Crudeoilwti

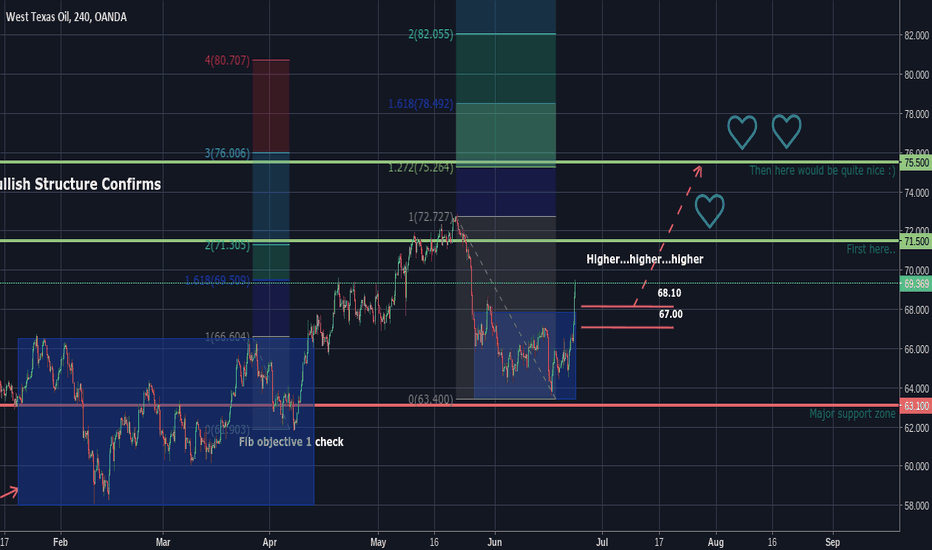

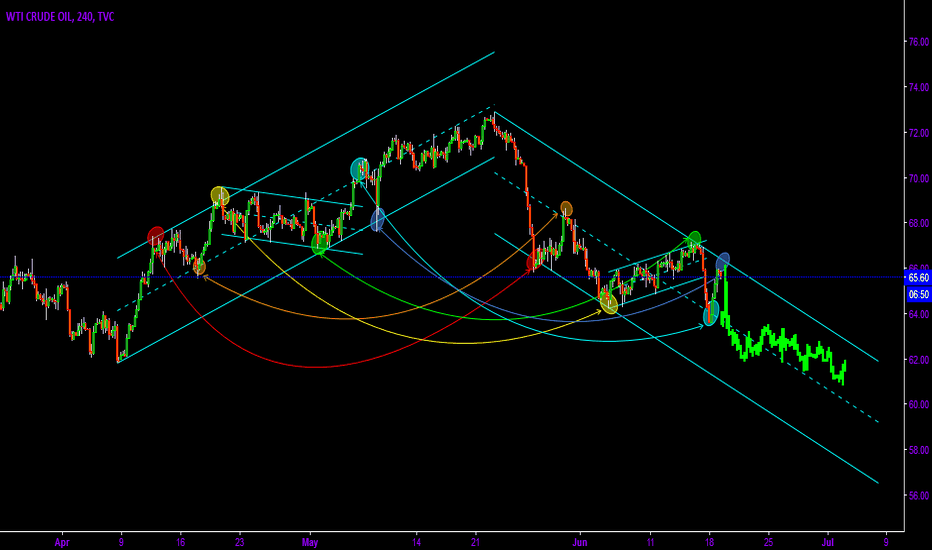

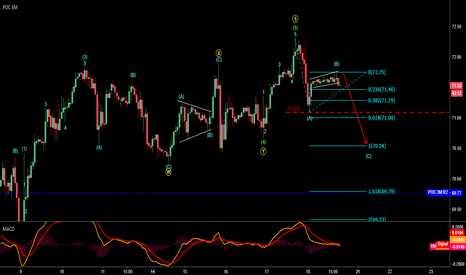

CrudeOil Bullish Structure ConfirmationHere we go again! Crude oil's super mega uptrend looks to continue! Last time we saw a trend like this was 2009, and it's a long time coming after the major declines in 2014.

Quick summary why I'm bullish in the next weeks:

1. Overall bullish trend

2. Consolidate and form a higher low

3. Failed breakout lower, breakout higher

My next target is 75.50, and if we really move then 80 and 90 are still possible. The announcement of OPEC's higher production limits this Friday potentially puts a limit on the overall trend. Higher production with relatively constant demand (I mean we didn't just start needing 600k/day barrels more oil overnight) should weaken price. Will need to see this in the charts before I give it much weight.

So what do you think? Am I crazy to be so bullish? We've already moved so far...will it keep going? Share with me your charts, ideas, and comments! Love to hear other traders opinions!

Peace, love, and sweet bamboo,

tbp

Note: All ideas expressed here are presented solely for learning and educational purposes only. Any gains or losses assumed by trading ideas presented by The Bad Panda are done so at your own risk.

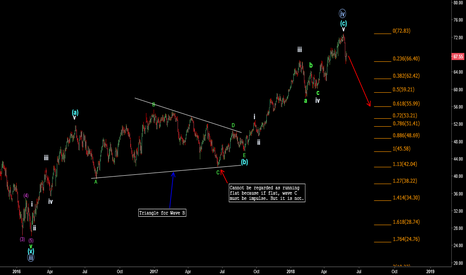

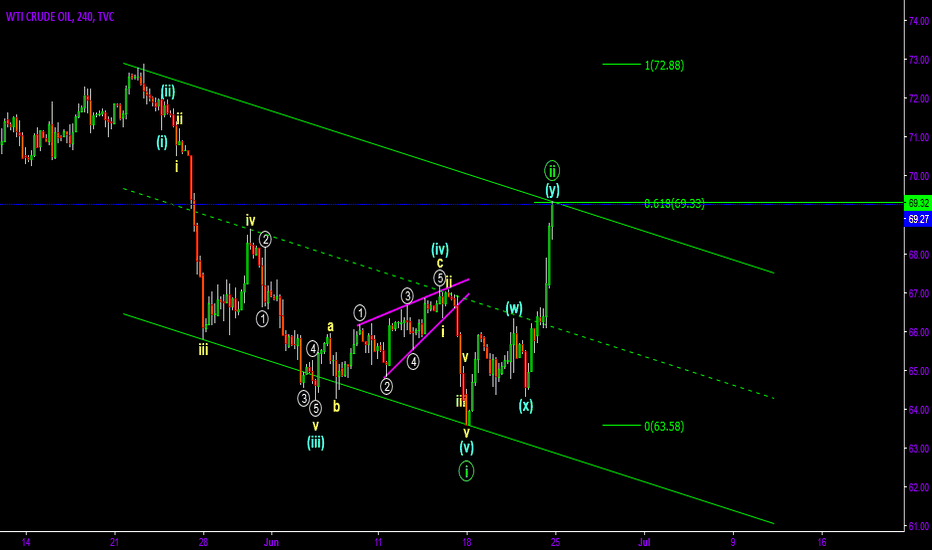

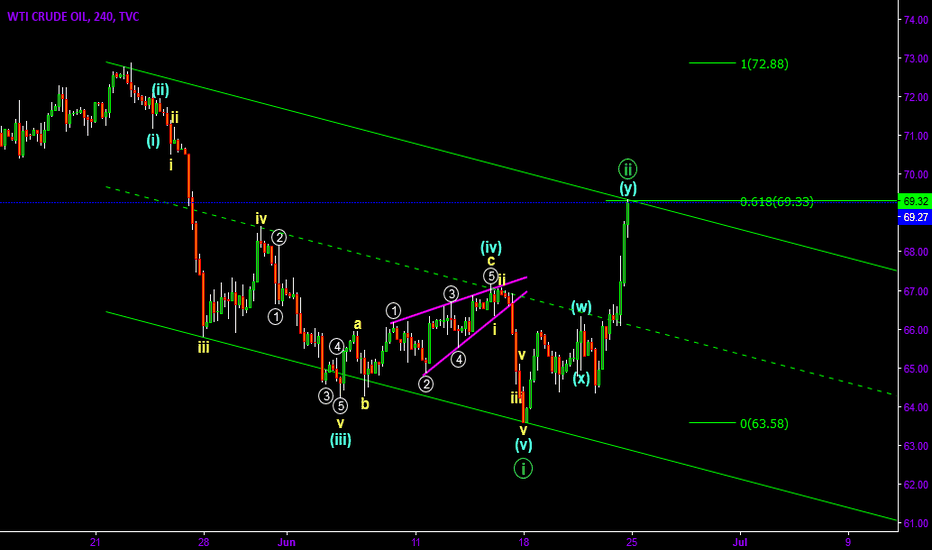

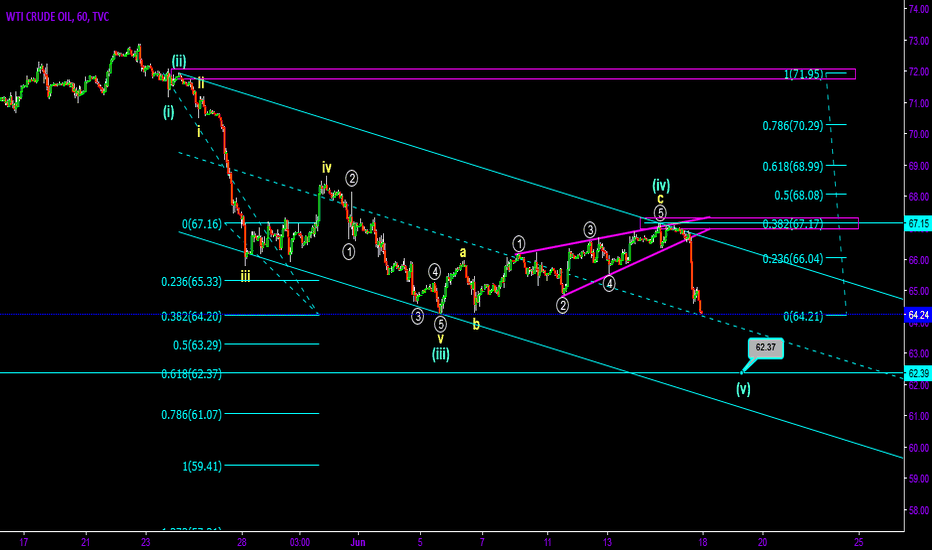

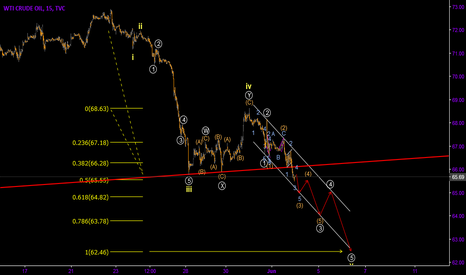

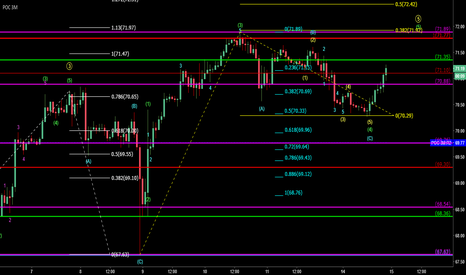

Crude Oil Elliott Wave IdeaNot enough coffee before posting this morning...I think my last chart is incorrect as Y wave must be an ABC, not 5 wave structure, so this is the alternative and a look at smaller timeframe below:

1H > B wave correcting .236 of A wave.

5M > Wave 4 of A correcting 0.5, fib levels seem to make sense

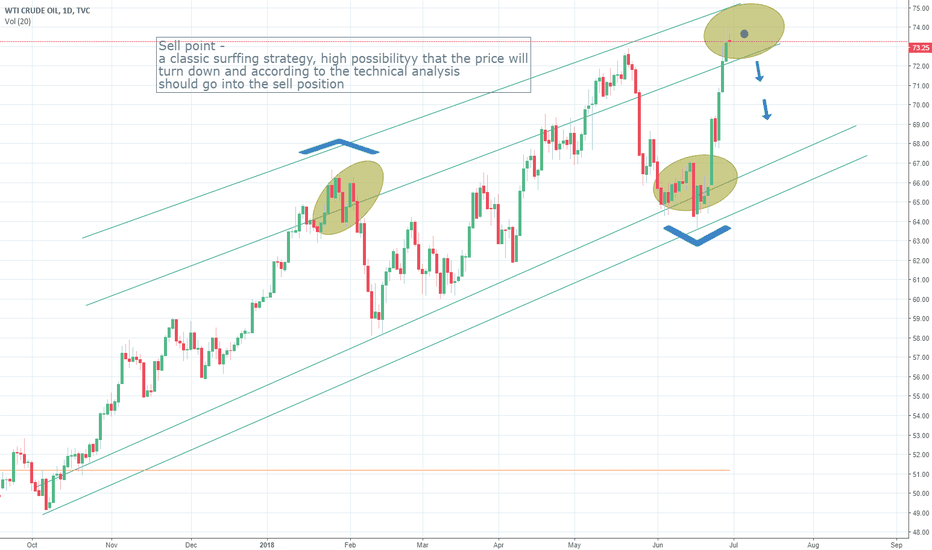

Crude Oil downside to continueCrude Oil have been strong from last year with succession of new tops and lows-whilst it just broke the multi-days bullish channel and undergoing a linear compression setup. Price action and momentum indicators are suggesting the downside to continue towards the prior support area around 61.94. I am looking to short this market around 67.27-66.20 with stop around 68.69, for a target to 61.94 over the coming days.

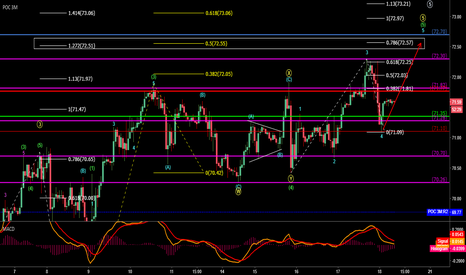

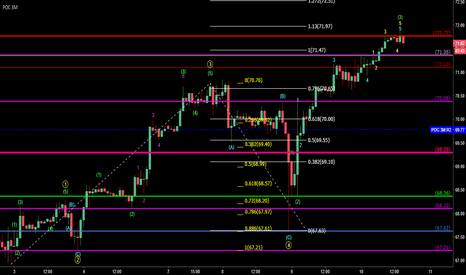

Short the Impulsive Wave!The current price movement could be the BIG B (with subwaves abc in it) of wave 4 or it could be the start of wave 5. Nevertheless, it's impulsive (5 legs). The plot are just for the nearby targets. The targets in the white boxes could be lower/higher. Those are just high probabilities.

Wave 5 About To End (Alternative Wave Count)Thanks to @manish_damani for his comment on my previous post entitled "Monthly Wave Count For Crude Oil"

This chart is an alternative wave count for my previous chart:

There is a solid ground that we are around the top of wave 5 of wave C, instead of wave 3. The reason is...there is an ending diagonal (refer to the turquoise converging lines at the right side of the chart). As stated in the notes from Elliott Wave International,

" An ending diagonal is a special type of wave that occurs primarily in the fifth wave position at times when the preceding move has gone "too far too fast," as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B-C formations. In double or triple threes (to be covered in Lesson 5), they appear only as the final "C" wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement. "

In an ending diagonal, wave 5 often makes a throw-over. In other words, throw-over happens because the market makers (the big boys) want to get more contracts to sell. So they push the price synthetically above the majority expectations to hit the stop loss of other traders. Therefore, in my opinion, it's quite hard to predict where the top will be.

Nevertheless, often there are throw-overs, but at times there might be no throw-over too. :)

Anybody would like to share on your short entry plan? Jeff Kennedy taught to entry short (sell stop limit) below wave 4 in the ending diagonal. But the stop loss is huge (above the top of wave 5), especially if throw-over occurred in wave 5 of the ending diagonal.

Any suggestion(s)?

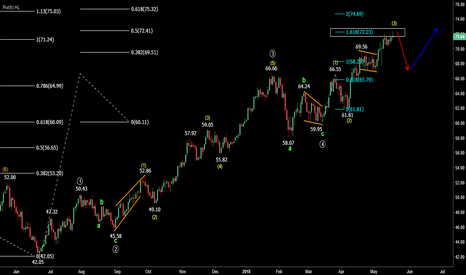

Monthly Wave Count For Crude OilI believed we are in wave 4. Wave 4 can be a double / triple tree. That means it is possible we are still in the subwave c of A. Soon, wave B will start. Bearish divergence at monthly, weekly and daily tf are so obvious. Be careful for those who are thinking that price will keep on going up until USD100. Anything is possible in this world but...let's be practical. :)

Wave 4 Was A Running FlatX went higher than top of wave 3 (green in bracket). Y made 5 legs (impulse) but didn't went down below W. And then price kept on making higher highs. That should gave us a hint that wave 4 was a running flat. Look out for the confluence of fibo levels in the white box and the blue horizontal line at 72.70. That might be the next target.

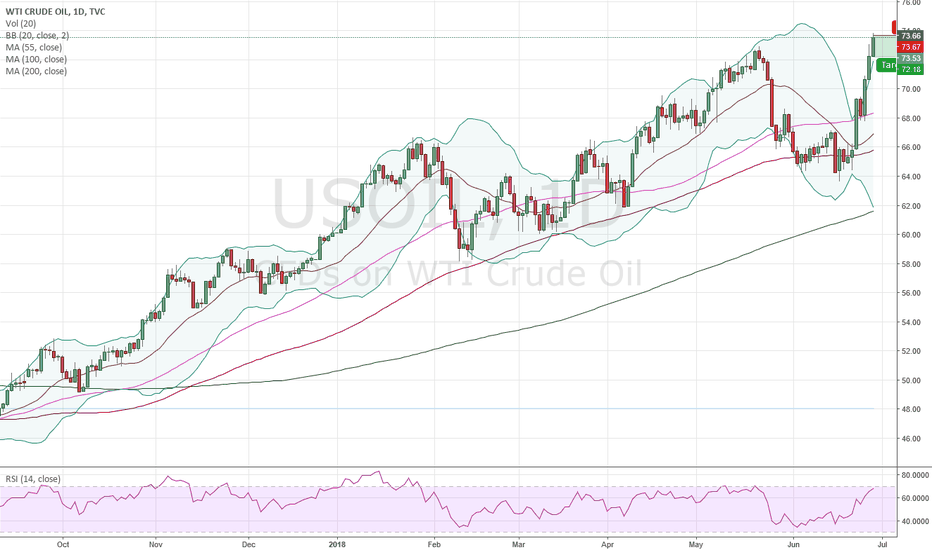

Crude OilCrude have been in strong uptrend since last year, but for now short term momentum indicators suggesting a small retracement, but however the medium term trend is still strong, so i am expecting a test of 72.95 over the coming days or so. I would be building a long position around 65.74, with a tight stop below 65.03, targeting 72.95.