TradeCityPro | Bitcoin Daily Analysis #141👋 Welcome to TradeCity Pro!

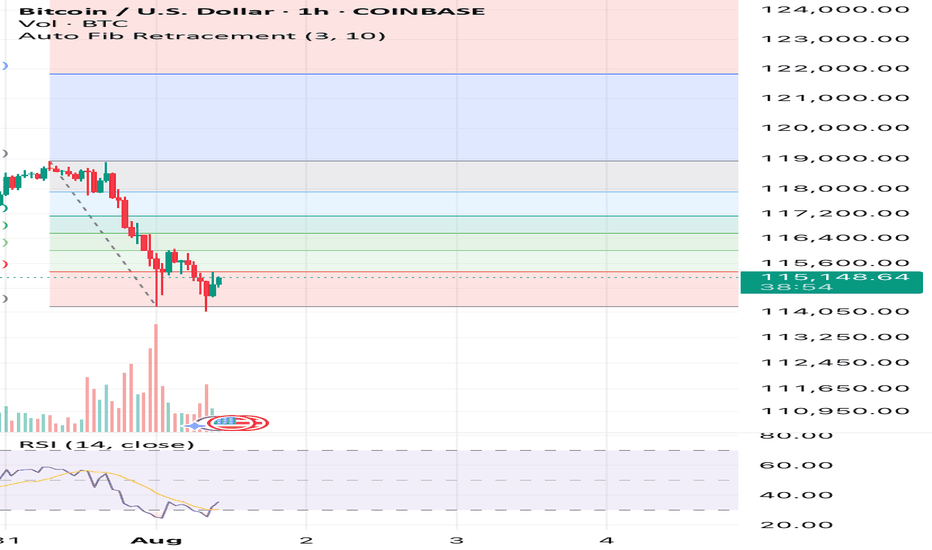

Let’s dive into Bitcoin analysis. Yesterday, the exact bearish scenario I told you about happened. Let’s see what opportunities the market is offering us today.

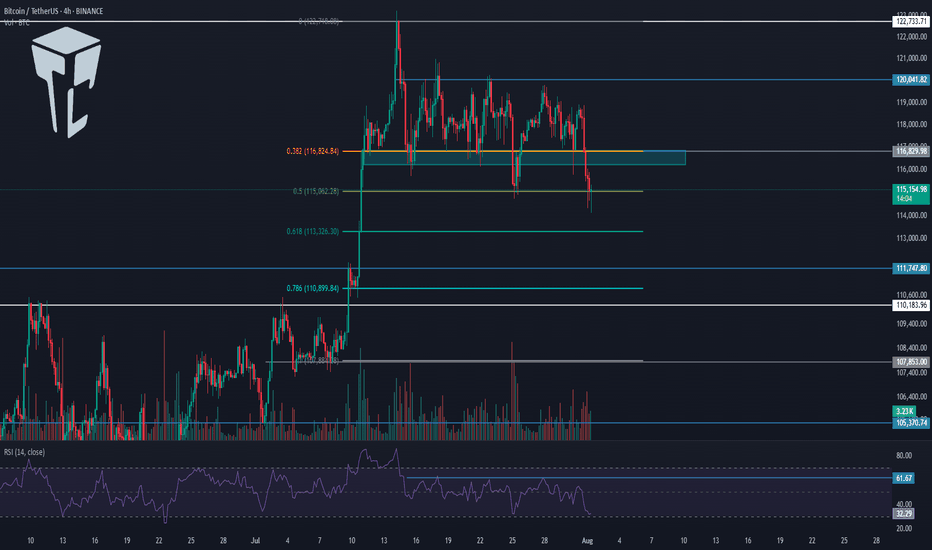

⏳ 4-Hour Timeframe

Yesterday, I mentioned that the price had tested the 116829 zone too many times and that this area had become very weak. I also said that if the price made a lower high than 120041, deeper corrections would be likely.

✔️ Another perspective I have on the market is that sometimes certain support and resistance levels simply aren’t strong enough to continue the trend.

🔑 For example, in this case — despite Bitcoin being in an uptrend across all cycles — the 116829 support couldn’t hold, and the price broke it to reach a stronger support zone, one that might be capable of continuing the trend.

📊 Right now, this is what might be happening again. Support levels like 0.5, 0.618, and 0.786 Fibonacci retracement zones could be where the next bullish leg begins.

✅ At the moment, price has reached the 0.5 Fibonacci level, and the previous strong bearish momentum has slightly weakened. If you look at the volume, momentum is still in favor of sellers, but based on the long lower wicks on the candles, we can say the bearish trend is showing signs of weakness.

💥 On the other hand, RSI is approaching 30, and in an uptrend, when RSI nears the Oversold zone, it can often be a good entry point for a long. However, we’re not acting on this yet — we’ll wait for more confirmations before opening any positions.

⭐ For now, there’s no trigger for a long position on this timeframe. A break below 115000 could act as a short trigger, but given the trend Bitcoin is in, I’m not opening any short positions at the moment.

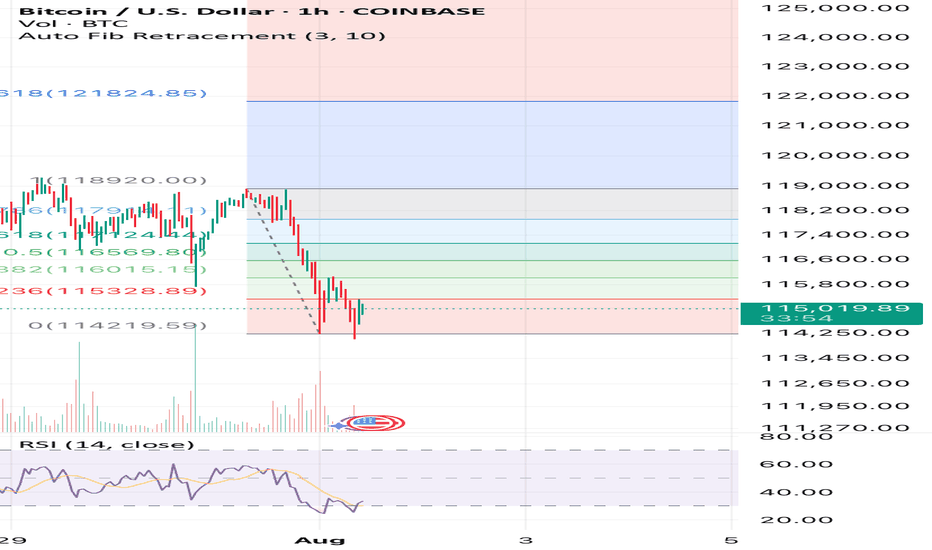

⏳ 1-Hour Timeframe

The price has dropped down to 114560, and I believe today we might enter a corrective phase. However, if the price stabilizes below 114560, the correction could continue. The next targets would be the Fibonacci levels from the 4-hour timeframe.

🔽 I won’t open a short position with the break of 114560, and I suggest you don’t take that short either.

📈 If this move turns out to be a fakeout, the first trigger we have now is at 118736, which is quite far from the current price. For this trigger to activate, we’d need to see a V-pattern form.

🔍 There are no other triggers right now. But if more range structure forms, we might consider opening a risky long on the breakout of the range top.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Cryptomarket

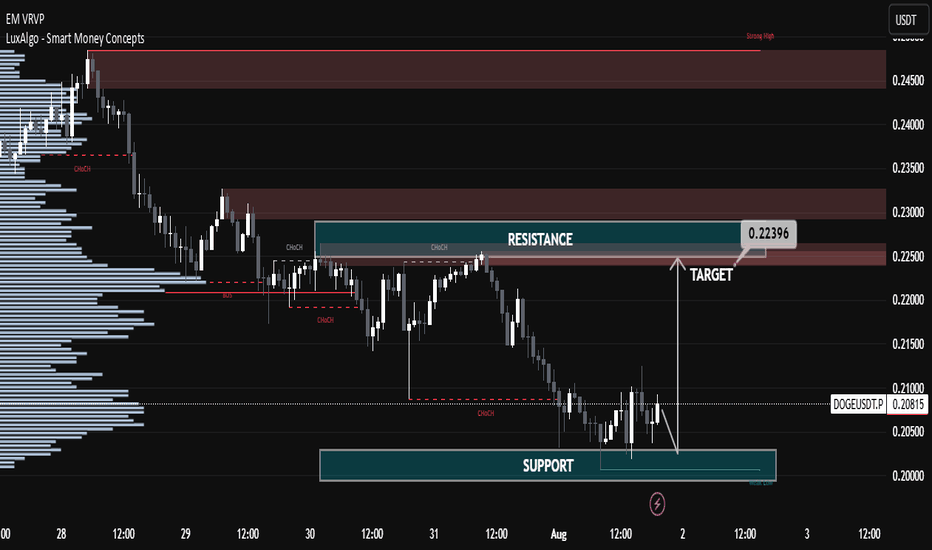

DOGEUSDT Technical Analysis – Bullish Reversal Anticipated DOGEUSDT Technical Analysis – Bullish Reversal Anticipated

🔍 Key Technical Zones:

Support Zone: $0.1990 – $0.2015

Strong bullish reactions noted from this level in previous attempts.

Confluence with volume accumulation on the left (as seen in the Volume Profile).

Signifies a strong demand zone where buyers are stepping in.

Resistance Zone / Target: $0.2220 – $0.2240

Previous structural high and supply zone.

Marked as the first major liquidity area.

Also aligns with imbalance and CHoCH (Change of Character), a common SMC concept.

🔄 Market Structure:

CHoCH (Change of Character) marked multiple times, indicating attempts by bulls to reclaim structure.

Recent price action shows accumulation near support.

Sideways consolidation suggests potential for a bullish breakout.

Liquidity sweep of recent lows could indicate that smart money is accumulating positions before a move higher.

🎯 Trade Setup Idea:

Entry Area: Between $0.2000 – $0.2060 (inside the support zone)

Target: $0.22396 (as marked)

Stop Loss: Below $0.1980 (below the visible support range)

🔧 Indicators and Tools Used:

Volume Profile (VRVP): Shows most volume traded around $0.205 – $0.207, indicating strong positioning from market participants.

Smart Money Concepts (SMC): CHoCH and liquidity concepts signal potential accumulation and reversal.

Price Action Analysis: Clean swing structure with support-resistance rotation visible.

📌 Conclusion:

DOGEUSDT is currently trading in a range-bound structure with a bullish bias from the support zone. If the price sustains above $0.205 and breaks above minor resistance, the upside target of $0.22396 is likely. This setup is supported by strong volume accumulation and smart money structure shifts.

TradeCityPro | Bitcoin Daily Analysis #140👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis. Yesterday, the interest rate decision by the US Federal Reserve was announced, and once again, just like the past few months, it remained unchanged. Let’s see what impact it had on Bitcoin.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, after the announcement of the unchanged interest rate and Powell’s speech, Bitcoin printed a red candle on the support zone and even wicked lower, but then recovered and the price returned back into the box.

✔️ Basically, we can say that this month’s rate decision had no real impact on the market, and Bitcoin is still moving inside its range box. The fact that the support zone wasn’t lost is a positive sign for the continuation of the trend.

⭐ But the important point is this: if the uptrend is going to continue, the price must print a higher high or at least a level equal to 120041, and in my opinion, if for any reason a lower high gets printed, the chances of breaking below 116829 significantly increase.

📊 I currently have no new position on Bitcoin, and all my entries are below 110000. But if 120041 breaks, I’ll open a long position for the next bullish wave that Bitcoin might start.

💥 A major trigger for starting a new leg is the 61.67 level on the RSI. As long as RSI remains below this level, there’s no bullish momentum in the market — and considering that the number of touches to 116829 has increased, the probability of a correction is also rising.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

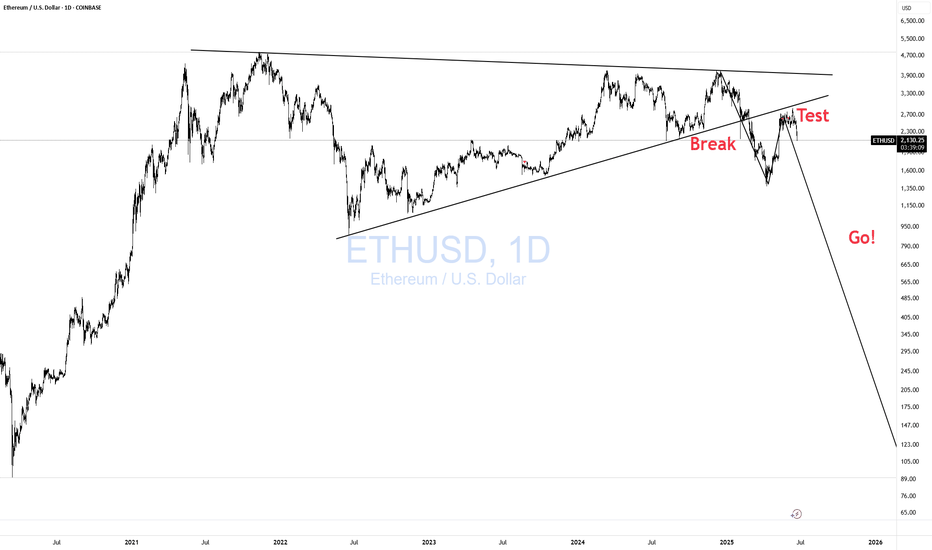

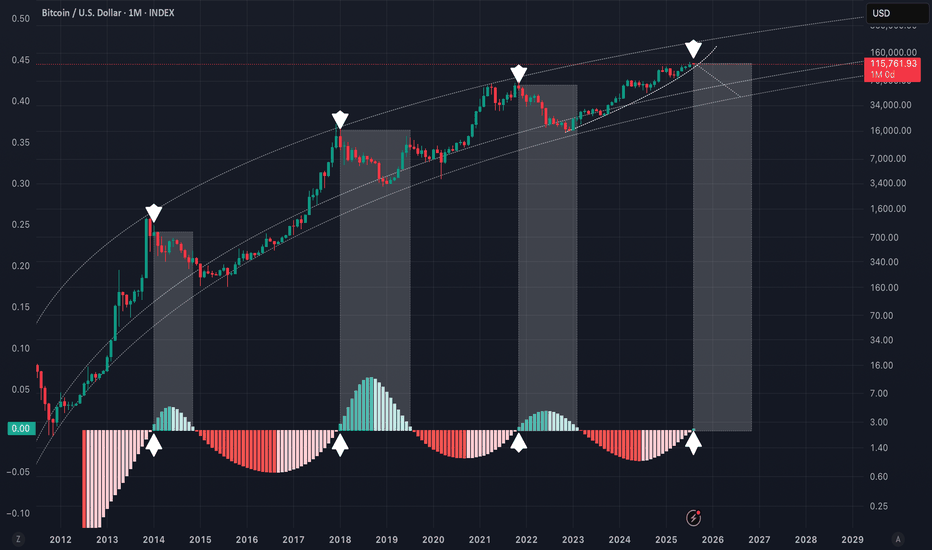

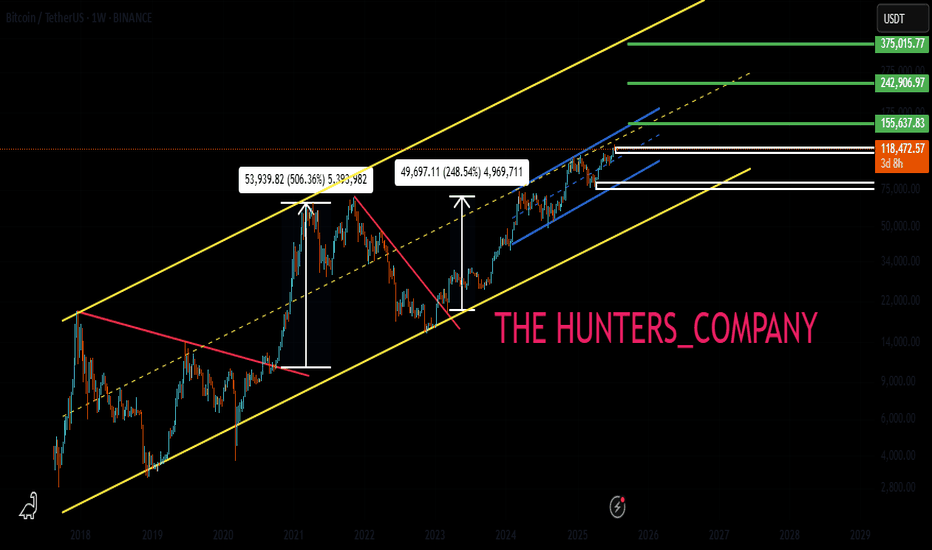

We might be changing the trend in the coming months!I found this indicator extremely accurate for the past tops. We are focusing on the histogram today and looking once that green candles starts growing momentum taking BTC down the hill. If this idea proves right we might be bottoming around 400 days perhaps August 2026 ~45k

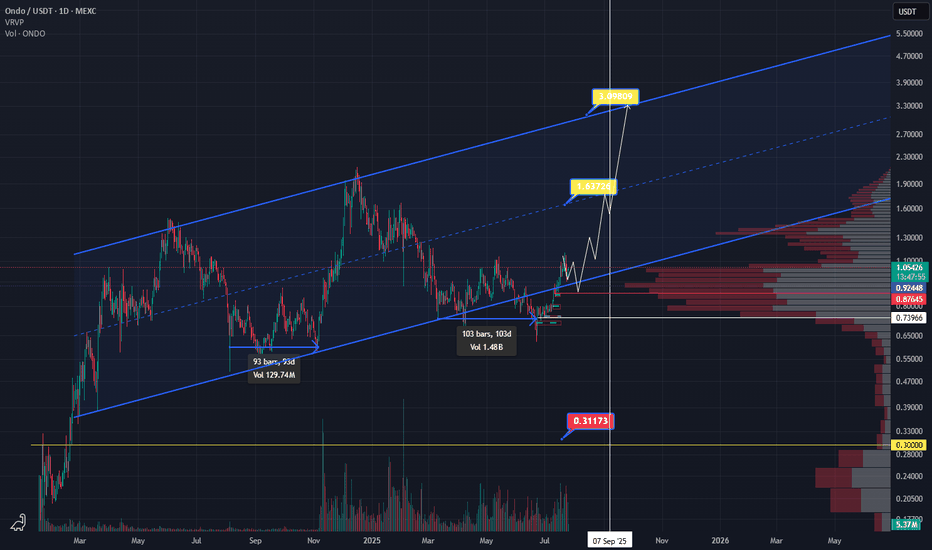

TradeCityPro | ONDO Builds Strength Beneath Key Supply Barrier👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ONDO coin for you — one of the RWA projects, currently ranked 37th on CoinMarketCap with a market cap of $2.93 billion.

📅 Daily Timeframe

In the daily timeframe, as you can see, this coin has formed a range box between the levels of 0.7354 and 1.1933, and the price is currently sitting in the upper half of this box.

✔️ At the moment, the price is hovering around 0.9037, and it’s forming a higher low above 0.7354. If this low gets confirmed, the probability of breaking above 1.1933 increases.

⭐ The 1.1933 zone is a very significant supply level that was previously acting as support in late 2024, and after being broken, has since acted multiple times as resistance.

📊 If this area breaks, we can open a long position, or even buy this coin in spot. Personally, if this trigger is broken, I’ll open a long-term long position.

✨ The target for this position is 2.0565, and once the price reaches this level, we can take profits and consider a spot buy.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

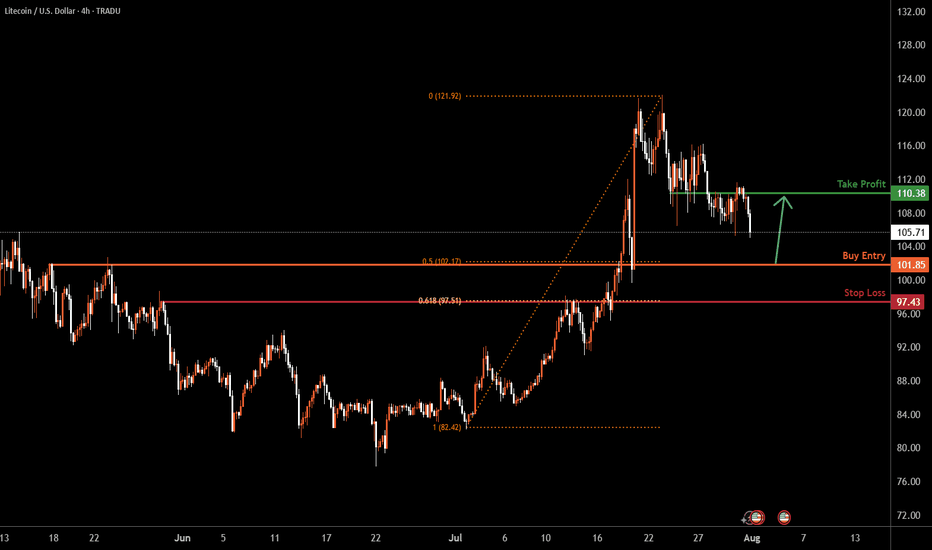

Litecoin H4 | Bullish bounce off 50% Fibonacci supportLTC/USD is falling towards the overlap support and could bounce to the take profit

Buy entry is at 101.85, which is an overlap support that lines up with the 50% Fibonacci retracement.

Stop loss is at 97.43, which is a pullback support that aligns with hte 61.8% Fibonacci retracement.

Take profit is at 110.38, an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

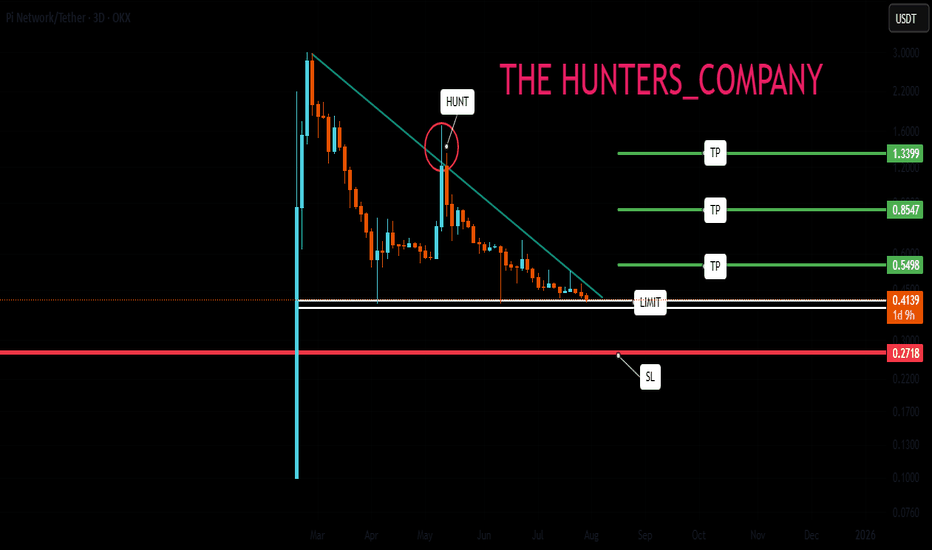

PI NETWORK : Will it finally be pumped?Hello friends🙌

👀According to the decline we had, you can see that the price has reached an important area and has formed a floor in this area. Considering the classic ego that is forming on support, you can enter the trade by breaking the resistance, of course, by managing risk and capital and moving with it to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

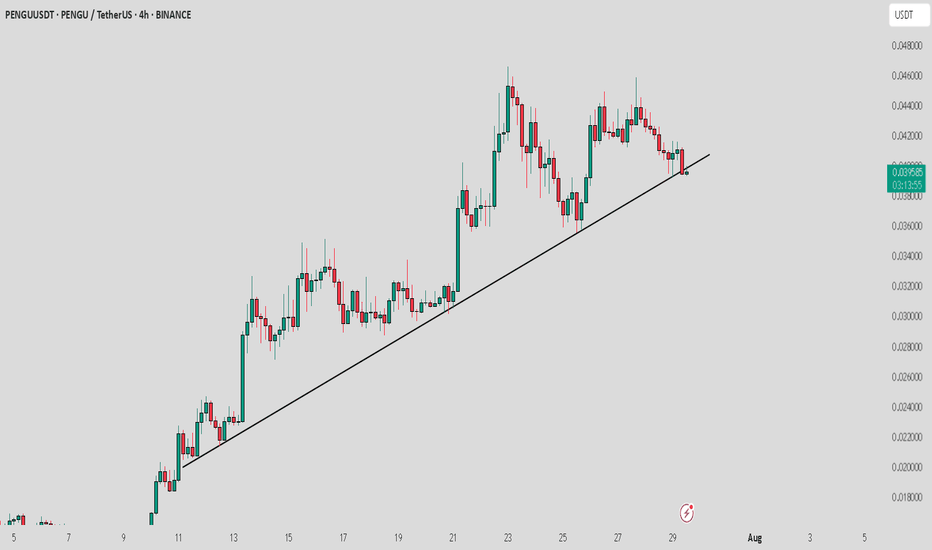

PENGU / USDT : Breaking down from Trendline supportPENGU/USDT is breaking down from the trend line support, but the retest is still in progress. Watch for rejection at key levels.

Pro Tip: Wait for confirmation of rejection before entering the trade and always apply proper risk management to safeguard your position.

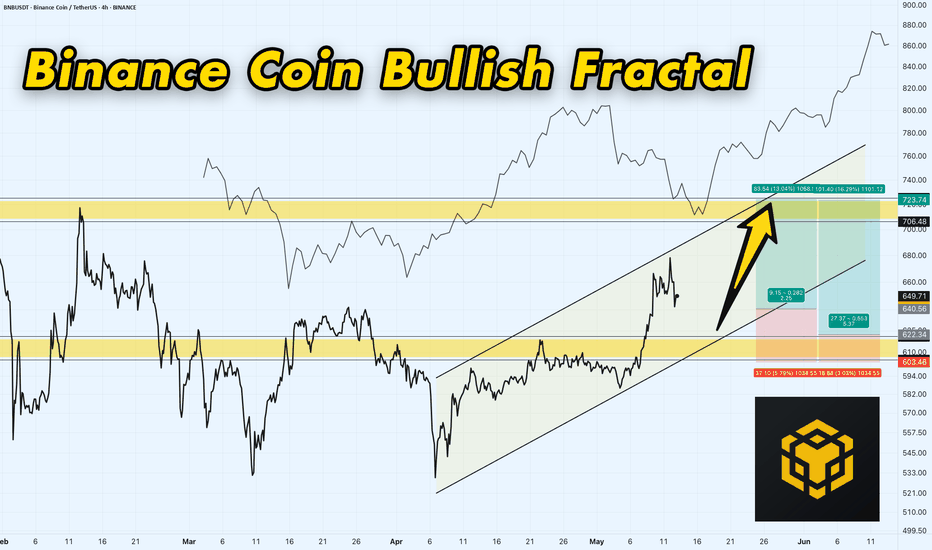

BNB/USDT 4H Chart: Rising Channel with Fractal Vibes!Hey traders! Binance Coin is showing some promising action that’s got me on the edge of my seat!

We’ve got a clear rising channel in play, with BNBUSDT moving beautifully in sync with a fractal line pattern shown above the chart — mirroring past price behavior like a roadmap! BNBUSDT is currently trading at $650 , I think price will continue bouncing between the channel’s support at $620-$600 and move upwards to the key resistance target at $700-$720 . A breakout above this resistance could send BNB soaring to new highs, potentially targeting $800 or beyond!

However, if BNB fails to break through, we might see a pullback to the channel support at $620-$600 .

Key Levels to Watch:

Resistance: $700-$720

Support: $620-$600

Breakout Target: $800+

Breakdown Risk: $600

Is BNB about to blast through $720, or will it retreat below support? Let’s hear your thoughts below!

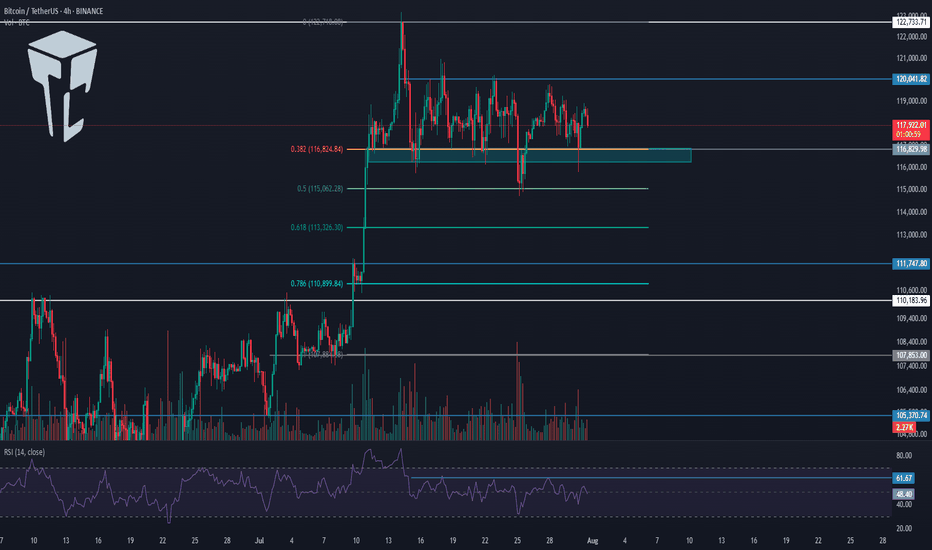

Bitcoin willIt hold if we stay above $115k ?? Fixing up last post I’ve deleted now as image was not good. Anyway simple RSI and Auto Fib Retrace with only general CRYPTOCAP:BTC market understanding backing this. This isn’t finacial advice at all. It’s pure speculation this post and anything related to it. I’m

Not a finacial advisor and I will not be held accountable for anyone’s actions that I didn’t do.

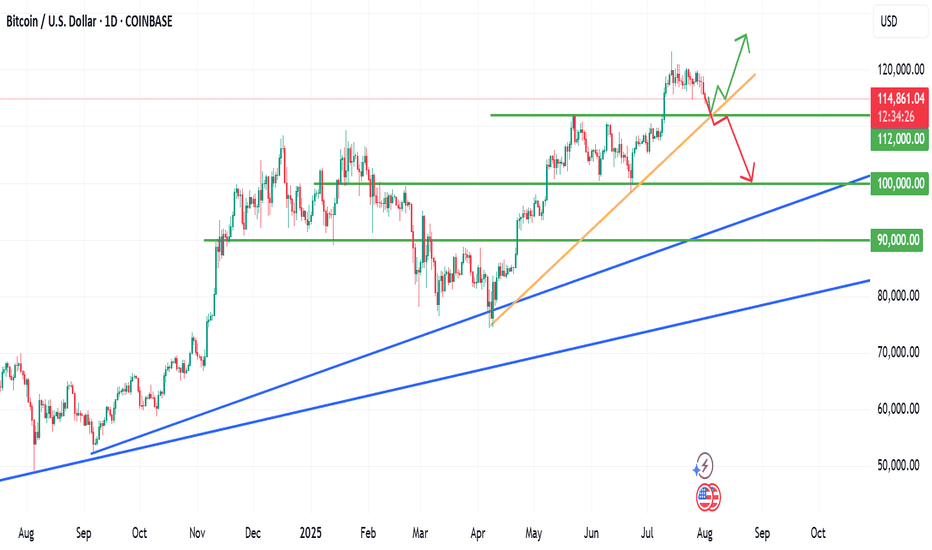

BTC : The future of Bitcoin...Hello friends🙌

👀According to the price history, the price has always been bullish and is in a long-term bullish channel.

📈Now that the price is struggling in the middle of the channel and is gathering strength for a big move, which is expected to break the middle of the channel in the form of a resistance or middle channel, the price will move to the ceiling of the channel.

⚠Don't forget risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

MEW : A meme coin that hasn't grown yetHello friends🙌

Given the decline we had, you can see that buyers entered the specified support area and entered the price into the ascending channel. That is why we can buy with risk and capital management and stay with it until the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

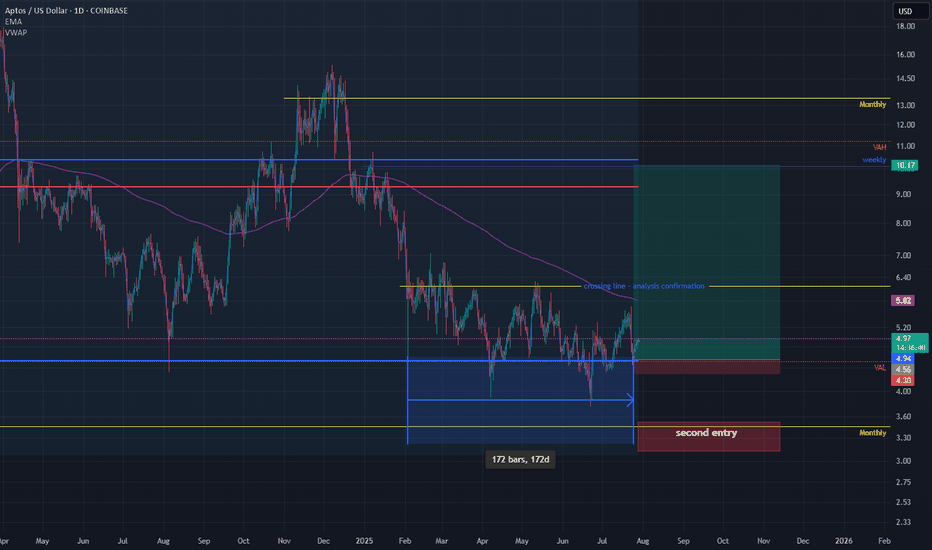

APT - HUGE POTENTIAL (130+% SPOT) You probably forgot about this altcoin but it is justified. Downtrend since 2023 and lower highs, lower lows but....

If we look more close and use tool fixed price volume we can see that price is above VAL (Value area low), we had break through but price returns..Also good reaction of FVG (Fair value gap).

Now, we can try buy this coin and have some stop lose. Price is in range 172 days and all people forget abut this coin. Analysis is right only if we close daily candlestick about 6$.

Stop lose can be below 4.4$ which is 6-7% of losing.

Second entry is monthly level at 3.3 and stop lose should be below the lowest low 3$.

For me is great opportunity because risk reward is excellent.

Ivan

$TOTAKEKE – Dark Cheems Building Momentum? Meme Bull Run SetupOverview

Totakeke (aka Dark Cheems) is positioning itself as the “brother coin” to the well-known meme Cheems on BSC. It’s been quietly gaining attention. It has been tweeted by PancakeSwap, Trust Wallet, Four Meme, and even interactions from CZ on X! HOLY SHIII! With meme coins leading this market cycle, Totakeke’s early-stage market cap of $6.2M puts it in prime territory for explosive moves if narrative momentum holds.

Initial discovery pump around July 25–26 → price surged to 0.025 before sharp retrace.

Current -75% pullback into accumulation zone (0.0058–0.007) matches classic meme cycle setups (PEPE, BONK patterns).

Liquidity at $408K = thin books; big buys/sells swing price 20%+ easily.

Key Levels

Accumulation Zone: 0.0058–0.007

Breakout Trigger: 0.009–0.01 (close above signals next wave)

Previous ATH: 0.025 (first upside target)

Meme Extension Target: 0.04–0.05 (6–8x potential if bull run continues)

Narrative Catalyst

Strong ties to BSC meme culture (Cheems brother narrative).

Engagement by top ecosystem accounts (PancakeSwap, Trust Wallet, CZ).

Community buzz forming → potential for “viral rotation” if meme bull run expands.

Play Idea (Meme Bull Logic)

Accumulate quietly in base range; position size small due to volatility.

No tight stop-loss: meme coins wick hard; manage risk via exposure, not micro stops. aka nut up or shut up

Upside targets: 0.01 / 0.025 / 0.04 (scale out as narrative develops).

Lose 0.0058? Next support ~0.0045 (still viable base in meme context).

Totakeke fits the early-stage meme cycle template.. strong narrative tie-ins, early ecosystem attention, and chart structure that mirrors successful meme plays pre-run. If meme momentum continues across BSC, this could be one to watch for multi-x potential.

Not financial advice. Meme coins are extremely volatile... play size and timing matter more than tight TA.

ADA Setup – Eyeing Entry After 70%+ RallyCardano (ADA) has surged over 70% in recent weeks. A healthy pullback is underway, and we’re watching the key support zone for a potential long entry targeting the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.65 – $0.67

• Take Profit Targets:

o 🥇 $0.98 – $1.15

o 🥈 $1.50 – $1.60

• Stop Loss: Just below $0.62

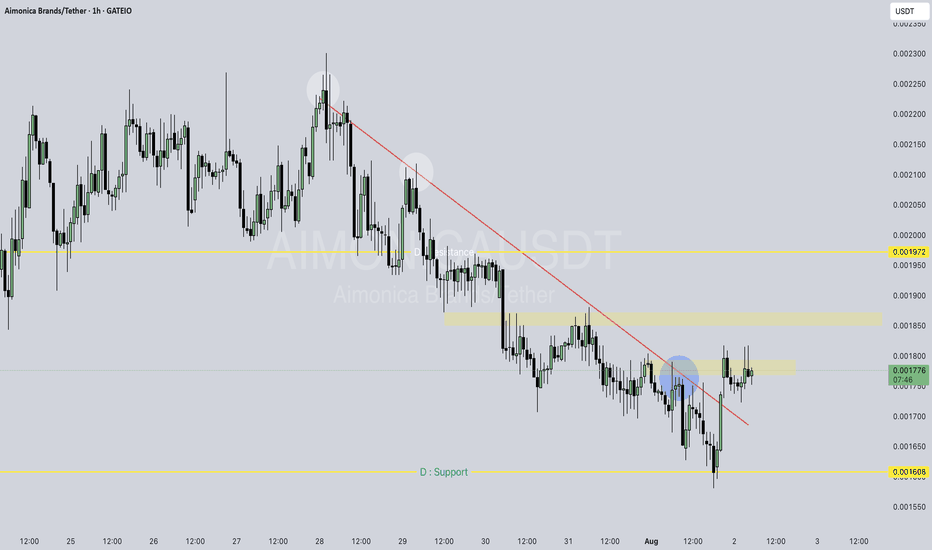

Aimonica / UsdtGATEIO:AIMONICAUSDT

### **Aimonica Brands / TetherUS (1h) - Gate.io**

- **Price**: 0.001769 (+0.17%, +0.000003)

- **High/Low**: 0.001781 / 0.001752

- **Buy/Sell**: 0.001769 (BUY/SELL at same price)

- **Key Levels**:

- **Resistance**: 0.001972, 0.002000

- **Support**: 0.001700 (D), 0.001608

- **Market Sentiment**: Neutral/minor bullish (no strong momentum).

**Summary**: Slight uptick, low volatility. Watch for breakout above 0.001972 or dip below 0.001700.

---

### **⚠️ Disclaimer**

This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves high risk, and past performance is not indicative of future results. Always conduct your own research (DYOR) and consult a financial advisor before making investment decisions.

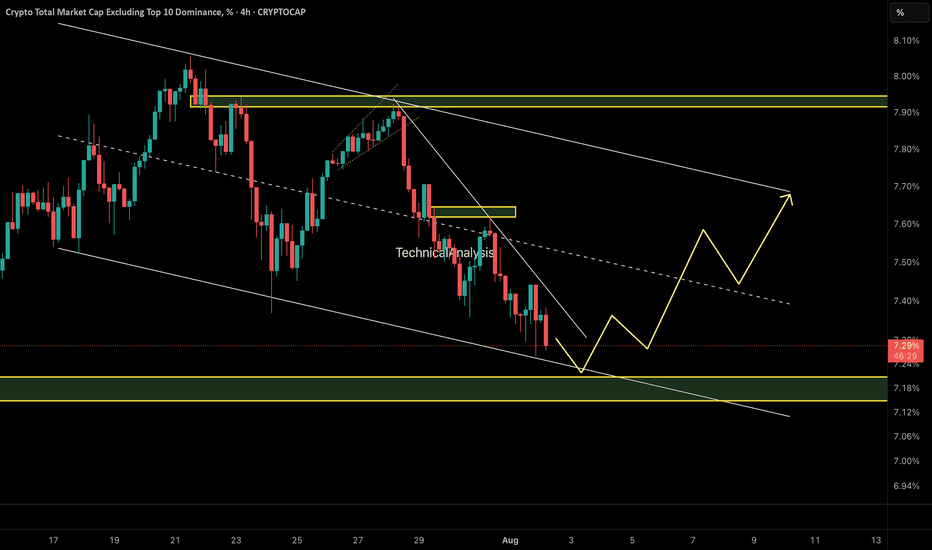

OTHERS.D – Perfect Reaction to Previous AnalysisAs predicted in the last update, OTHERS.D broke structure and dropped sharply toward the 7.20% demand zone — exactly as expected.

Now, we’re waiting for a potential bullish reaction from this key area. If demand holds, a move toward the upper channel boundary (~7.70%) could follow.

🧭 Technical Outlook:

• Price tapped into a key demand zone at 7.20%, which aligns with the lower boundary of a descending channel.

• A bullish reaction is forming, suggesting short-term strength in altcoins.

• A move toward the channel top near 7.70% is now on the table if demand holds.

⚠️ Important Note:

This move is likely to remain a corrective rally unless we see a proper breakout above 7.70% with volume and structure shift. Be selective with altcoin longs.

🔍 Watch for:

• Reaction at 7.50% midline

• Price behavior at 7.70% resistance

• Structure shift or failure pattern near channel top

⚠️ Caution: This remains a corrective rally unless price breaks 7.70% with structure shift.

🔗 Analysis by CryptoPilot

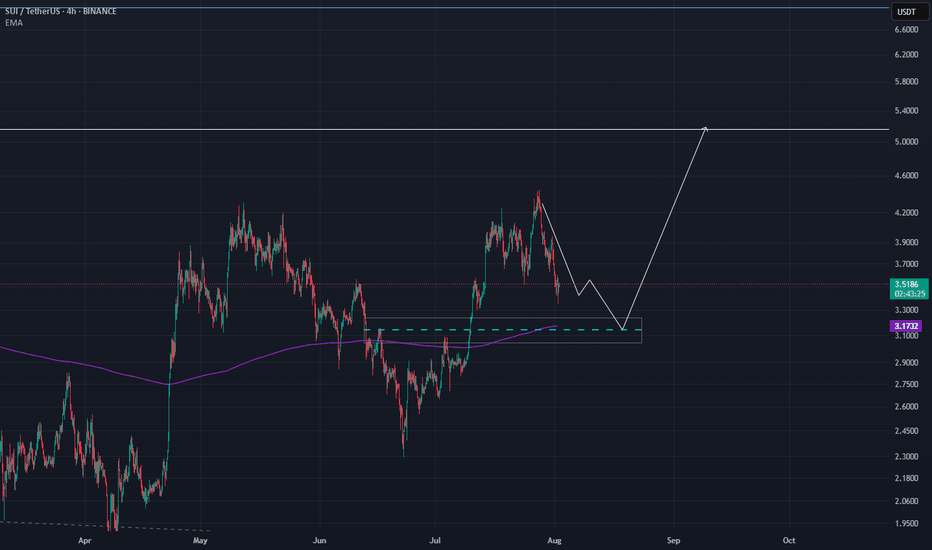

Sui chance for +60% on this zoneSui continue to grap liquidation but on the monthly and weekly timeframe we are still bullish.

I just saw good zone for trade. At 3.15 we have daily EMA + fibonacci 0.64 + Daily FVG.

I will suggest to add some leverage because invalidation is close to 2.9.

In this mid term bull market of altcoins we can see that SUI has good performance.

Ivan

ONDO Bullish structureOndo is back to bullish scenario. We can see long accumulation more then 100 days. As you can see price 0.9 is back and then bullish coming. So 0.85 and 0.9 have to hold and we can buy the dip.

Keep in mind if Ethereum start to attack ATH, Eth ecosystem will grow much higher. So watch this level in next couple weeks and months.

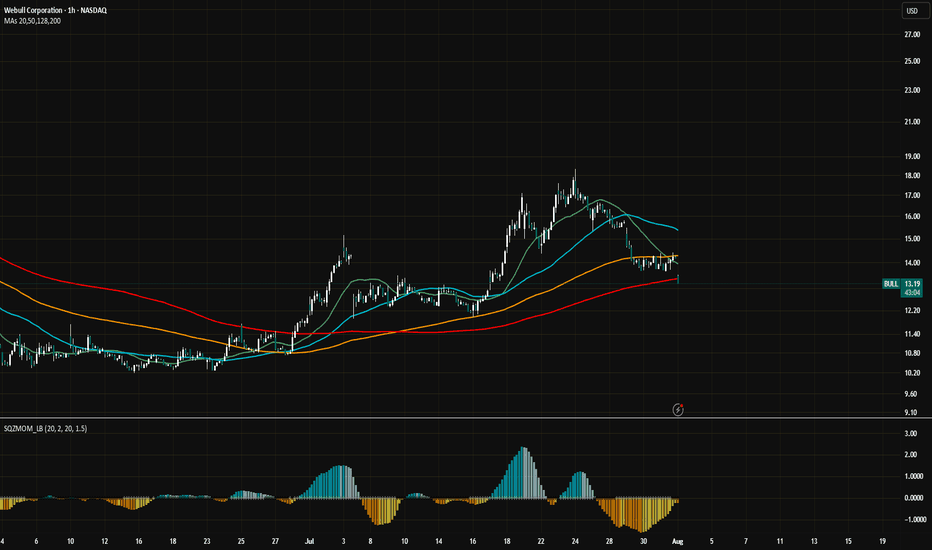

WeBull Look Ahead $BULLRecently took a look at WeBull and I believe there is a huge arbitrage opportunity from NASDAQ:HOOD to $Bull.

Although RobinHood is building something much much bigger than anticipated, including banking, I think WeBull can take some of $HOODS market share depending on their direction.

-Webull's total revenues grew 32% year-over-year to $117 million in the first quarter of 2025, according to SEC filings

-Customer assets increased 45% year-over-year, reaching $12.6 billion at the end of Q1 2025, according to Webull

-The number of registered users grew by 17% year-over-year, according to Webull

-Partnership with prediction market Kalshi will grow profits for WeBull exponentially.

www.nasdaq.com

This Might be the best price to get in today depending on WeBull's Success.

BTC is likely to resist falling below $112000BTC is likely to resist falling below $112000

If the confluence between the yellow trendline and the top green horizontal support level dont hold strong, we are likely to see BTC retrace to $100K

Please trade with care.

My thoughts are shown on the chart technically

I hope to connect with you.

Please like, share, comment and follow me.

Bitcoin has an upside to it if we hold above $14,900See what you think it’s simple Auto Fib Retracement and RSI. That’s all I’m using here and also past times and other data outside of this image but inside the CRYPTOCAP:BTC market.

What you think? Up to $118k again before down or sideways? Or will this be the end of the large bull flag formation? We’ll soon find out!