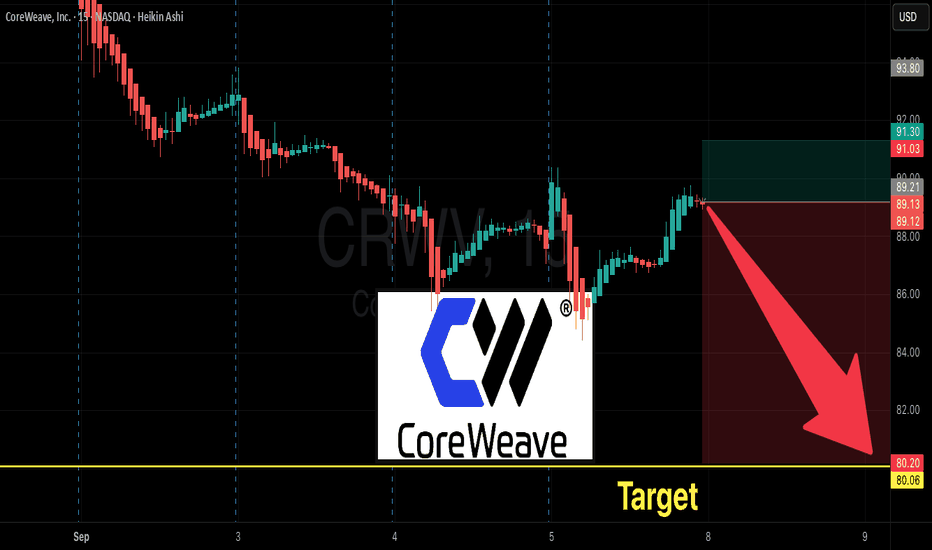

CRWV Breakdown Setup — $80 PUT in Play!

# 🐻 CRWV Weekly Trade Setup (Sep 6, 2025) 🐻

### 🔎 Market Consensus

* **Momentum:** Daily RSI 35.2 ↓, Weekly RSI 45.4 ↓ → bearish trend.

* **Performance:** -13.3% last week → downside pressure.

* **Volume:** 0.7x → weak institutional support.

* **Options Flow:** C/P = **1.61** → contrarian bearish (likely retail call chasing).

* **Consensus:** 📉 Moderate → Strong Bearish Bias

---

### 🎯 Trade Plan

* **Instrument:** CRWV

* **Direction:** PUT (SHORT)

* **Strike:** 80.00

* **Expiry:** 2025-09-12 (6 DTE)

* **Entry Price:** 0.73

* **Profit Target:** 1.46 (+100%)

* **Stop Loss:** 0.37 (-50%)

* **Size:** 1 contract (scale risk 2–4% max)

* **Entry Timing:** Market Open

* **Exit Rule:** Take profits early if hit; hard exit **by Thu Sep 11** (avoid Friday decay).

* **Confidence:** 🔥 65%

---

### ⚖️ Key Risks

* Call flow heavy (C/P 1.61) → possible squeeze/hedge pops.

* Weak volume could limit follow-through.

* News/gap risk can reverse quickly.

* Theta decay accelerates mid-week — OTM puts decay fast if price stalls.

---

📊 **TRADE DETAILS (JSON)**

```json

{

"instrument": "CRWV",

"direction": "put",

"strike": 80.0,

"expiry": "2025-09-12",

"confidence": 0.65,

"profit_target": 1.46,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-09-06 10:25:45 EDT"

}

```

---

🔥 \ NASDAQ:CRWV | \ AMEX:SPY | \ NASDAQ:QQQ | #OptionsTrading #BearishSetup #TradingView #PutOptions #GammaSqueeze #StocksToWatch#MarketMoves#EarningsSeason#MomentumTrading#RiskReward

Crwvshort

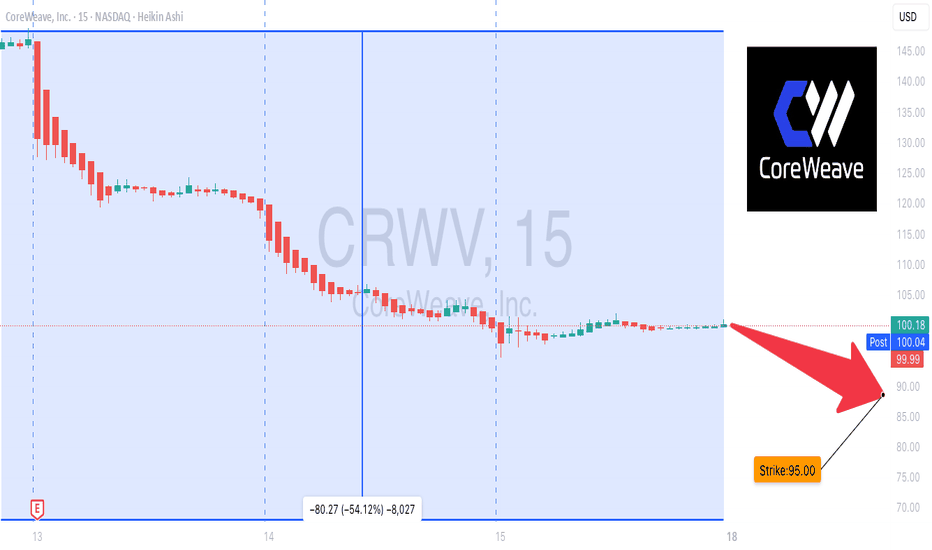

CRWV Bearish Breakdown – $82P Loading

# ⚠️ CRWV \$82P – Bearish Breakdown Alert 🚨📉

**Summary (2025-08-20):**

CRWV is flashing strong **bearish momentum** across all models:

* 📉 Daily & Weekly RSI both below key thresholds = heavy downside pressure.

* 💼 Volume up **1.5x vs last week** = institutional selling confirmation.

* 🔻 Options skew bearish: High OI at **\$80 & \$85 puts**, Call/Put ratio = 1.00 (neutral on surface, but leaning bearish).

* 🌐 VIX at **16.6** = stable environment for weekly option plays.

---

## 📊 Trade Setup

* 🎯 **Instrument:** CRWV

* 🔀 **Direction:** PUT (SHORT)

* 💵 **Entry Price:** 0.94

* 🎯 **Profit Target:** 1.40 → 1.88 (50–100% gain)

* 🛑 **Stop Loss:** 0.42 (\~45% risk)

* 📅 **Expiry:** 2025-08-22

* 📈 **Confidence:** 75% (strong institutional selling + bearish momentum)

* ⏰ **Entry Timing:** Market open

---

### 🚨 Key Risks:

* High **gamma risk** with only 2 days left.

* Potential short squeeze due to clustered OI at \$80–\$85 puts.

---

💡 **Play Idea:** Short-dated **\$82 puts** align perfectly with the bearish setup — but manage risk tightly due to gamma heat.

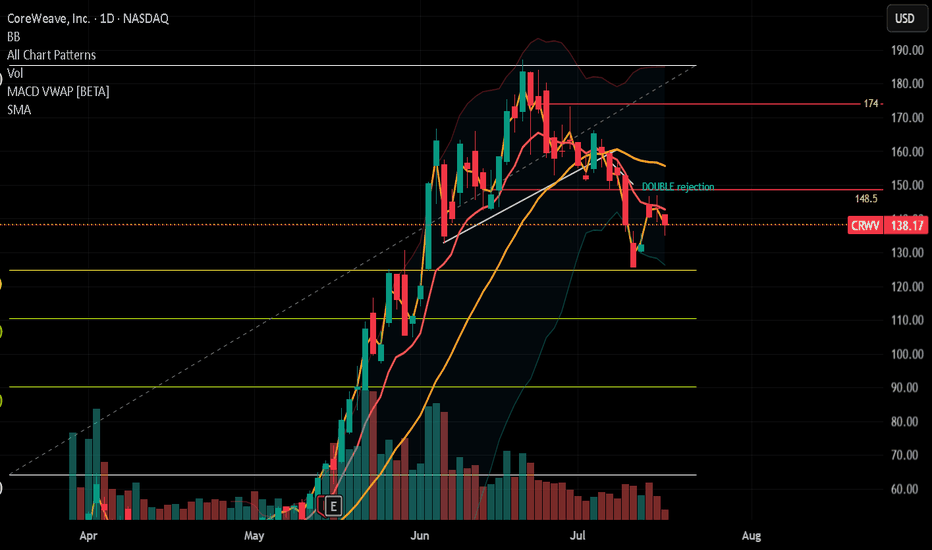

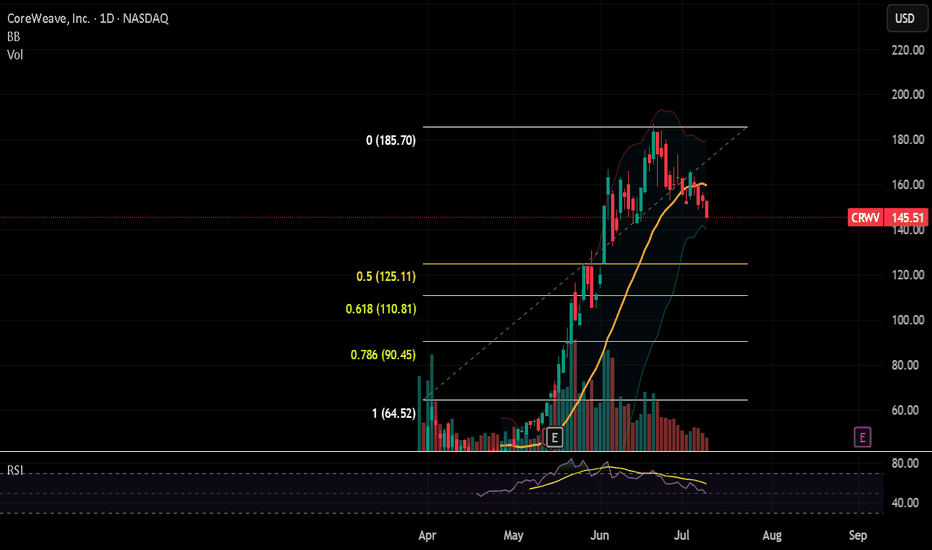

CRWV Breakdown Alert: Short Setup Ready!

## **⚠️ CRWV Bearish Swing Setup – Puts in Play!**

**Moderate Bearish Bias | Aug 15, 2025**

**📊 Key Highlights:**

* **RSI:** 37.9 – Clear bearish momentum 📉

* **5D Perf:** -17.98% 🚨

* **10D Perf:** Similar heavy downside pressure

* **Volume:** Average (1.0x) – no panic selling, but no bullish rescue either

* **Options Flow:** Neutral Call/Put (1.00)

* **VIX:** 14.84 – Low volatility, clean downside setups

---

**💡 Trade Plan:**

* **Type:** Aug 29 ’25 \$95 PUT

* **Entry:** \$6.50 (on confirmed break < \$98)

* **Stop Loss:** \$2.52 (-40%)

* **Target 1:** \$9.45 (+50%)

* **Target 2:** \$15.75 (+150%)

* **Confidence:** 75%

---

**⚠️ Risks:**

* Reversal above \$100 = high risk of stop hit

* Premiums elevated vs historical norms

* Weak volume = could slow downside momentum

---

📆 **Signal Time:** 2025-08-15 11:46 EDT

💎 **Execution:** Enter at open ONLY if \$98 breaks with momentum

---

\#CRWV #OptionsAlert #SwingTrade #PutOptions #NASDAQ #BearishTrade #MomentumStocks #StockMarket