CVX Earnings Trade Setup — August 1, 2025

## 🚨 CVX Earnings Trade Setup — August 1, 2025 🚨

🔍 **Chevron (CVX) Earnings Analysis | High Conviction Call Play**

### 🧠 Model Consensus (Multi-LLM Blend)

* 📉 **Revenue Trend:** -1.0% TTM growth, margin pressure from falling oil

* 📈 **Analyst EPS Expectation:** \$11.04 with 26.2% YoY growth est.

* ⚠️ **Miss Rate:** 50% EPS beats w/ average surprise -2.2%

* 💬 **Consensus Sentiment:** ⚖️ *Moderate Bullish (Confidence: 60%)*

---

### 🔥 Options Heatmap

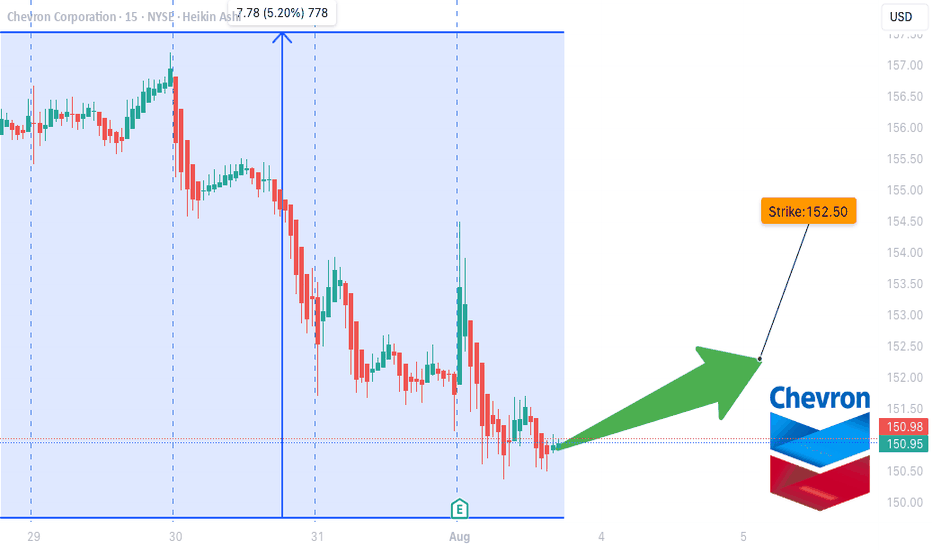

* 🟢 **Most Active Call:** \$152.50 strike, 🔥 ask volume at 152

* 🔺 **IV Rank:** 63% → *Moderate move expected*

* 🧊 **Put/Call Skew:** Defensive bias with light bullish divergence

* 🕵️♂️ **Dark Pool:** Mild accumulation hints by institutions

---

### 📉 Technical Breakdown

* 🔹 Near 50/200 MA — Neutral Pre-Earnings Drift

* 🔸 Support: \$150 | Resistance: \$155

* 🔻 Volume: 0.53x avg → *Weak conviction*

---

## 🎯 TRADE SETUP

🛠️ **Strategy:** Long Call (Pre-Earnings Entry)

💰 **Strike:** \$152.50

📅 **Expiry:** 2025-08-01

💸 **Entry Price:** \$3.70

🧠 **Profit Target:** \$11.10+ (200–300%)

🛑 **Stop Loss:** \$1.85

📊 **Risk/Reward:** \~2.5:1

🕓 **Exit Timing:** 1–2 hrs post-earnings (to avoid IV crush)

---

### 🧪 Earnings Catalyst Trade

Chevron’s setup shows a **classic low-volume/high-upside IV play**. Risk tightly managed with a defined stop, but room for explosive move if earnings surprise to upside.

---

📦 **Trade JSON Snapshot:**

```json

{

"instrument": "CVX",

"direction": "call",

"strike": 152.50,

"expiry": "2025-08-01",

"confidence": 60,

"profit_target": 11.10,

"stop_loss": 1.85,

"size": 1,

"entry_price": 3.70,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-01",

"earnings_time": "AMC",

"expected_move": 5.0,

"iv_rank": 0.63,

"signal_publish_time": "2025-08-01 13:05:25 UTC-04:00"

}

```

---

📈 **#OptionsFlow #CVX #EarningsPlay #TradingViewSetups #LongCall #EnergySector #IVCrushProtection #PreEarningsTrade**

Cvxanalysis

Chevron: Progress!Chevron has dropped decisively, significantly advancing our primary scenario. In this scenario, we expect the ongoing turquoise wave 2 to find its low just above the support at $135.37, which should set the stage for fresh upward movement. In the meantime, the probability of our alternative scenario has been reduced to 32%. Still, the possibility of an already established low of the turquoise wave alt.2 and, thus, a direct breakout above the resistance at $166.91 should be considered.