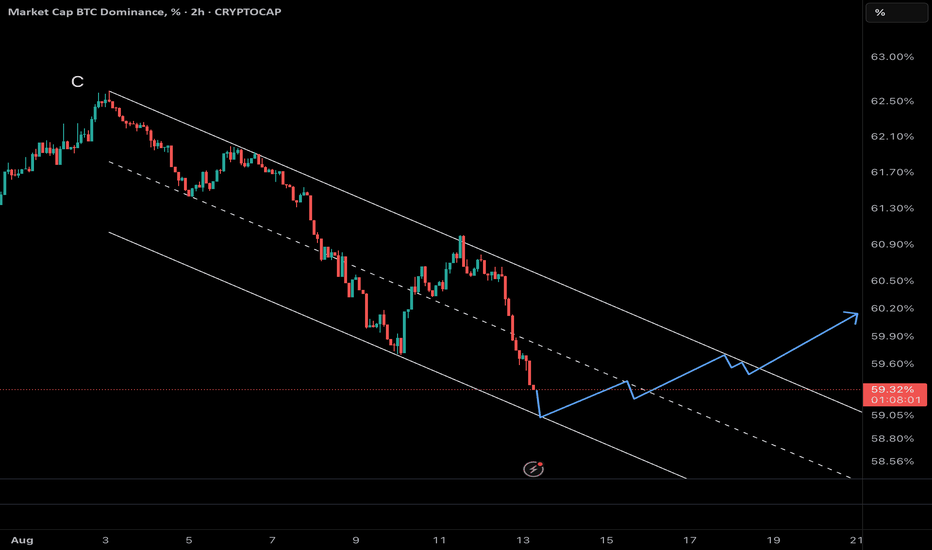

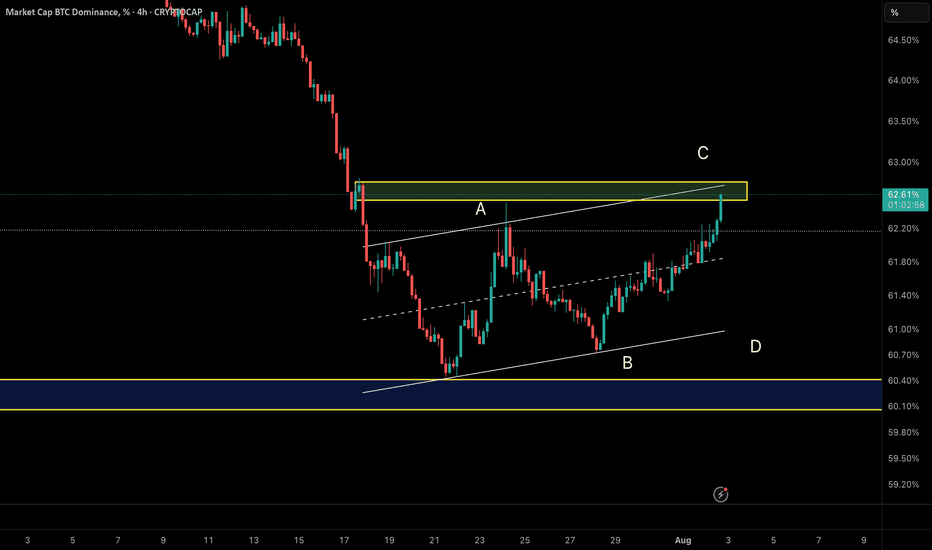

Bitcoin Dominance Hits Channel Floor – Altcoin Storm Incoming?Bitcoin dominance has been sliding within a well-structured descending channel since early August. Now, it’s touching the channel’s lower boundary — a level that has previously sparked strong reversals.

A bounce from here could ignite a short-term uptrend in BTC dominance, targeting the channel’s midline and possibly its upper boundary.

If this happens, capital is likely to rotate back into Bitcoin, applying pressure on altcoins and triggering a corrective phase in the broader altcoin market.

Key Takeaway: Watch for bullish price action at the channel’s floor. A confirmed breakout in dominance could mark the start of an “altcoin cooldown” phase.

Cryptopilot

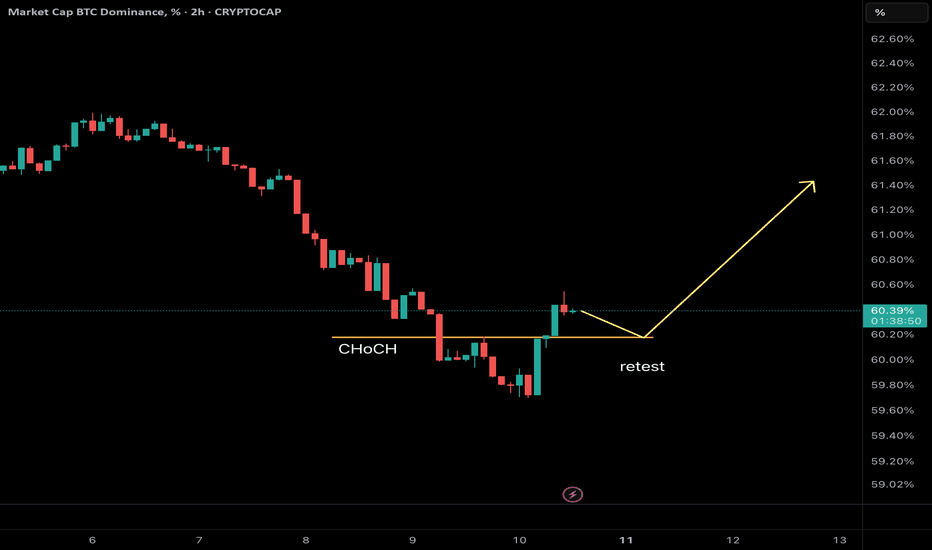

BTC.D , Bitcoin Dominance Ready to RiseAfter a descending wedge pattern, Bitcoin Dominance has shown the first signs of an upward move. A CHoCH (Change of Character) has formed on the 4-hour timeframe, signaling a potential trend reversal.

We are now awaiting a retest of the broken resistance level before continuation of the bullish trend. However, the price might skip the retest and proceed directly higher.

Stay tuned for confirmation and manage your positions accordingly.

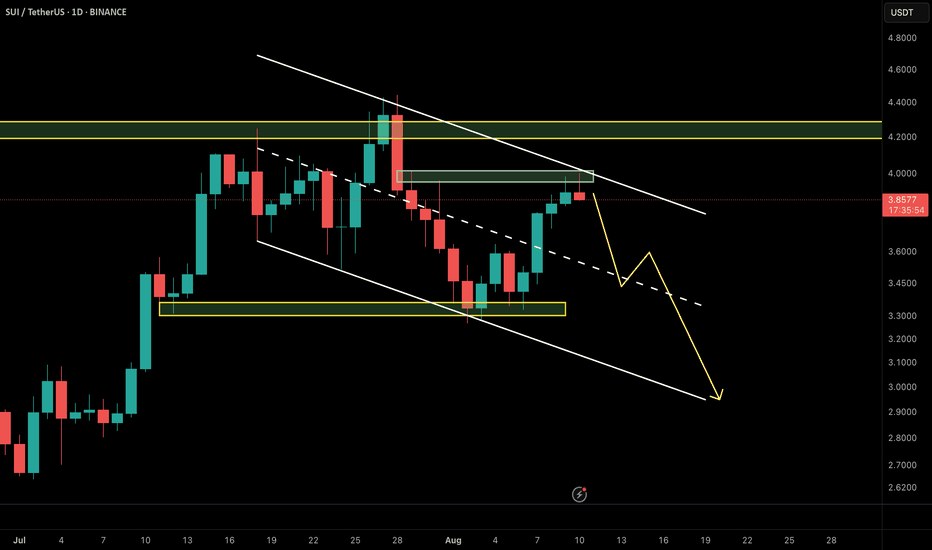

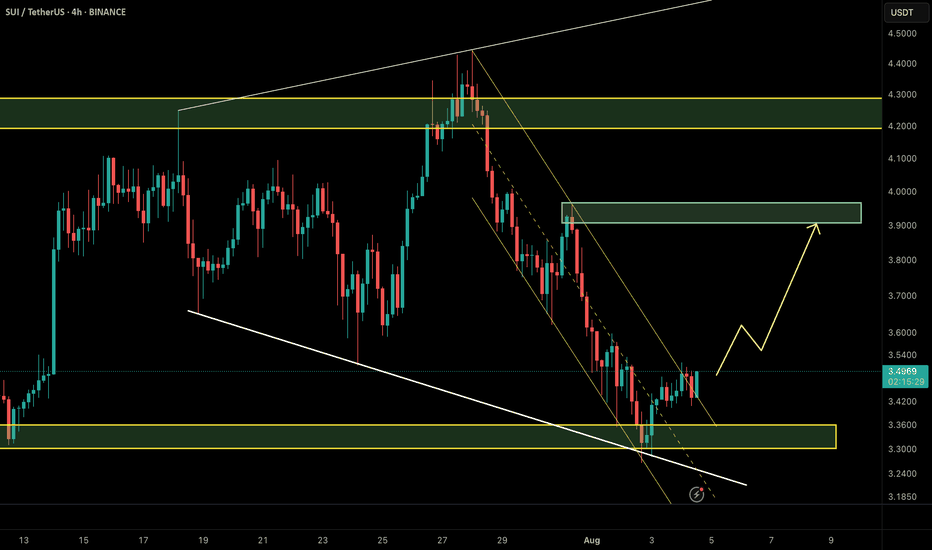

SUI – Ready to Drop from the $3.96 Supply WallSUI has rallied right into a key confluence area — the strong supply zone & bearish order block at $3.90–$4.00, which also aligns perfectly with the descending channel’s upper boundary.

📌 Bearish Scenario (preferred):

If price shows rejection at this zone and breaks below $3.85, a corrective move toward $3.55–$3.60 is highly probable, with potential extension toward $3.35 demand zone.

📌 Invalidation:

A 4H candle close above $4.05 would invalidate the short setup and open the door for a continuation toward $4.25+.

💡 Note: Confluence of channel resistance + supply OB + psychological $4 level makes this a high-probability short area. Watch for lower-timeframe BOS or liquidity sweep before entering.

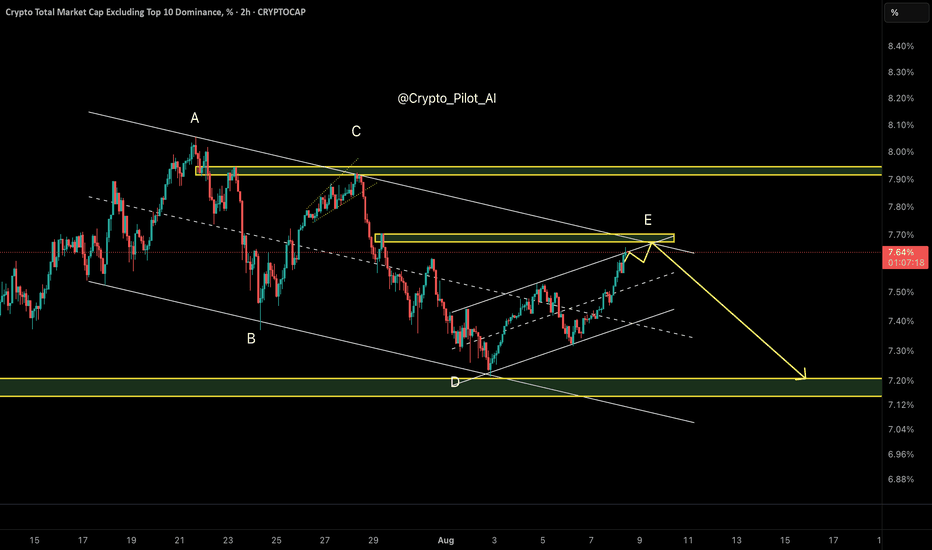

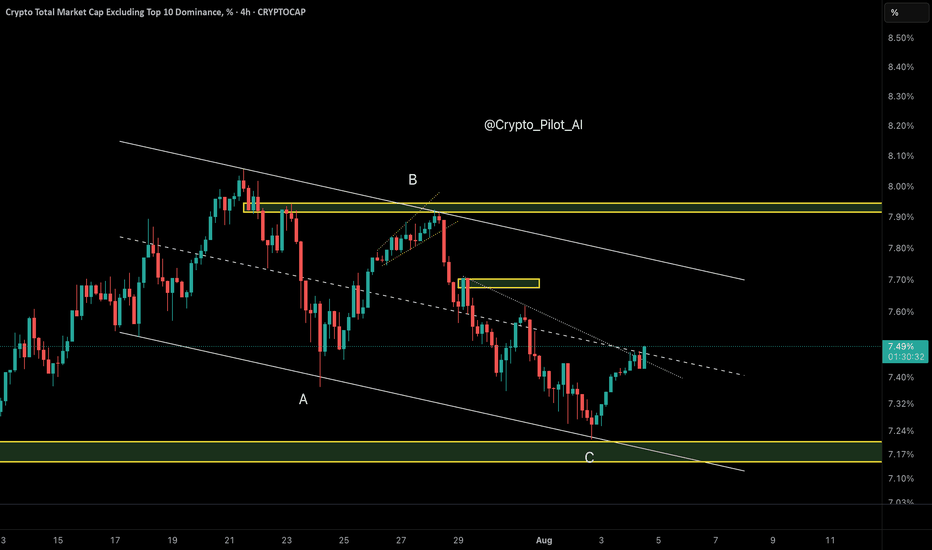

Is It Time for Altcoins to Dump? – OTHERS Dominance Final Wave As predicted in the last update, OTHERS.D reached the 7.20% demand zone precisely, showing a textbook reaction. The price has now rallied back toward the upper boundary of the descending channel and is testing the resistance area near 7.70%, where wave E likely completes within a Diametric structure (ABCDE).

This is a critical juncture: if rejected here, the next bearish wave could trigger an altcoin sell-off.

⸻

🔸 Market Structure:

• Diametric correction (ABCDE), with wave E likely terminating near 7.70%

• Price is testing the confluence of channel resistance and prior supply

🔸 Key Observations:

• Clear rejection signals are emerging around 7.70%

• No evidence of a sustained breakout yet

• Structure typically resolves with a deeper decline (wave F)

⸻

🔹 Scenario:

Base Case:

• Rejection from 7.70% supply

• Bearish continuation toward 7.20% demand

• Potential sweep down to 7.10–7.00% liquidity zone

Invalidation:

• Sustained breakout and acceptance above 7.80%

⸻

📌 Summary:

OTHERS.D is likely finalizing wave E. If this resistance holds, expect a bearish wave F and possible pressure on altcoins. Be cautious with heavy altcoin exposure until a confirmed breakout appears.

⸻

✅ Investment Strategy Selection:

Since declining OTHERS dominance = bearish for altcoins, you’d mark SHORT bias (expecting altcoin underperformance)

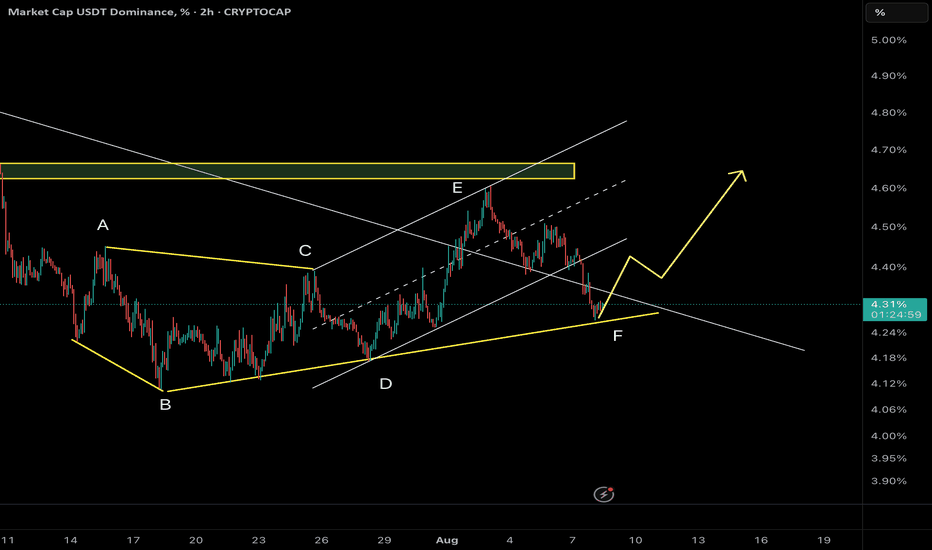

USDT Dominance – Precision Repeats: Final Wave F or Wave G Awake🔸 Market Structure:

Following the previous analysis, which precisely reached both projected targets, Tether Dominance continues unfolding its Diametric formation. After completing Wave E, price action has decisively shifted into Wave F, progressing toward the final stages of this structure.

⸻

🔸 Key Observations:

• The prior scenario anticipated a corrective decline, and price perfectly respected both the 4.40% and 4.28% targets before stabilizing.

• Currently, price is testing the ascending trendline and mid-range of the Diametric.

• Momentum remains corrective but has yet to show clear exhaustion.

⸻

🔹 Scenario 1 (Sc1) – Shallow Wave F Completion (~4.22%):

• Support around the minor ascending trendline.

• May trigger an early bounce if buyers step in.

• Less balanced geometrically for a clean Diametric conclusion.

🔹 Scenario 2 (Sc2) – Extended Wave F Completion (~4.12%):

• Aligns with the lower boundary of the Diametric.

• Provides better proportion and symmetry to finalize Wave F.

• Coincides with prior demand zone and the last reaction pivot.

• Statistically, this remains the higher probability path.

⸻

🎯 Expected Path:

Wave F is approaching maturity, and a deeper test near 4.12% remains likely before any sustainable reversal. Upon confirmation, this could trigger the start of Wave G upward, historically associated with altcoin weakness.

⸻

📌 Summary:

After executing the prior analysis with precision, USDT Dominance has advanced into the final legs of Wave F within the Diametric. Monitoring price behavior near 4.12% will be critical. A bounce here could catalyze Wave G and renewed pressure on altcoins. Should short-term support at 4.22% fail convincingly, deeper retracement becomes even more probable.

⸻

✅ Action Plan:

Closely track the reaction zones at 4.22% and 4.12%. A strong reversal signal (e.g., bullish divergence) could confirm the transition to Wave G.

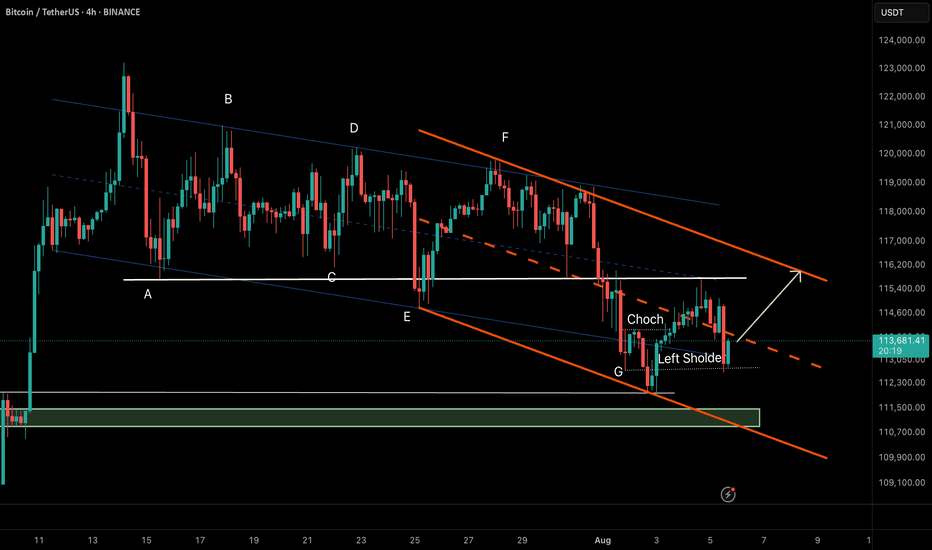

Bitcoin (BTC/USDT) – RTM Reversal Pattern in Action🔸 Market Structure:

Bitcoin has formed a descending channel after a prolonged correction. Recently, price tapped the channel bottom and printed a CHoCH (Change of Character), indicating a potential reversal.

The price has now retraced to the left shoulder of a potential inverse head & shoulders pattern—an RTM classic structure—which held as support, suggesting bullish continuation.

⸻

🔸 Key Technical Signals:

• ✅ CHoCH confirmed at demand zone near $112,300

• ✅ Retest of the left shoulder validates bullish structure

• ✅ Holding above the internal bullish trendline

• ✅ Price aiming toward upper channel resistance

⸻

🎯 Target:

$116,200 – Top of the descending channel & next key resistance.

❌ Invalidation:

Break and close below $112,800 would invalidate the current RTM setup and open room for deeper correction.

⸻

📌 Summary:

This is a textbook RTM reversal:

CHoCH → Retracement → Left Shoulder Test → Continuation

As long as the structure holds, we remain bullish toward the channel top.

Altcoin Dominance (Others) – Triangle Progress UpdatePrice is likely unfolding a Contracting Triangle after the previous impulsive move. We are currently inside Wave D, which has broken above the midline of the descending channel.

📌 Key Point:

Watch the reaction near the channel top. If rejected, Wave E (final leg down) may follow. A breakout would shift the structure bias.

SUI/USDT – Price Outlook (2H TF)🔍 Updated Aug 4, 2025 | SMC + NeoWave

SUI has broken out of the descending channel and is currently holding above the strong demand zone around $3.35–$3.40. This zone overlaps with a bullish order block and prior trendline support.

📌 Bullish Scenario (preferred):

Price confirms support → Push toward $3.90–$4.00 supply zone.

📌 Invalidation:

A close below $3.35 invalidates the setup and suggests continuation of the correction.

💡 Tip: A breakout of structure (BOS) + mitigation of OB = solid confluence for long setups.

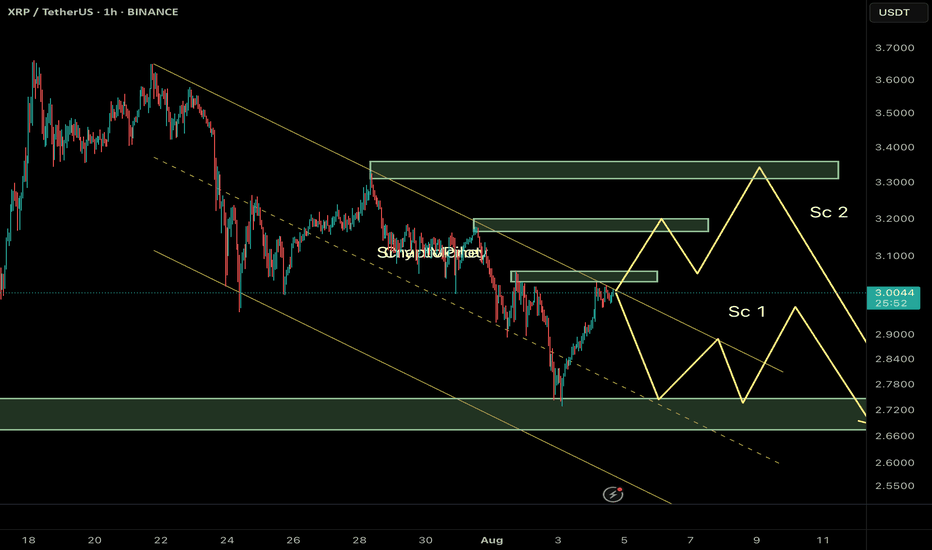

Ripple (XRP/USDT) Technical Analysis – 1H Timeframe🔰 Current Market Context:

After breaking below the ascending channel near $3.50, XRP has entered a corrective phase within a descending channel. Price is now hovering around a mid-range resistance zone, and we can outline two key potential scenarios from here:

⸻

📌 Scenario 1 (Sc1) – Immediate Rejection and Bearish Continuation

In this case:

• Price gets rejected from the current resistance zone ($3.05–$3.10).

• A quick corrective pattern (likely a Zigzag or Flat) plays out.

• XRP moves down to test the next demand zone near $2.70–$2.65, breaking below recent swing lows.

✅ This scenario aligns with the current weak structure and visible sell-side pressure. Liquidity above recent highs has likely been swept, creating a setup for continuation downward.

⸻

📌 Scenario 2 (Sc2) – Extended Correction with a Final Bull Trap

In this case:

• Price pushes higher toward a deeper resistance zone near $3.30–$3.40.

• A liquidity grab above the prior highs triggers a sharper reversal afterward.

• The overall structure could form a Diametric or Complex Correction, suggesting a deeper and more time-consuming wave before resuming the bearish trend.

⛔ This scenario requires strength and acceptance above $3.15, and should be treated as an alternative unless proven by price action.

⸻

🎯 Summary & Trade Strategy:

Scenario 1 is currently more probable unless we see a strong break and close above $3.10. Expectation: XRP may head toward the $2.70–$2.65 demand zone if resistance holds.

⚠️ Avoid entering early. Wait for confirmation via internal BOS (Break of Structure), bearish engulfing near OB zones, or signs of rejection with volume at resistance.

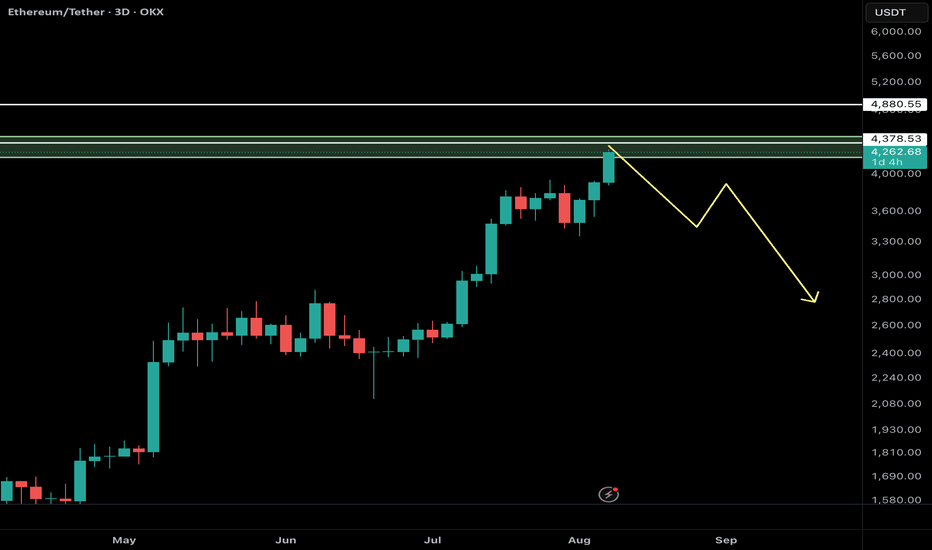

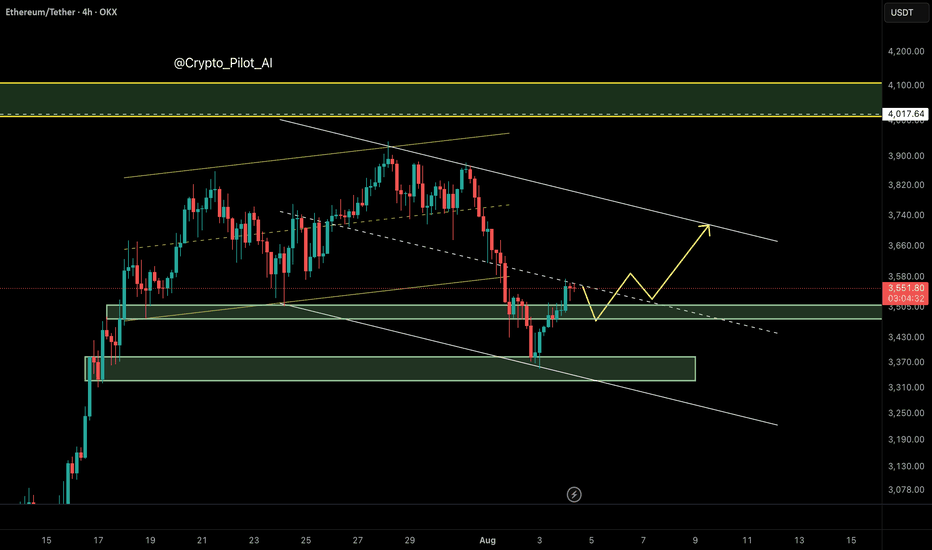

Ethereum (ETH/USDT) – Bearish Channel Structure Developing

⸻

🔍 Technical Overview

Ethereum has broken down from its ascending channel, invalidating the earlier bullish projection toward $4,000. After failing to hold the channel midline around $3,577, price dropped sharply to $3,360, forming a new bearish descending channel.

Currently, ETH is trading near the midline of this bearish channel, which typically acts as a decision point — not a buying zone — in smart money models.

⸻

🧠 NEoWave Interpretation

We may be inside a Complex Corrective Wave, possibly a Running or Contracting Flat evolving after the March top. The current structure resembles a B-wave trap, where price fakes out the upside before shifting momentum sharply downward. The break below the ascending channel midline confirms this bearish shift.

⸻

📊 Smart Money Summary

• 🟥 BOS confirmed on 1H and 4H (lower highs and lower lows)

• 🔻 Midline failure acted as a smart money trap, followed by a liquidity sweep below $3,490

• 📦 Bullish Order Block around $3,490–$3,520 has been tapped, prompting a minor reaction

• 🟡 Current resistance sits near the channel top ~ $3,715

⸻

🎯 Trade Scenarios

📌 Bearish Continuation:

If price fails to reclaim above $3,715, a retest and rejection from the channel top could trigger continuation toward $3,300–$3,250.

📌 Bullish Reversal (less likely for now):

Only a clean break and hold above $3,720 would suggest that bulls are regaining control, opening path toward $3,900–$4,000 — though this scenario is weakened after structural damage.

⸻

⚠️ Trader Tip:

Avoid buying into midline reactions in weak channels. Better long setups form after stop-hunts, ideally near bullish OBs + internal BOS confirmations.

⸻

✅ Conclusion

Ethereum remains under bearish pressure after losing its ascending structure. Unless price reclaims the $3,715 resistance zone with momentum, downside continuation remains likely.

⸻

📌 Save this analysis

💬 Share your thoughts or alt wave counts in the comments.

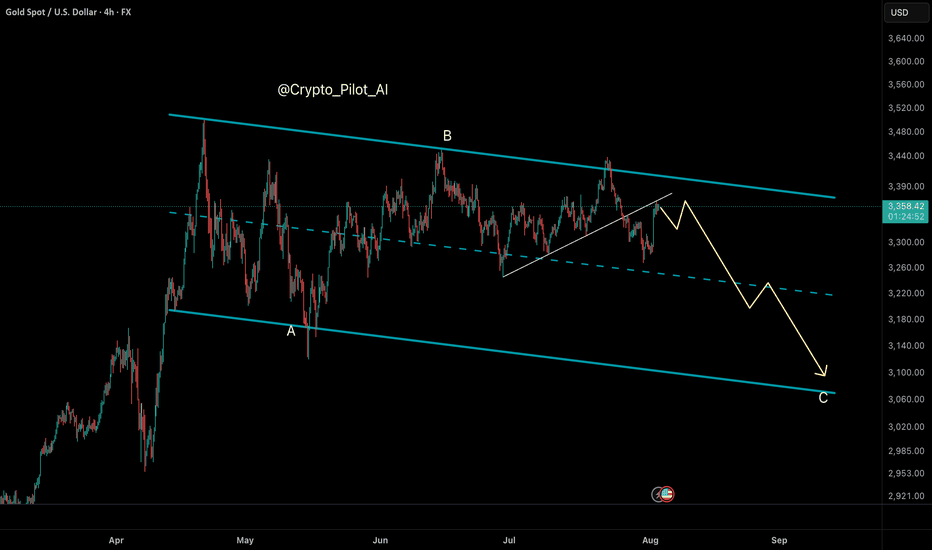

Gold (XAU/USD) Technical Analysis – NeoWave Perspective📅 August 2025 | 📈 4H Chart

📍Posted by: @ CryptoPilot

Gold completed a corrective Wave A near $3160 at the bottom of the descending channel. It then rallied to $3440, followed by a decline toward the channel’s midline at $3227, beginning a potential Wave C.

Attempts to break and hold above the channel failed. Price has since broken below the trendline and is now pulling back to retest it from below.

⸻

🔍 Key Insights:

• 📉 No long entries recommended at current levels

• ✅ Bullish confirmation requires a clear breakout and close above the channel top

• 🛒 Safer long setup may emerge near $3120 at the channel bottom and possible Wave C completion zone.

⸻

🔑 Key Levels:

• Resistance: $3380–$3440

• Support: $3120

• Invalidation / Stop-loss: Below $3110

⸻

📌 Follow @ CryptoPilot for more wave structure insights, SMC confluence, and multi-timeframe strategies.

💬 Drop your thoughts and alternate counts in the comments below!

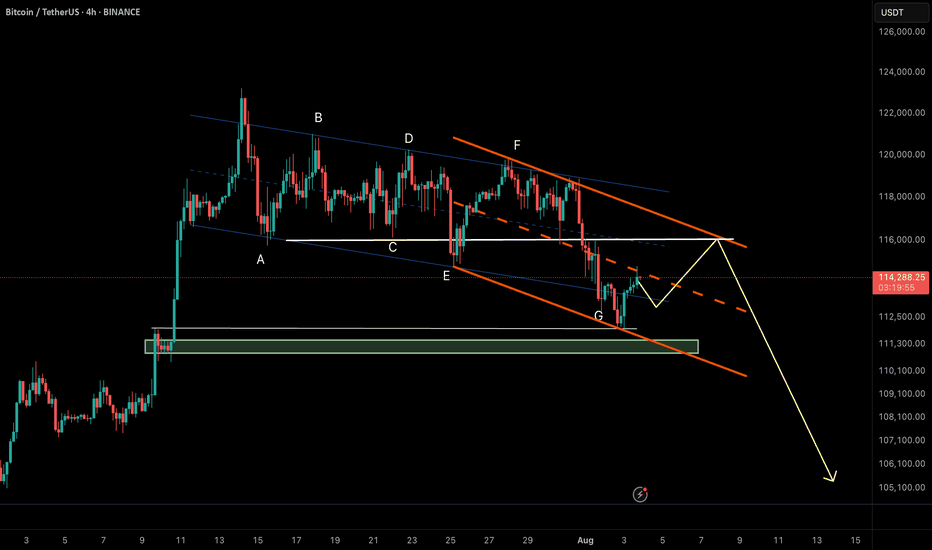

NeoWave Alert: BTC G-Wave Sets Up a Brutal Drop After $116K PumpAs anticipated in our previous NeoWave analysis, the market appears to be deep within Wave G of a Contracting Diametric structure (A–G), originating from the March 2025 high.

⸻

🔻 Key Developments:

• After rejecting from $119,000–119,500 (Wave F resistance), price dipped to $112,000, breaking below the previous channel’s lower bound, and now appears to be forming a steeper descending channel.

• This new channel’s resistance has shifted lower to $116,000, becoming a potential bull trap zone.

• The bounce from $112K is likely a liquidity sweep, preparing for one final upside to $116K, followed by aggressive distribution.

⸻

💡 Trading Thesis:

We’re likely seeing a trap-style rally within Wave G, aiming to:

• Attract liquidity up to $116K

• Induce late longs before initiating a more violent selloff toward $105K or lower

⸻

🔍 Smart Money Confluence (SMC / ICT)

• 🟥 Confirmed bearish structure on 1H (Lower Highs + BOS)

• 🟨 Liquidity above $120K already swept during Wave F

• 📉 Order blocks around 119.5K rejected

• 🔻 Price currently trades above $114K, but trapped inside a sharper descending range

• 🧲 Unfilled FVGs between $113K–$110K may serve as magnets

⸻

🧠 Wave G Structure (Diametric)

• Possibly unfolding as a Zigzag or Complex Combination

• Channel boundary now capped at $116K

• Wave G likely targets a breakdown below Wave E ($113K) and toward $105K

⸻

📌 Primary Scenario:

• Final push to $116K → strong rejection expected

• Bearish continuation targeting $110K → $105K

🧯 Invalidations:

• Clean breakout & daily close above $120.5K invalidates this diametric structure

• Watch for triangle or flat morphing if structure shifts

⸻

⚠️ Risk Management:

• $116K = key distribution zone

• Watch closely for rejection and breakdown confirmation

• Shorts valid below $114K with tight invalidation above $117K

⸻

📌 Conclusion:

Bitcoin is nearing the climax of a multi-month complex correction. The current setup favors a liquidity trap toward $116K, followed by continuation of Wave G toward major demand zones. Smart money bias remains bearish below $117K.

⸻

💬 Drop your alternate wave counts or SMC confirmations in the comments!

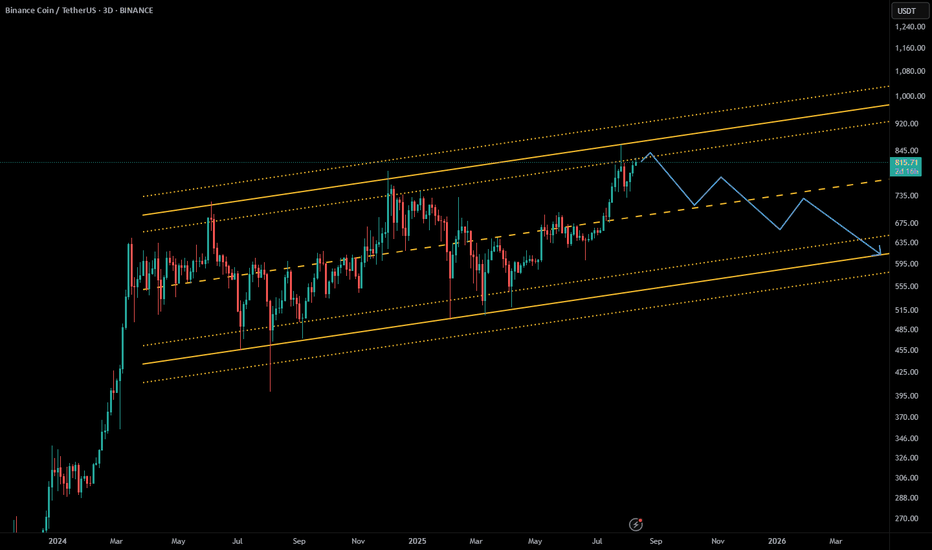

Smart Money Watching BTC Dominance – Rotation to Alts IncomingAfter a deep correction, BTC Dominance has entered a corrective upward phase inside an ascending channel.

Wave A rallied from 60.5% to 62.3%, followed by Wave B retracing to 60.74%.

Currently, Wave C is developing and has reached around 62.2%.

The key resistance sits near 62.7%, exactly at the upper trendline of the channel. This could act as a reversal point, potentially ending Wave C and triggering a bearish move.

💡 Implication:

If dominance drops from this zone, we could see capital rotation into altcoins, supporting a bounce across the broader altcoin market.