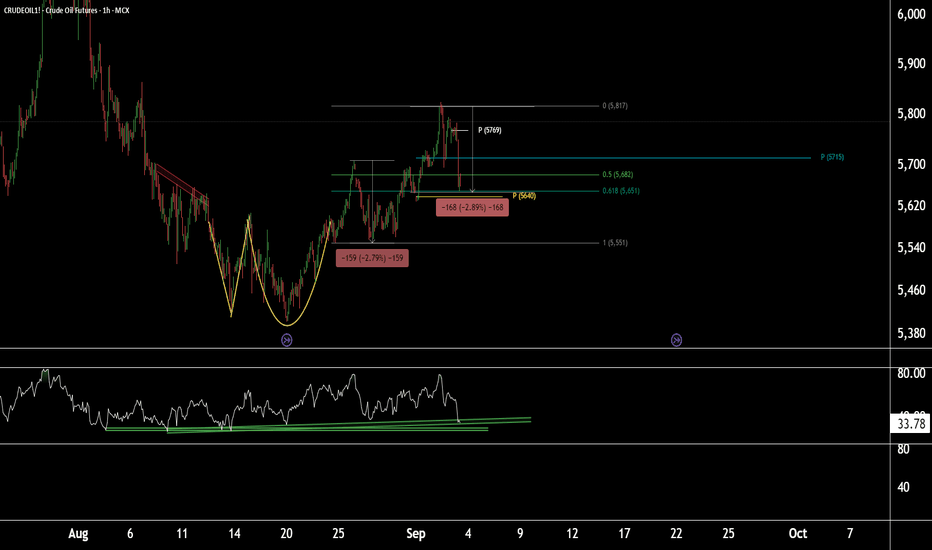

Price action + RSI support = fresh buy opportunity in CrudeOil1!CrudeOil1! (1-Hour Timeframe) Technical Outlook

CrudeOil1! is currently sustaining at the Fibonacci Golden Ratio level of 0.618, with the weekly pivot placed near 5640. Based on Fibonacci projections and price action, this 5640 zone appears to be a crucial area, as it aligns with a 2.8% retracement completion.

On the 1-hour timeframe, the RSI is showing a decline but may take support near the current levels, adding further weight to this support zone.

All technical indicators together suggest that the 5640–5650 zone could act as a strong support in the short term. If this support holds, we may see upside targets at 5715 and 5750, with the potential for CrudeOil1! to make a new high if the bullish momentum continues.

Thank you.

CRUDEOIL1!

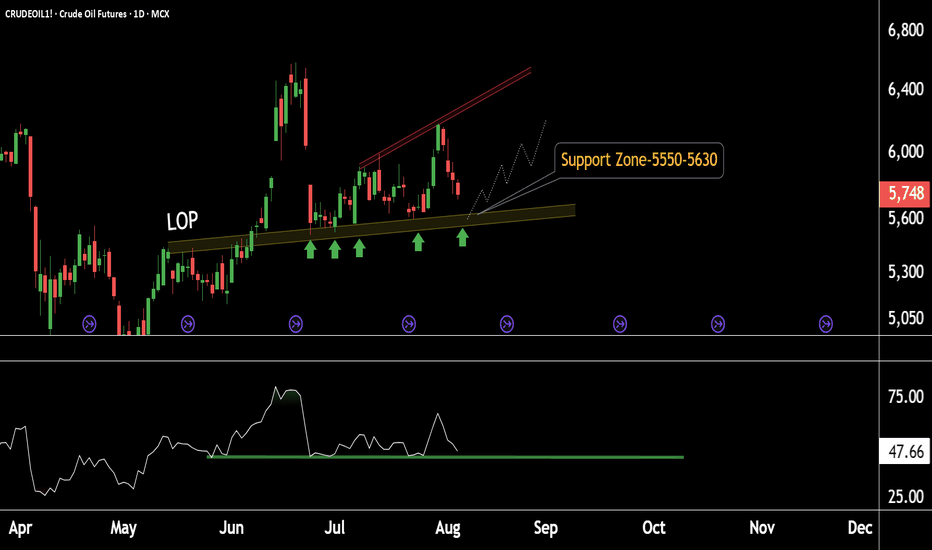

Crude Oil Bouncing from Demand Zone – Eyes on UpsideThis is the daily chart of Crudeoil!

CRUDEOIL1! having a good law of polarity (support)near at 5550-5600 range.

CRUDEOIL1! is taking support on RSI and sustain above 45 level.

If this level is sustain then we may see higher prices in CRUDEOIL1!.

Thank You !!

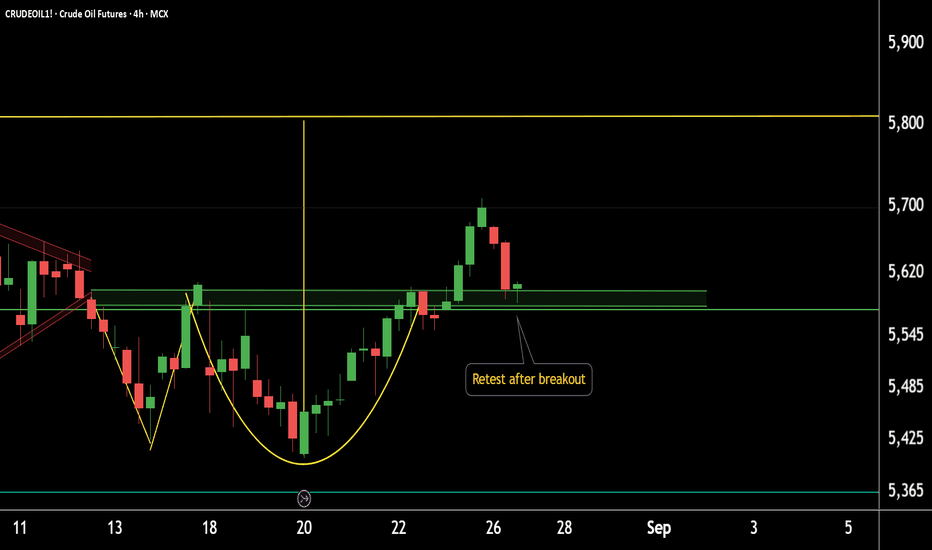

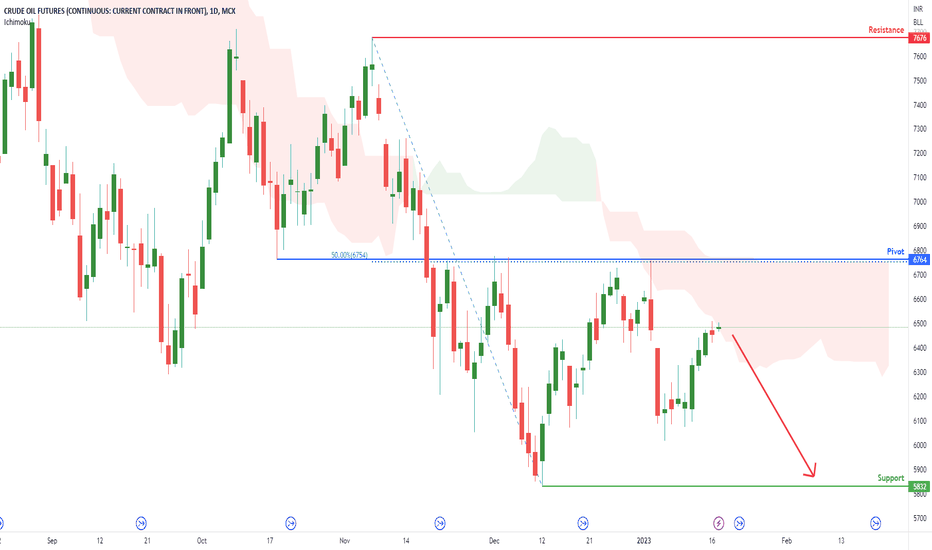

CrudeOil Futures ( CRUDEOIL1! ), H4 Potential for Bearish DropTitle: CrudeOil Futures ( CRUDEOIL1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 7676

Pivot: 6764

Support: 5832

Preferred case: On the H4 chart, we have a bearish bias. To add confluence to this, price is crossing below the Ichimoku cloud which indicates a bearish market. If this bearish momentum continues, expect price to possibly continue heading towards the support at 5832, where the previous swing low is.

Alternative scenario: Price may possibly head back up to retest the pivot at 6764, where the 50% Fibonacci line is.

Fundamentals: There are no major news.