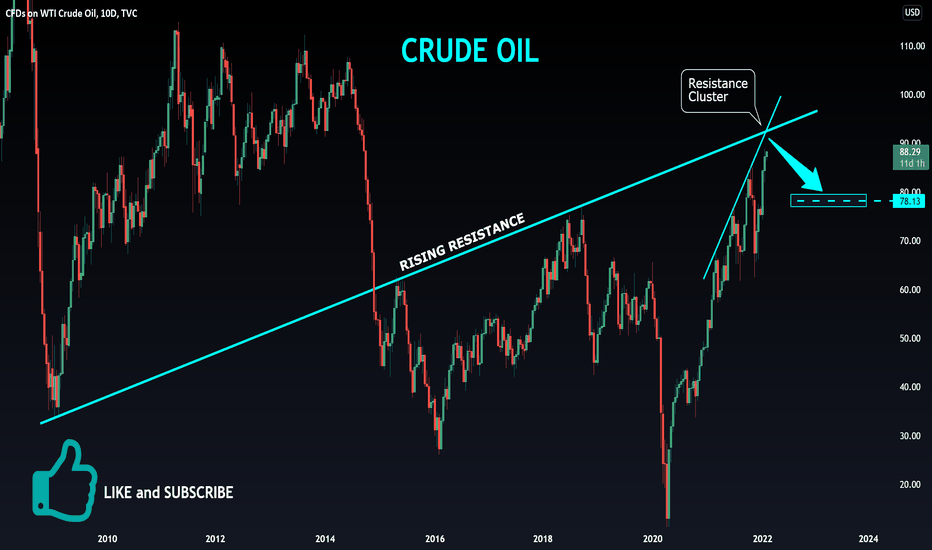

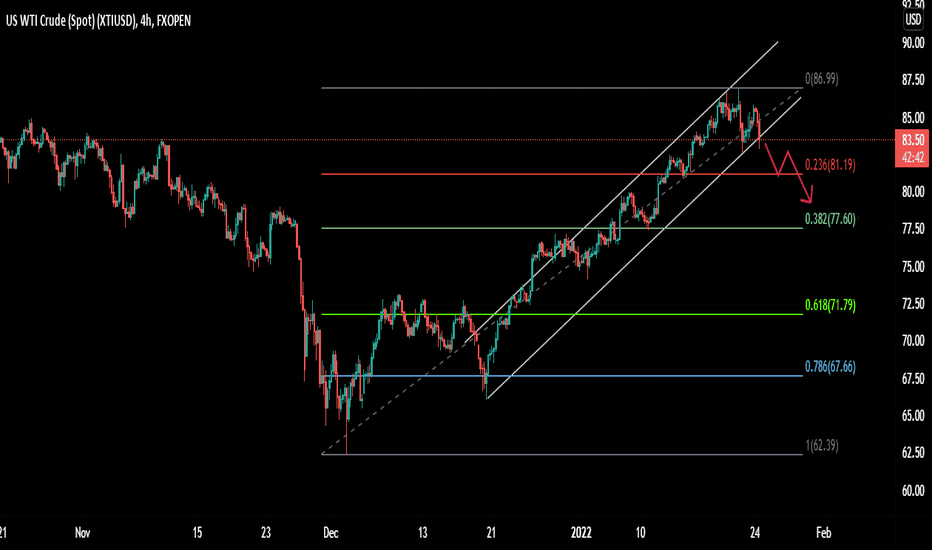

CRUDE OIL Bearish Bias! Sell!

Hello,Traders!

CRUDE OIL is in the strong uptrend

And is going up almost without pullbacks

So I think the commodity is oversold

But there are no horizontal resistance levels nearby

So I use a confluence of the two rising resistance lines

As a potenital point from where we might see a bearish correction on oil

And I will be watching this price level with interest

Looking for the reversal clues

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

Crude-oil

Crude Oil -Whom Do You TrustThe operators whipsawed the Back Gold and managed to create

another Fake Break @ Highs.

CL always pulls this stunt.

Now it's up to the Specs to pony up.

_________________________________________________________

API & EIA have not been supportive of the Price.

OPEC is now Silent.

__________________________________________________________

China has a 5-year SPR locked up along with foodstuffs.

__________________________________________________________

US Oligarchs can't wait to gobble up Companies on the Cheap.

The Rockies exited Oil for a reason.

___________________________________________________________

Can they stage the move back into the Channel and run to new highs

or is it lower lows... I never trust these pricks.

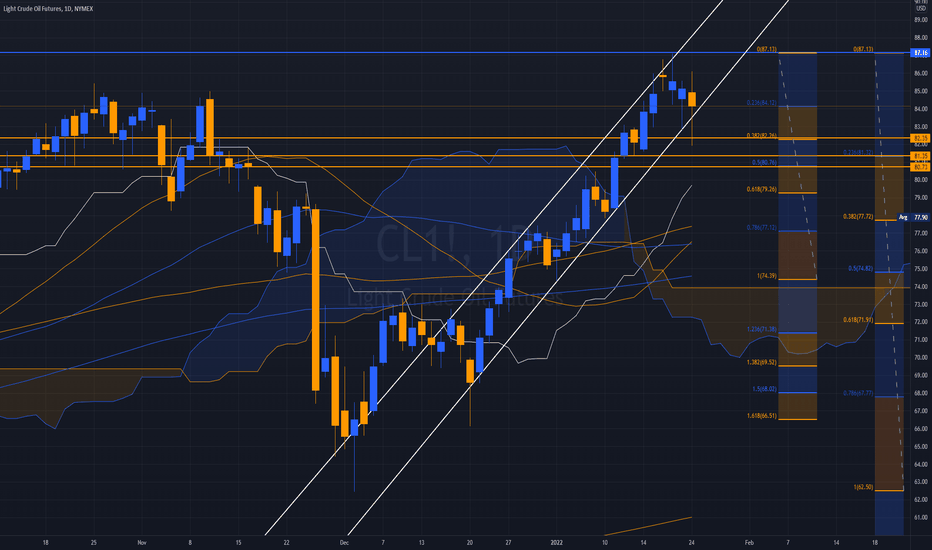

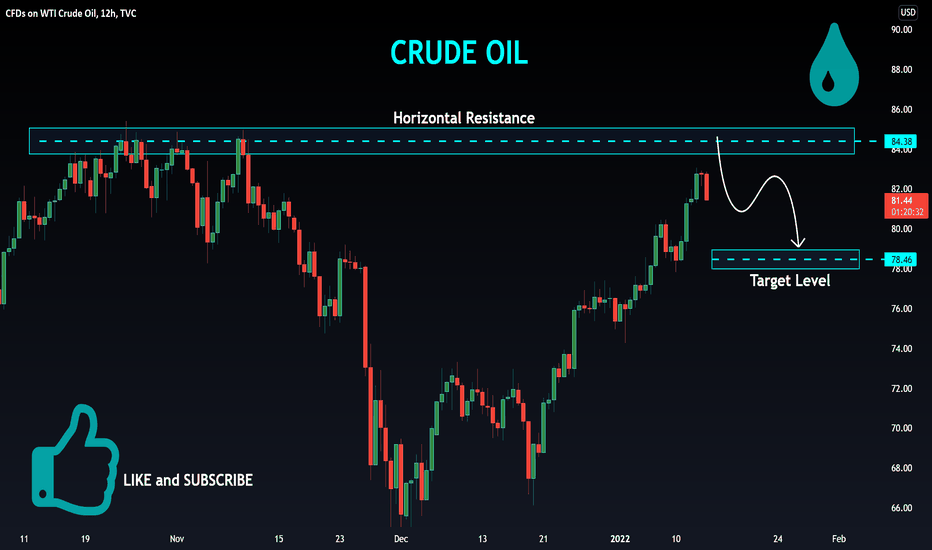

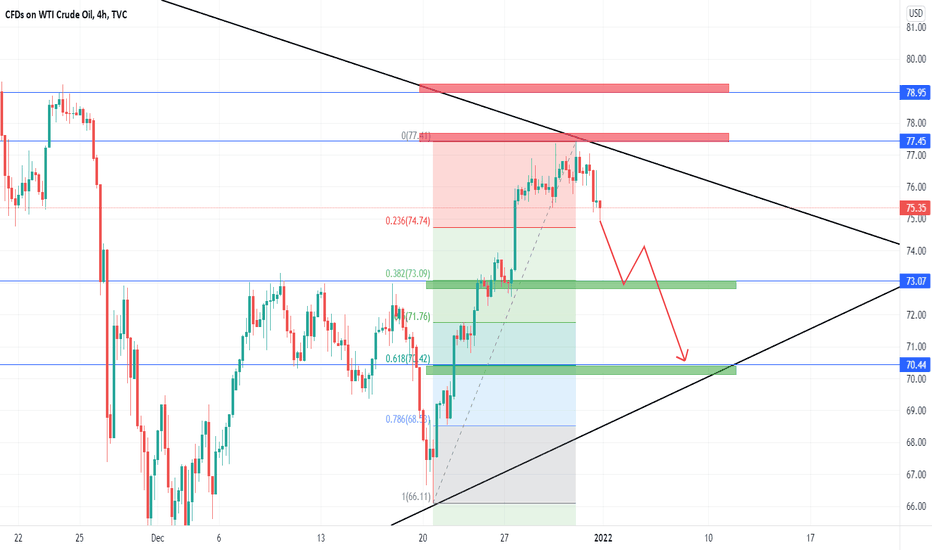

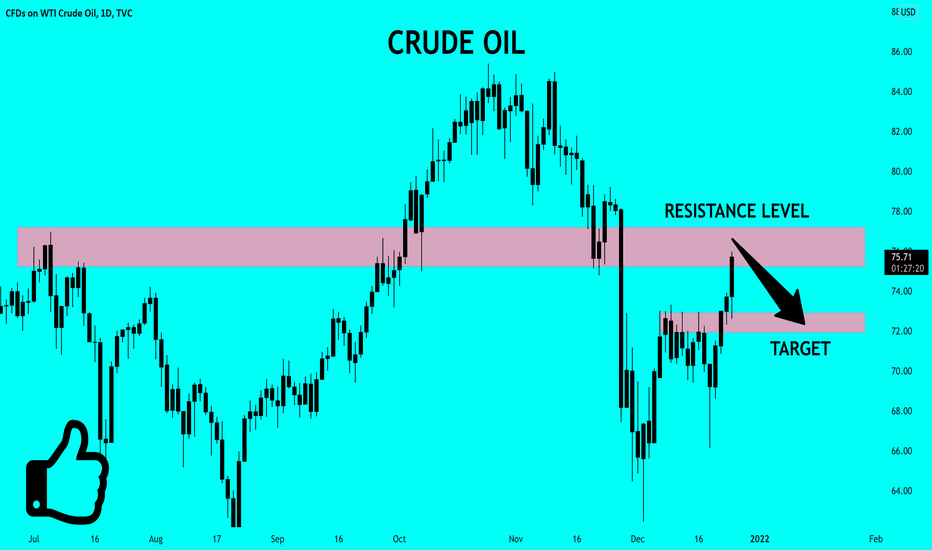

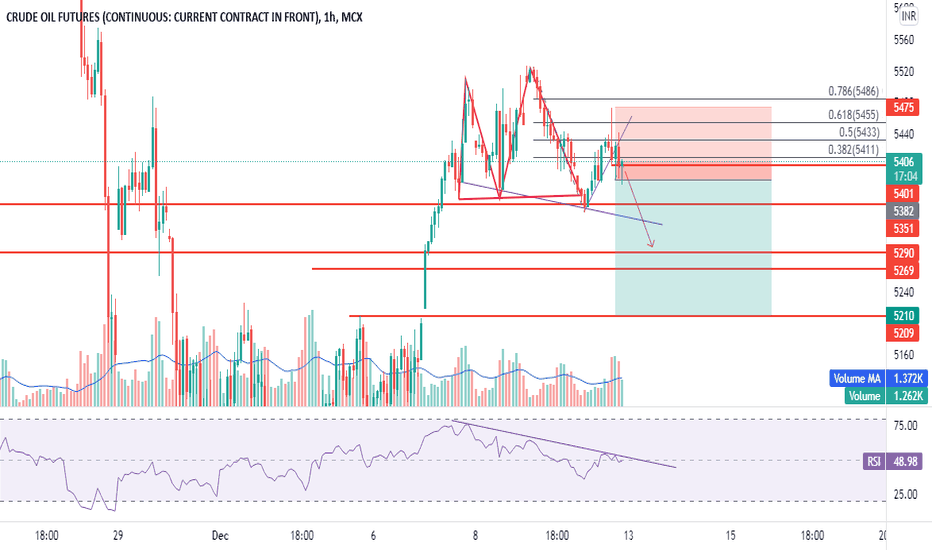

CRUDE OIL Local Short! Sell!

Hello,Traders!

CRUDE OIL is trading in an uptrend

But the price is about to hit the strong resistance level

And as oil looks locally oversold I would be

Expecting a local bearish correction

Towards the target below

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

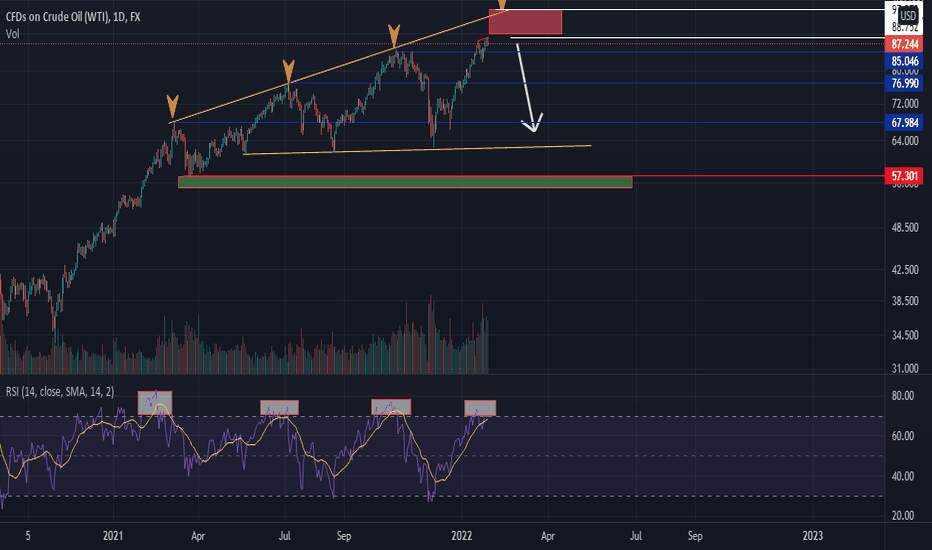

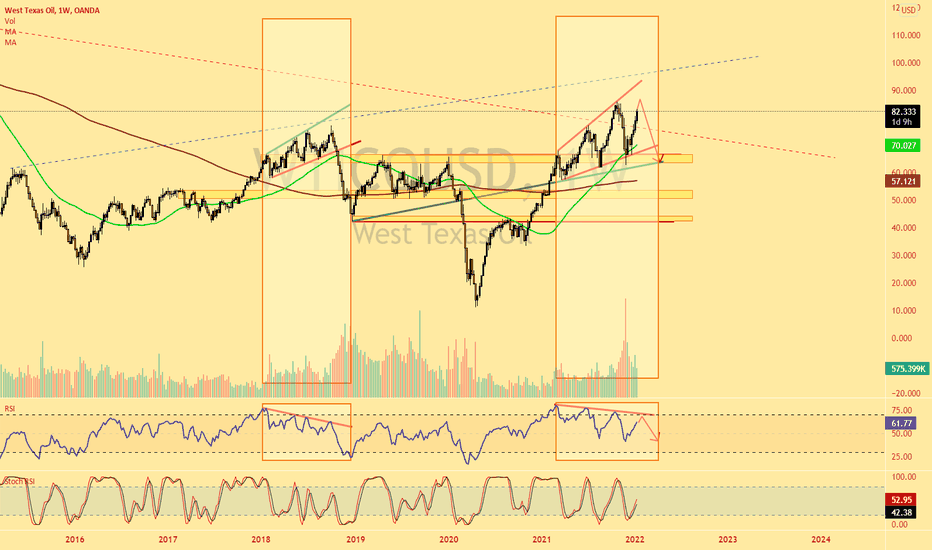

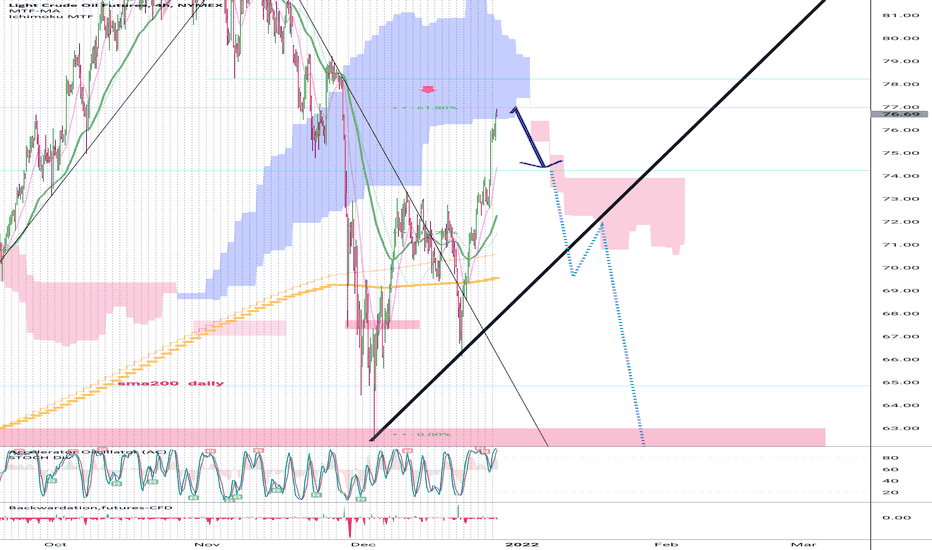

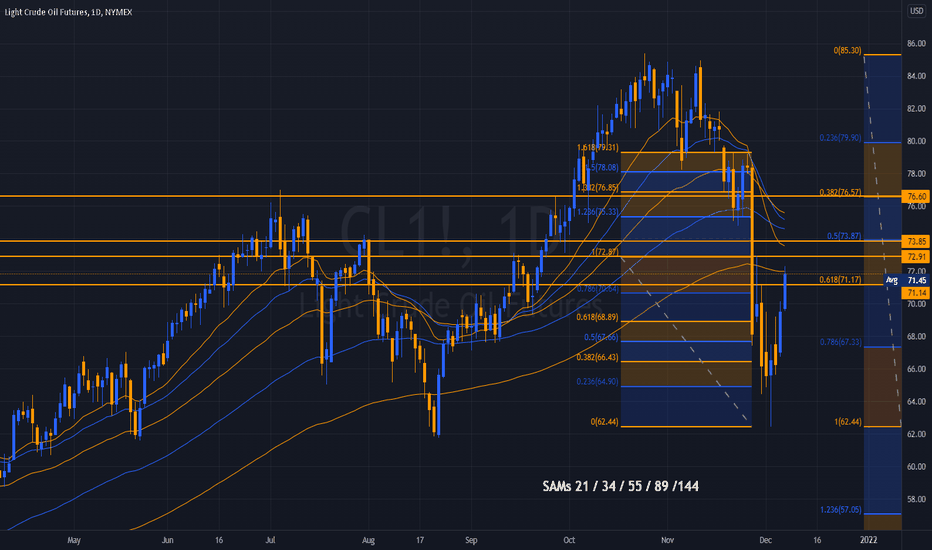

WTI Same Price Action in between Jan-Oct 2018Good Afternoon Traders,

WTI weekly chart seems to be forming the same price action between January 2018 and October 2018.

RSI chart losing momentum while price getting new highs.

Price should pass Oct 2021 highs to lose momentum and get in the range between $50-65.

I decided to watch Crude oil and set up some alerts regarding its price action.

I will share ideas and I look for a good Short set-up for US OIL .

If you enjoy my graph, please make sure you like and follow me .

Your feedback will always be appreciated.

Wish you a great day and Stay Safe! TVC:USOIL

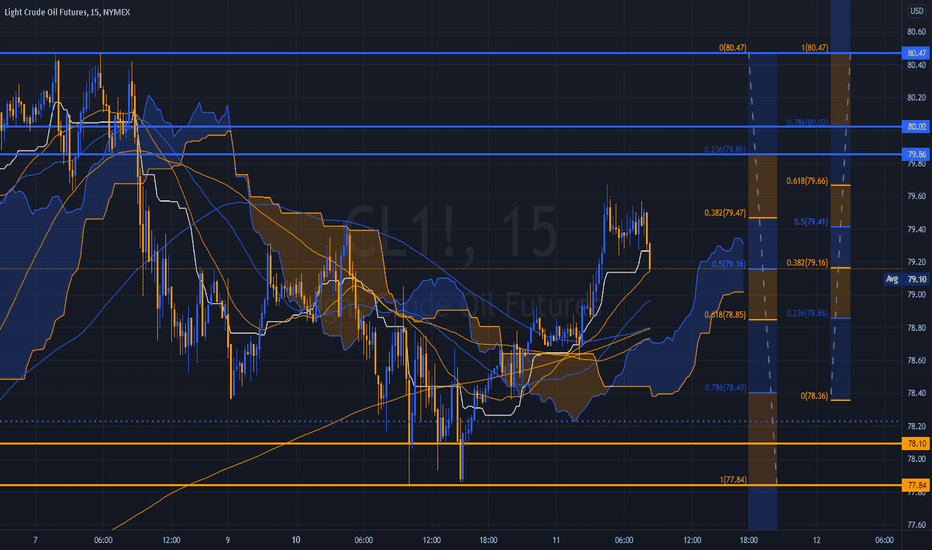

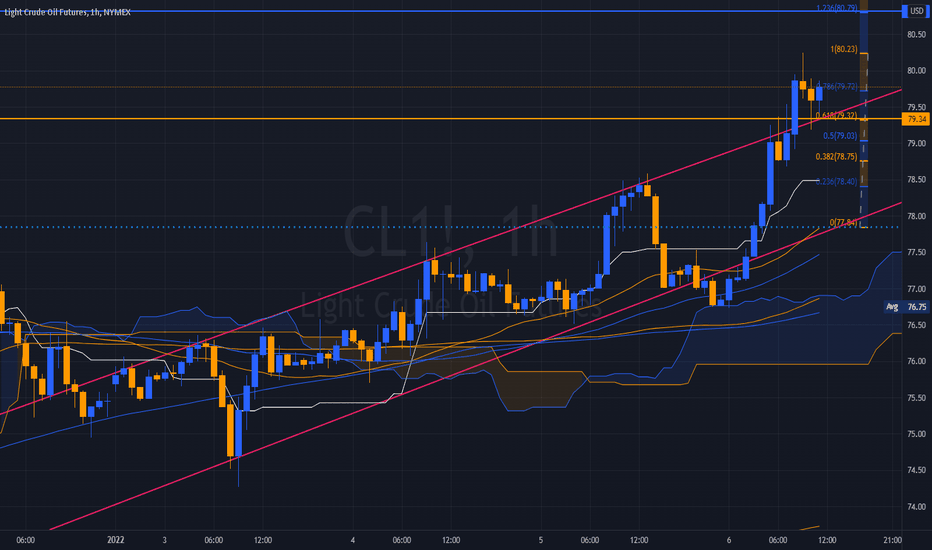

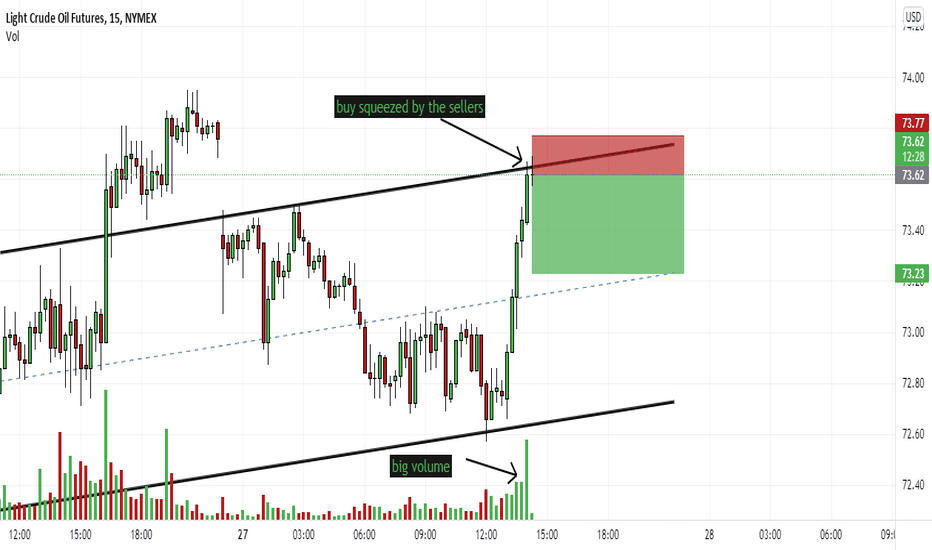

CL - 15 Minute MicroCrude Oil has an expanded range from 78.36 to 80.48.

Sellers have been roundly pushed back as CL would simply

collect the energy and grind higher.

API Today and EIA T0morrow will provide direction, the

Gap remains overhead and should be filled.

Rates have had a mild impact on CL, as has the DX.

___________________________________________________

We currently hold no positions and are awaiting the next break of 80

or support to trade to consider a Position.

The Weekly and Monthly ranges are quite large and have us squarely

on the sidelines while the Indices are providing greater Velocity

Intra-Day.

Should TNX backtest the breakout, we will be closely watching the

reaction within Energy.

NG came up nicely off its 3.50/3.70 range to move back over $4.

RBOB remains in a larger Range and is becoming a leader in the

Energy Complex into March as reformulations begin to gain momentum.

CL - Into the Gap Fill81.12 to 83.32 are not open for the Fill and Overthrow.

There is plenty of Oil regardless of API / EIA Non0-sense.

Hookahs are having a party at Virtual Davos this Year.

Bless them, them as the Sultan is worth $2.1 Trillion, makes

Gates, Buffet, Besos, and Elon look like Pikers.

_____________________________________________________

NQ will be in trade on NPK for Spring Argo-Biz and reformulations.

CL usually peaks this time of YEar with Nasty January / February effect

now in trade due to December effect push forward.

All in all it's broken the Channel we indicated would be important for the

toss over, mission accomplished.

It's been giving SELLERs Hell on a pitchfork, why then keep coming back

is beyond me, but we will gladly pick their pockets,

CL - The Gapit appears OPEC is providing the nudge for Crude Oil.

Gasoline demand certainly is NOT.

_________________________________________________

Macro factors will catch up with it soon enough, overall

we remain in wait and see mode for CL.

No positions simply Sell on PO's hit - today Sold 78.44 PO and

closed at 77.93

It is hanging on to the 50 SMA @ 75.96 for now, the 200SMA is

below @ 70.92.

MACD is diverging while A/D is sharply Positive.

Appears to be another Squeeze, an unrelenting one.

CRUDE OIL SHORT HH TO HL AND MARKET FORMATION crude oil sell position expected as for market formation double top along with HH TO HL HTF retracement

CL - SMA ChecklistCL is trading both FIbs ad SMAs.

They have a higher price in Trade, but

have gaps both Above and Below.

70.16 / 70.11 would be the Pullback,

but the BOts won't allow this until after

Lunch and the EU Session ends.

We took a small sell only to be stopped

take a $900 loss.

NQ a different story as we took a small

long there and enjoyed the run.

16400 is the New NQ Price Objective, we'll

see how CL responds as it is tracking with

NQ against the OVX.

____________________________________

Crude Oil continues to trade vertically in Extensions.

One after another...

OVX - Crude Oil VolatilityThe current volatility is above historical volatility, traders anticipate higher volatility for

Price in the Short to Intermediate-Term.

Crude Oil WTI Jan '22 (CLF22)

66.26s -0.24 (-0.36%)

Crude Oil WTI Feb '22 (CLG22)

66.10s -0.17 (-0.26%)

Crude Oil WTI Mar '22 (CLH22)

65.93s -0.10 (-0.15%)

Crude Oil WTI Jun '22 (CLM22)

65.26s +0.02 (+0.03%)

Crude Oil WTI Dec '22 (CLZ22)

63.69s +0.26 (+0.41%)

_______________________________________________________________________________

Currently, the Term Structure for Crude Oil is in very slight Backwardation.

The Teem Structure is flattening somewhat - this will change in time, for now

it is in the Confidence Cycle interest to keep things tightly aligned, both Up and Down.

CL remains a hostage to further News Cycle surrounding OPEC's attempt to

support Price to the best of their abilities within reason.

They do not want to spook the Market but instead will attempt stability in the very short term.

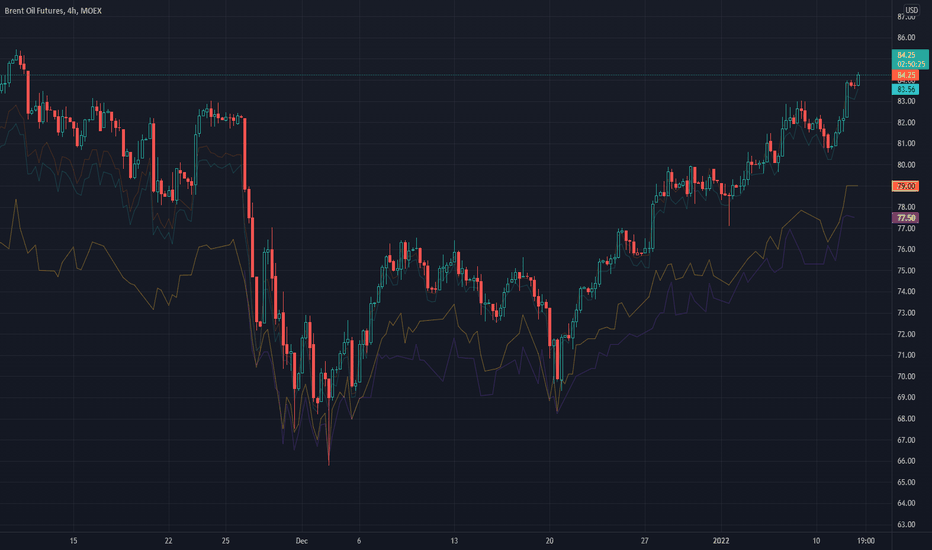

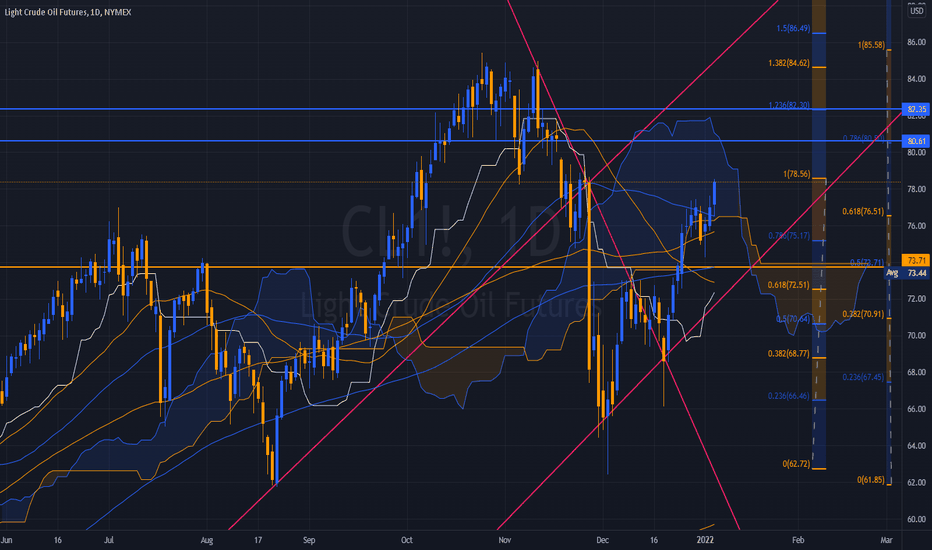

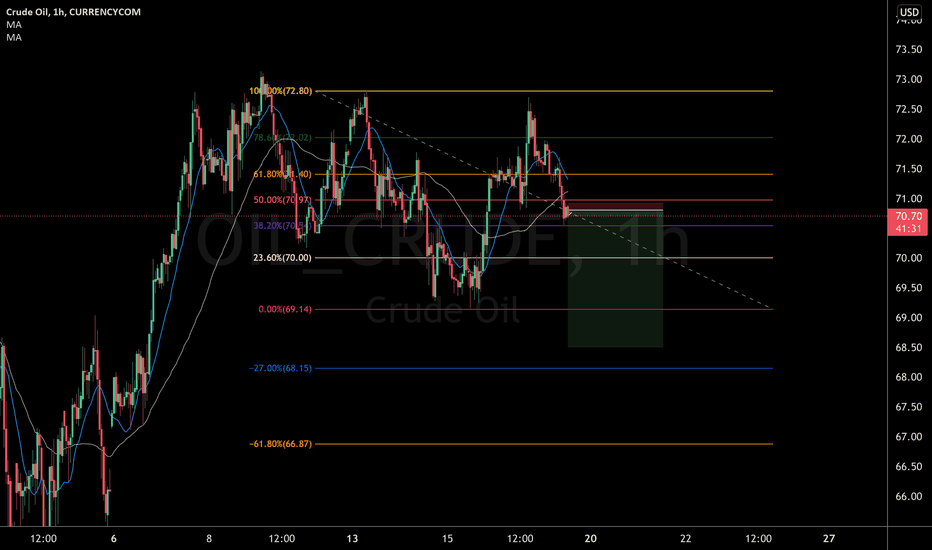

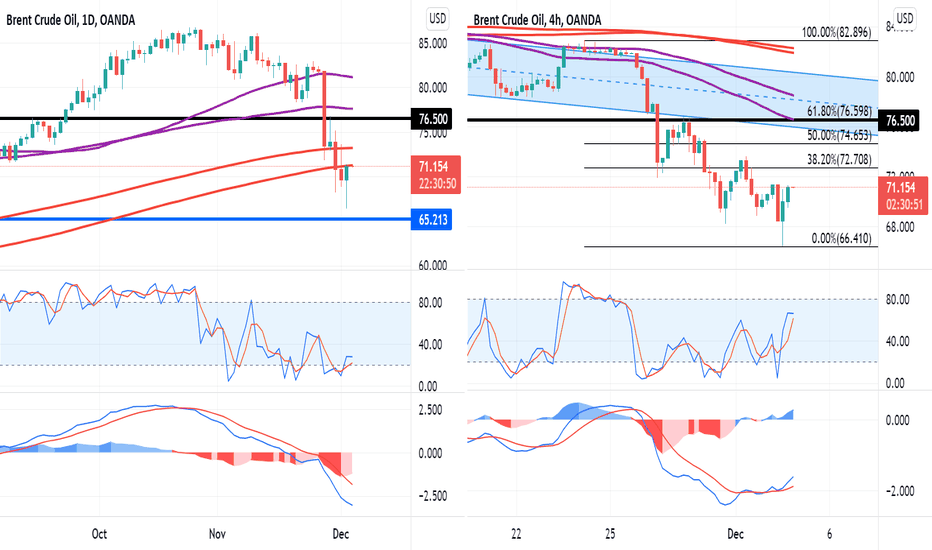

Brent Crude - Further to Fall?Brent crude has been tumbling in recent weeks, forced lower by slowing growth, a coordinated SPR release and this past week, the new Omicron variant.

OPEC+ had an opportunity to arrest the slump today and at first, it appeared they'd passed up the opportunity. But the decision to maintain not change their planned increases each month came with an important caveat, that they would do so at any point if they think it's warranted.

In other words, they didn't have enough data to hand today but if that arrives at any point between now and the next meeting and warrants an adjustment, they'll do so immediately.

With crude off its lows and higher on the day, has it bottomed out? Possibly. But that will depend on the information that appears over the coming weeks and how bad it is for the global economy.

In the meantime, the price had been falling prior to the announcement but as you can see on the 4-hour chart, it was losing momentum all the time. So the caveat provided the excuse the market was already hoping for.

If it has bottomed for now, how big a correction can we expect? Or can we expect it to rally from here?

While we may see some tests around the 38.2 and 50 fib levels on the way up, the big test above here lies around $76.50 where the 61.8 fib on the 4-hour chart coincides with the bottom of the channel, 55/89-period SMA band and a major prior level of support and resistance. A move above here could put us back into more bullish territory.

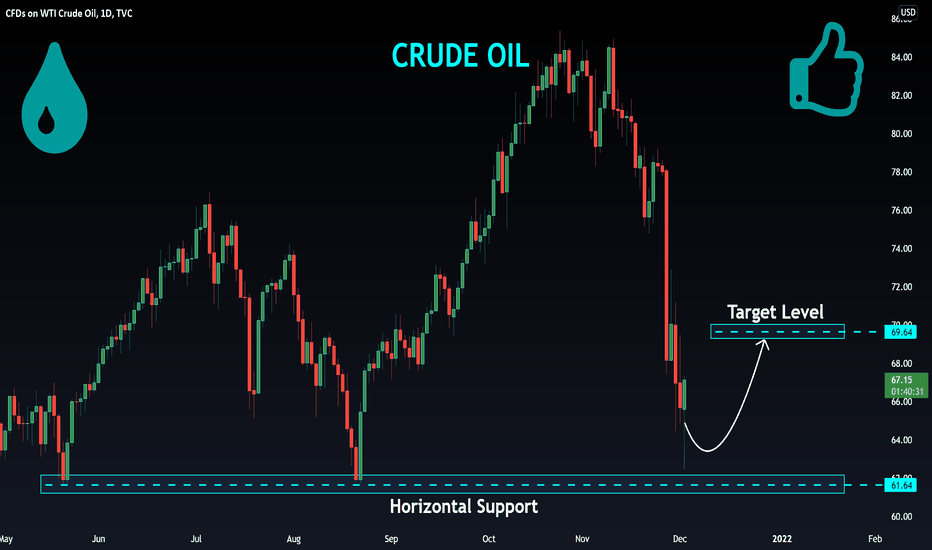

CRUDE OIL Long From Support! Buy!

Hello,Traders!

CRUDE OIL fell sharply and lost almost 28%

But then the price hit a strong daily strucutre

And a bullish reaction followed

I think that the level will hold

And if you take a look at what is happening

On the lower timeframes, you will see

A kind of a bullish wedge pattern

So after a potential retest of the level

And a breakout of the wedge

I belive oil will go up again

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!