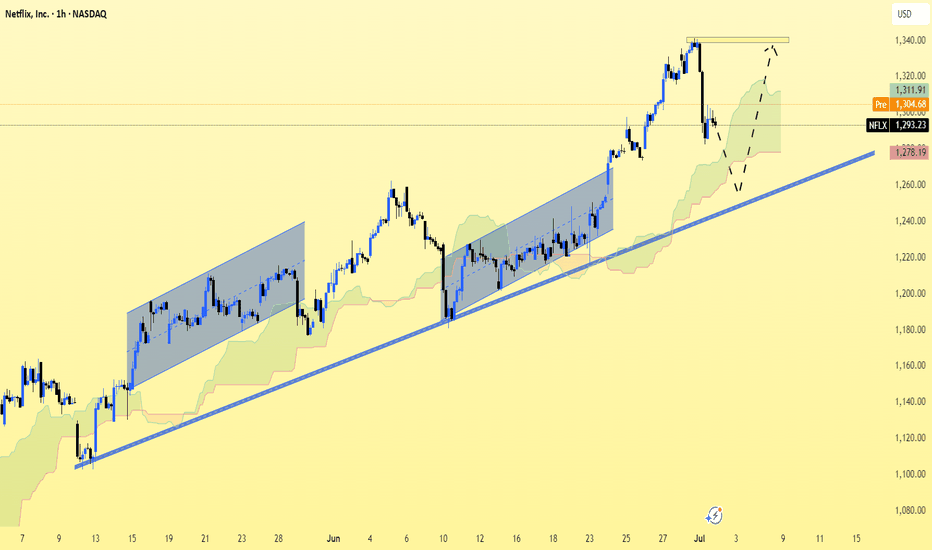

NFLX (Netflix Inc.) on the 1-hour chart (NASDAQ)NFLX (Netflix Inc.) on the 1-hour chart (NASDAQ) using price action, trendlines, and Ichimoku Cloud.

Observations:

There's a strong uptrend with higher highs and higher lows.

Price recently pulled back and is currently testing the Ichimoku cloud support, possibly forming a bullish continuation pattern.

A trendline from June is acting as dynamic support.

I have a yellow resistance zone drawn at the top, signaling the next potential bullish target.

---

🎯 Target (Short-Term):

Primary Target Zone: $1,335 – $1,340

(This is the previous swing high and resistance area you've marked.)

Secondary Target (if breakout succeeds): $1,350+

---

🛑 Suggested Stop Loss:

Below $1,270, or below the trendline/Ichimoku cloud for safer risk management.

---

📝 Summary:

Bias: Bullish continuation.

Buy zone: Near current price (~$1,290–$1,295) or on confirmation candle.

Target: $1,335–$1,340

Invalidation: Break and close below $1,270 trendline.

Let me know if you'd like a breakdown for a swing or intraday trade.

Crypto

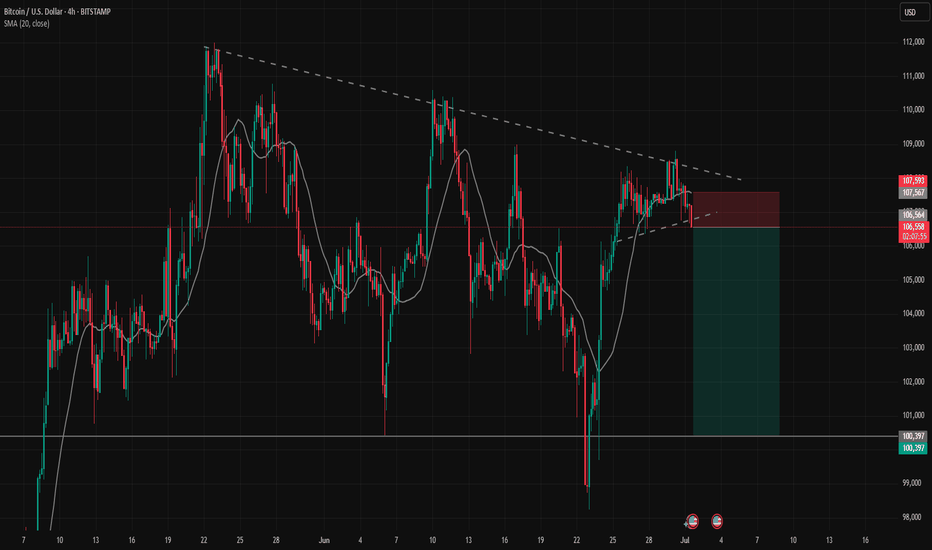

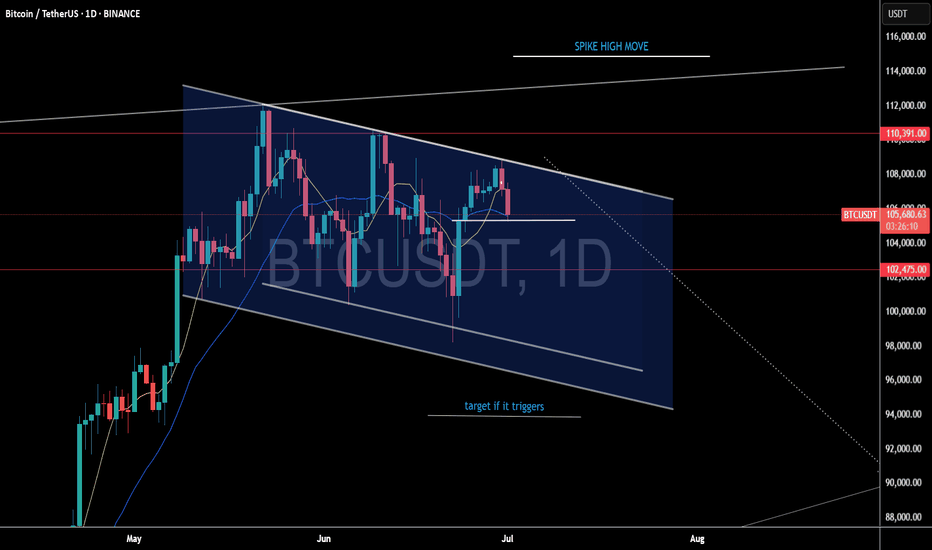

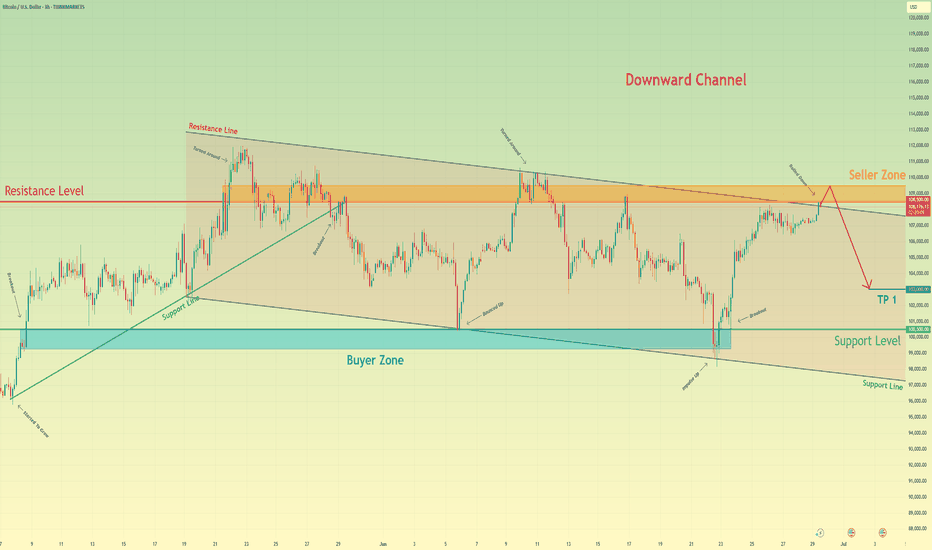

SELL BTCUSD trading signalBTCUSD confirmed the weakness at the trendline resistance zone on the h4 time frame.

The h1 time frame price confirmed that the sellers won when the candle closed below the nearest trendline support zone.

In terms of wave structure, there is no strong support zone that is strong enough to keep the BTC price uptrend in the short term. Therefore, the target of the SELL signal can reach 100,400. That is the wick area of the past liquidity candle where the buyers won over the sellers and pushed the price up sharply.

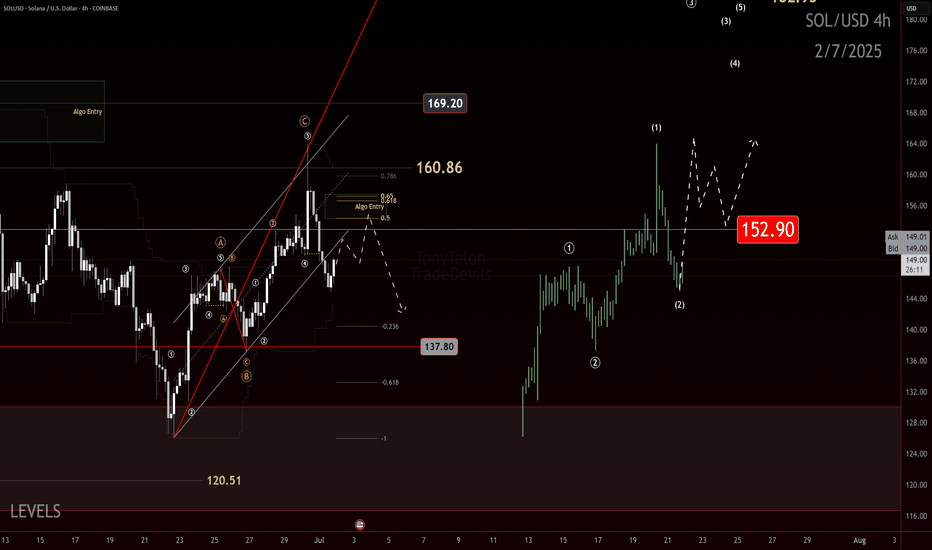

Sol searching, for an entry. If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

The Elliottician’s Paradox: 12-12 or Zigzag? Bias Is the Key

Ever stare at a chart and ask, “Is that a 12-12 or a classic zigzag?” Yeah… welcome to the paradox we Elliotticians live in. Pattern recognition’s a blessing and a curse because context is everything, but confidence can get you wrecked.

This one’s got me on the edge.

What’s Happening Here

We’re currently watching a move that could be either:

- A corrective zigzag (5-3-5), or

- A 1-2, 1-2 setup, gearing up for a blastoff

That’s the core dilemma — two valid options, both technically legal. So what tips the scales? Bias.

The Line in the Sand: 152

Here’s what I’m watching for:

Key Level: 152

- That’s the bull/bear line for me.

- A strong impulsive reclaim above 152 flips the script. I’d reconsider the bearish view if price surges with intent.

- But if we return to 152 in a sluggish, corrective way? I’ll be eyeing continuation lower, aligned with a more traditional zigzag structure.

Elliott View

This is where the paradox plays out:

If we’re looking at a 1-2, 1-2 setup, expect:

- A powerful Wave 3 soon (should not be shy)

If it’s a Zigzag ABC:

- Then we should expect a corrective internal retracement and continuation to the down side, at minimum past the origin of the initial move.

The chart will speak loudest. But structure and strength of this next leg will confirm the story.

Final Thoughts

Trading isn’t about being right. It’s about managing scenarios — and this one’s a classic fork-in-the-road moment. I’ve got a plan for both directions.

152 is my trigger. Stay below it and fade the rally. Break above it impulsively, and I’ll flip my bias with it.

The Elliottician’s paradox isn’t a trap — it’s an invitation to stay sharp.

Your Turn

How are you reading this structure? Do you favor the zigzag or the 1-2 setup? Drop a comment and let me know.

Trade safe, trade clarity!

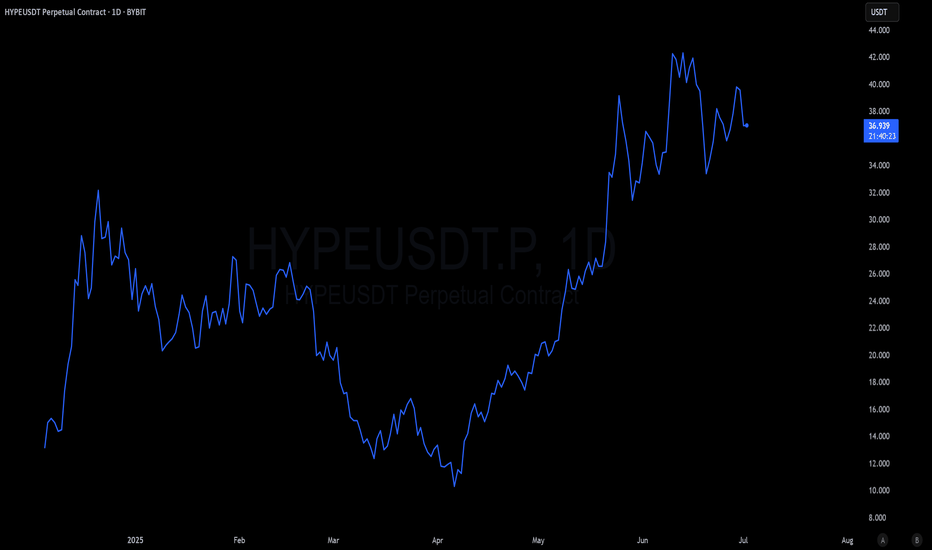

HYPEUSDT Probably CookedToken driven by demand from trading on Hyperliquid. Crypto looks set for a few month long consolidation probably into Q4.

That loss in trading volume will reduce demand for the token and the company may be forced to sell the token to come up with large gains for its clients. Either way it's a bearish catalyst for the token which has really ran hard. Ugly head and shoulders as well as a topping pattern in an overall financial market that looks like it wants a pull back

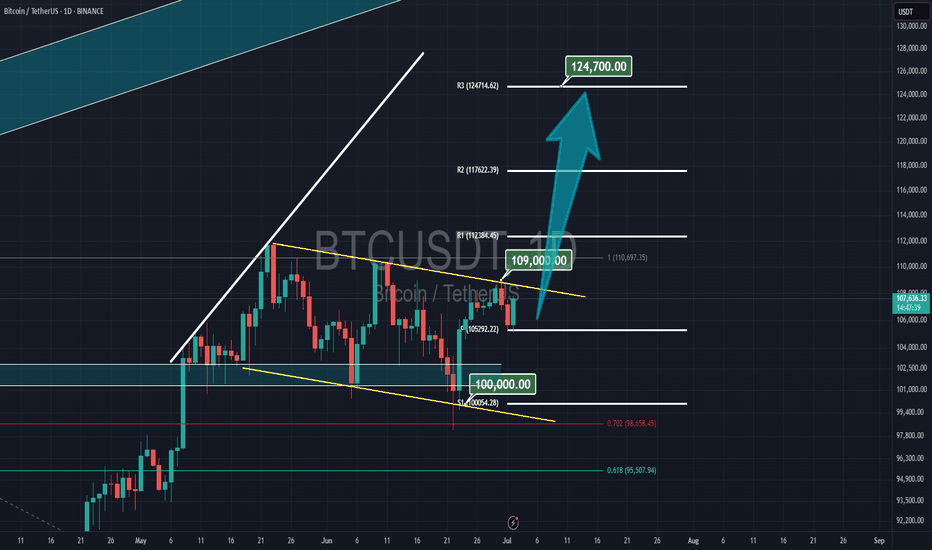

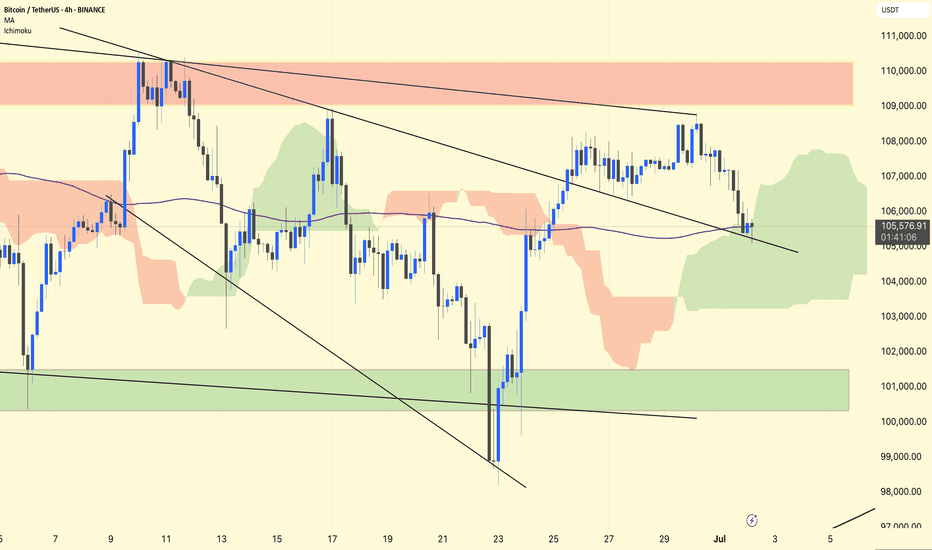

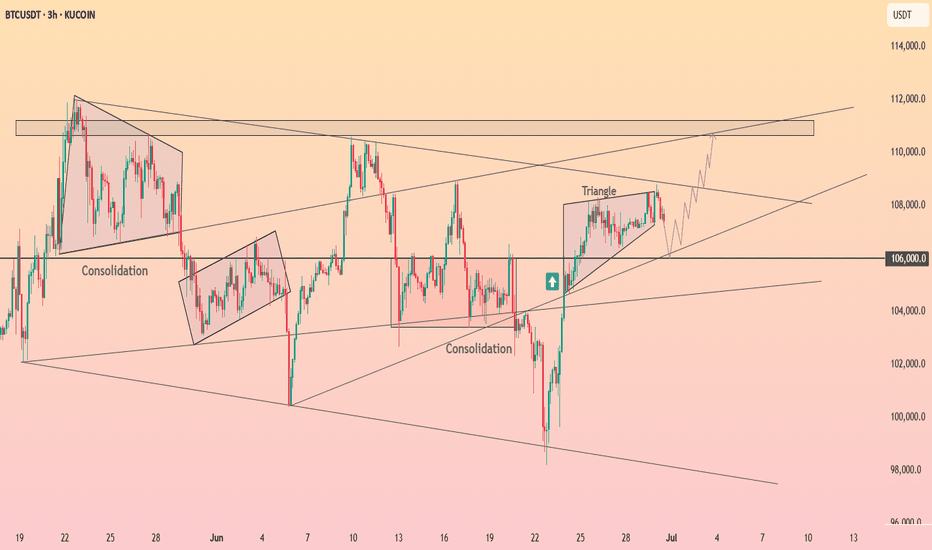

BTC/USDT 4H Analysis.

BTC remains in a retest phase after breaking out of the first descending broadening wedge.

The price has returned to test the upper wedge trendline, which is now acting as support around ~$105,500.

The purple 1 00-period MA (~105,570) overlaps this retest zone, adding additional confluence to the support.

Ichimoku

BTC is inside a green cloud, indicating indecision but not a confirmed trend reversal.

The cloud provides dynamic support in the ~$104,500–105,500 area.

Stay alert!

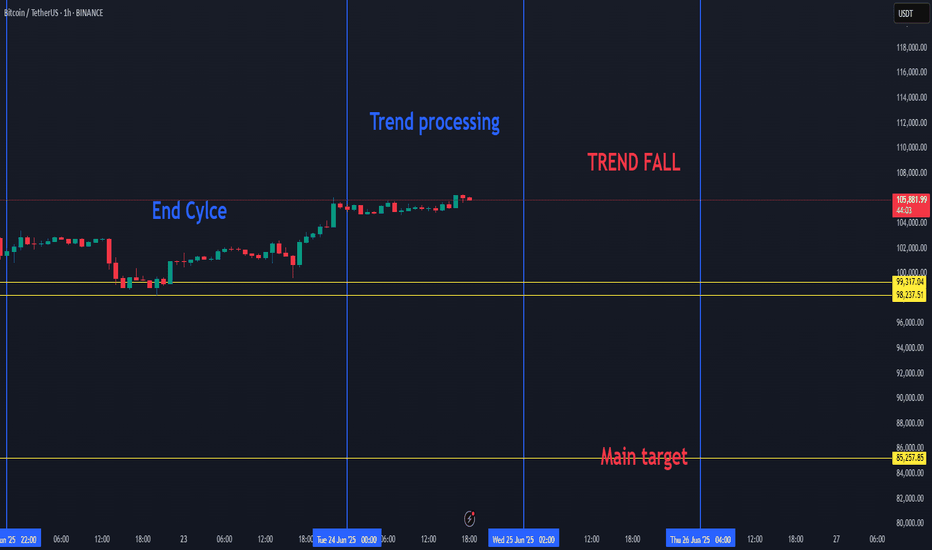

BTC HIGH DATA SHOW BREAKDOWN TO 85K FOR BITCOIN SOON.Bitcoin Market Update

BTC SEEMS TO ENTER A NEW CORRECTION PHASE SOON.

Recent data suggests that the current Bitcoin (BTC) cycle is coming to an end. As a result, we may soon see a downward move in BTC's price. The key target in this potential drop is around $85,000, with expectations that BTC will fall below $100,000.

This week, Bitcoin completed its cycle trend and is now entering a processing or transitional phase. Once this phase ends, we anticipate another decline in price.

This outlook is based on recurring patterns seen in previous BTC cycles, which have shown similar behavior in the past.

BTC can play on the low time frame with uptrends and downtrends, but if we will choice a side, then it will be the red trend.. since BTC cycle is ending.

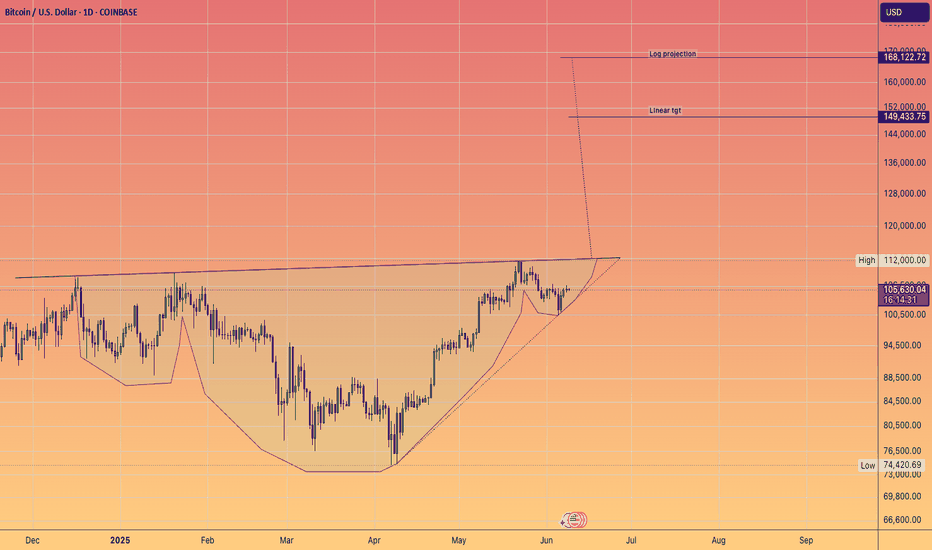

Bitcoin - An Epic Move Awaits!Bitcoin gained 13% in H1 2025, outperforming Ethereum and Solana, which dropped ~25% and ~17% respectively—highlighting BTC's strength in turbulent market conditions.

Institutional wedge: spot-BTC ETFs saw huge inflows—BlackRock’s took in $336M, and total crypto product inflows approached $45B+ this year.

AI models foresee BTC holding $105K+ by end-June, with ChatGPT pointing to $118K and Grok forecasting $108K, based on momentum and ETF flows.

We see BTC holding the 20 MA and spiking to new all time highs.

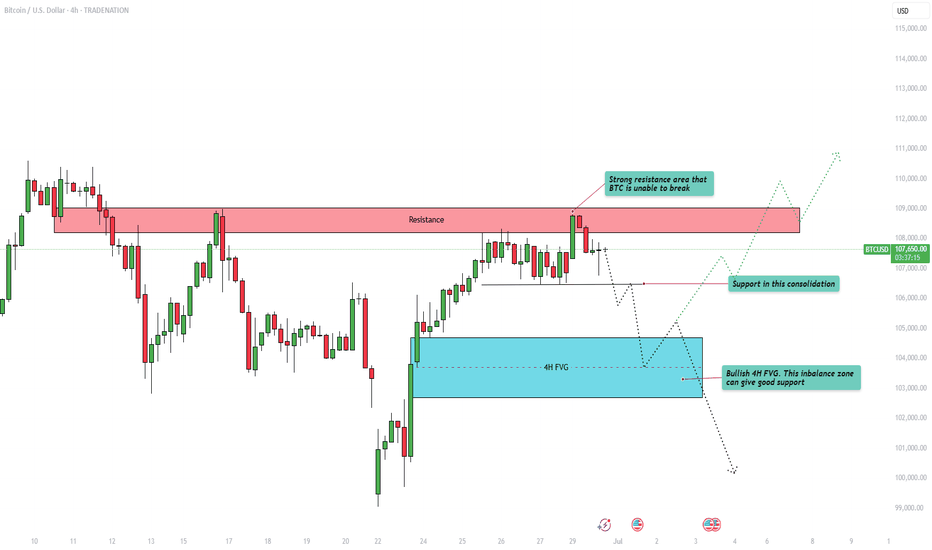

Bitcoin - Price struggles below resistance, correction to $104k?This 4-hour chart for BTC/USD illustrates a detailed technical analysis scenario highlighting key resistance and support zones, as well as a critical fair value gap (FVG). The chart shows that Bitcoin is currently facing strong resistance in the $108,000 to $109,000 range. This area has been tested multiple times without a successful breakout, indicating significant selling pressure. The price is currently trading just below this resistance zone, struggling to gain momentum above it.

Support zone in the consolidation

A clear support level has been marked in the recent consolidation area around $106,000. This zone has served as a short-term base during the recent upward movement, and a retest here could provide a temporary bounce or pause in bearish momentum. However, if this support fails to hold, the next major area of interest lies within the 4-hour bullish FVG between approximately $103,000 and $104,000.

4H FVG

There is a clear 4-hour bullish FVG between approximately $103.000 and $104.000. This level can act as a strong support for buyers after filling up the inbalance zone. it is highly important to hold this level as support and not to break below it.

Upside potential

On the upside, if BTC can defend the support in the consolidation zone and reclaim momentum, a push back to the $108,000 to $109,000 resistance area is probable. A successful breakout above this zone would invalidate the bearish scenario and may trigger a bullish continuation, with the potential to reach higher targets such as $111,000 or beyond.

Downside risk

The downside risk becomes more pronounced if BTC breaks below the 4H FVG. A sustained move beneath this level would likely signal weakness in buyer interest and potentially open the path to deeper downside targets. In such a scenario, the price could accelerate lower toward the psychological support level at $100,000. This round number also carries technical and emotional significance for traders, which could create both a strong support area and potential buying interest.

Conclusion

In conclusion, Bitcoin remains at a critical juncture. The key levels to watch are the support within the current consolidation and the 4H FVG imbalance zone. A breakdown below the FVG could lead to a decline toward $100,000, while holding above these levels keeps the door open for another test of resistance at $108,000 to $109,000. A breakout from there would indicate bullish strength and a shift in market sentiment. Traders should remain cautious and reactive to how price behaves around these critical areas.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

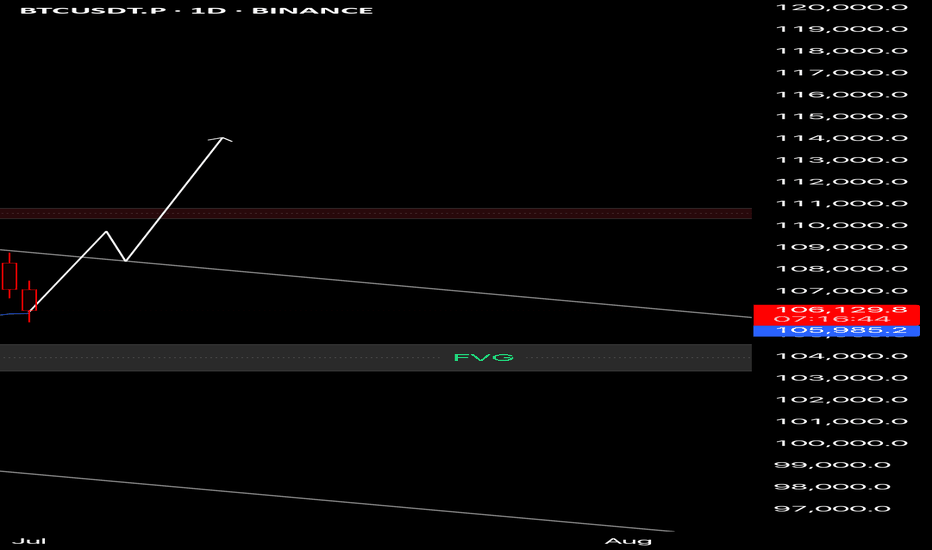

BTC 1D Analysis📊 BTC 1D Analysis

Price is respecting the channel and currently holding the 21 EMA as dynamic support.

If we see a strong daily close above the descending resistance, it may trigger a breakout toward the $110,000–$112,000 zone.

Key levels:

🔹 Support: $105,980

🔹 Resistance: $110,800

Bias: Bullish if breakout confirms

Watch the next 1–2 candles for confirmation.

🔔 Set alerts – don’t chase!

#BTC #Bitcoin #CryptoAnalysis #TradingView #CryptoSignals #DYOR

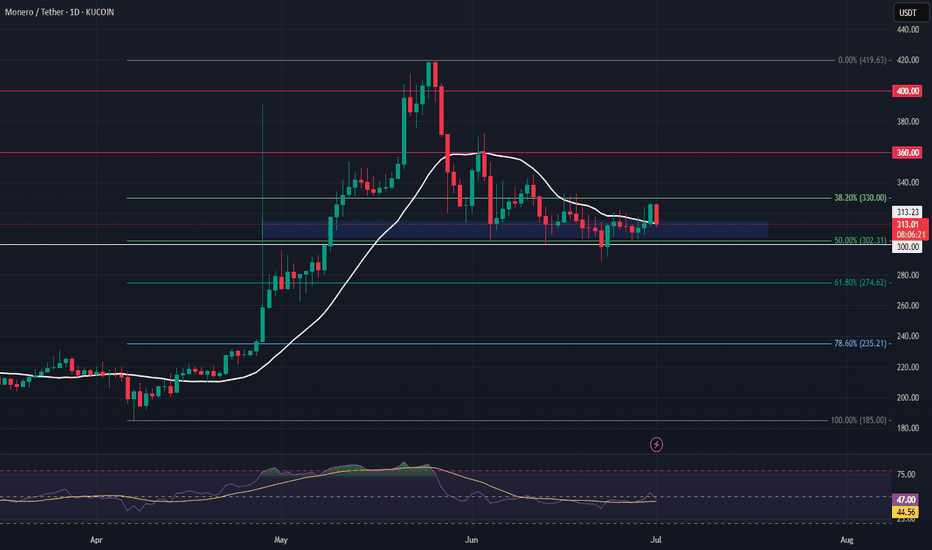

XMR Long Swing Setup – 50% Retrace with Structure ShiftXMR rallied from $200 to $400 and has now pulled back 50% of that move. With price reclaiming the 20-day SMA and a recent structure shift, there’s a solid setup forming with ~60% probability of continuation.

📌 Trade Setup:

• Entry Zone: $305 – $315

• Take Profit Targets:

o 🥇 $360

o 🥈 $400

• Stop Loss: Daily close below $300

Bitcoin can turn around from seller zone and start to declineHello traders, I want share with you my opinion about Bitcoin. The price previously broke above the support line and made a strong bullish move from the buyer zone (99300–100500 points). After the breakout, the price started rising steadily and is now approaching the Seller Zone (108500–109500), which also coincides with the resistance line of the downward channel. This area has shown strong bearish pressure in the past. Every time the price entered this zone, it quickly reversed. It’s a key area where many traders seek short-term opportunities. Currently, price is just entering this zone again and showing early signs of weakening momentum. Given the channel's structure, past price behavior near this resistance level, and the presence of the seller zone, I expect BTCUSD to turn around soon. Once the price rejects this level, I anticipate a reversal and a move back into the channel, continuing the downward trajectory. My first target is set at 103000 points, near the center of the range and above the support level (100500). This area has been tested multiple times before and may act as a strong buffer again. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

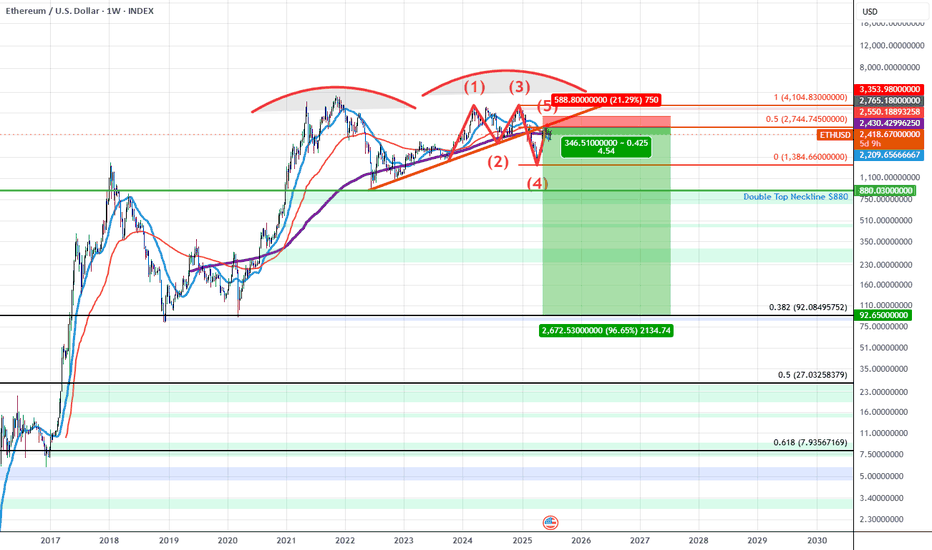

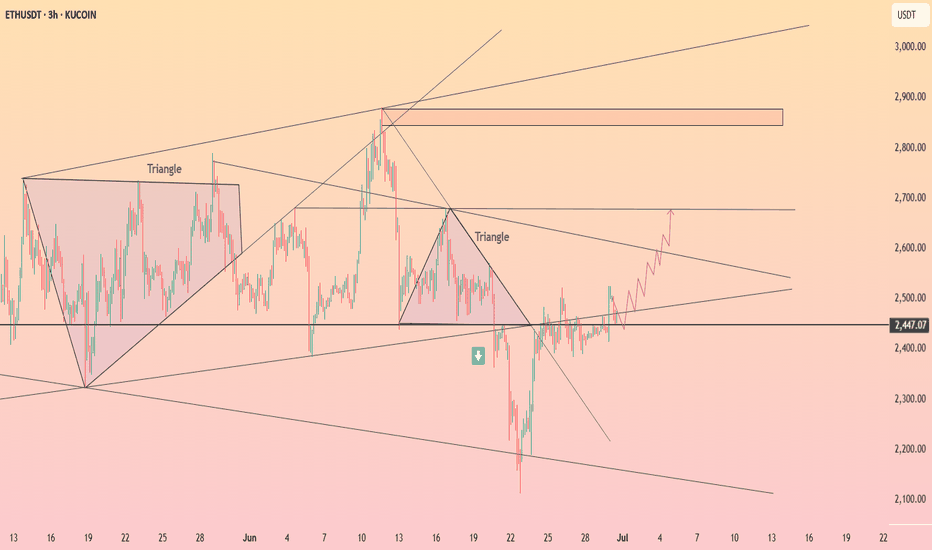

ETHUSD: Double Top into A Bearish 5-0 BreakdownETH for the last 5 years has been developing a Double Topping pattern which has put in a series of lower highs during the most recent 2nd run up. As we've confirmed these lower highs we've broken down below trendline and found resistance at the trendline which happens to have confluence with the PCZ of a Bearish 5-0 wave formation.

As we begin to find weakness and Bearish price action begins I suspect price will make it's way towards the neckline of the double top aligning with the $880 price level if ETH breaks below that level there will be no significant support until it reaches the all-time 0.382 retrace down at around $92.10.

In short it seems ETH is in the early stages of a macro breakdown which could result in value declines greater than 80%.

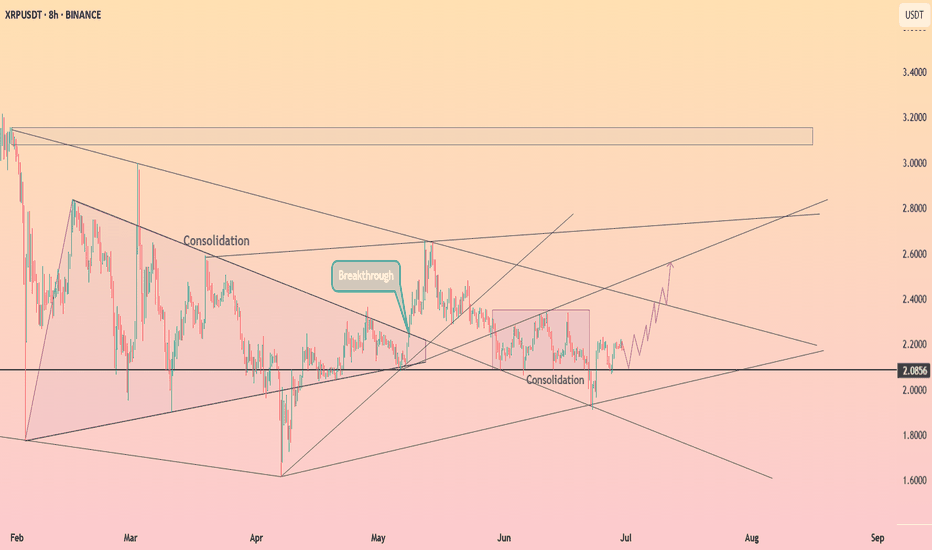

HolderStat┆XRPUSD before retest of the $2 levelBINANCE:XRPUSDT has rebounded from its 2.08 base and broken out of consolidation, aiming for the upper diagonal resistance near 2.40–2.60. With recurring bullish patterns and a history of strong follow-through after similar setups, momentum may build if 2.20 is cleared.

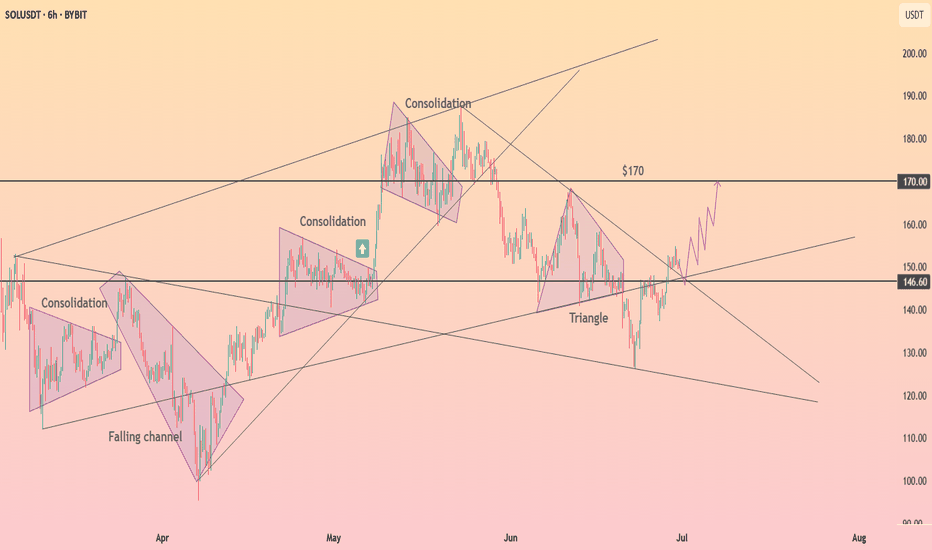

HolderStat┆SOLUSD aims for the $170 levelBINANCE:SOLUSDT has broken above triangle resistance, retesting the $146.60 level as new support. The breakout echoes earlier consolidation-based rallies, opening the path toward $170. As long as the structure remains intact, bulls could extend the climb over the next few sessions.

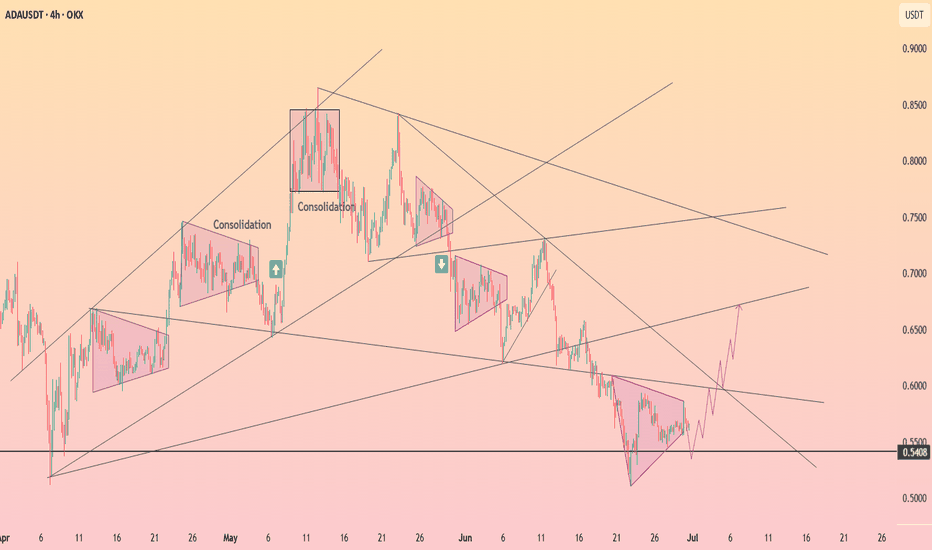

HolderStat┆ADAUSD formed rising bottomBINANCE:ADAUSDT has formed a symmetrical triangle after finding firm support around 0.54. Previous consolidation zones have led to significant breakouts, and the current structure is showing early signs of a similar rally. If bulls manage to reclaim 0.58, a climb toward 0.66 and 0.70 becomes likely, with upper trendline resistance acting as a magnet for price.

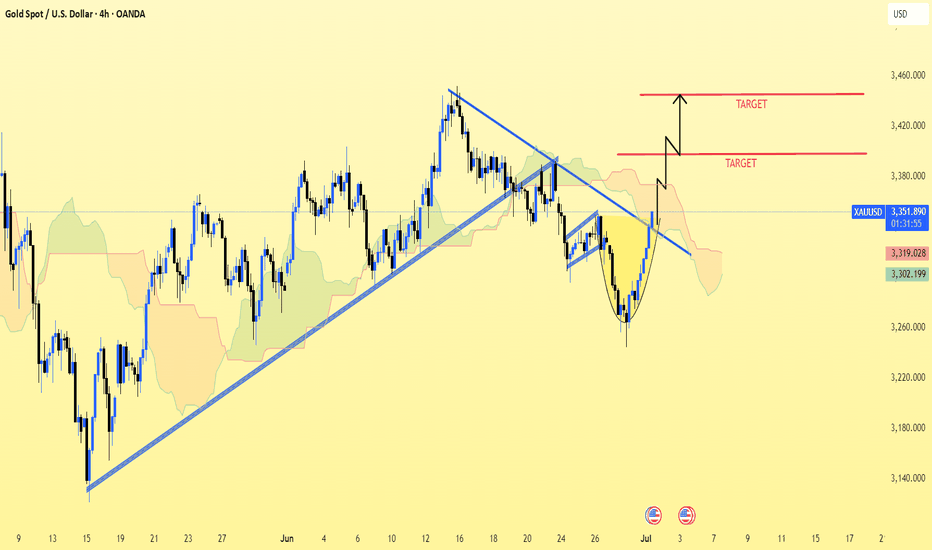

XAU/USD (Gold vs. US Dollar) 4h chart pattern XAU/USD (Gold vs. US Dollar) on the 4-hour timeframe displays a bullish cup and handle pattern forming, with a breakout above the handle resistance and Ichimoku cloud.

Technical Observations:

Cup and Handle pattern indicates bullish continuation.

Breakout has occurred above trendline and handle.

Price is trading near $3,350 (approx).

Two upside TARGETS are marked on the chart.

---

🎯 Projected Targets (Approximate):

Based on your chart:

1. First Target (TP1): Around $3,390 - $3,395

2. Second Target (TP2): Around $3,425 - $3,430

These targets align with the measured move of the cup height projected from the breakout level.

---

✅ Confirmation:

Price is above the trendline and trying to hold above the Ichimoku cloud.

Entry would be ideal on a pullback to the breakout zone (~31,335-$3,340) for lower risk.

Stop-loss can be considered below the handle low (~$3,310 or $3,305).

Let me know if you want Fibonacci-based targets or support/resistance levels as well.

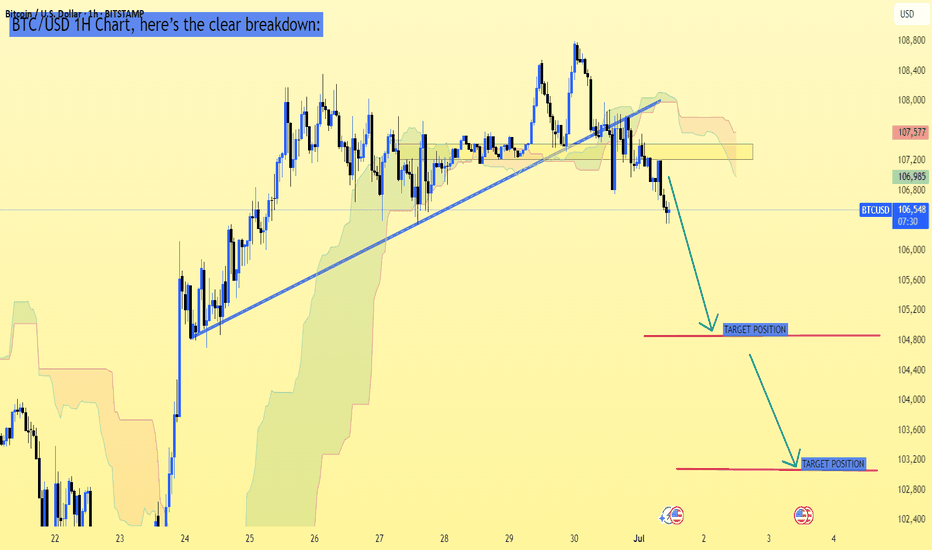

BTC/USD 1H Chart, here’s the clear breakdown:BTC/USD 1H Chart, here’s the clear breakdown:

---

Current Price:

Around 106,636 USD

---

Bearish Setup Observations:

Price has broken the ascending trendline support

Price is below Ichimoku Cloud — bearish confirmation

Retest of broken trendline area failed, suggesting more downside

---

Target Levels Based on Your Chart:

✅ First Target: Around 105,200 - 105,400 USD

✅ Second Target (Final Target): Around 103,200 - 103,500 USD

---

Conclusion:

Bearish momentum is strong; watch for price to test 105,200 zone

If that level breaks, likely move toward 103,200

Resistance area remains near 107,200 - 107,500 (good stop-loss zone for shorts)

---

Would you like a risk management suggestion for this setup? Let me know!

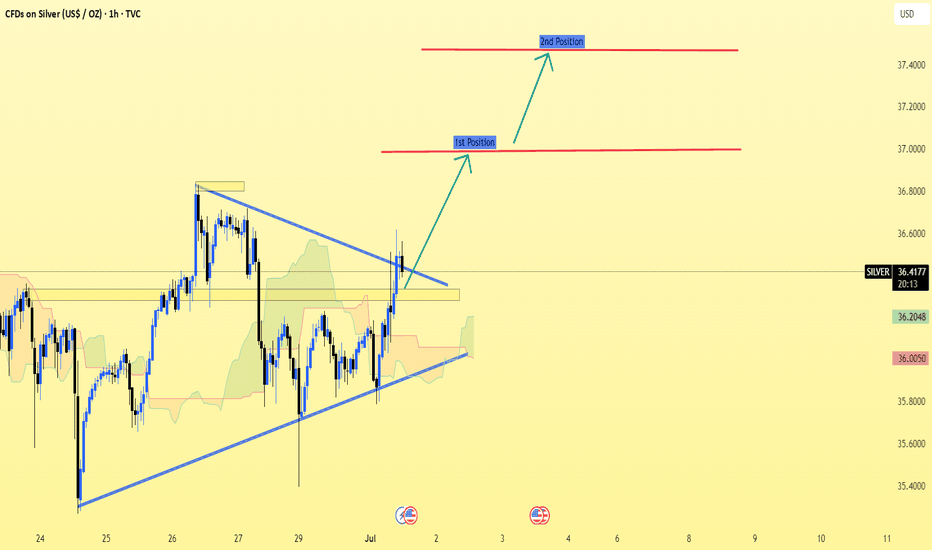

Silver (XAG/USD) on the 1-hour timeframe.Silver (XAG/USD) on the 1-hour timeframe, the chart shows a bullish breakout from a symmetrical triangle pattern. Here's the target breakdown:

📈 Silver Bullish Targets:

Current Price: Around 36.42

1st Target (TP1): Approximately 36.95 – 37.00

2nd Target (TP2): Approximately 37.40 – 37.50

These targets are based on the breakout from the triangle and previous resistance zones marked on your chart.

🛑 Suggested Support Zone (Breakout Retest Area):

Around 36.00 – 36.20 (acts as support now after the breakout)

If price holds above this zone, the bullish structure remains valid. Let me know if you'd like stop loss suggestions or lower timeframe analysis.

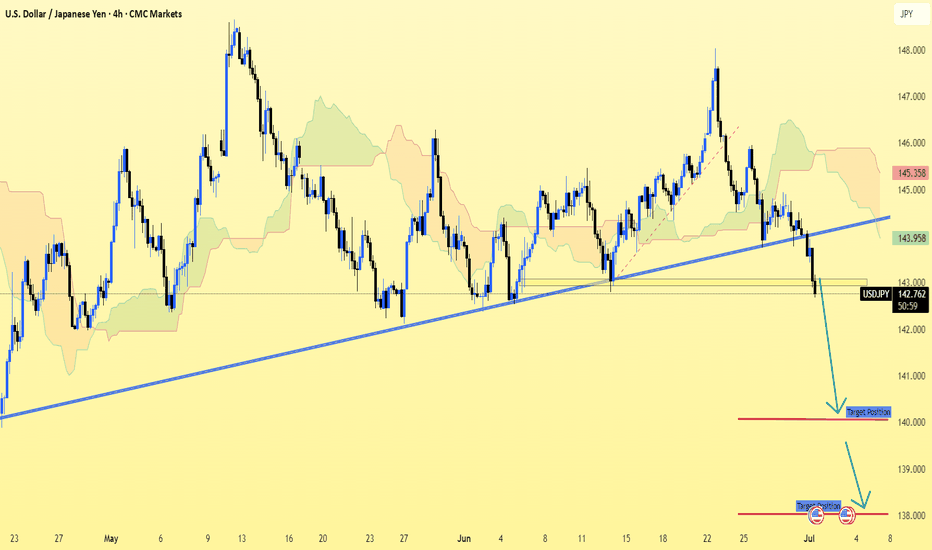

USD/JPY (4H timeframe) shows a clear break 0ut.USD/JPY (4H timeframe) shows a clear break below the ascending trendline and Ichimoku cloud support, suggesting a bearish continuation.

Key Bearish Targets (Based on the chart):

1. First Target Zone:

📉 140.88

This level aligns with previous structure support and is marked as the initial target on the chart.

2. Second Target Zone:

📉 138.85 – 139.00

This is a deeper support zone and is indicated as the next bearish leg if price momentum continues downward.

Summary:

Current Price: ~142.74

Trend: Bearish (Breakdown from trendline + Ichimoku bearish signals)

Target 1: 140.88

Target 2: 138.85

Let me know if you want SL (stop-loss) or entry suggestions.