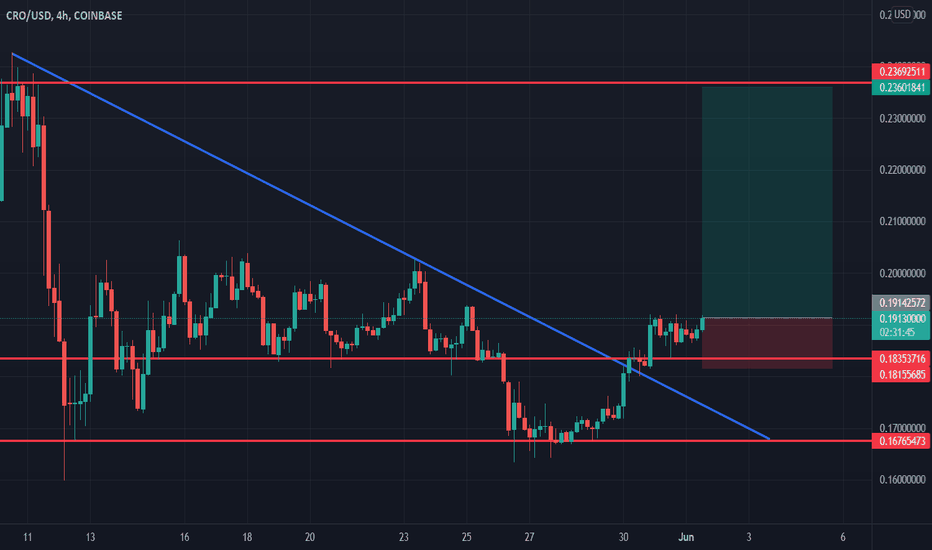

LOCAL REFUND OF THE PRICE CROHello everyone, let's take a look at the 4H CRO to USDT chart as you can see the price is moving below the local downtrend line.

Let's start with setting targets for the near future that we can take into account:

T1 = $ 0.1081

T2 = $ 0.1109

T3 = $ 0.1140

and

T4 = $ 0.1181

Now let's move on to the stop loss in case of further market declines:

SL1 = $ 0.1061

SL2 = $ 0.1046

SL3 = $ 0.1031

SL4 = $ 0.1011

and

SL5 = $ 0.0984

Looking at the CHOP indicator, we can see that at the 4H interval, the energy slowly begins to increase, while the MACD indicator indicates a local upward trend.

CRO LongHello Traders, here is the full analysis for CRO , let me know in the comment section below if you have any questions.

The ellipse could represent a possible zone with good risk/reward to accumulate long position.

Please note that all the information and publications hera are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. What you will find here, are only views of a Cat passionate about Finance.