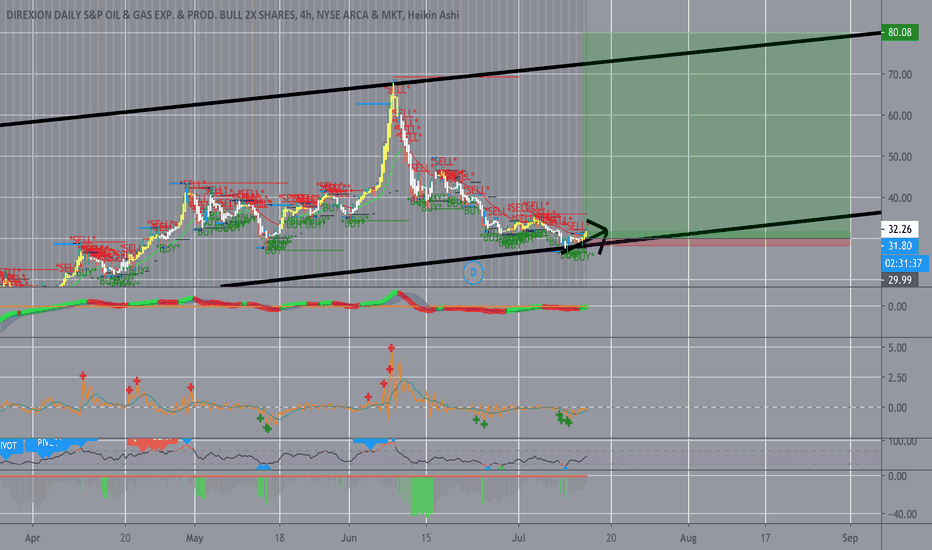

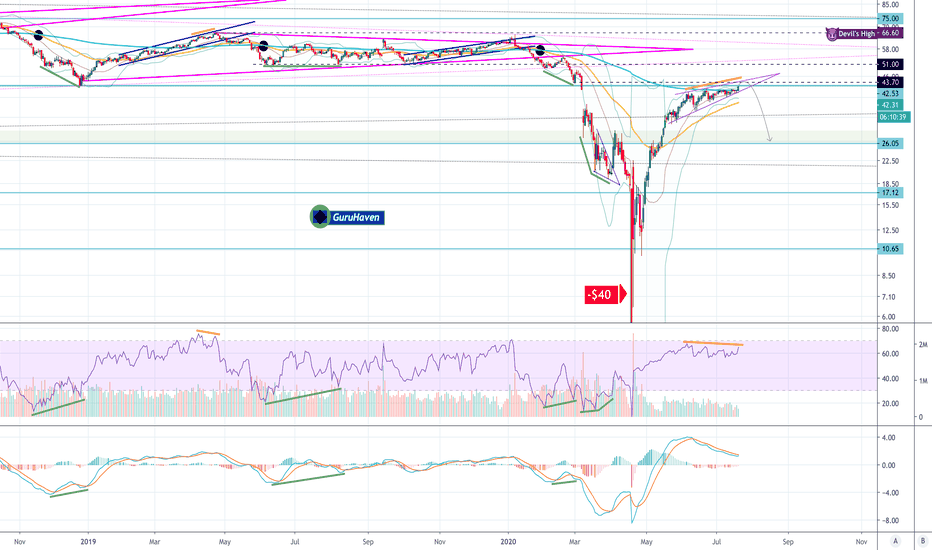

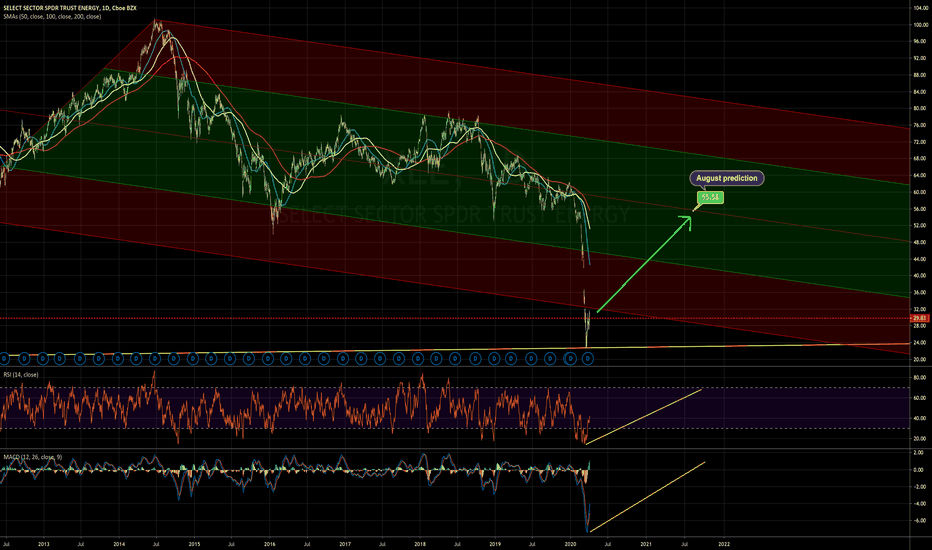

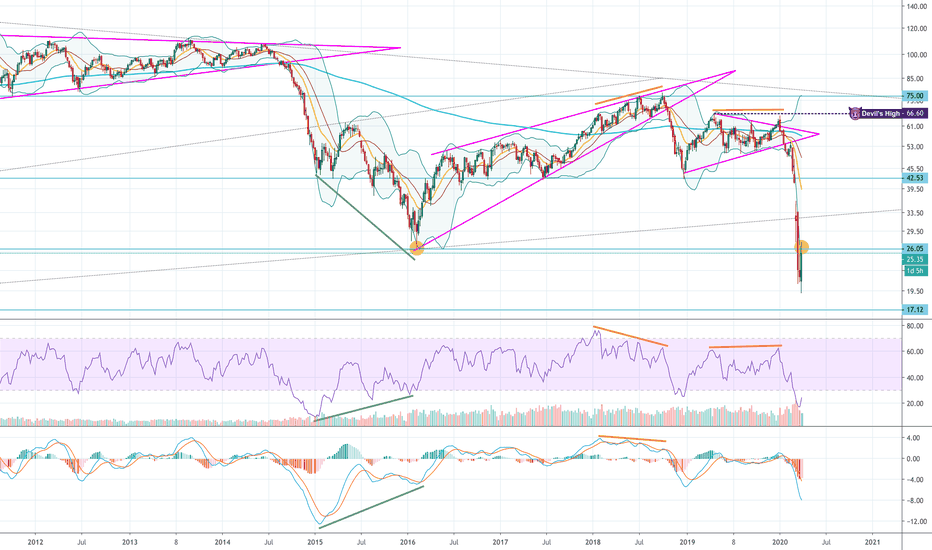

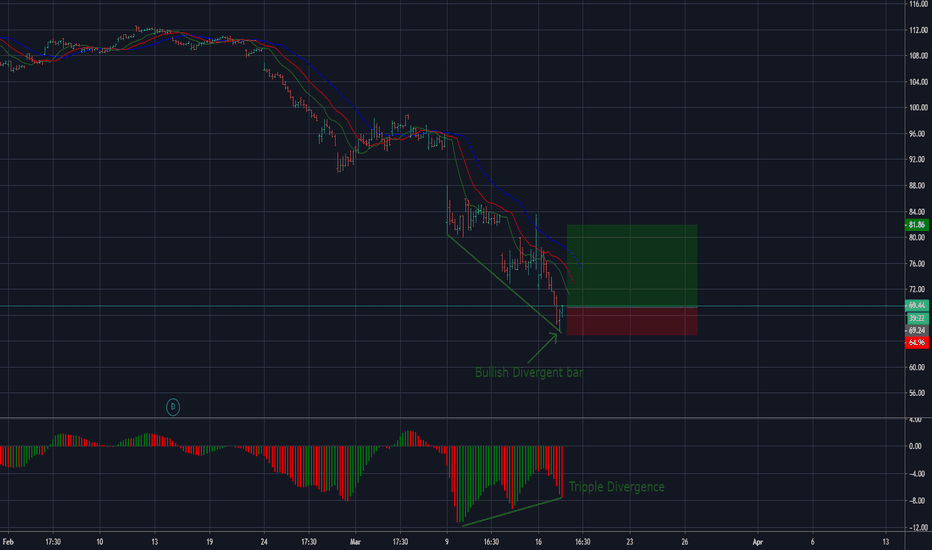

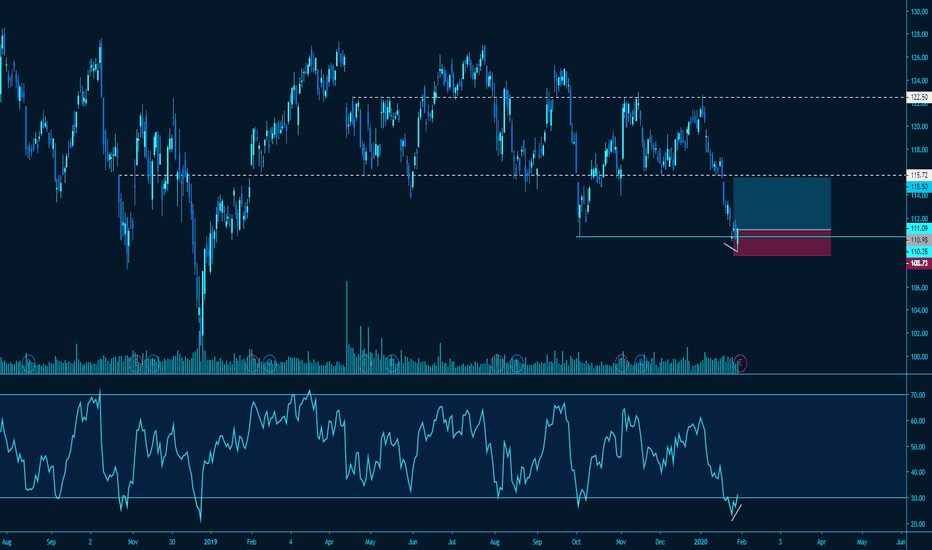

Market Rotation Into Energy (XLE) The past week there was rotation into Energy (XLE). There is precedent for rotations into energy marking tops and continuing as safe havens during corrections.

In the bottom chart, you see the rotation happening in September 2018, just before three months of market declines (21% on S%P 500 and 24% for Nasdaq).

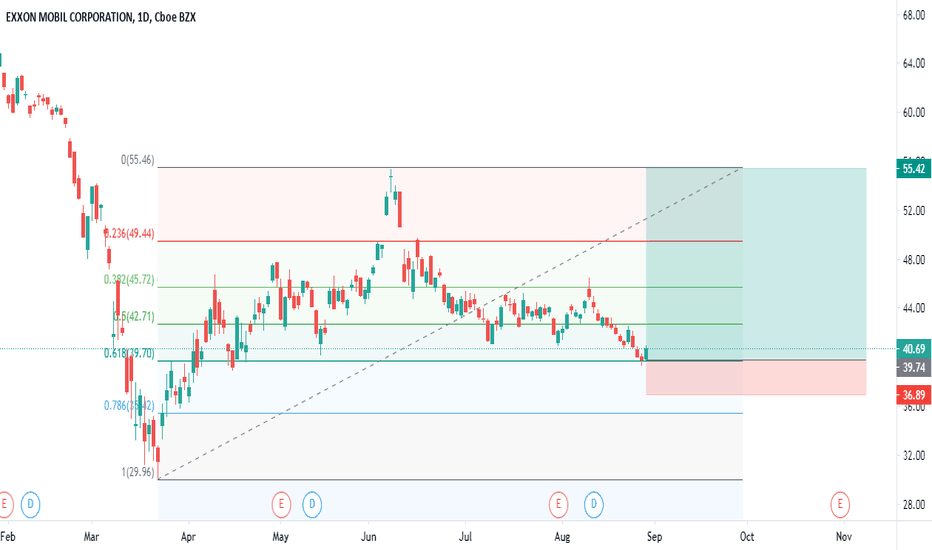

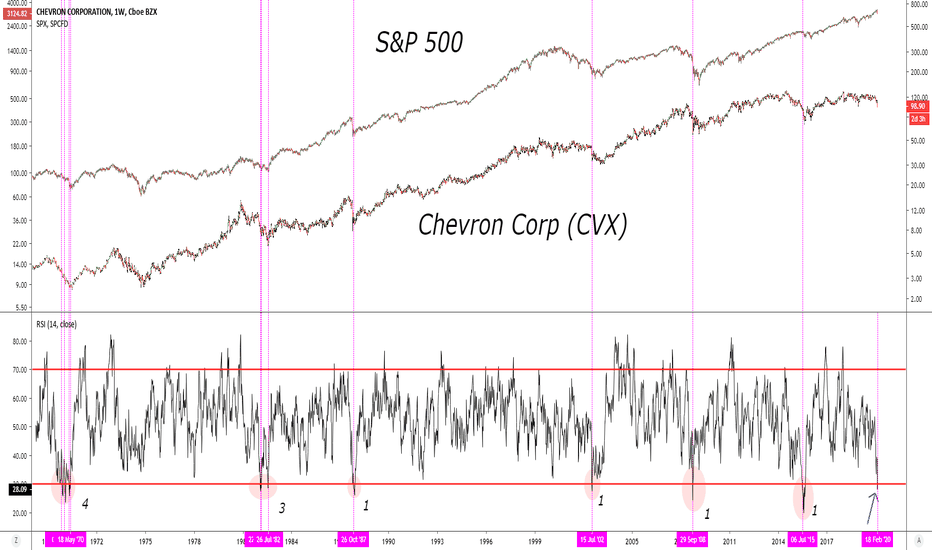

Looking back further to the 2000 tech bubble, look at stocks like CVX, XOM and SLB. These stocks are going up or sideways while the market is crashing around them.

On the other hand, 2018 these stocks fell along with the market.

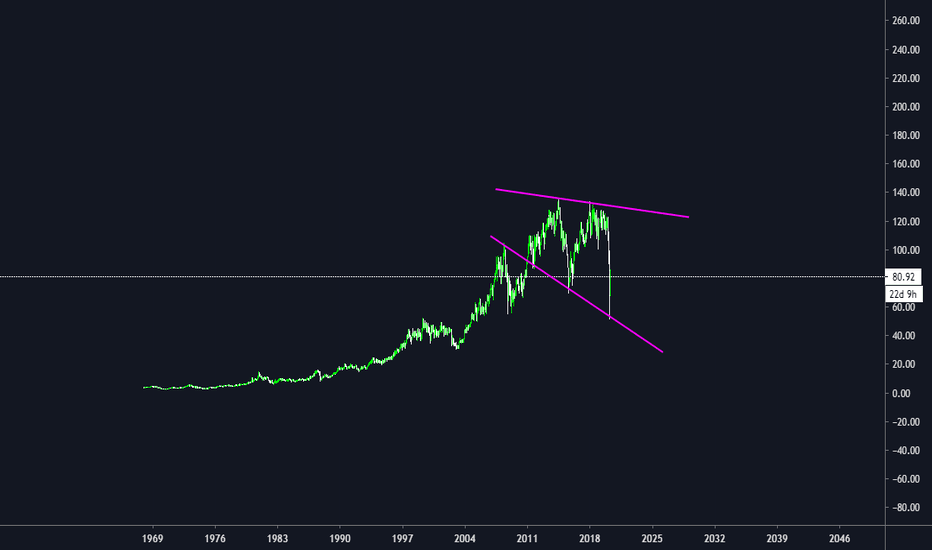

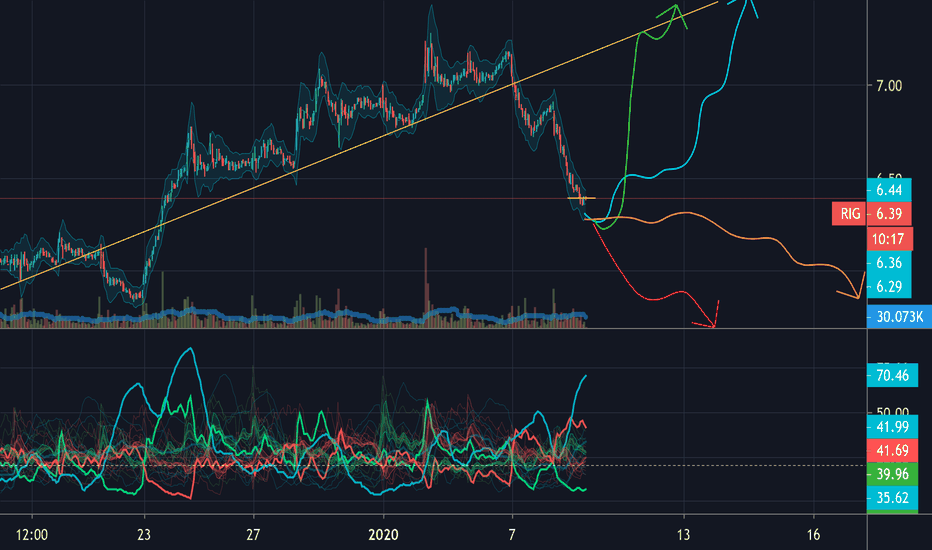

So the question is are we in a correction?

If so, is it more like 2000 or 2018?

Have energy stocks been held down while the tech bubble grew?

Will we see energy stocks climb over the next few months?

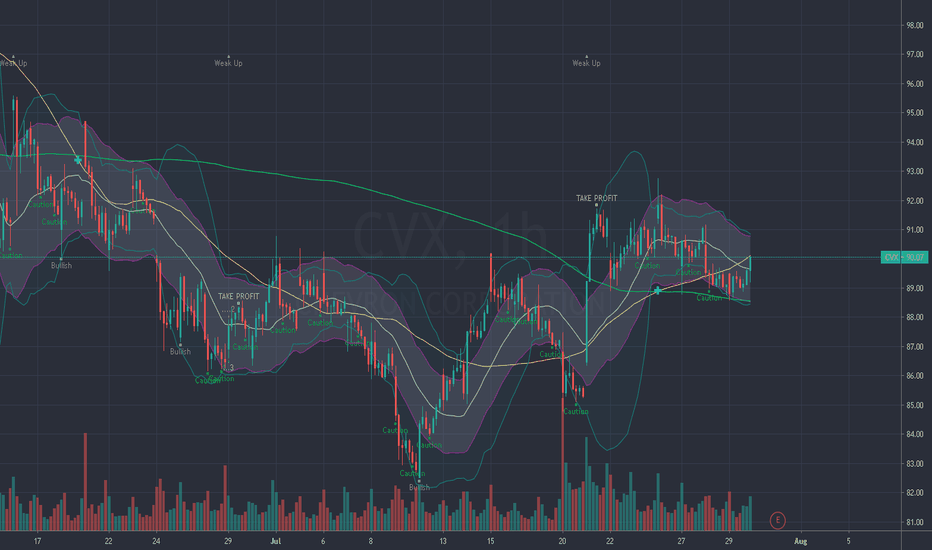

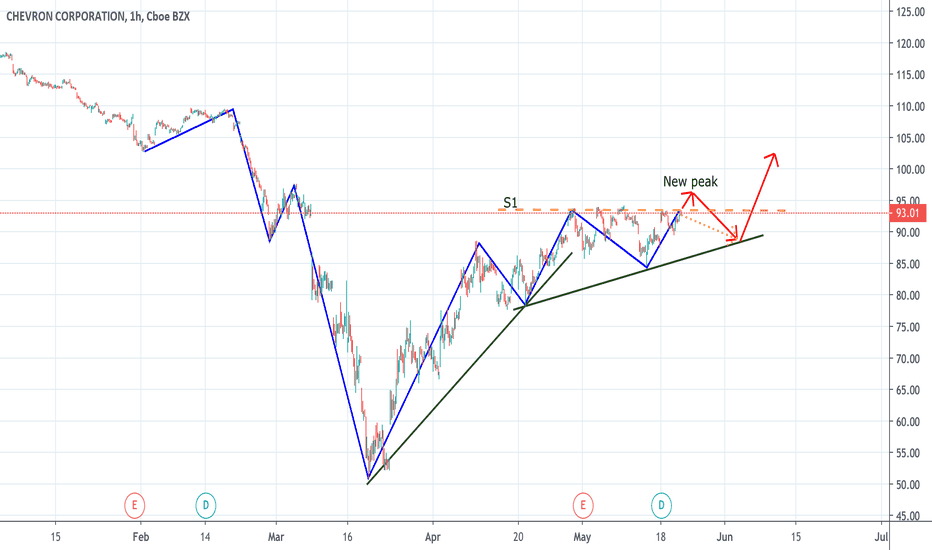

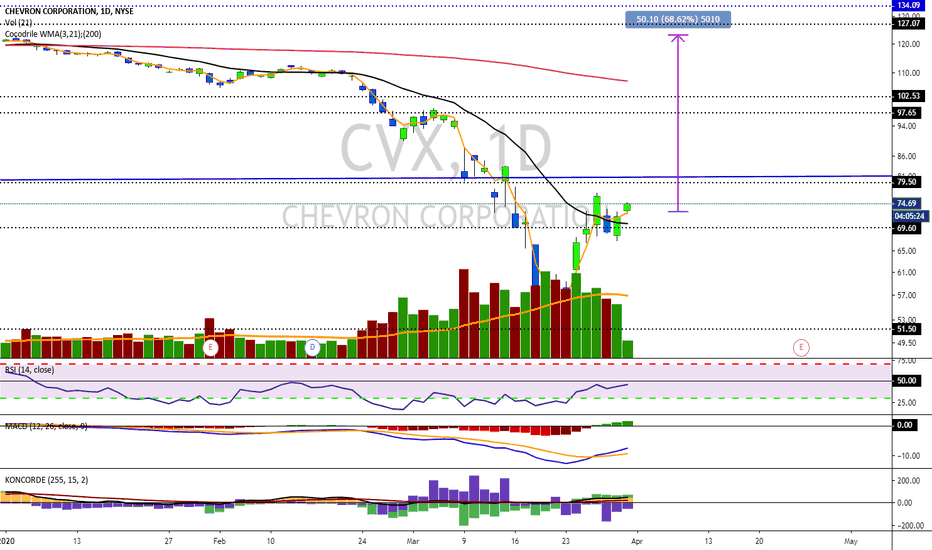

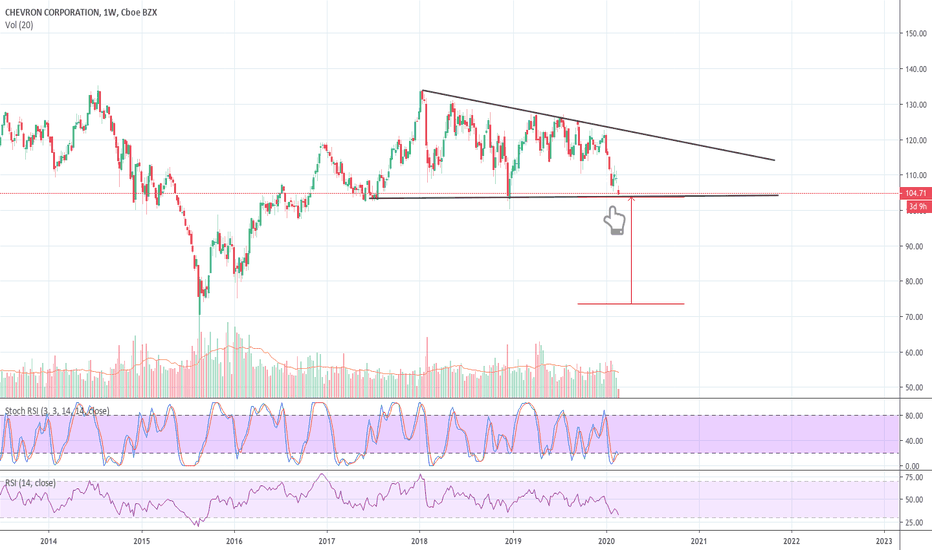

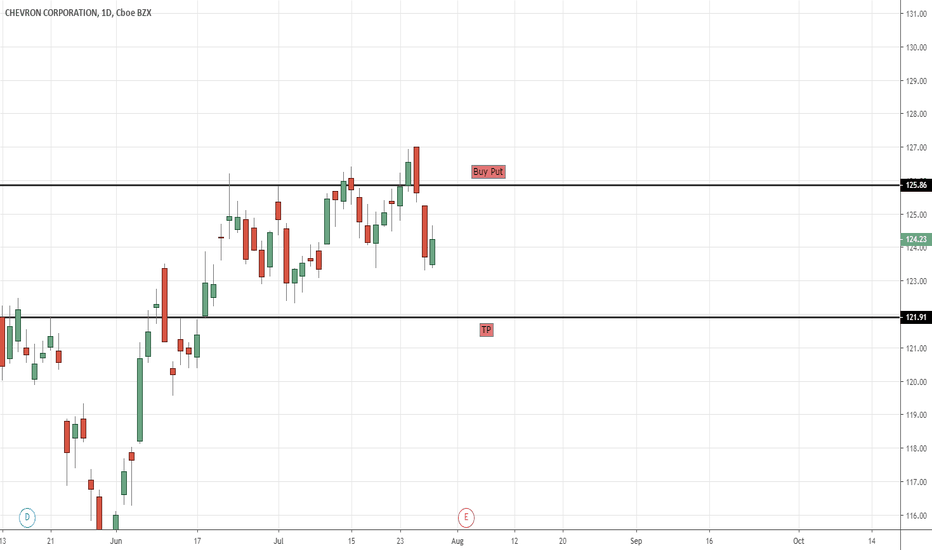

CVX

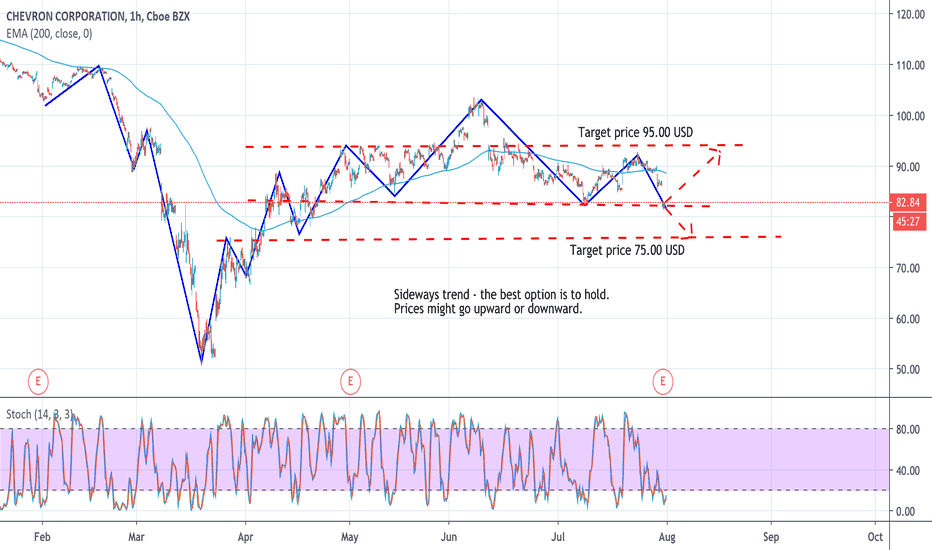

Chevron (CVX) Stock AnalysisSideways trend - the best option is to hold.

Prices might go upward or downward.

Chevron (CVX) – Chevron reported a quarterly loss of $1.59 per share, wider than the 92 cents per share that analysts were expecting. Revenue also came in below forecasts, amid lower oil and gas prices and the pandemic-related drop in fuel demand.

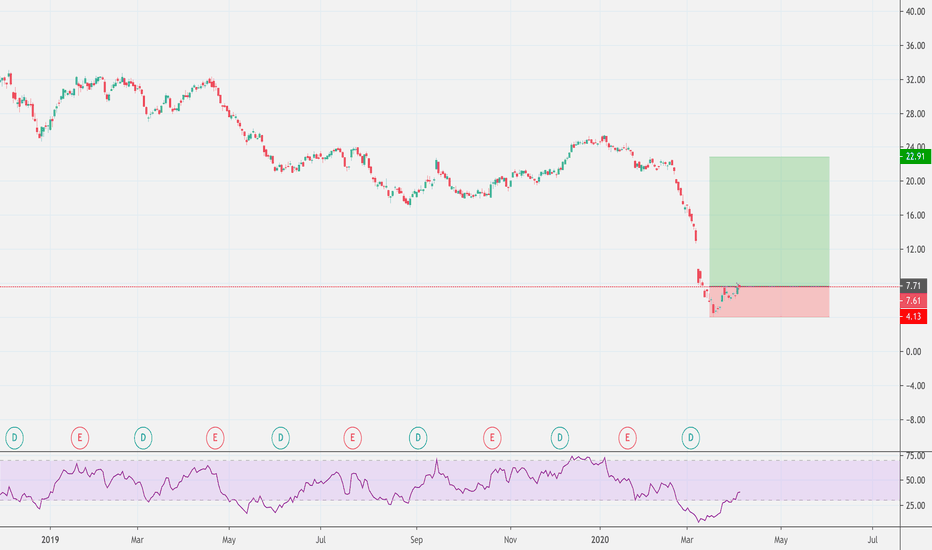

Big Time Rewards - Longterm BUY and HOLD (Scared?)Not going to say nows the best time to buy - its probably not - but I'm willing to bet my left almond shares will be trading around $20 in a year or two.

Seems like an extremely safe yearish long buy and hold. Fun to let things build slow sometimes anyways.

Position size accordingly, look for dips to load up .

Adios,

Fishy

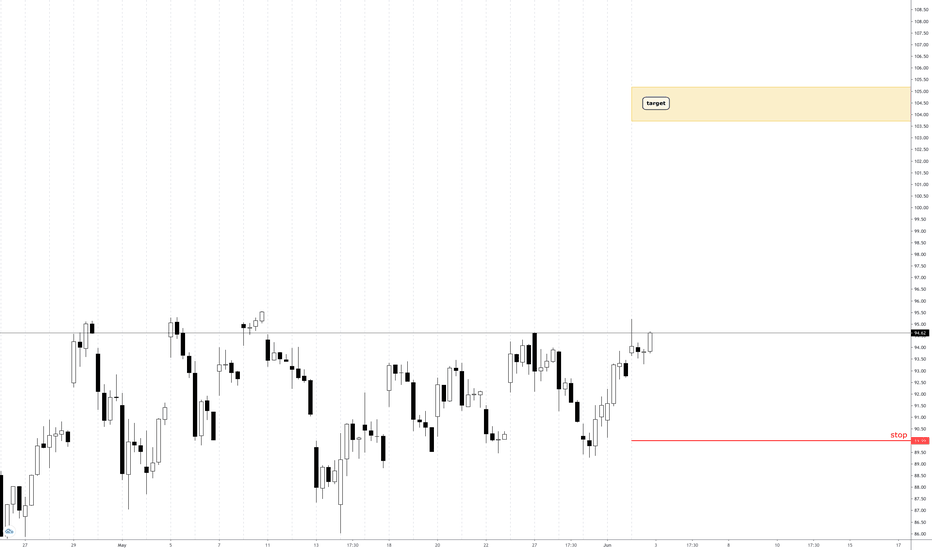

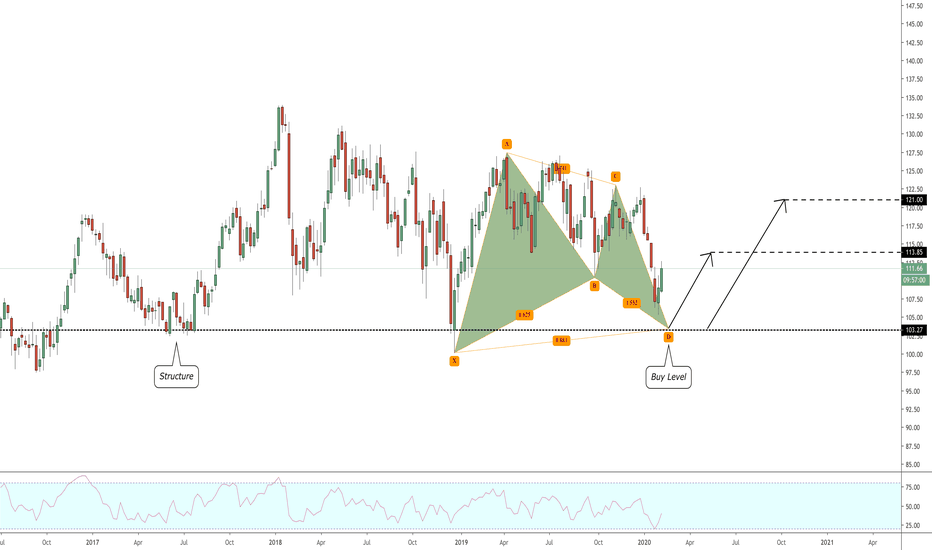

CHEVRON (CVX): Close To Key Structure

chevron is coming closer and closer to a key structure support level.

I would consider a buying opportunity from 103.0 level with a potential bullish reaction to 114 / 121 levels.

with a stop below the X the position will be protected against the volatility and occasional fluctuations!

good luck!

CVX long setupCVX’s innovation outlook is trending down based on a current score of 77 out of 99, outperforming sector average. Jobs growth over the past year has decreased and insiders sentiment is negative. CVX is an Average Performer in terms of sustainability. It is most exposed to BP p.l.c. as its supplier. Over the past 4 quarters CVX beat earnings estimates 3 times and it pays dividend lower than its peers.

For more analysis and articles visit our website