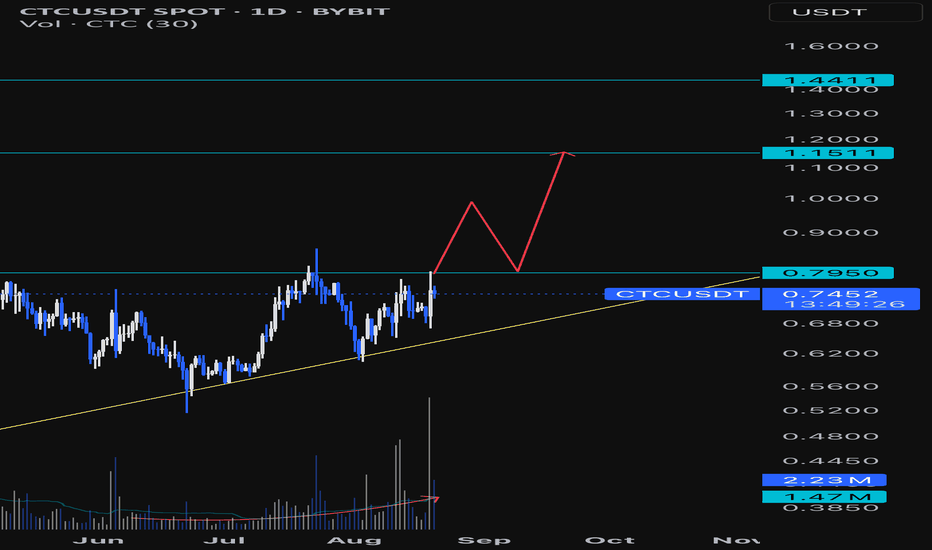

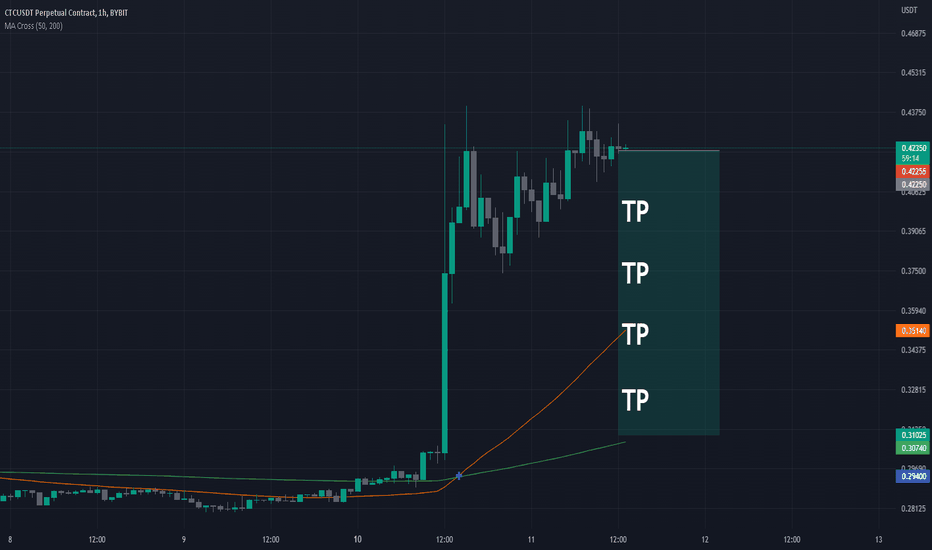

CTCUSDT 1D Chart Analysis | Ascending Momentum Targets Major BOCTCUSDT 1D Chart Analysis | Ascending Momentum Targets Major Breakout

🔍 Let’s break down CTC/USDT spot price action and map out the upward scenario as bullish momentum gains traction, with a focus on trendline support, volume dynamics, and key resistance levels.

⏳ 1-Day Overview

CTC/USDT on the daily chart is carving out an ascending triangle formation, supported by a firm rising yellow trendline. Price is pressing against key horizontal resistance at $0.7950 as trading volume builds, hinting at buying interest ahead of a breakout move.

📈 Volume & Structure Insights

- Steady volume expansion as price approaches the apex, confirming accumulation and bullish intent.

- Strong base forming above the yellow ascending trendline, which has consistently held since April.

- Immediate upside resistance stands at $0.7950; higher levels to target are $1.1511 and $1.4411 on a convincing breakout.

📊 Key Highlights:

- Technical structure: Clear ascending triangle signals bullish continuation if resistance cracks.

- Volume spike: Increasing volume supports the validity of the upward move.

- Breakout scenario: If price closes above $0.7950, expect momentum to carry toward $1.1511 (next resistance), followed by $1.4411.

- Price projection: Short-term retests are likely (see mapped path), but trend bias favors upside as long as the rising support holds.

🚨 Conclusion:

CTC/USDT is poised for a breakout, with momentum and volume aligning for an upward move. Watch for a daily close above $0.7950 as the trigger—targets are $1.1511 and $1.4411. Volume acceleration and bullish structure reinforce the setup. Stay alert for invalidation if the ascending trendline fails to hold.

CTC

#CTC/USDT

#CTC

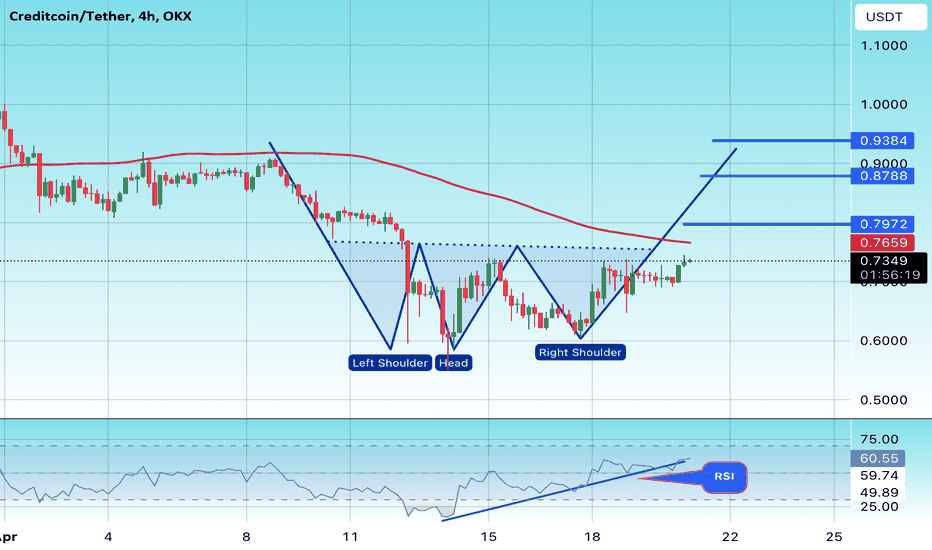

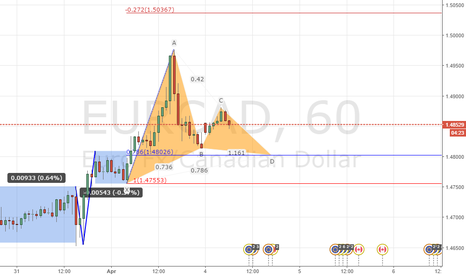

We have a head and shoulders pattern on a 4-hour frame, the price moves within it and adheres to its limits well, and the right shoulder has been completed.

We have a tendency to stabilize above moving average 100

We have an uptrend on the RSI indicator that supports the price higher

Entry price is 0.7300

The first target is 0.7970

The second goal is 0.8770

the third goal is 0.9380

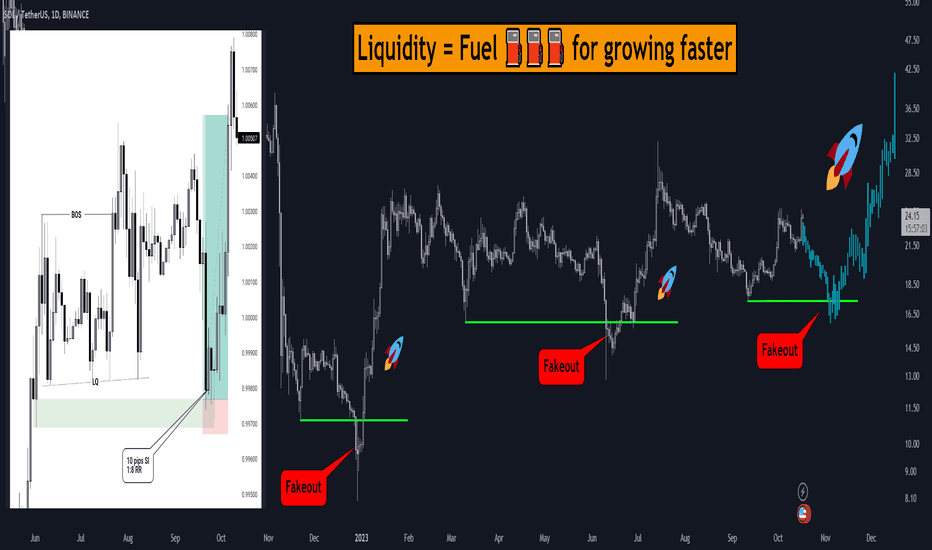

SOL : Liquidity Game 📈💡Solana (SOL) has been a hot topic lately, and for a good reason. It's been on a relentless upward trajectory following liquidity sweeps of key lows. What's more, I'm anticipating another liquidity sweep around the $17 level, which could ignite another round of growth. It's a reminder that liquidity is the fuel that powers price movements. 📈💡

Liquidity Sweeps Fuel Price Movements:

Liquidity sweeps occur when market participants push the price briefly to clear out buy or sell orders clustered around a particular level. This process can often be a precursor to a price surge. Liquidity acts as the fuel that propels price action, and the crypto market is no exception. 🚀💰

Anticipating the Next Move:

In the case of SOL, the anticipation of a liquidity sweep around $17 could be a pivotal moment. It might create the conditions for a further price increase as orders are cleared out. However, the crypto market is dynamic and unpredictable, so it's crucial to stay vigilant and adapt your strategy accordingly. 📊🔍

Trading Strategy:

Patience and Caution: If you're considering a position, waiting for the liquidity sweep to occur and looking for confirmation in price action could be a prudent approach.

Risk Management: Use risk management tools such as stop-loss orders to protect your investments.

Fundamental Awareness: Stay informed about Solana's fundamentals and any news that could influence its price.

Conclusion:

The cryptocurrency market is a unique arena where liquidity plays a crucial role in shaping price movements. While liquidity sweeps are often seen as potential catalysts for growth, they are not foolproof guarantees.

As a crypto trader or investor, it's essential to exercise caution, stay informed, and adapt to the ever-changing market conditions. Liquidity can be the fuel, but it's your strategy that steers the ship.

❗️Get my 3 crypto trading indicators for FREE❗️

Link below🔑

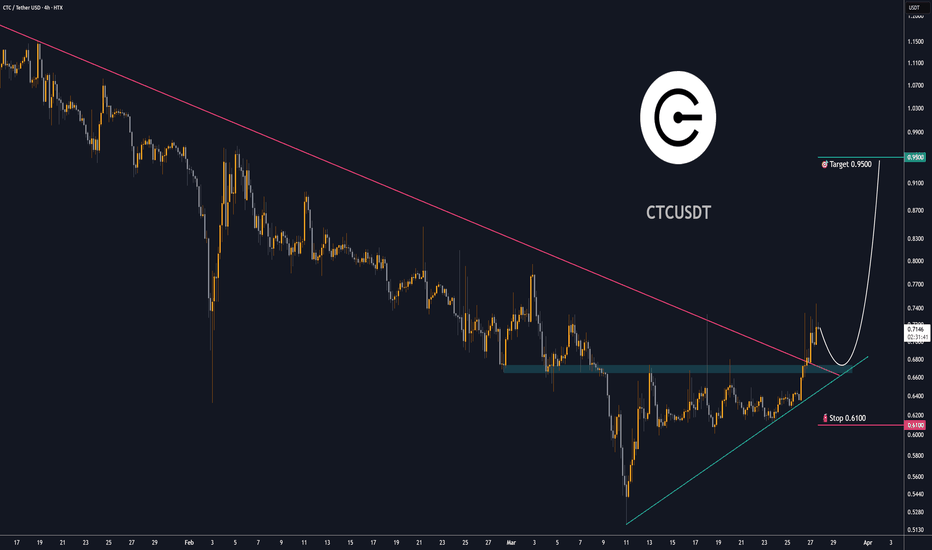

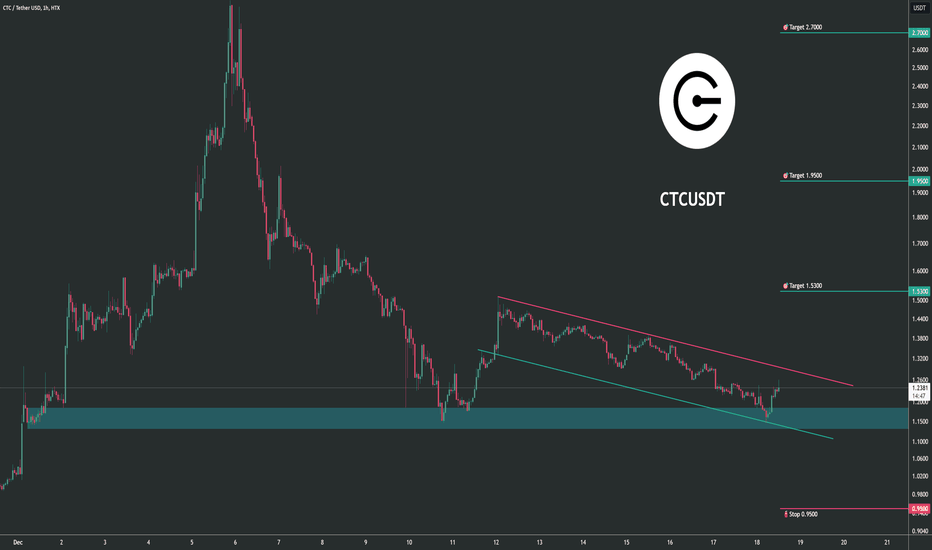

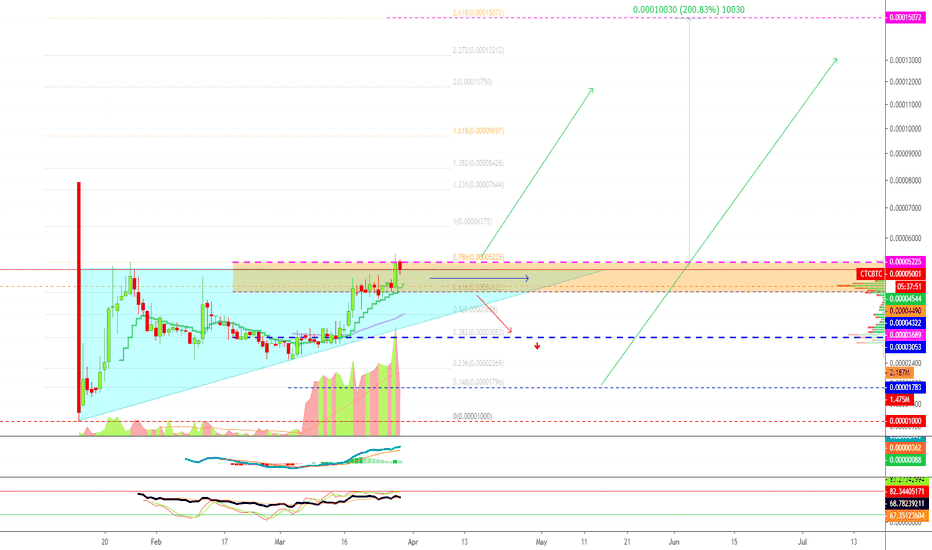

Creditcoin (CTC) New Bittrex Add! (200% Target Mapped)Creditcoin (CTC) Overivew

About Creditcoin

Launched on 04/04/2019 by a team based in the US, Canada, South Korea, Nigeria, and Estonia, Creditcoin aims to address the lack of credit system among the unbanked in the emerging market. People who cannot access the banking system have to borrow from non-banks. However, credit records with non-banks are not accepted by the banks since they cannot trust the data. The project aims to solve the problem by recording credit transaction history objectively on a public blockchain.

The concept of this project sounds pretty good...

Here we have the chart for Creditcoin (CTCBTC) on Bittrex, a young chart.

Right now we are looking at a potential "ascending triangle" and also increasing volume... Anything is possible here since we have no past history to look at.

I've mapped the potential future paths by highlighting the strongest support and resistance levels.

Even if prices drop we remain bullish long-term.

Thanks a lot for reading.

Namaste.