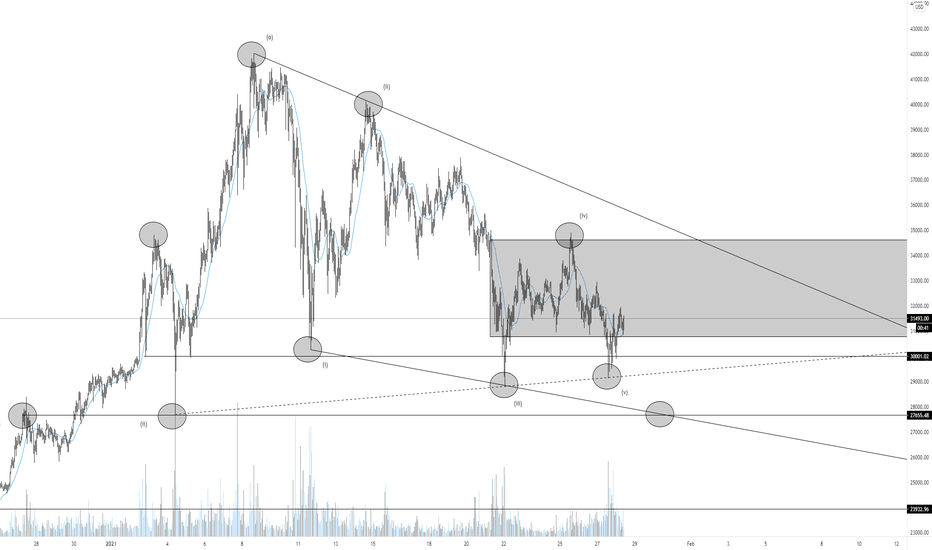

If bears flip $29,200 into resistance (s/r flip) target $27,777 Good morning traders,

Lots of important things to discuss coming into the trading day.

My last TA was a possible scenario where this entire move could be just one massive fake out to the downside before a moon shot back to $42,000 and new ATH's.

HOWEVER, we're still printing lower highs and that in technical analysis would be considered bearish (the trend is your friend until it's not anymore) Thus being said, until we flip $32,500 - $33,500 into support (s/r flip) I'll have to remain bearish for the time being.

Yesterday we closed the daily candle just below $30,500 - $30,800, and if we get yet another lower high like we've been seeing it will likely confirm a move to at least local support ($29,200) zone with likely continuation to the downside around $27,777 (which if you've been following my trading view you've had known)

We're in an area of uncertainty and things can go either way at this point and time so it's important to know your validation points, invalidation points, where you get in on your trade, where you exit the trade, and overall just having a constructive trading plan for both directions so you can capitalize and get some nice returns.

Momentum oscillators aren't the most reliable source of data towards future price action because as you know on the way up things remained overbought for months and every time someone sold they got liquidated.

WELL, if bitcoin wants to retest the $23,999 - $27,777 level it will happen regardless of any over sold conditions because the market was likely priced in to reach a certain target during Q1 2021.

There will be A LOT more information in my upcoming video this morning that will be posted to my YouTube channel after breakfast (it's 5am here in Canada), so stay tuned and get ready for your minds to be filled with price action talk and scenarios coming into the end of this week and the weekend in a few days.

I'll be going over market psychology, market sentiment, and other key things that help me make informed decisions on a day to day basis trading.

Please get this technical analysis to 30+ likes to unlock the following TA 👍

Crytpocurrecy

BTCUSD rejected from $13,000Bitcoin has suffered a heavy technical rejection from the $13,000 level, as bulls failed for the second day to maintain price above this crucial area. The bearish head and shoulders pattern on the four-hour time frame is now complete, with the $11,800 level back in focus. The overall negative sentiment in the entire cryptocurrency market is also weighing on the BTCUSD pair.

The BTCUSD pair is only bullish while trading above the $12,400 level, key resistance is located at the $13,000 and $13,300 levels.

If the BTCUSD pair trades under the $12,400 level, sellers may test towards the $10,500 and $9,600 support levels.