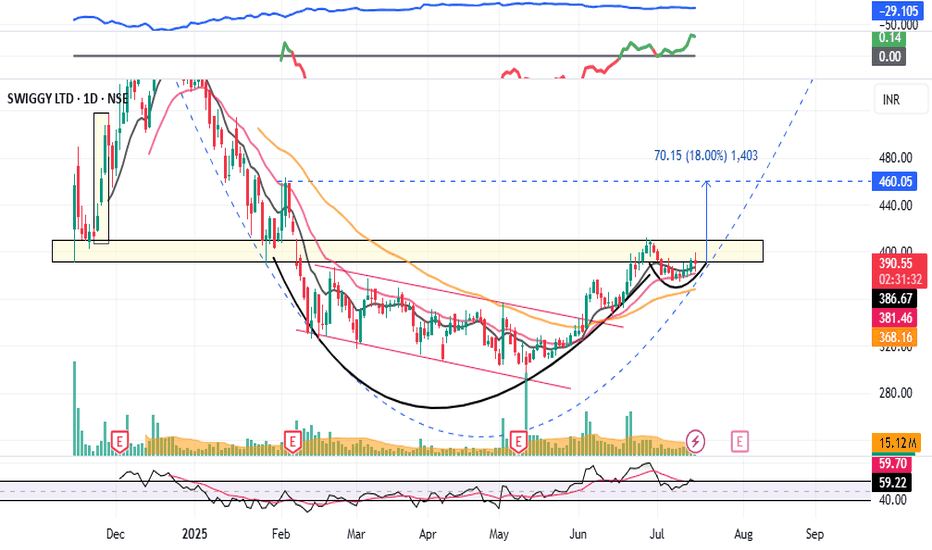

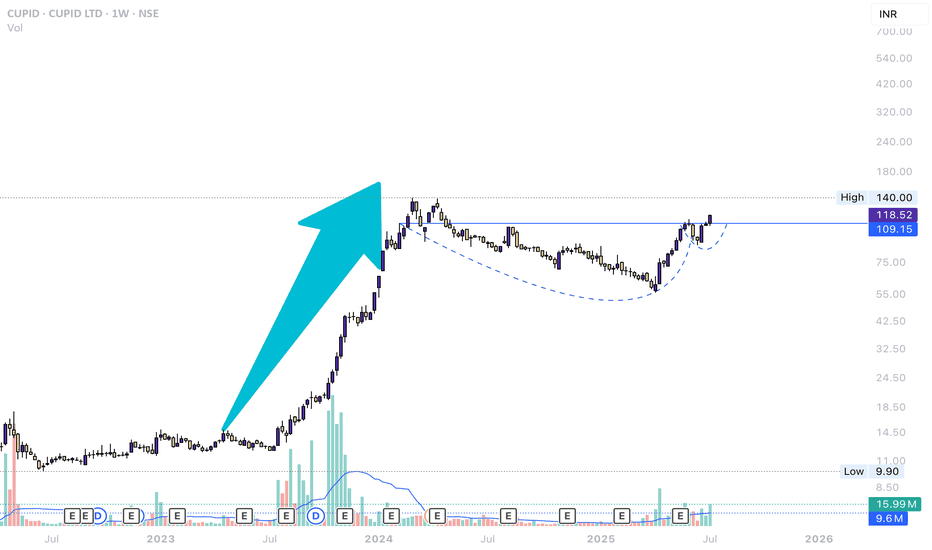

SWIGGY - Breakout Soon (1-3 months)#SWIGGY #breakoutstock #patterntrading #cupandhandle #roundingbottom #trendingstock

SWIGGY : Swing Trade (1-3 Months)

>> Breakout candidate

>> Trending stock

>> Cup and handle pattern

>> Rounding bottom in the long run

>> Good Strength & Volumes Dried up

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

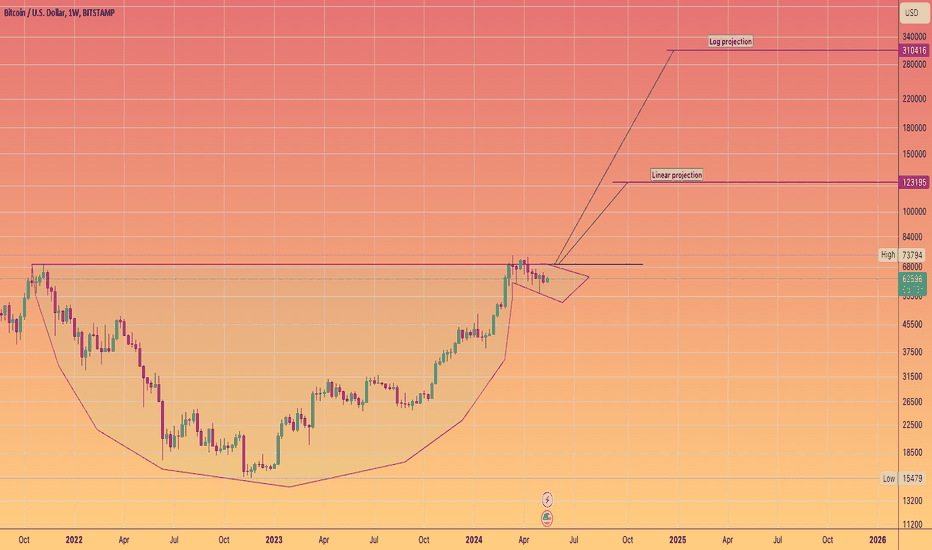

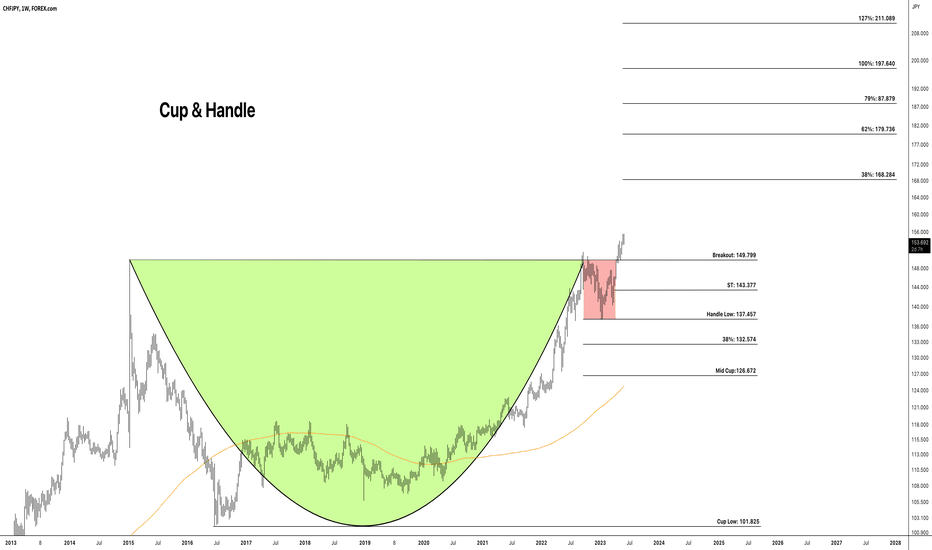

Cup And Handle

Balla is still Bullish on BITCOIN. Cup & Handle pattern. The trend is still our friend.

I still see bullish developments in the price action.

We must have patience.

Dips still must be bought.

The plan hasn't changed.

We still aiming for that time period of 9 -15 months post #BTC Halving.

We are only one month down :)

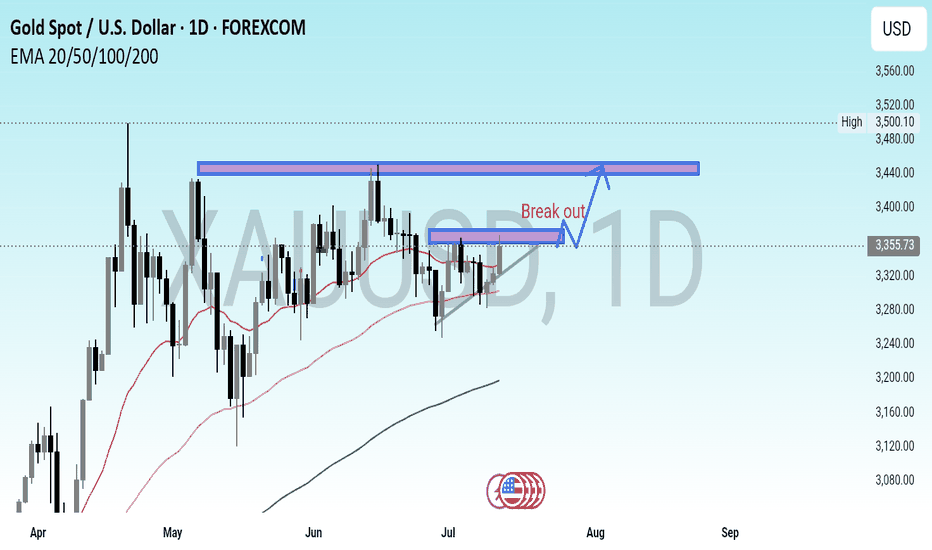

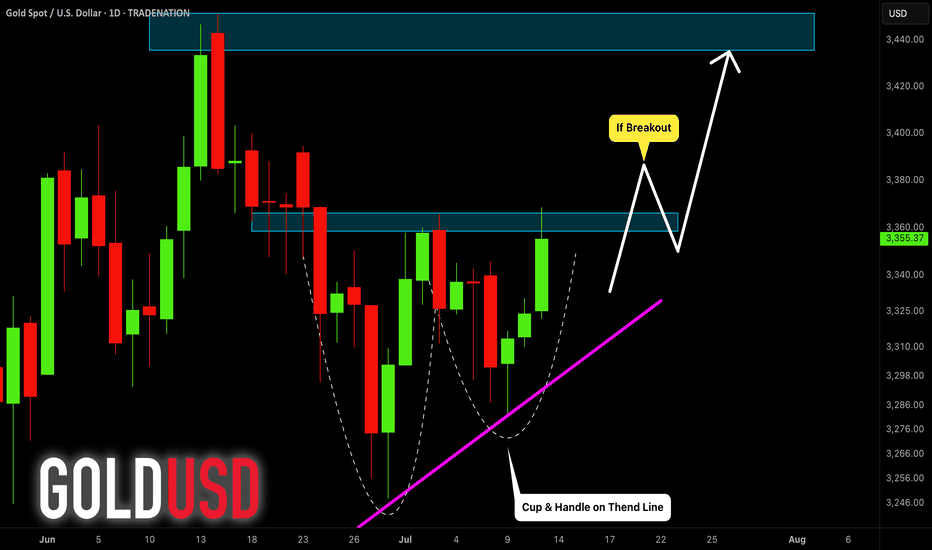

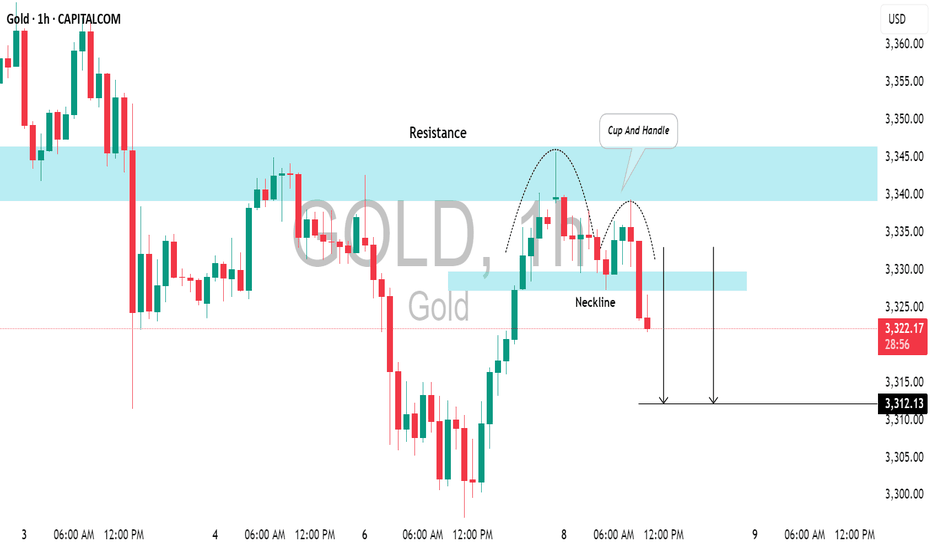

XAUUSD Approaching Breakout Zone – Watch for Confirmation GOLD (#XAUUSD) – High-Probability Bullish Continuation Setup

Gold is maintaining its strong bullish structure on the daily timeframe, having recently respected a rising trendline, confirming ongoing buyer interest and market confidence.

Currently, price action is forming a well-defined Cup & Handle pattern, which is considered a high-probability bullish continuation formation. The market closed last week near the neckline resistance around the 3367 level, showing signs of pressure building for a breakout.

Key Technical Insight:

A daily candle close above 3367 will confirm a breakout of the neckline and validate the bullish setup. However, for entry confirmation, a clean breakout and daily close above 3380 will provide a stronger technical signal and reduce the likelihood of a false breakout.

Technical Summary:

Chart Pattern: Cup & Handle

Trend Structure: Rising Trendline (Confirmed)

Neckline Resistance: 3367

Breakout Entry Level: 3380+

Bias: Bullish

Timeframe: Daily

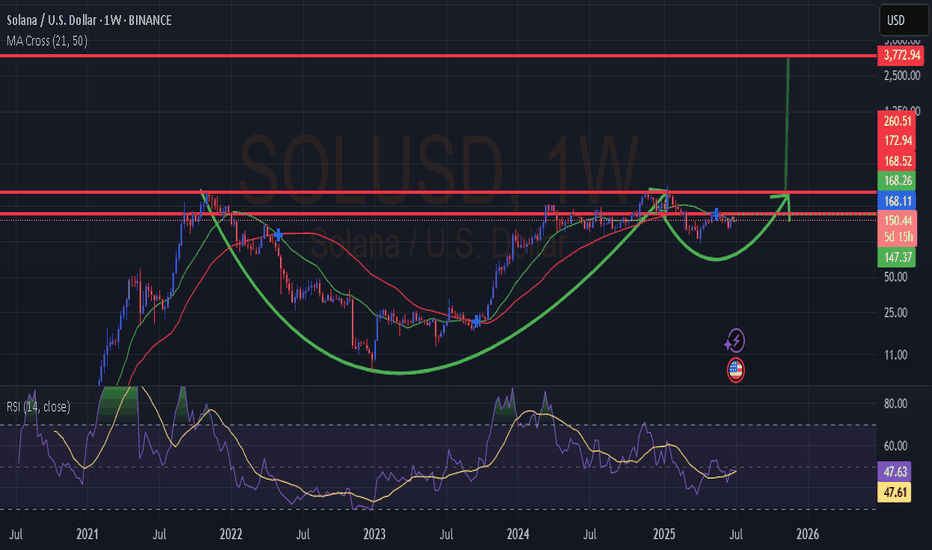

GOLD (XAUUSD): Another Bullish Pattern

Gold perfectly respected a rising trend line on a daily and

bounce from that, as I predicted earlier.

I see a strong bullish pattern on that now.

The price formed a cup & handle pattern and closed

on Friday, testing its neckline.

The next bullish confirmation that you should look for is its breakout.

Daily candle close above 3367 level will provide a breakout validation.

A bullish continuation will be expected then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

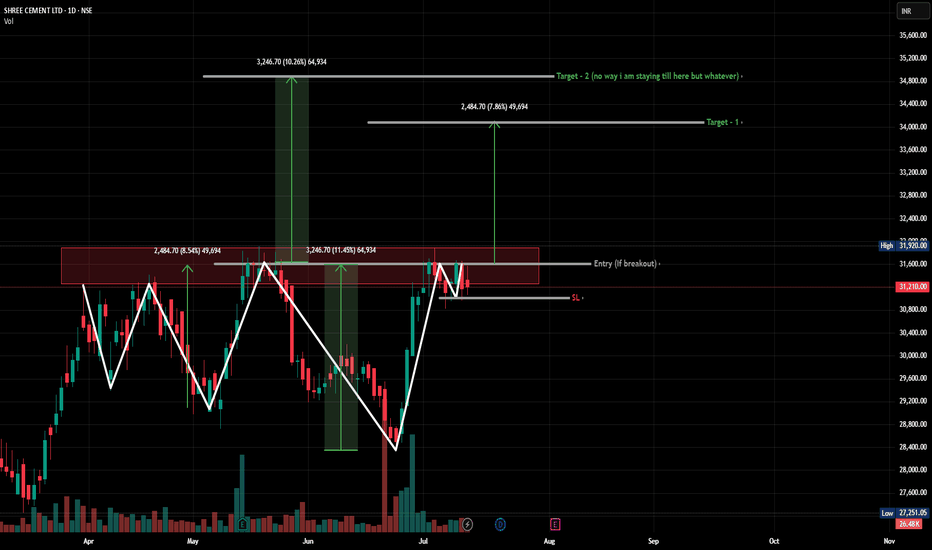

Invert Head and shoulder + cup with handle + 2x Double bottomOkay so I tried naming this pattern but gave up halfway because:

There’s a clean Inverted Head & Shoulders

A perfectly awkward Cup with Handle

And not one but two Double Bottoms, stacked like technical lasagna

All that drama right under the same resistance zone

👹 The red rectangle? It’s been tested five times already. FIVE.

If this level breaks, it won’t just be a breakout — it’ll be a ritual summoning. A support level forged in volume, trauma, and the unholy power of pattern layering.

If it flips, this zone is gonna be support backed by every TA demon in the book.

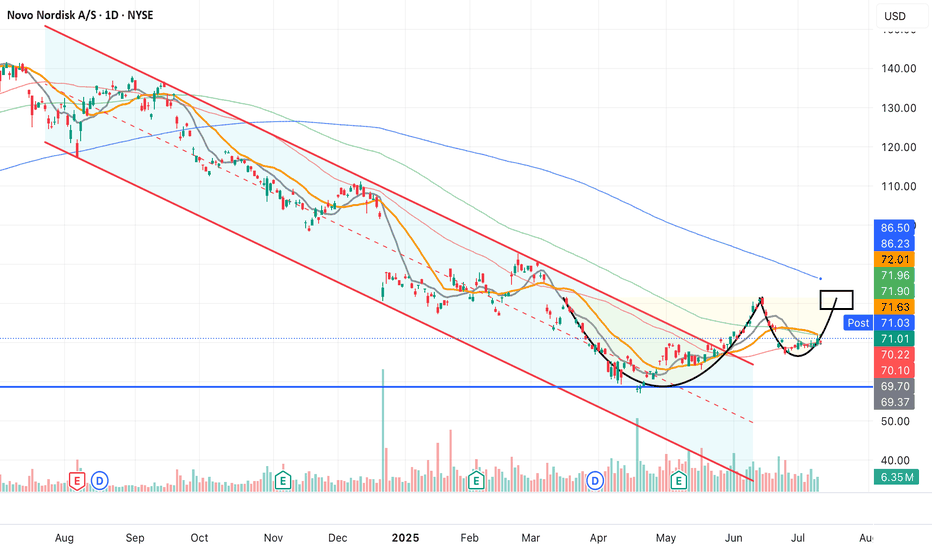

Cup & Handle to 81$ (and much more)Breakout successful from the red descending channel where we had left it in the previous idea.

The price is now completing the 'handle' of the pattern in question.

Resistance is around $81.5, and a close above it, accompanied by strong volume, could push the price back toward $100

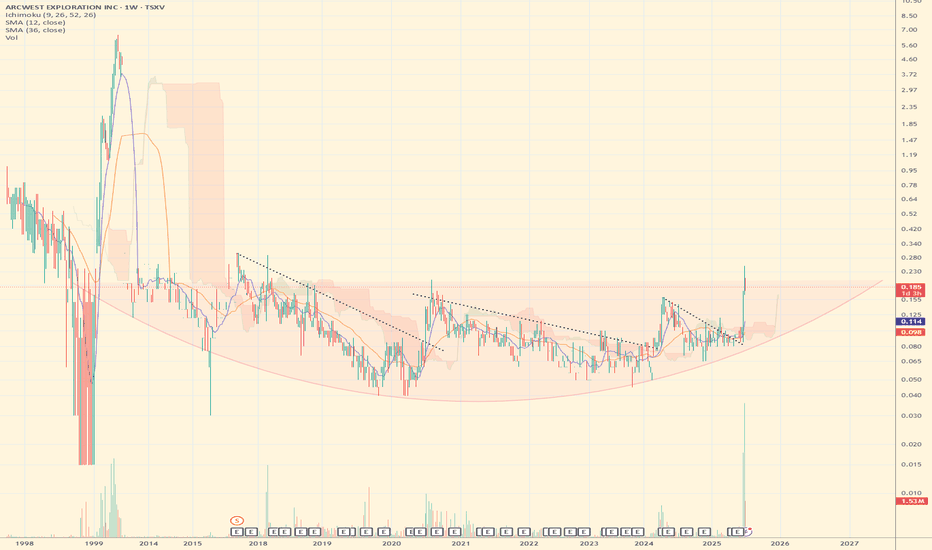

AWX - Breakout from Multi-Year Cup & Handle + JV Deal with FCXArcWest Exploration (TSXV: AWX) just broke out of a 7-year cup & handle formation, hitting C$0.21 with record weekly volume (1.53M).

📉 Long-term downtrend decisively broken

📊 12W SMA (0.114) > 36W SMA (0.098)

☁️ Weekly Ichimoku turns bullish

🔻 Pullback to C$0.185 (-7.5%) may offer entry

🔎 Next resistance zone: C$0.30+

Fundamental trigger:

ArcWest Exploration is a project generator focused on porphyry copper-gold systems in British Columbia, operating under a JV-based model. The company currently has eight 100%-owned projects, several of which are already partnered with major producers.

The recent breakout follows the announcement of a joint venture agreement with Freeport-McMoRan on the Eagle project, where Freeport can earn up to 80% interest by spending C$35M over 10 years, including staged cash payments and a commitment to fund exploration.

This deal marks ArcWest's second major JV partnership, alongside Teck Resources (on the Oxide Peak project), further validating the quality of its portfolio. Both Freeport and Teck are known for targeting large, long-life copper assets, which adds strong institutional backing and long-term exploration potential.

The alignment of technical breakout + institutional interest signals a possible structural re-rating as the market begins to price in multi-asset optionality and tier-1 partnerships.

The chart and fundamentals now align, suggesting multi-year upside potential.

📌 Do your own research before investing!

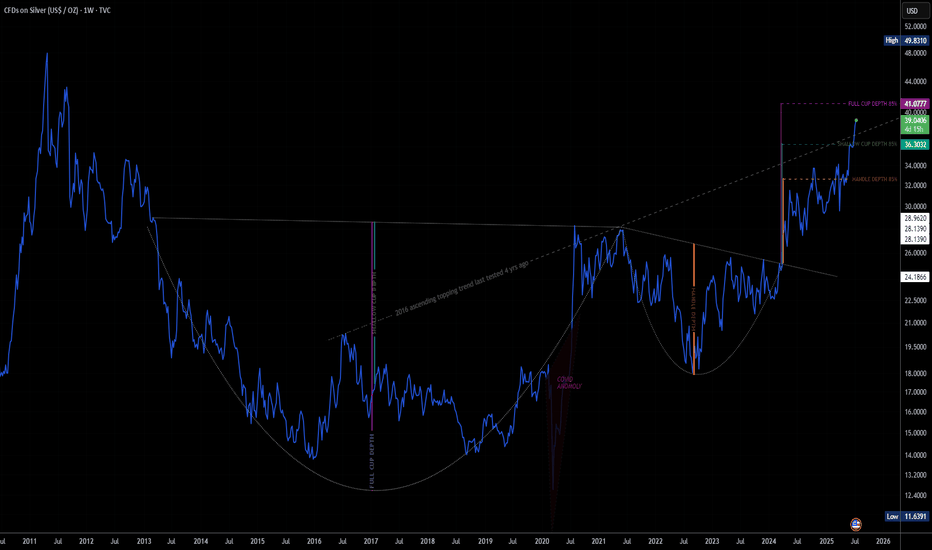

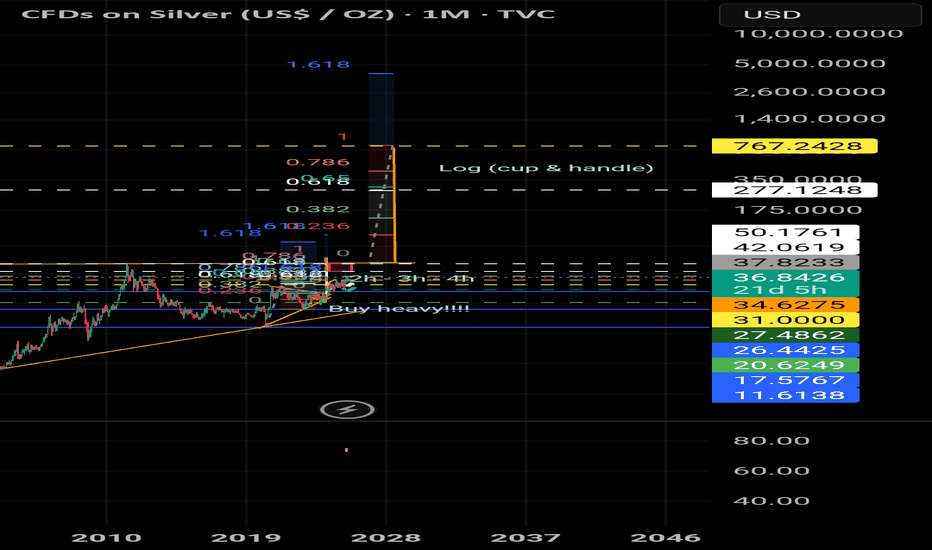

XAGUSD ~750 USD!?Hello. SILVER is approaching the cap of a multi-decade 'cup and handle' pattern. The measured move from that pattern reaches ~750USD/oz. GOLD has already reached the capping line of the 'cup and handle' and has continued up. Silver is known to lag Gold and outperform in the end. Position wisely my brothers and sisters.

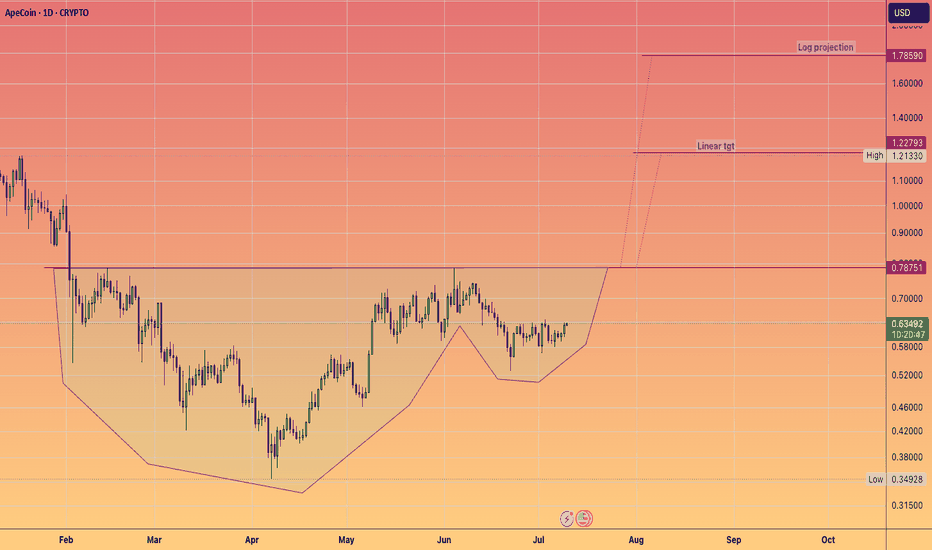

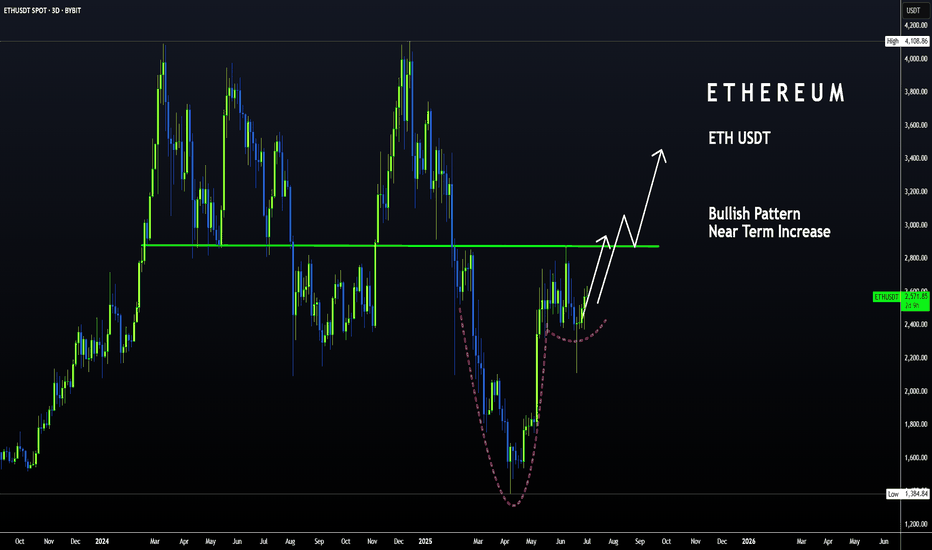

ETH | Bullish Pattern - Cup and Handle +15%A Bullish pattern is appearing on the Ethereum chart.

From a Cup and Handle pattern, we can easily expect atleast a 15% increase. This is true for the near term. A +15% would put us here:

Just under $3K we may see heavy resistance. This is also the neckline resistance, as it was the previous support for the breakout that ultimately led to a new ETH ATH.

_______________________________

BYBIT:ETHUSDT

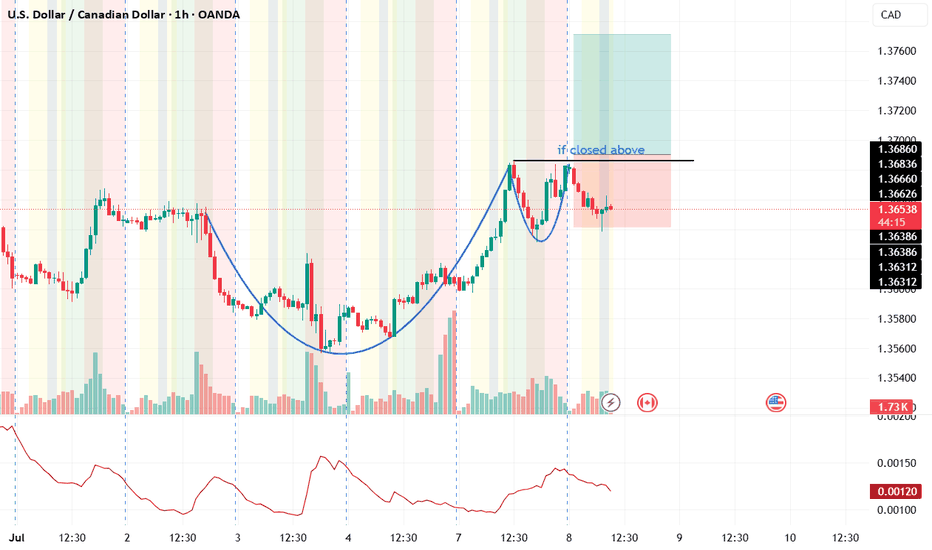

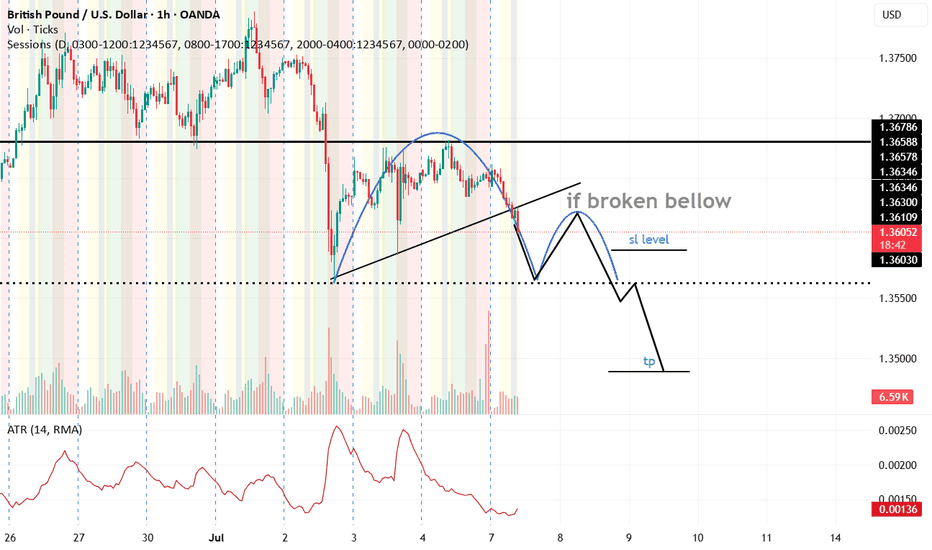

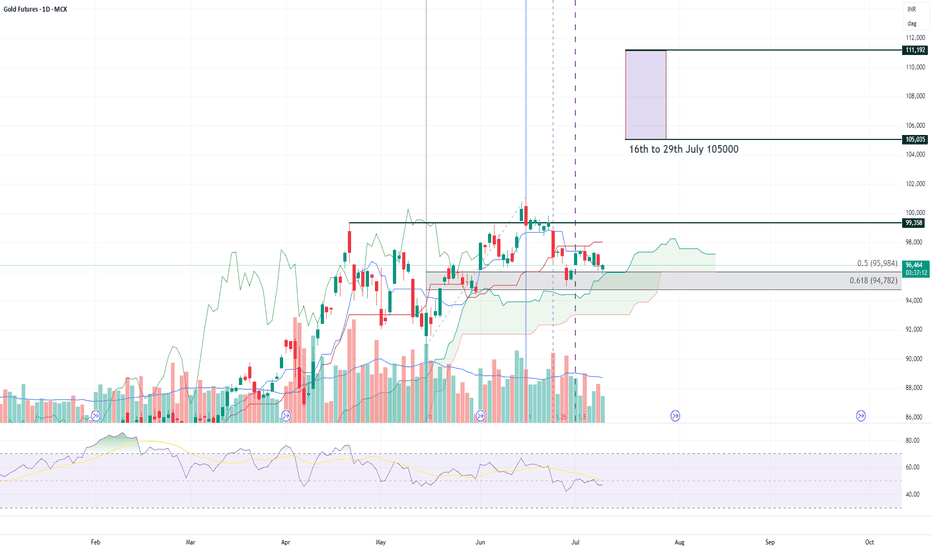

GBPUSD: Bullish Move After Liquidity Grab 🇬🇧🇺🇸

GBPUSD formed a bullish high range candle with a long lower wick going

below a key horizontal demand zone on a 4H.

A consequent recovery and a bullish London session opening suggest

a highly probable rise today.

Goal - 1.363

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

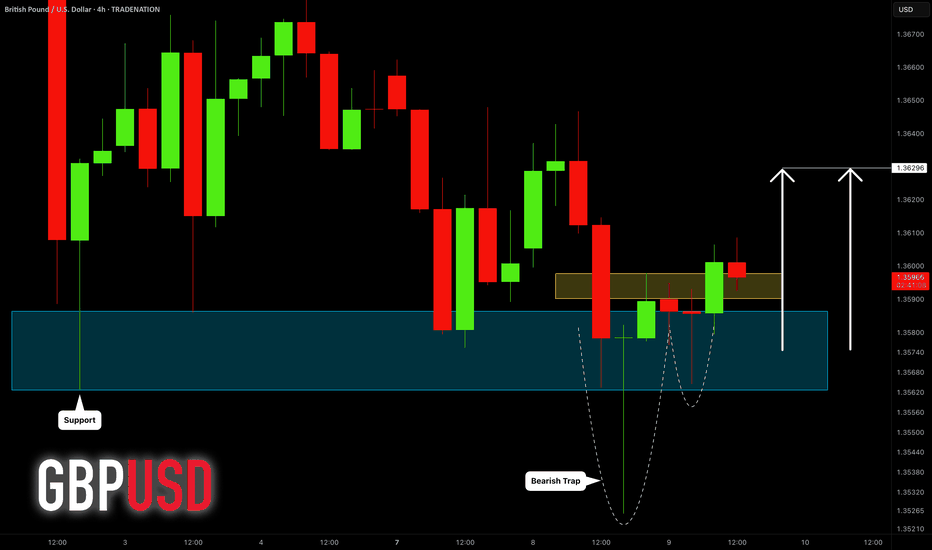

SULUSD Cup & HandleHi All, SOLUSD in a textbook cup & handle pattern. It might break sooner than indicated. Current price is a steal imo. Keep an eye for a strong breakout. Not financial advice. If you enjoyed the content of this analysis, please do leave a like for future updates. Lets crush this market. Be safe.

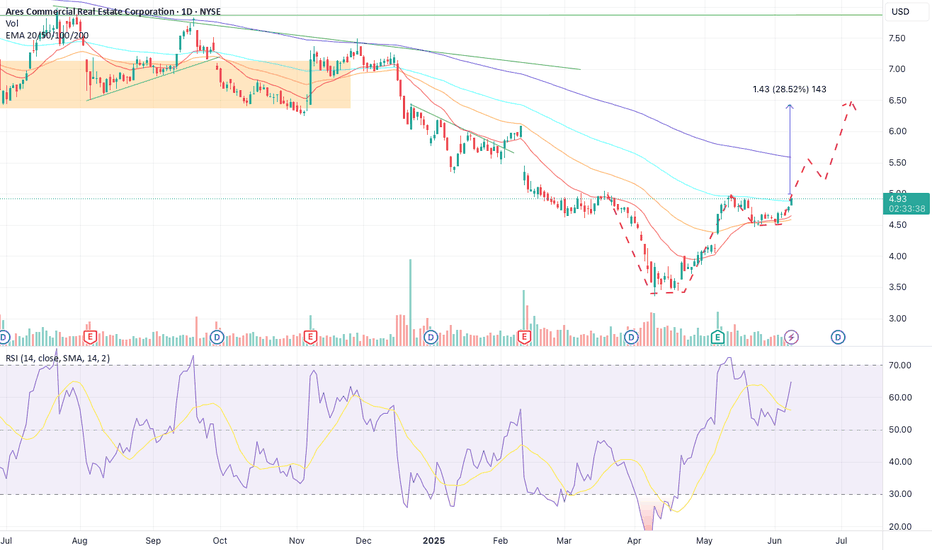

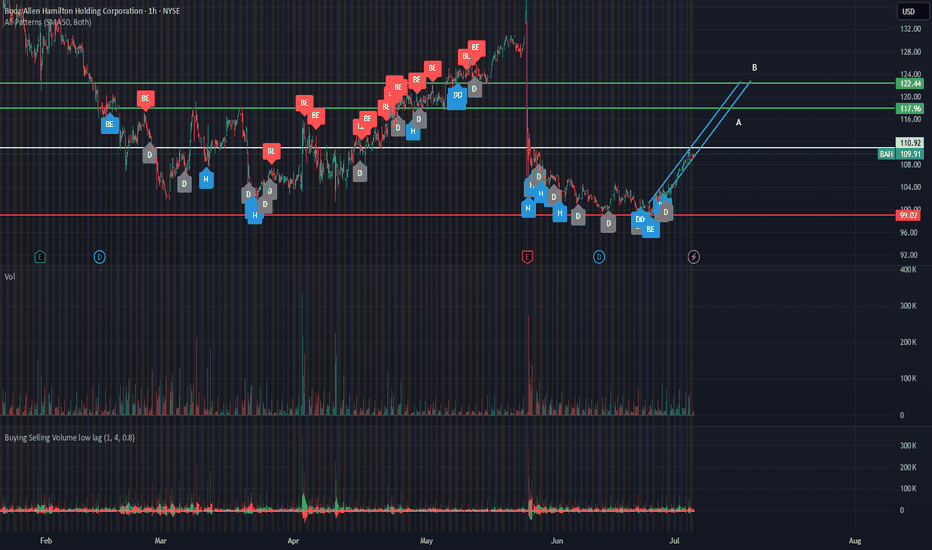

BAH Gaining Momentum With New DOD ContractsBAH recently fell after missing earning expectations, though the results were quite decent. It is currently sitting at 57% of 52 Weeks high. Seems oversold. Its AI products are going to contribute significantly to future revenues. Recently on June 16th, it won a DoD contract worth $96.07 million. Plus, the SMA (10) is finally crossing above SMA (50).

First target (A) seems to be $115 ish. If it breaks that resistance, 2nd target (B) seems to be about $122+.

NFA, just sharing my learning. :)