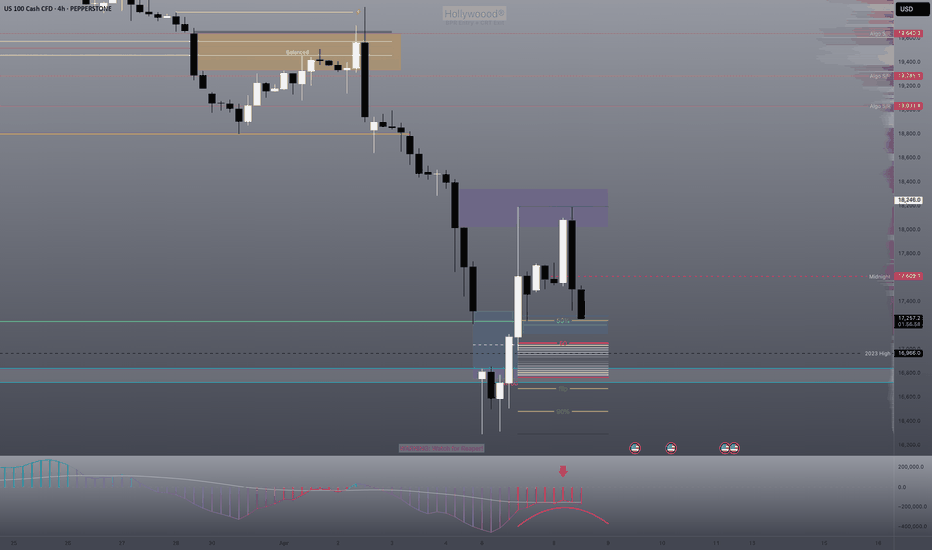

Where is the support level for Nasdaq?! Is the bloodbath over?Bearish fair value gap ranges are taking over this chart and when we rally up into them, they have been sending us down over and over.

This week we have had the advantage of a bearish gap from last week's low. This gave us clear reason to seek longs to fill the gap. Now we have a small cushion of long interest in this range after retesting the 2023 yearly candle's broken high.

As long as we remain above this yearly level--16.960ish (Using last year's low for NQ 17,570ish)-- we will see a neat consolidation and sitting upon these levels before the rally that may lead us out of this range.

That is what I expect, however, if we lose these levels, you already know we are headed to the dungeon of a true recession.

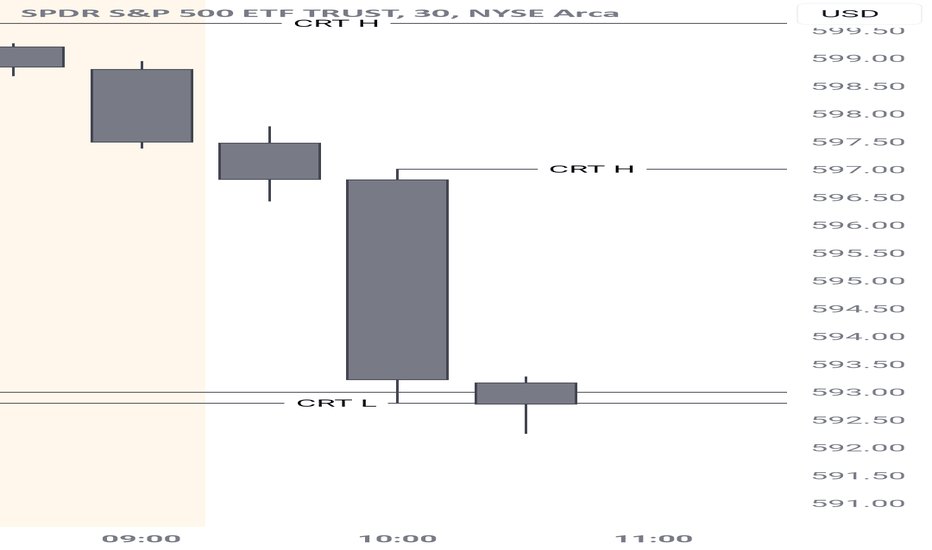

20 min breakdown:

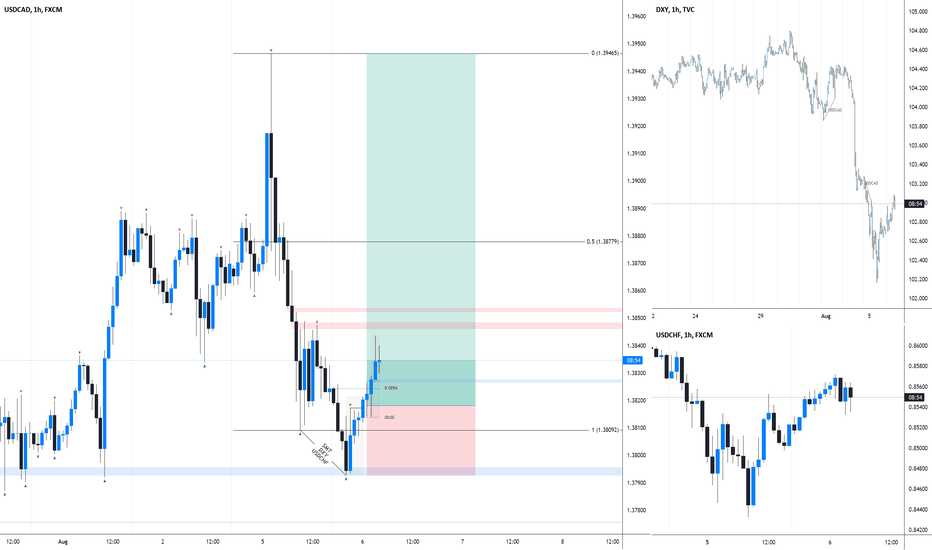

CRT

TRUMPUSD Daily CRTDisclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

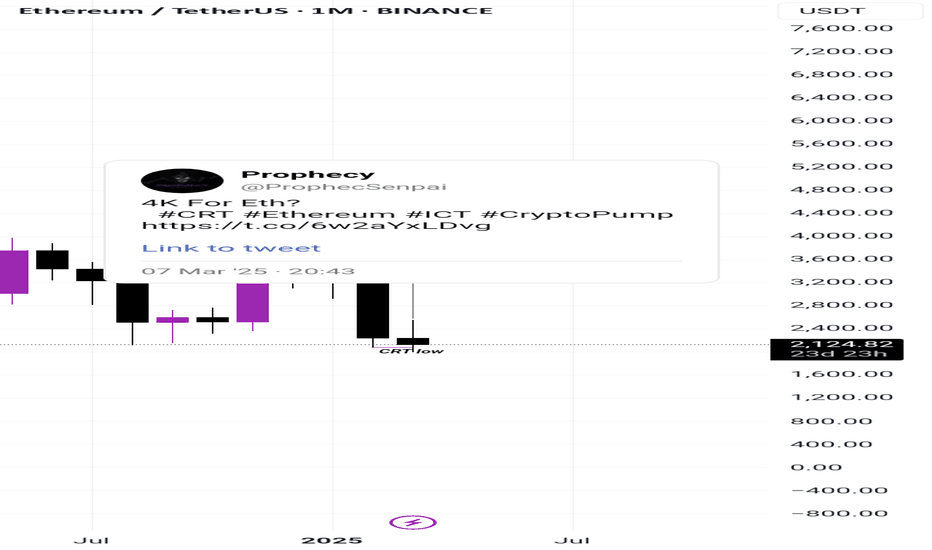

ETHUSD Daily CRTDisclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

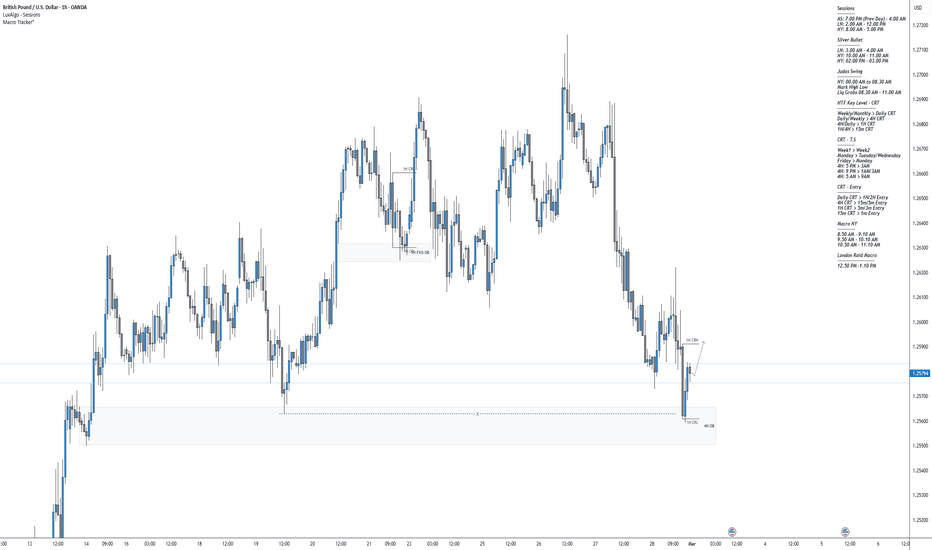

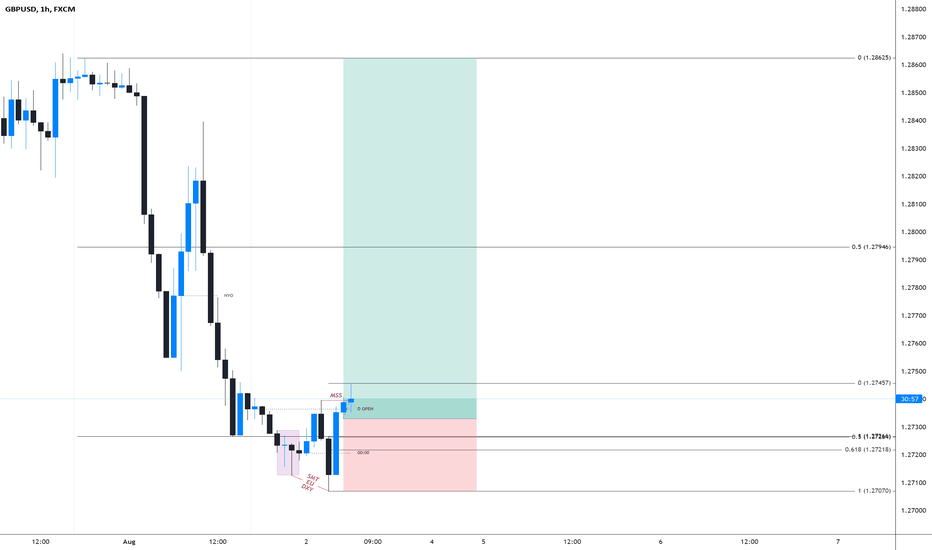

GBPUSD 1H CRT Disclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

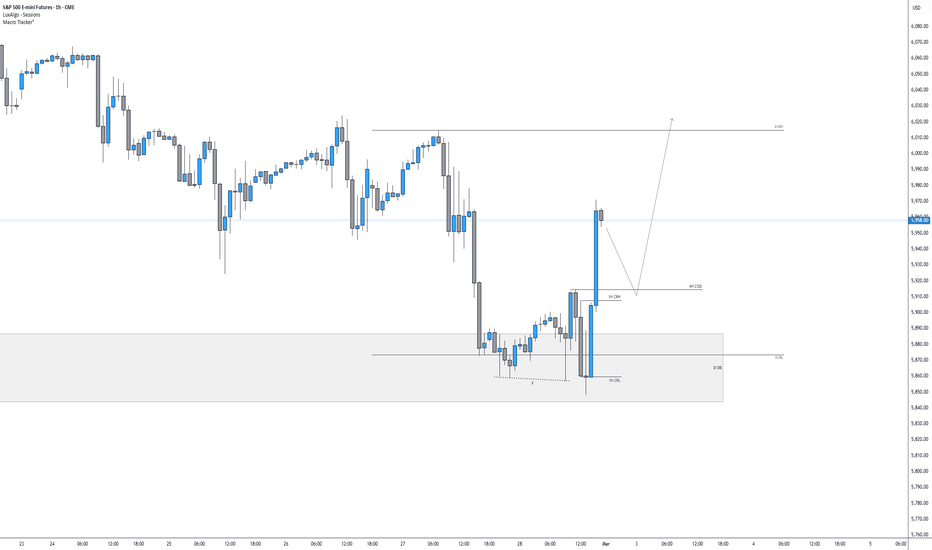

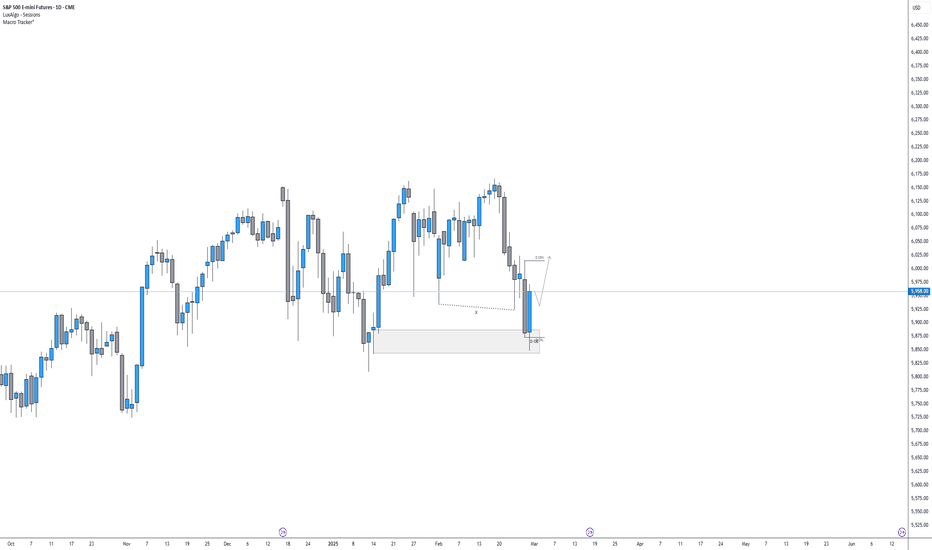

S&P 500 Daily CRT - 1H EntryDisclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

S&P 500 Daily CRTDisclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

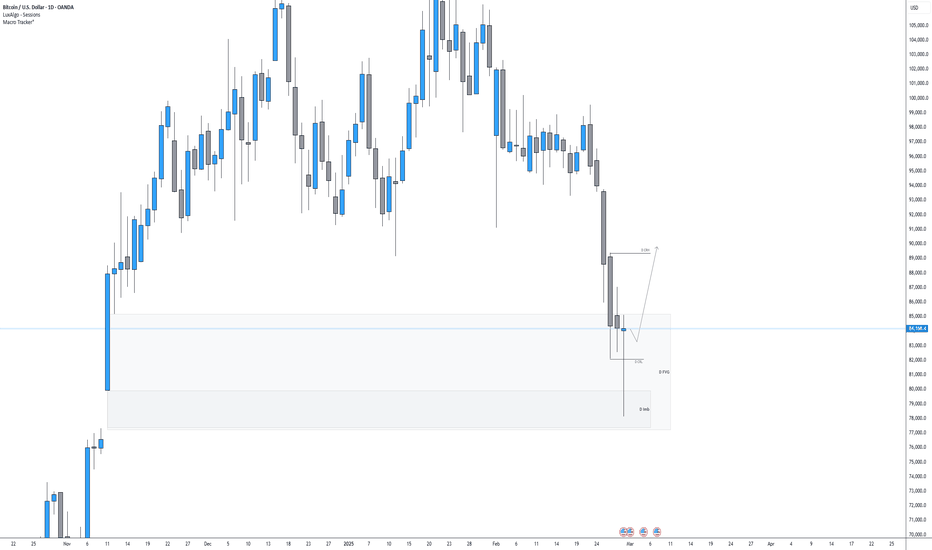

BTCUSD - Daily CRTDisclaimer: The charts and analysis presented here are based on my personal research and insights. I am not a financial advisor, and this content is not intended as financial advice or a recommendation to buy or sell any financial instruments. Please conduct your own research and consult with a professional advisor before making any investment decisions.

Credit: Special thanks to Romeo and ICT for their invaluable contributions to the forex industry.

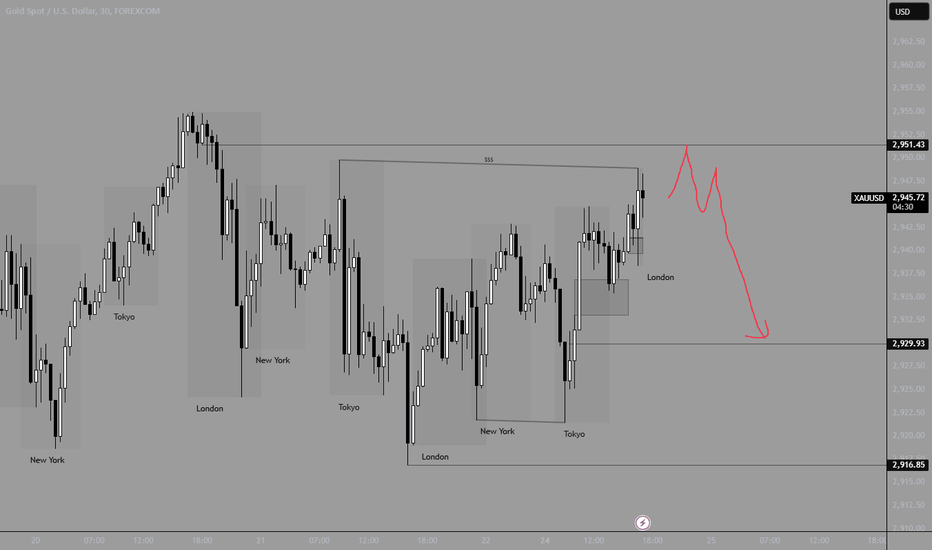

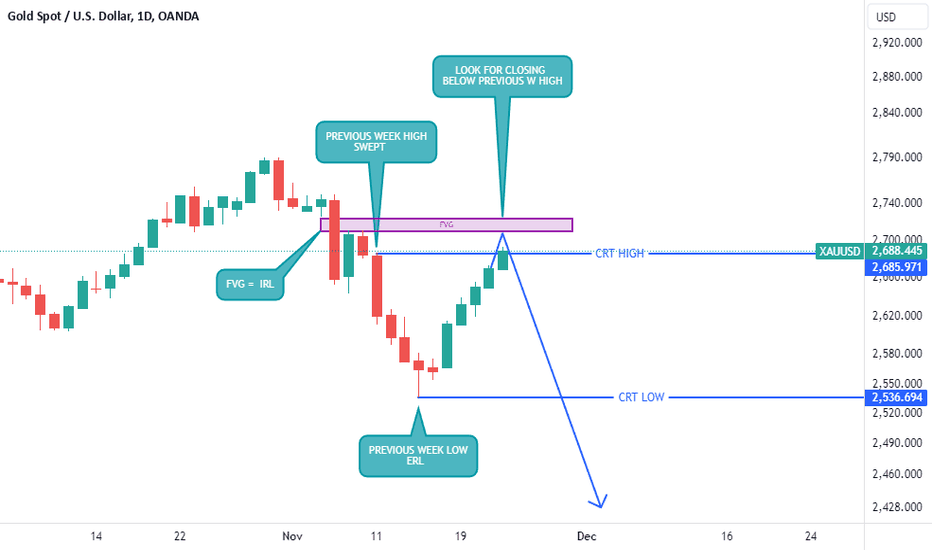

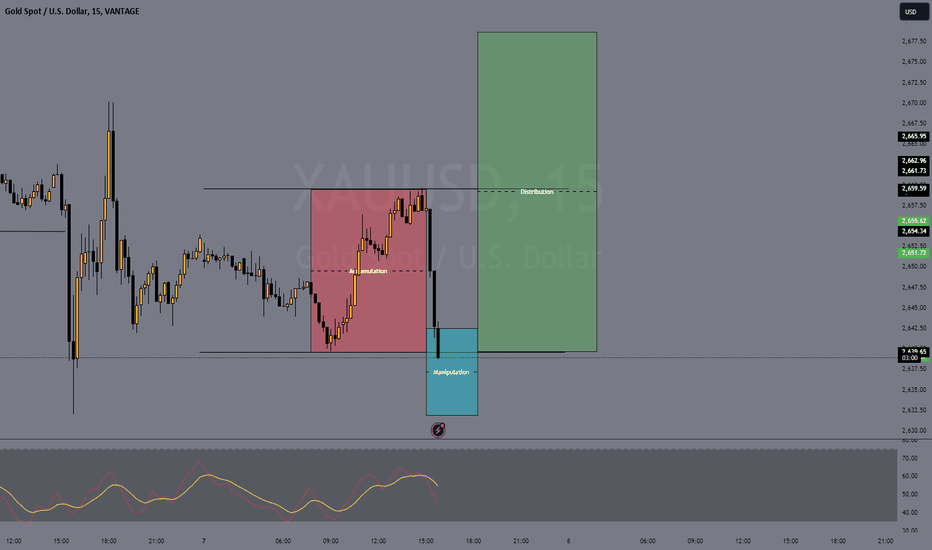

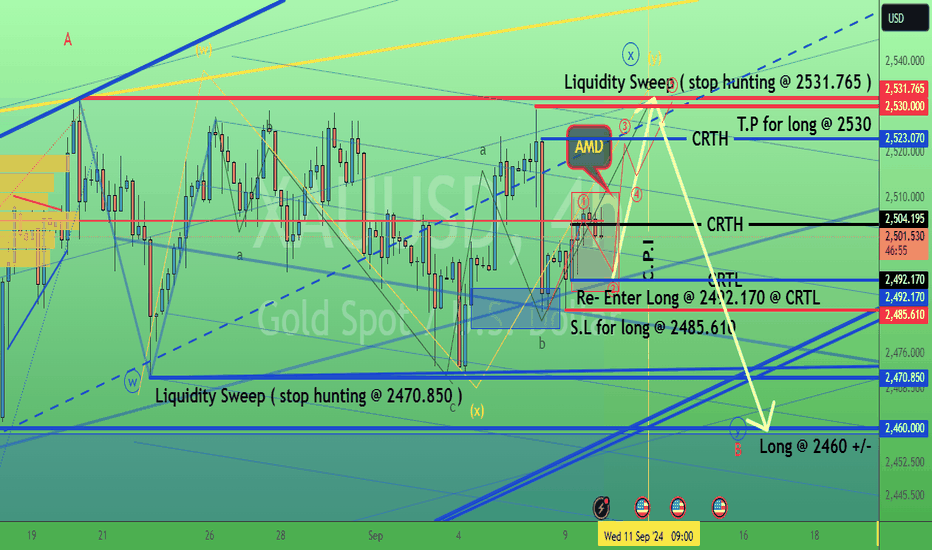

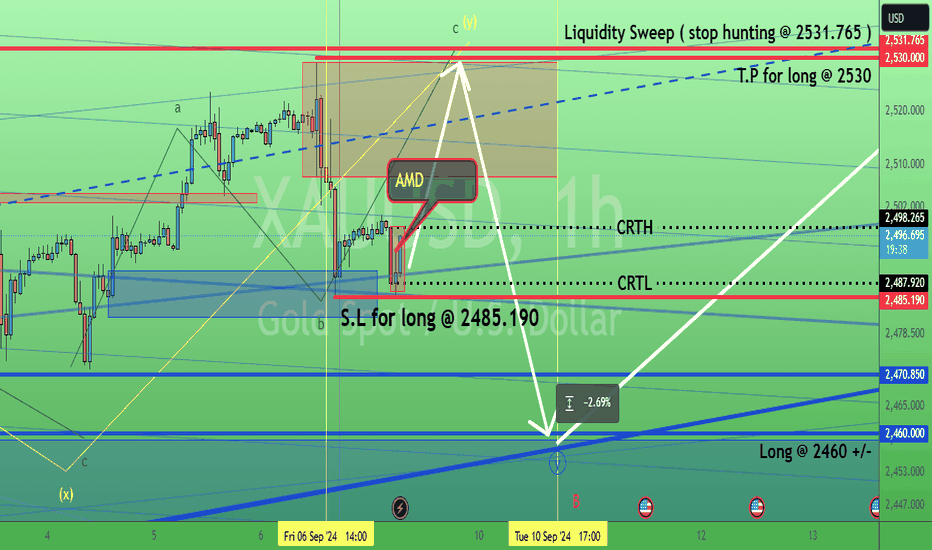

GOLD HIGHT PROBABILITY SETUP!!According to Candle Range Theory (CRT), GOLD price swept the previous week high (CRT LOW), and this daily candle (today's candle (22/11/2024)) must close below the previous week high (CRT HIGH). If this daily candlestick closes below, the whole week next week (25/11/2024) gold will be selling (bearish). The target will be Previous week low (CRT LOW).

Another thing, on weekly timeframe you will see gold has touched the bearish fair value gap (FVG) which was our internal range liquidity (IRL) but on Daily timeframe we still have to touch the bearish FVG with a rejection, then we can sell.

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.” - Jim Rogers

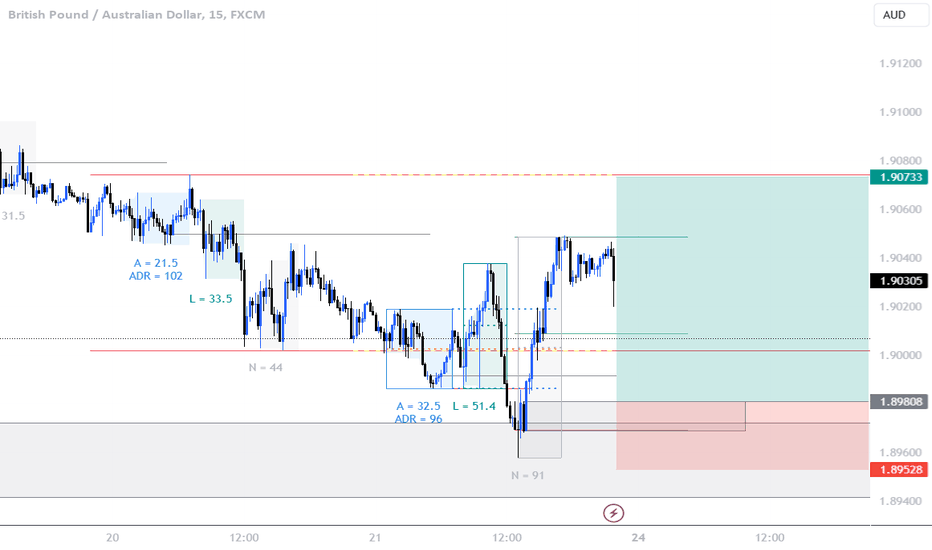

gbpaud looking for higher pricesdaily time frame has taken previous days low and closed back within

4hr has come into a 4h poi

15m has push up breaking structures

monday will be looking for longs depending how we open and what asia session does taking price back up to arond 1.90741 which is a daily high

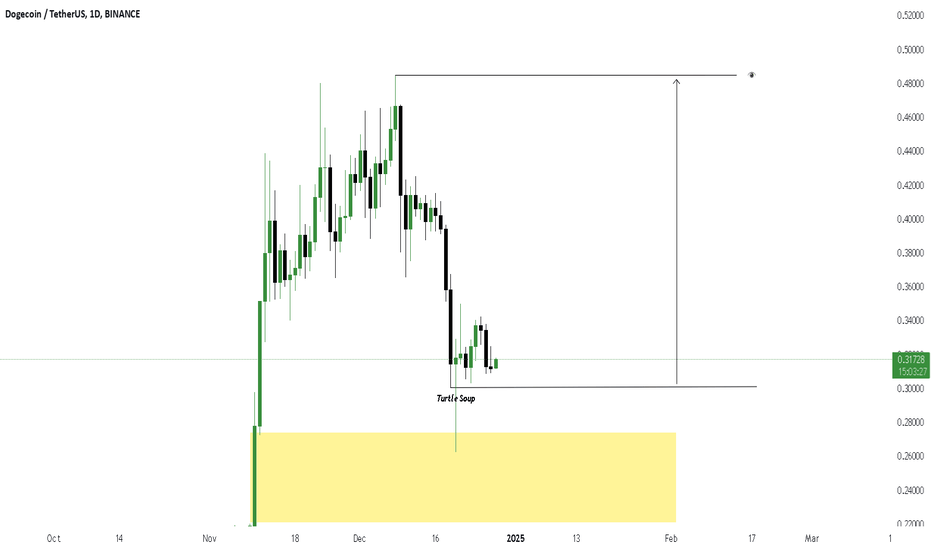

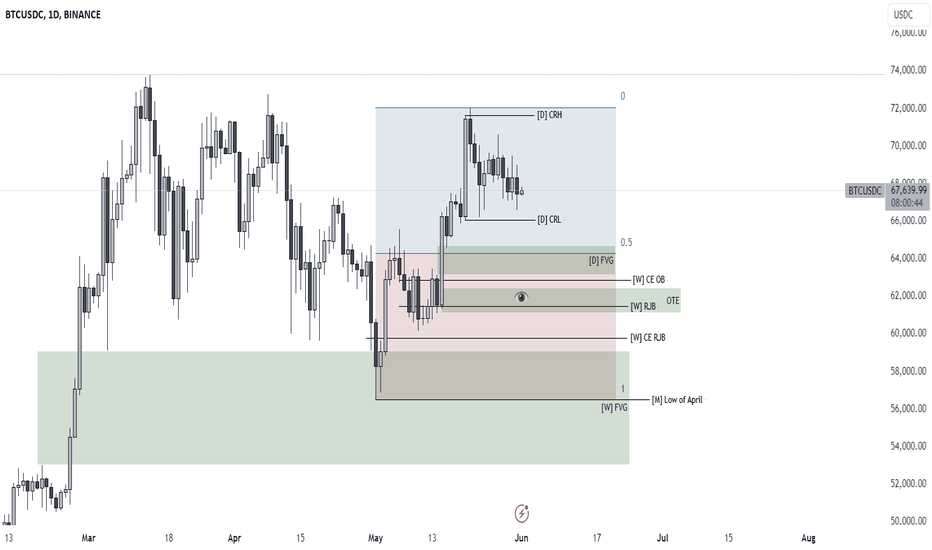

BTC/USDC looking for buys after capturing stops.Hello everyone !

In this analysis we are waiting for BTC to purge orders below the CRL and enter the liquidity pool so we can start looking at purchases, let's see how the market will behave after the

US Average Hourly, US Non-Farm Employment Change and US Unemployment Rate.

For now, just wait, patience is the key!