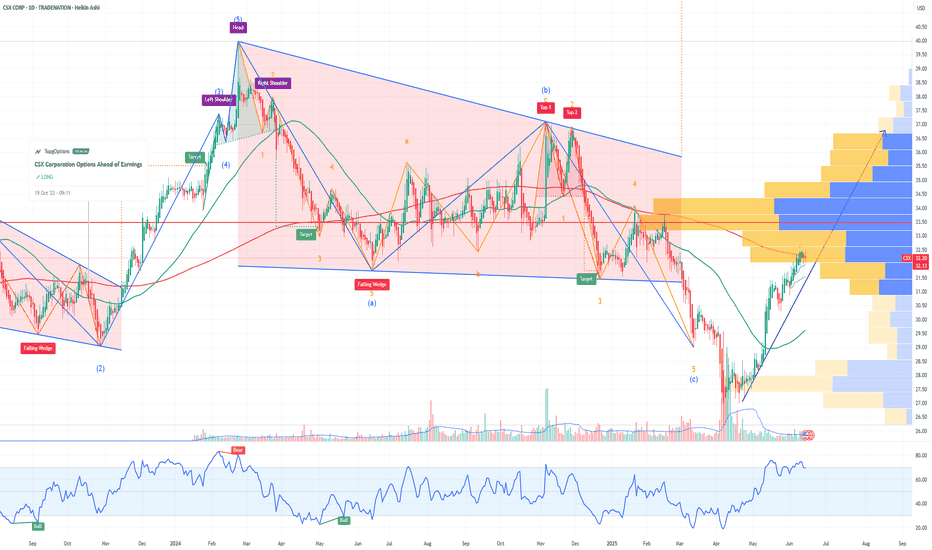

Why CSX Corporation CSX Could Reach $37.50 by the End of 2025If you haven`t bought CSX ahead of the previous earnings:

Now CSX Corporation CSX, a leading North American rail freight operator, is positioned for a meaningful upside in 2025, with a realistic price target of $37.50. This target is supported not only by strong fundamentals and industry tailwinds but also by recent options market activity showing significant call option interest at the $37 strike price, indicating growing investor conviction around this level.

1. Strong Options Market Signals at $37.50

Recent options data reveals a notable concentration of call open interest and volume at the $37 strike price in the CSX options chain, especially for near- and mid-term expirations.

This elevated activity suggests that institutional and retail investors are positioning for a rally toward $37–$38, reflecting confidence that the stock will surpass $35 and approach $37.50 by year-end.

The options market’s pricing and demand at this level provide a real-time, market-driven validation of the $37.50 target, adding weight to the fundamental bullish case.

2. Analyst Price Targets and Upward Revisions Support $37.50+

Several analysts have price targets ranging from $35 up to $38–$39, with recent upward revisions reflecting improving operational metrics and resilient demand.

Bank of America and Goldman Sachs, among others, have raised targets closer to or above $35, and the options market activity suggests investors expect further upside beyond these levels.

3. Operational Improvements and Network Optimization

CSX continues to address past network challenges, improving service reliability and operational efficiency, which are expected to drive volume growth in key sectors such as agriculture, minerals, and intermodal freight.

These improvements are critical for margin expansion and revenue growth, underpinning the stock’s appreciation potential.

4. Favorable Macroeconomic and Industry Tailwinds

The resilient U.S. economy and ongoing federal infrastructure investments support sustained freight demand.

Rail’s environmental advantages and cost efficiency over trucking position CSX to capture increased market share as companies seek sustainable logistics solutions.

5. Financial Strength and Shareholder Returns

CSX boasts strong free cash flow generation, enabling consistent dividend growth and share repurchases.

The company’s valuation remains attractive relative to peers, with a P/E around 15.5 and a dividend yield near 1.4%, making it appealing for both growth and income investors.

6. Technical Support and Market Sentiment

The stock has held solid support near $30–$31 and is trading near $34.60 as of mid-June 2025, showing resilience amid market volatility.

Positive sentiment from institutional investors and steady trading volumes reinforce the potential for a breakout toward $37.50.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CSX

CSX Corporation Options Ahead of EarningsIf you haven`t bought CSX before the previous rally:

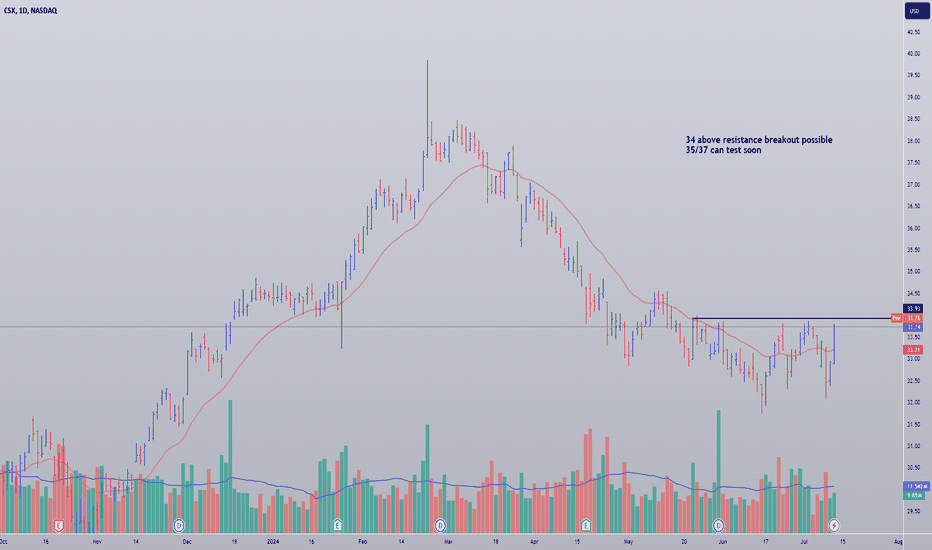

Now analyzing the options chain and the chart patterns of CSX Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

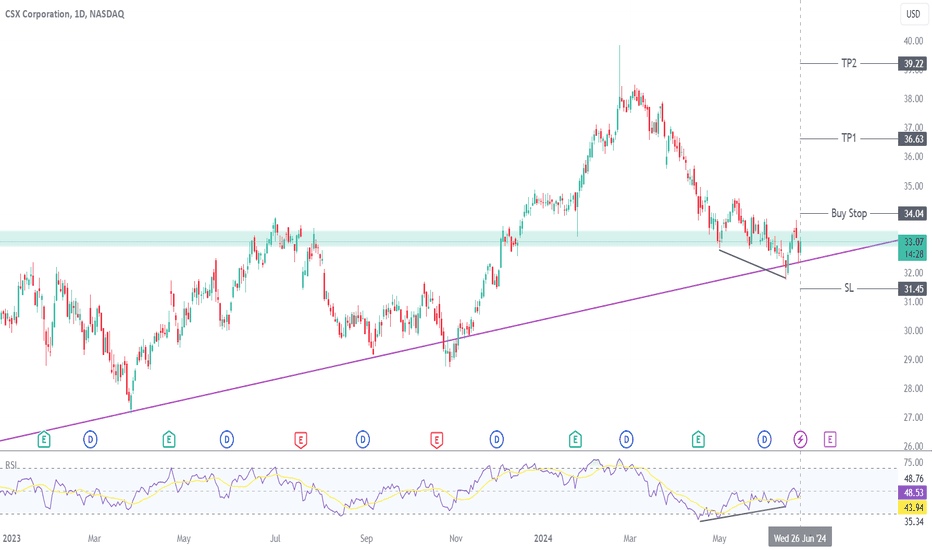

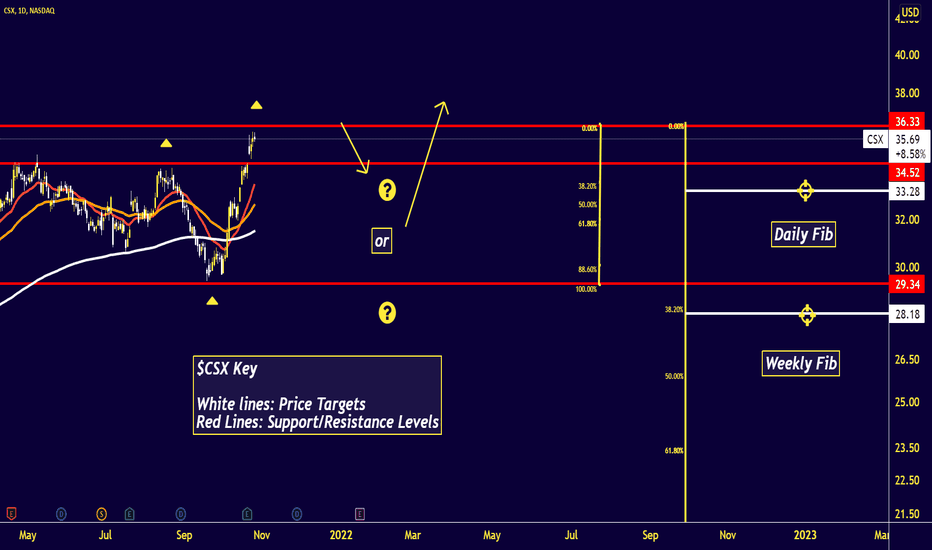

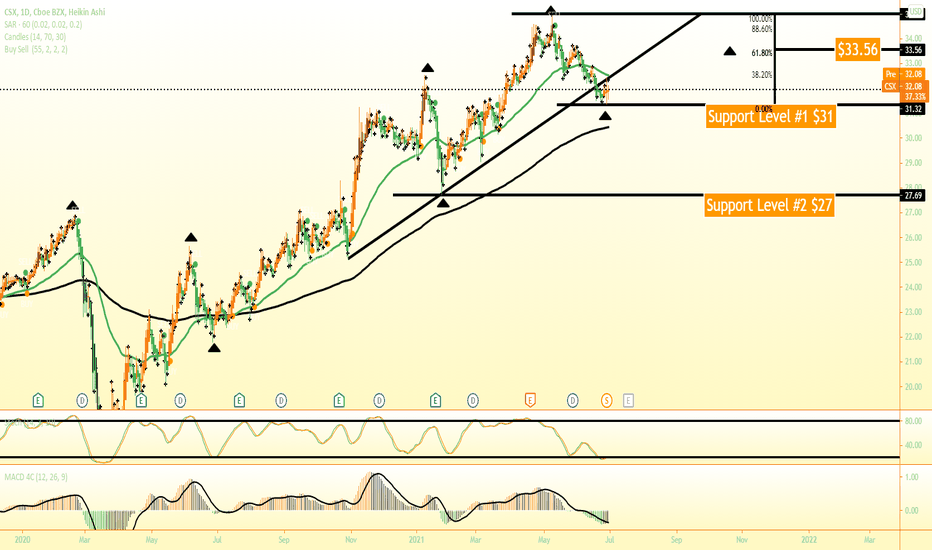

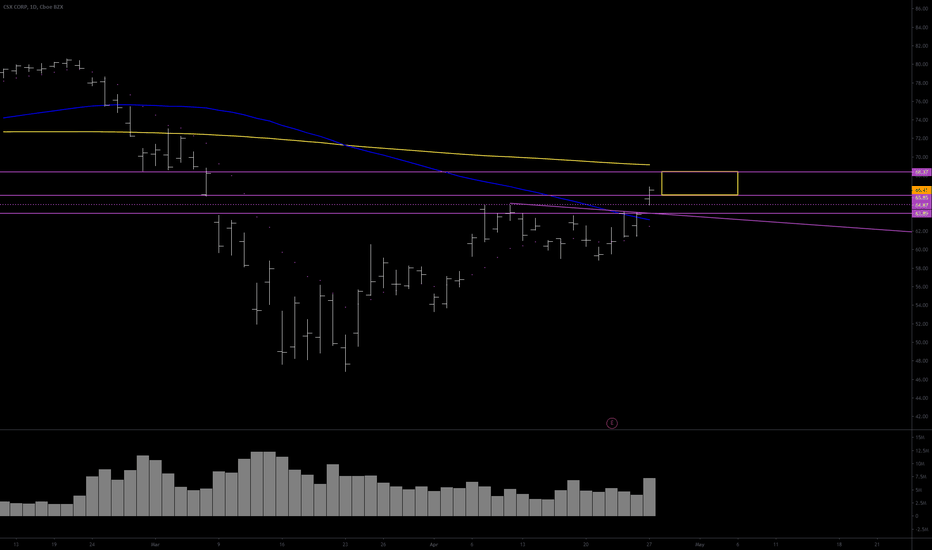

CSX potential Buy setupReasons for bullish bias:

- Price respecting weekly trendline

- Price is at strong horizontal support

- Simple DOW theory

- Safe Entry at LH breakout for bull trend confirmation

- Bullish divergence

Here are the recommended trading levels:

Entry Level(Buy Stop): 34.04

Stop Loss Level: 31.45

Take Profit Level 1: 36.63

Take Profit Level 2: 39.22

Take Profit Level 3: Open

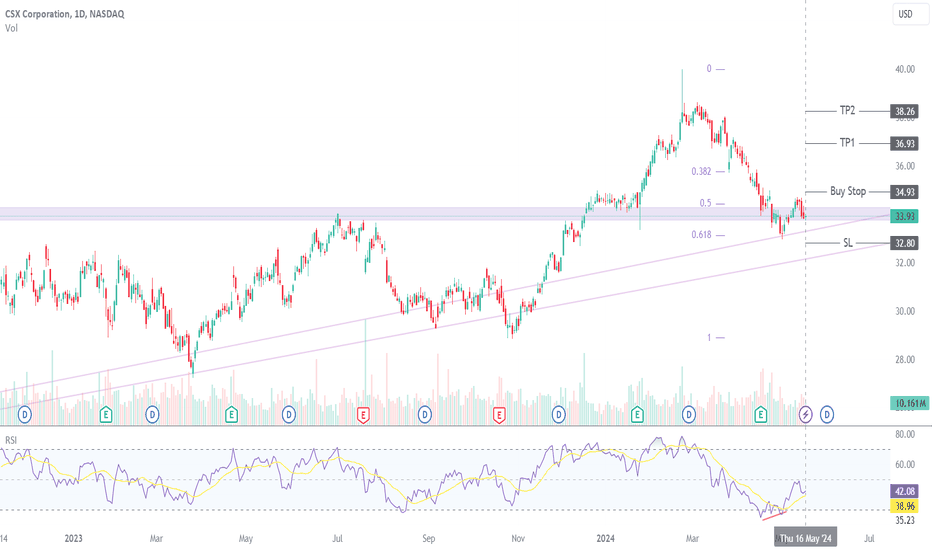

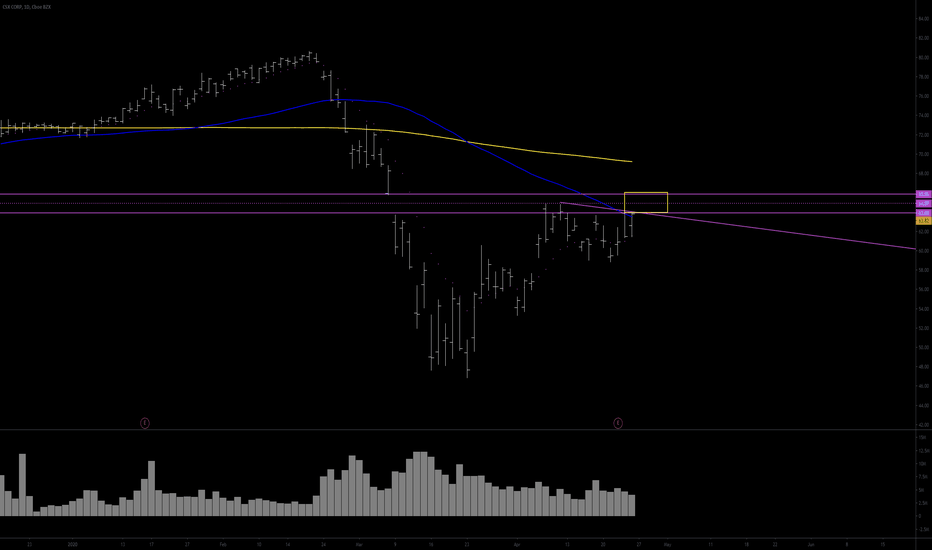

CSX potential Buy setupReasons for bullish bias:

- Price is at weekly support

- Safe entry at LH breakout(DOW)

- Price respecting strong trendline

- Bullish divergence

- 0.618 Fib level

- Positive Earnings

Here are the recommended trading levels:

Entry Level(Buy Stop): 34.93

Stop Loss Level: 32.80

Take Profit Level 1: 36.93

Take Profit Level 2: 38.26

Take Profit Level 3: Open

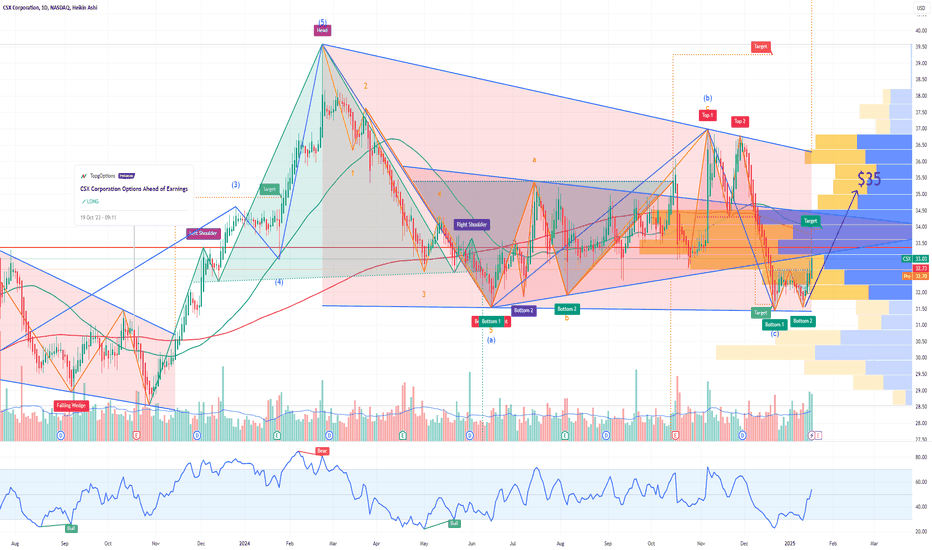

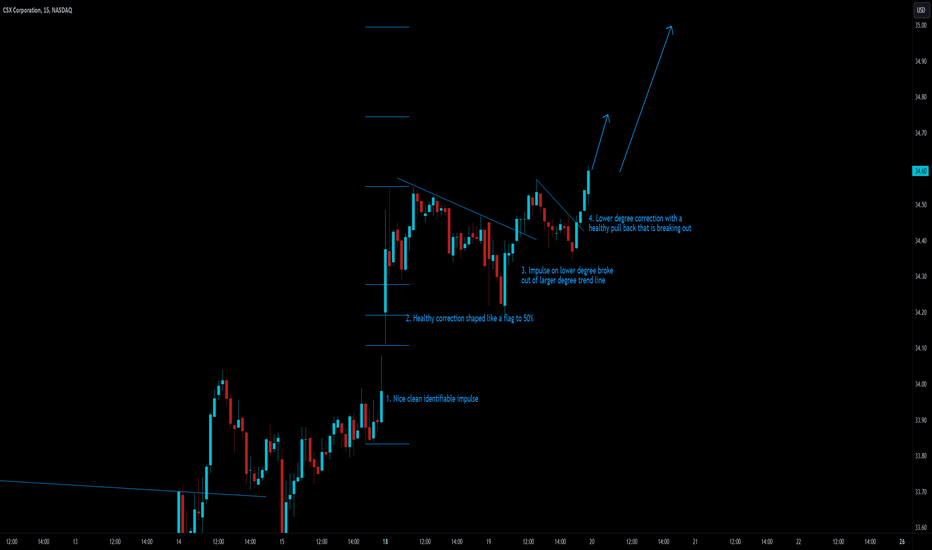

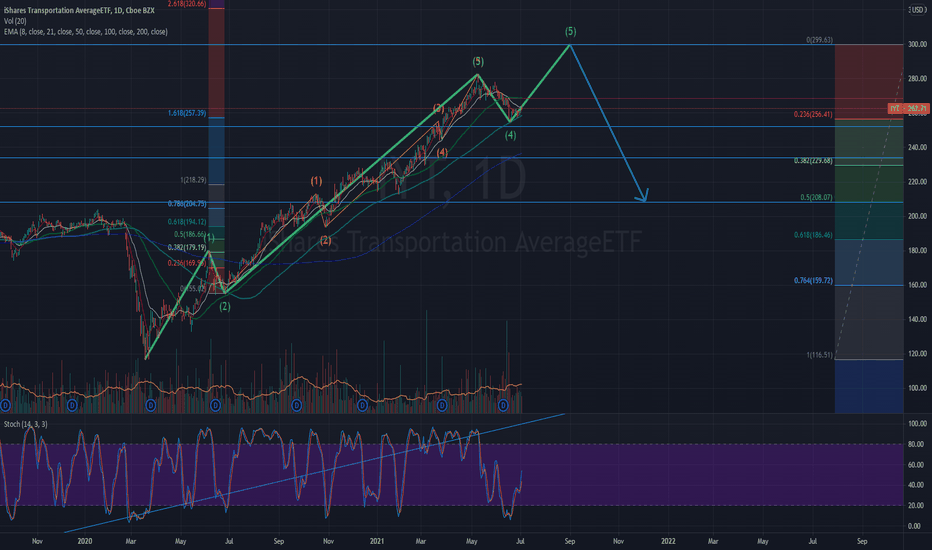

📈#CSX Catch it if you can!Hey guys, just like yesterday with NYSE:ALK on my previous post, this is a great setup that might take off once the market opens. But you might also have a chance to catch this bullish move.

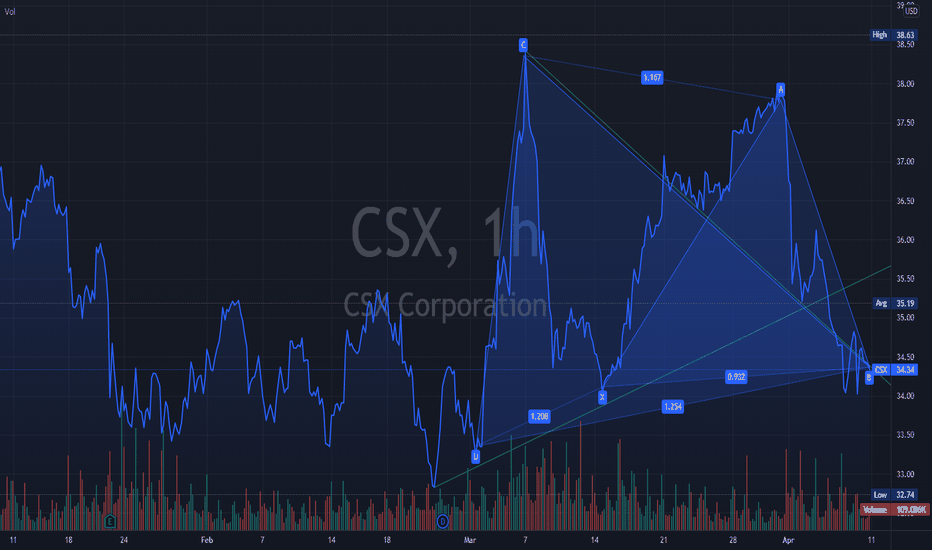

Currently, there is a clear impulse with a healthy correction shaped like a flag to the 50% retracement level. There also is a lower degree impulse with a correction that is breaking out of the larger degree trend line with bullish structure as confirmation.

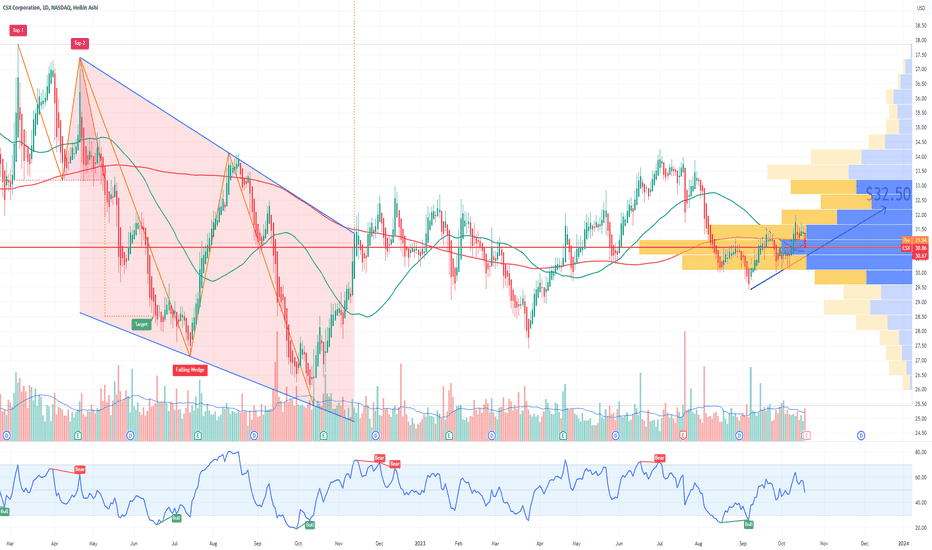

CSX Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CSX Corporation prior to the earnings report this week,

I would consider purchasing the 32.50usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $0.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

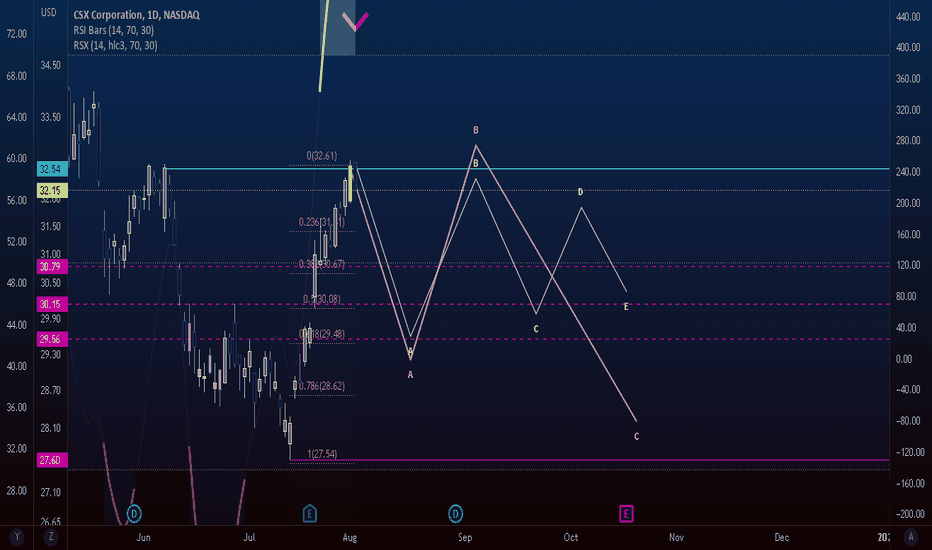

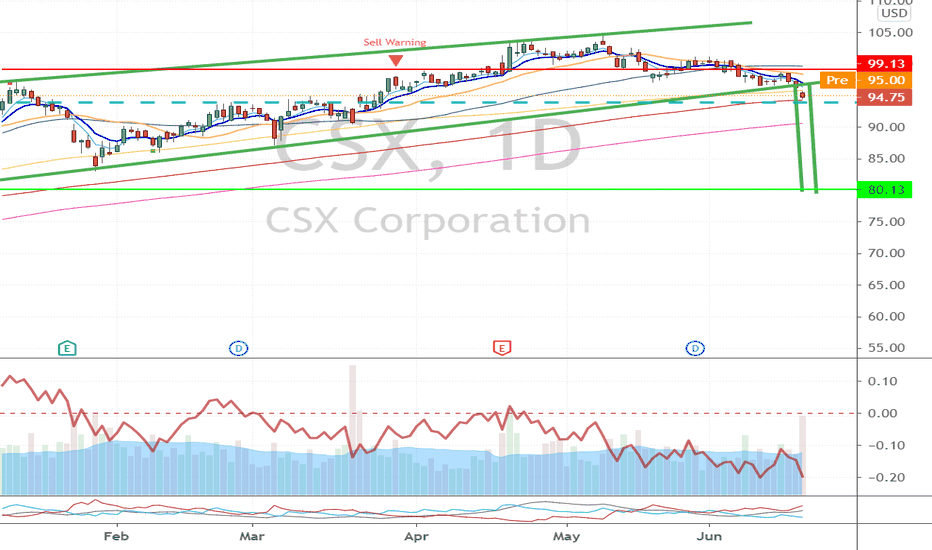

CSX Overbought on the Daily. CSXPossibly completing Wave A of something bigger. Deductively this leaves us with many scenarios, and we are speculating that a zigzag or a ABCDE is next, we cannot possibly tell from this standpoint. In either case a significant overbought on the daily leaves chances for a reversal and a bearish scenario to follow.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

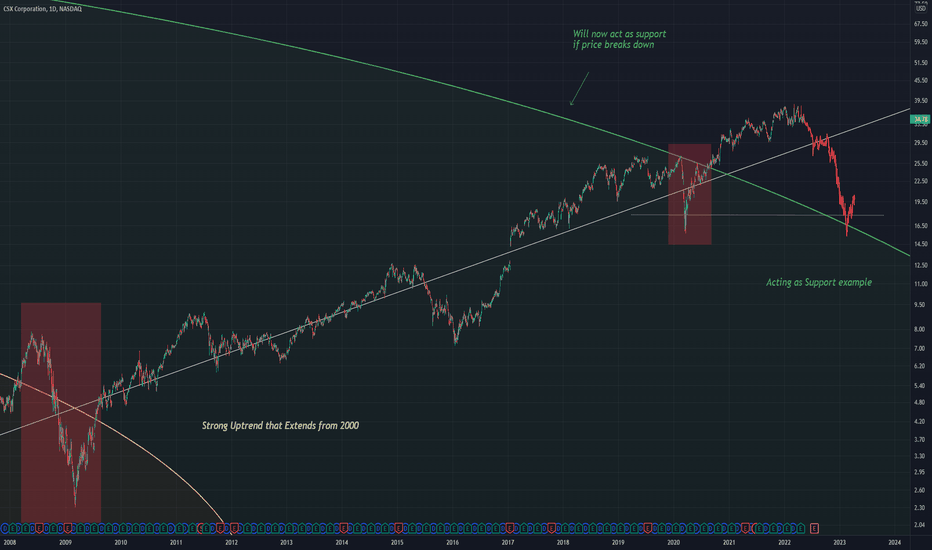

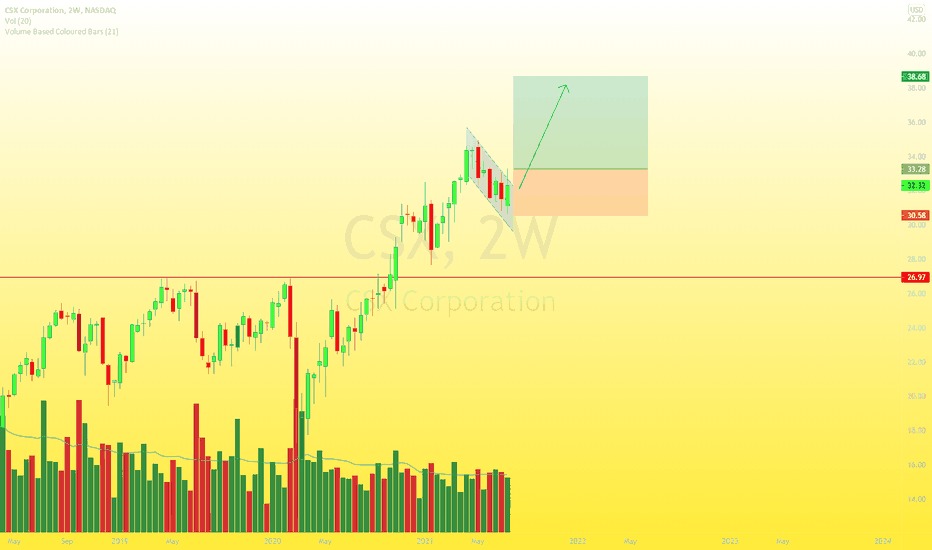

CSX Continuation LikelyPlaying with hypotheticals regarding the breakdown of the large trendline that extends from the year 2000. It is very strong.

If price breaks down it is currently supported by the 4.618 fib

however this is just speculation, it is a lot more likely that continuation of the uptrend will result

Areas in red are very similar rejection points

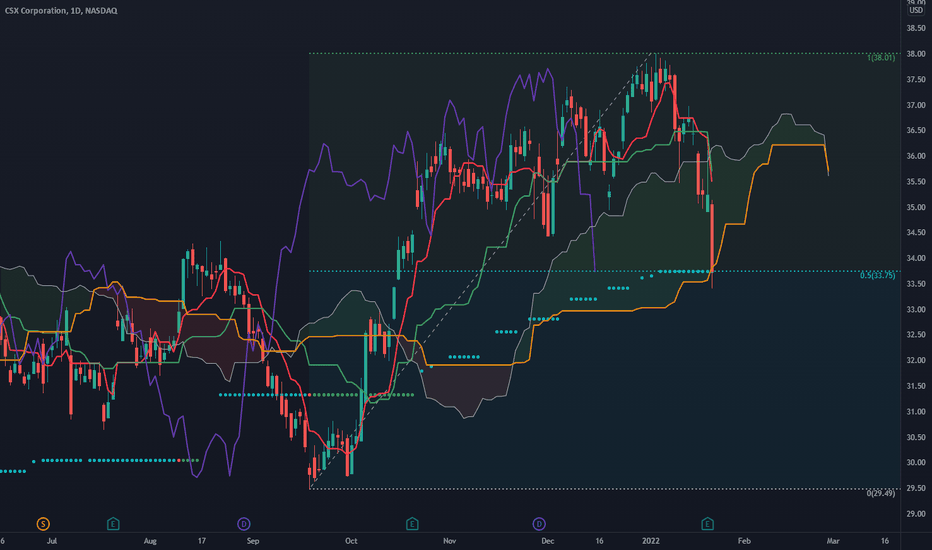

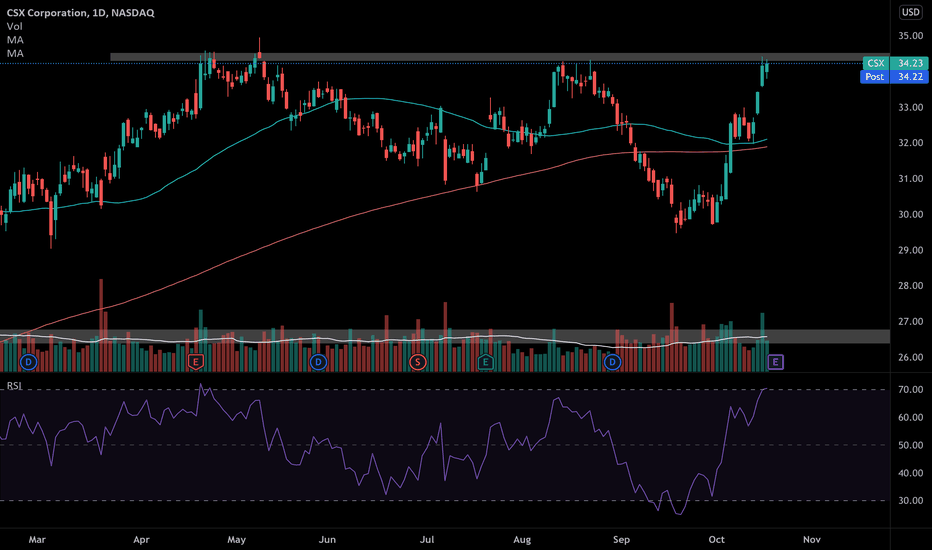

CSXIt looks like we are currently at a high that has broken the previous high since August 23rd. I want to wait until price gets closer to my 20 (red) and 50 (orange) ema's It seems as if we started trading above the 200 ema after we had bearish candles that broke under temporarily where it reached and rejected a strong support level of around $29. Between Dec 2020 and May 2021, there is some heavy traffic on the railway. I would like the current price to retrace its previous low from Sept 27th up to at least 38% - 61% with some bullish candles and price action on the 15 min timeframe to see if we are ready for a ride up if CSX does actually drop. Best case scenario, I want price to bounce off of the 38% daily Fibonacci level to continue towards the upside (creating a lower high). None of my words are law. Just an idea! Oh....I'm tired of getting stopped by trains and I always see a CSX train everytime smh.

CSX 4th top to heads up, resistance contacttradingview.sweetlogin.com

RSI overbought on daily chart.

Price make contact with resistance area for the 4th time,

Volume seams great so far to expect a breakout anytime soon.

Buying signal must be consider before taking any position.

In case of a short position fibo 0.5 is a good option, as usual.

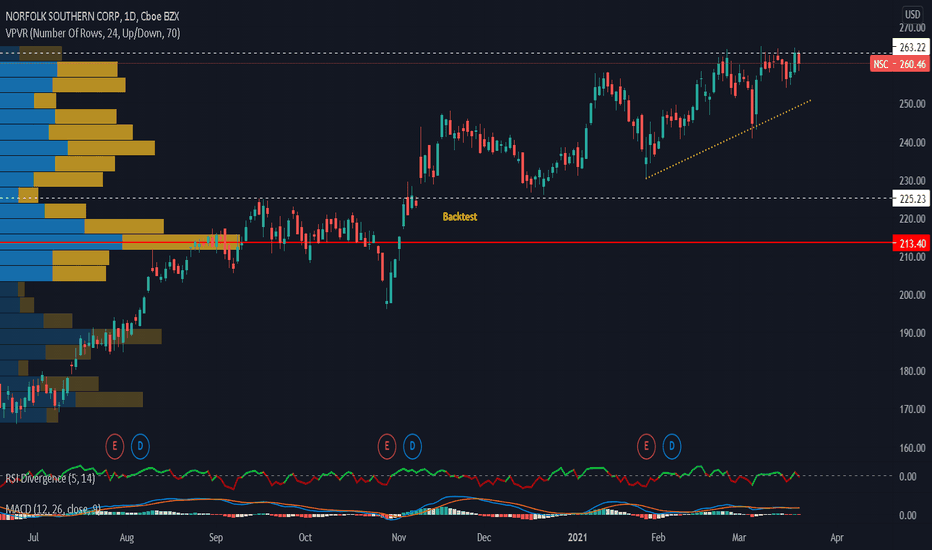

NSC - Ascending triangle, sector newsNSC - Ascending triangle, Rail sector news. Canadian Pacific Railway (CP) To Buy Kansas City Southern (KSU) In US$29 Bln Deal. NSC is forming an Ascending triangle on daily TF. There will only be 5 rail stocks left with a positive ROI, based on Finviz.com screener.