Currencis

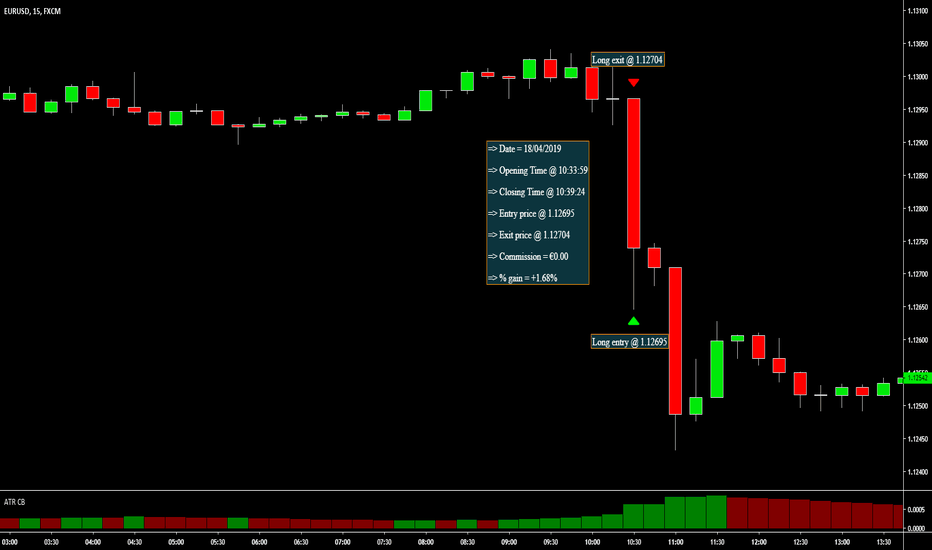

$EUR/USD - BE CAREFUL OF EVENT TRADING -> NET +1.68%Hey everyone,

Managed to trade a quick scalp on the EUR/USD. Prior to my entry there was the German Manufacturing PMI coming out (was released -ve). Usually the price movements on that kind of event are not anything major however on this occasion the pair plunged by about 50 pips shortly after its release. It goes to show that you should never underestimate news events, be it strong / weak impact it's good to always have them at the back of your mind especially as a day-trader.

I will be posting both the screenshot from my broker's platform as well as the 5m chart below so that you can clearly see the levels laid out. (cannot post an idea below the 15m TF and my trade was taken on the 5m)

Details:

Trade (1) - BUY

Entry @ 1.13021

Exit @ 1.13005

**NOTE THAT THESE TRADES HAS ALREADY BEEN TAKEN, IT IS NOT A RECOMMENDATION TO TRADE

www.mql5.com

Follow and leave a like if you enjoyed this post and want to see more :)

GBP/USD outlookFriday’s rebound from 50-DMA if followed by a daily close today above 1.2582 would open the doors to 1.2706-1.2773 (upper Bol Band). The ADX has been flat lined for quite some time…hence the odds of the trend gathering pace are high. A move higher to 1.27 could also yield a bullish crossover on the DMI.

On the downside, a daily close below 50-DMA would add credence to bearish DMI, push RSI below 50 and thus could yield a sell-off to 1.2255 (Jan 18 low).

AUD/USD – Increased risk-off of a sell-off· Pair’s repeated failure around 0.78 handle followed by a retreat to 0.76 handle has led to a Gravestone Doji formation on the weekly chart.

· The monthly RSI and MACD suggest loss of bullish momentum.

· The spot thus appears poised for a sell-off to 0.74 handle.