CVX Earnings Trade Setup — August 1, 2025

## 🚨 CVX Earnings Trade Setup — August 1, 2025 🚨

🔍 **Chevron (CVX) Earnings Analysis | High Conviction Call Play**

### 🧠 Model Consensus (Multi-LLM Blend)

* 📉 **Revenue Trend:** -1.0% TTM growth, margin pressure from falling oil

* 📈 **Analyst EPS Expectation:** \$11.04 with 26.2% YoY growth est.

* ⚠️ **Miss Rate:** 50% EPS beats w/ average surprise -2.2%

* 💬 **Consensus Sentiment:** ⚖️ *Moderate Bullish (Confidence: 60%)*

---

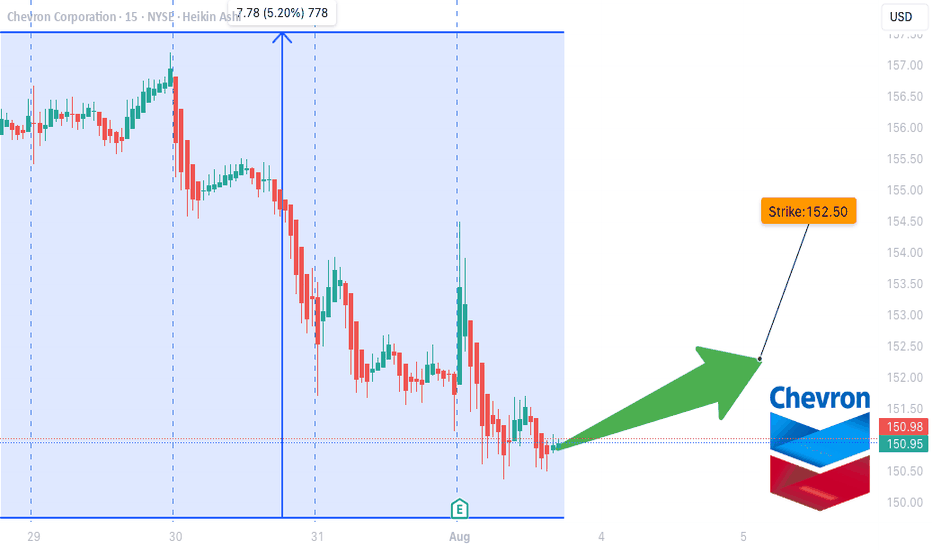

### 🔥 Options Heatmap

* 🟢 **Most Active Call:** \$152.50 strike, 🔥 ask volume at 152

* 🔺 **IV Rank:** 63% → *Moderate move expected*

* 🧊 **Put/Call Skew:** Defensive bias with light bullish divergence

* 🕵️♂️ **Dark Pool:** Mild accumulation hints by institutions

---

### 📉 Technical Breakdown

* 🔹 Near 50/200 MA — Neutral Pre-Earnings Drift

* 🔸 Support: \$150 | Resistance: \$155

* 🔻 Volume: 0.53x avg → *Weak conviction*

---

## 🎯 TRADE SETUP

🛠️ **Strategy:** Long Call (Pre-Earnings Entry)

💰 **Strike:** \$152.50

📅 **Expiry:** 2025-08-01

💸 **Entry Price:** \$3.70

🧠 **Profit Target:** \$11.10+ (200–300%)

🛑 **Stop Loss:** \$1.85

📊 **Risk/Reward:** \~2.5:1

🕓 **Exit Timing:** 1–2 hrs post-earnings (to avoid IV crush)

---

### 🧪 Earnings Catalyst Trade

Chevron’s setup shows a **classic low-volume/high-upside IV play**. Risk tightly managed with a defined stop, but room for explosive move if earnings surprise to upside.

---

📦 **Trade JSON Snapshot:**

```json

{

"instrument": "CVX",

"direction": "call",

"strike": 152.50,

"expiry": "2025-08-01",

"confidence": 60,

"profit_target": 11.10,

"stop_loss": 1.85,

"size": 1,

"entry_price": 3.70,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-01",

"earnings_time": "AMC",

"expected_move": 5.0,

"iv_rank": 0.63,

"signal_publish_time": "2025-08-01 13:05:25 UTC-04:00"

}

```

---

📈 **#OptionsFlow #CVX #EarningsPlay #TradingViewSetups #LongCall #EnergySector #IVCrushProtection #PreEarningsTrade**

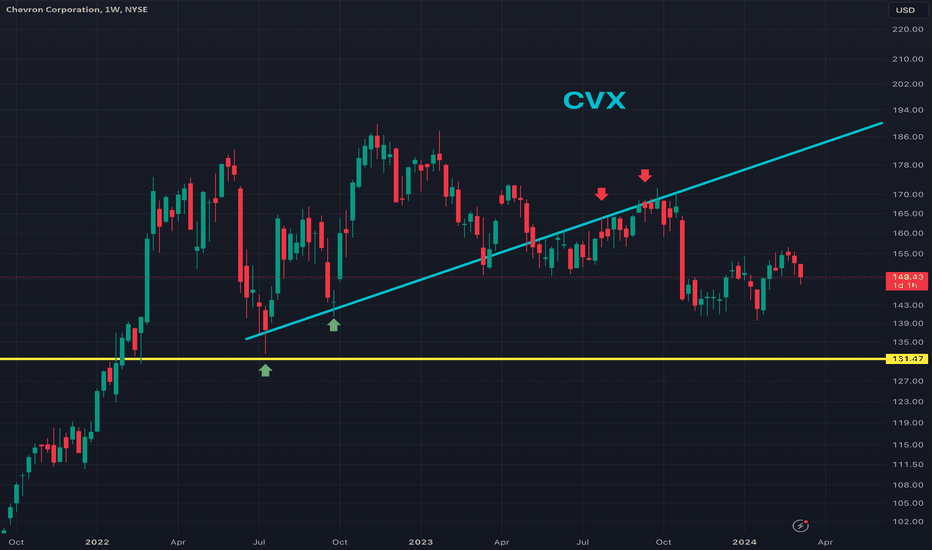

Cvxchart

CVX is Neutral With Two Key Price Levels to MonitorNYSE:CVX has lost support at the light blue resistance line, and this light blue trendline has flipped into resistance. CVX is trading above a yellow support level at $131.47. There is neutral price action here, and I think CVX doesn't have a clear direction for now. I would look for buy opportunities at or below the yellow trendline if CVX starts trending down, I think there will be a rebound there. If CVX starts trending up I would monitor for a rejection at the light blue trendline. I think CVX should find a direction within a few weeks, and I'd be happy to revisit the chart.

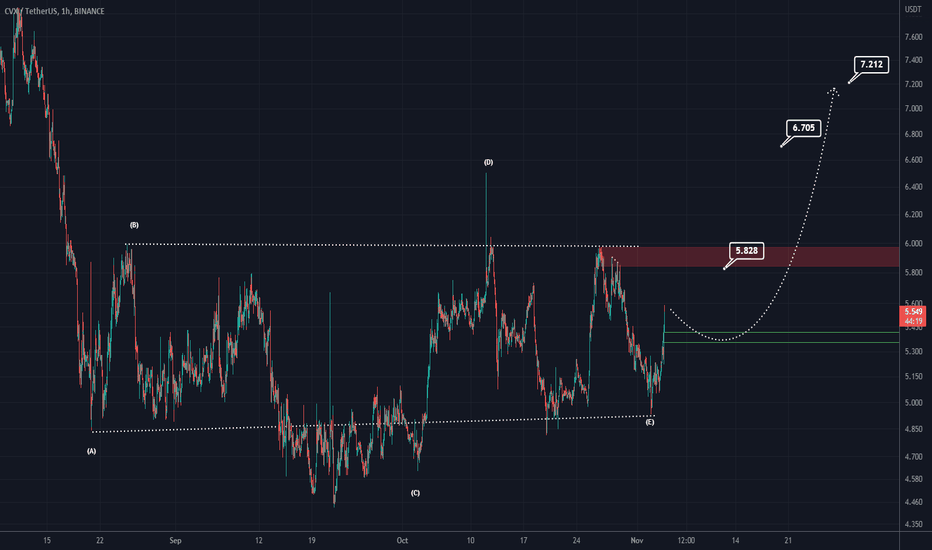

CVX CAN PUMP MOREHello, dear traders. how are you ? Today we have a setup to buy/long the LIT symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You